LCRUDE trade ideas

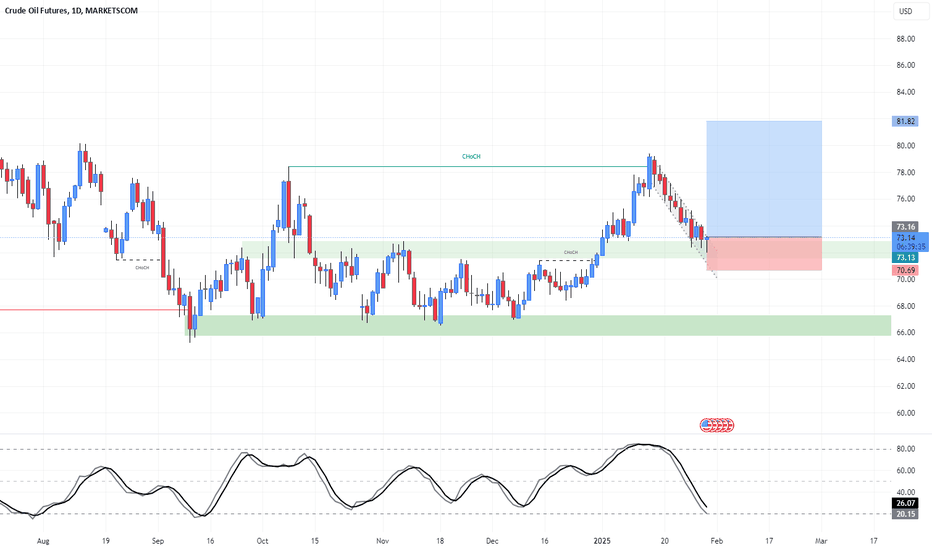

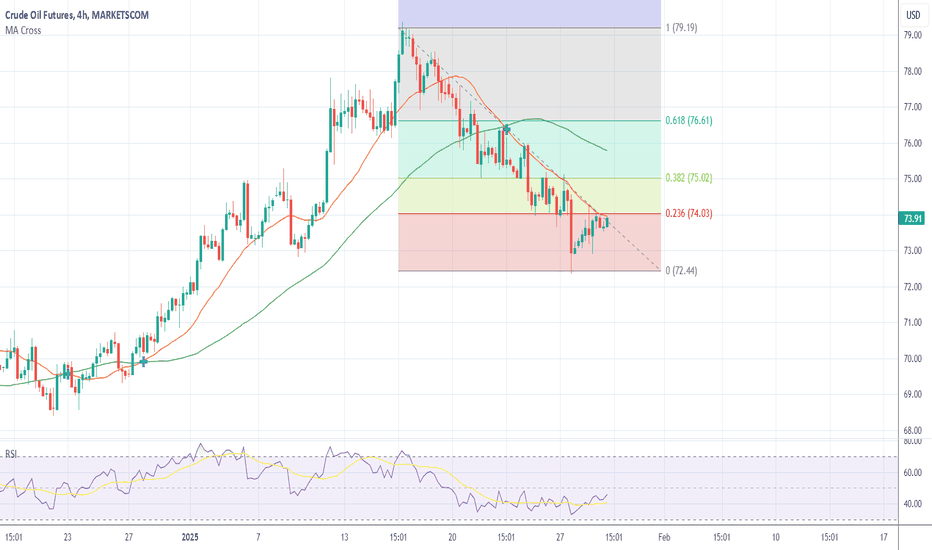

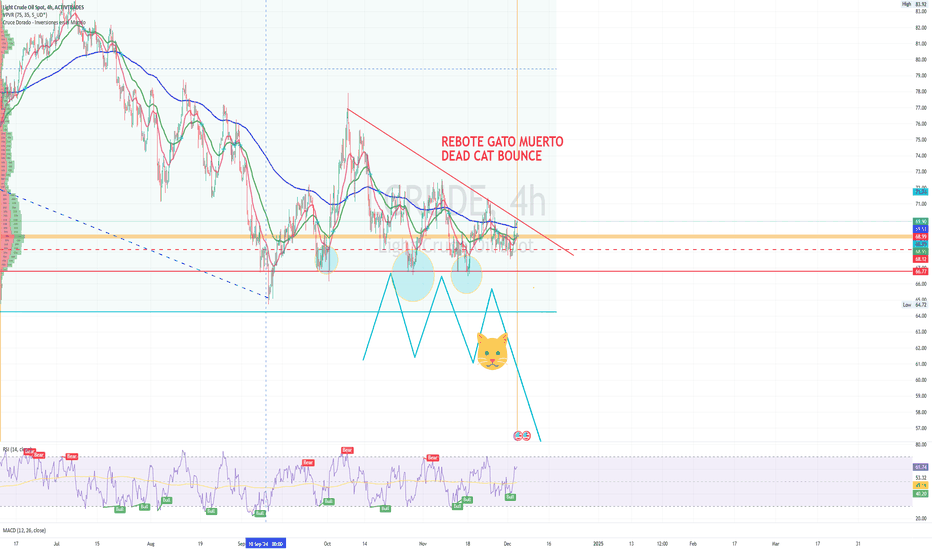

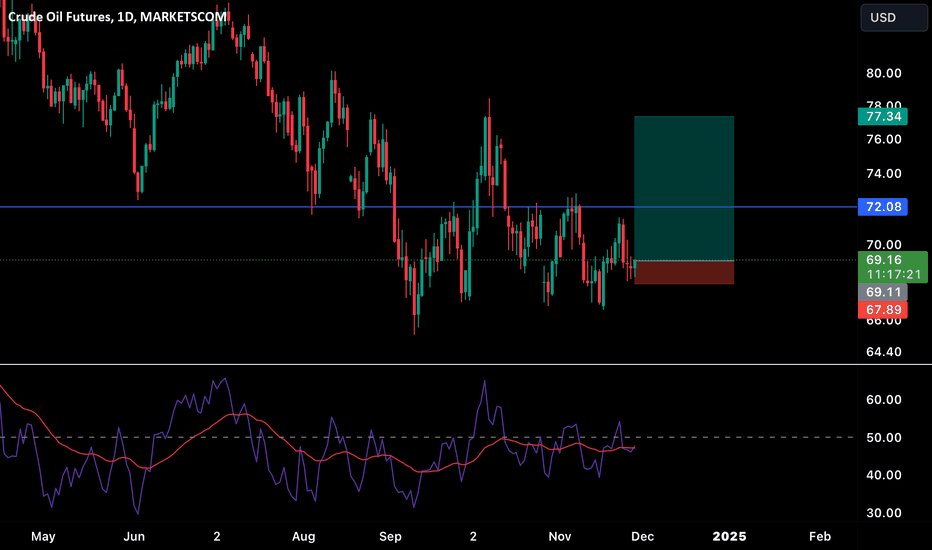

4-hr OIL: Bears to Drive Oil Down $4There is a clear shift in the momentum in the Oil market, with the commodity dropping with nearly 10% for the past 2 weeks. The Death Cross, a classic sell signal, is indicating that sellers are indeed in control and we are lookin now at a strong downward momentum. The minor pullback from 72.40 to 74 wasn't unexpected, after all it was triggered by early sellers taking profit, which is healthy for the broader trend. This correction was also very short lived, as it only tested the immediate resistance at 23% Fibonacci retracement. Besides the technical set up, looking at the broader market we see rising demand for risky assets such as stocks, which further supports the hypothesis speculators are shifting from Oil to equities. This is why we prefer to enter a sell trade with a target $4 below the current price.

Brent and WTI: Quarterly OutlookBy Ion Jauregui - ActivTrades Analyst

At the end of January 2025, Brent and West Texas Intermediate (WTI) crude oil prices have shown significant movements in the global energy market. Brent is trading around $77.47 per barrel, while WTI stands at $73.81.

Economic Analysis

Several economic factors are influencing the current dynamics of oil prices:

1. economic data from China: the recent contraction in Chinese manufacturing activity has raised concerns about a possible decline in demand for crude oil, given that China is the world's largest importer.

2. U.S. Trade Policies: The Trump administration has announced the imposition of 25% tariffs on imports from Canada and Mexico, and is considering similar measures for China. These actions could affect oil imports, as Canada and Mexico are key suppliers to the United States.

3. Production Efficiency: Oilfield services companies in the U.S. face a decrease in demand for hydraulic fracturing and increased production efficiency, which has led to a reduction in the number of active rigs and could influence future crude oil supply.

4. U.S. Inventory Expectations: U.S. crude oil inventories have shown an increase in recent weeks, indicating lower consumption or an increase in production. According to the latest reports from the Energy Information Administration (EIA), stockpiles have increased by approximately 3.5 million barrels, which could put downward pressure on prices in the short term. If this trend continues, it could reinforce bearish expectations for Brent and WTI.

