KSMUSDT.PS trade ideas

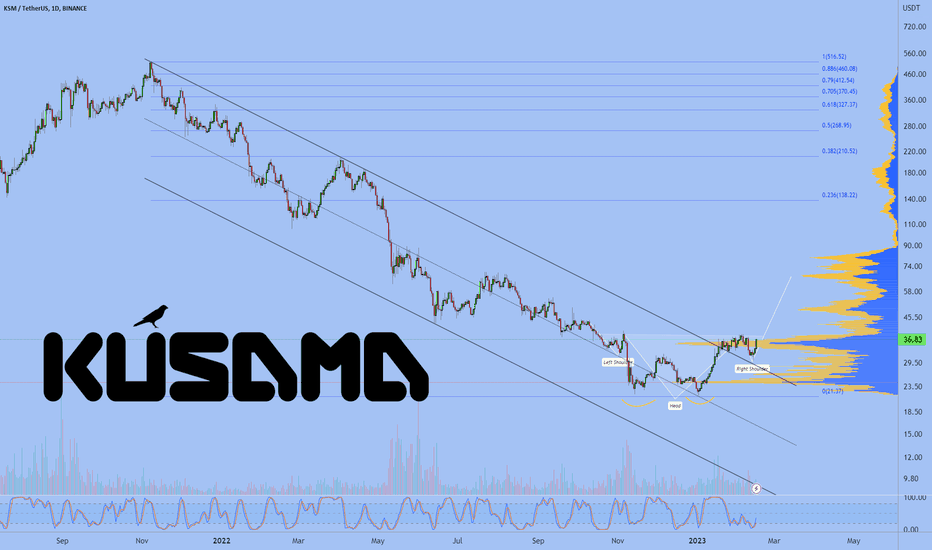

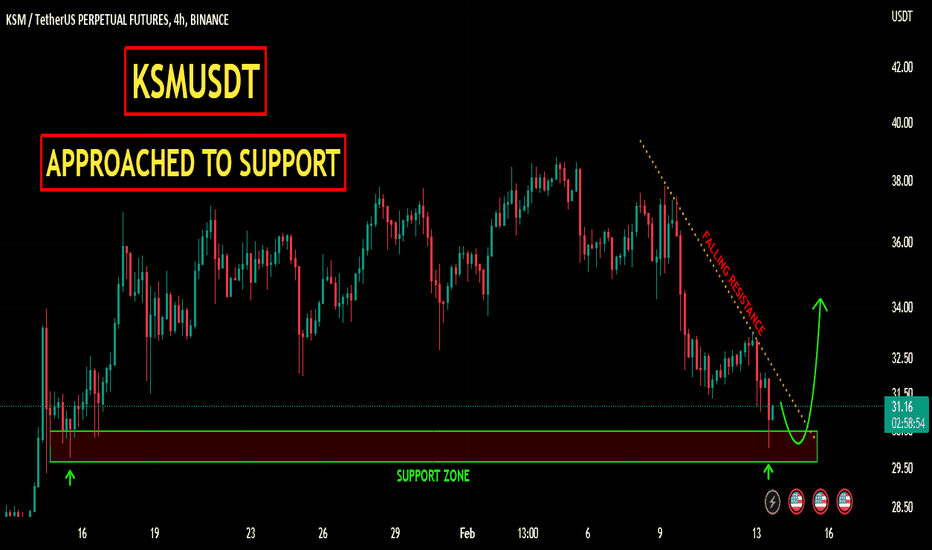

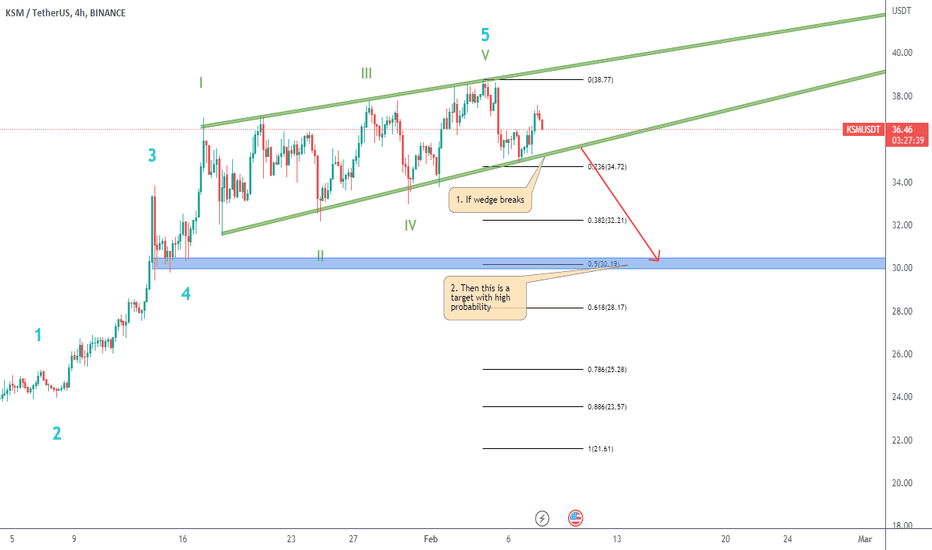

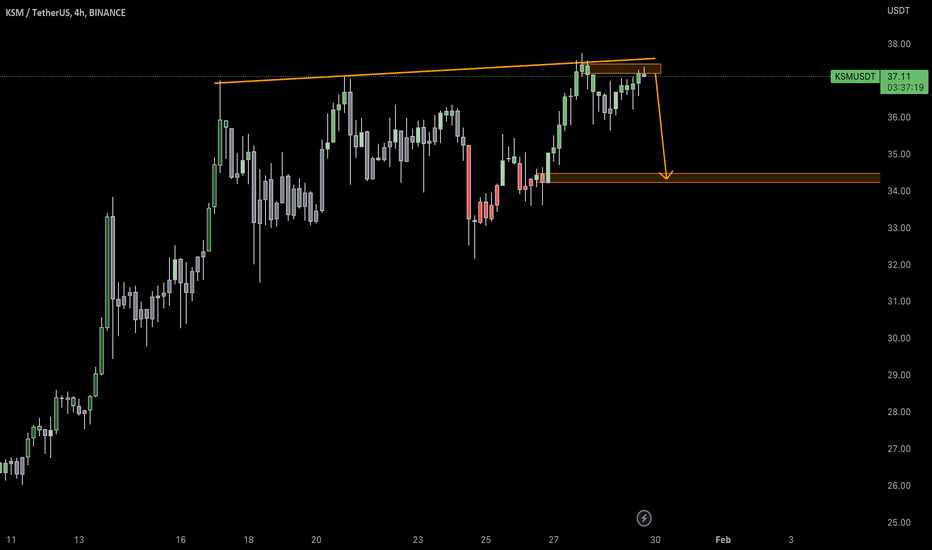

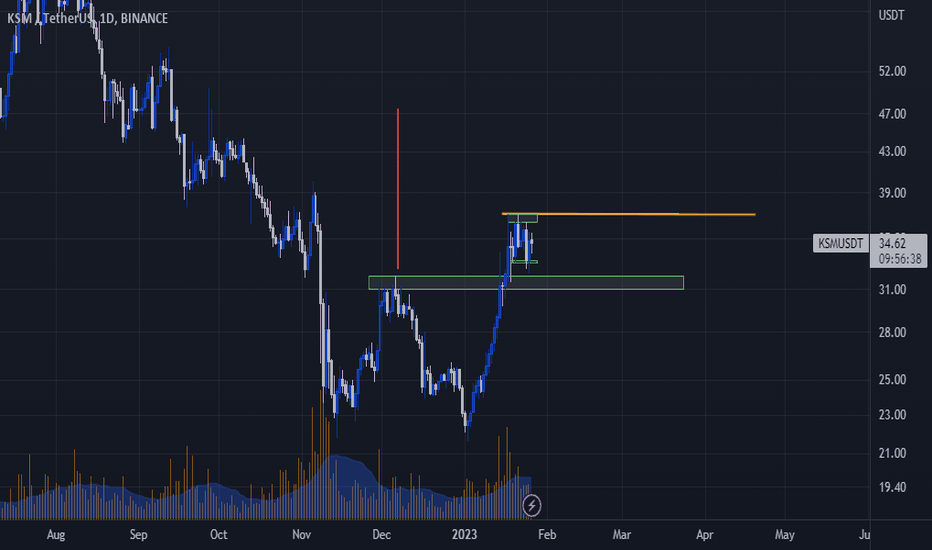

