JPYUSD trade ideas

Bears On The Prowl, Key Supports In FocusAnalysis

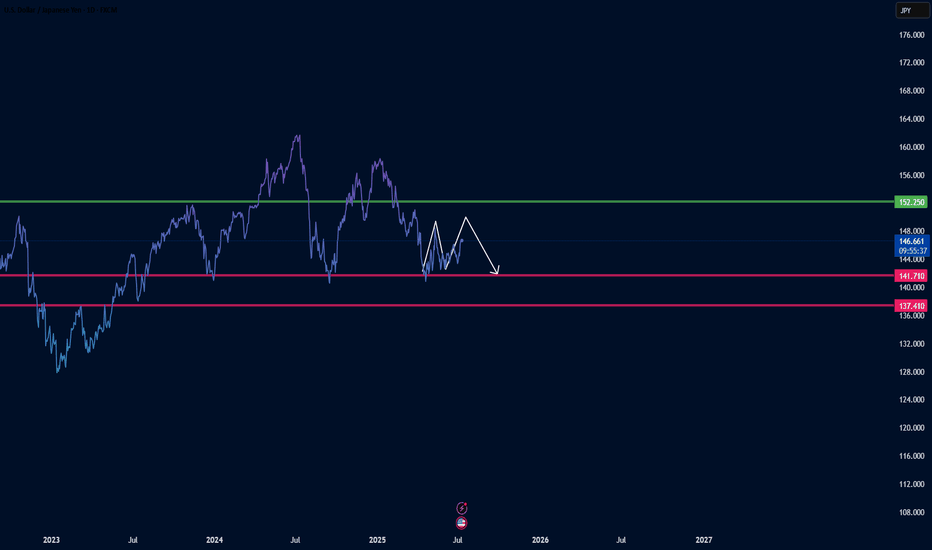

USDJPY has faced downward pressure recently and is currently trading below a key resistance level around 152.250. This level acts as a significant barrier to upward movements, and the inability to decisively break above it reinforces our bearish outlook.

Key Observations

🔹 Dominant Bearish Pressure: Despite fluctuations, bulls (buyers) seem to be struggling to maintain higher levels, while bears (sellers) are asserting pressure.

🔹 Key Resistance: The 152.250 level serves as a strong resistance. As long as the price remains below this level, the bearish view will prevail.

🔹 Crucial Supports: The levels of 141.710 and 137.410 are acting as critical support zones for this pair. A break below either of these levels could pave the way for further declines.

🔹 Momentum Indicators: (Here, you can add details about specific indicators that confirm your bearish view. For example: "The RSI is moving towards oversold territory, suggesting continued downside momentum," or "The MACD is showing a bearish crossover, indicating potential for further weakness.")

Potential Scenarios

🔴 Primary Scenario (Bearish): As long as USDJPY remains below the 152.250 resistance, we anticipate continued downward pressure. The bears' initial target will be to test and break the 141.710 support.

🔻 Break of First Support: If the 141.710 support is broken decisively (with strong candles and significant volume), this would be a strong bearish signal. In this scenario, the next target for the price would be to test the lower support at 137.410. A break below this level could lead to even deeper declines.

🟢 Alternative Scenario (Bullish): Should USDJPY manage to decisively break above the 152.250 resistance and sustain itself above it, our bearish view would be temporarily invalidated, and we might see a corrective upward movement. However, until this occurs, the focus remains on the bearish scenario.

Fundamental Considerations

🔘 US-Japan Interest Rate Differential: The significant interest rate differential between the US Federal Reserve and the Bank of Japan continues to be a major factor. Any shift in market expectations regarding the monetary policies of these two central banks could impact USDJPY.

🔘 Bank of Japan (BoJ) Policy: Any signs of a change in the BoJ's ultra-loose monetary policy (e.g., an interest rate hike or a reduction in asset purchases) could strengthen the JPY and put downward pressure on USDJPY.

🔘 US Economic Data: Upcoming US economic data, particularly inflation figures and statements from Federal Reserve officials, could influence the dollar's value and, consequently, USDJPY.

🍀HAVE PROFITABLE TRADES🍻

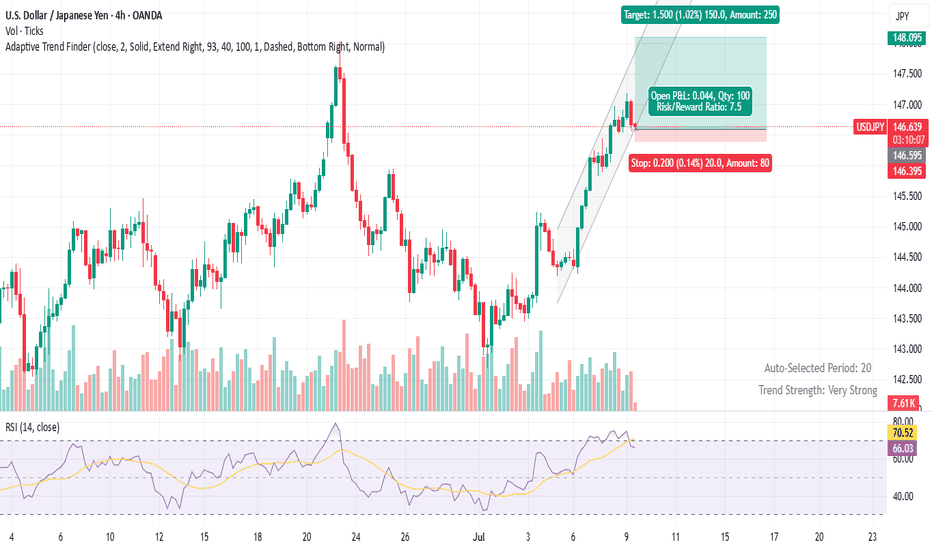

USD/JPY Long Trade SetupBuy dips - 146.50-146.60

Stop Loss -145.80 - Below retest zone; invalidates breakout.

TP-1 148.80 - Scale 50 % Pattern target / June high cluster.

