CADJPY A Fall Expected! SELL!

My dear subscribers,

My technical analysis for CADJPY is below:

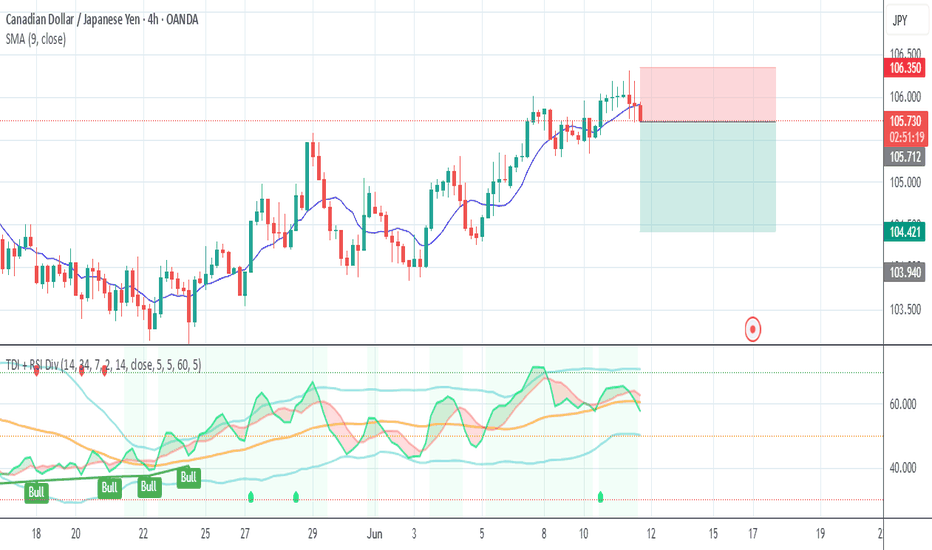

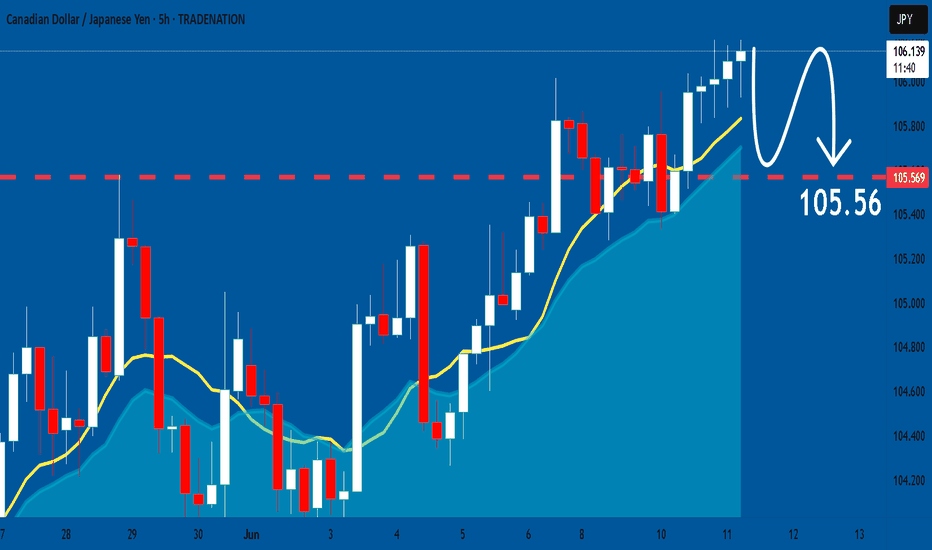

The price is coiling around a solid key level - 105.97

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 105.56

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

JPYCAD trade ideas

CADJPY BUY TRADE PLANJPY** – *June 13, 2025*

---

### 📋 Plan Overview Table

| Type | Direction | Confidence | R\:R | Status |

| ----- | --------- | ---------- | ------- | ------------ |

| Trade | Long | 7.5 / 10 | \~2.4:1 | Active Setup |

---

### 📈 Market Bias & Type

**Bias**: Bullish

**Type**: Continuation from higher low structure on H1-H4 with strong bullish engulfing recovery from 105.00 zone.

---

### 🔰 Confidence Level

**75% Confidence Breakdown**:

* ✅ H4 Bullish Continuation + Market Structure: **25%**

* ✅ H1 Demand Zone Reaction (105.00–105.10): **20%**

* ✅ Bullish Engulfing + Volume Push: **15%**

* ✅ W1 Bias Recovery Attempt: **10%**

* ❌ No H4 Divergence / Overbought RSI: **-5%**

---

### 📍 Entry Zones

* **Primary Entry Zone**: 105.60 – 105.75 (current break retest)

* **Secondary Entry Zone**: 105.25 – 105.40 (demand zone + wick support)

---

### ❗ SL with Reasoning

* **Stop-Loss**: 104.90

**Reason**: Below recent higher low & key demand rejection (104.95). Structural invalidation of bullish bias.

---

### 🎯 TP1/TP2/TP3 Targets

* **TP1**: 106.40

* **TP2**: 106.85

* **TP3**: 107.30 (W1 upper range test)

---

### 🧠 Management Strategy

* **Risk**: 1% per entry

* **Scaling**: Add at secondary entry if retest holds with bullish confirmation

* **Breakeven**: At 106.10 (after break of micro-structure)