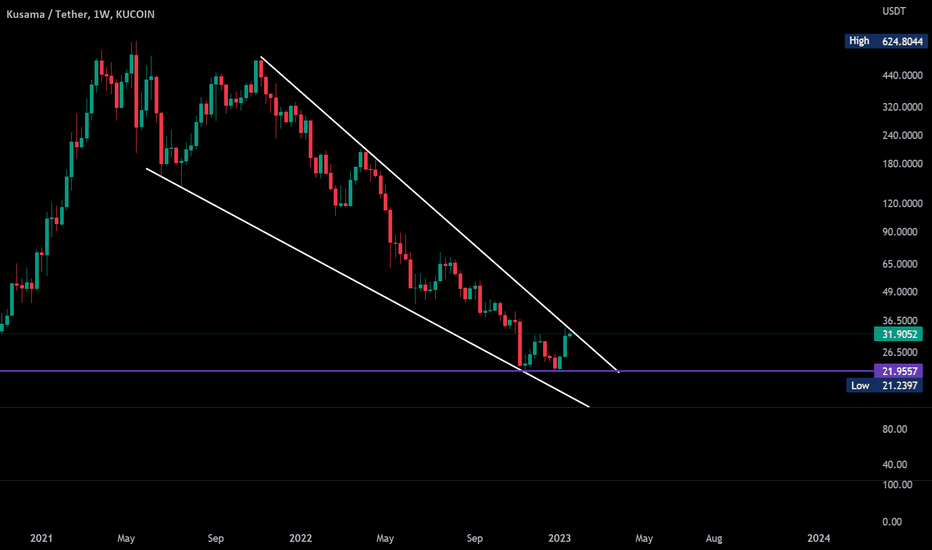

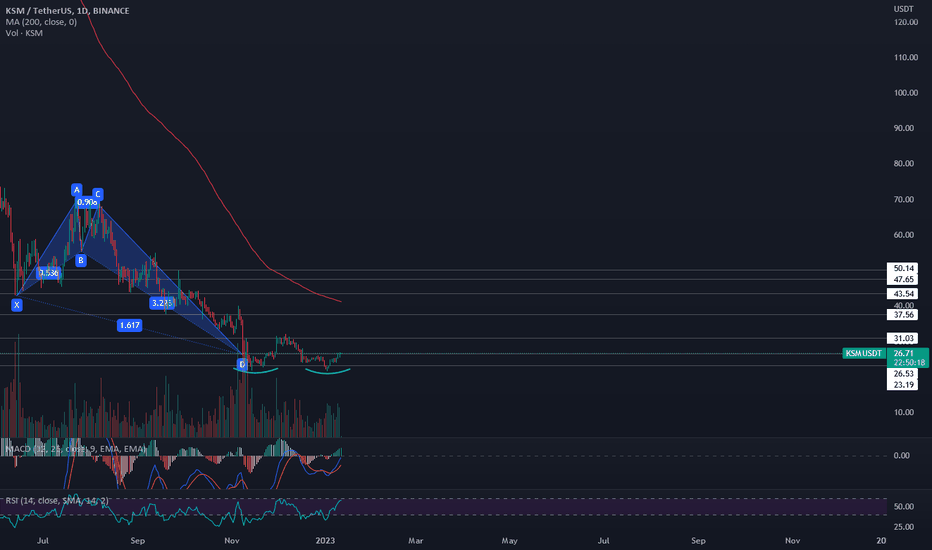

KSMUSDT | APPROACHED TO SUPPORTKSMUSDT is at horizontal support where bulls once again can show some momentum, while having a double bottom too. The falling trend line is a hurdle for bullish trend continuation. There is a bullish divergence on RSI too.

The break above falling trend-line will give complete control to bulls. While break below double bottom will give strength to bears.

Trade your levels accordingly.

