KIO trade ideas

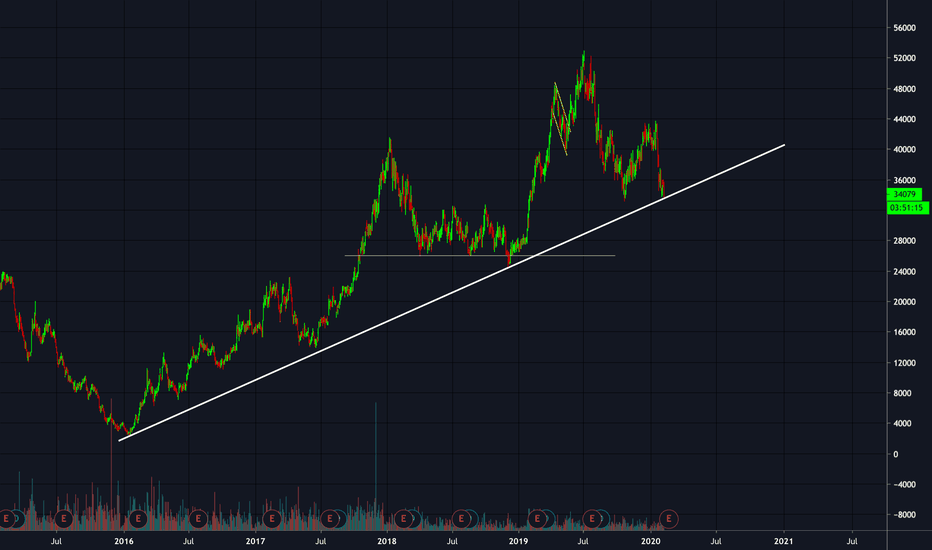

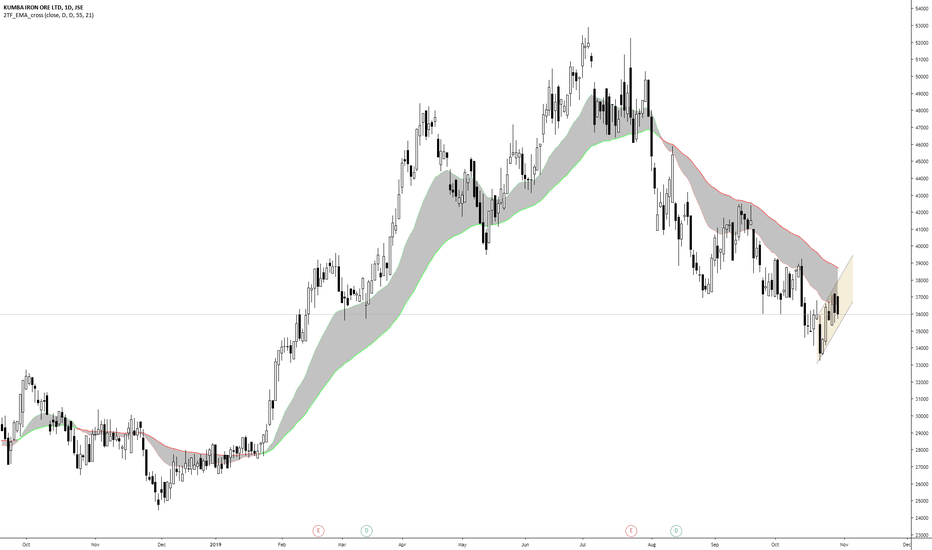

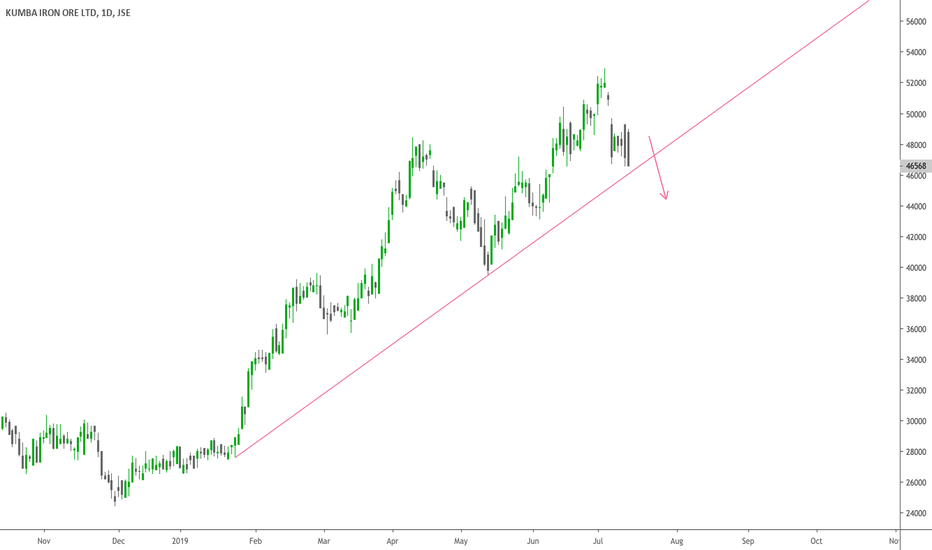

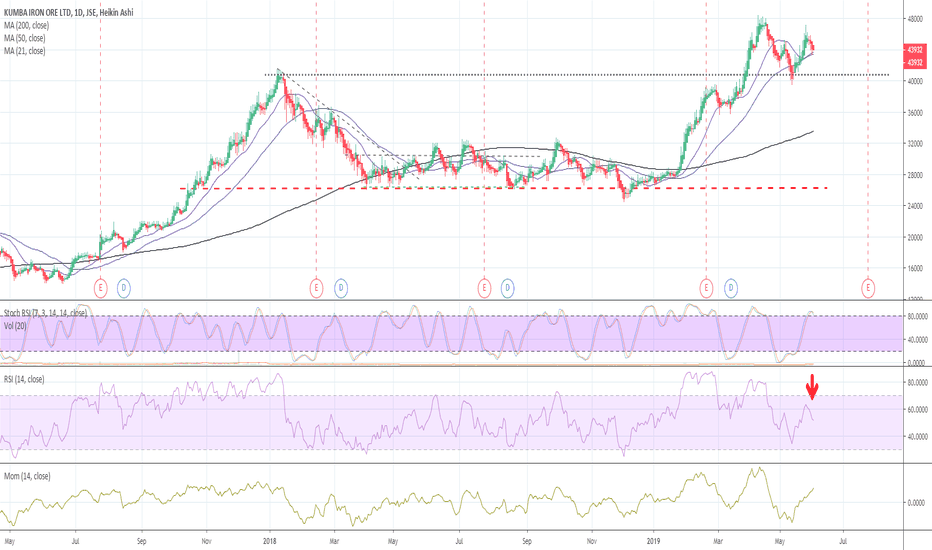

Weekly game plan 2 February 2020 - KIOIt's a bit of a complex story, 'ol Kumba... but our thinking is that we want to watch the way the stock behaves around this longer-term support level / trend line. We think that there could be a nice weekly time-frame trade setting up here. For now though, we are just watching.