Technical Analysis

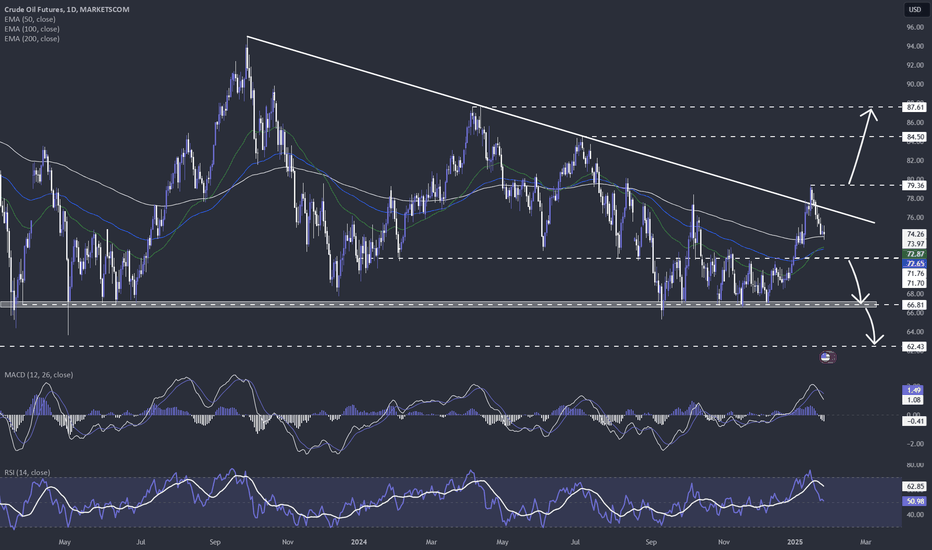

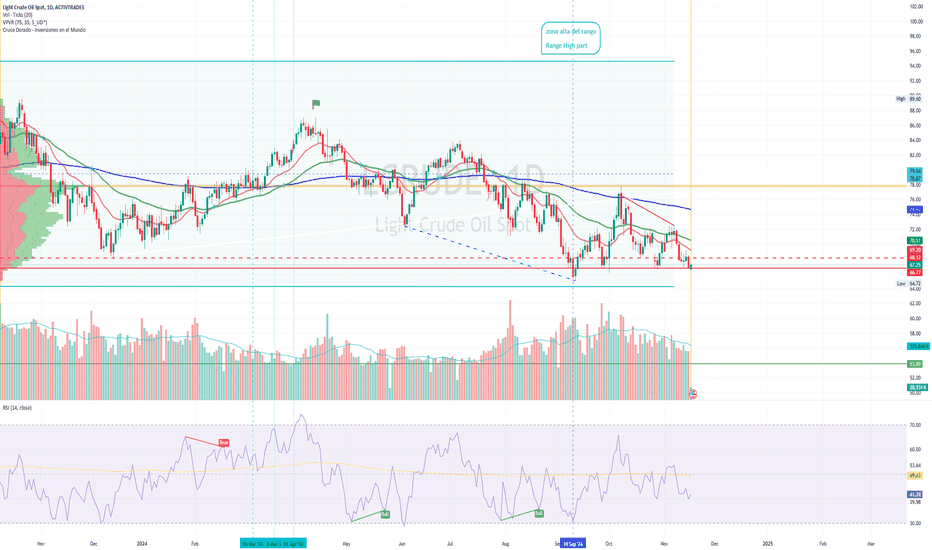

From a technical perspective, in the short term Brent (Ticker AT: Brent) , after reaching lows since January 9, has shown a slight recovery. Immediate resistance is around $80, a level that, if overcome, could open the way for further gains. However, the inability to overcome this barrier could result in a consolidation or pullback to previous supports. The Brent price has been moving in a very high volatility range since March 18, 2023 to date with its mid-zone being $84 - $80.74 indicated by the checkpoint (POC). Looking at the chart it has pierced its uptrend on August 8, 2024, to fall to a new support zone at lows of $68.46. Looking at the 3 consecutive touches below the $95.12 high to the current price zone, it does not appear to be evolving in a bullish direction from the March and June 2022 highs. The commodity trend has been moving downward since then. Since July 29, 2024 there has been a bearish crossover of averages reversing the trend of the averages. At the moment since January 3 of this year there has been a crossover in the opposite direction and currently the 50-average has overtaken the 200-average, but the 100-average has still lagged behind. We will have to watch to see if the price pierces the indicated checkpoint again, if this is the case as a new checkpoint the next two ceilings around $88 and $91.56. In a more than likely bearish scenario, if the strong price of $70.08 is pierced it will mean that industrial production has increased to a large extent.

In the case of WTI (Ticker AT:Lcrude) it has reached a key trend line around $72.50, suggesting a possible support point. Price's ability to hold above this level could indicate a continuation of the uptrend, while a break below could signal a deeper correction.

The WTI price has been moving $79 and the $72.40 in the last period of the year, it has been similar to brent with a similar bearish tone to its European counterpart. The strong support zone is found at lows of $63.94 and $68.37. Its current average zone is around $78.88 and $72.50. Its current control point (POC) is at $72.30, so it will be necessary to observe if, despite the conflict between Donald Trump and OPEC in its lack of productivity, the production increase forecasts are fulfilled at least on the US side. If we observe the bearish context and this is fulfilled, the price could retake the $60 area, although this is also unlikely due to OPEC's disinterest in listening to an American government with a “Drill baby Drill” anthem that only Canada and in particular Alberta, its main supplier, listens to.

