KGDG2026 trade ideas

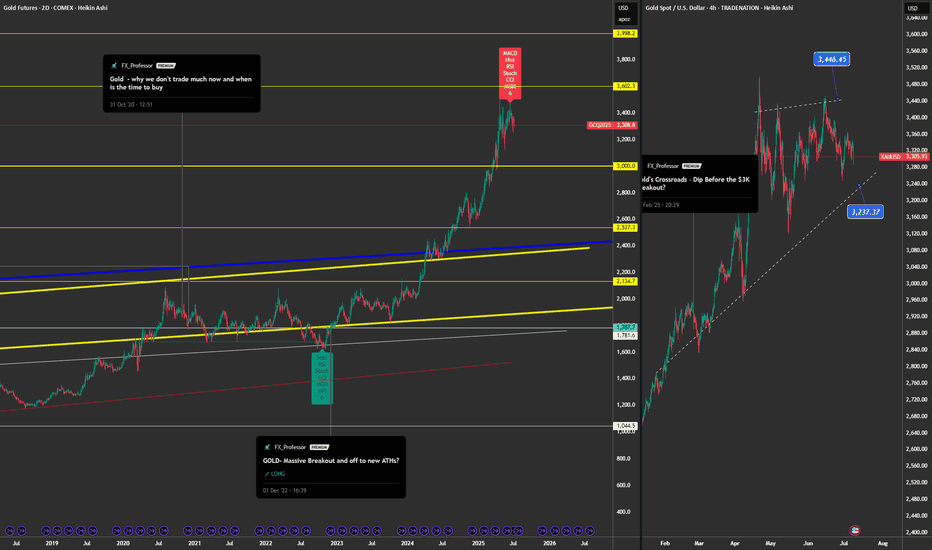

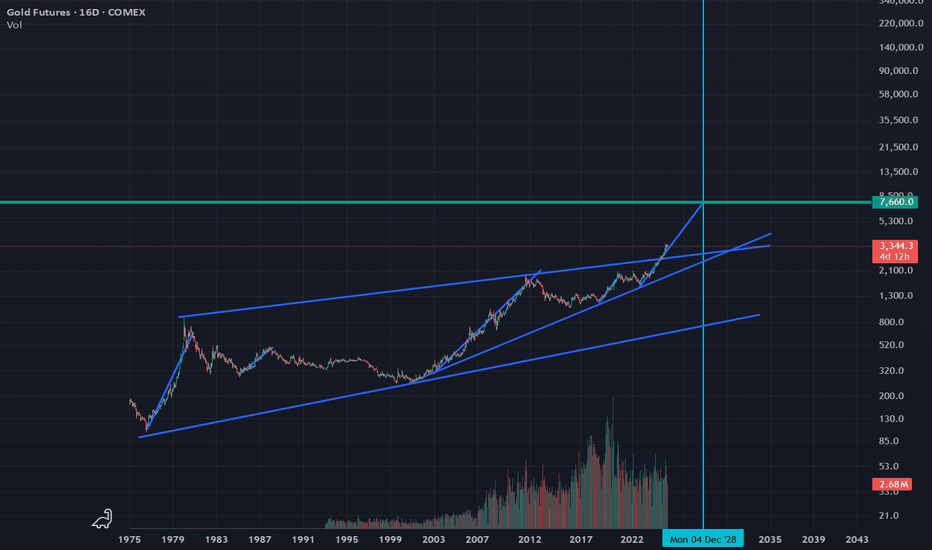

Goldman Says $4K – My Chart Says Sell💥📉 Gold Analysis – Divergences, Resistance, and a Short Bias 🪙⚠️

Hey Traders,

As promised in the latest video, here's the official chart update for Gold – and the message is clear: I'm short.

📊 What I See on the Chart

We're now well below the 3,446 resistance, with early signs of weakness showing up across multiple timeframes. I’ve laid out both the 2-Day and 4H charts in this post, and here’s what I’m tracking:

⚠️ Technical Warning Signs:

🔻 2D chart: Six bearish divergences

– RSI, Stochastic, CCI, OBV, MFI, and MACD all flashing red

📉 1D chart: Same thing — six divergences, telling me momentum is fading

⏳ 4H chart: Price action breaking trendlines, and support at 3,237 looks shaky

🚨 If that breaks, my main support zone is at $3,000 – and that’s where I believe we’re heading.

This is not just a pullback. This is the kind of confluence you can’t ignore if you trade technically.

🔁 Sentiment Shift

Back in December '22 and again earlier this year, I was long Gold – and it was the right call. But now?

📌 This chart has gone from momentum to exhaustion.

📌 I see less demand, softer momentum, and strong bearish divergence stacking across every major timeframe I watch.

🎯 Trade View

✅ I’m short Gold.

🎯 Targeting the $3,000–3,050 zone.

📉 Invalidated if we reclaim and close above $3,446 with strength.

It’s that simple. Nothing personal – just structure, divergence, and flow.

🧠 The Chart vs. The Narrative

Recently, I saw a note from Goldman Sachs forecasting $4,000 Gold. Maybe they’re right.

But I’ll be honest with you – I don’t buy the media hype.

I'm not here for the headlines.

I'm a chart guy. Always have been. Always will be.

The chart is the map to the treasure – and that’s the only thing I follow.

🧠 I cover this and the broader macro setup (Dollar, BTC, DAX, Tech, BTC.D, and more) in the full 20-min video just dropped. If you haven’t watched it yet, go catch up — it explains the logic and why this isn’t just a gold story.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