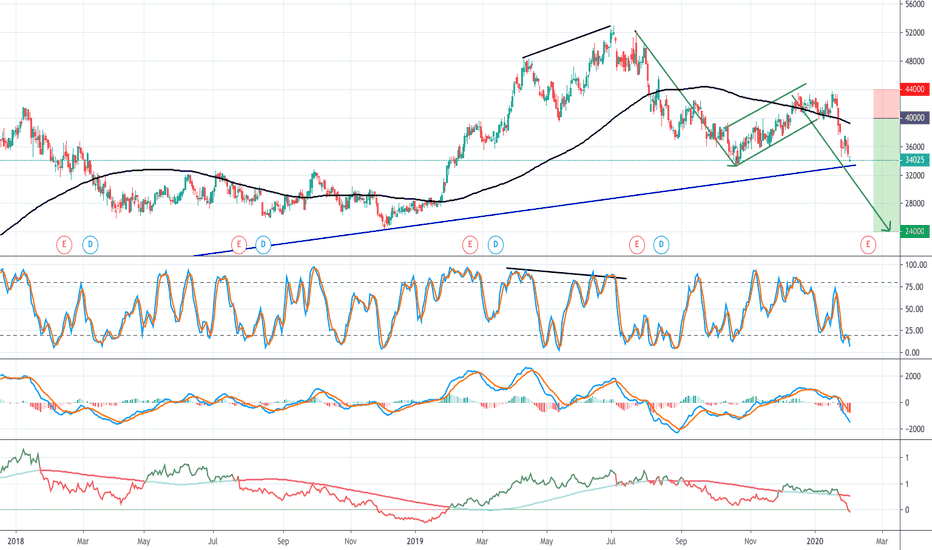

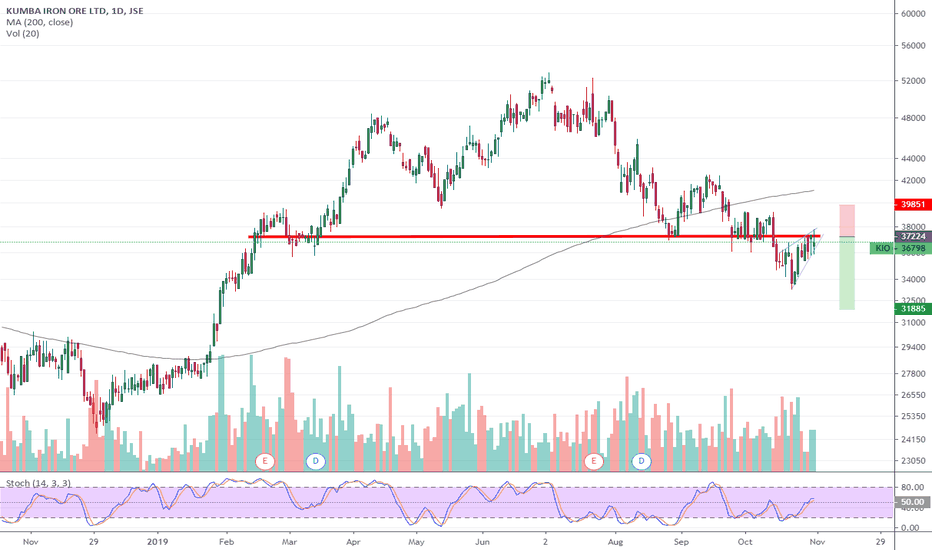

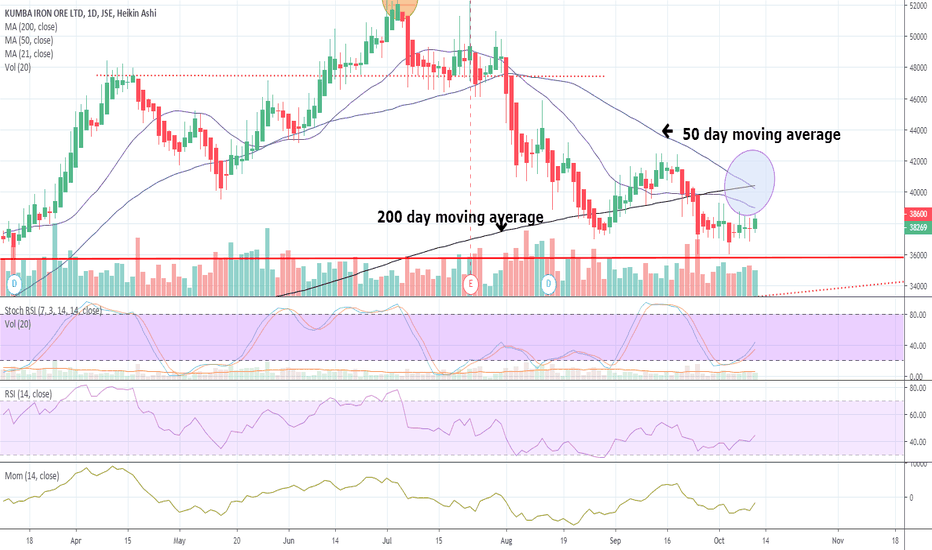

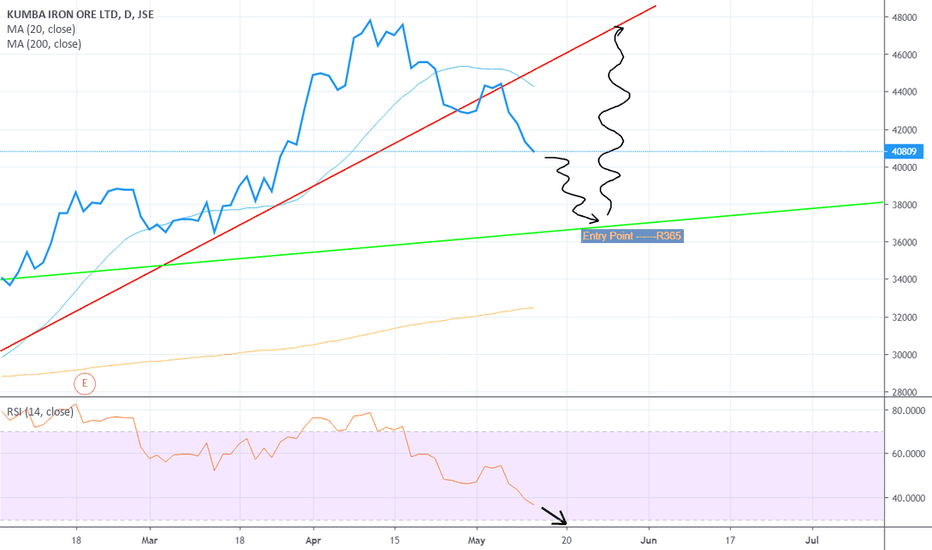

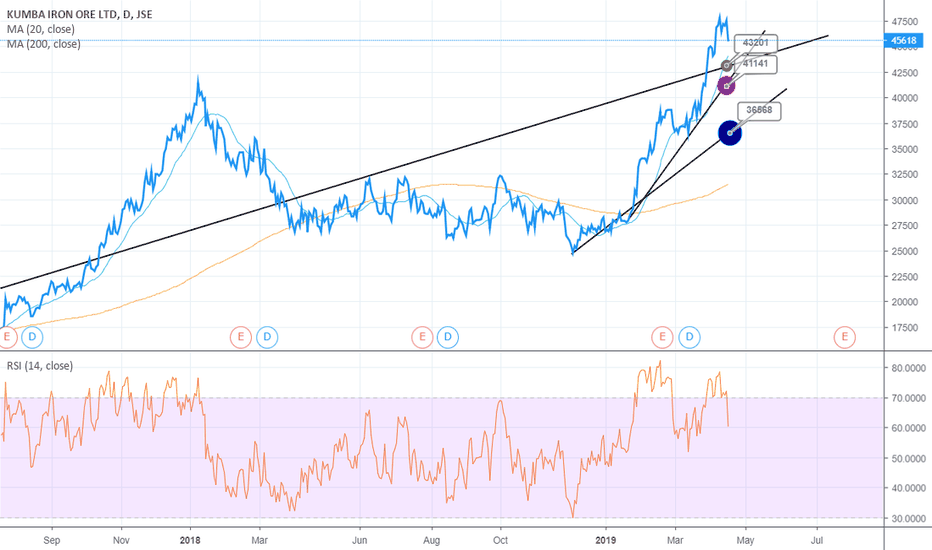

Kumba Iron Ore Equities Local | Kumba Iron Ore | The inverse head and shoulder technical formation previously flagged at 385 has played out with the share reaching a recent high of 43428c. At current levels we have a moderate probability of a reversal with Friday's candle having printed a 'bearish engulfing' at the 200-day. Additionally, the RSI is starting to roll over while the medium term upward channel is at risk. Fresh longs should wait for a pullback to 380-385. Alternatively, a pop toward the 338/343 level is a fresh opportunity to potentially make a short term short sale.

