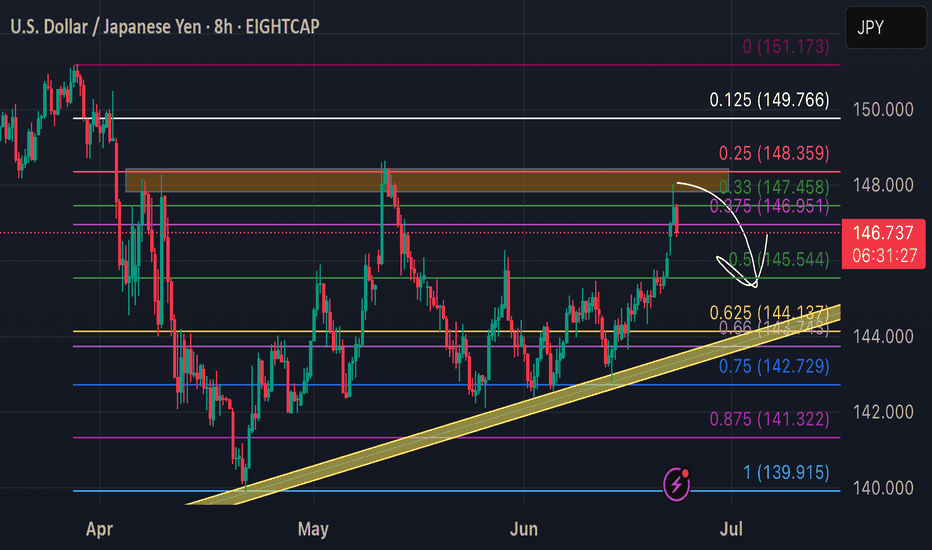

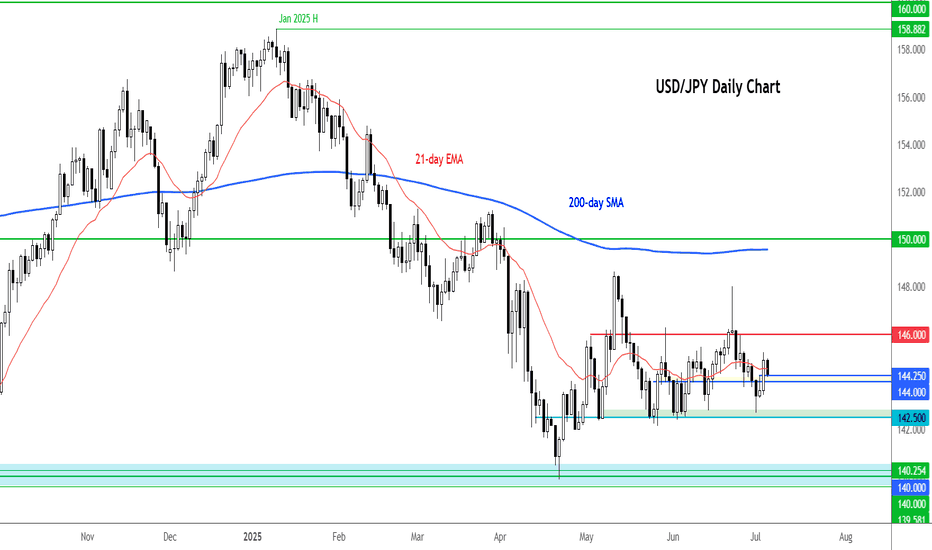

back to daily support USDJPY touched 148 this morning ahead of US PMI.

According to methodology

1. Resistance Zone:

• The 0.125 level (147.820) acted as a resistance point where selling pressure overwhelmed buying pressure, causing the price to reverse downward. Since the price reached 148.000 (just above 147.820), it tested and failed to sustain above this level, reinforcing its role as a barrier.

2. Daily Support

•The daily support trend line (yellow box) has been an area to watch as price continues to try and get over the 148 hump. Until then, this pair is going to wedge until a break confirmation.