TP-2 150.00 - Round-number magnet, option strikes.

Rationale

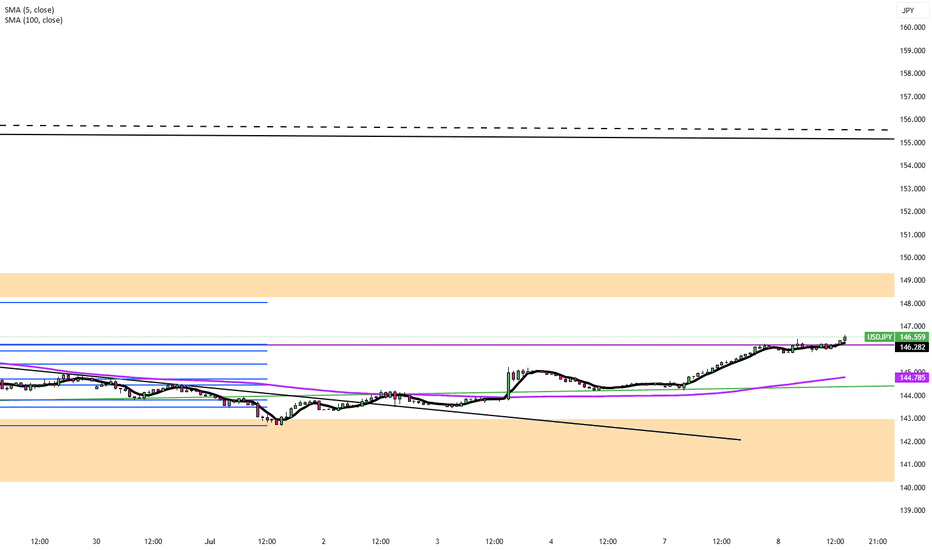

The dollar-yen cross has snapped out of its early-summer drift and vaulted back above the 100-day simple moving average for the first time since February, reaching ¥147.19 on 9 July – a two-and-a-half-week high – as the greenback rides an upswing in U.S. yields and tariff-driven inflation fears. The technical breakout puts the familiar 148.00/150.00 band – the June swing high and the psychological round number – back in play for trend-followers over the next several sessions.

Policy divergence as wide as ever

Federal Reserve – higher-for-longer: Minutes from the June FOMC showed staff pushing inflation projections higher and flagging “upside risks” should tariff pass-through accelerate, reinforcing the market’s view that rate cuts will be pushed into Q4 at the earliest. Five straight sessions of rising Treasury yields have followed, lifting the 10-year to 4.45 % and widening the U.S.–Japan real-rate gap.

Bank of Japan – stuck on hold: Former BOJ board member Makoto Sakurai told Reuters the central bank will “wait at least until March 2026” before considering another hike, as Trump’s 25 % tariff on Japanese goods (effective 1 August) clouds the export outlook and will likely force the BOJ to cut its growth forecast at the 31 July Outlook Report. With headline CPI still only just above target and real wages contracting.

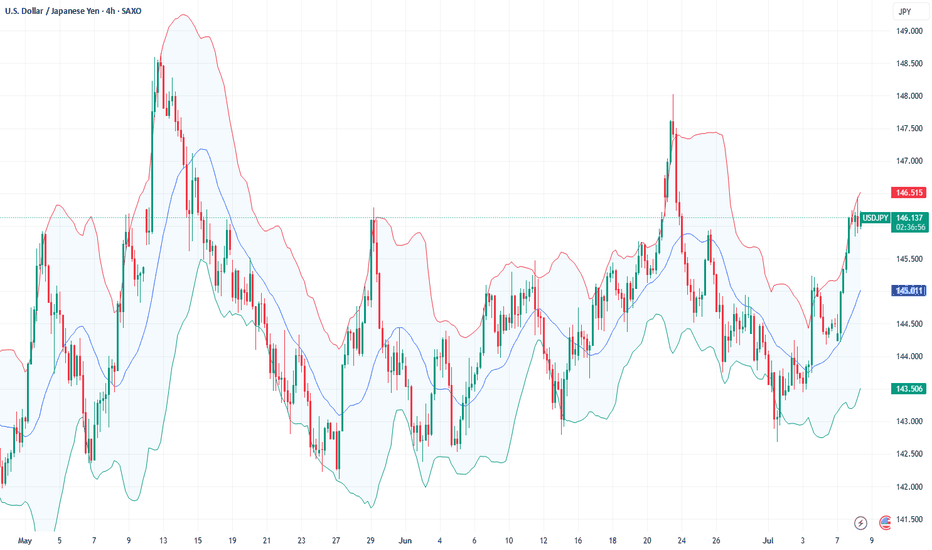

Yen Falls After Trump's 25% Tariff on JapanThe Japanese yen weakened beyond 146 per dollar on Tuesday, hitting a two-week low after President Trump confirmed a 25% tariff on Japanese imports starting August 1, lower than the earlier 35% threat but still above the standard 10%. Japan’s Prime Minister Ishiba pledged to keep negotiating for a favorable outcome. Although Japan’s May current account surplus came in stronger than expected, disappointing wage growth limited hopes for further Bank of Japan rate hikes, adding pressure on the yen.

Key resistance is at 146.20; major support at 144.85.

Fundamental Market Analysis for July 8, 2025 USDJPYThe yen remains under pressure from trade frictions. President Donald Trump has confirmed 25 percent tariffs on Japanese goods effective 1 August, fuelling U.S.-inflation expectations and reducing the odds of a near-term Fed rate cut. Ten-year Treasury yields have climbed above 4.45 percent, while the spread over equivalent JGBs hovers near 380 basis points—supportive for the dollar.

Japan’s domestic backdrop offers little relief. Nominal wage growth has slowed for a third straight month, and real household incomes have posted their deepest decline in twenty months. The weak earnings momentum complicates the Bank of Japan’s exit strategy and keeps ultra-loose policy firmly in place, encouraging further capital outflows from the yen.

