KASUSDT trade ideas

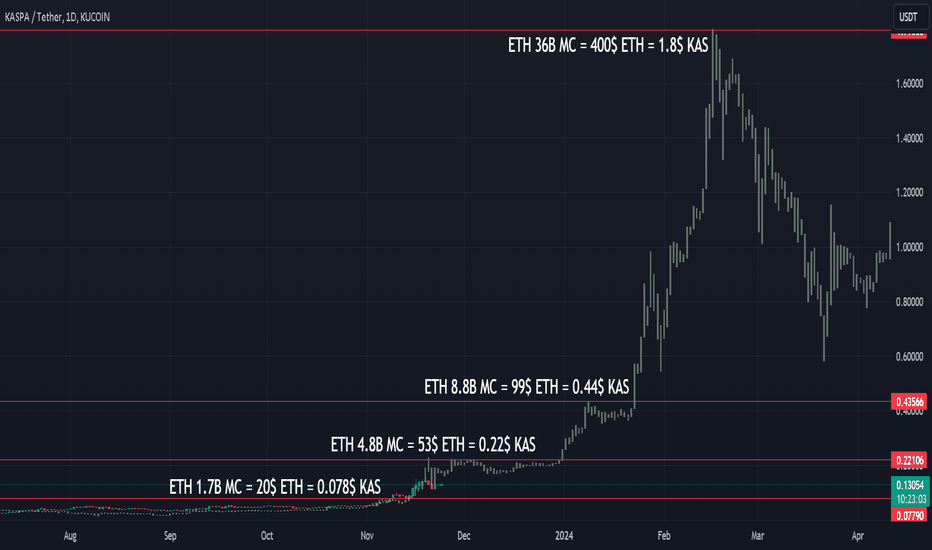

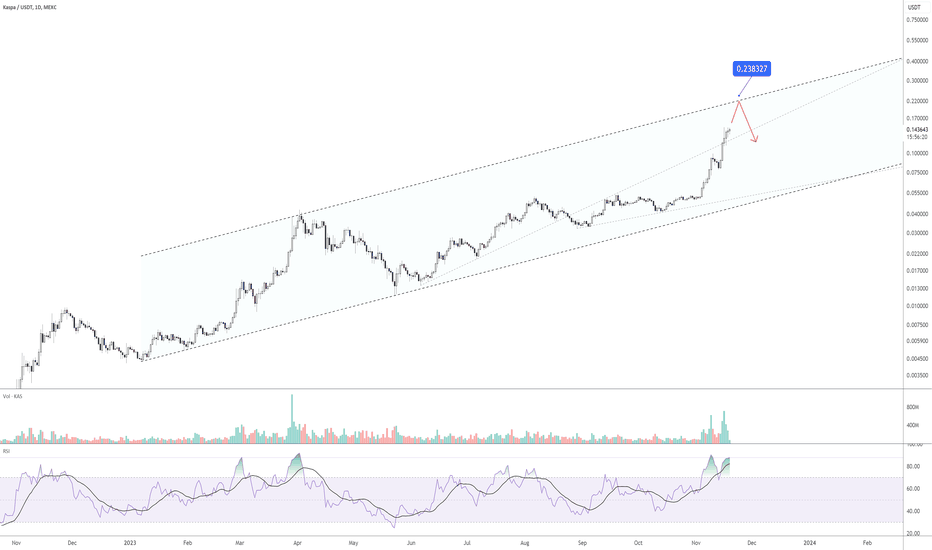

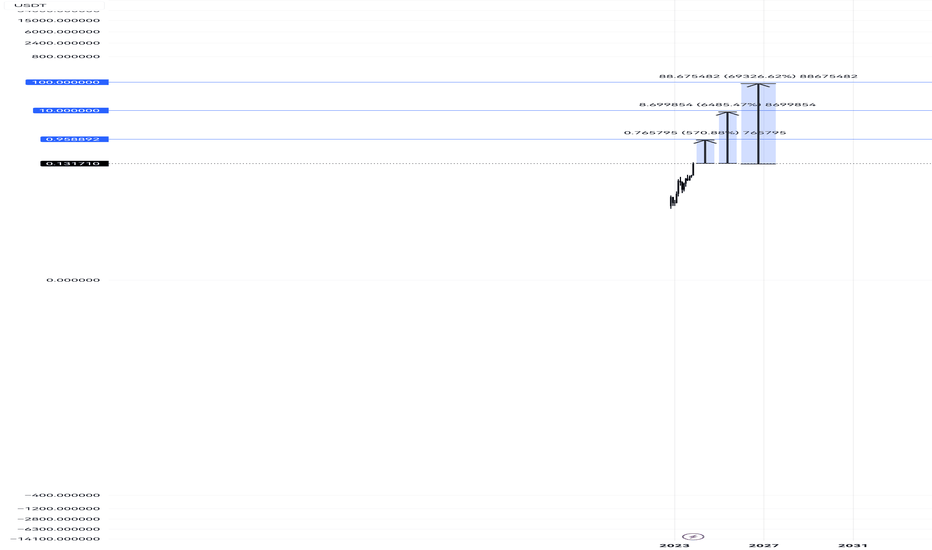

10x in 3 months?Could KASPA do a 10x in 3 months like ETHEREUM did back in early 2017? This would take us all the way up to 1.8$ per KASPA which was where ETHEREUM was at 400$. Later that year it climbed even higher up to 1400$ and that is 6.3$ in KASPA price. The sky is the limit and the limit is speculation and speculation is greed and greed is how you loose all your money!