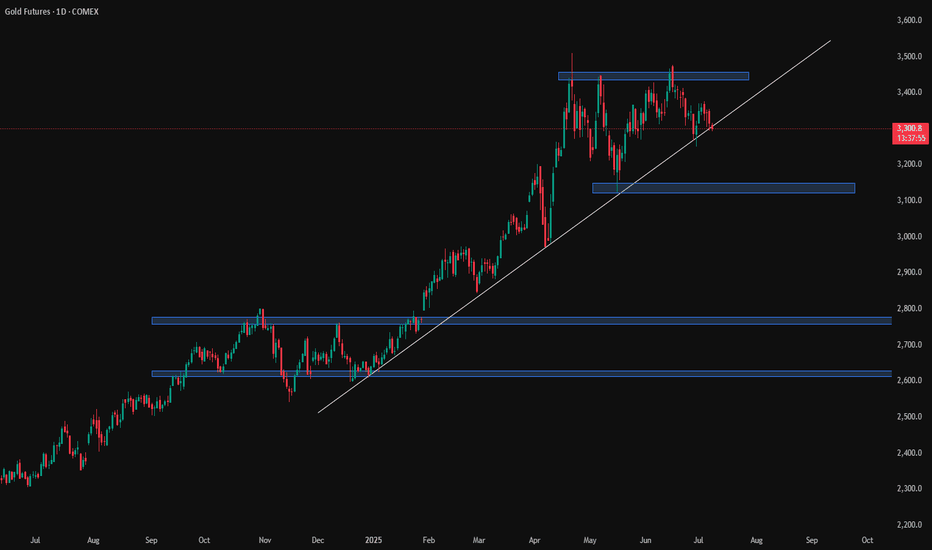

Gold Futures (GC1!) – Accumulation Brewing? Major Move IncomingGold has been stuck in a tight range since April, and to me, this looks like a textbook accumulation zone forming on the daily chart.

Price is coiling within a defined box, showing signs of both strength and weakness — classic behavior before a manipulative move (fake breakout) followed by distribution (true direction). This is where many traders get trapped, chasing the first breakout — only to get caught before the actual move begins.

I’m not committed to a direction yet, but here’s my roadmap:

🧠 First breakout = likely trap (manipulation)

🧭 Wait for confirmation of rejection/failure, then prepare for the real move out of the range

This kind of price behavior often precedes explosive volatility, so I’m watching closely for:

False breakouts above or below the box

Volume spikes or traps

Shift in market structure on lower timeframes

📍 No trade for now, but I’ll be reacting — not predicting.

What’s your bias? Do you think the breakout will hold or fake out?