---

### ⚠️ Confirmation Checklist

| Element | Status |

| --------------- | ----------- |

| H1–H4 Engulfing | ✅ Confirmed |

| Key Volumes | ✅ Increased |

| Sessions Tested | ✅ Asia + EU |

---

### ⏳ Validity

* **H1**: 12h (until breakout continuation fails)

* **H4**: 48h+ (structure intact above 105.00)

---

### ❌ Invalidation Conditions

* Break below 104.90 with momentum

* No bullish rejection from secondary zone

* Daily close below 105.00

---

### 🌐 Fundamental & Sentiment Snapshot

* **JPY Weakness Bias**: BoJ dovish tone + low inflation

* **CAD Mixed**: Crude oil neutral, BOC expected to hold rates

* **Net Flow**: JPY underperforms across board – supports long CADJPY

---

### 📋 Final Trade Summary

> A **bullish continuation trade** setup on CADJPY backed by H4 market structure and session volume. Re-entry from 105.60 zone with clean SL under structural invalidation at 104.90. Targets 106.40 / 106.85 / 107.30.

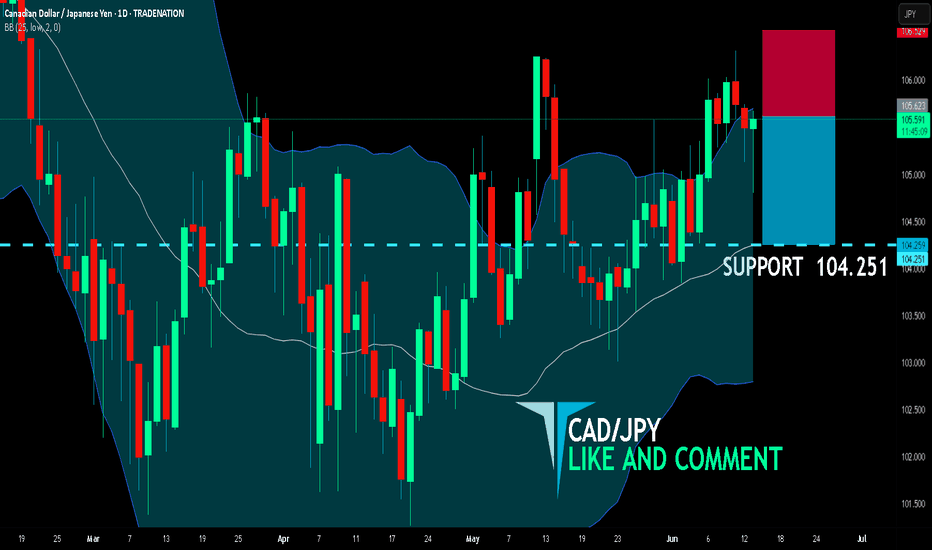

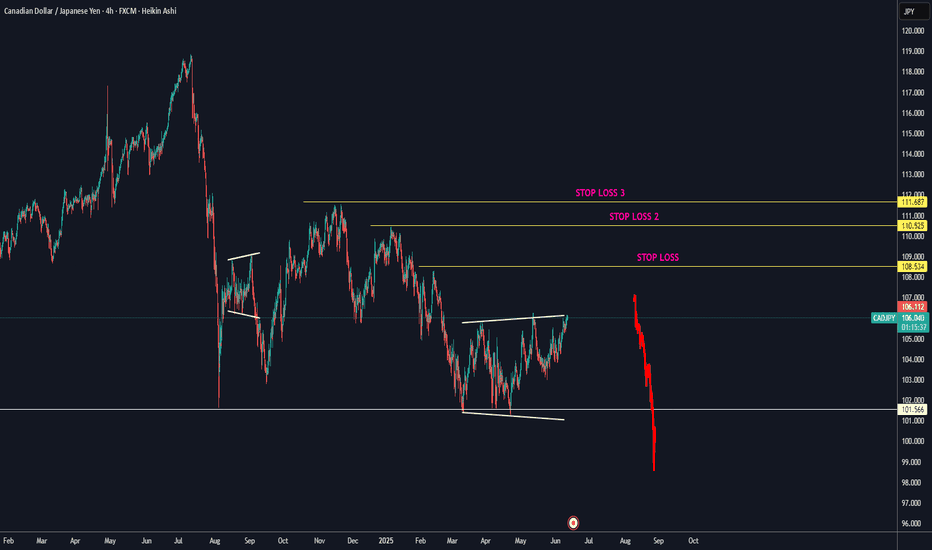

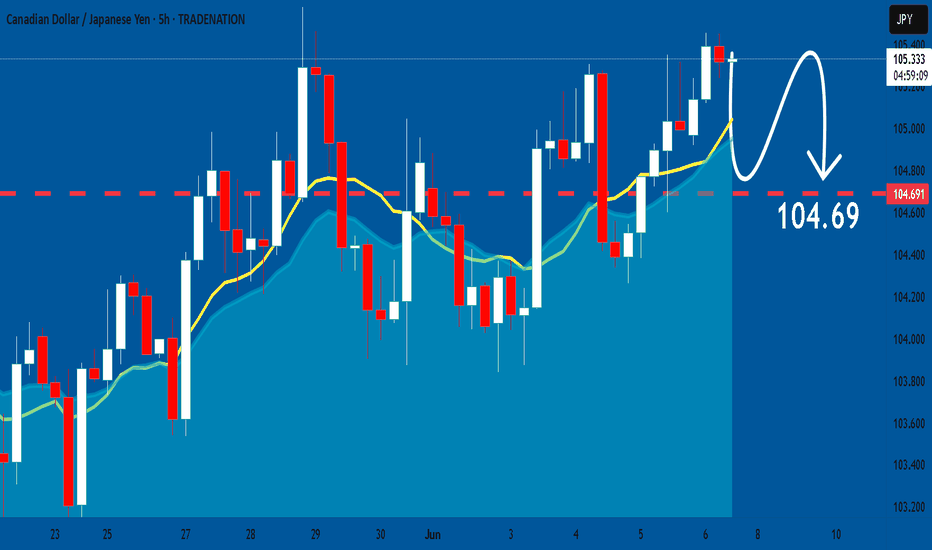

CAD/JPY BEARS ARE GAINING STRENGTH|SHORT