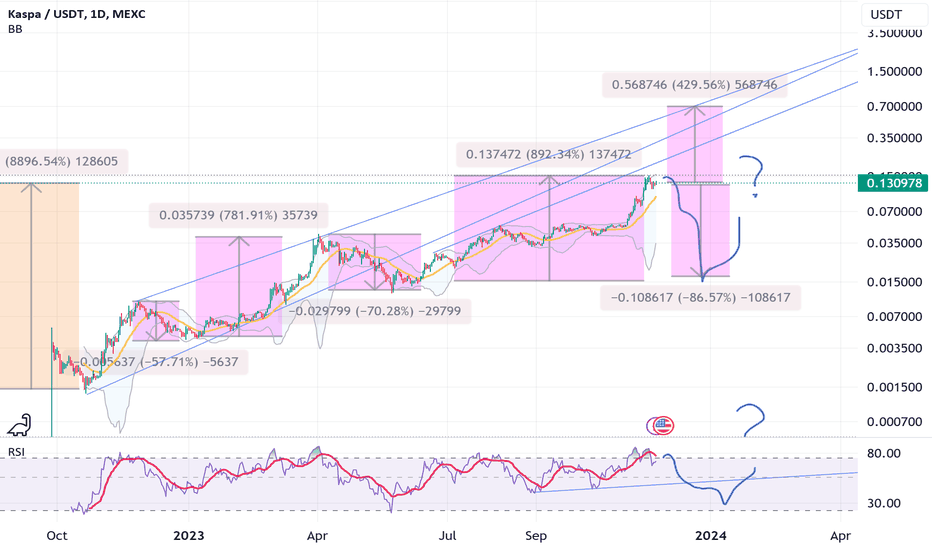

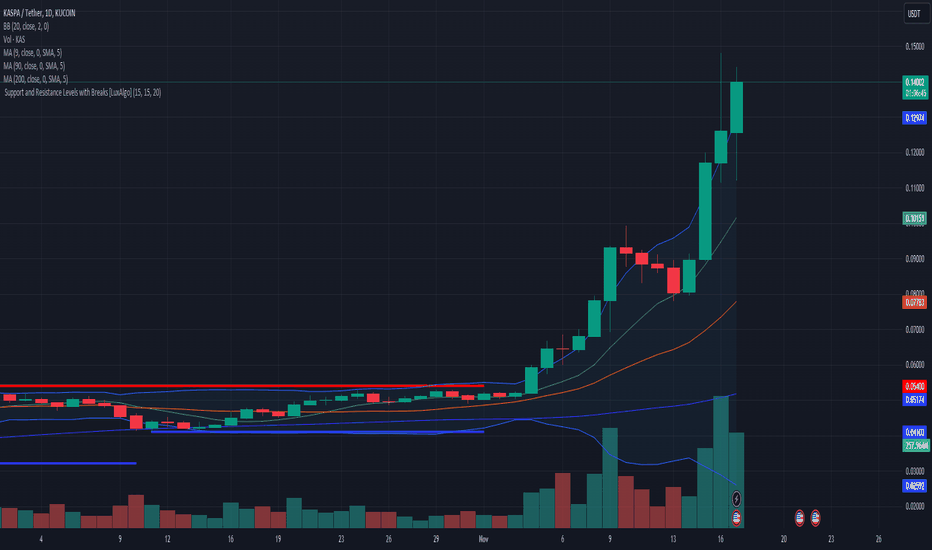

KAS/USDDT for investing purposes chart with future outlook.KAS/USDDT for investing purposes chart with future outlook.

On a daily chart RSI is overheating, on a weekly chart looks like there is some room to get some pump, but don't get excited over the massive run that KAS had Since Inception pumped up massively 71,535%, for long-term it's unsustainable in my point of view.