JPYUSD trade ideas

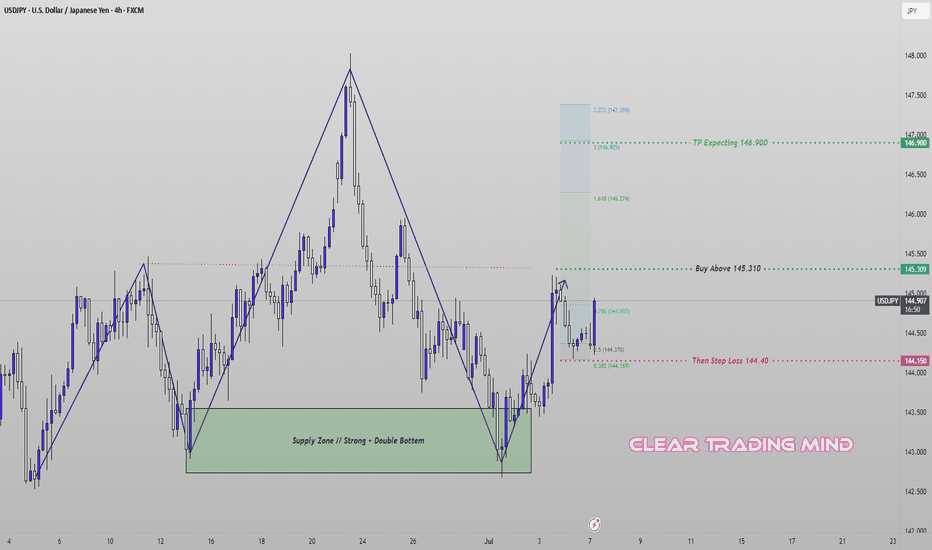

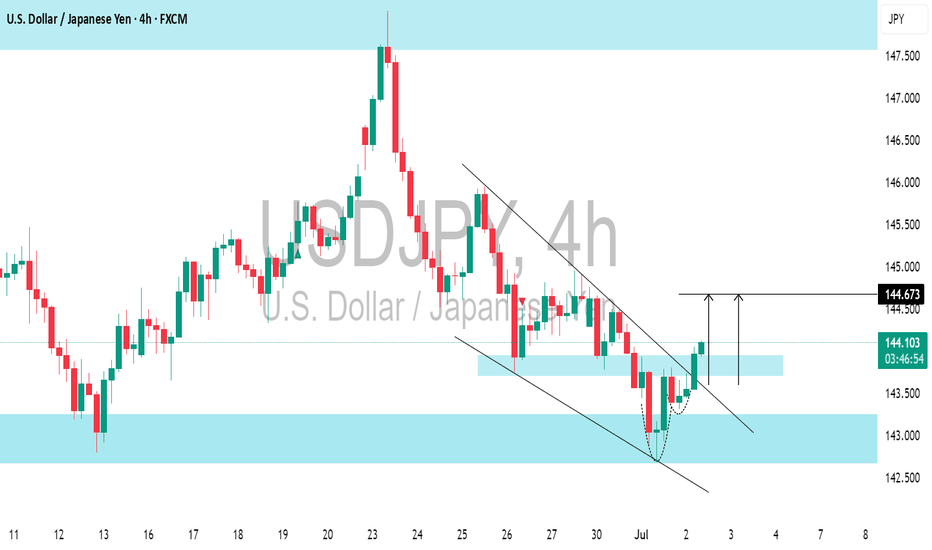

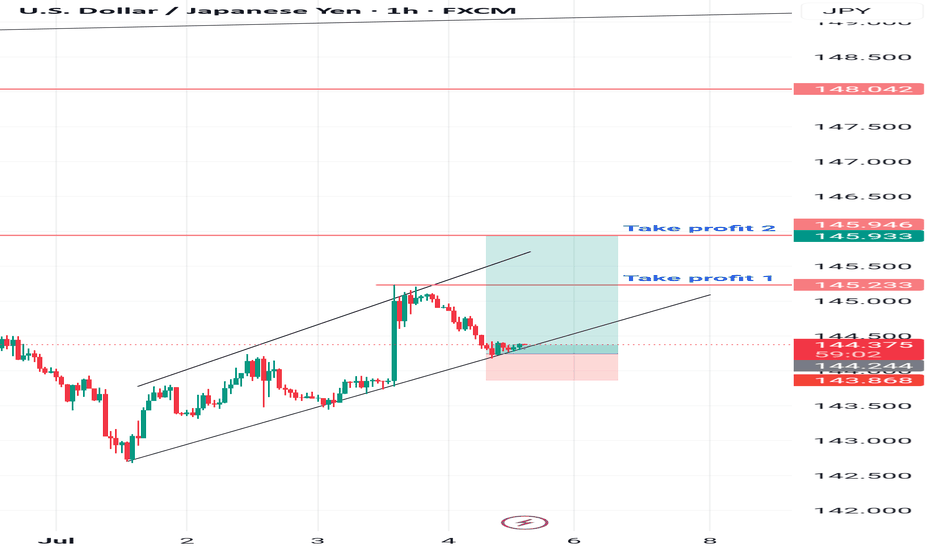

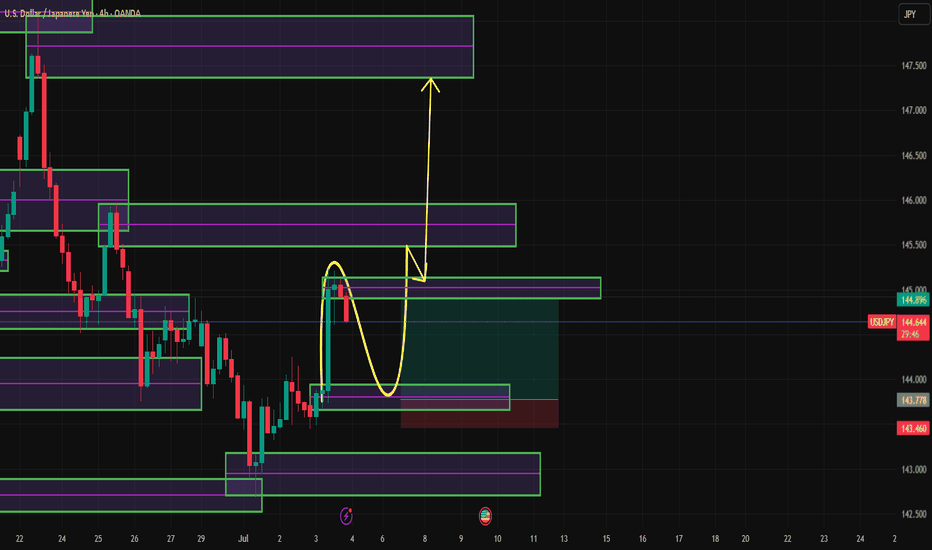

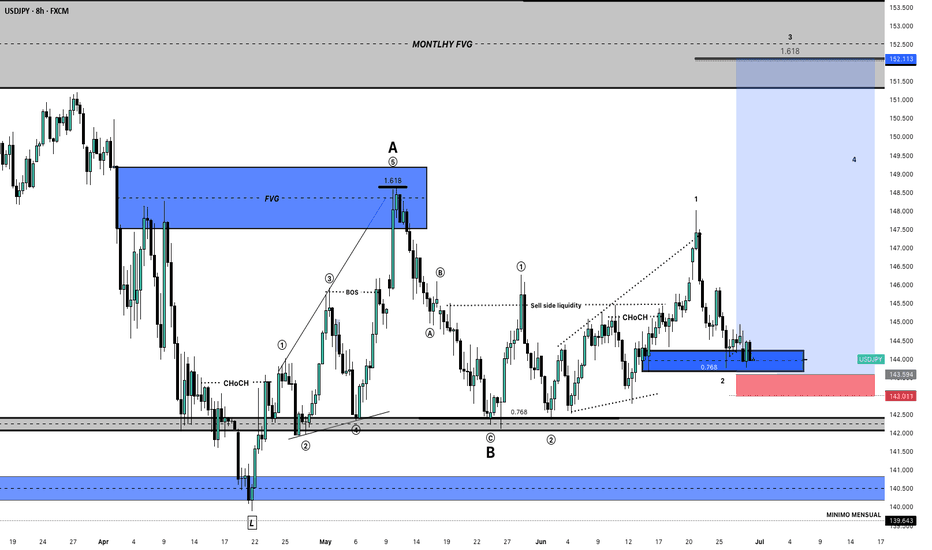

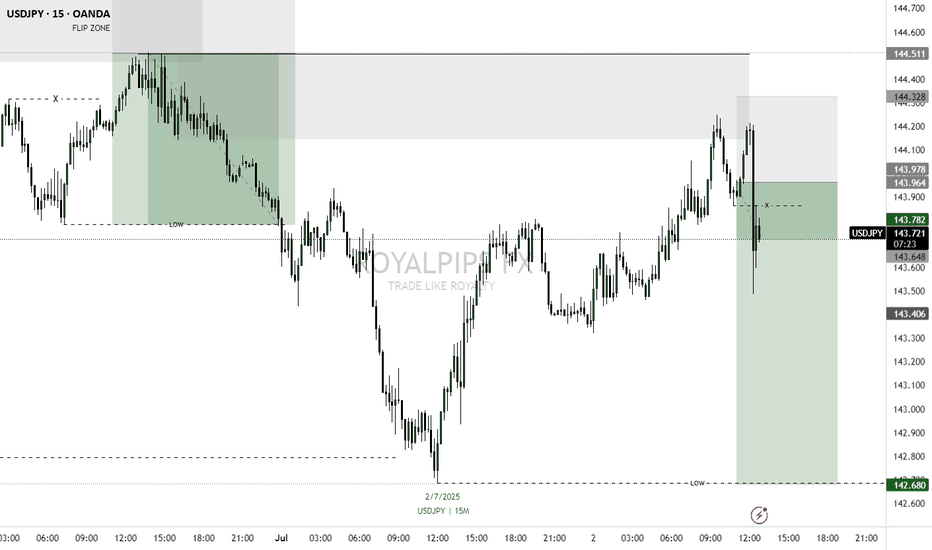

USDJPY Pre-Breakout Setup – Eyes on 145.310 for Bullish EntryThe recent structure on USDJPY (4H chart) shows a bullish shift supported by a strong double bottom formation within a defined demand zone. After a clean impulse from the bottom, price is now consolidating below the key resistance.

🔹 Trade Idea:

I am patiently waiting for the price to break and close above 145.310 to confirm bullish continuation. Entry is valid only above this level to avoid false breakouts.

🔹 Technical Highlights:

- Price rebounded from a strong demand zone with a double bottom.