CAD/JPY SIGNAL

Trade Direction: short

Entry Level: 105.623

Target Level: 104.251

Stop Loss: 106.529

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

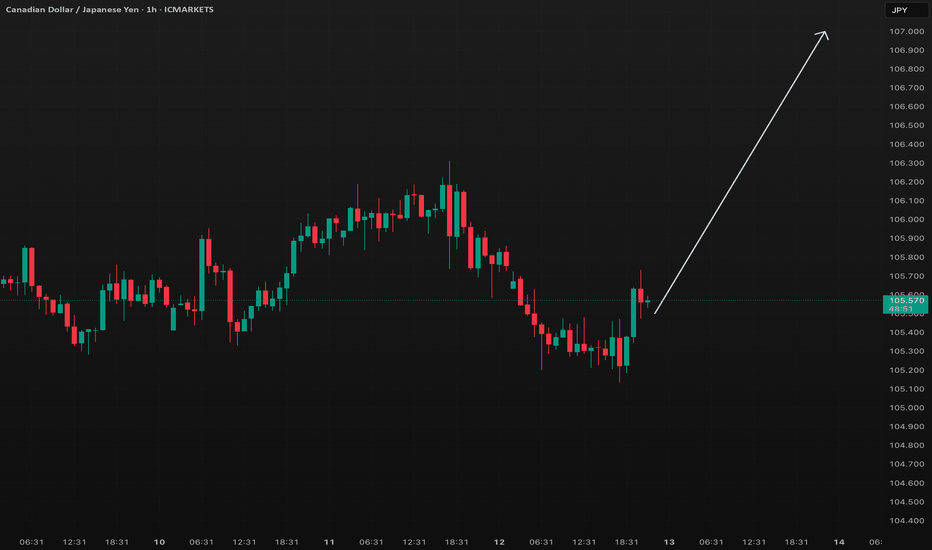

Friday 13th vs. The war

First and foremost, I want to extend my deepest sympathies to all those affected by these wars. The world would be a much better place if everyone were more aware of their mental well-being.

At the moment, I’m long on CAD/JPY. It was a very poorly executed trade due to placing a market buy at a highly unfavorable moment.

Lastly, crypto was discussed. XRP is showing very impressive price action and is holding up incredibly well structurally.

We're in a market environment where management, in my opinion, is more important than ever. I’ll need to assess whether I’ll hold this position over the weekend due to the upcoming market close and potential gaps caused by these ongoing conflicts, among other things.

Price action would need to trade far from my entry point for me to consider holding through the weekend.

The analysis has been discussed in the video.

Stay safe chads!