Future Outlook

Projections for 2025 indicate a downward trend in oil prices, with an expected average of $73 per barrel for Brent and an average of $71.50 for West Texas. This forecast is based on the anticipation of an increase in global inventories and a moderation in demand.

In summary, the Brent and WTI crude oil market is being shaped by a combination of technical and economic factors. Investors should closely monitor production trends, trade policies and global economic indicators to make informed decisions in this volatile environment.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

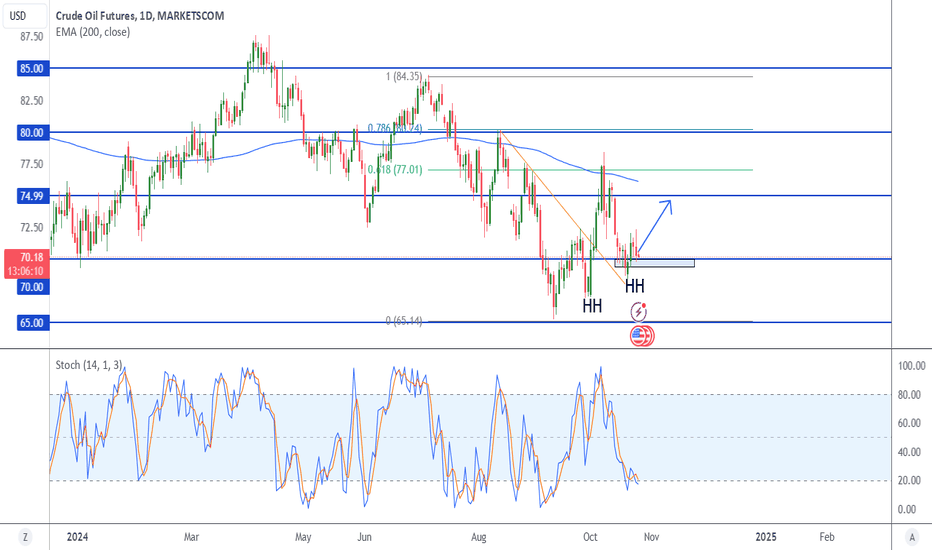

Does WTI Oil have enough energy to travel back up?After an unsuccessful breakout in mid-January, MARKETSCOM:OIL made its move back down. That said, it's currently finding support near the 200-day EMA. On one hand, it may seem that this is the place for a potential rebound, however, the bulls should not get their hopes up, because there some indication for a possible drift further south. Take a look at the video idea.