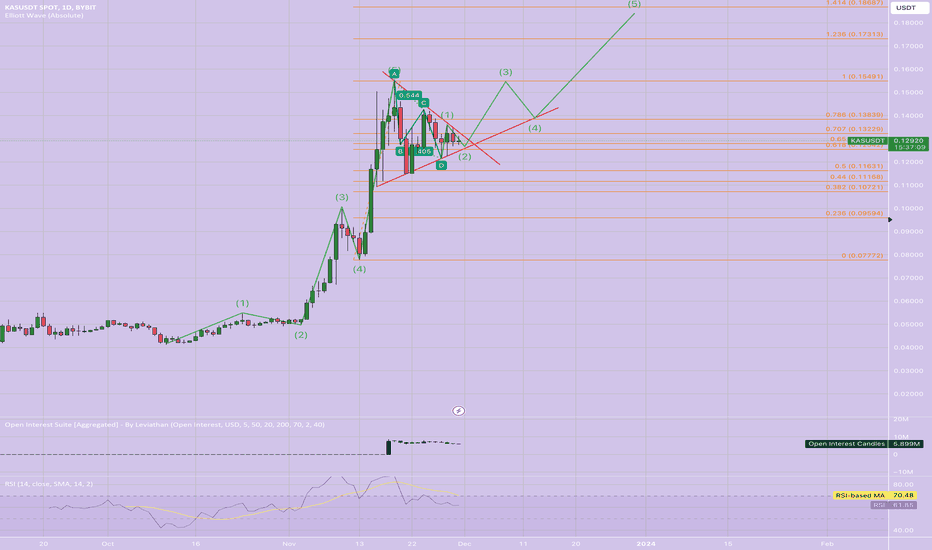

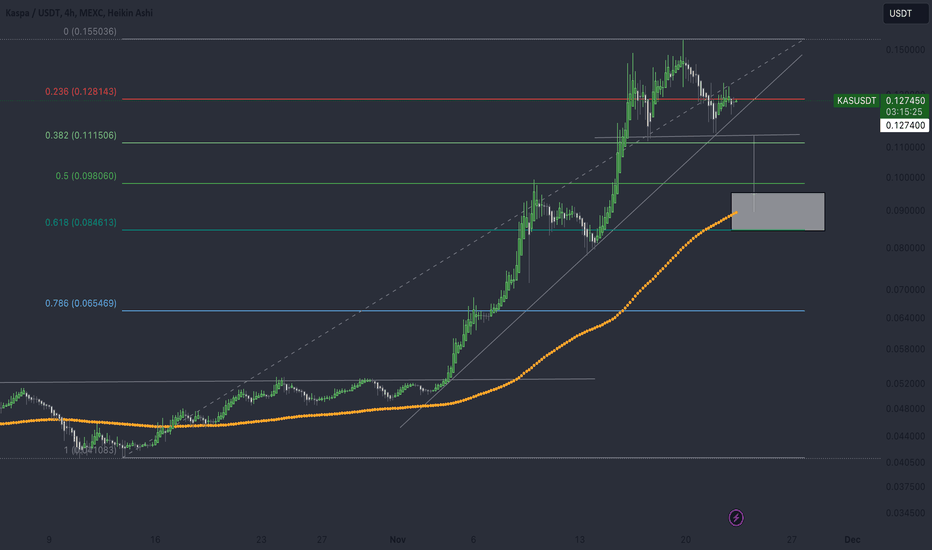

KASPA 4hr Trend AnalysisKaspa remains bullish after breaking out to new highs this month but a potential head and shoulders could be forming on the 4hr. If current trend were to break and this scenario play out, the target has rough confluence with the 0.618 golden pocket and chart structure. That being said, the trend is still holding at time of posting and that fib level is below the key psychological level of 10 cents, which would likely be defended quite strongly.

KASUSDT IDEA - KASPA IDEA#KASUSDT #KASUSD #KASPA

NO Comment!

⚠️ Disclaimer: The viewpoints shared represent my individual outlook on the market, based on publicly accessible information and historical data. While a portion of these opinions is influenced by my actual trades, others are not. It's important to note that I am not a financial advisor, and I do not assume any responsibility for the decisions you make in your trading activities.

✅ Feel free to share your inquiries or suggestions in the comments. I am more than willing to assess and analyze any cryptocurrency, forex currency pair, or stock index that piques your interest, so, Please don't hesitate to ask or mention the specific currency chart you'd like me to review.