- A new bullish leg formed, approaching the 0.786 Fibonacci retracement level.

- A clear impulse-correction structure signals potential for further upside if resistance is broken.

🔹 Trade Plan:

- Buy Above: 145.310 (confirmation breakout)

- Stop Loss: 144.40 (below structure and 0.382 Fib)

- Target: 146.900 (aligned with 1.618–2.0 Fibonacci extension)

⚠️ Note: No trade if price fails to break and hold above the entry trigger. Patience is key.

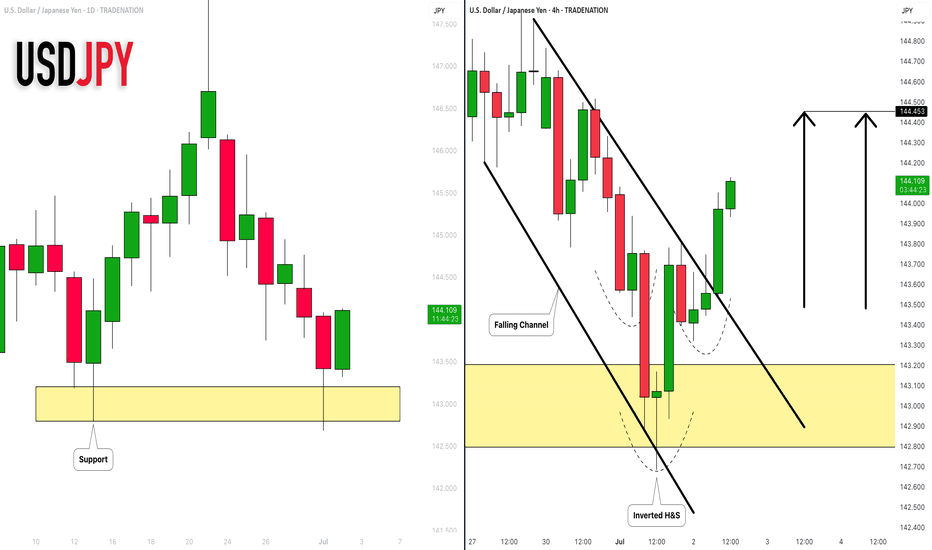

USDJPY: Strong Bullish Price Action 🇺🇸🇯🇵

I see 2 strong bullish confirmation on USDJPY after a test of a key daily

support cluster.

The price violated a trend line of a falling channel and a neckline of

an inverted head & shoulders pattern with one single strong bullish candle.

The pair may rise more and reach 144.45 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