TVC:USOIL

RISK DISCLAIMER

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

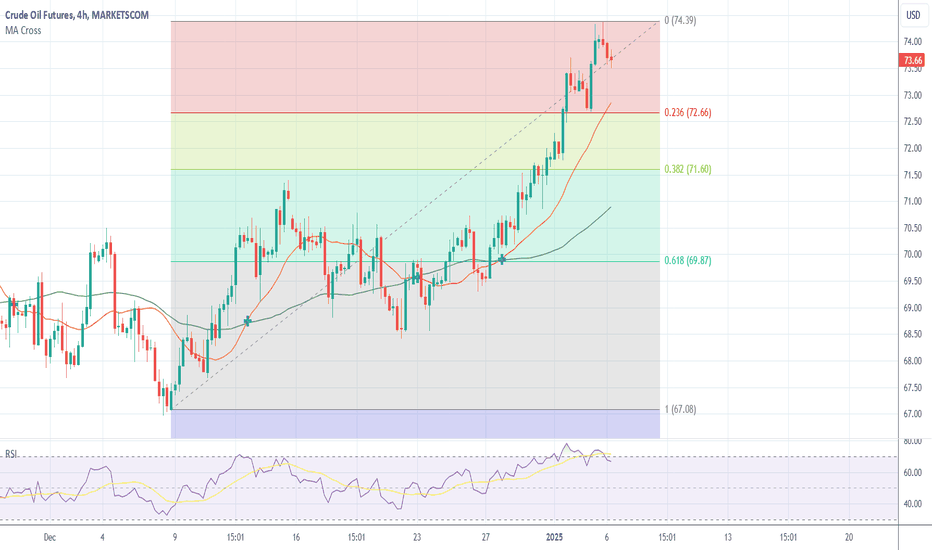

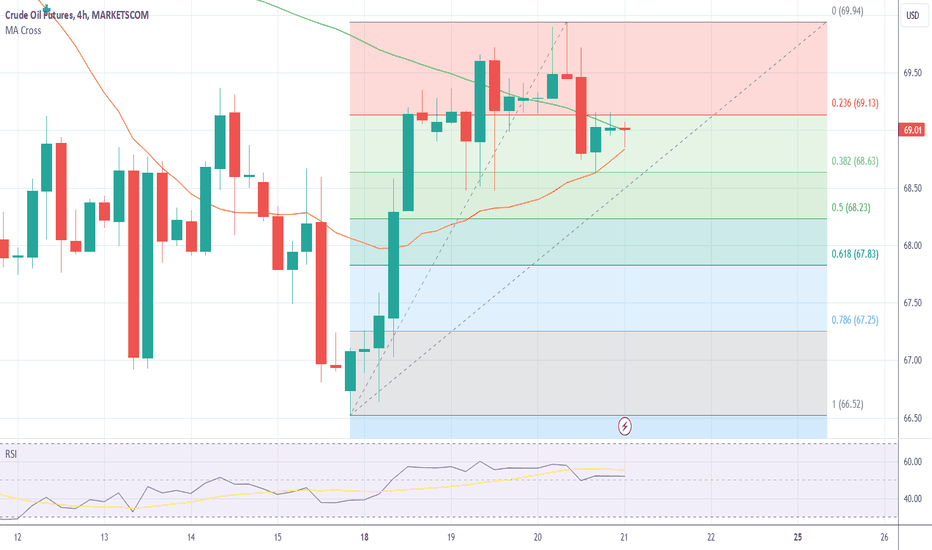

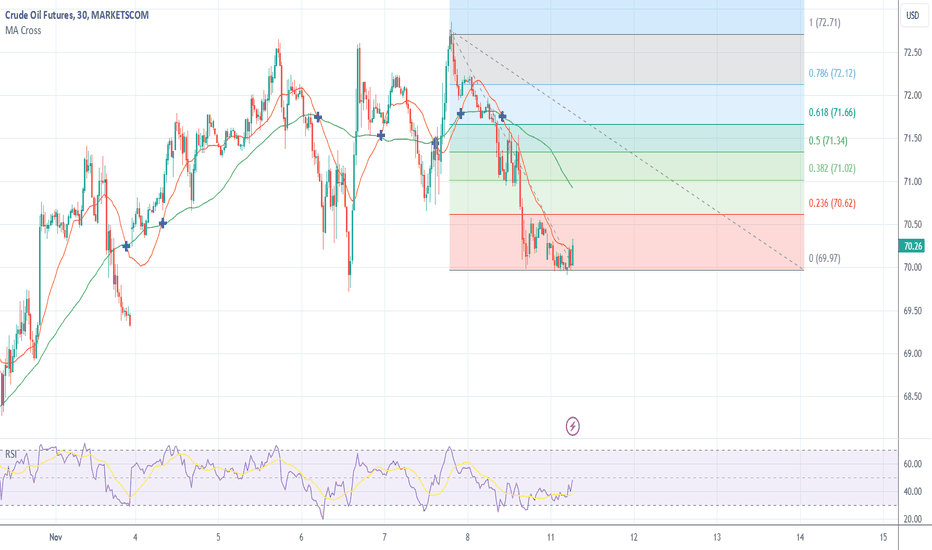

4-hr CRUDE OIL: Retesting $71.50, before the Up Trend ExtendsOver the past month, oil prices have surged by $8, marking an impressive 15% return in less than 20 business days. The commodity is clearly in an upward trend, with buyers maintaining strong control. This bullish momentum is further validated by two Golden Cross patterns, a classic buy signal. However, since Friday, a decline in buying volume suggests potential conditions for a correction. Early buyers might be taking profits, increasing supply and potentially triggering a broader pullback.

We anticipate the price may correct to $71.50, a swing high from mid-December, which coincides with the crucial 38.2% Fibonacci retracement level. If this support holds, the broader uptrend could resume. Buyers looking for a better risk-to-reward ratio might wait for this correction before entering the market.

Oil Market Outlook for 2025: Balancing Supply and DemandThe oil market in 2025 faces a challenging equilibrium between supply and demand, heavily influenced by OPEC+ strategies. Building on the success of their 2024 production cuts, OPEC+ is expected to continue regulating output to maintain market stability.

If no significant economic or geopolitical disruptions occur, oil prices are projected to remain within the $70–80 per barrel range, a level that benefits key market players. However, slower economic growth in China poses a potential downside risk to global demand. China's current policies, including procuring discounted oil from Iran and Russia, help mitigate domestic economic pressures and limit their impact on global prices.

In the United States, the long-term feasibility of achieving production targets set by the Trump administration appears realistic. With infrastructure already supporting output at 14.5 million barrels per day, further expansion will require significant investment in pipelines and other facilities.

Increased U.S. production is likely to add downward pressure on oil prices, but it’s unlikely to push them below $60 per barrel. Strategic interests, including budgetary allocations for the Strategic Petroleum Reserve, position the $60–65 range as a critical floor. A price range of $70–75 per barrel is deemed optimal for the U.S., enabling economic growth and bolstering tax revenues to support the budget.

This dynamic interplay of global strategies and regional policies will shape the oil market's trajectory, demanding vigilance from stakeholders to navigate the evolving landscape.