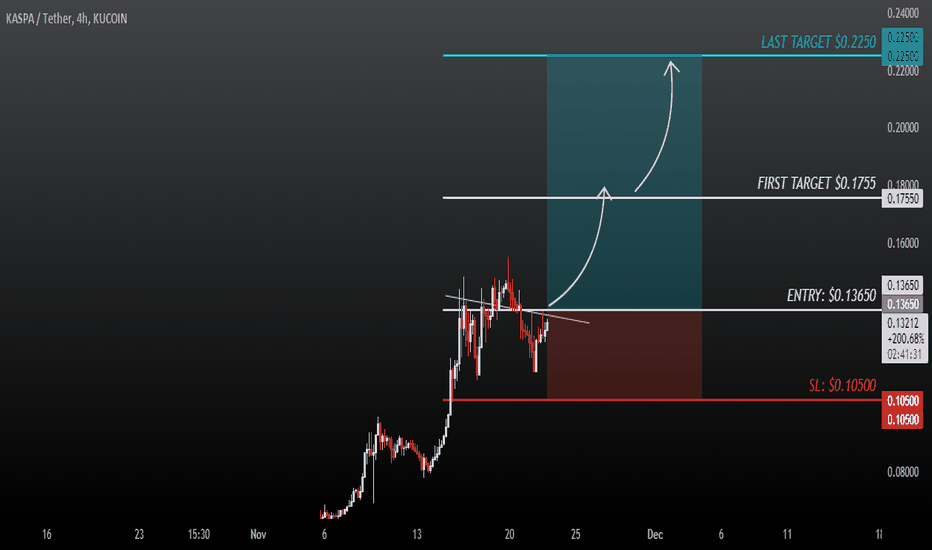

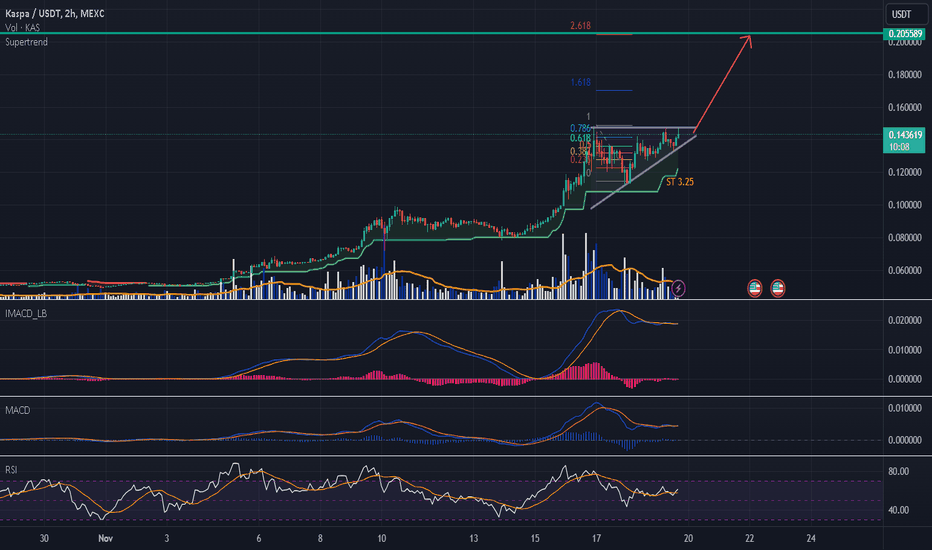

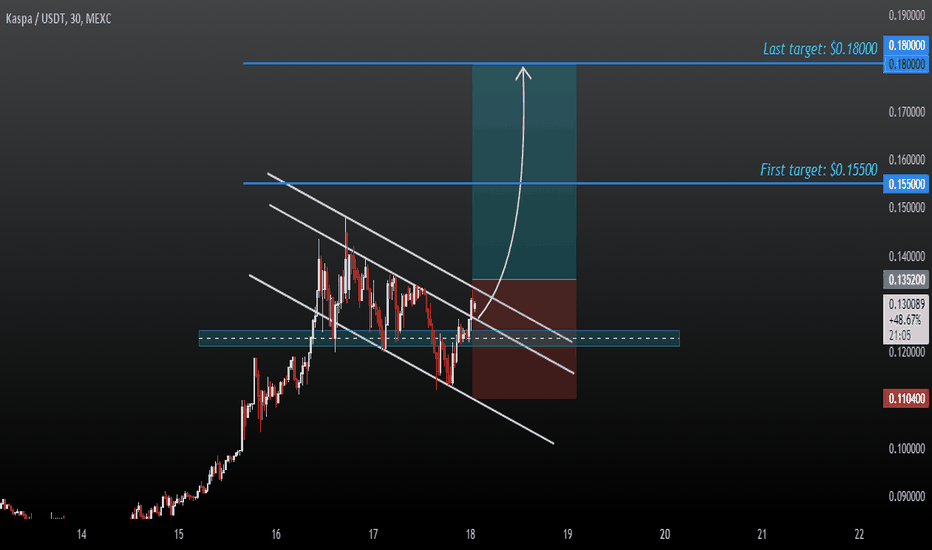

KAS LONG SETUPHi, dear traders. how are you ? Today we have a viewpoint to BUY/LONG the KAS symbol.

By protecting the green zone, it can move up and defeat the previous peak.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

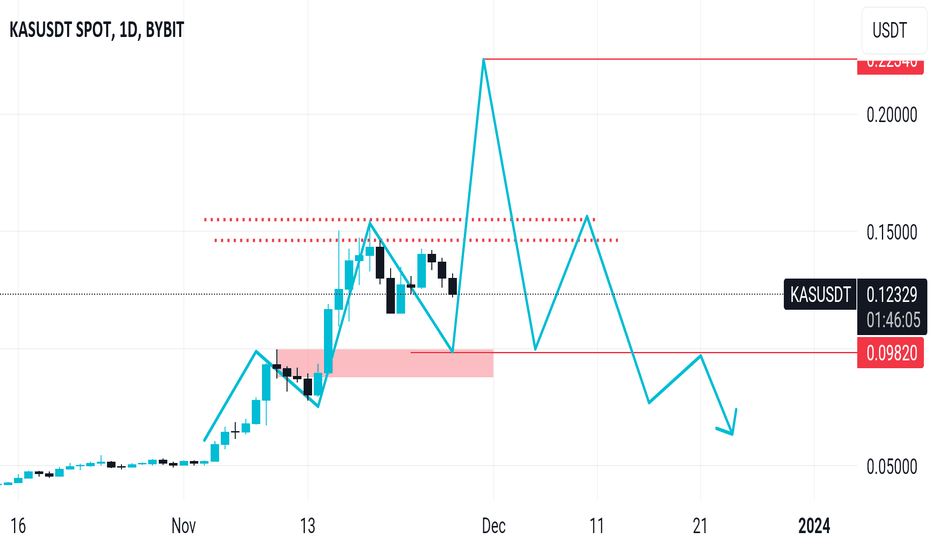

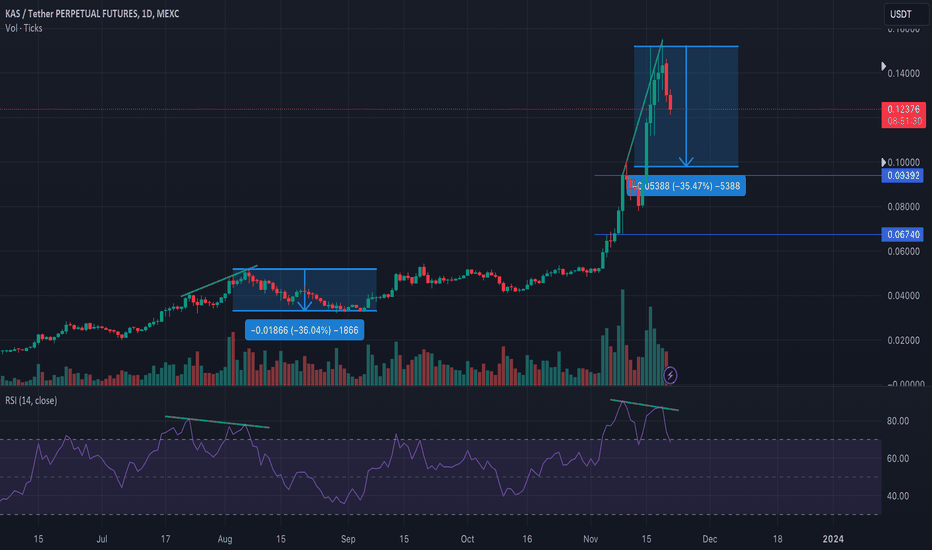

KASPA Buy Sell overviewKASPA had a really beautiful parabolic uptrend. But as it is evident from the past chart history when there was a bearish divergence on daily timeframe price did 35% correction.