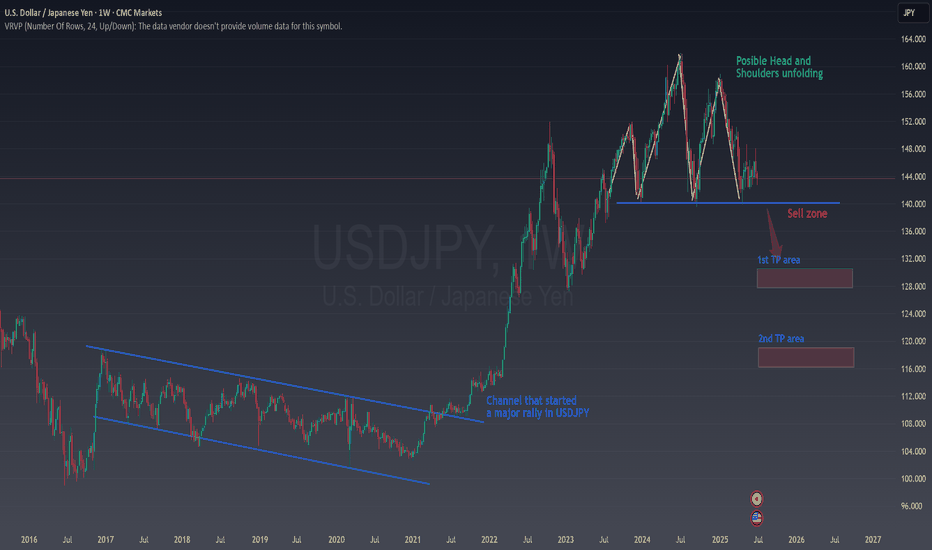

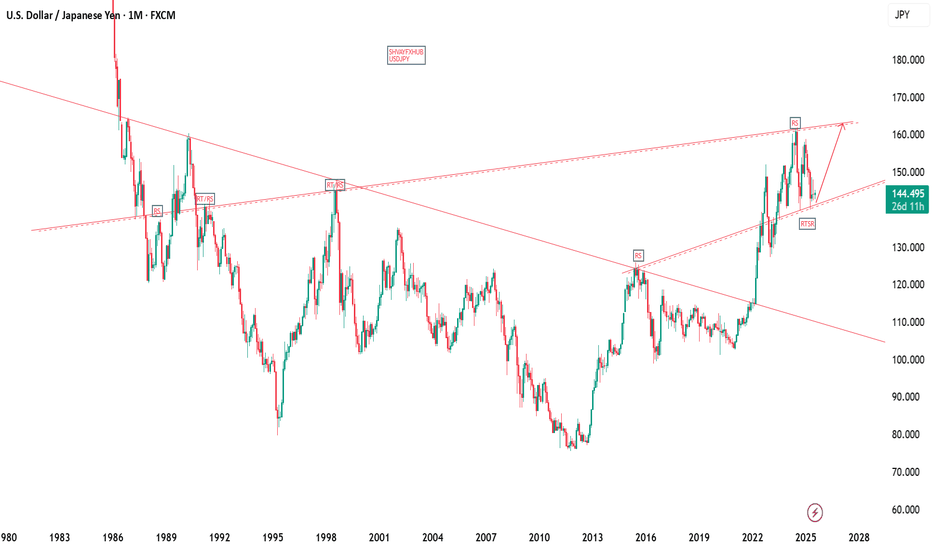

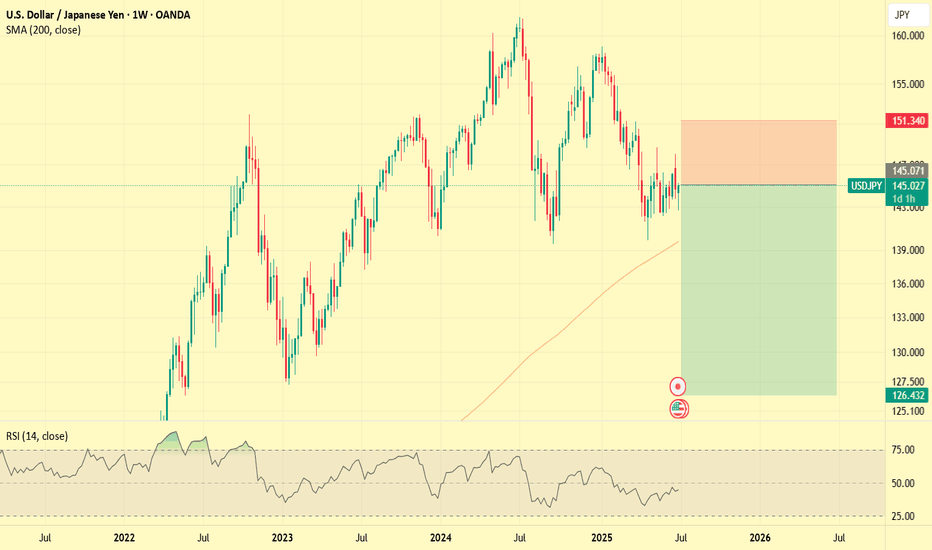

USDJPY is showing an historical patternThe USDJPY is forming a head and shoulders pattern and has a very clear support line at 140.

If the price goes below this line, we could see a big drop in the pair, with the first easy target at 130 and a second, more difficult target at 120. The risk is very low, and also, currency pairs allow you to use leverage to earn much higher profits.

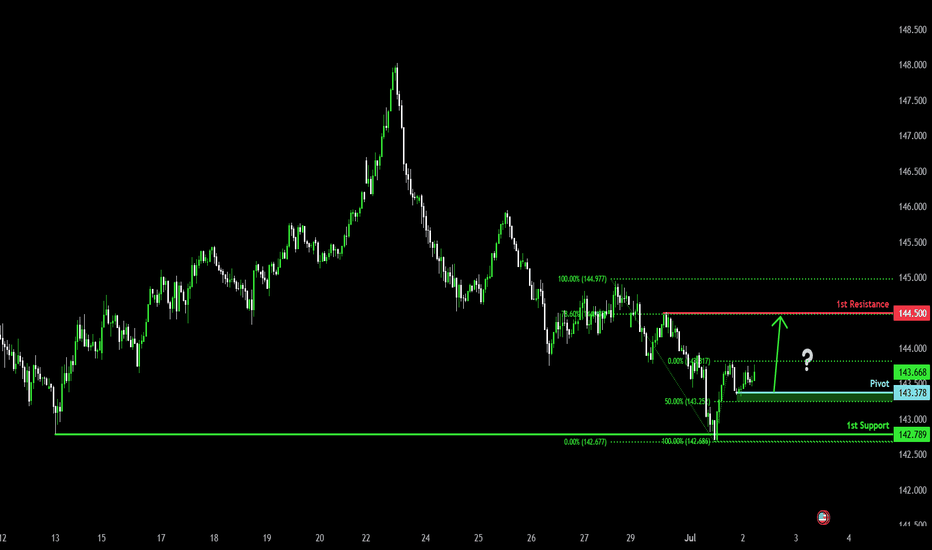

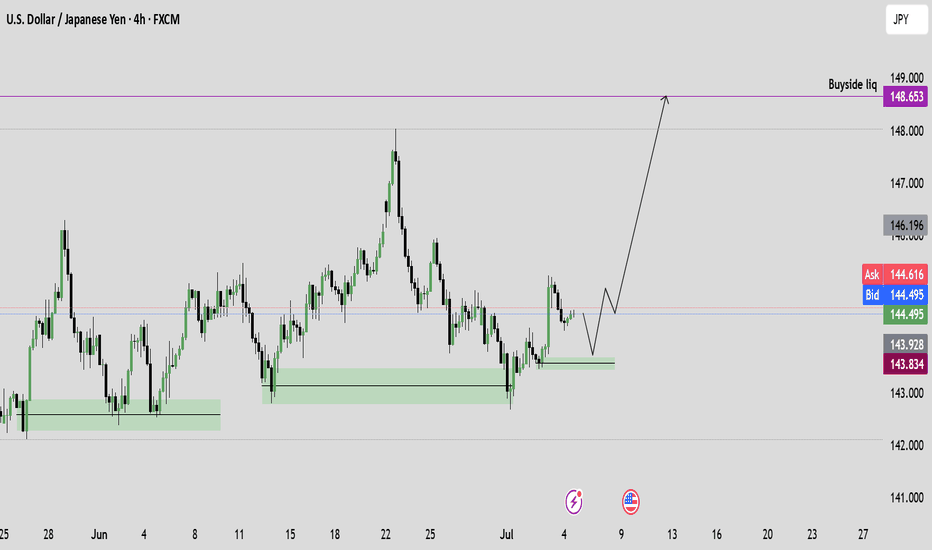

Potential bullish continuation?USD/JPY has bounced off the pivot and could rise to the 1st resistance, which aligns with the 78.6% Fibonacci retracement.