TVC:USOIL

SSE:000300

Continued bearishness in crude oil pricesOn December 17, 2024, oil prices showed a slight stabilization following the drop in U.S. crude inventories and the Federal Reserve's (Fed) interest rate cut. However, gains were limited by expectations that the Fed will slow the pace of cuts in the coming months. Brent crude oil futures rose 20 cents, closing at $73.39 per barrel, while West Texas Intermediate (WTI) crude rose 50 cents, reaching $70.58. Despite these increases, gains moderated after market close.

The U.S. Energy Information Administration reported a drop in crude oil and distillate inventories, while gasoline inventories increased in the week ending December 13. In addition, total product supply, a key indicator of demand, grew to 20.8 million barrels per day, reflecting an increase of 662,000 barrels from the previous week.

Despite the partial optimism around demand, crude oil prices fell briefly following the Fed's announcement to cut interest rates, although the pace of these cuts is expected to slow. The Fed projects only two additional rate cuts through the end of 2025, which could boost oil demand, but also dampen near-term expectations.

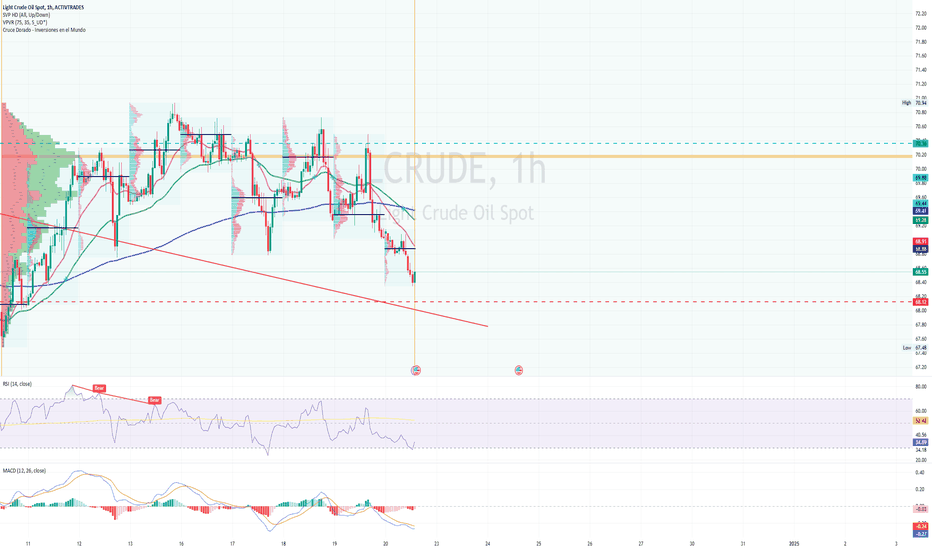

On technical analysis, crude oil continues to lose value, with the price looking for the $68 area since the start of the European session. The POC mid-zone is around $70.20, and the RSI is highly oversold at 30%. The crossover of the 200-average over the 100-average reinforces the prospect of a bearish continuation, as anticipated in previous weeks.

Ion Jauregui - ActivTrades Analyst

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

Crude Oil: Watch for Key Support Levels Next WeekRecent Performance: Crude oil has been navigating a downtrend influenced by

geopolitical tensions, oversupply issues, and weak demand signals. As of

late, concerns about peaking U.S. shale production have introduced

volatility, with prices currently facing resistance around the $68 mark and

critical support established at approximately $67.

- Key Insights: For those considering trading crude oil, paying close attention

to the established support ($66.63) and resistance levels ($68.14) will be

key for short-term strategies. Additionally, the contrasting dynamics of

rising demand in India against softer demand in China may present unique

trading opportunities. The current bearish sentiment creates potential for a

market rebound if conditions shift favorably.

- Expert Analysis: Analysts express caution regarding the continued bearish

commercial net positions. However, a pivot in market conditions could lead

to increased prices if the assumption about U.S. shale production is

validated. The need to monitor geopolitical developments remains paramount

as these could dramatically sway market psychology and pricing.

- Price Targets: Next week, for traders looking at potential long positions,

ideal target levels appear to be: T1: $69.7, T2: $70.5. It is essential that

stop levels are adhered to, with: S1: $66.63, S2: $66.05. If considering

short positions, one needs to be cautious as the thresholds are close at

play.

- News Impact: The global landscape remains heavily influenced by geopolitical

tensions, particularly in the Middle East, compounded by market news

surrounding the differing recovery rates between the Indian and Chinese

economies. Such dynamics will likely affect both short and long-term

investment strategies within the crude oil sector. Investors should remain

vigilant of these developments to better navigate their trading decisions in

the upcoming week.