Against this backdrop, USD/JPY is consolidating above its 100-day moving average around 146.40–146.50. Absent a sudden flight to safe-haven assets, the pair could break 147.00 in the coming sessions, while the 145.950–146.000 zone is widely viewed as an attractive area to add to long positions.

Trading recommendation: BUY 146.250, SL 145.950, TP 147.000

USDJPY InsightHello to all our subscribers!

Please feel free to share your personal opinions in the comments.

Don't forget to like and subscribe!

Key Points

- U.S. President Trump has officially announced that he will sign an executive order extending the reciprocal tariff suspension deadline to August 1st.

- Through a post on Truth Social, President Trump revealed that he had first sent tariff letters to allies South Korea and Japan, addressed directly to their heads of state, stating that a 25% tariff would be imposed on both countries starting August 1st.

- Hajime Takata, a member of Japan’s Monetary Policy Board, hinted at the possibility of additional rate hikes, stating: “If solid capital investment, wage increases, and the sustainability of price pass-through can be confirmed, we will need to shift gears one step at a time.”

This Week's Major Economic Events

+ July 8: Reserve Bank of Australia (RBA) Interest Rate Decision

+ July 9: Release of FOMC Meeting Minutes

+ July 10: Germany’s June Consumer Price Index (CPI)

+ July 11: UK May GDP Report

USDJPY Chart Analysis

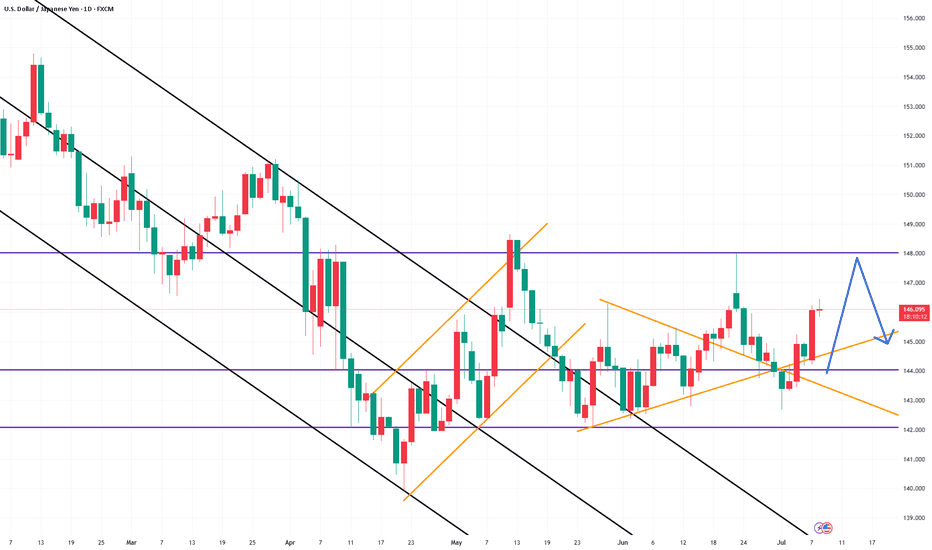

The pair rebounded near the 142 level, showing upward momentum. This appears to reflect the impact of Trump’s announcement of high tariffs on Japan.

If negotiations proceed, the upward trend may stall. In such a scenario, a potential high around 148 is likely.

However, if the 148 level is breached, there could be an additional rally toward the 151 level.

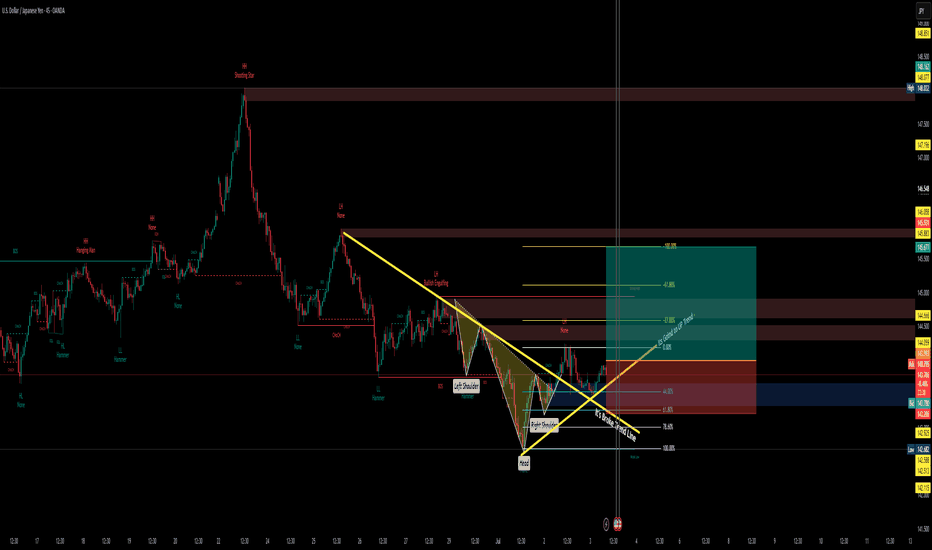

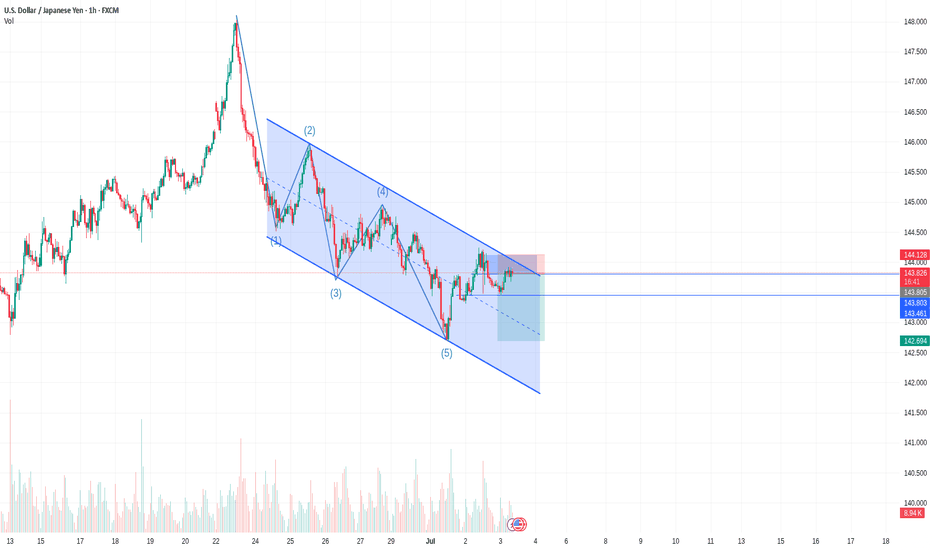

USDJPY1. Inverted Head and Shoulders Pattern

This is a classic bullish reversal pattern.