FX:CADJPY CRYPTO:BTCUSD CRYPTO:ETHUSD CRYPTO:XRPUSD

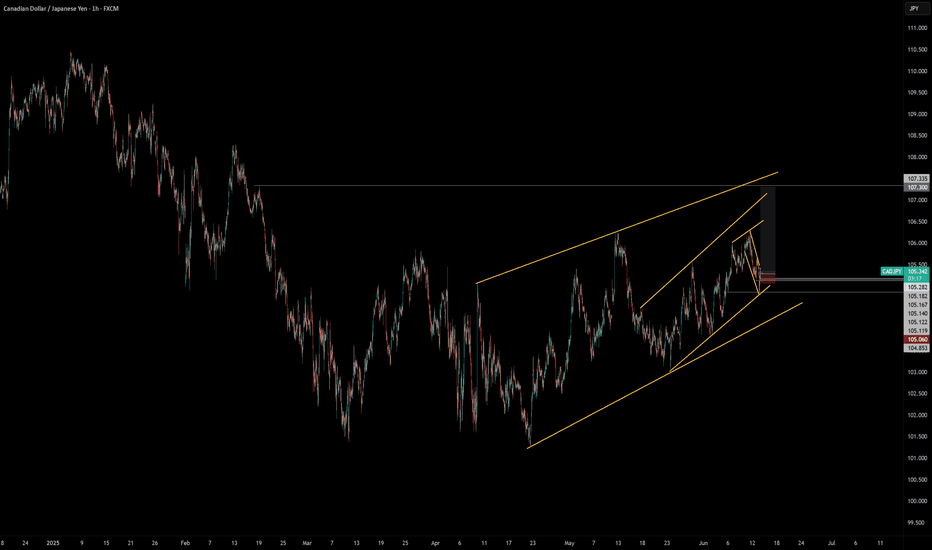

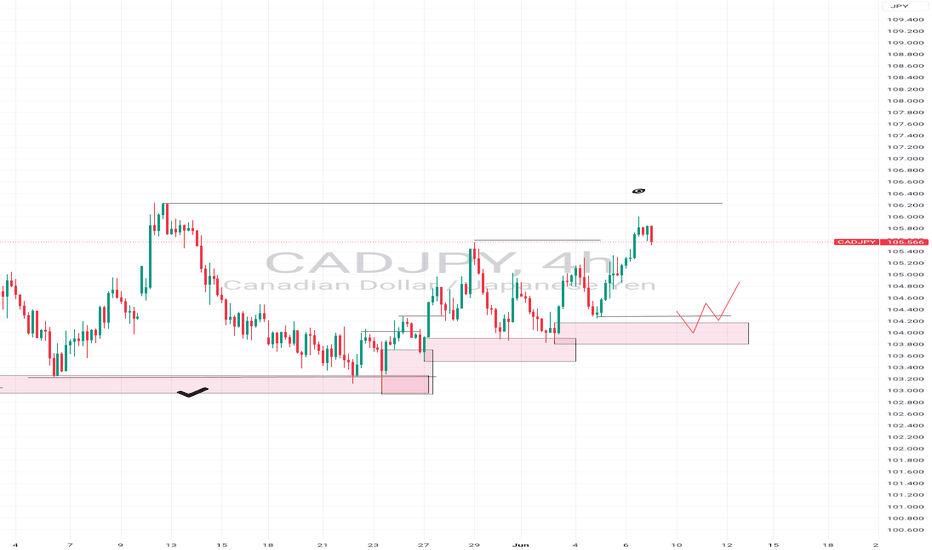

CADJPY BUY TRADE PLAN🗓️ Date: June 12, 2025

📊 Type: Tactical Intraday Plan

📍 Execution Style: Confirmation-based (Market entry with candlestick validation)

🎯 Bias: Bullish intraday continuation

🔁 Order Style: Market (Confirmation Only)

🔍 Multi-Timeframe Breakdown

* Weekly: CADJPY holding a long-term bottoming formation between 103.00–106.00. Clean reclaim off prior wick lows (103.70) into a slow grind higher. Mid-structure chop, but signs of reversal forming.

* Daily: Price formed a bullish impulsive structure from the May lows. Recent pullback rejected at 104.80 support (prior daily OB). Wick rejection and higher close hint at demand pickup.

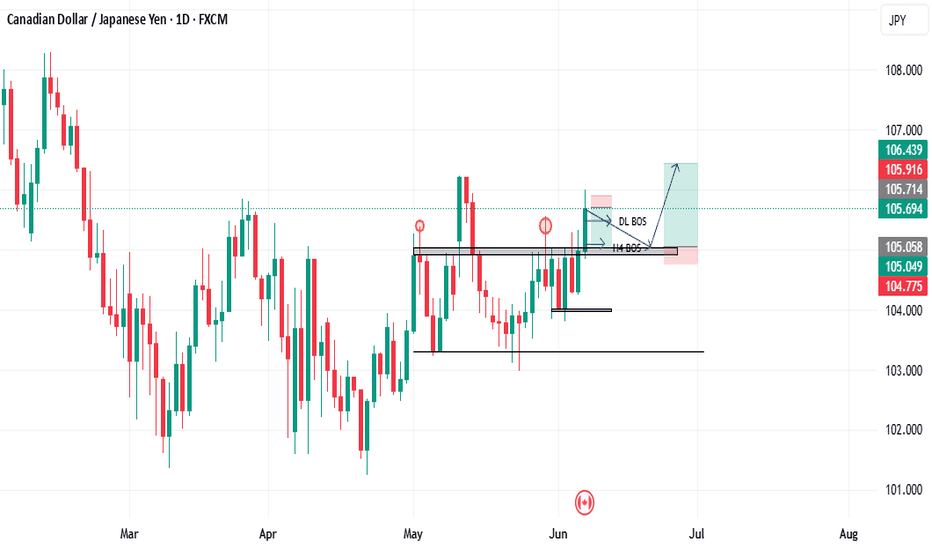

* 4H: BOS (break of structure) after retracement — bullish engulfing off demand near 105.20. Market retesting this area now. Solid internal HH/HL structure is forming.

* 1H: Sharp bounce off 105.30. Clean engulfing breakout of micro-structure, now printing small-bodied candles — sign of decision point near retest zone.

🧭 Trade Plan – Primary Bias: Buy (Bullish Continuation)

🔁 Entry Zone: 105.45 – 105.55

🛑 Stop Loss: 105.05 (below 1H bullish OB and internal structure)

🎯 Take Profits:

* TP1: 105.90 (recent swing high – partial close zone)

* TP2: 106.40 (4H supply rejection zone)

* TP3: 107.00 (D1 continuation target, HTF range edge)

📌 R:R: Approx. 1:2.8 to TP2, 1:4.5 to TP3

🔁 Trigger: 1H bullish candle from 105.45–105.55 zone OR strong reaction near NY open with volume

🧠 Why This Works:

* Clean bullish structure on all lower timeframes

* 4H engulfing + H1 reversal confluence

* HTF still in recovery zone – not in resistance

* Price respected prior OB and held internal liquidity under 105.20

❌ Invalidation Criteria:

* H1 bearish engulfing closes below 105.00

* NY open fails to produce volume follow-through

* DXY or risk flows shift against CAD

🔮 ForexGPT Elite Forecast Bias – CADJPY

Direction Probability Reason

🟢 Bullish 70% Structure breakout, bullish OB retest, H1 demand respected

🔴 Rejection Risk 30% If DXY strengthens or Yen spikes on risk-off, false break likely

📌 Execution Note (What I Would Do):

I would wait for NY session reaction — if price dips into 105.50 zone and prints bullish engulfing / M15 pin + volume, I’d enter with SL below 105.05. I’d take partials early and let the rest ride to 106.40+ if momentum holds.