There was a clear bearish divergence on daily timeframe as of now and this time we also had a decreasing volume. Price has started going down since making new all time high. If we are to repeat history and we can drop 35% from the ATH which should bring most investors to start buying into KASPA again.

For me my best buying opportunity starts from 0.092-0.095 range.

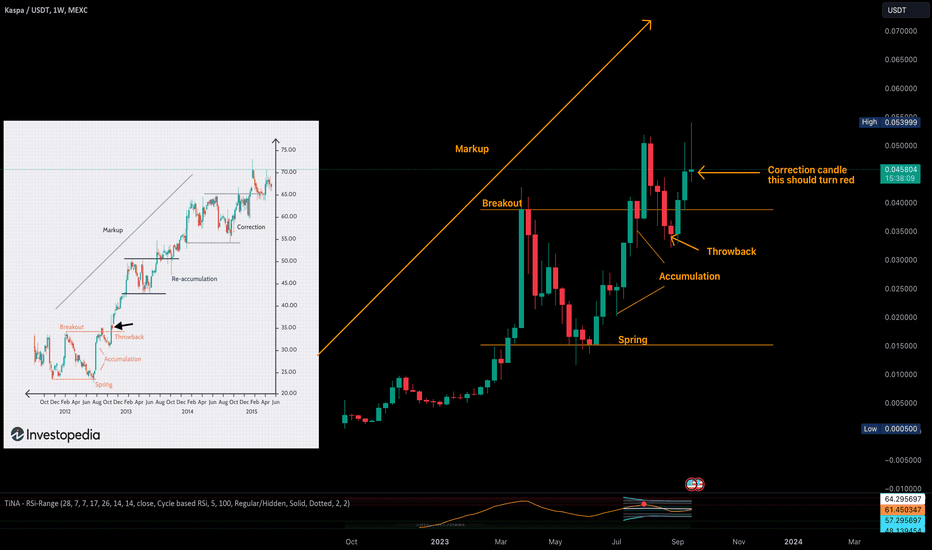

KAS, beginning of Wyckoff Accumulation?This is my idea for $KAS, if you look left to the investopedia chart of Wyckoff accumulation it has surprisingly the same looks. The black arrow I've drawn on the investopedia chart is what I think is the candle we're now on, a correction before another push up.

This is an idea only and not financial advice.......

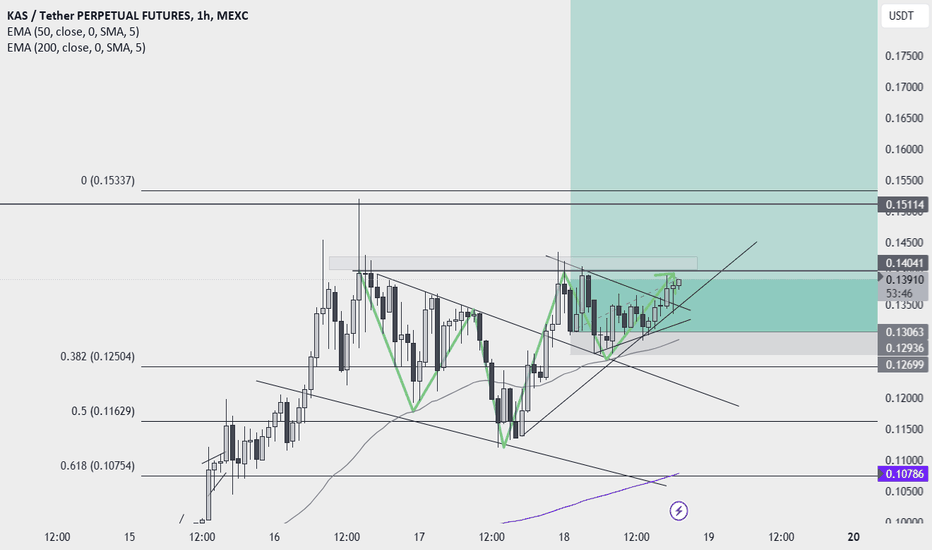

Kaspa Update | KASUSDT UpdateKUCOIN:KASUSDT CRYPTO:KASUSD

Hello, dear traders!

Ah, well, well...

