Kadena BUY SETUP Hi everyone if you like the idea or setup please give it a like and a follow

Here’s a requested analysis on Kadena

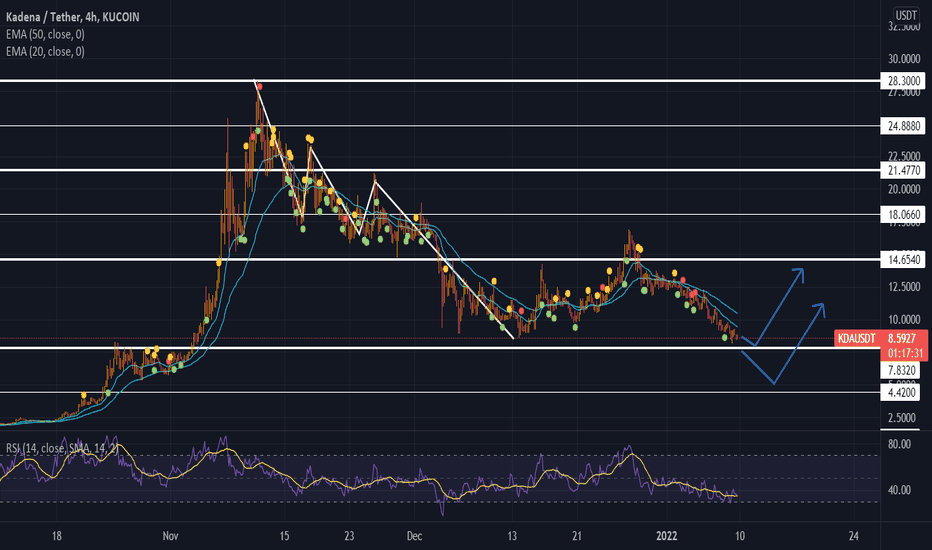

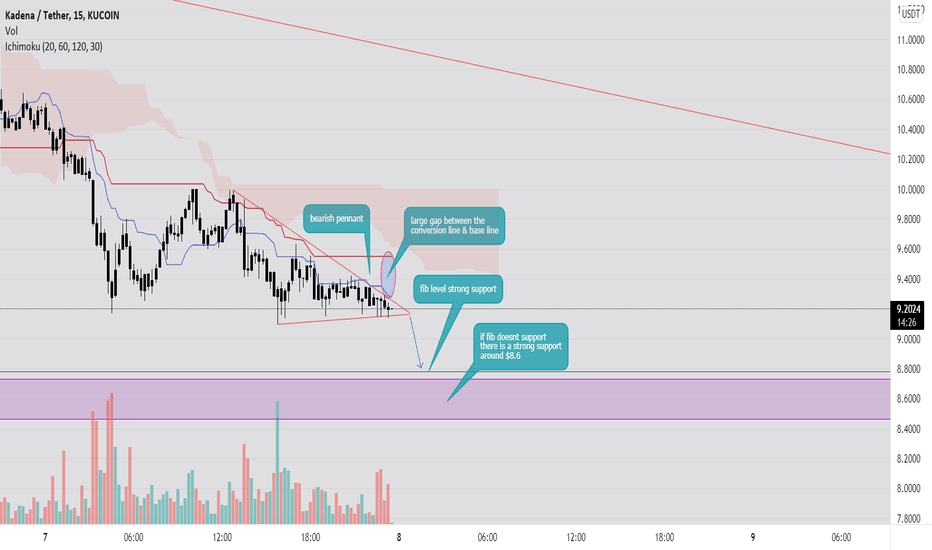

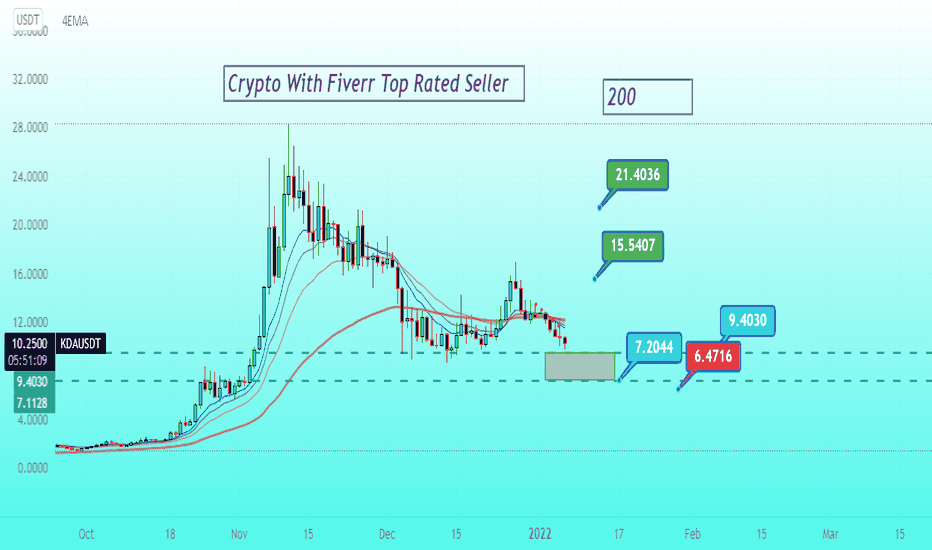

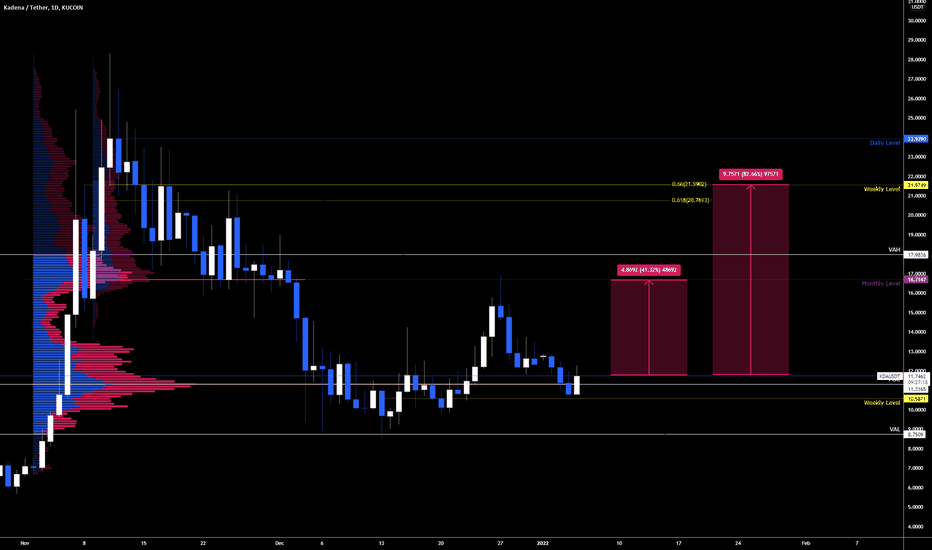

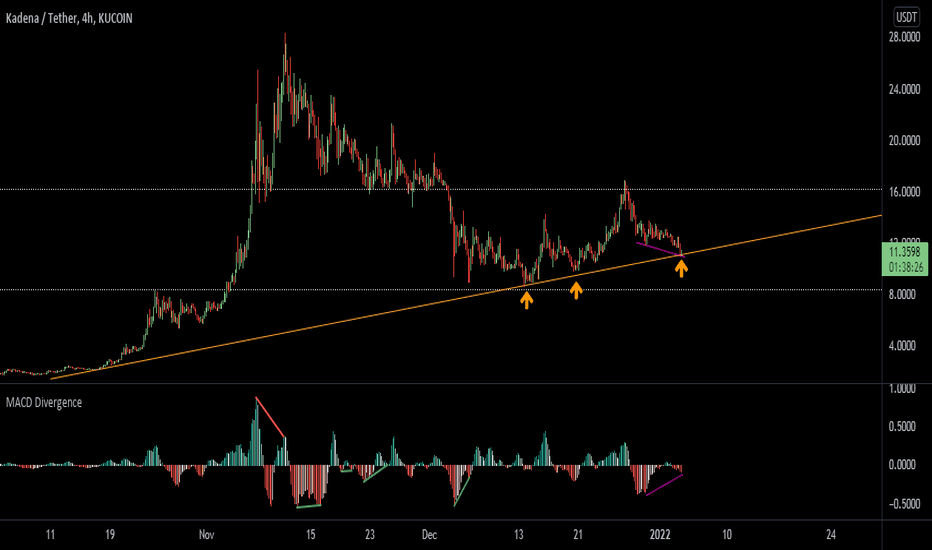