Pivot: 143.37

1st Support: 142.78

1st Resistance: 144.50

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

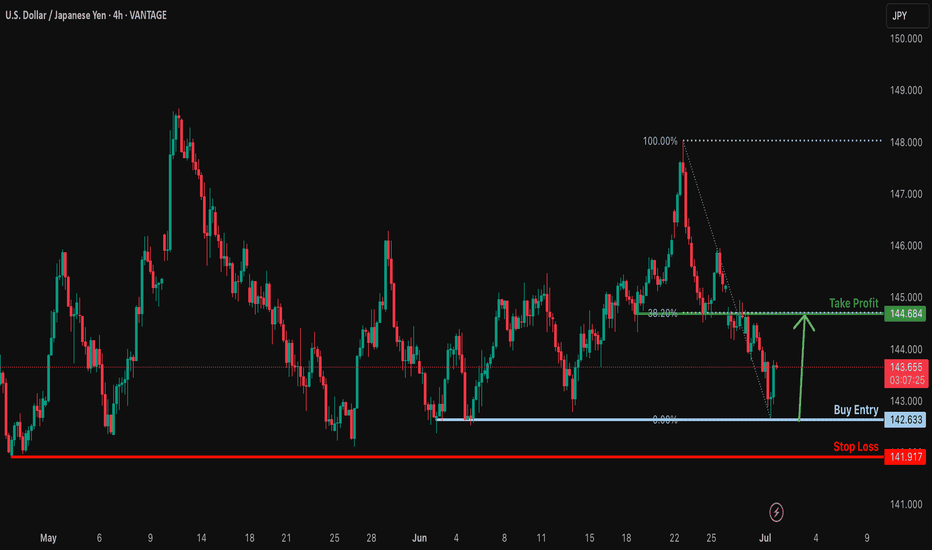

Bullish bounce off pullback support?USD/JPY has bounced off the support level which is a pullback support and could potentially rise from this level to our take profit.

Entry: 142.63

Why we like it:

There is a pullback support.

Stop loss: 141.91

Why we like it:

There is a pullback support.

Take profit: 144.68

Why we like it:

There is an overlap resistance that lines up with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

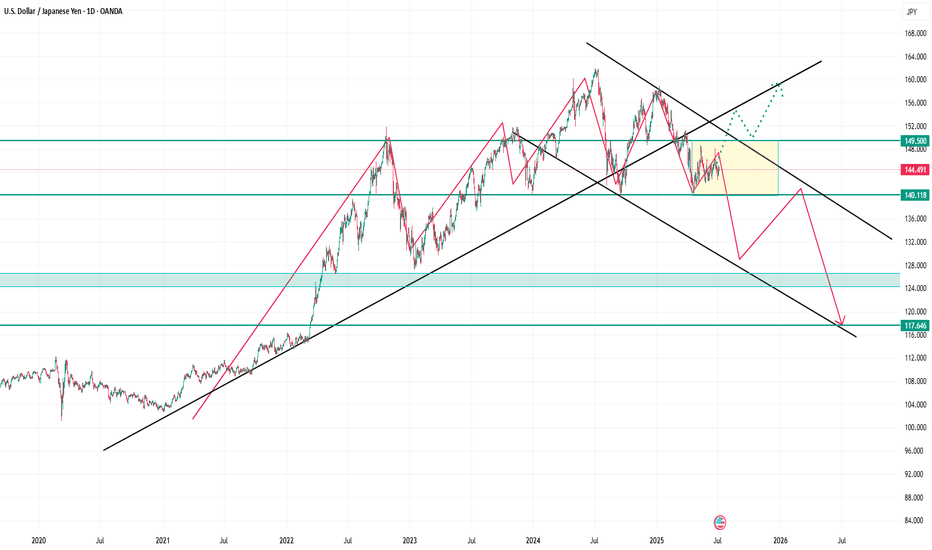

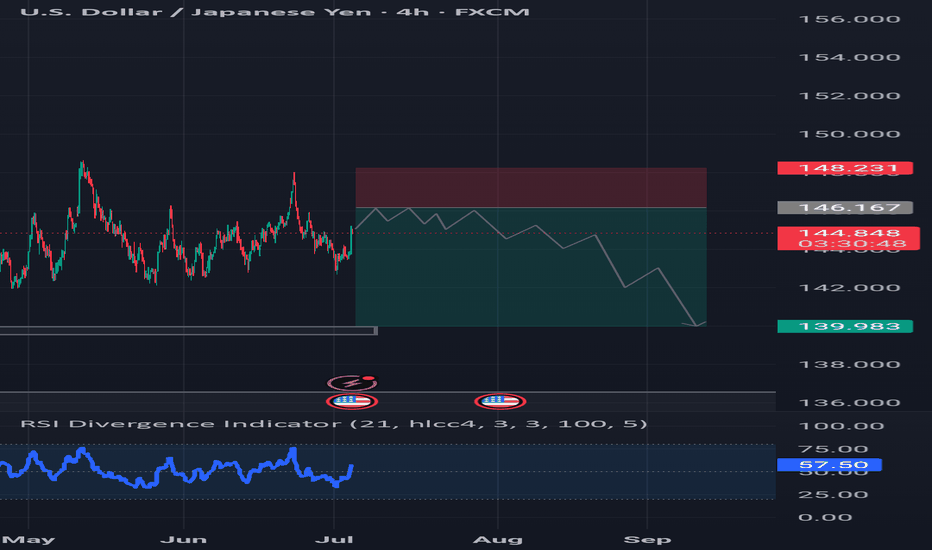

USD/JPY at Crossroads: Breakout or Big Drop Ahead? USD/JPY Analysis – July 2025

🔍 Technical:

Price: 144.50

Key Resistance: 149.50

Key Support: 140.12, then 117.64

Two possible moves:

Bullish: Break above 149.50 → Target 156+

Bearish: Stay below 149.50 → Drop to 140 → 128 → 117

🌍 Fundamental:

USD Strength: If inflation stays high, Fed may delay rate cuts.

