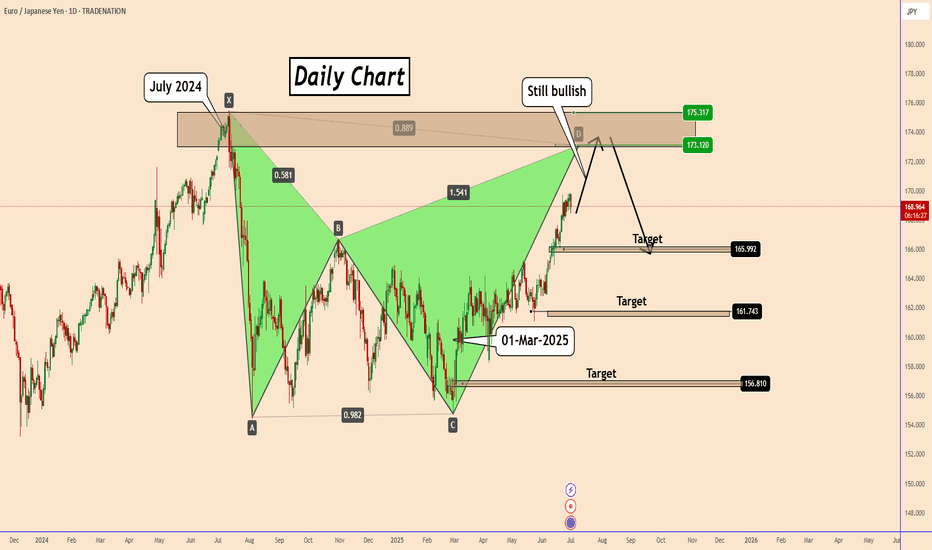

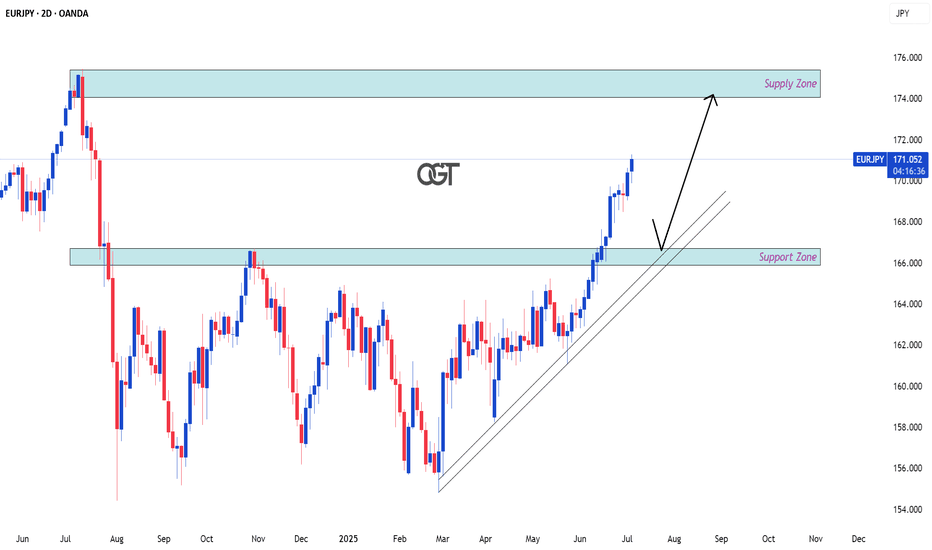

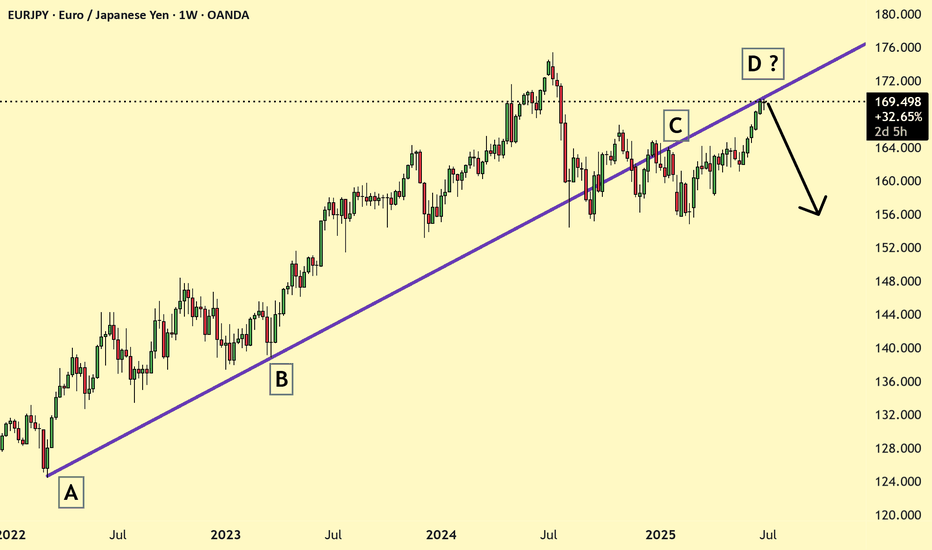

EURJPY is rising to 173 for a bearish and larger pattern.EURJPY is rising to 173 for a bearish and larger pattern.

Since the beginning of March 2025, EURJPY started an uptrend and is still rising in a clear way with no signs of reversal.

As long as the BOJ has no plans to change its monetary policy statement or make any significant interventions in Forex, then EURJPY can continue to rise higher.

There is a high possibility that Eurjpy will complete a major daily harmonic pattern near 173.00.

Given that EURJPY may be close to the all-time high zone, the reversal could also occur within the zone, but I think EURJPY may start a reversal between 173.00 and the higher level. We can look for sell signals there.