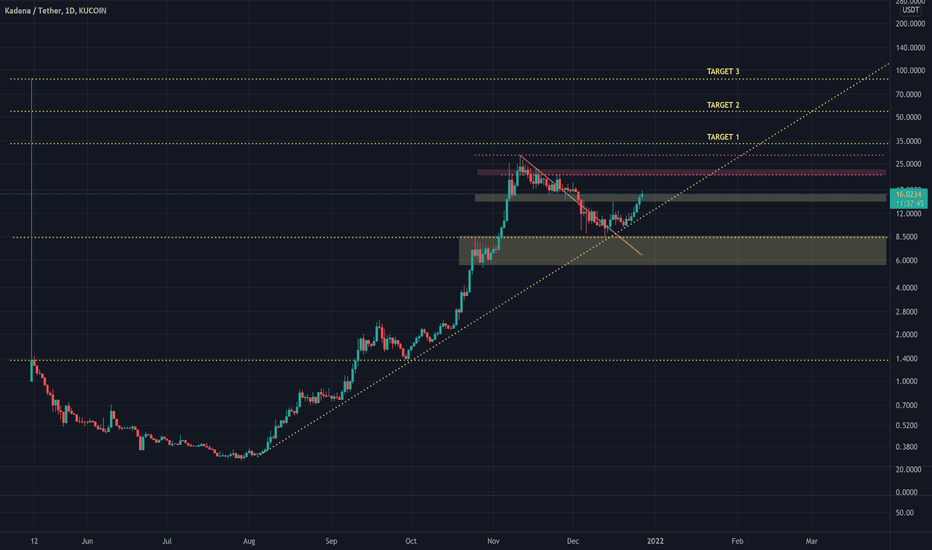

Seems to be a a good entry level at the time, market pulled back to our Fibonacci magic level of 0.61 completing its pullback, market hasn’t gone too far from the price since then and most times when markets move sideways it only means its accumulating and getting orders in and getting ready to move.