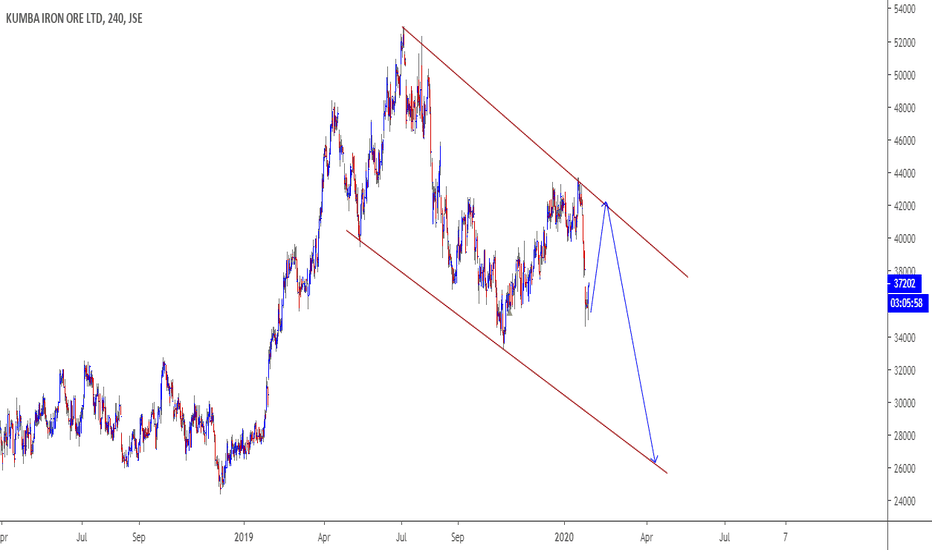

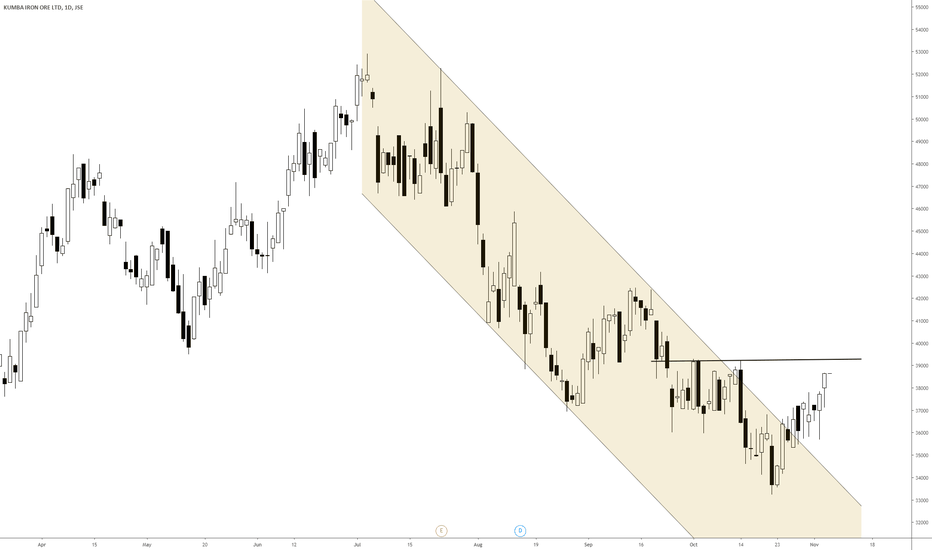

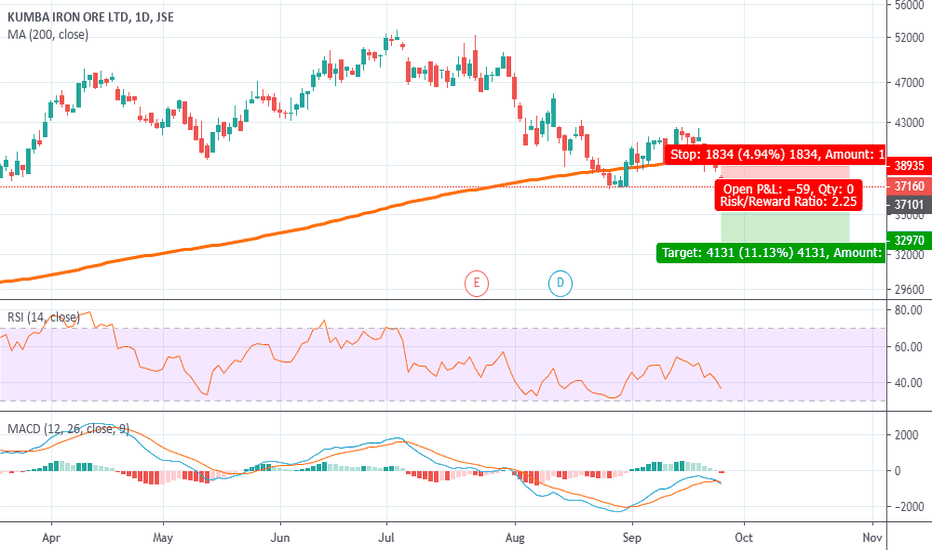

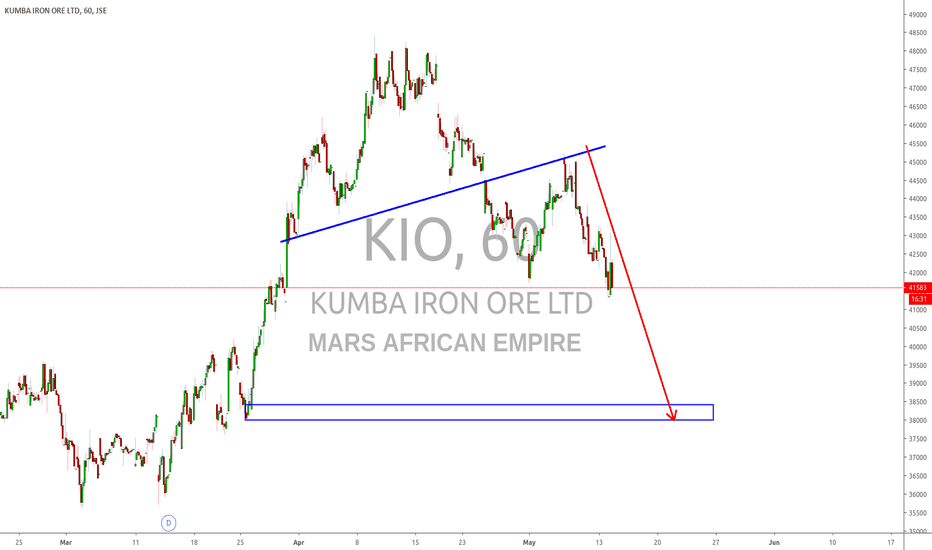

JSEKIO - KUMBA Short setup- Price is at a major resistance level

- Bear flag has developed

- Closed wih an indecision candle (spinning top)

- For a less risky entry, wait for the close below the flag on the daily

- R:R is 1>2

- MANAGE YOUR RISK -

Disclaimer: All ideas are my opinion and should not be taken as financial advice.