At the moment, EURJPY is rising and may rise to 173.00, although not in a clear way.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JPYEUR trade ideas

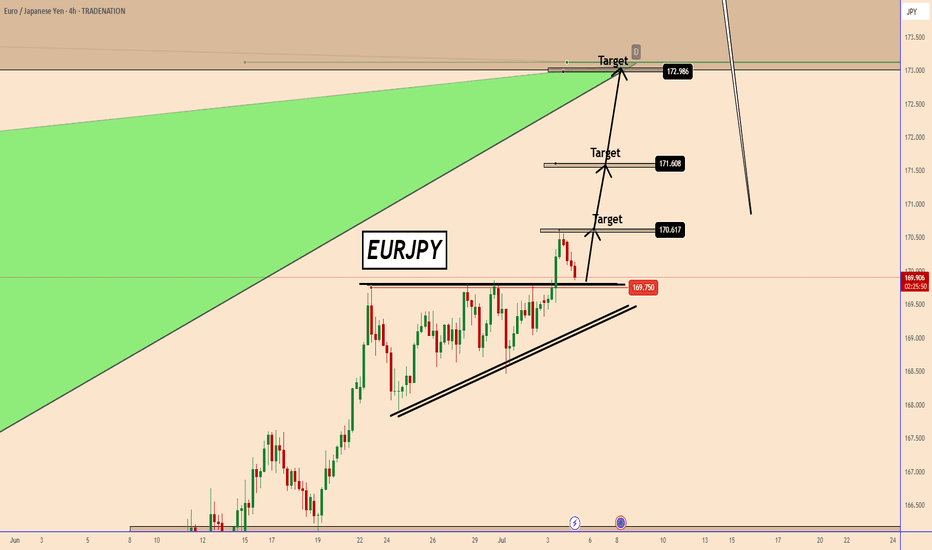

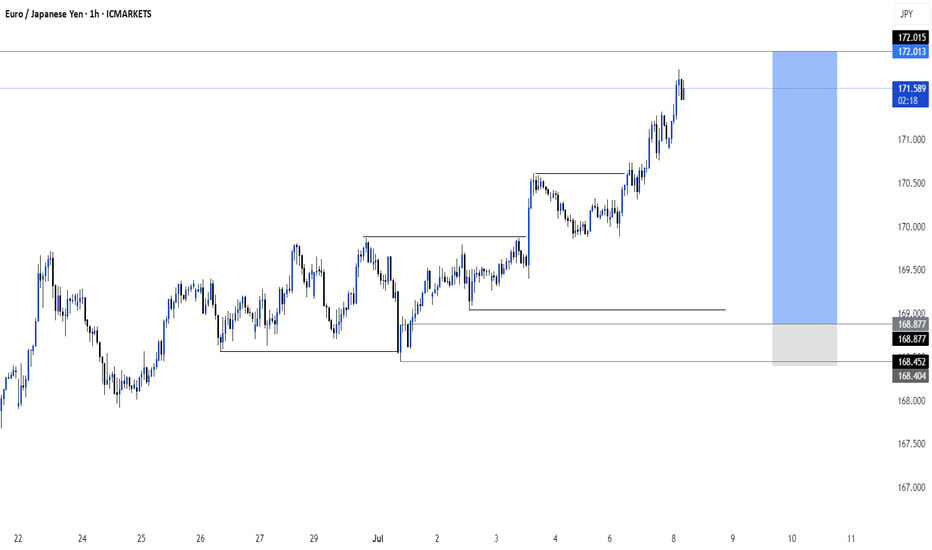

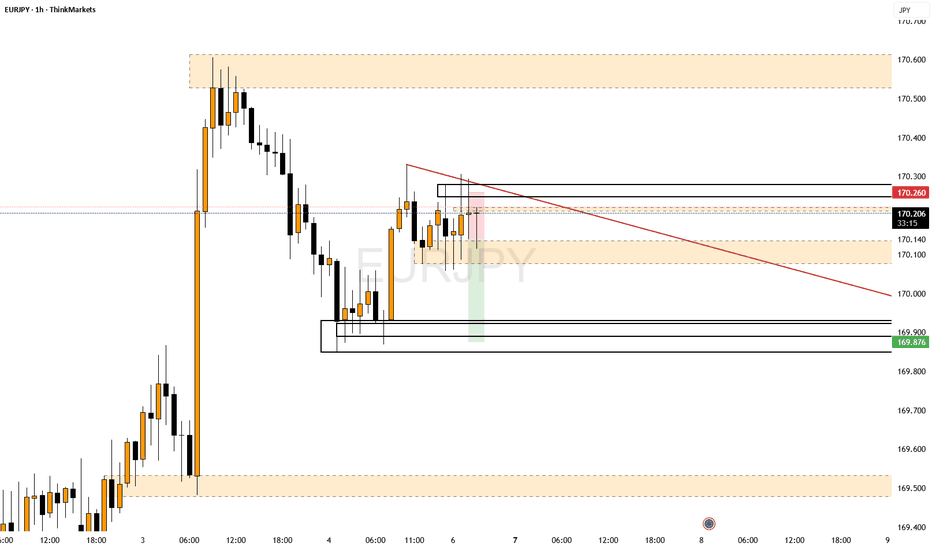

EURJPY: Another Bullish pattern pushing EURJPY to 173 EURJPY: Another Bullish pattern pushing EURJPY to 173