As always, Be patient, but don’t time the markets

KDAUSDT trade ideas

KDAJust look at the scribbles. I believe it will go down long term this is just another opportunity to sell higher if it goes up. I was selling only in thousands previous peaks i will try tens of thousands now and rebuy for my dreamy lucky $7. Worst that can happen is sell for $15 and buy for $10. Those are achievable targets imo. I will might reach $20 after listing on Binance for now its crab season.

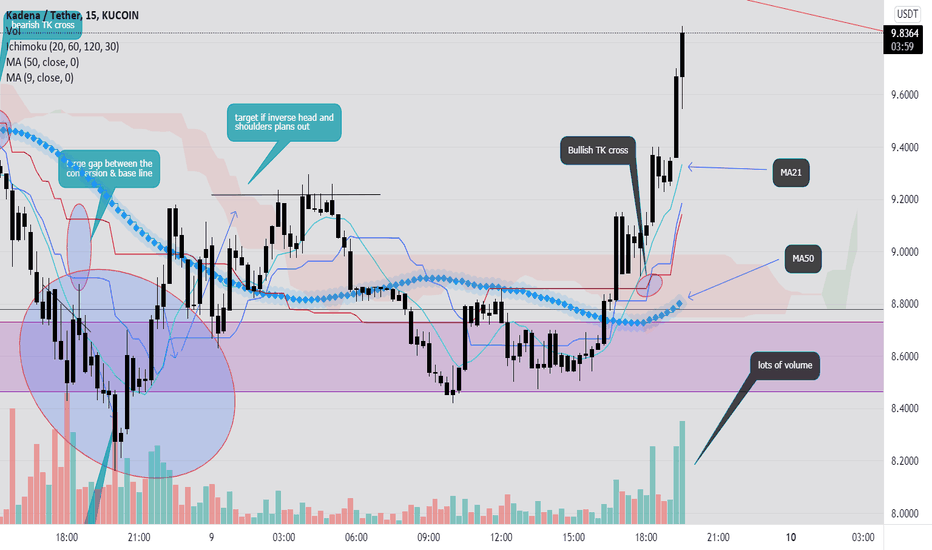

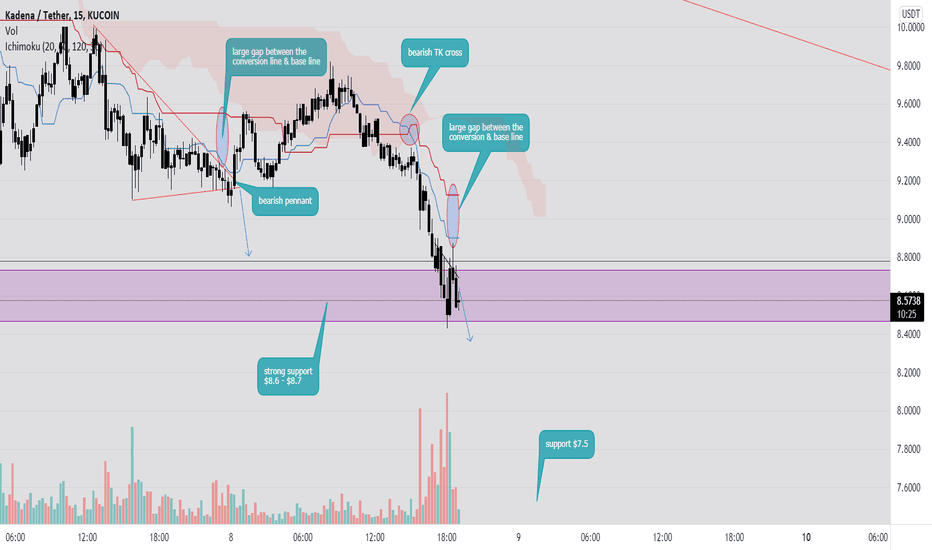