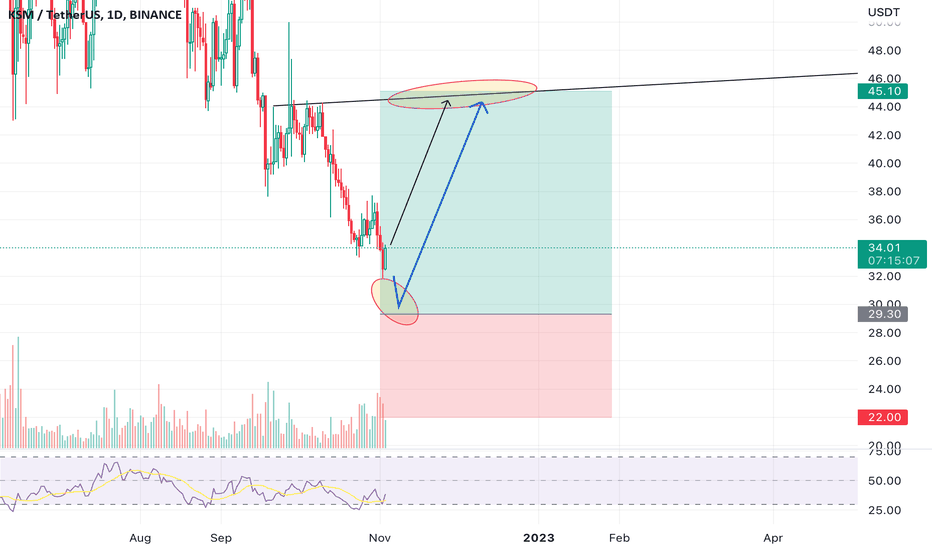

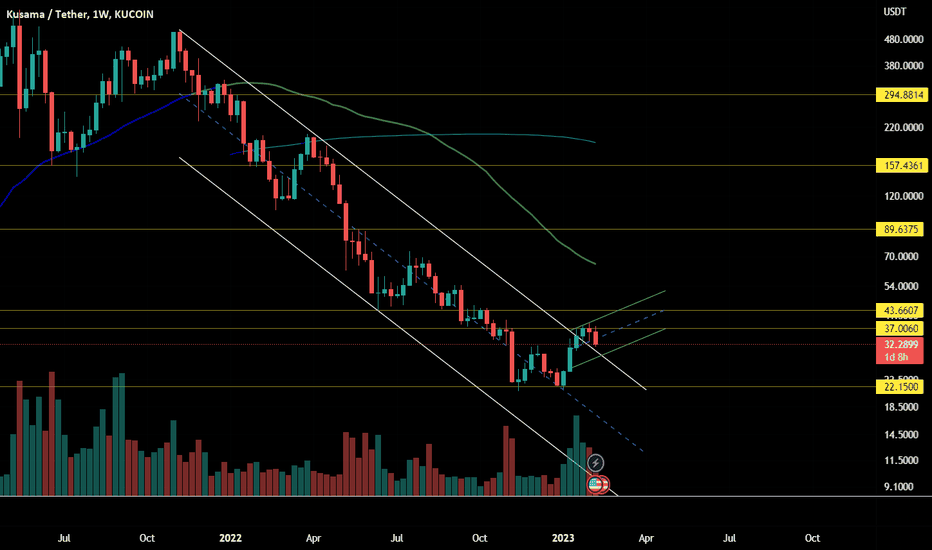

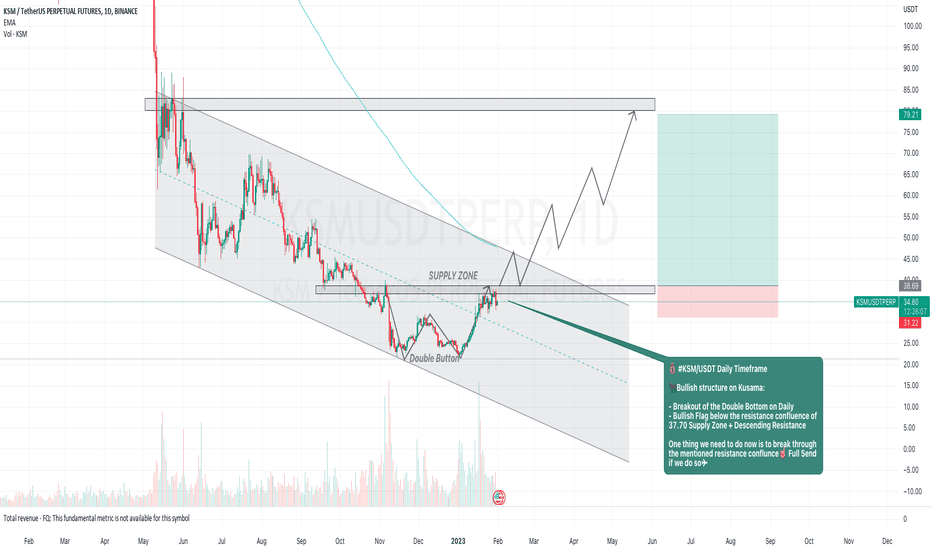

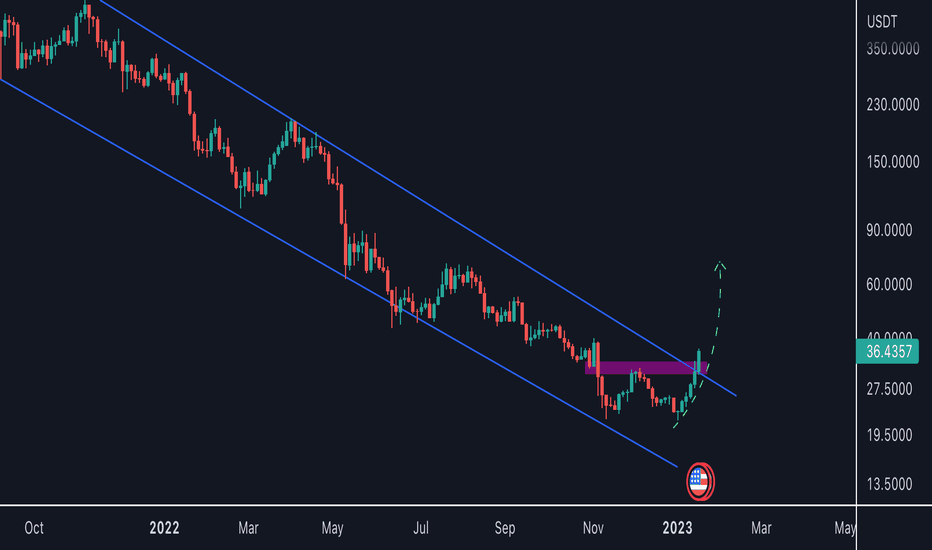

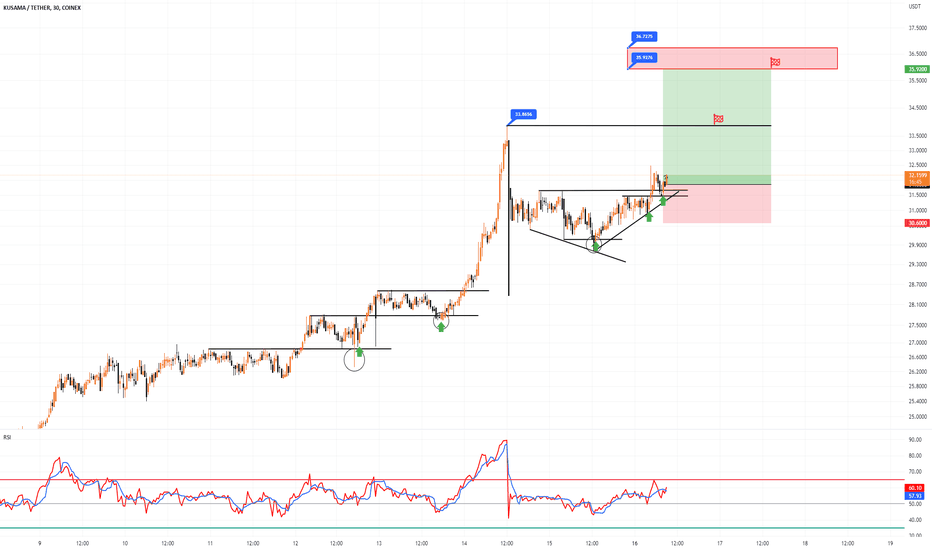

KSM/USDT. 💰 #KSM/USDT Daily Timeframe

🐃Bullish structure on Kusama:

- Breakout of the Double Bottom on Daily

- Bullish Flag below the resistance confluence of 37.70 Supply Zone + Descending Resistance

One thing we need to do now is to break through the mentioned resistance conflunce☝️ Full Send if we do so ✈️

BitVero Crypto Academy.