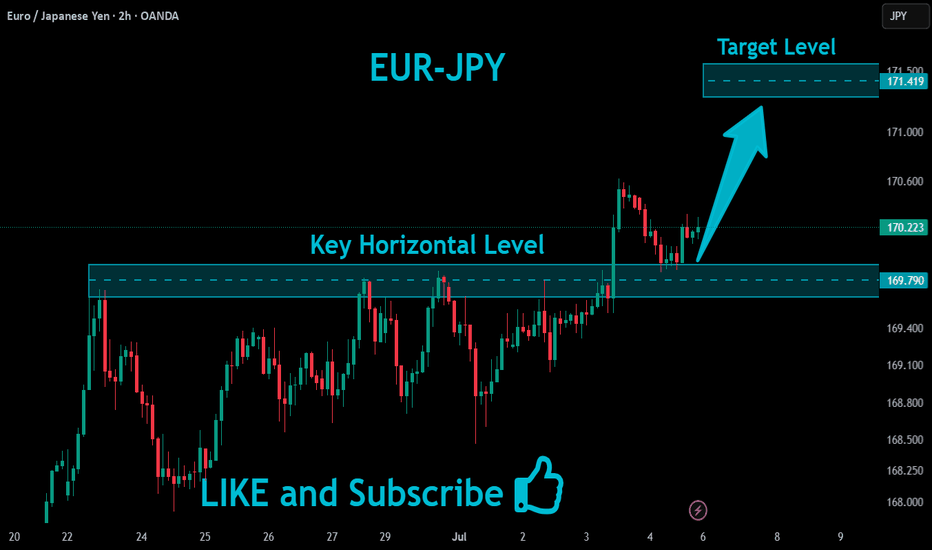

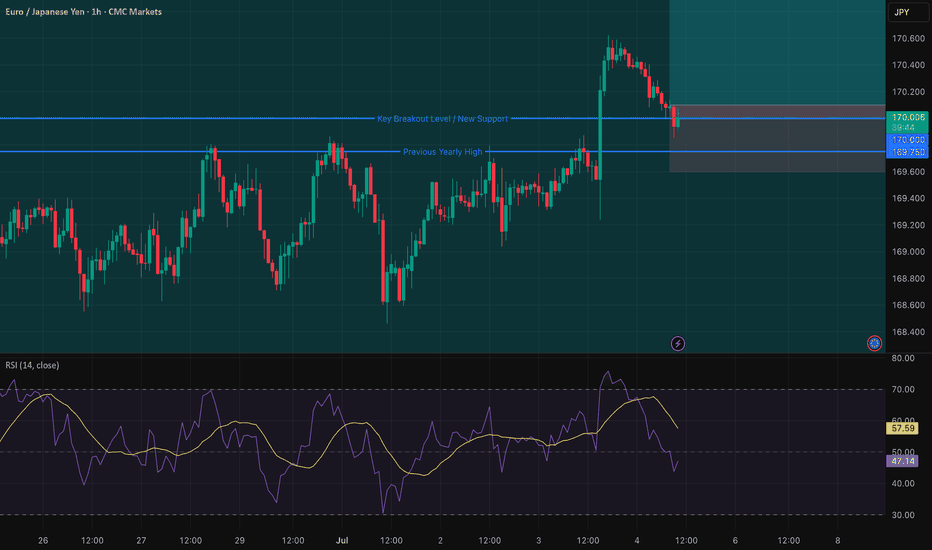

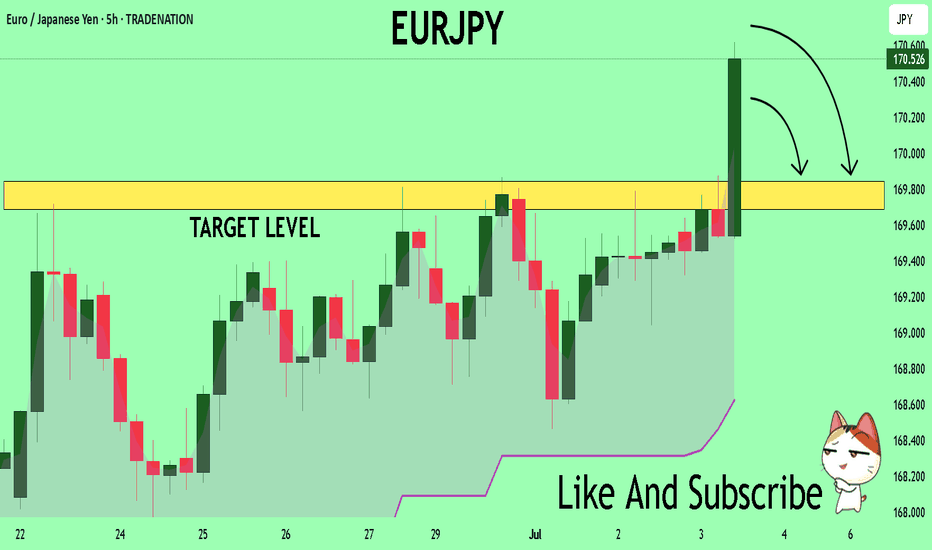

Yesterday, EURJPY confirmed a bullish triangle pattern during the opening of the U.S. market.

EURJPY has already reached 170.60 and is coming back for a retest of the broken resistance before moving higher again.

It's a complex situation, but if the price holds above the 169.75 pattern, the chances of a clear uptrend will increase further.

Remember that the larger pattern will be almost complete near 173.00.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