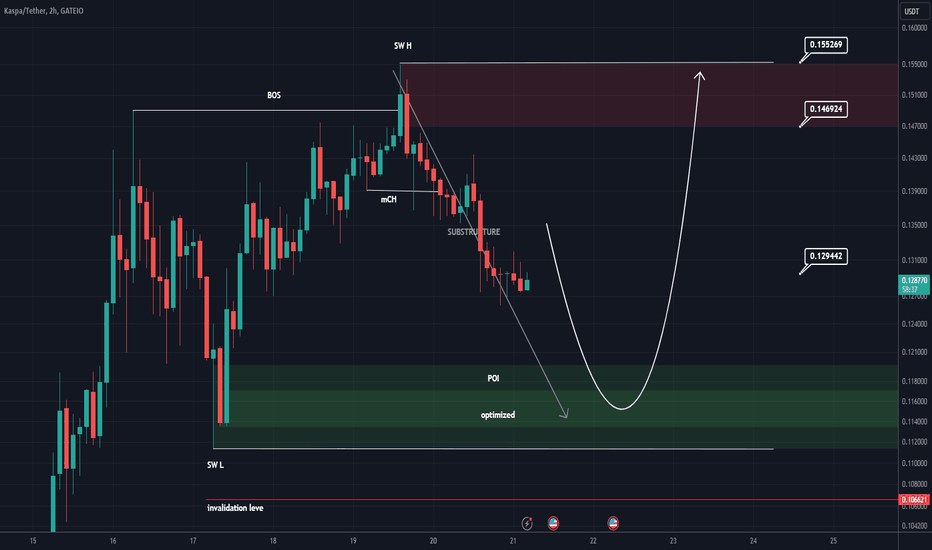

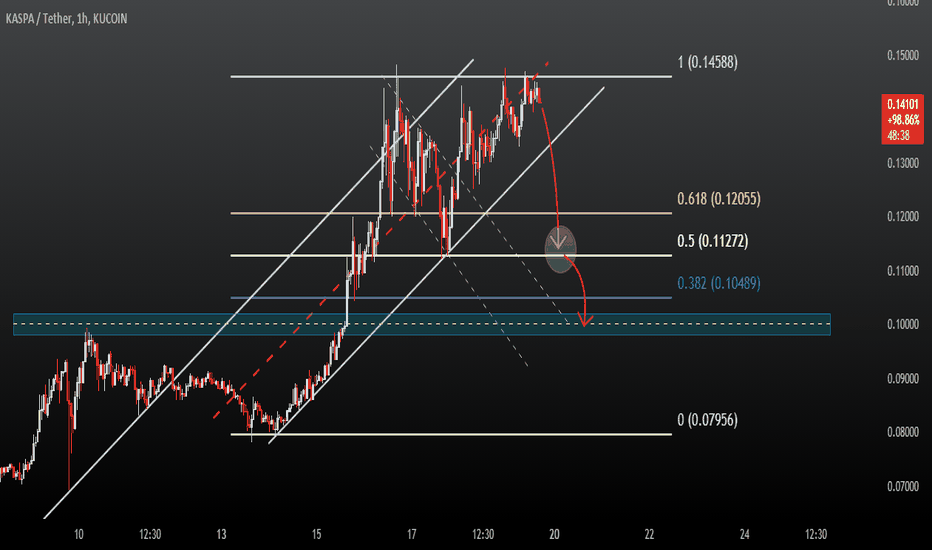

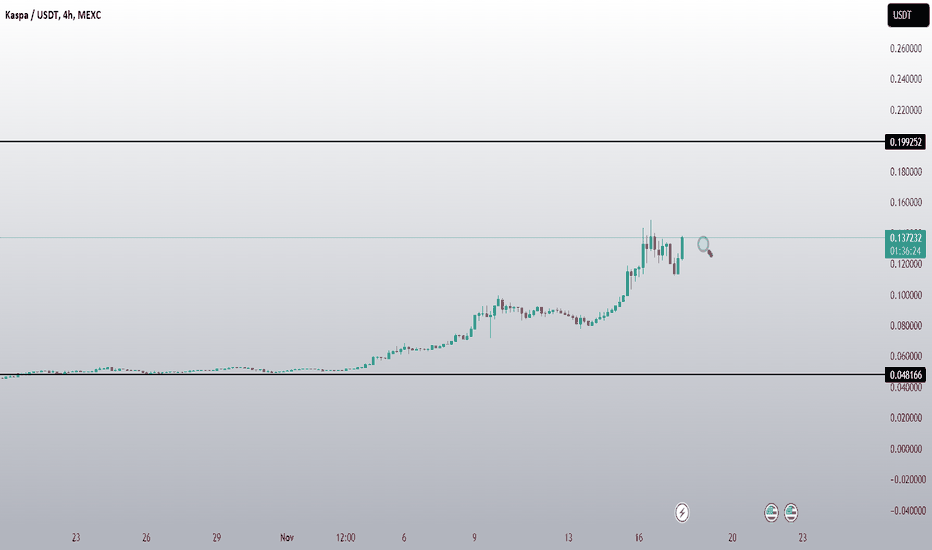

Our price chart's been playing hard to get with that stubborn $0.1500 resistance, giving it a go three times, no less! But alas, here comes the downturn.

Buyers, feeling a bit let down by the lack of perpetual growth, are wrapping up their trades, and wouldn't you know it, the bears decide to join the party. We're looking at a drop, folks.

Now, down to the 0.500 Fibonacci Ratio, we're in for a price slide. After a little breather, expect the downtrend to strut its stuff all the way down to the $0.1000 level.

✅ Wishing you all the luck in the trading arena. May the charts be ever in your favor. ✅

⚠️ Disclaimer: The viewpoints shared represent my individual outlook on the market, based on publicly accessible information and historical data. While a portion of these opinions is influenced by my actual trades, others are not. It's important to note that I am not a financial advisor, and I do not assume any responsibility for the decisions you make in your trading activities.

✅ Feel free to share your inquiries or suggestions in the comments. I am more than willing to assess and analyze any cryptocurrency, forex currency pair, or stock index that piques your interest, so, Please don't hesitate to ask or mention the specific currency chart you'd like me to review.