You've marked the left shoulder, head, and right shoulder, and the neckline is broken to the upside.

Breakout confirms trend reversal from bearish to bullish.

2. Break of Trendline

A long-term bearish trendline was clearly broken.

Price broke above it with momentum, showing bullish strength.

3. Fib Confluence

Entry area is around the 61.8%–78.6% Fibonacci retracement zone.

Combined with support zone = high-probability reversal area.

4. Change of Character (CHoCH)

CHoCH confirms that the market has shifted structure from lower highs/lows to potential higher highs/lows.

You can see the higher low (HL) forming already.

5. Strong Bullish Candles

The breakout move is supported by strong bullish candles, showing buying pressure.

We're entering on a confirmed bullish reversal – Inverted Head & Shoulders breakout, trendline breach, and bullish market structure shift. Fib zone confluence seals the setup. Buy-side pressure is in control.

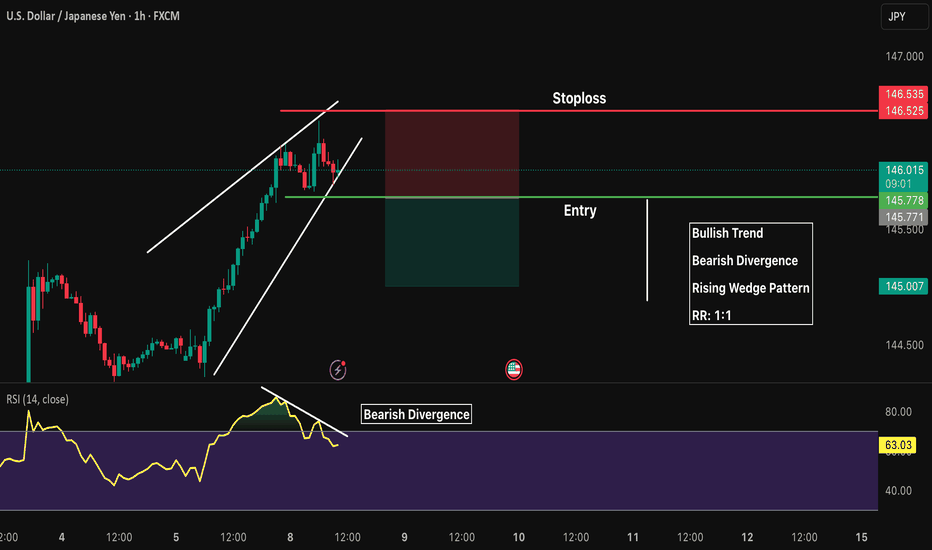

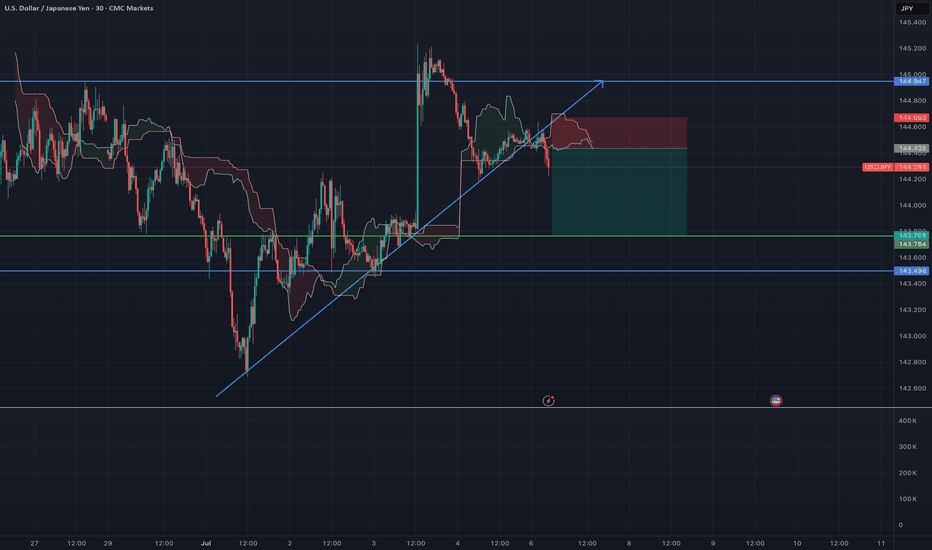

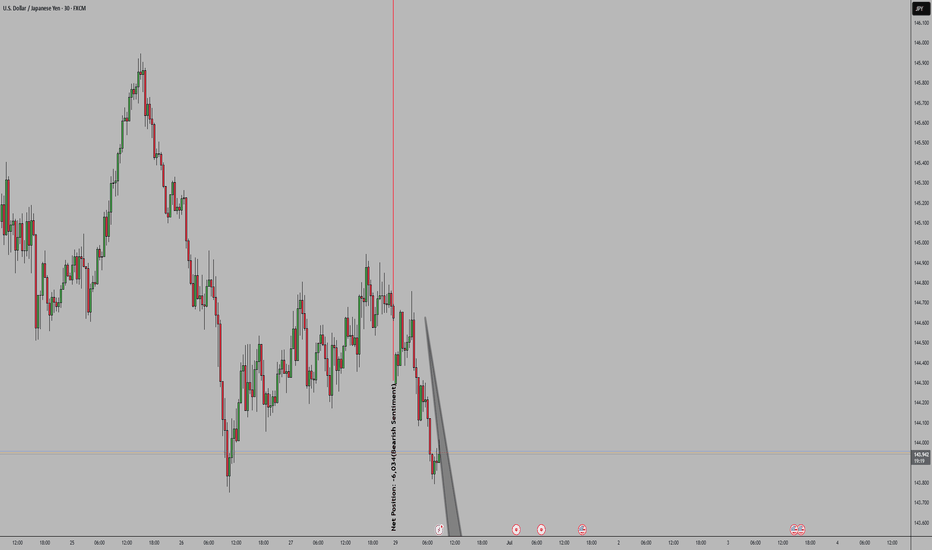

USD/JPY - Channel BreakoutThe USD/JPY pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the downside and a higher likelihood of further advances in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Entry (Sell Limit): 144.435