JPY Strength: BOJ may shift policy or intervene if Yen weakens more.

🔑 Upcoming Events:

July 11 – US CPI

BOJ outlook & Fed comments matter

🎯 Outlook:

Bearish bias if price stays below 149.50.

Bullish only if clean breakout above resistance.

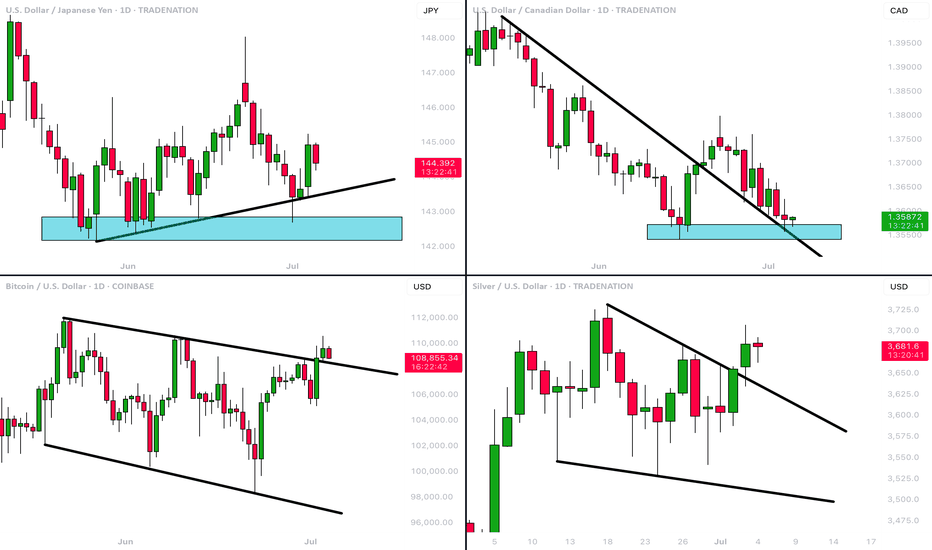

MarketBreakdown | USDJPY, USDCAD, BITCOIN, SILVER

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #USDJPY daily time frame 🇺🇸🇯🇵

The market nicely respected a rising trend line

and bounced from that, forming a high momentum bullish candle.

I think that the pair will continue rising and reach 145.8 level soon.

2️⃣ #USDCAD daily time frame 🇺🇸🇨🇦

The price is currently approaching an important confluence

zone based on a falling trend line and a horizontal support.

I will expect a pullback from that.

3️⃣ #BITCOIN #BTCUSD daily time frame

The price successfully violated a resistance line of a bullish

flag pattern and closed above that.

It is a critical bullish signal. I believe that the price will test

a current high then and will violate that with a high probability.

4️⃣ #SILVER #XAGUSD daily time frame 🪙

The market broke a resistance line of a bullish flag.

Uptrend is going to continue, and the price is going to reach 37,14 level soon.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

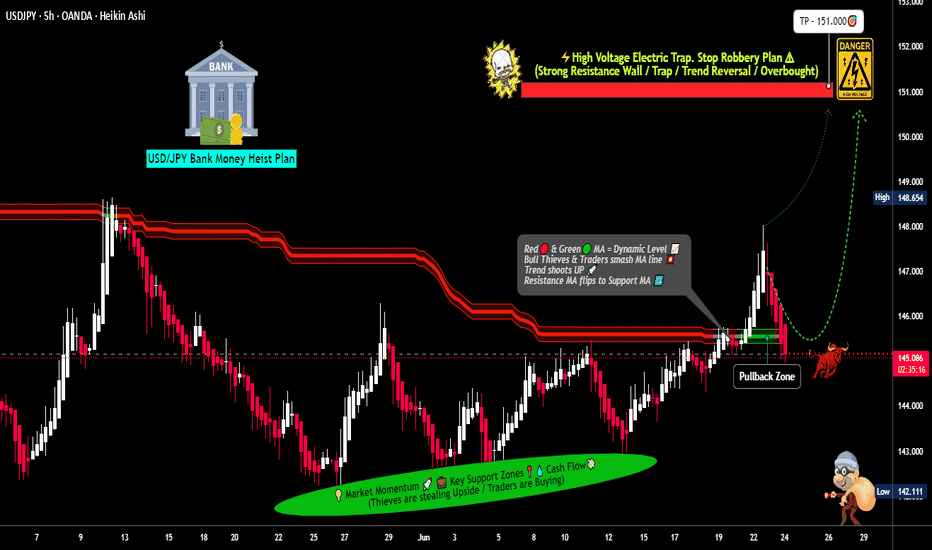

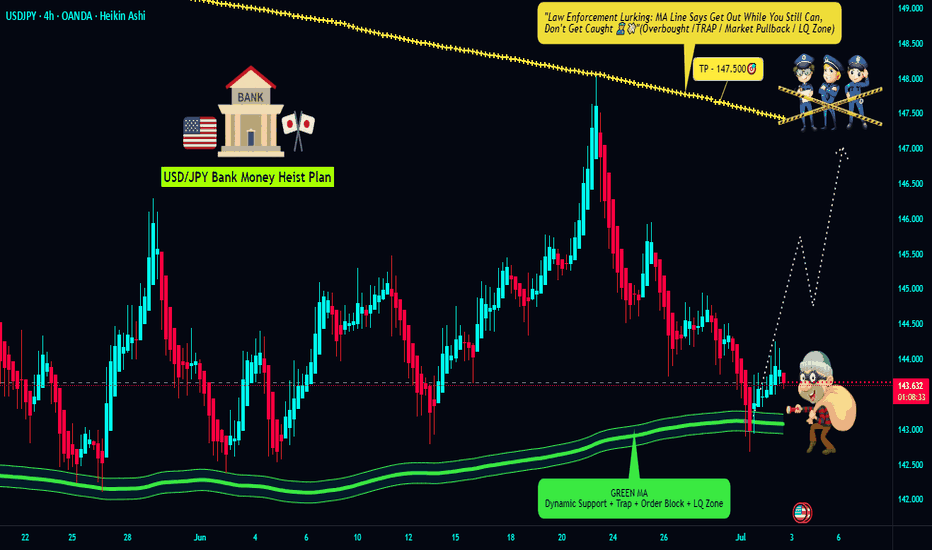

USD/JPY Profit Heist – Are You In or Missing Out?"🔥💰 "USD/JPY NINJA HEIST: Bullish Loot Before the Trap! (Thief Trading Style)" 💰🔥

🌟 Attention Market Robbers & Profit Takers! 🌟

🚨 Thief Trading Alert: USD/JPY "The Ninja" is primed for a BULLISH HEIST!