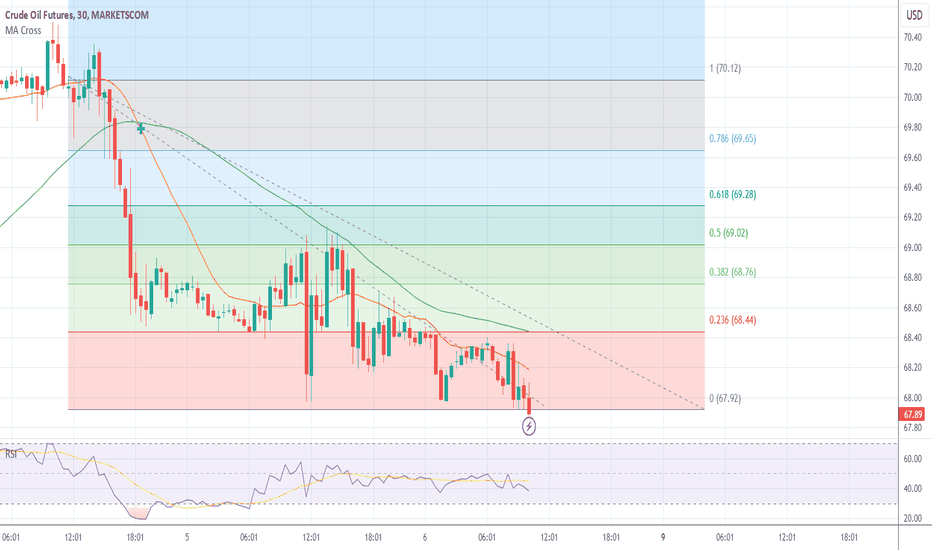

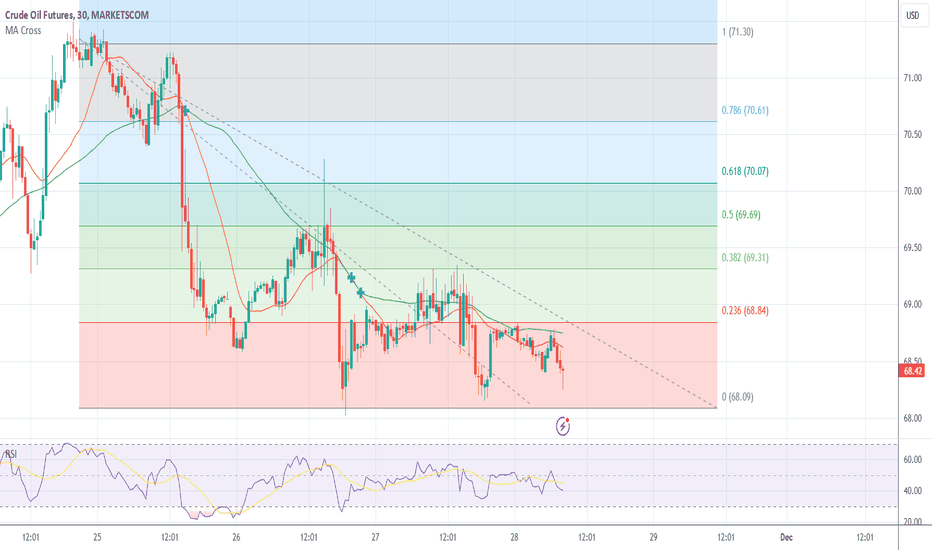

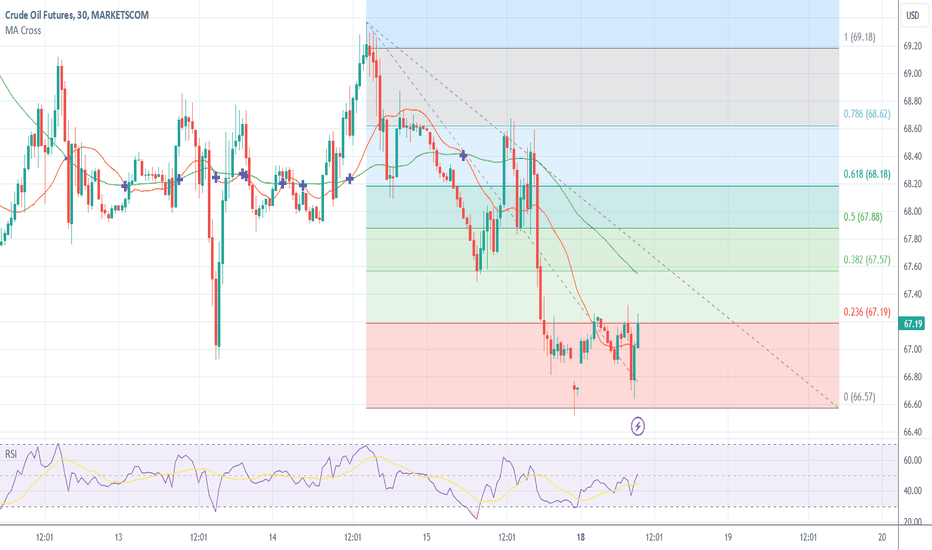

30-mins OIL: Death Cross Indicates Downward Momentum If you followed us for some time now, you probably notice that our trading methods heavily rely on MA crosses and Fibonacci. In this particular case, we registered a Death Cross, where a short term MA breaks below a longer term MA. This is a classic sell signal and indeed, after the signal was triggered, short sellers saw a $700 per lot running profit. Our preference is for Oil to carry on dropping down, because investors are now shifting capital to tech stocks and crypto. First however, and in order to secure better risk to reward, short sellers might want to wait for a pullback. Cheap oil price might attract short term buyers, so its not impossible for the price to retest the area around $68.80. This aligns with the critical 38% Fib retracement and if this resistance area holds, further drops seem logical.