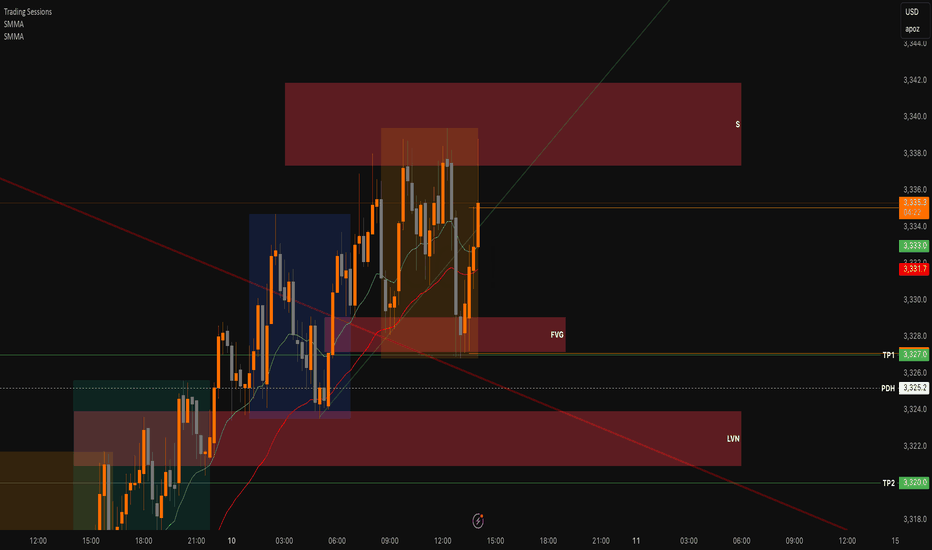

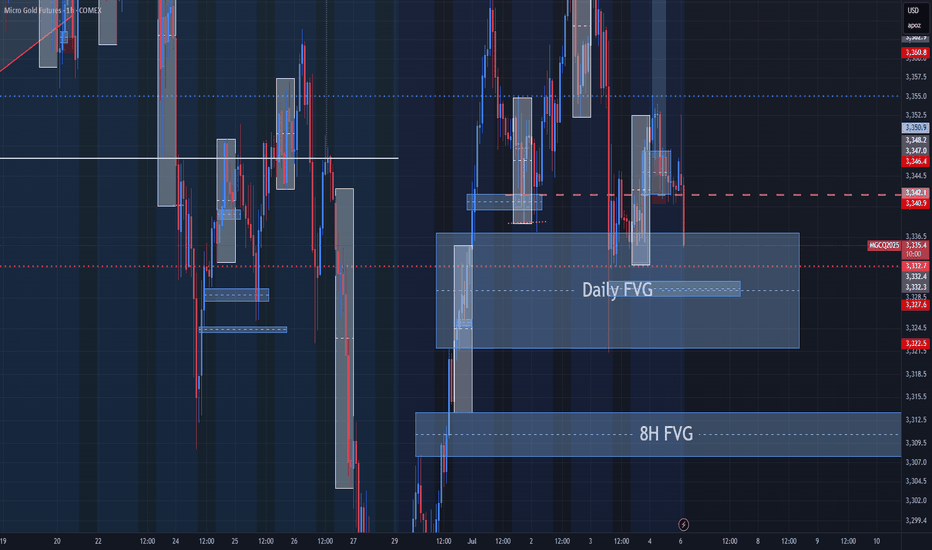

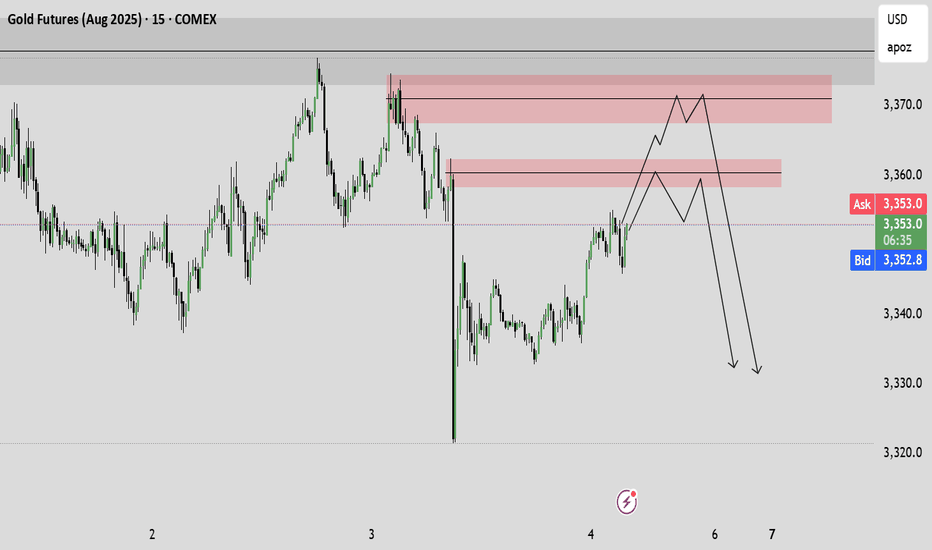

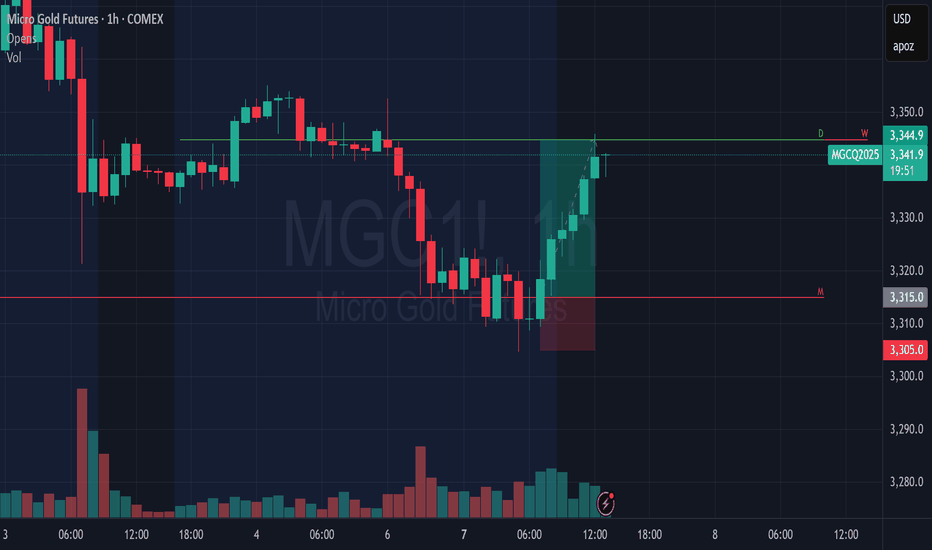

Bearish Rejection from SupplyDuring the NY session open, Gold (GC1!) broke above the 30-min ORB high at 3335.8, briefly entering a known supply zone (3342–3345). The move lacked follow-through and immediately reversed — signalling a liquidity sweep and classic NY session trap setup.

This invalidates the bullish breakout and supports a short-biased play back toward the ORB low and into deeper demand.

Trade Details:

Entry: 3336.0 (short after failed breakout + rejection candle)

Stop Loss: 3342.0 (above the supply zone high)

Take Profit 1: 3327.1 (ORB low)

Take Profit 2: 3320.0 (prior demand zone)

Take Profit 3 (optional): 3315.0 (liquidity void fill)

Risk:Reward: ~1:1.3 to TP1, ~1:2.2 to TP2

Position Type: Short

Execution Time Frame: 5-min/15-min

Model Tags: Liquidity Sweep, NY Session Fade, Supply Rejection

🔍 Quant Notes:

Price action exhibited a false breakout — NY session opened with an expansion move above ORB high, which was immediately rejected.

Re-entry into the ORB range confirms buyer exhaustion and makes a move back to the ORB low highly probable.

Bearish bias is reinforced by multiple upper wicks, supply zone rejection, and failed structure reclaim.

Key Confirmation:

Bearish engulfing or strong close back below 3335

Failure to reclaim EMAs or trend line

Momentum shift on 5-min with volume divergence

Closing Thoughts:

A failed ORB breakout into supply during NY open is a classic trap — and today’s price action on GC1! fits the model. This short setup targets the full ORB range retrace with potential continuation if sellers hold control.

How to Trade Double Tops & Bottoms in TradingViewLearn how to identify, validate, and trade double top and double bottom reversal patterns using TradingView's charting tools in this comprehensive tutorial from Optimus Futures. Understanding these classic chart formations can help you spot potential trend reversals and capitalize on contrarian trading opportunities in the futures markets.

What You'll Learn:

• Understanding contrarian vs. continuation trading strategies and when to use each approach

• The psychology behind buying low and selling high through reversal pattern trading

• How to identify double top and double bottom formations on any timeframe

• Key characteristics of valid double tops and bottoms, including volume confirmation

• Using TradingView's XABCD pattern tool to validate potential double top/bottom setups

• Real-world example analysis using crude oil futures charts

• Risk management techniques for trading reversal patterns

• How to calculate appropriate entry points, stop losses, and profit targets

• Setting up 1:1 risk-reward ratios for mathematical trading edge

• Understanding win rate requirements for profitable pattern trading

• How double bottom patterns work as the inverse of double top formations

This tutorial may benefit futures traders, swing traders, and technical analysts interested in contrarian trading strategies and reversal pattern recognition. The concepts covered could help you identify potential turning points in market trends and develop systematic approaches to trading these classic chart formations.

Visit Optimus Futures to learn more about trading futures with TradingView: optimusfutures.com/Platforms/TradingView.php