CADJPY: Expecting Bearish Movement! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell CADJPY.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

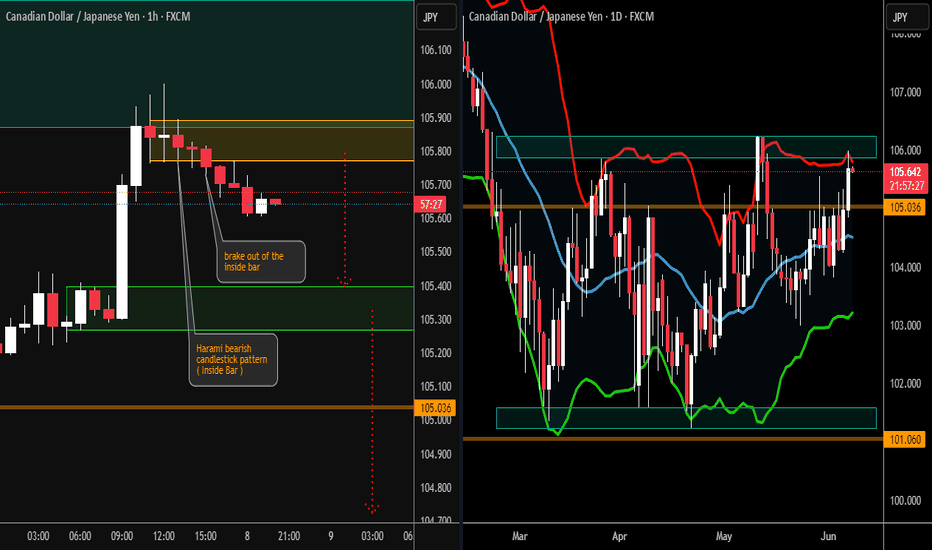

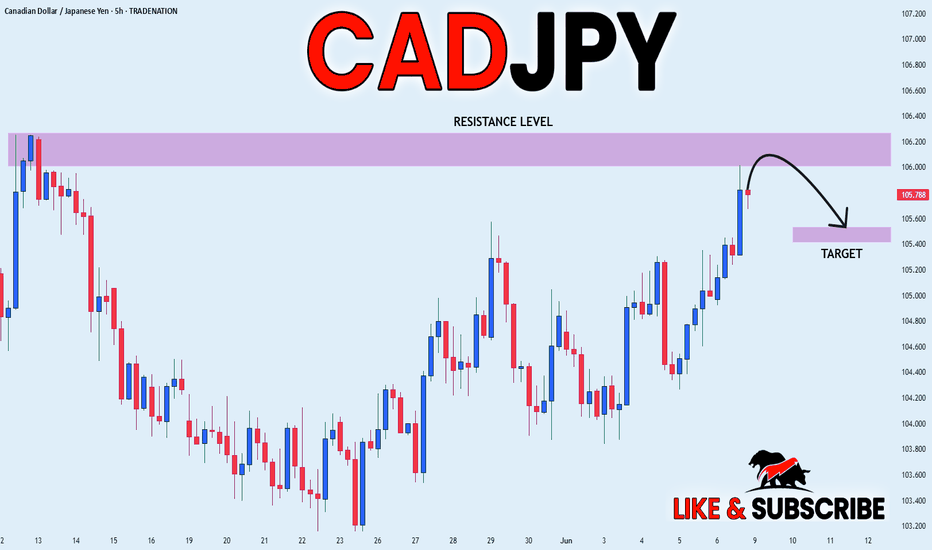

CAD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

CAD/JPY pair is in the uptrend because previous week’s candle is green, while the price is obviously rising on the 1H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 105.344 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