Disclamer:

We are not financial advisors. The content that we share on this website are for educational purposes and are our own personal opinions.

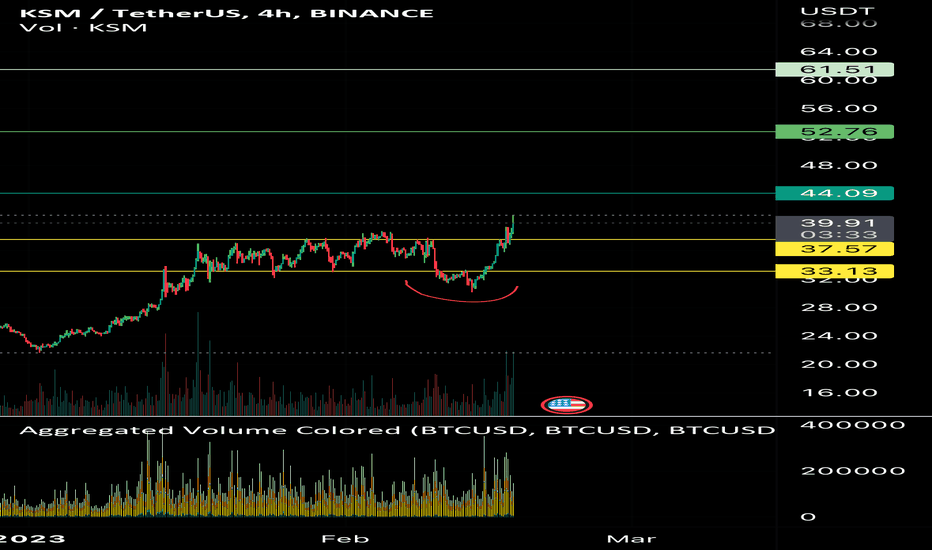

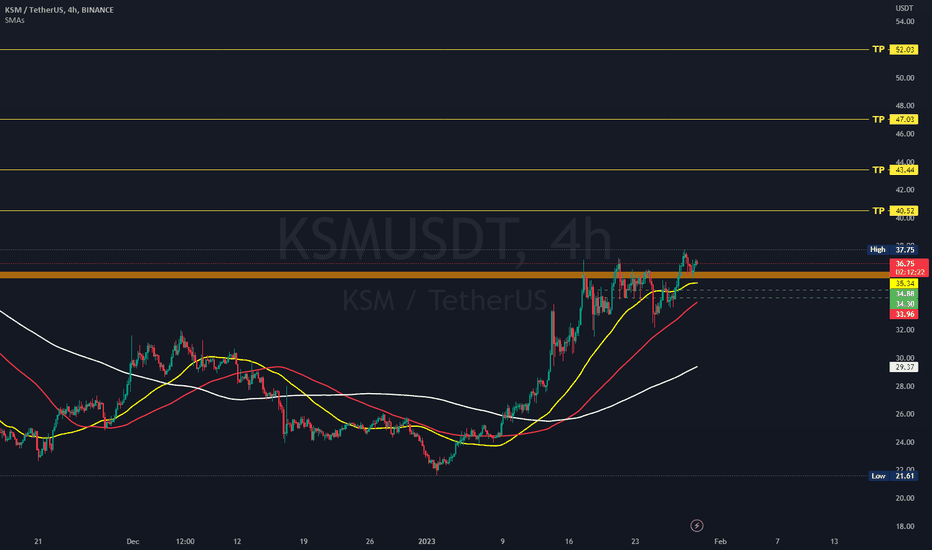

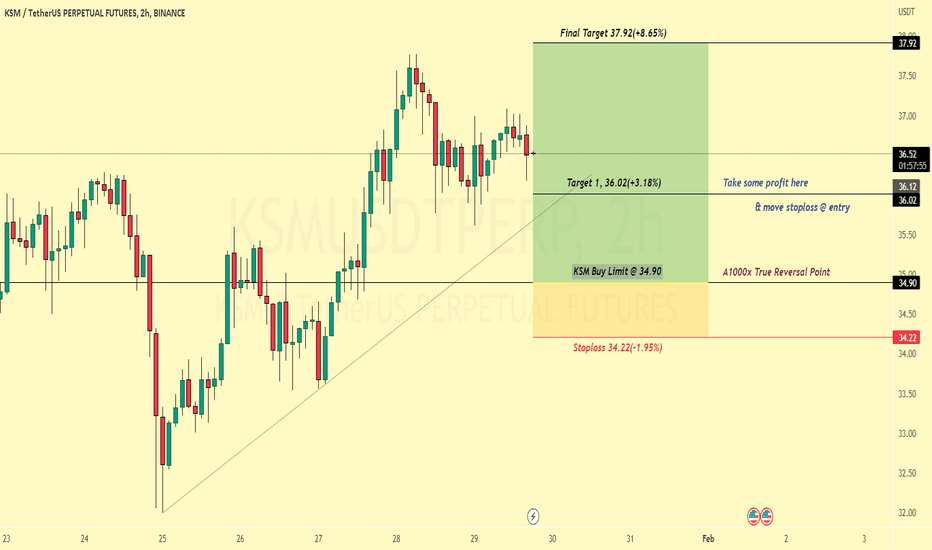

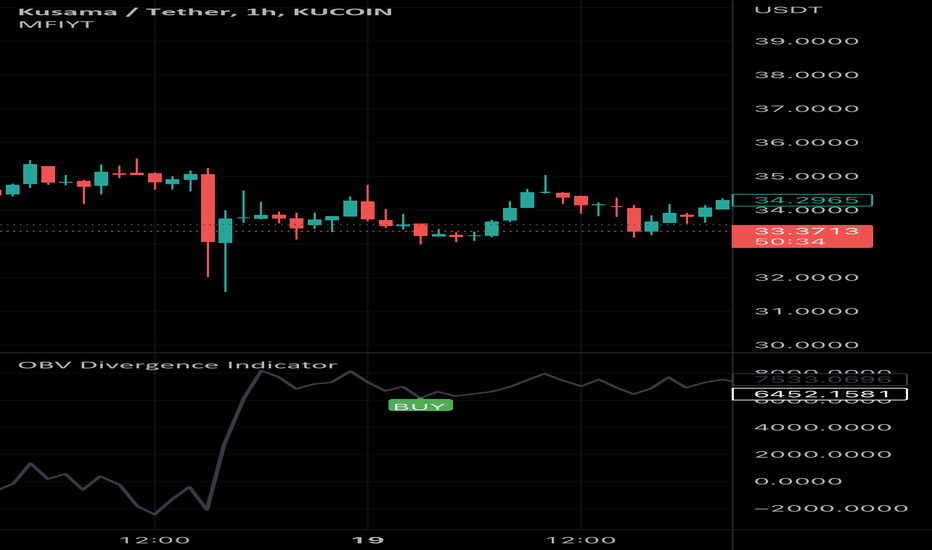

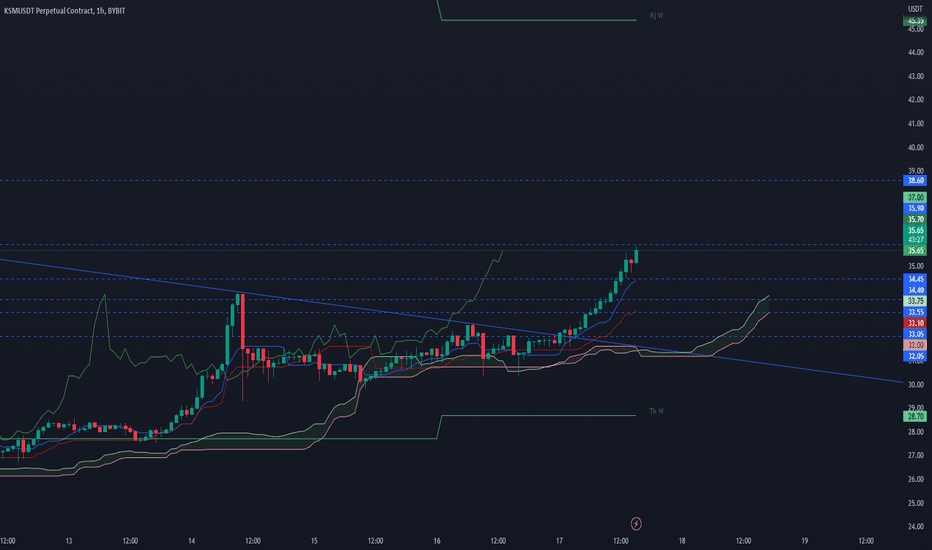

KSM Buy the breakoutHello Traders!

Welcome back to another trade with Analyst Aadil1000x.

Today we are preparing to buy the KSM after a breakout. We are aiming minimum of 3.2% move. We are setting a buy limit at the reversal point.

KSM Buy Limit @ 34.90

Stoploss 34.22(-1.95%)

Target 1, 36.02(+3.18%)

Final Target 37.92(+8.65%)

Don't forget to hit the like button and follow to stay connected.

Go go//@version=4

study(title="OBV Divergence Indicator")

pivot_right = 5

pivot_left = 5

max_range=50

min_range=5

obv_value=obv

plot(obv_value, title="OBV", linewidth=2, color=color.black)

//check if we have pivot low in obv

pivot_low_true = na(pivotlow(obv_value, pivot_left, pivot_right)) ? false : true //returns price of the pivot low point. It returns 'NaN', if there was no pivot low point.

//Create a function that returns true/false

confirm_range(x) =>