Stop Loss: 144.669

Take Profit: 143.768

This is Sell Limit entry and wait for pullback to enter the trade

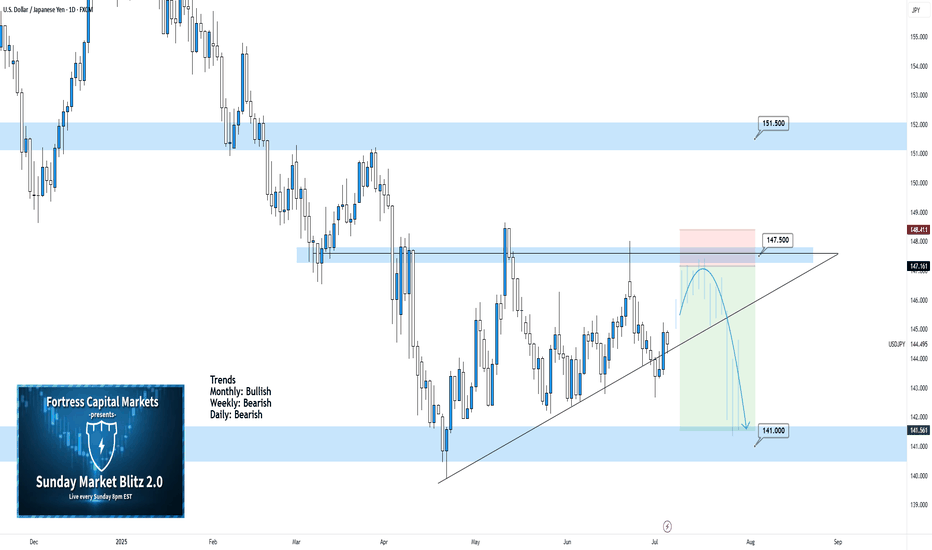

USDJPY Daily TF - July 6th, 2025USDJPY 7/6/2025

USDJPY Daily Neutral Idea

Monthly - Bullish

Weekly - Bearish

Daily - Bearish

We’re still on the daily timeframe with UJ as there is nothing worthwhile. We are clearly in some daily consolidation phase and price action has no clear direction from a swing perspective.

Bearish Continuation - For us to consider a bearish continuation, which is the most likely, we would like to see a retest of our 147.500 zone followed by strong bearish rejection. If we can spot rejection around the 147.500 zone it could present some decent short positions. I’d be looking to target lower toward key support levels.

Aside from this potential setup i’m not looking at any other scenarios for UJ.

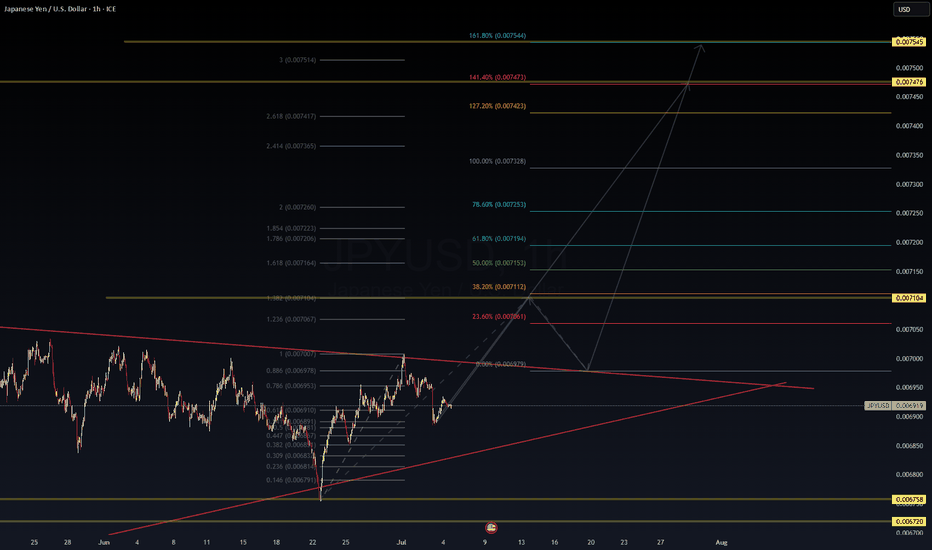

JPY/USD – Compression Breakout Toward Fib Extension Zone | High-📈 JPY/USD – Compression Breakout Toward Fib Extension Zone | High-Conviction DSS Setup

🧠 WaverVanir DSS | Fib x Volume x Structure Alignment

🔹 Timeframe: 1H

🔹 Instrument: JPY/USD

🔹 As of: July 6, 2025

🔹 Bias: Bullish Breakout

🔹 Conviction: High-Probability Reversal-Continuation Hybrid

🔍 🧠 Thesis Summary

JPY/USD has coiled into a symmetrical triangle following a strong internal structure shift. With price compressing against major Fib/SMC levels and anchored volume support at 0.00685–0.00690, the most probable outcome is a bullish breakout targeting the 127–161% extension levels.