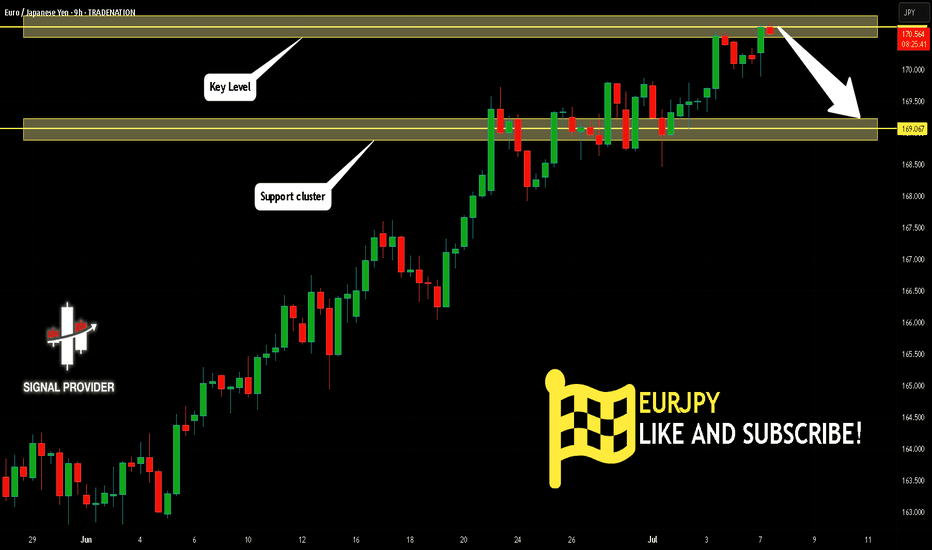

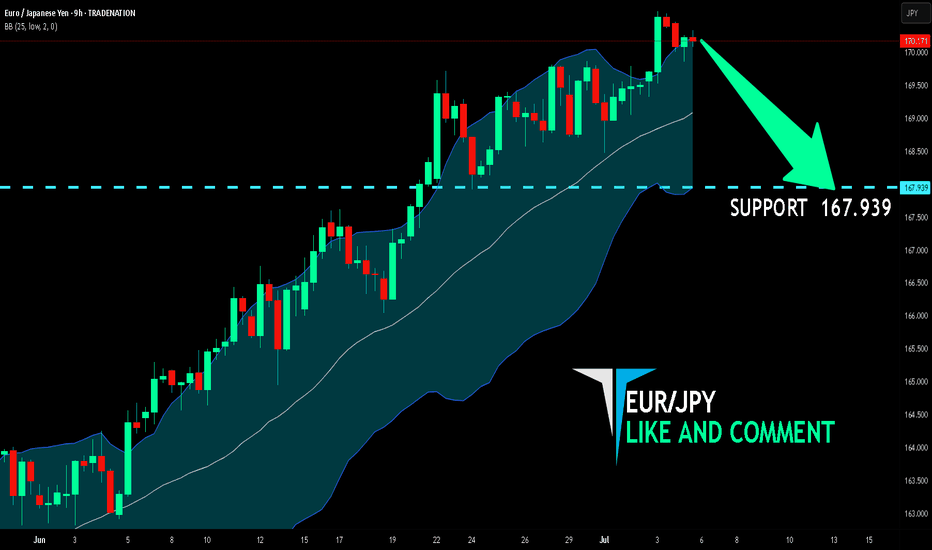

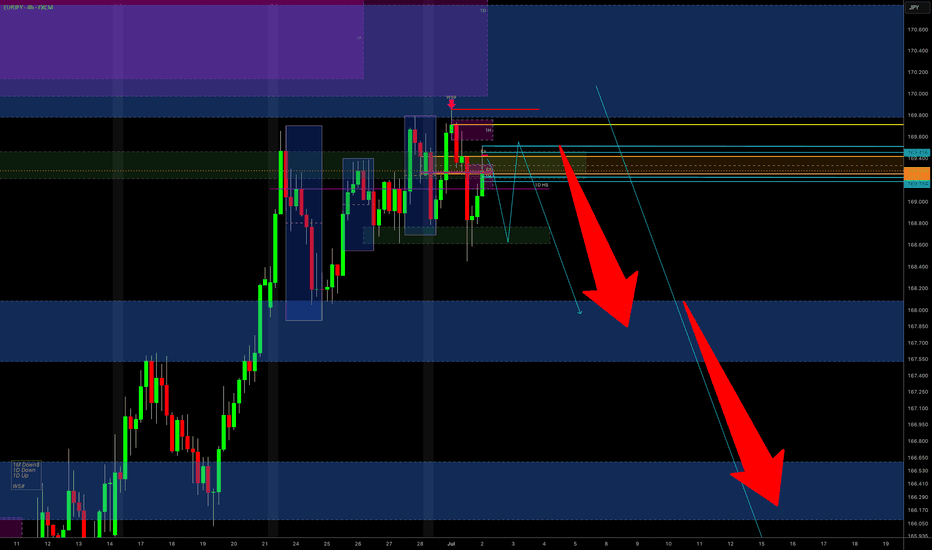

EURJPY Will Go Lower! Sell!

Please, check our technical outlook for EURJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 170.636.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 169.067 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

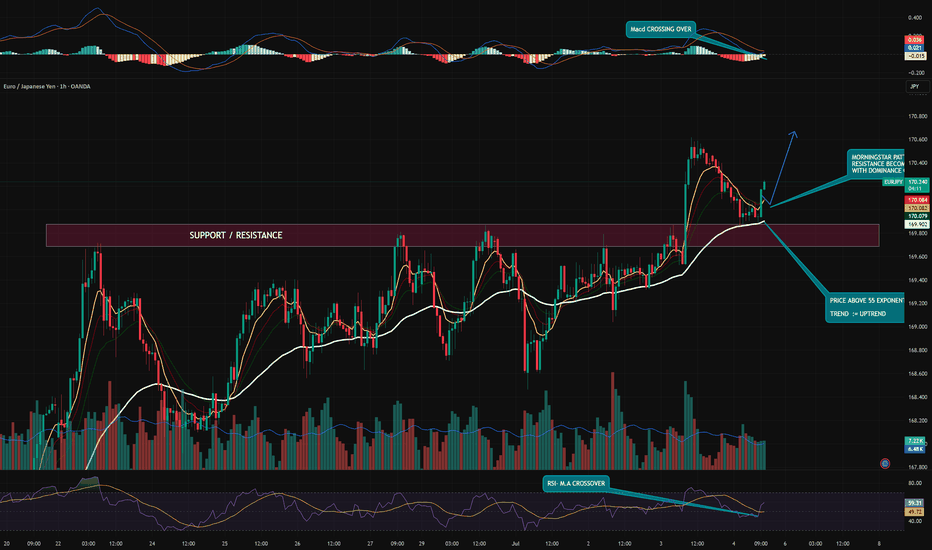

EUR/JPY – Morning Star Reversal with RSI/MA Bullish ConfirmationTechnical Snapshot (1H Timeframe):

✅ Morning Star pattern at key support/resistance zone (169.90–170.00), indicating potential bullish reversal.

📈 Price holds above 55 EMA, confirming structure support and sustained uptrend.

💥 MACD Bullish Crossover signaling renewed upward momentum.

🔄 RSI crossover above its MA from the 50 level – a classic sign of buyer strength resuming.

Bias: Bullish

As long as price sustains above the EMA cluster and doesn’t close below the 170.00 zone, bulls are in control. Watch for a retest + push scenario for low-risk entries.

This idea is for educational purposes only – not financial advice.