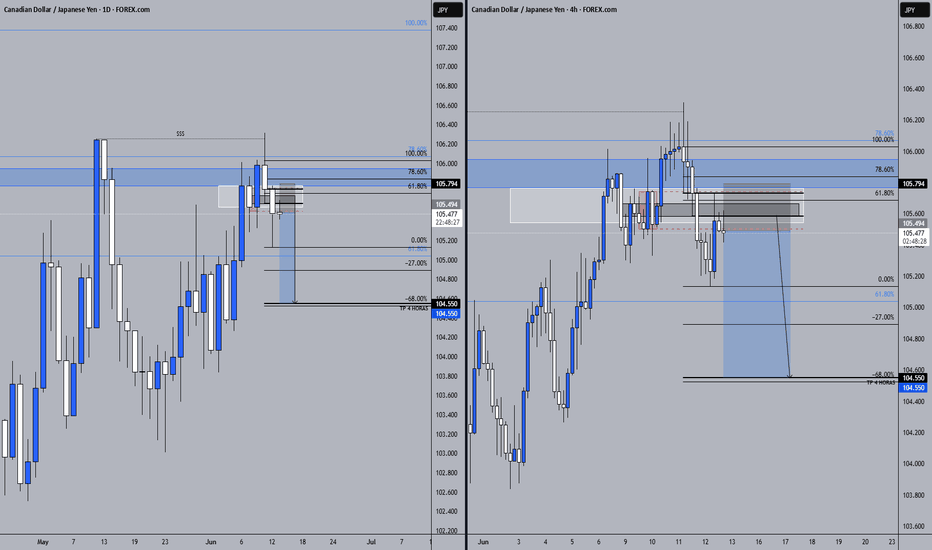

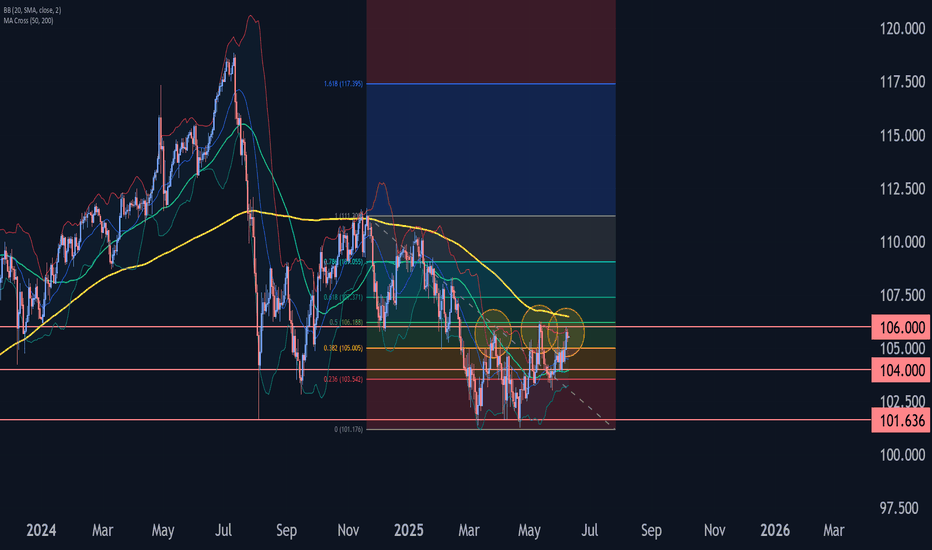

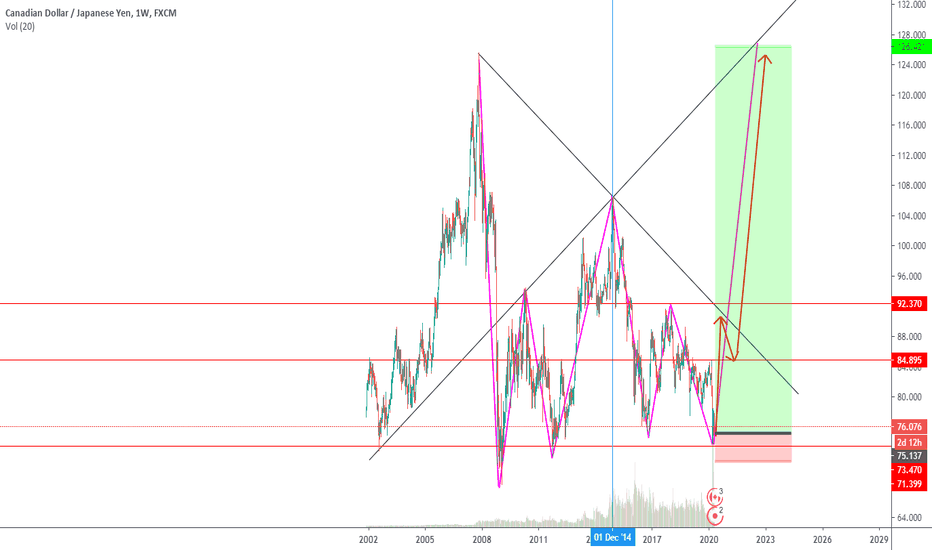

CADJPY Wave Analysis – 9 June 2025

- CADJPY reversed from resistance area

- Likely to fall to support level 104.00

CADJPY currency pair recently reversed down from the resistance area between the pivotal resistance level 106.00 (which has been reversing the price from March), upper daily Bollinger Band and the 50% Fibonacci correction of the downward impulse from January.

The downward reversal from this resistance area stopped the previous short-term correction 2.

Given the strength of the resistance level 106.00 and the daily downtrend, CADJPY currency pair can be expected to fall to the next support level 104.00.

CADJPY: Bullish Momentum vs. Overextension Risk!🚀 CADJPY Analysis 🚀

CADJPY is in a strong bullish trend on the 4H chart, with momentum still pushing higher. However, I’m noticing signs that the pair might be overextended 📈. While there could be a bit more upside, both the weekly and daily timeframes show price pushing into previous highs, which often leads to a retrace back to equilibrium ⚖️.

🔍 Key Levels:

I’m watching the Fibonacci 61.8% retracement for a potential pullback, with the 50% level also marked as a key equilibrium zone. I’m not looking to go long at these elevated prices—prefer to wait for a healthy retrace for a more optimal entry 🎯.

💡 Macro Consideration:

We also took a look at the NASDAQ 🧑💻, since tech stocks can impact the JPY as flows move between risk assets and safe havens. With a lower high forming on the NASDAQ, risk sentiment could shift, impacting CADJPY as well.

🗓️ It’s Monday—let’s trade cautiously and wait for the best setups! Patience pays.

Not financial advice.