🧮 📊 Probabilistic Trade Plan

Element Value

🎯 Entry Zone 0.00691–0.00693 (live)

📍 SL (Invalidation) 0.006758 (structural)

🎯 TP1 0.00715 (Fib 50%)

🎯 TP2 0.00732 (Fib 100%)

🛸 Final TP3 0.00745–0.00754 (127–161%)

📈 R/R ~1:3.5+ (conservative trail)

📊 Probability ~72% (VolanX DSS Estimate)

🔐 Confluence Stack

✅ Volume Profile: Major absorption at 0.00685–0.00690

✅ Fibonacci Expansion: Break above 1.0 targets 127–161%

✅ Structure: Break of descending triangle + higher low

✅ Macro Tailwind: BOJ policy weakness + USD resilience

✅ No Major Resistance until 0.00732–0.00745

🧠 Risk Logic

Breakdown below 0.006758 = invalidate bull thesis (structural fail)

Favor scaling out at TP1 and TP2, trail runner to TP3

If price consolidates under 0.00701, wait for re-confirmation

📍 Visuals (Chart Already Published)

📌 See attached chart for full Fib ladder and volume path tracking

🔄 Execution Note

This is a probabilistic trigger-based plan, not a fixed signal. Align entry only after confirmation of strength above 0.007007 (1.0 Fib breakout zone).

⚠️ Disclaimer

This is a strategic framework powered by WaverVanir’s VolanX DSS. Manage risk accordingly.