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

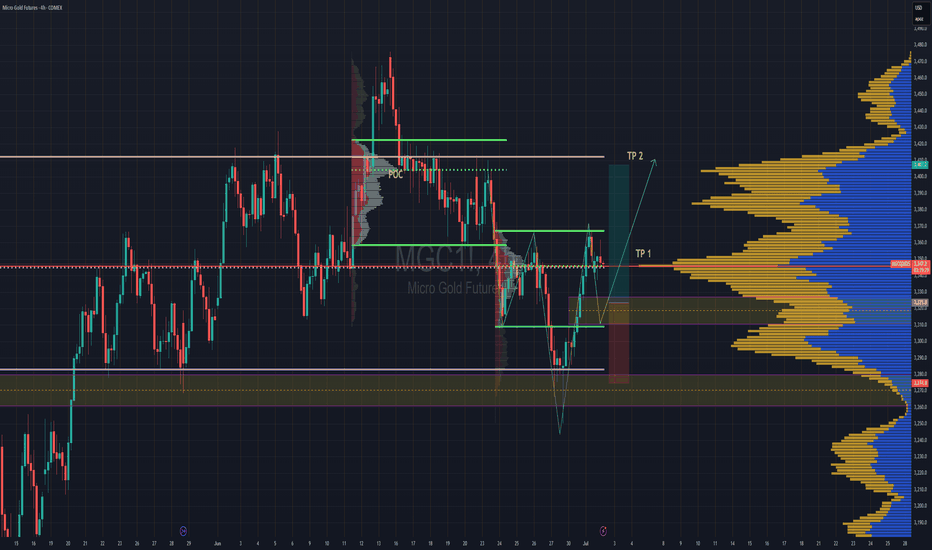

Possible Heads & Shoulders FormingWhen you see the inverse Heads n Shoulders forming, its hard to unsee it. I love this because it's lining up perfectly with the VAL of the intra day range and LVN ..This long trade is in line with my last week and current week forecast. We already hit TP1, TP2 is looking very likely after the pullback is done.

We are currently sitting at the POC, so expect some condolidation. Especially since we have ADP Non-Farm 2morow & Thurs. The news is the only thing that can throw a wrench into this setup.

Be sure to check out my last tradingview post and also checkout the weekly recap and weekly forecast videos i just posted on our youtube channel breaking down the in-depth analysis of this trade so you can understand my thought process on how it use Trend & Volume to execute this trade. Link is in my bio.

DEFINITIIONS

POC - Point of Control

VAL - Value Area Low

LVN - Low Volume Node

Study up on those.