Based on our stealthy technical & fundamental analysis, we’re locking in a long entry strategy. The plan? Loot profits before the RED ZONE danger hits! Overbought? Maybe. Risky? Sure. But the real robbery happens before the bears wake up! 🏴☠️💸

🎯 ENTRY: The Vault is OPEN!

Buy Limit Orders: Swipe the dip on pullbacks or jump in at key swing lows.

Aggressive? Enter now & ride the wave!

🛑 STOP LOSS (Thief-Style Escape Plan):

Swing Low (5H TF): 143.600 (Adjust based on your risk & lot size!)

Multiple orders? Scale SL wisely—don’t get caught!

🎯 TARGETS:

Main Take-Profit: 151.000 (Or escape earlier if the trap triggers!)

Scalpers: Only play LONG—trail your SL & lock in quick loot!

📢 SCALPERS & SWING TRADERS:

Got deep pockets? Ride the wave now!

Small account? Join the swing heist & rob the trend slowly!

📈 WHY USD/JPY?

Bullish momentum + Macro/Fundamental tailwinds!

COT Report, Sentiment, & Intermarket Analysis all hint at more upside! go ahead to check 👉🔗🌏

⚠️ WARNING: NEWS = VOLATILITY!

Avoid new trades during high-impact news!

Trailing SL = Your best friend! Protect profits & avoid jail (stop-out)!

💥 BOOST THIS IDEA TO SUPPORT THE HEIST!

More boosts = More robberies = More profits for YOU!

Stay tuned—next heist coming soon! 🚀💰

🔥 Like, Share, & Follow for Daily Steals! 🔥

Analysis on USD/JPY LONGHello! As we all know the Thursday NFP came in positive for USD thereby making usd to be in stronger position against the JPY. More analysis are stated below

US–Japan Interest Rate Divergence

Bank of Japan (BoJ) remains cautious post its January rate hike, with rates near 0.5% and monetary policy likely on hold through 2025

U.S. Federal Reserve (Fed) has postponed cuts amid robust job data and inflation above target; markets have pulled forward rate cut expectations to autumn rather than summer .

The interest-rate gap (USD >4%, JPY ~0.5%) favours a stronger dollar but carries a steep “carry cost” for yen investors .

Economic Outlooks & Trade Dynamics

Japan’s Q2 business sentiment (Tankan) is slightly positive, despite export weakness due to tariff risks

U.S.–Japan trade tensions are escalating, with looming tariffs on Japanese car imports potentially impacting growth and yen sentiment

reddit.com

Persistent Japanese inflation (~2.5% in Tokyo) and wage gains (~2.8%) bolster long-term BoJ tightening expectations

Summary: The dollar remains supported by stronger U.S. policy and treasury yields. Meanwhile, Japan’s cautious BoJ, inflation, and trade vulnerabilities push the yen—and thus USD/JPY—into a volatile bracket.

USD/JPY loses bulk of NFP-related gainsThe USD/JPY has given back a bulk of yesterday's NFP-driven gains. Although the data was not as strong as the headlines suggested, the fact that we saw decent moves in bond and equity markets suggests investors were overall impressed by the figures. So it seems the market is preparing itself for some more tariff-related volatility as we approach the 9 July deadline, when 'Liberation Day' tariffs will revert. Trump has suggested letters are being sent out to trading partners over the next few days, informing them of their new tariff rate. If you recall, during the worst of April's volatility, the likes of the franc, euro and yen were all outperforming. Could we see a similar pattern this time?

Well, looking at the USD/JPY, traders have certainly sold into yesterday's rally. But we need a more decisive breakdown of support between 140.00-140.25 now to trigger some long side liquidation. Below this area, key support comes in around 142.50. Resistance comes in at 145.00, followed by 146.00.

By Fawad Razaqzada, market analyst with FOREX.com

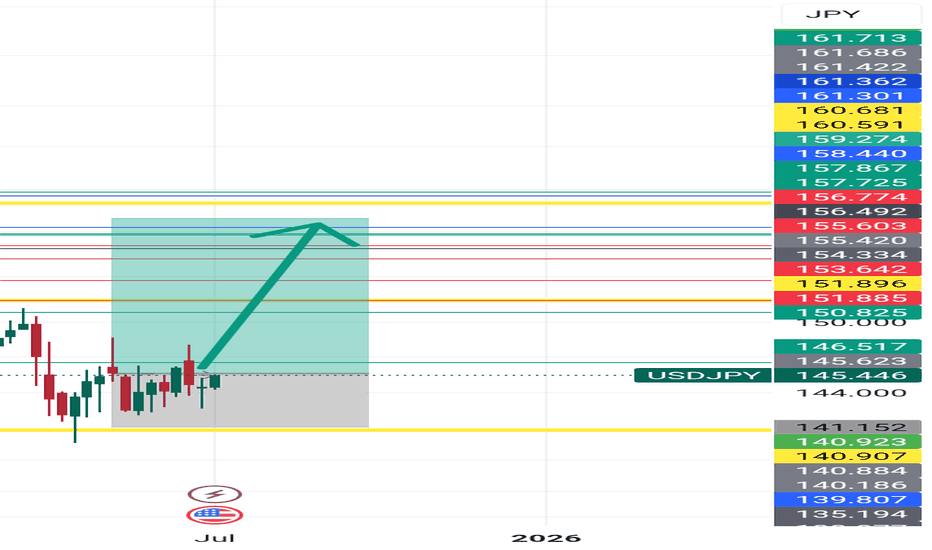

USDJPYUSDJPY Exchange Rate

USDJPY: 144.495(July 5, 2025)

The pair has been trading in the 144.0–145.0 range in early July, reflecting recent yen strength and a broadly weaker US dollar and japan economic outlook.