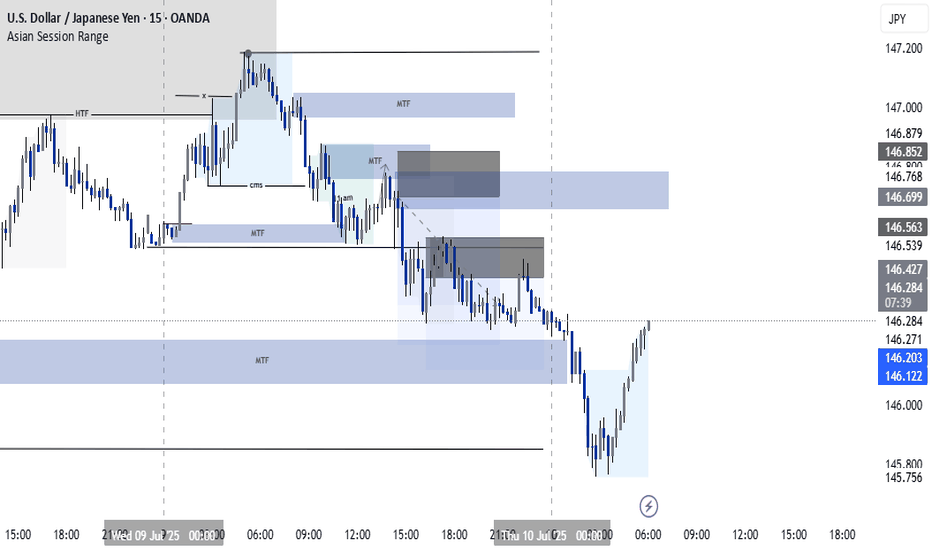

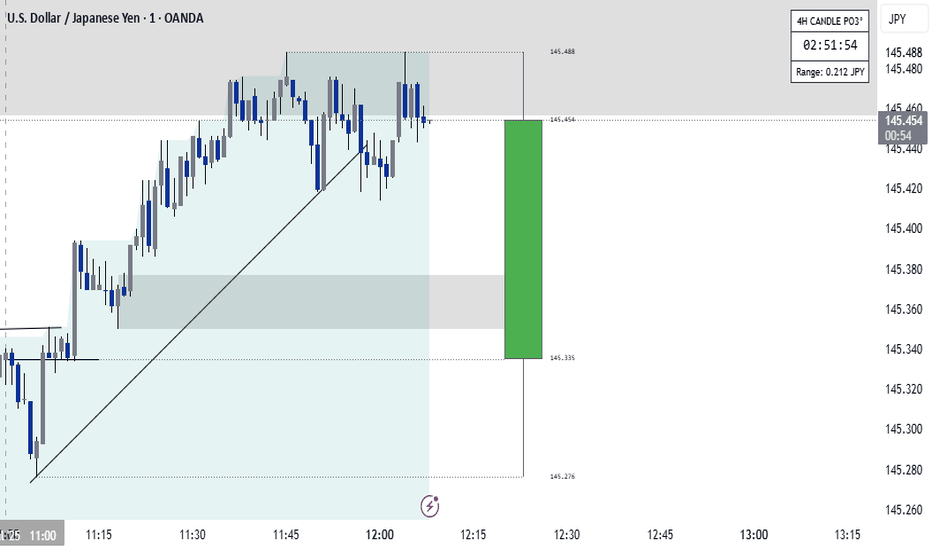

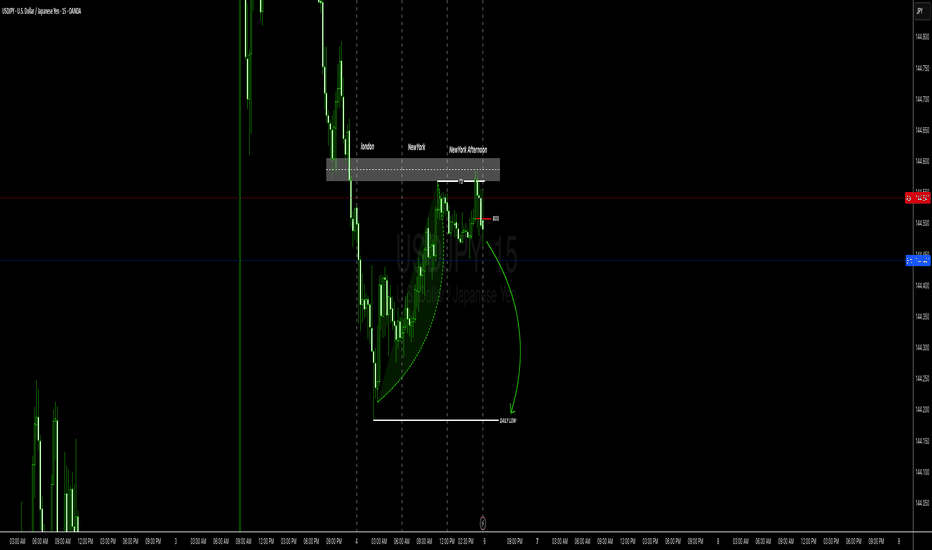

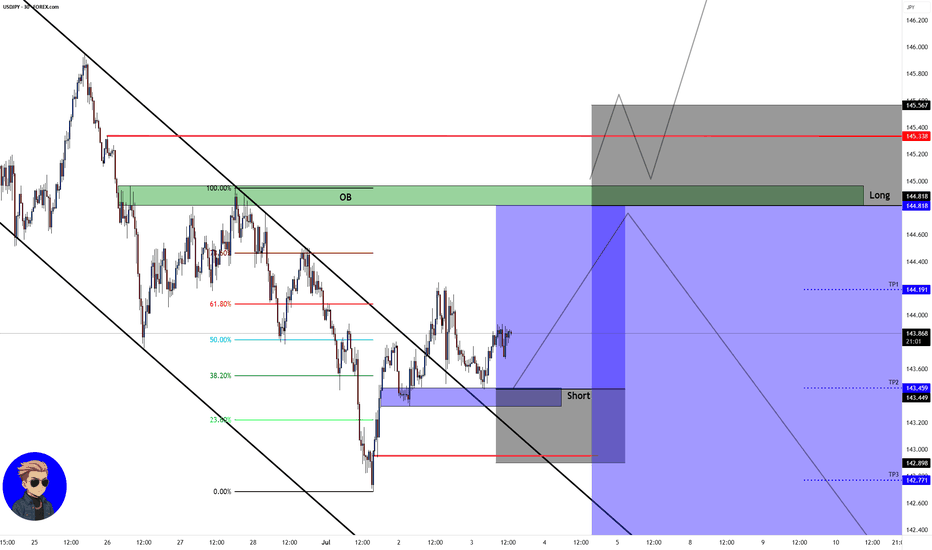

USD/JPYusdjpy did not take last days high or low, but in did manipulate london's high in new york session, as you can see london and NewYork made low resistance liquidity, that is most likely to be taking out sundays opening, on high time frame we are on a resistance for so called order block, we touch near the zone once and then took out people who put there stop loss there, creating a turtle soup, we a most likely to go after friday low as target, this is not finance advice.