CHEERS

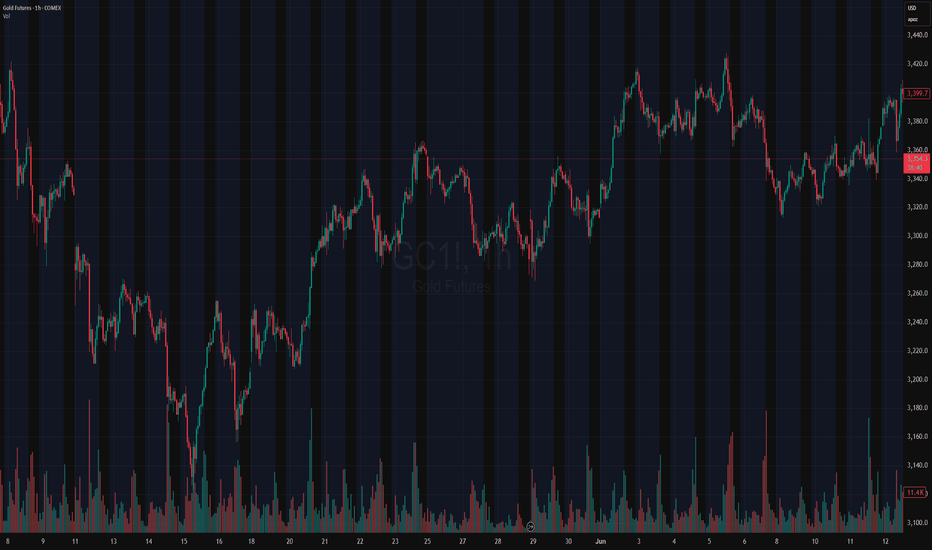

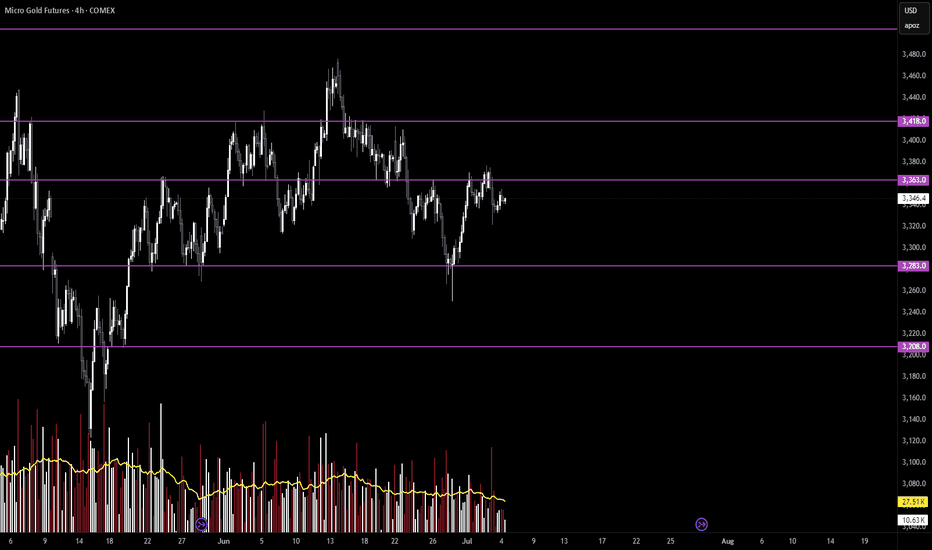

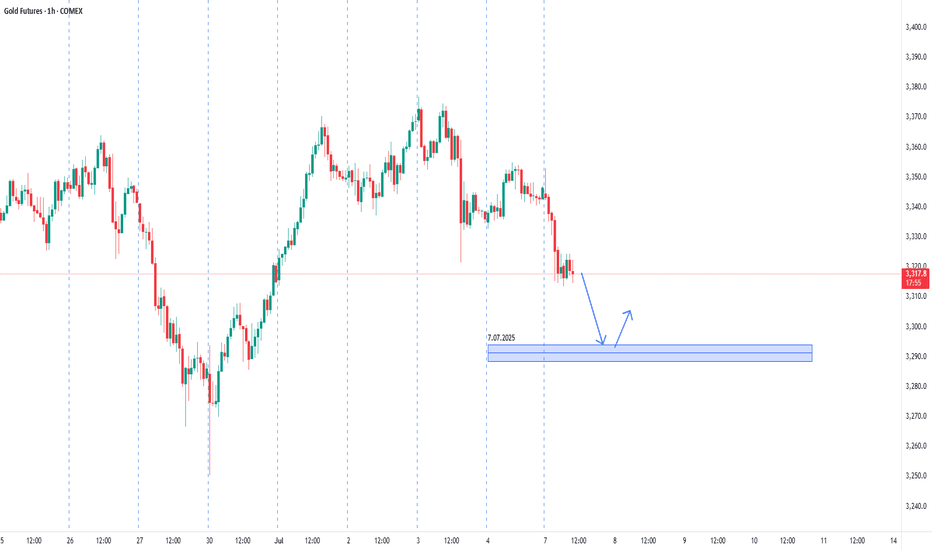

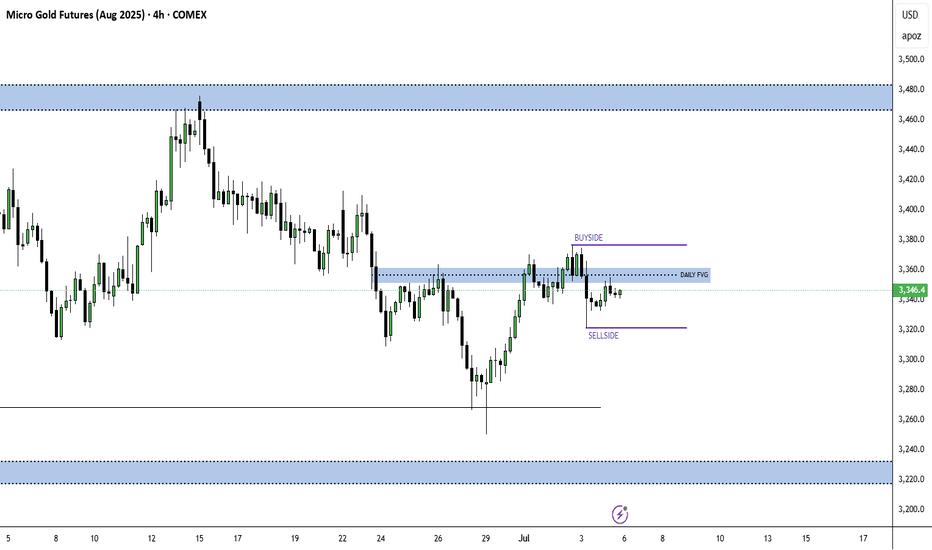

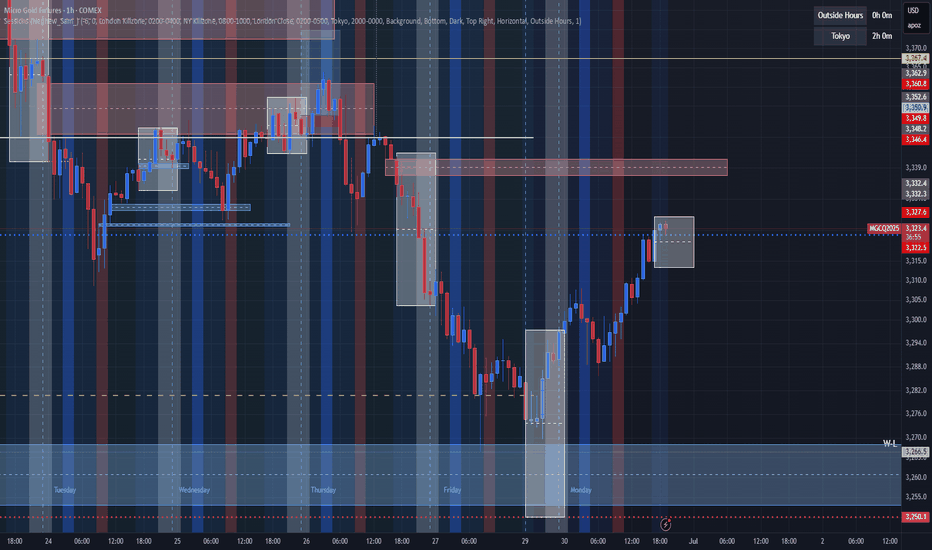

$GC / $MGC /Gold - Elliot Wave Analysis - Weekend Update - 7/6Hello fellow gamblers,

As we prepare for a new trading week, I revisited my EW count and was able to come up with 2 scenarios to present to you today.

- For our bullish scenario, I am looking for a break above 3418 and my next target will be at the 3574 - 3525 range.

- For our bearish scenario, I am looking for a break below 3283 and my next target will be at the 3086 - 2846 range.

- Price went through a consolidation as we closed last week's candle, and we are now at POC.

- Levels to Watch: 3418, 3363, 3283

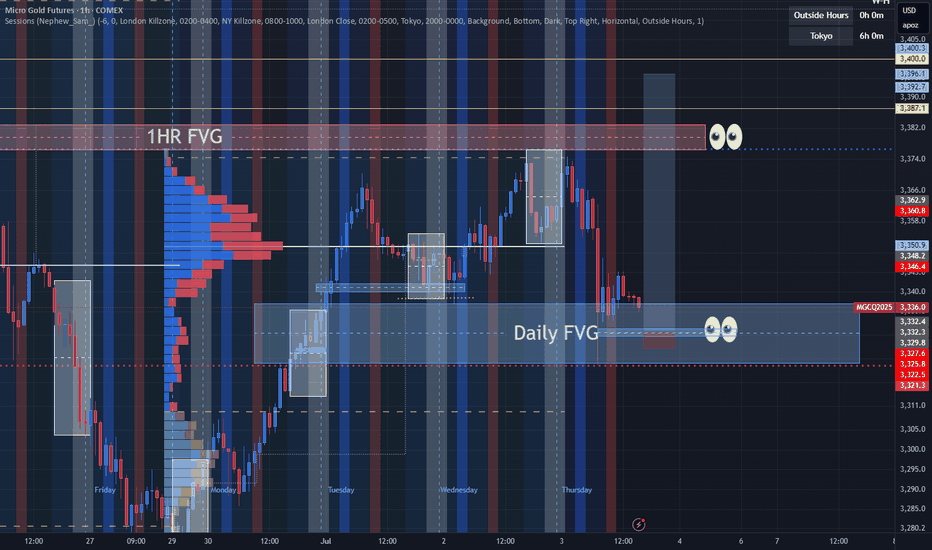

Will The new Week kick off more bullish Pressure for GOLD?looking for more bullish activity this week but need to sit on my hands for now to see if they establish a Low for the week first. Once we see that and start to see HH's made then we can consider a entry to get in on the move. I cant rush it though. Have to be patient.