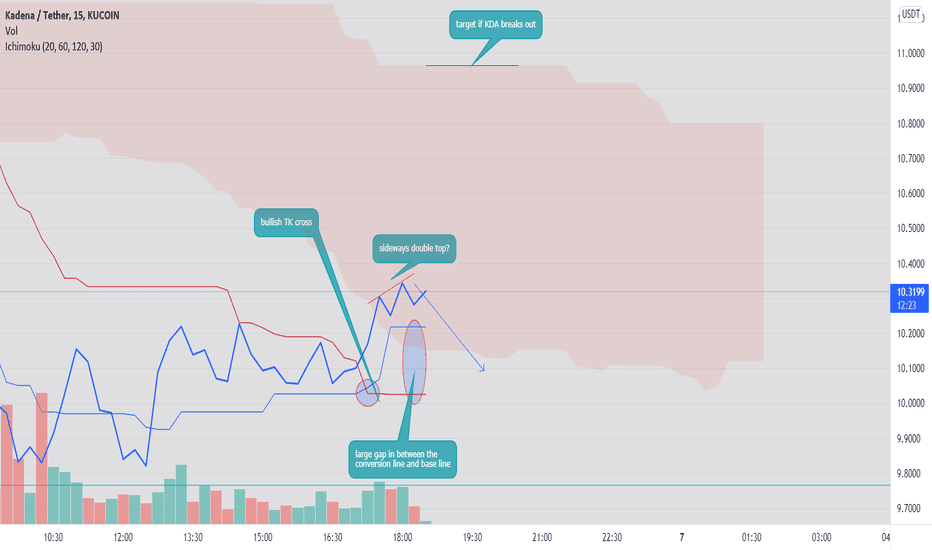

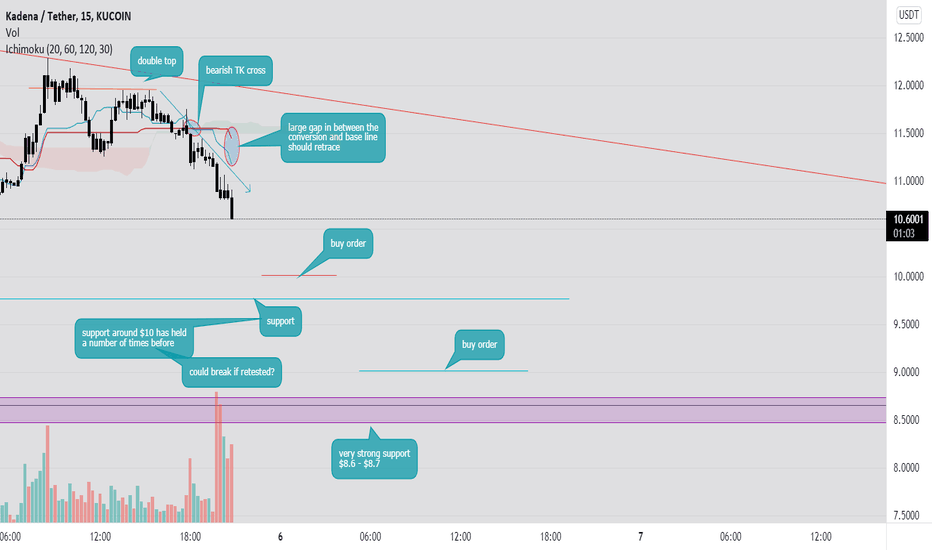

KDA 15m timeframe. Bullish or Bearish?mixed signals on the KDA 15m timeframe

- there has been a few candle closes in the red ichimoku cloud which indicates a leg up to the top of the cloud or above

- there is also a bullish TK cross which supports this move up

- but there is a large gap between the conversion line and base line which indicates a move down

- also a double top which supports the idea of a move down

i expect a move up as prices are low, people surely are buying the dip.