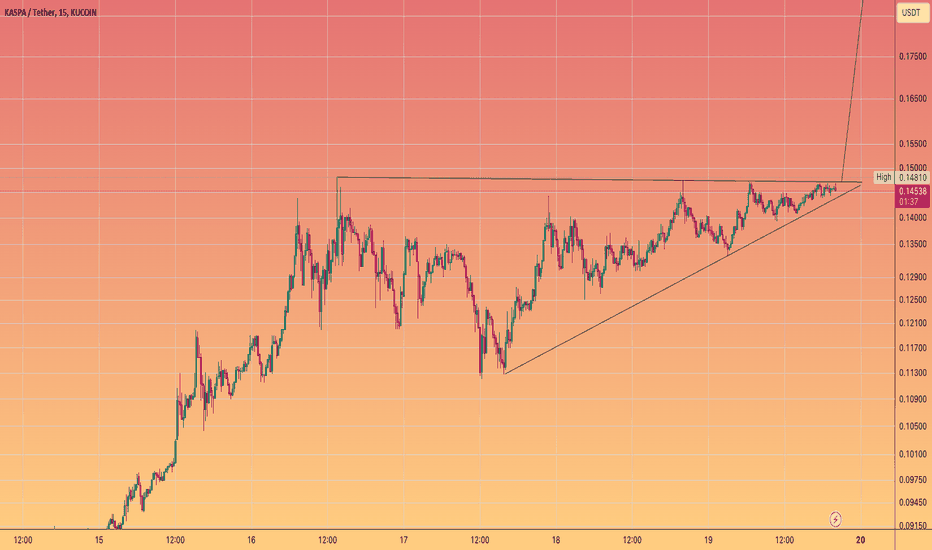

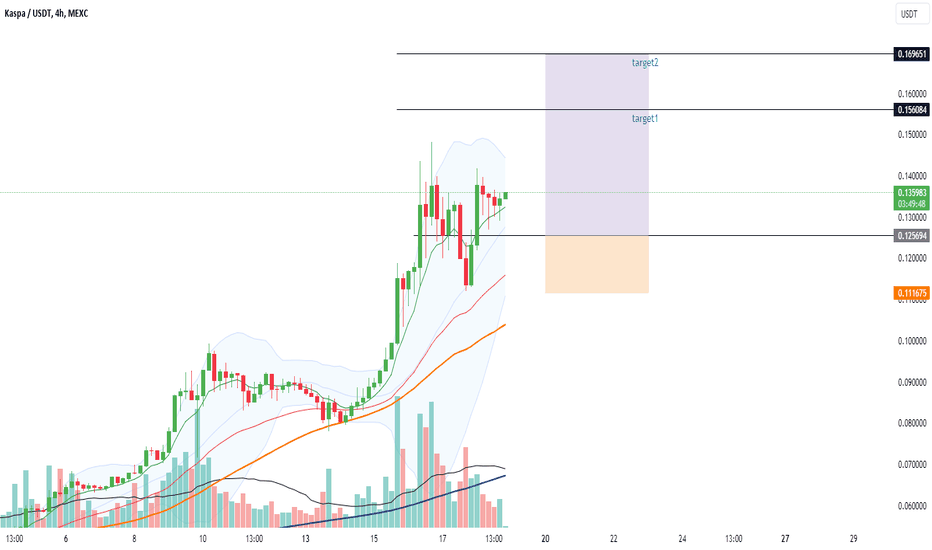

Kaspa to the moon?KASPA ( CRYPTOCAP:KAS ) has recently shown signs of consolidation, setting the stage for a potential bullish surge. With a strong foundation and several fundamental catalysts in play, KASPA appears poised to ascend to new heights in the crypto sphere.

Technical Analysis:

Consolidation and Accumulation: KASPA has undergone a period of consolidation, forming a strong support level around . This accumulation phase suggests a possible impending breakout.

Bullish Indicators: Multiple technical indicators, such as the MA, are signaling a bullish momentum gaining traction.

Volume Surge: Noticeable spikes in trading volume during the consolidation phase indicate increased interest and potential accumulation by investors.

Fundamental Catalysts:

Unique Technology: KASPA distinguishes itself with its innovative technology .

Market Expansion: Plans for expanding into new markets or regions, along with increased community engagement, could drive further demand.

Price Target and Strategy:

Given the technical setup and fundamental strength, a price target of 0.5 within the 6 months seems achievable. Traders might consider accumulating KASPA on dips near the support levels for a potential breakout trade.

Risks to Consider:

Market Volatility: Cryptocurrency markets are highly volatile, and price movements can be unpredictable.

Regulatory Changes: Regulatory developments or changes could impact the crypto market sentiment.

Competitive Landscape: Competition within the crypto space may affect KASPA's growth trajectory.

Conclusion:

KASPA ( CRYPTOCAP:KAS ) is positioned for a significant move upwards based on its technical setup and robust fundamentals. Traders eyeing a potential rally should closely monitor the price action, considering both technical indicators and upcoming fundamental developments.

KASUSDT | KASPA IdeaKUCOIN:KASUSDT MEXC:KASUSDT Kaspa vs Tether

No comment!

⚠️ Disclaimer: The viewpoints shared below represent my individual outlook on the market, based on publicly accessible information and historical data. While a portion of these opinions is influenced by my actual trades, others are not. It's important to note that I am not a financial advisor, and I do not assume any responsibility for the decisions you make in your trading activities.

✅ Please don't hesitate to contact me with any inquiries or suggestions. I am more than willing to evaluate and analyze any currency pair or index that captures your attention.