10-Year Government Bond Yields

Country 10-Year Yield Date

Japan 1.45%

US 4.31-4.38%

Yield Spread (US10Y - JP10Y):

2.86 percentage points (US yield higher)

Policy Interest Rates

Country Policy Rate

Japan 0.50%

US 4.25–4.50%

Key Insights

USDJPY:

The yen has strengthened in 2025, with USDJPY falling from above 160 earlier in the year to the mid-144s in July. This reflects narrowing yield differentials and shifting global risk sentiment.

Bond Yields:

The US 10-year yield remains elevated at 4.31-4.38%, while Japan’s 10-year yield is at 1.45-1.43%, since 2019 jp10y is on the rise ,reflecting japan strong economic outlook

Yield Differential:

The US-Japan 10-year bond yield spread is 2.86%, favoring the US dollar. However, this spread has narrowed from earlier highs, contributing to recent yen strength.

Interest Rate Policy:

The Federal Reserve maintains a 4.25–4.50% target range, with markets expecting possible cuts later in 2025.

The Bank of Japan holds its policy rate at 0.50%, the highest since 2008, but remains cautious about further hikes due to growth and inflation uncertainties.

Summary Table

Metric US Japan Differential

Policy Rate 4.25–4.50% 0.50% 3.75–4.00%

10-Year Bond Yield 4.31% 1.45% 2.86%

Market Implications

USDJPY Direction:

The narrowing yield spread and expectations of Fed rate cuts have pressured USDJPY lower, supporting the yen.

Bond Differential:

The still-wide, but narrowing, US-Japan yield gap remains a key driver for capital flows and currency moves.

Interest Rate Outlook:

Any shift in Fed or BOJ policy will directly impact both the yield spread and USDJPY direction in the coming months.

#usdjpy

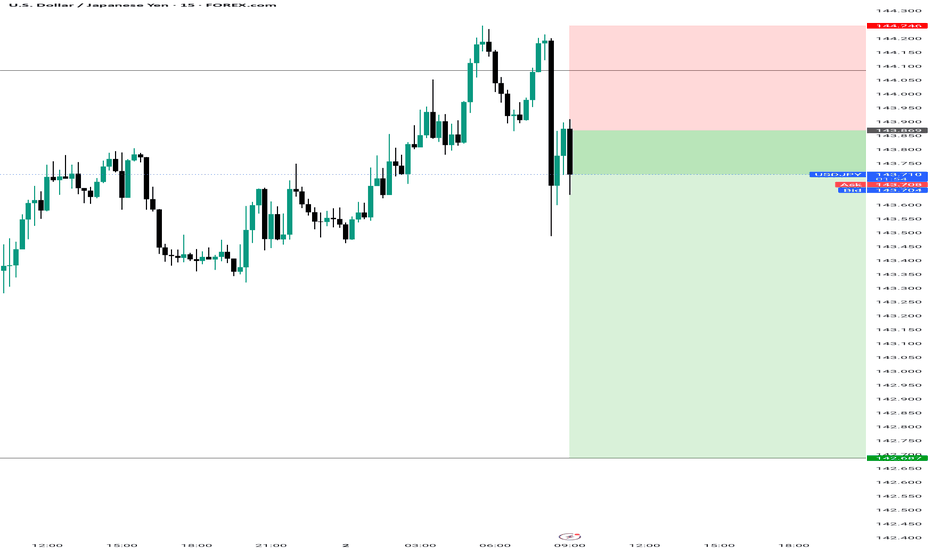

USDJPY Forecast – Bullish Roadmap with Key Retracement LevelsUSDJPY is currently sitting around 144.658. From this level, I’m anticipating a short-term retracement down toward the 143.800 zone, which may act as a demand area or liquidity grab before a bounce.

From 143.800, price is expected to climb back to 144.646, potentially breaking slightly above into 144.652, where intraday liquidity or stop hunts might occur. If bullish momentum remains strong, a slight retracement into the 145.132 region could follow — possibly retesting a breakout zone or OB — before a final bullish continuation*targeting 147.353.

> 🔽 Short-term pullback zone: 143.800

> 🔼 Initial bullish target: 144.646 – 144.652

> 🔁 Expected mid-level retracement: 145.132

> 🎯 Final bullish target: 147.353

> 📍 Current price: 144.658

I’ll be monitoring each key level closely for reactions such as W formations, bullish engulfing candles, or break of internal structure to confirm momentum shifts.

📌 Risk Management Note:

This is not financial advice. Always use strict risk management:

✔️ Risk no more than 1–2% per trade

✔️ Use proper **risk-to-reward setups (min 1:2 RR)

✔️ Wait for **clear confirmations before entering

✔️ Protect capital — consistency beats intensity

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

147.500 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

USD/JPY pair struggles due to a weaker US DollarOn the JPY side, nothing has changed fundamentally, and the currency has been mainly driven by the risk sentiment. As a reminder, the BoJ kept interest rates unchanged at 0.5% and reduced the bond tapering plan for fiscal year 2026 as expected at the last meeting. The BoJ continues to place a great deal on the US-Japan trade deal and the evolution of inflation.

USD/JPY is moving lower despite the disappointing Industrial Production report from Japan. The report showed that Industrial Production increased by +0.5% month-over-month in May, compared to analyst forecast of +3.5%. However, I think that if we respect this area, we might see upward momentum coming soon.

Forecast USDJPY Disclaimer:

This is not financial advice, and I do not encourage anyone to follow my analysis blindly. I’m simply sharing my personal market view based on my strategy, experience, and interpretation of the data.

Everyone is responsible for their own decisions.

The USD/JPY market has likely just exited

its accumulation phase after several weeks of quiet consolidation. What we’re seeing now is a clear buy-side manipulation orchestrated by major players. Despite weak fundamentals for the dollar — disappointing NFP, rising unemployment, and a slowdown in services — price exploded to the upside, trapping early sellers and drawing in retail buyers through a false breakout.

Technically, the market is overbought on H1 and H4, with a hidden bearish divergence extending all the way from the historical highs of 1971, combined with a confirmed bearish reversal divergence on the weekly chart. On top of that, institutional speculators (COT data) are heavily short USD/JPY, reinforcing the idea that this rally is not genuine but engineered for liquidity grabs.

I’m not rushing in. I’m waiting for 146.00, a key psychological and structural level where this manipulation could reach its peak. That zone would likely mark the end of the fake bullish move and the beginning of a real distribution phase. All signals — technical, macro, and behavioral — are aligned. This could be one of the best short opportunities on USD/JPY in months.