but who knows could go either way

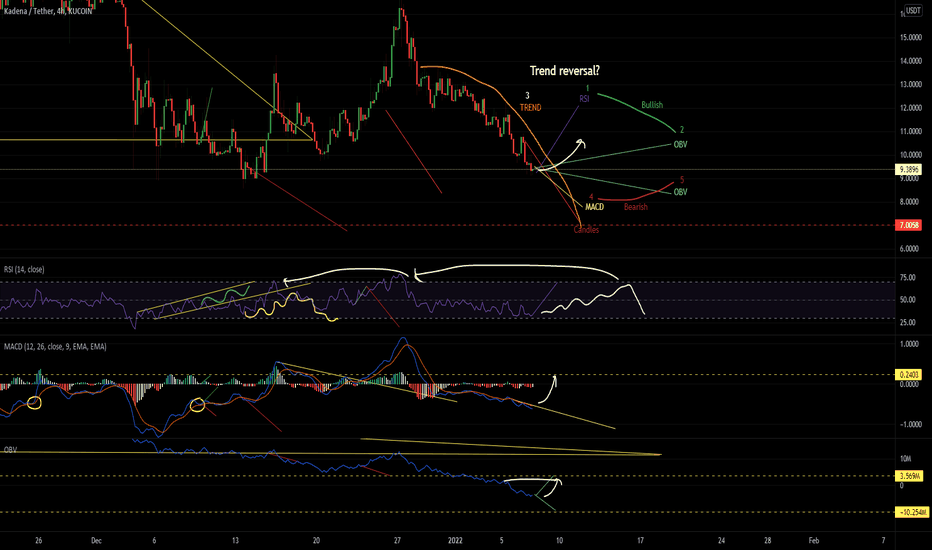

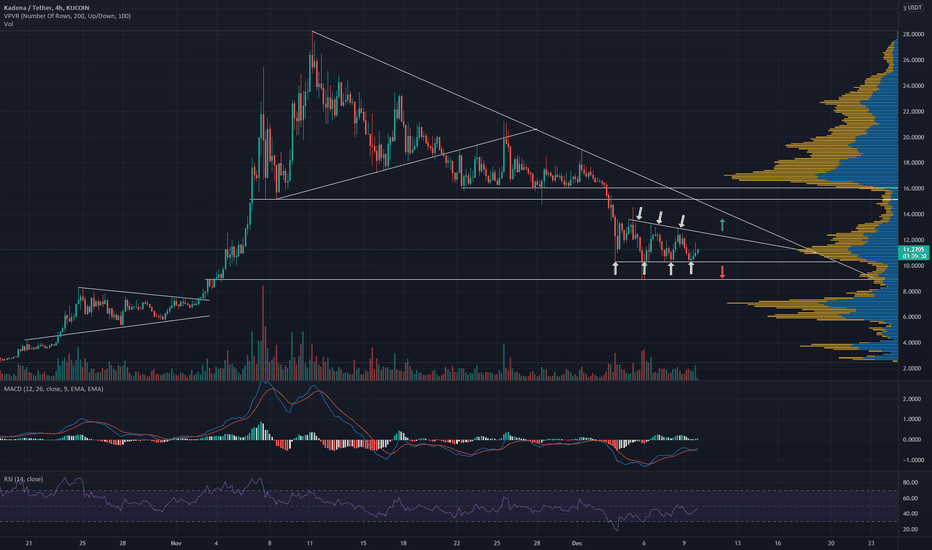

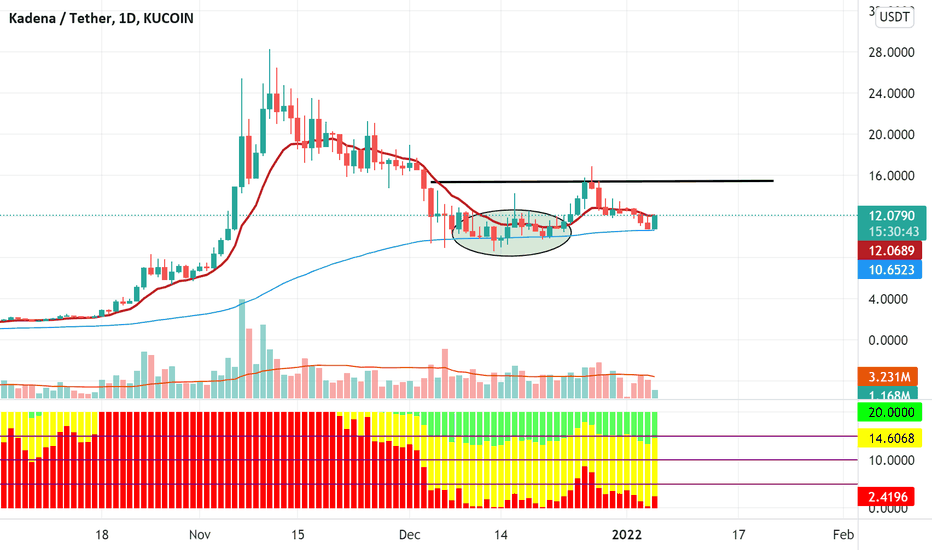

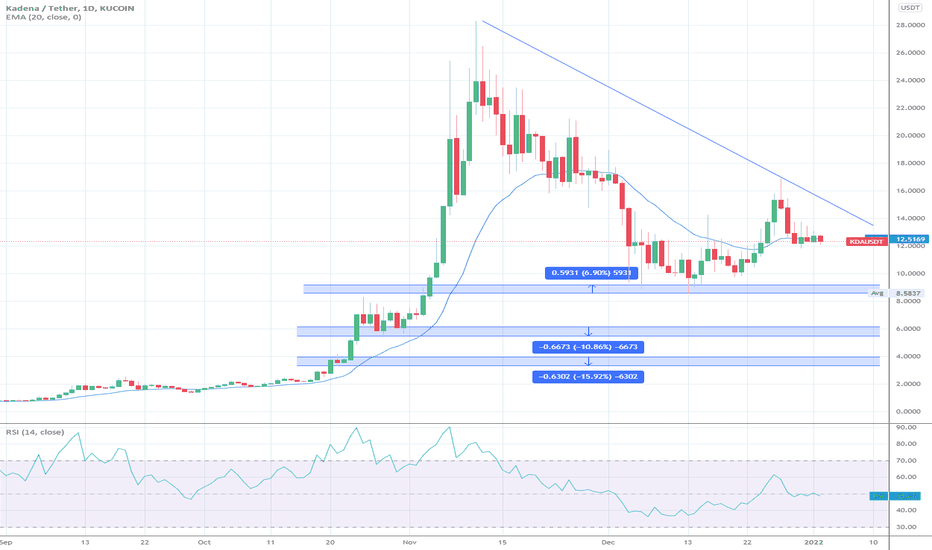

$KDA - Time for Reversal or Keep Going Down?Kadena has had a nice run in November from around $6 all the way to around $28!

However, since its top, we have reached around 60% down from all time highs in November 11th.

Since then, it has been in a consistent downtrend.