bars = barssince(x == true) //Counts the number of bars since the last time the condition was true

min_range <= bars and bars <= max_range // makes ure bars is less than 60 and less than 5 and returns true

//------------------------------------------------------------------------------

// obv higher low check

OBV_HL_check = obv_value > valuewhen(pivot_low_true, obv_value , 1) and confirm_range(pivot_low_true )

// Price Lower Low check

price_ll_check = low < valuewhen(pivot_low_true, low , 1)

bullCond = price_ll_check and OBV_HL_check and pivot_low_true

//Plot the areas, terneary conditional operator

plot(

pivot_low_true ? obv_value : na,

offset=-pivot_right,

linewidth=3,

color=(bullCond ? color.green : color.new(color.white, 100)))//colornew applies the specified transparency to the given color

)

plotshape(

bullCond ? obv_value : na,

offset=-pivot_right,

text=" BUY ",

style=shape.labelup,

location=location.absolute,

color=color.green,

textcolor=color.white

)

2//@version=4

study(title="OBV Divergence Indicator")

pivot_right = 5

pivot_left = 5

max_range=50

min_range=5

obv_value=obv

plot(obv_value, title="OBV", linewidth=2, color=color.black)

//check if we have pivot low in obv

pivot_low_true = na(pivotlow(obv_value, pivot_left, pivot_right)) ? false : true //returns price of the pivot low point. It returns 'NaN', if there was no pivot low point.

//Create a function that returns true/false

confirm_range(x) =>

bars = barssince(x == true) //Counts the number of bars since the last time the condition was true

min_range <= bars and bars <= max_range // makes ure bars is less than 60 and less than 5 and returns true

//------------------------------------------------------------------------------

// obv higher low check

OBV_HL_check = obv_value > valuewhen(pivot_low_true, obv_value , 1) and confirm_range(pivot_low_true )

// Price Lower Low check

price_ll_check = low < valuewhen(pivot_low_true, low , 1)

bullCond = price_ll_check and OBV_HL_check and pivot_low_true

//Plot the areas, terneary conditional operator

plot(

pivot_low_true ? obv_value : na,

offset=-pivot_right,

linewidth=3,

color=(bullCond ? color.green : color.new(color.white, 100)))//colornew applies the specified transparency to the given color

)

plotshape(

bullCond ? obv_value : na,

offset=-pivot_right,

text=" BUY ",

style=shape.labelup,

location=location.absolute,

color=color.green,

textcolor=color.white

)