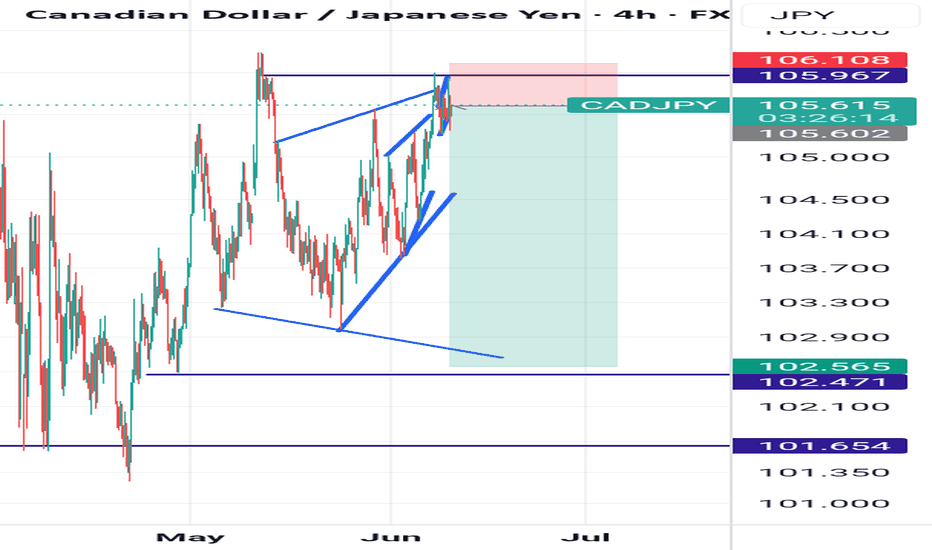

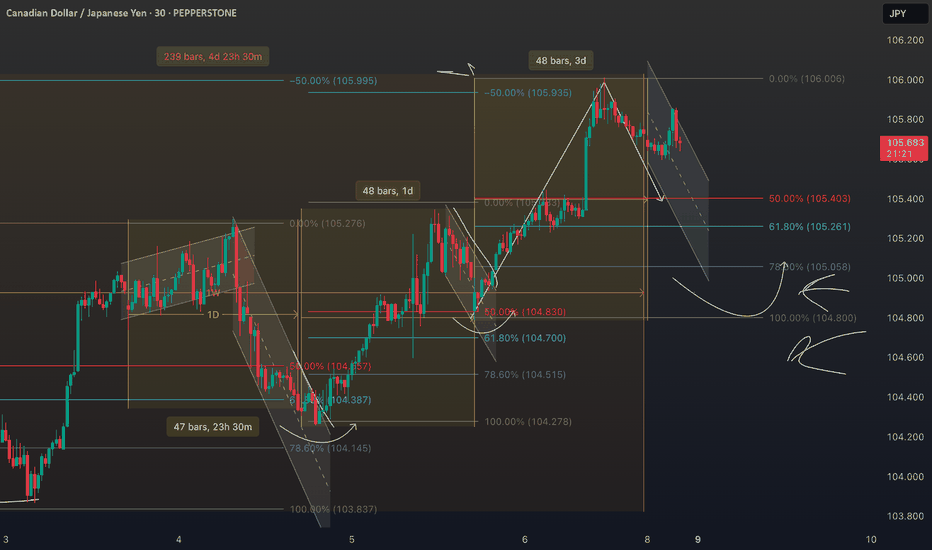

CADJPY SHORTHello traders, here is my own thoughts on CADJPY Daily and 1h TF. On the Monthly/Weekly and Dily, the mkt is trending to the down side and since on the 10th of March 2025 the mkt have been in a consolidation up till now inside a support and resistance pivot point aera at the top and at the bottom. Right now i can see that price is at 105.639 aera the S/R/PP aera on the weekly/daily on to the 1h TF. So at this point i will be looking go short after a price action and a bearish candlestick pattern formed.

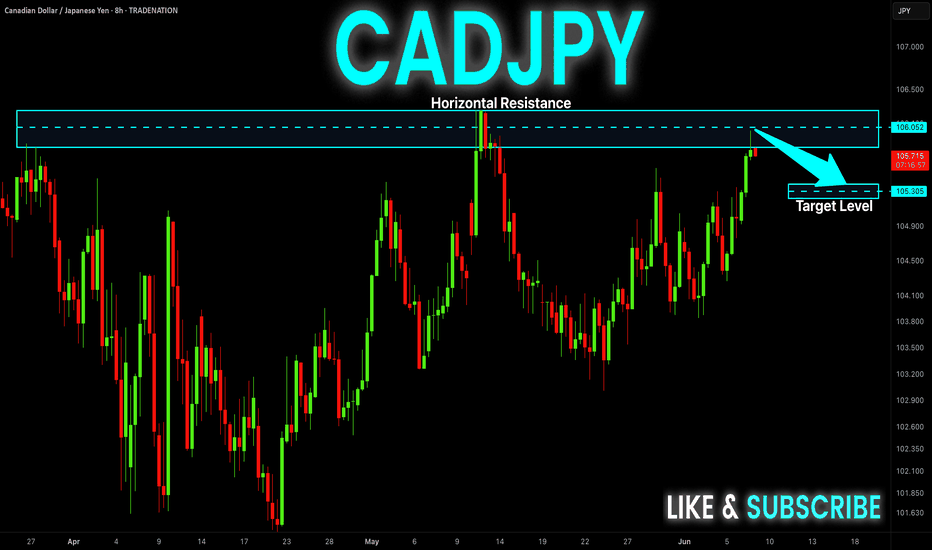

CAD-JPY Pullback Expected! Sell!

Hello,Traders!