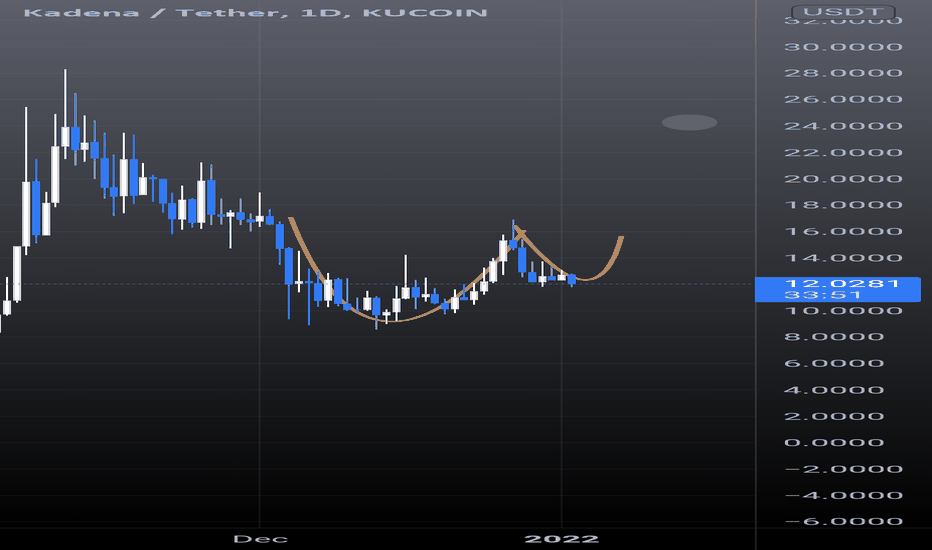

However, at these levels, are buyers ready to step up?

We are now sitting in the lower channel on $10.45 - $13.30 range.

For Longs - Need to hold $10 support level.

Ultimately breakout of this channel and create new highs above $12.9.

For Shorts - We would like to stay under $13 resistance level

As well as Breakdown Channel under $10.25.

Let me know what you all think.

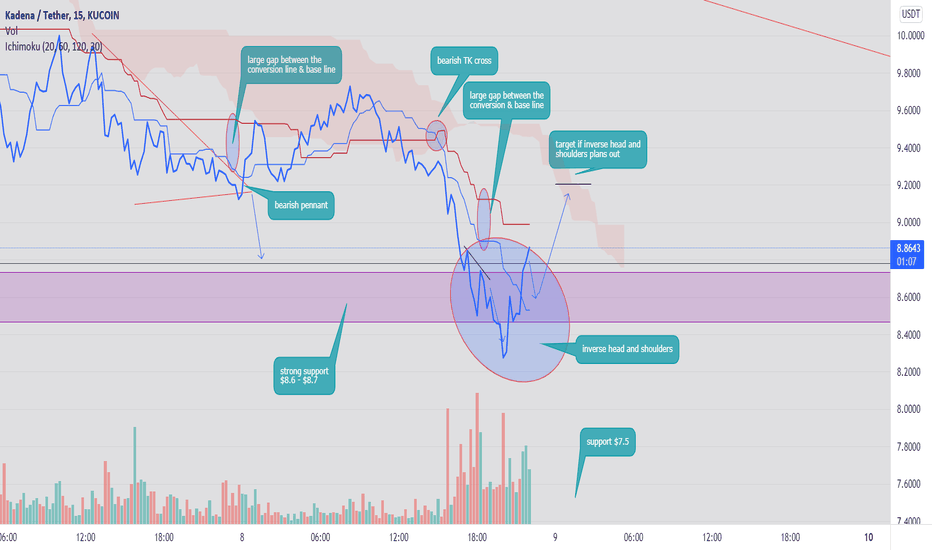

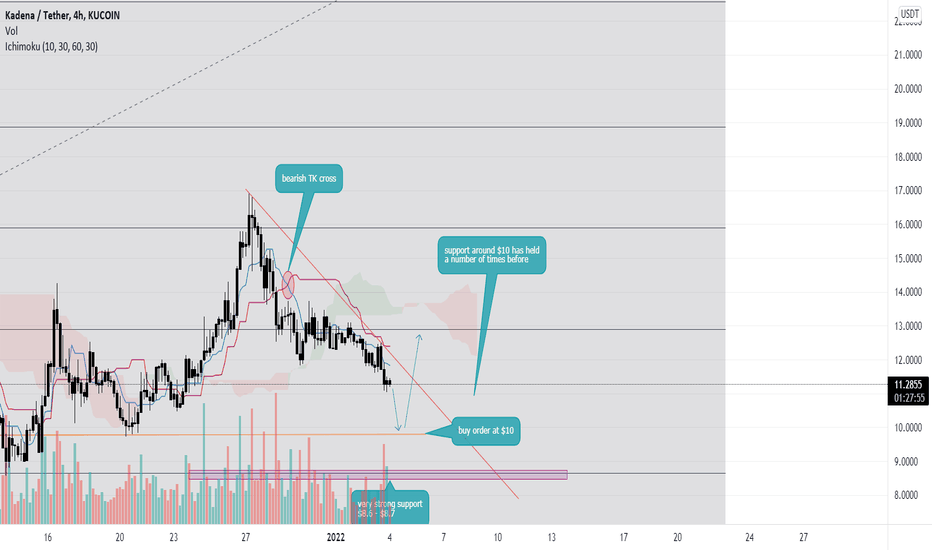

KDA/USDT on a 15m chart- double top

- bearish TK cross

- large gap in between the conversion line & base line = bearish

- support around $9.7 may break as its been tested a number of times in the past, however if this does break a support at $8.7 will hold