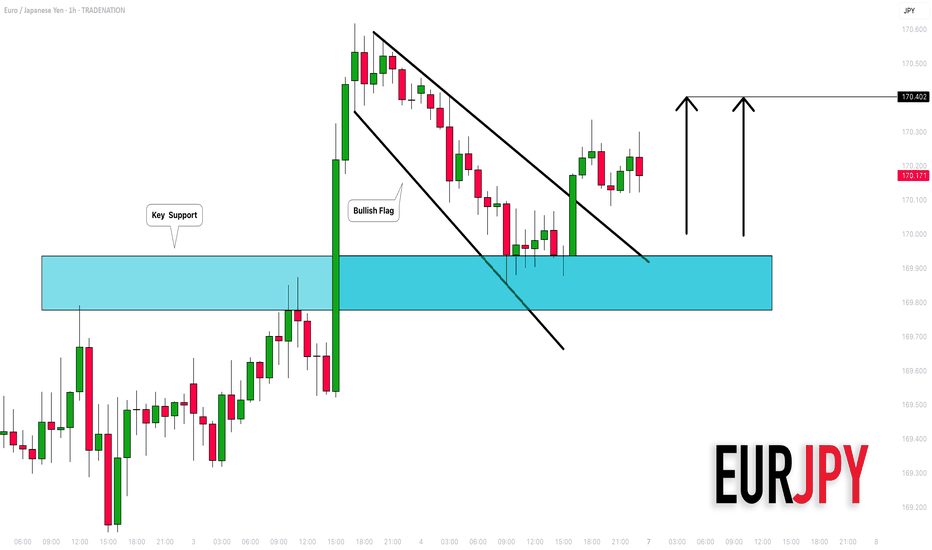

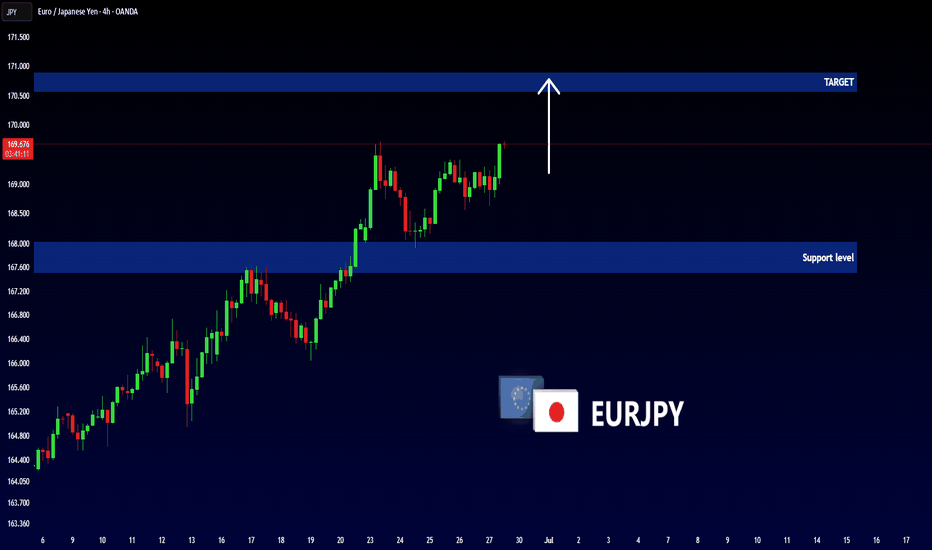

EURJPY: Bullish Outlook Explained 🇪🇺🇯🇵

There is a high chance that EURJPY will continue rising

from an underlined horizontal support.

I see 2 strong price action confirmations:

the price violated a resistance line of a bullish flag

and a neckline of a double bottom pattern.