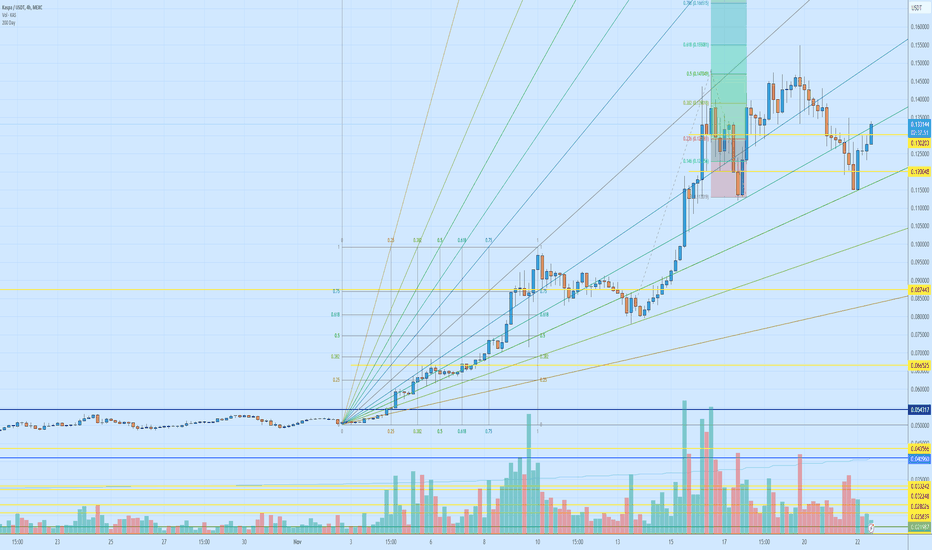

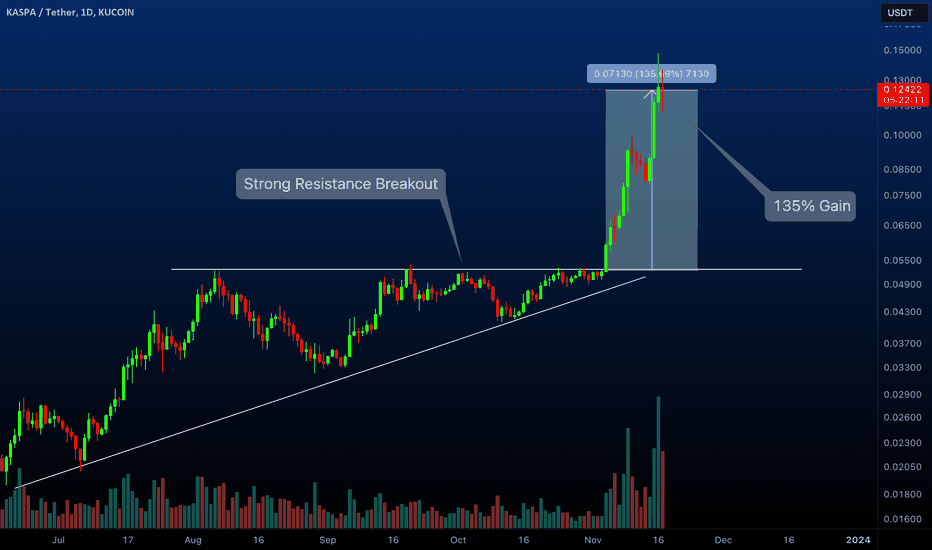

How strong resistance breakout is best buy ?When price is rejected at the resistance level multiple times and when price finally manages to breakout the resistance is one of the best opportunity for the LONG trade (Vice versa for short trade)

In the above chart of KASPA is one of the best example showing this behaviour.

KASPA price got rejected more than 4 times because of strong resistance and once the price managed to breakout the resistance , price went up in a sudden surge gaining 135% in space of 1-2 weeks.

We should keep an eye on these type of resistance breakouts, these are the best entry for LONG trades with very minimal list.

Follow us for more such tips and share your thoughts in the comments.

Cheers

GreenCrypto

Unlocking the Future of Kaspa: Navigating the Waves of OpportuniIntroduction:

As the Kaspa ecosystem continues to evolve, traders and investors find themselves at a pivotal juncture. The crypto market has witnessed the resurgence of Kaspa, with its price bouncing back to 5.4 cents. However, beneath this apparent revival lies a complex web of factors that demand careful analysis and strategic decision-making. In this comprehensive analysis, we delve into the various facets of Kaspa's current state and its future prospects.

The Binance Listing Dilemma:

One of the most anticipated events for Kaspa is its potential listing on Binance. While such a listing could propel the coin to new heights, it also carries the looming risk of a price dump. Traders should remain vigilant, as the immediate aftermath of a Binance listing often results in price volatility.

Mining Difficulty and Increased Sell Pressure:

Another critical factor to consider is the impending wave of ASIC miners entering the Kaspa network. This influx will undoubtedly increase the mining difficulty, potentially forcing miners to sell a higher percentage of their coins to cover operational costs. This added sell pressure could impact the market dynamics, causing short-term price fluctuations.

The Retail Moonbaggers' Dilemma:

Retail investors, often referred to as "moonbaggers," have played a significant role in the recent surge of Kaspa. However, there are concerns that many of them have exhausted their capital reserves and might not have the resources to further support the coin. This situation may limit the buying pressure from this segment of the market.

Early Whales Cashing Out:

Early Kaspa whales, who took substantial positions when the coin was at its infancy, are now cashing out their holdings. They anticipate a return at the 5-cent mark, highlighting the cyclic nature of speculative, high-volatility assets. This trend indicates a level of uncertainty among the more seasoned investors.

The Inevitable Bubble Burst:

In speculative markets like Kaspa, the cycles of euphoria and disillusionment are a well-established pattern. The current price levels at 14 cents may not be sustainable in the long run. As the bearish sentiment of the market wanes, and moonboy bagholders start to sell, there may be a lack of demand to support these elevated prices.

Conclusion:

In conclusion, Kaspa is at a crossroads, with multiple factors influencing its price trajectory. The impending Binance listing, increasing mining difficulty, and the dynamics of retail and early investors all contribute to a complex landscape. Traders and investors should approach Kaspa with caution and consider the cyclic nature of speculative assets. This analysis serves as a reminder that prudent risk management and profit-taking strategies are essential in navigating the ever-changing crypto market.

Disclaimer: This analysis is for informational purposes only and should not be construed as financial advice. It is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.