JSE:KIO

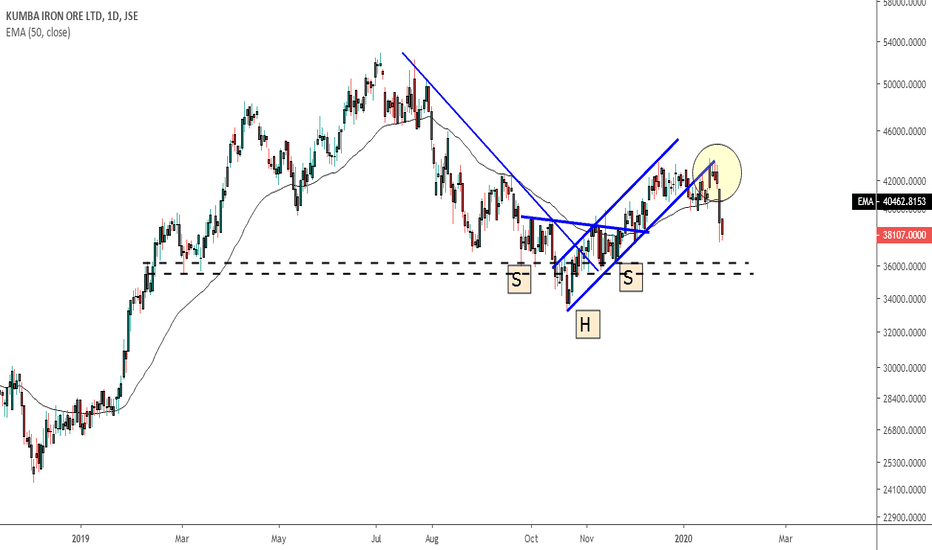

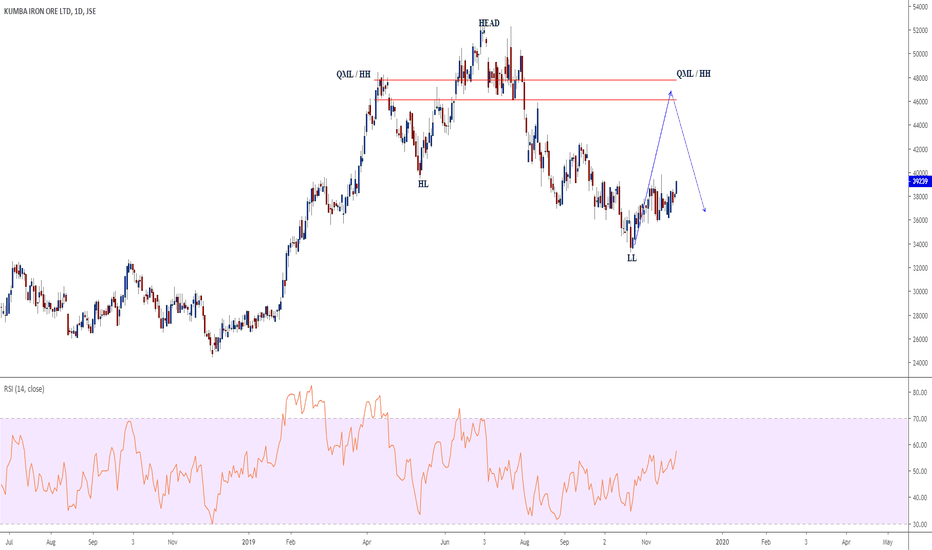

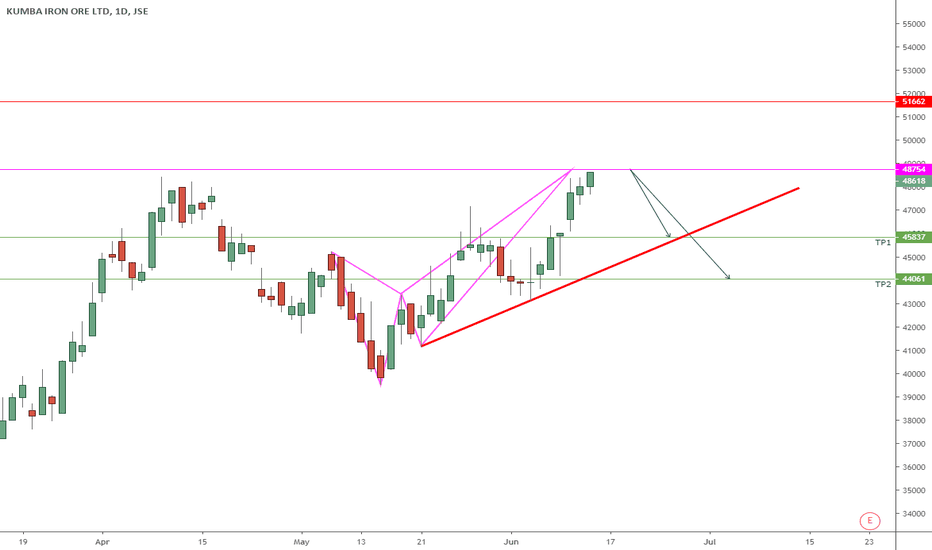

KIO - Amazing Trade (Update)We may derive the following from the Daily KIO chart:

1. Price reached our first target and caught a bid. See linked trade.

2. Price should in all probability consolidate for a while.

3. Monitor price action and look out for further short opportunities.

4. As always - maintain your risk.

Note: The views provided herein do not constitute financial advice.

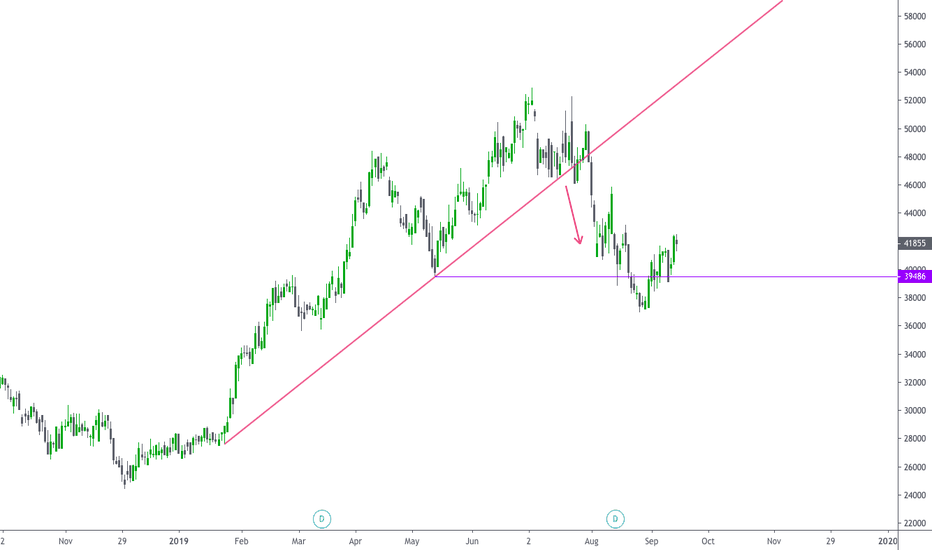

KIO - Danger Ahead!We may derive the following from the Daily KIO chart:

1. Price is approaching its daily uptrend.

2. The past few daily candles have been extremely bearish.

3. Price i.m.o should break the uptrend and continue to decline.

4. As always - maintain your risk.

Note: The views provided herein do not constitute financial advice.

Kumba seeking supportA two day reversal on the Iron ore price and a strengthening Rand has seen some weakness creep into the share price of Kumba. We can see that the RSI has turned lower after yesterday's price action SO I don't think the price will stay in over-bought territory much longer. I won't be surprised to see Kumba trade lower from here to test that "psychological" R400.00 level as support.