Goal - 170.4

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

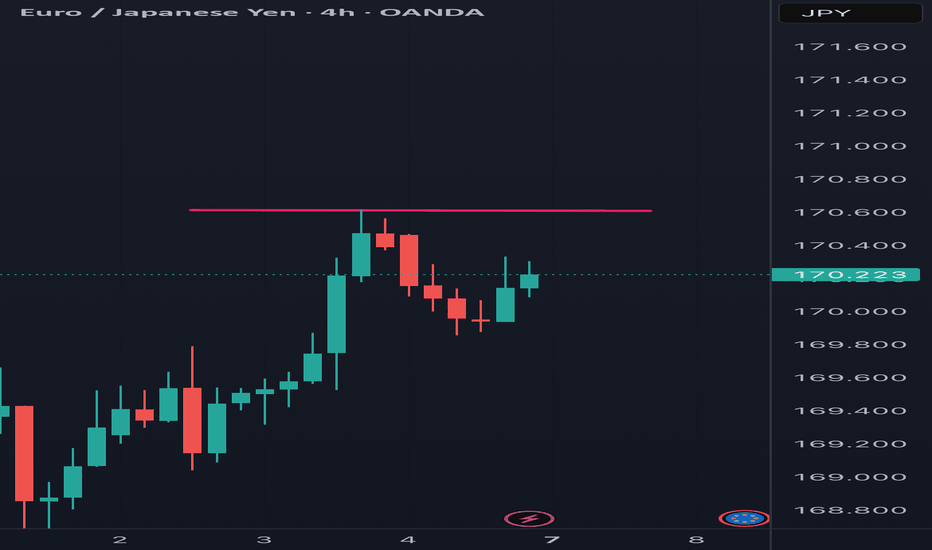

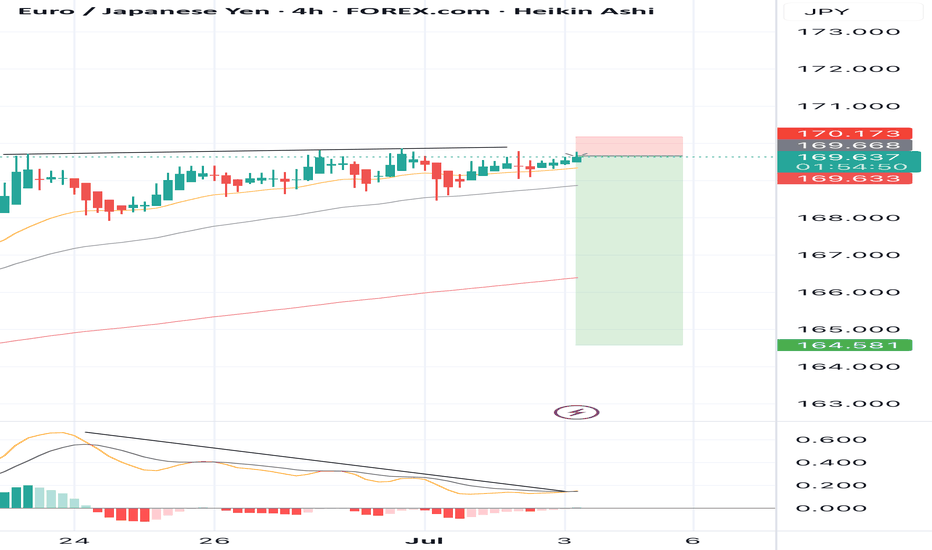

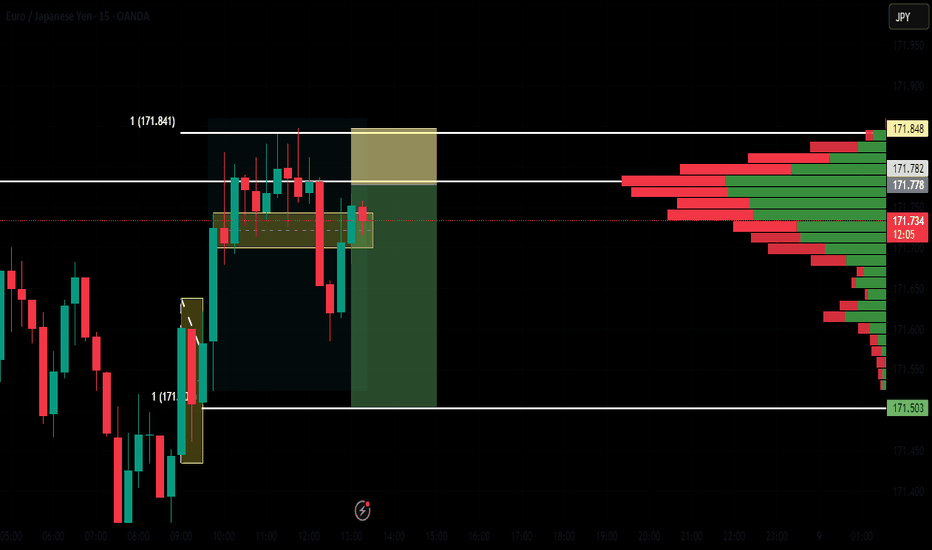

SELL EURJPY for bullish trend reversal STOP LOSS: 170.17SELL EURJPY for bullish trend reversal

STOP LOSS: 170.17

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the MACD already and There is a strong trend reversal on the 4 hour time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we

are looking for the trend reversal and correction push from here .....

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything

Remember to risk only what you are comfortable with….....trading with the trend, patient and good risk management is the key to success here