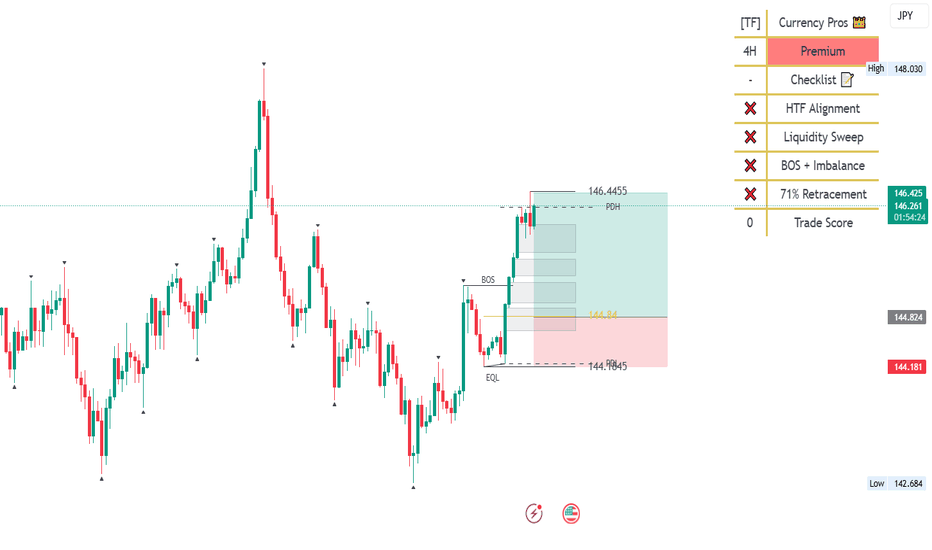

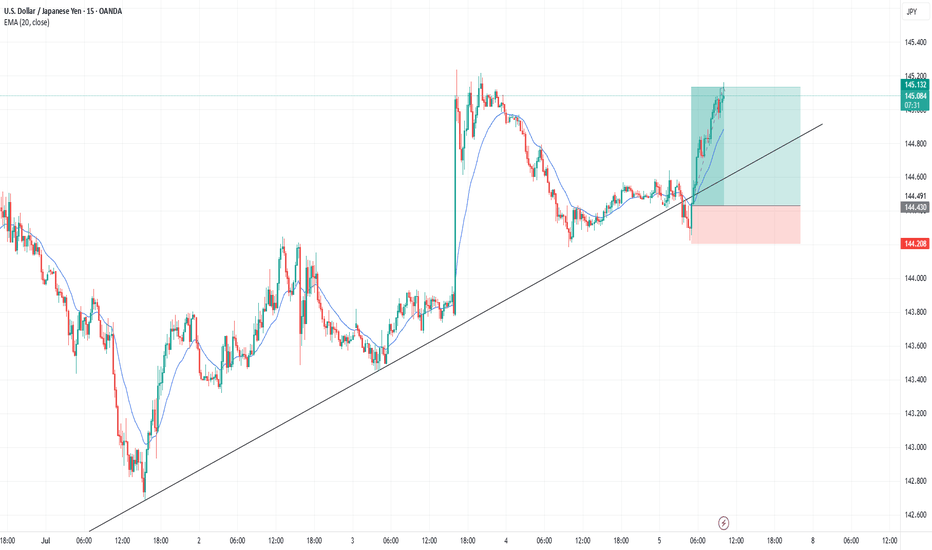

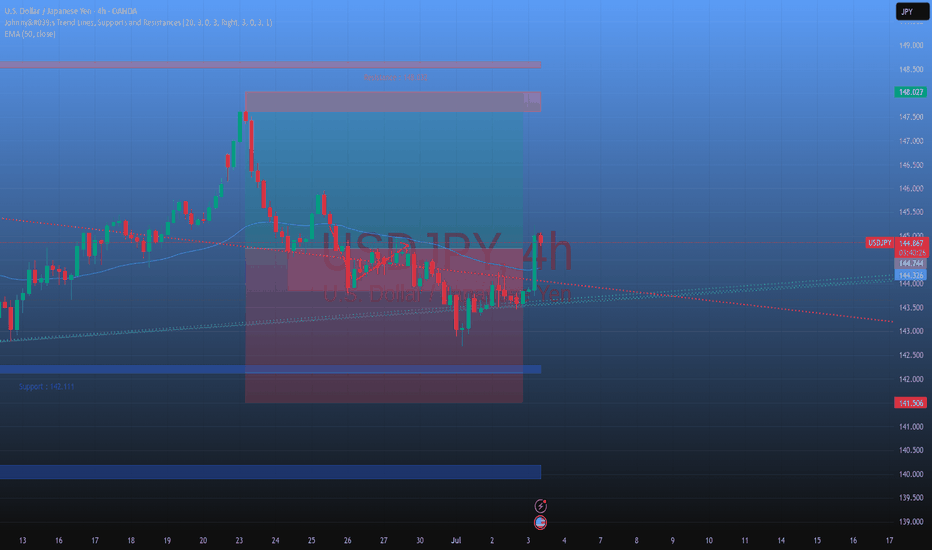

USDJPY| - Bullish Structure Holding | Waiting For Mitigation Pair: USDJPY

Bias: Bullish

Timeframes: 4H, 30M, LTFs

• 4H is showing clean bullish structure — internal high was breached, confirming bullish pressure.

• 30M broke the LH, showing further signs of demand holding.

• Now waiting on price to return and mitigate the OB zone for possible LTF confirmation.

🔹 Entry: Once price hits OB and gives CHoCH/sweep confirmation on LTFs

🔹 Entry Zone: Marked OB on 30M

🔹 Target: Near structure highs (continuation path if demand holds)

Mindset: Ride the wave, not the noise. Let the structure print, and don’t blink when price gives your cue.

Bless Trading!

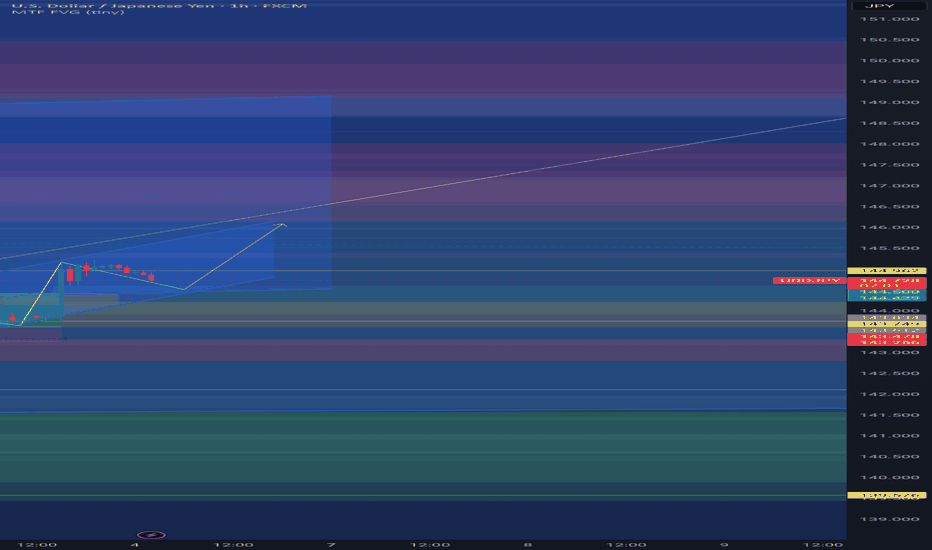

Another supplement to the previous bullish setupAs we now have bounced off as I described in the previous idea. This month is bullish

Ps: Whoever says trendlines don't work I can explain to you in whatever strategy you use it's the umbrella ☔ of all forex strategies. Fibonacci, SnDs, ICTs, even FVGs like this example here. FVG trader can confirm. Etcetera

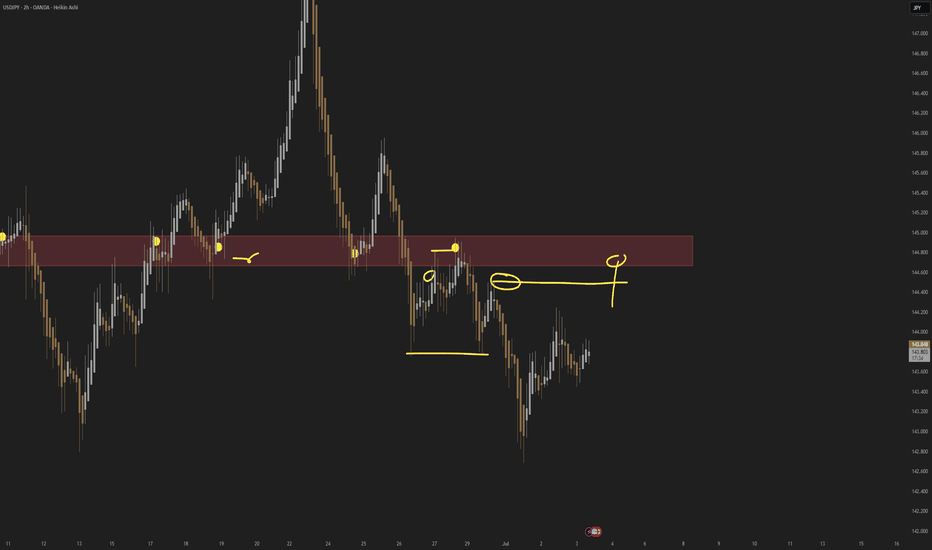

USDJPY; Heikin Ashi Trade IdeaOANDA:USDJPY

In this video, I’ll be sharing my analysis of USDJPY, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