Gold Short Source, Trust me bro.

I mean well its in a downtrend and the price just keeps hitting lower, the 4h reacting very bearishly and the 1 day also didnt say much more than daily downtrend (recently).

So i think i have good confidence in this trade as i took the long pullback trade yesterday and the price showed that its respecting my analysis, so i would assume this will work out.

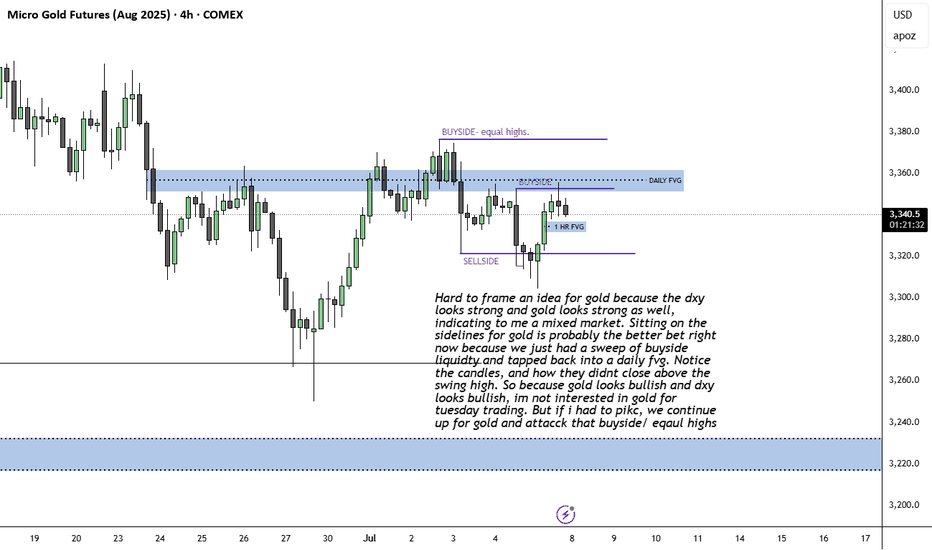

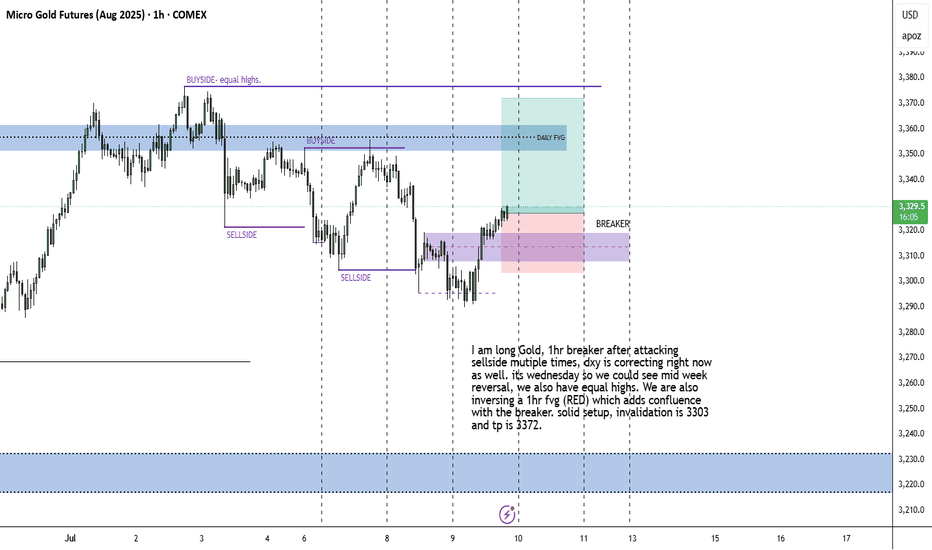

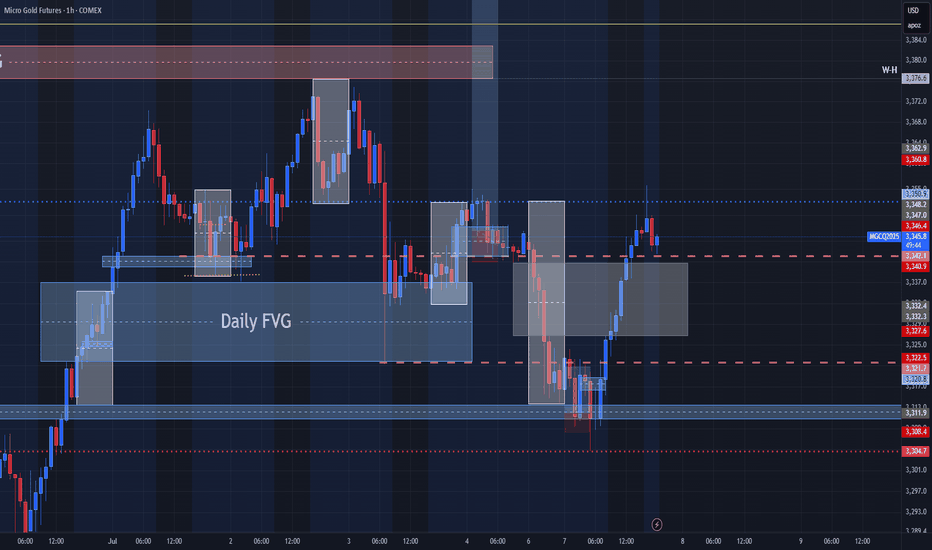

Mixed market for GOLDHard to frame an idea for gold because the dxy looks strong and gold looks strong as well, indicating to me a mixed market. Sitting on the sidelines for gold is probably the better bet right now because we just had a sweep of buyside liquidty and tapped back into a daily fvg. Notice the candles, and how they didnt close above the swing high. So because gold looks bullish and dxy looks bullish, im not interested in gold for tuesday trading. But if i had to pikc, we continue up for gold and attacck that buyside/ eqaul highs