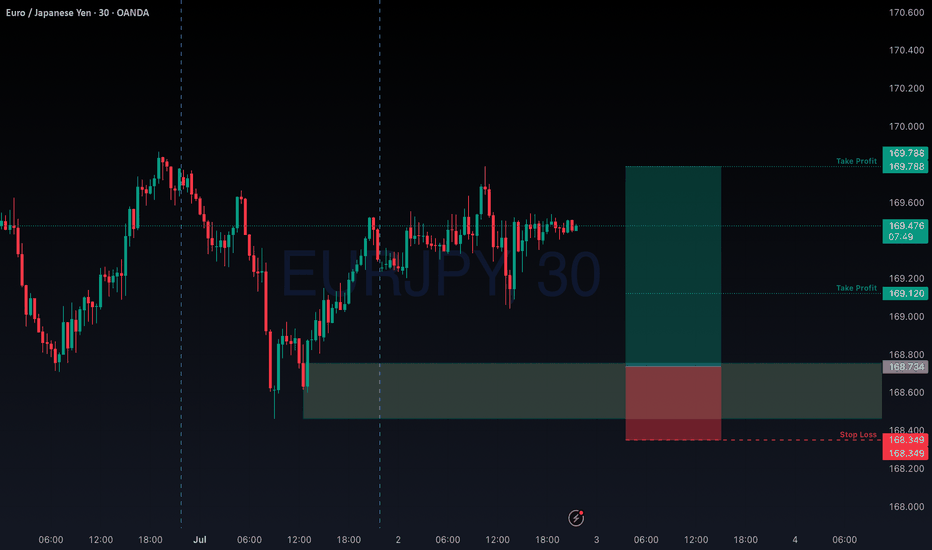

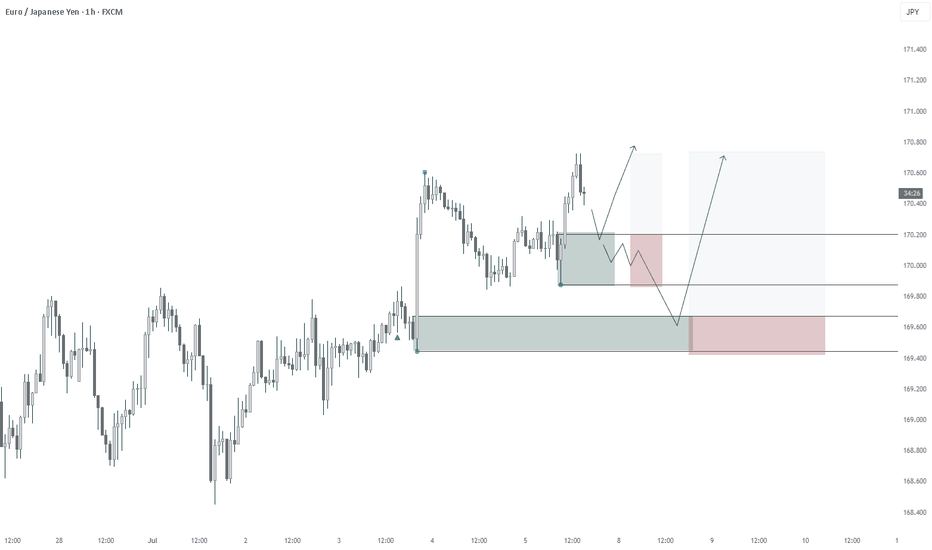

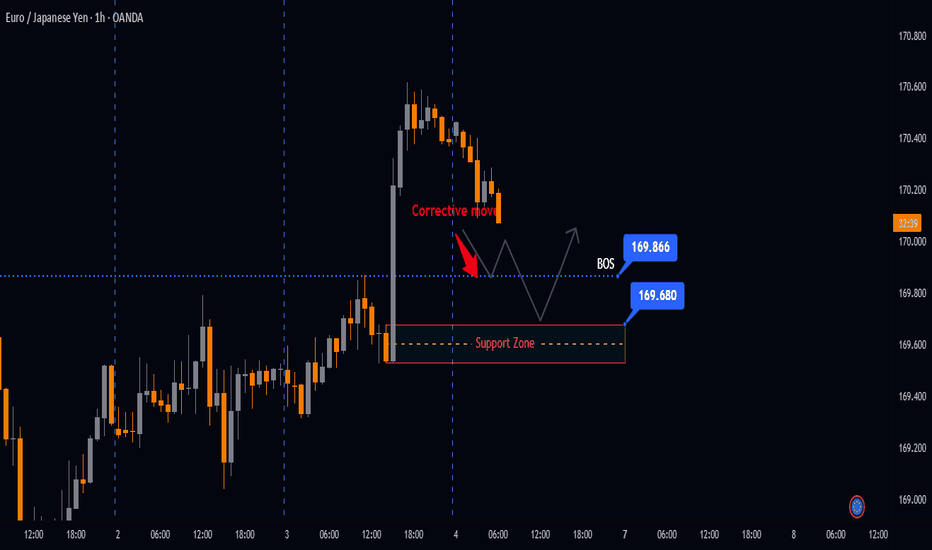

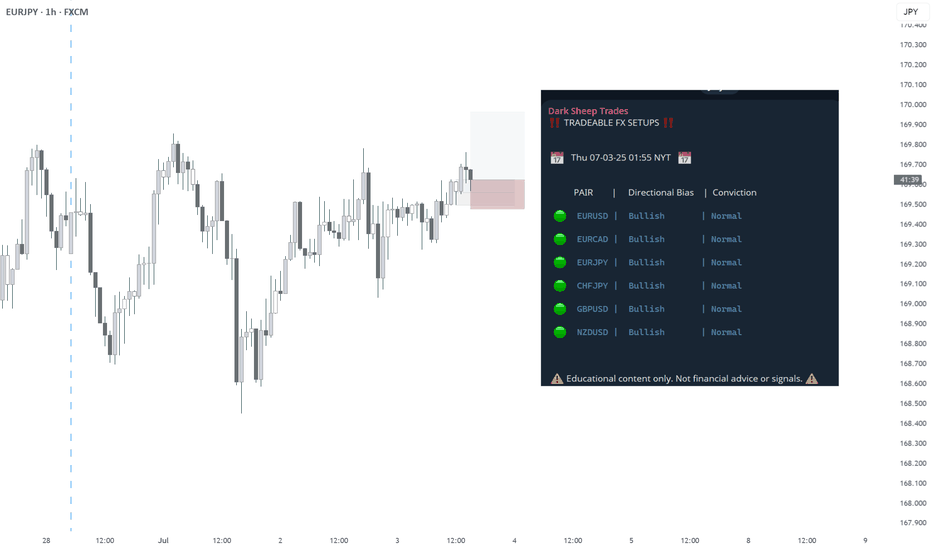

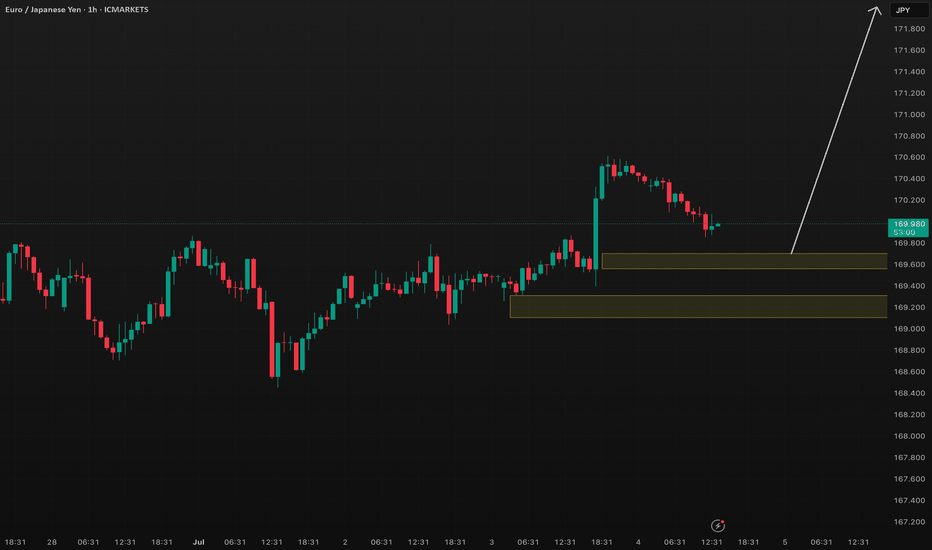

Potential Bullish setups on EURJPYRecapping price action from yesterday, EURJPY broke above 169.866, with momentum appearing to be bullish, a corrective move could be in play and perhaps a continuation towards the upside. If EURJPY remains above our support zone a BULLISH directional bias remains.

Buy zone: 169.866 - 169.680

Target Levels 170.469 - 170.617

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

EUR/JPY: Healthy Correction Expected Before the Next Leg UpWelcome back! Let me know your thoughts in the comments!

** EURJPY Analysis !

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support! Welcome back! Let me know your thoughts in the comments!

