Retrying the Edge to Edge trade on KomodoI recently had a loss on a stopped out E to E trade on KMD and a few of my others. Nearing the end of the day KMD is closing above the Kijun, in the cloud, and with a TK cross on the Daily. All these considered I will enter the trade with the close fulfilling all the above conditions. Just because a trade failed once doesn't mean you shouldn't try it again (with good conditions of course).

KMDBTC trade ideas

So Many Edge to Edge Trades available with great R:RThere are many great edge to edge trading opportunities here with good Risk to Reward Ratios.

Most involve big possible percentage gains, but range from 10 to 20 percent possible losses. Make sure to only risk what you can afford to lose. For me that is about 1% of my account on every trade, but with all these opportunities I have decreased that to .5%. This gives me more opportunities to trade in the long run, but fewer gains in the short run.

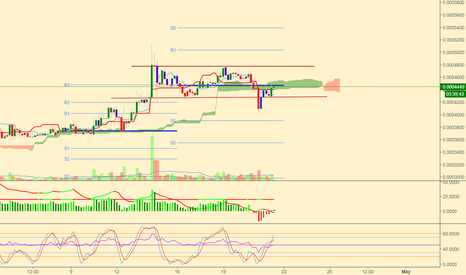

KMD C&H to to .00053KMD broke out of downtrend a bit ago and has since pushed a first leg up into a correction. That correction has landed right on the 0.618 fib level which is a bullish bounce off from there and now has formed a handle to make a cup and handle. The handle retraced to the 0.5 fib level which both fib retraces are normal cup and handle retraces. Volume profile is right as left of the cup has most volume and it has decreased since and the handle has a decreasing volume profile as well. The handle also retraced right into the strong VPVR order block and has bounced. The pattern will be verified on a break of the cup neckline with significant localized volume.

Target: 0.00053 which is about 15% from price now however the safest way to play this is to enter upon cup break especially with the left side of the cup having a large wick we must have a real volume breakout to know it has broken that resistance.

KMD Bullish running into oversold zoneKMD has broken out of its bearish trend at the vertical blue line. KMD is looking to establish new support after it runs into oversold RSI and ADX. KMD is a legit project with the first decentralized exchange BARTARDEX to offer atomic swap. A very underrated project with strong developers, lots of github commits, and read this medium.com

KMD will blow your mind and they are definitely going to disrupt the crypto space. One of my high recommended buy coins.

A $KMD bag holder charting $KMDtargets are fibs, no target timeframe

you'd want to have gotten in before .00038 but hindsight bias a b*tch

I'm not gonna tell you where to put your stop loss or give R:R because I think you should be able to do that according to your balance/capital/equity

anyways DYOR, leave a follow, a comment, some hate, whatever

always willing to learn more so if you feel like you can open up opportunities for a pleb like me feel free to reach out

Komodo cup handle poised for breakoutKMD having formed a giant parabolic cup in the last few weeks is coming up to a handle formation.

It is now moving downwards in a channel forming the handle and possibly nearing the bottom and ready to break out to the upside,

target (in green)

0.0005695 or Fib 1, whichever first

Points of resistance:

Fib 0.5 (0.0004952)

Fib 0.618 (0.0005122)

Fib 0.786 (0.0005363) to 0.0005506

Entry: you can wait for confirmation on the breakout before buying in to be sure.

Stop loss would be bottom of the channel, where it exits to the break out.

Profits: Take profits along the way, I typical sell portions of my position to secure profits along the wya, before each points of resistance.

Goodluck!

KMDBTC (re-up 16/4) short-term (gain confirmed)16/4

KMD -1.64% having really good signs right now:

- golden crossed D1 chart

- downtrends broke and retest

- H&S pattern target reached + RSI down so now it supposes to be retracement a bit

The order should be around 4045 - 4276 or buy right now if you're really bullish

(because sometimes 30-50s above buy target is okay for solid trends).

As usual:

- stoploss: below 4000

+ target 1: 5650

+ target 2: 6722

17/4

Gonna reach buy order target!

Komodo VS Bitcoin Slow ReversalKomodo has established support and resistance areas, around 30k and 90k satoshis. Price continues to range between those levels, and currently is at the bottom of the range. 76.4% Fibonacci retracement level is being rejected, confirming the potential bottom of the current wave down.

From the 30k satoshis area, the price is likely to start moving upwards, although it could be a very slow reversal that could take another month. First of all KMD/BTC has to break above the downtrend trendline, with a daily close above 45k satoshis. And secondly break above 60k satoshis should confirm a strong move up, that should take price up to 88k, 100k or 122k satoshis levels. In the unlikely event, when the 30k support is broken, Komodo could get back to 17k satoshis level.