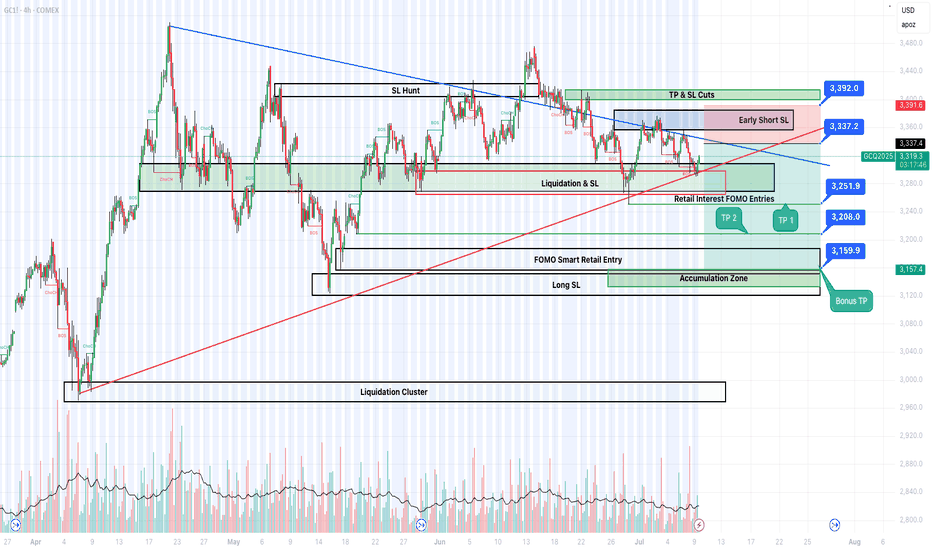

Retail trapped. Volume confirmed. Liquidity targeted.🔻 We are in a highly reactive zone where emotional long entries and early short SLs create perfect liquidity magnets.

🔍 Key Levels & Zones:

• Early Short SL Zone → 3337.2

• Retail FOMO Entry Block → 3251.9

• Volume-based Rejection Point → 3392.0 (SL/TP sweep)

• TP1 & TP2 Zones → 3251.9 / 3208.0

• Bonus TP → 3159.9 → Complete sweep of long SLs and demand exhaustion

• Final Trap Exit Zone → 3157.4 — Institutional reload zone

💡 Volume confirms this cycle of:

• Trap > SL hunt > Emotional entry > Volume fade > Dump > Accumulation > Reversal

🧠 This is NOT financial advice. I post to share deeper insight into manipulation mechanics & sniper-level liquidity structure analysis.

If you’re still trading candles, you’re playing retail games. Start seeing the architecture.

🧷#XAUUSD #SmartMoney #LiquiditySweep #VolumeStrategy #TradingPsychology #RetailTrap #SniperMindset

Extremely bullish on gold I am long Gold, 1hr breaker after attacking sellside mutiple times, dxy is correcting right now as well. its wednesday so we could see mid week reversal, we also have equal highs. We are also inversing a 1hr fvg (RED) which adds confluence with the breaker. solid setup, invalidation is 3303 and tp is 3372.

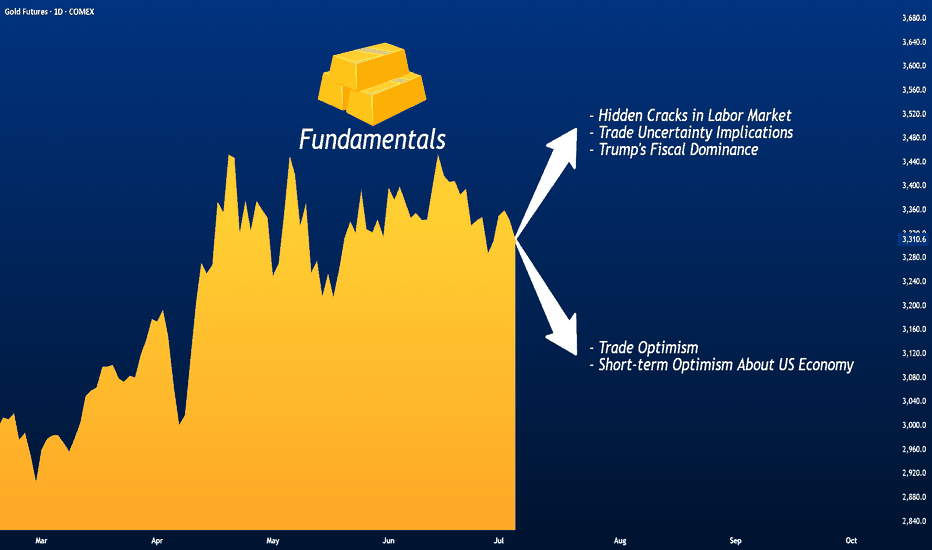

Gold Between Trade Optimism and Economic Concerns

Gold is declining for the second consecutive session, although it remains above the critical psychological level of $3,300 per ounce in early spot trading this morning.

Losses in the precious metal come amid renewed optimism over potential trade agreements that could de-escalate the global trade war, alongside upbeat sentiment regarding the strength of the U.S. economy following last Friday’s labor market data.

The 90-day suspension of tariffs imposed by the administration of President Donald Trump is set to expire on Wednesday, but it could be extended at least until August 1, according to statements from both the president and Treasury Secretary Scott Besant.

Both the United States and its allies and trade rivals appear eager to reach an agreement. China and the U.S. are moving to implement the framework of a previously reached trade deal by reviewing the export restrictions imposed on one another. Meanwhile, European officials stated last week that a draft agreement with the U.S. may be near, aiming to maintain base tariff rates at just 10%, according to The Wall Street Journal .

Markets appear largely unbothered by trade developments, given the flexible and seemingly open-ended deadlines and the lack of major surprises, according to analysts cited by Reuters . This easing of concern may lead gold to gradually lose the risk premium it had gained from fears of a global trade war.

Still, those concerns could return swiftly if negotiations fail and heavy tariffs are reinstated. The Washington Post reported that a potential U.S.-Vietnam trade deal may anger China and, in turn, reduce the likelihood of a broader deal between Beijing and Washington.