EUR/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are now examining the EUR/JPY pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 167.939 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/JPY: Bullish Setup on 170.00 Breakout & Dovish BoJWe've identified a compelling, high-conviction long trade setup on EUR/JPY, perfect for a limit order right now. This trade leverages a powerful combination of fundamental divergence and a confirmed technical breakout, setting the stage for quick execution and potential profit! 🎯💰

Fundamental Rationale: 🌍📊

Japanese Yen (JPY) Weakness: The JPY is under significant bearish pressure. 📉 The Bank of Japan's (BoJ) persistently dovish monetary policy, keeping interest rates at historic lows, creates a wide interest rate differential. This fuels "carry trades," where investors borrow low-yielding JPY to invest in higher-yielding currencies like the Euro, increasing JPY supply. Recent weak economic data, including a decline in Tokyo CPI, reinforces expectations that the BoJ will not hike rates in 2025. Additionally, a global "risk-on" sentiment diminishes the JPY's safe-haven appeal, leading to capital outflow and sustained Yen depreciation. 🐻📉

Euro (EUR) Stability: While the Euro isn't showing explosive bullish momentum, its relative stability provides a crucial counter-balance to the weakening Yen. 🇪🇺 The European Central Bank (ECB) is inclined to maintain its current policy, and recent Eurozone inflation data hasn't significantly altered expectations for further rate cuts in H2 2025. This steady footing, paired with the pronounced JPY weakness, creates a compelling bullish case for EUR/JPY. The Euro's role is to be a stable anchor against a fundamentally weak JPY, allowing the cross to climb. ⚖️

Technical Setup: 📊✨

Decisive Breakout Confirmed: EUR/JPY has achieved a powerful and decisive breakout above the critical psychological resistance of 170.00 and its previous yearly high of 169.75. This is a monumental technical event! Such a sustained move above key long-term barriers signals strong underlying buying pressure and confirms a "new trigger for the bulls," indicating a high probability of continued uptrend. 🚀⬆️

High-Probability Entry Strategy: Our entry strategy is designed for a quick and successful fill. Following the confirmed breakout, we anticipate a classic "breakout and retest" phenomenon, where price pulls back to retest the former resistance (now new support). By placing a limit order slightly below the current market price, at 170.10, we aim to catch this anticipated pullback, securing an optimal entry with a tighter risk profile. 🔄🎯

Clear Resistance Target: Our single Take Profit target is strategically set at 170.90, just below the next significant resistance: the 78.6% Fibonacci retracement level at 170.93. This level, derived from a previous long-term decline, represents a key area where price might encounter resistance. Targeting slightly below it increases the probability of the TP being hit before any potential reversal. 🎯✅

Trade Parameters: 📋✨

Currency Pair: EUR/JPY 💶🇯🇵

Direction: Long (Buy) ⬆️

Entry (Limit Order): 170.10

Take Profit (TP): 170.90

Stop Loss (SL): 169.60

Risk-Reward Ratio: 1.6:1 (A favorable ratio for a high-probability setup!) ✅

EURJPY What Next? SELL!

My dear friends,

My technical analysis for EURJPY is below:

The market is trading on 170.54 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 169.84

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURJPY BUY TRADE PLAN### 🔥 Pair + Date

**EURJPY – July 4, 2025**

---

### 📋 Plan Overview Table

| Type | Direction | Confidence | R\:R | Status |

| ---------------- | --------- | ---------- | ----- | ------------- |

| Momentum Retrace | Long | 78% | 2.8:1 | Active Watch |

| Value Limit Play | Long | 83% | 3.5:1 | Pending Setup |

---

### 📈 Market Bias & Type

* **Market Bias:** Bullish continuation on macro + structural trend (despite short-term pullback).

* **Type:** Continuation with retrace entry

---

### 🔰 Confidence Level

* **Overall Confidence:** 78% Momentum Retrace, 83% Deep Value

* **Breakdown:**

* Macro alignment: +7 sentiment

* Structure: Valid higher high / higher low formation

* Confirmation: Pending at retrace zone

---

### 📍 Entry Zones

* **Primary (Momentum Retrace):** 169.55 – 169.70 zone (structural retrace zone to broken high / support flip)

* **Secondary (Value Limit Play):** 169.10 – 169.30 (deep value at prior breakout cluster + H4 origin block)

---

### ❗ SL with Reasoning

* **Momentum Retrace SL:** 169.20 (below key low + liquidity sweep risk zone)

* **Value Limit SL:** 168.80 (below value zone + invalidation of bullish structure)

---

### 🎯 TP1/TP2/TP3 Targets

* **TP1:** 170.60 (recent swing high)

* **TP2:** 171.20 (expansion target)

* **TP3:** 172.00 (macro extension projection)

---

### 🧠 Management Strategy

* Scale out at TP1 (50%)

* Move to breakeven on rest after TP1 hit

* Trail above H1 swing lows post TP2

---

### ⚠️ Confirmation Checklist

✅ Bullish candle on H1 / M30 at entry

✅ Session: London / NY overlap preferred

✅ Volume spike or wick rejection on retrace

---

### ⏳ Validity

* **Momentum Retrace:** H1 plan valid 12-16 hours

* **Deep Value:** H4 plan valid 48 hours+

---

### ❌ Invalidation Conditions

* Clean break + close below 168.80 on H4

* Risk sentiment flips risk-off sharply (JPY safe haven flows surge)

---

### 🌐 Fundamental & Sentiment Snapshot

* Macro bias: Bullish EURJPY continuation (ECB hawkish tilt + BOJ still ultra-loose policy)

* Recent data: Post-NFP risk sentiment neutral-positive, no fresh JPY strength triggers

* Sentiment: +7 (supports trend continuation)

---

### 📋 Final Trade Summary

👉 EURJPY bullish continuation play. Primary focus on momentum retrace entry \~169.55–169.70 with deep value as secondary optional zone. SLs tailored per entry zone, R\:R targets healthy.

---

⚠ **Reminder:** This is *not* investment advice. Forex trading carries substantial risk. Use with licensed institutions only.

EURJPY Sell- Go for sell

- Refine entry with smaller SL for better RR, if you know how

- keep looking for sell even if price goes one more up

A Message To Traders:

I’ll be sharing high-quality trade setups for a period time. No bullshit, no fluff, no complicated nonsense — just real, actionable forecast the algorithm is executing. If you’re struggling with trading and desperate for better results, follow my posts closely.

Check out my previously posted setups and forecasts — you’ll be amazed by the high accuracy of the results.

"I Found the Code. I Trust the Algo. Believe Me, That’s It."