- thx to BTC for this retracement, also BTC to $42.5k

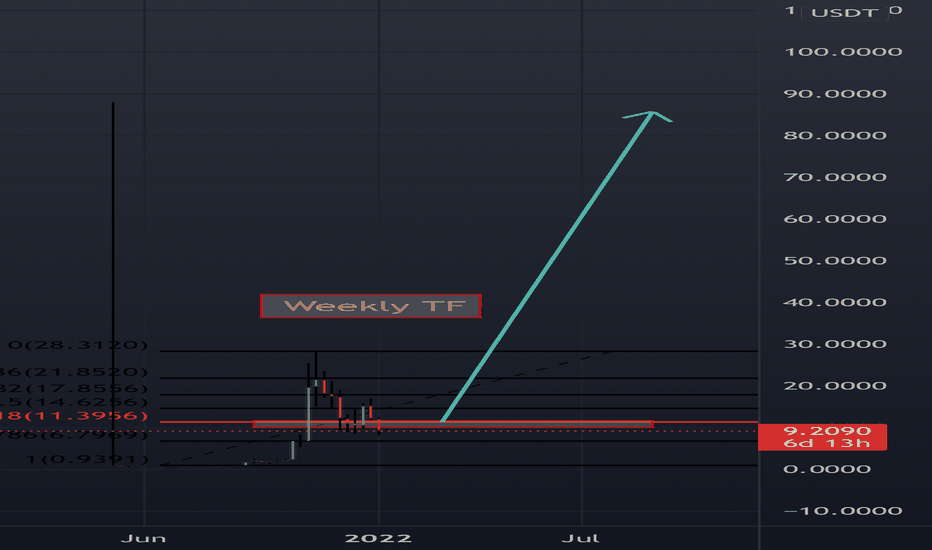

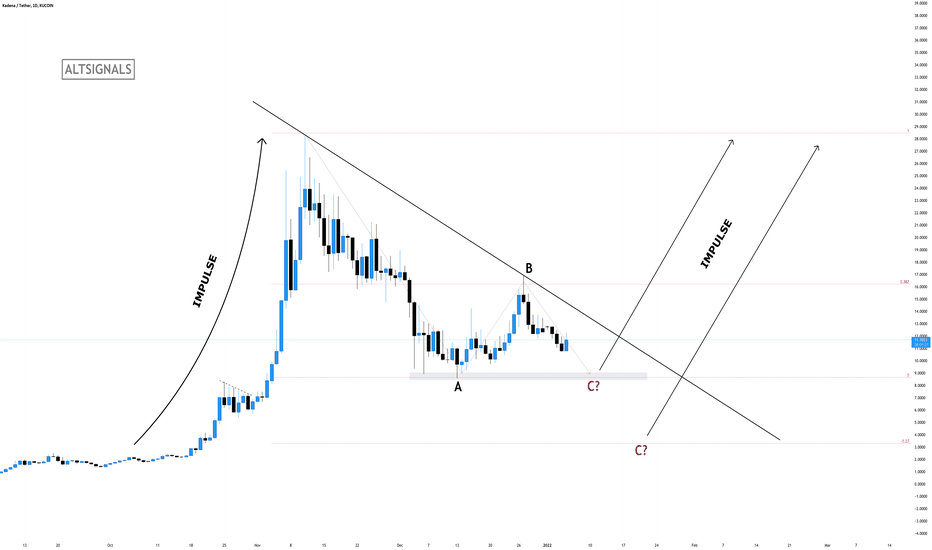

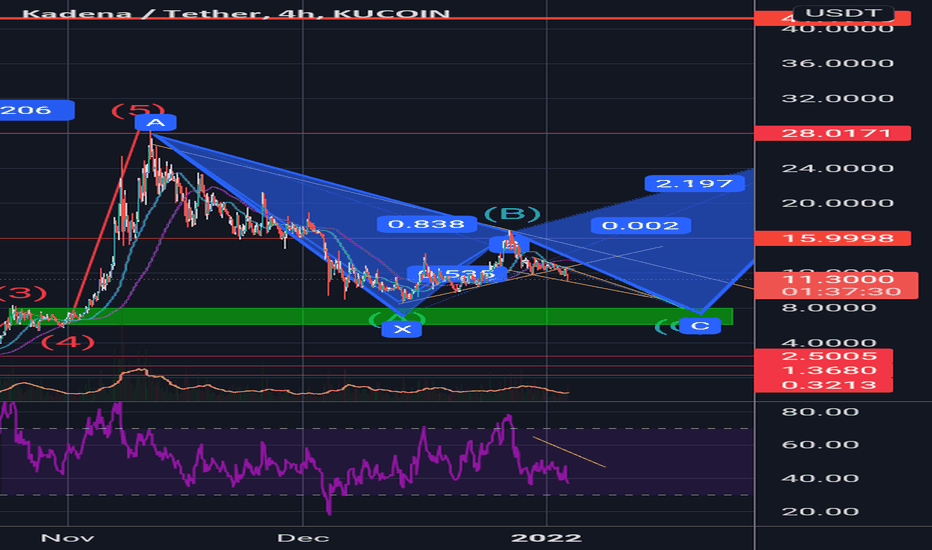

KADENA - EASY SETUP 🚀Kadena is showing us a very simple and easy setup. We had an impulse and now we're in an ABC correction, which will be followed up by another major impulse. Only question is where will the C wave stop.