Additionally, the prolonged uncertainty itself may start to weigh on the U.S. economy, which could, over time, rekindle demand for gold as a safe-haven asset. The Editorial Board of The Journal noted cracks in the U.S. labor market that lie beneath the better-than-expected headline figures released Friday. The report revealed weak hiring in key private sectors, a decline in manufacturing employment, and a drop in labor force participation to its lowest level since 2022.

The Editorial Board called for dissipation of uncertainty around trade policy to encourage private sector hiring, as companies remain hesitant amid the current indecision in the White House. Another report from The Journal also warned that prolonged uncertainty could weaken the U.S. dollar, delay corporate investment and spending, and dampen business confidence.

On a related front, The Journal’s chief economics commentator Greg Ip criticized what he called “fiscal dominance” under Trump, where the Federal Reserve may be pressured to lower interest rates to ease the burden of the rising deficit caused by tax cuts. He warned this could undermine economic strength and increase inflation in the long run.

In my view, the early signs of a deteriorating U.S. fiscal position could become one of the key long-term drivers of sustained gold gains—even if markets remain complacent for now and equities continue climbing to record highs. This would not reflect an economic cycle, but rather a deeper shift in market fundamentals characterized by eroding confidence in the U.S. economy and its currency.

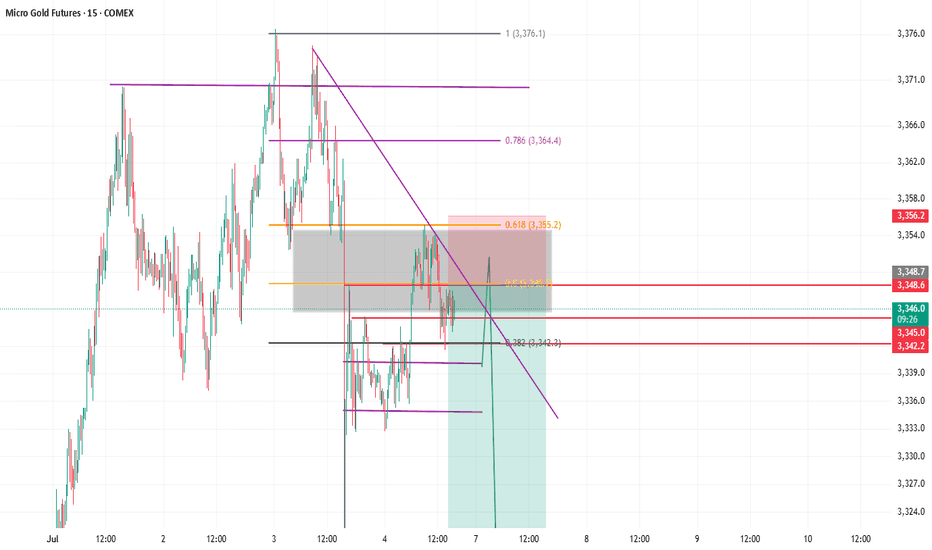

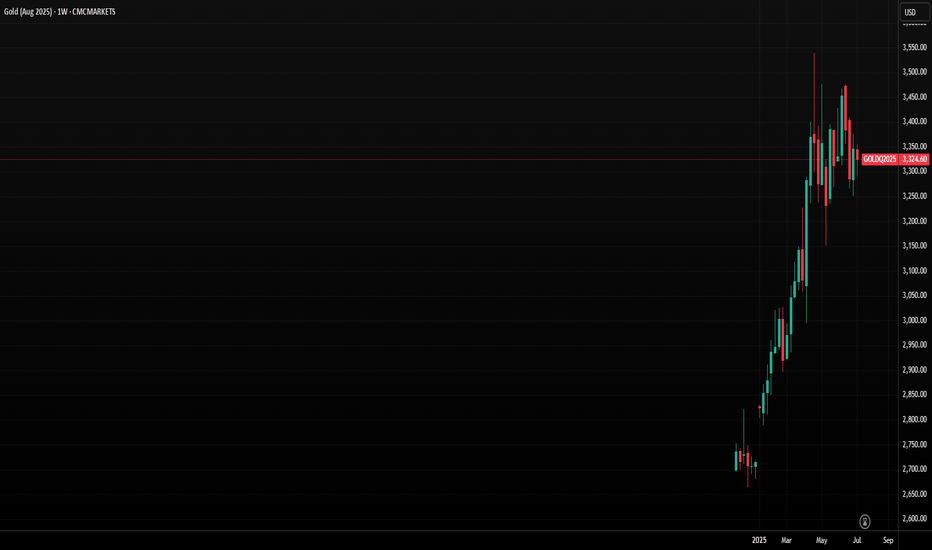

Gold at Critical Juncture as Bearish Momentum GrowsGold is showing signs of breaking down as the US dollar recovers from a steep decline. Gold and the dollar typically have an inverse relationship over the longer term. The precious metal has been trading sideways since April, but more importantly, it has been trending lower since mid-June. Gold is now approaching a critical juncture, testing an uptrend established in mid-May. Although it has previously held this support level, gold appears likely to break lower this time.

The Trend Lower Is Strengthening

The Relative Strength Index (RSI) is now trending steadily lower, forming a series of lower highs. This suggests that gold’s momentum is currently bearish, indicating potential for continued weakness in the days ahead. To reverse this bearish momentum and shift to a bullish outlook, the RSI would need to rise firmly above 50.

More significantly, gold is now very close to breaking a significant uptrend at $3,300, which was previously tested on June 27 and June 30. On both occasions, the price dipped intraday below this trendline but managed to close above it. The trendline was retested on 8 July, initially holding, but gold is dipping below this critical support level again on 9 July. A close below the trendline on July 9, followed by continued declines starting on July 10, would confirm that the uptrend has broken. This breakdown would signal further downside risk, with initial support at $3,230, followed by $3,170.

Triple Top

Perhaps even more crucially, a triple-top pattern established at the $3,400 becomes increasingly likely each time gold trends lower. The $3,170 support level is particularly significant because it forms the neckline of this triple-top pattern. A decisive break below $3,170 would confirm the triple top pattern and indicate a deeper decline, potentially targeting the range between $2,950 and $3,000.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Gold will continue with its bullish breakoutLooking for new highs to be made. Price has pushed bullish as trump started talking about the tariffs early today. Even though they are not supposed to discuss till the 9th. We can get a early move for the week. Monitoring the price action to see if I can get in where I fit in!