CAD-JPY made a retest of

The strong horizontal resistance

Level of 106.083 and as you

Can see the pair is already

Making a local pullback from

The level which sends a clear

Bearish signal to us therefore

We will be expecting a

Further bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

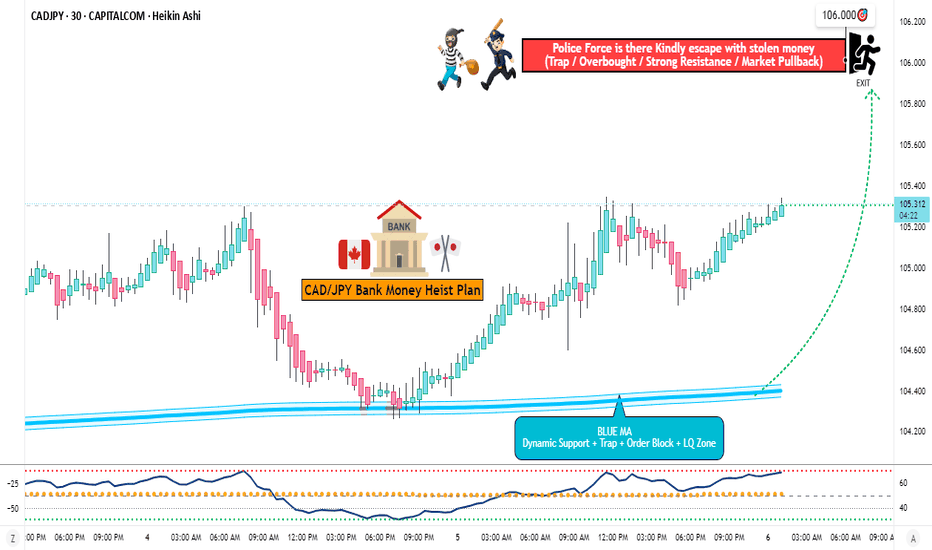

CAD/JPY "Loonie-Yen" Forex Bank Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "Loonie-Yen" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for pullback entries

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 30Min timeframe (104.800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 106.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CAD/JPY "Loonie-Yen" Forex Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.☝🏻👆🏻☝🏻👆🏻

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAD_JPY SHORT FROM RESISTANCE|

✅CAD_JPY has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 106.269

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

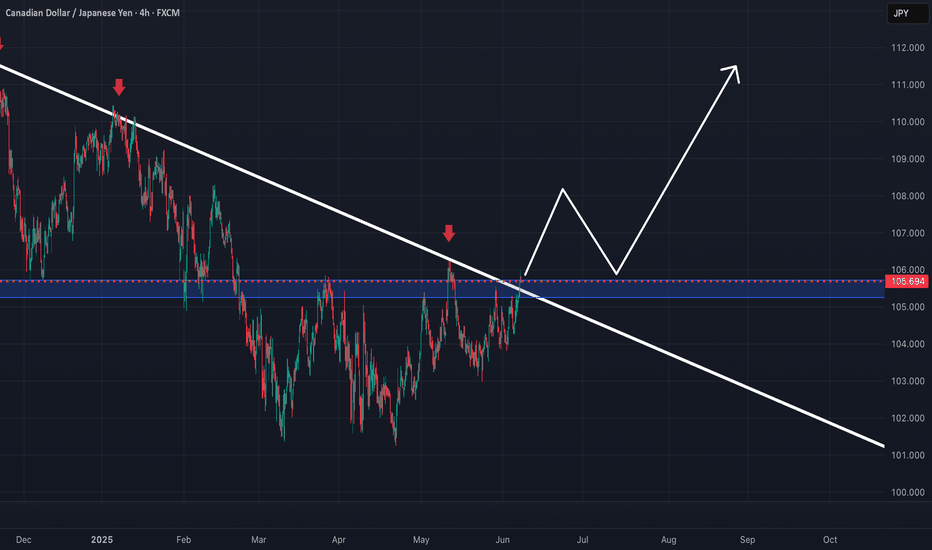

Potential Long Opportunity on CADJPYReasons I think this pair will rise:

- RSI was oversold on Daily and 4H Chart.

- Price gave us a double bottom which is a sign of trend weakness

- Trend line tested multiple times and may be suitable for a breakout

- Price printed a higher low after making contact with the trend line

What do you think?

CADJPY SELL IDEAPrice finally broke and closed above the resistance on the daily chart. The market is currently in an uptrend, but I see the price coming in for a retest on H4 before a significant upside move. I'll be on the lookout for a reversal signal on lower TFS for an entry in the new week.

Feel free to share your thoughts...

CADJPY: Bearish Forecast & Bearish Scenario

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the CADJPY pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CADJPY 4H Short Setup📘 Educational Caption for Your Trading Chat

🟥 CADJPY 4H Short Setup (Smart Money Strategy)

I'm currently short on CADJPY from 105.039 after price tapped into a refined supply zone and rejected aggressively, aligning with Smart Money Concepts (SMC) structure.

📉 Entry: 105.039

🎯 Target: 103.258

🛡️ Stop Loss: 105.642

⚖️ Risk-Reward: ~1:2.9 — decent asymmetric opportunity

This trade follows a recent Break of Structure (BOS) and a return to a premium supply area. The market showed signs of distribution before entry, increasing the probability of continuation downward.

🔔 Note: Smart entries rely on refined zones, not impulsive moves. Wait for confirmation, and let the market come to you.

⚠️ Disclaimer: Shared for educational purposes only. Always perform your own analysis and manage risk appropriately.