We have 2 areas where we are looking for the end of C and the start of the impulse.

First area: 8.5 to 9

Double bottom area

Second area: 3.3 to 4

-0.27 fib

Trade Idea:

- Watch for the completion of C wave at one of the 2 areas mentioned

- Enter when bullish price action appears

- Put stops below the rejected price

- Targets: 28 - 33 - Hold the rest

Goodluck!

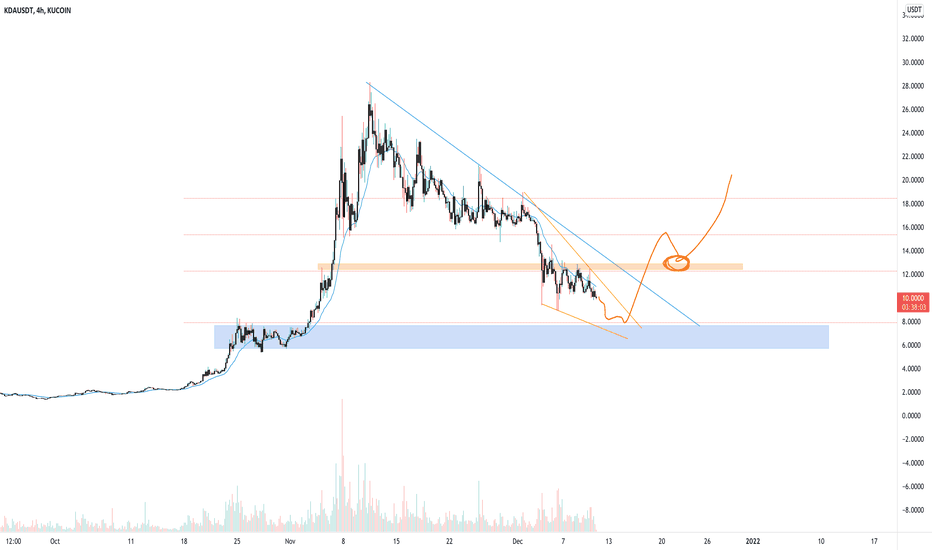

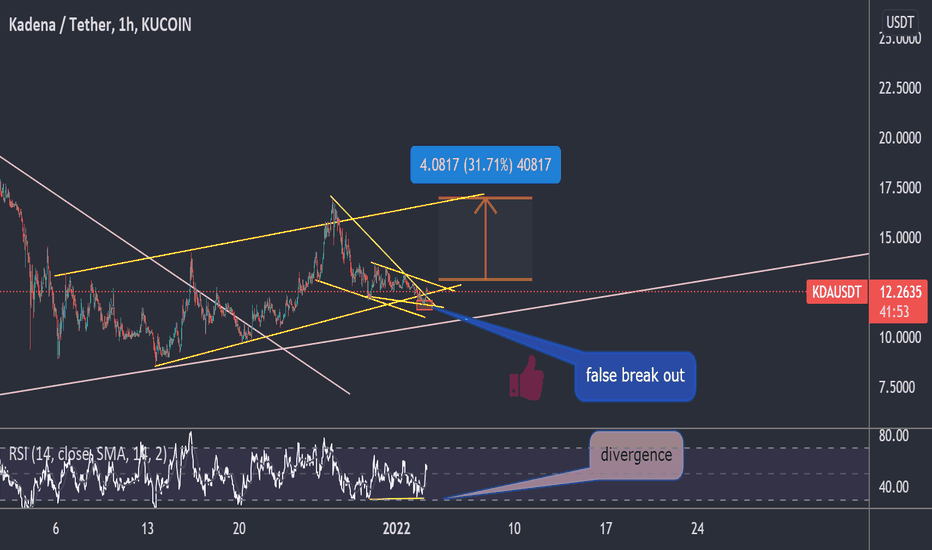

KDAUSDT is creating a falling wedgeKDAUSDT is creating a falling wedge inside the daily structure.

IF the price is going to have a breakout, According to Plancton's strategy (check our Academy ), we can set a nice order

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> <4h structure.

Breakout confirmed, possible batLike expected the bear flag broke out to the downside, breaking the trendline suport. We had a retest and now its heading further down, perfect for dca.

There is a gap below 9$, so curious to see how kda will react to the previous low. We could bounce back from there, create a double bottem reversal pattern and a possible bat formation suggest we should seek up previous ath.

If the 9$ doesnt offer suport, we will visit the 6$

Timing wise, btc is looking to hit his trendline in 2 weeks, where i expect a bounce. This is the same timing i see for the kda bottem around sunday 16jan.

From there its just pure moon.

Not financial advise, this is pure for my own educational research and backtesting theories.