Oil: New Global Tulip Crisis?In recent months, oil prices have fallen sharply, putting Brent and WTI below $70 per barrel, far from the highs reached in early 2024. For consumers, this drop may seem like good news, but for major producers, such as Saudi Arabia and Russia, it represents a significant economic challenge and has set off alarm bells in international markets. This phenomenon is not only a reflection of cyclical dynamics, but also of profound structural changes in the global energy landscape. With Brent and WTI falling to lows not seen in months, hydrocarbon-dependent economies face an uncertain outlook. The Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, account for more than 40% of the world's crude oil production and more than 60% of global exports.

A trillion dollar market

The crude oil market generates annual revenues in excess of $2 trillion, a large portion of which is captured by the major OPEC+ producers. For example:

- Saudi Arabia , the group's leader, relies on oil to generate approximately $326 billion a year, accounting for more than 70% of its export revenues.

- Russia , the largest non-OPEC ally, earns about $120 billion annually in crude exports alone.

- Iraq , OPEC's second largest producer, generates around $90 billion annually, which constitutes more than 90% of its fiscal revenues.

- The United Arab Emirate s, with its sophisticated export infrastructure, contributes approximately $80 billion to the global market.

Other members such as Kuwait, Nigeria and Venezuela are also critically dependent on oil revenues, which are critical to financing their economies.

Factors behind the drop in oil prices

1. Oversupply:

The price war between major producers, coupled with the U.S. shale oil boom, has led to oversupply. In 2023, the US reached a record production of 13 million barrels per day, increasing global competition and putting downward pressure on prices.

2. Slowdown in demand:

According to the International Energy Agency (IEA), global oil demand growth in 2024 will be just 900,000 barrels per day, a significant drop from 2023. This decline is largely due to the economic weakening of China, the largest importer of crude oil, and the transition to more energy-efficient economies.

3. Technological innovations and energy transition:

The rise of renewable energies and the adoption of technologies such as electric vehicles are reducing dependence on fossil fuels, structurally transforming global energy demand.

Global implications

• Oil-dependent economies: Countries such as Venezuela, Nigeria and Saudi Arabia face fiscal deficits and the need for economic adjustments, which could generate social and political instability.

• Impact on inflation: Although low oil prices reduce costs, they also contribute to global disinflation, posing risks of deflation in economies such as the Eurozone.

• Slowed energy transition: Low oil prices could discourage investments in clean technologies, affecting global sustainability goals.

• The impact of the downturn: Falling oil prices could cost these countries tens of billions of dollars in revenues if the downward trend persists. It also complicates efforts to balance national budgets that already face economic challenges.

With current prices in retreat, OPEC+ will need to decide whether to implement further production cuts to stabilize markets or let market forces continue to adjust naturally.

A new energy paradigm

The current oil crisis marks a turning point in the global energy market. As the OPEC oil giants face the dilemma of whether to cut production to support prices in preparation for a possible slowdown in global demand or whether to maintain their market share against competitors such as the US, investors and analysts will be watching the upcoming OPEC+ meetings to assess the next steps. This context could suggest a shift towards a less oil-dependent economy, with profound implications for economic growth and environmental sustainability. This critical moment will define not only the price of oil, but also the future of economies highly dependent on this resource. The challenge now lies in balancing these factors to build a more resilient and equitable energy future, especially in regions such as Europe, which is very focused on its Green Deal, or a China that, despite continuing to use fuel, is determined to a very “electrified” paradigm both in transportation and at the energy level in general.

The Tulip Crisis

The collapse of the oil market has certain parallels with the 17th century tulip crisis in Holland, especially in the excessive dependence on a single resource and the consequences of speculation. In both cases, oversupply and falling demand triggered collapses that severely affected the economies involved. However, while tulips represented a fleeting luxury, oil has a critical and global impact, where geopolitical decisions and energy transition play a central role in the current dynamics. The tulip crisis marked the decline of a market that had dominated for some time, leading to a shift in the Netherlands' economic priorities. If oil prices continue to fall or the energy transition accelerates the shift away from fossil fuels, producing countries could face a similar structural change, being forced to diversify their economies.

Ion Jauregui - ActivTrades Analyst

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

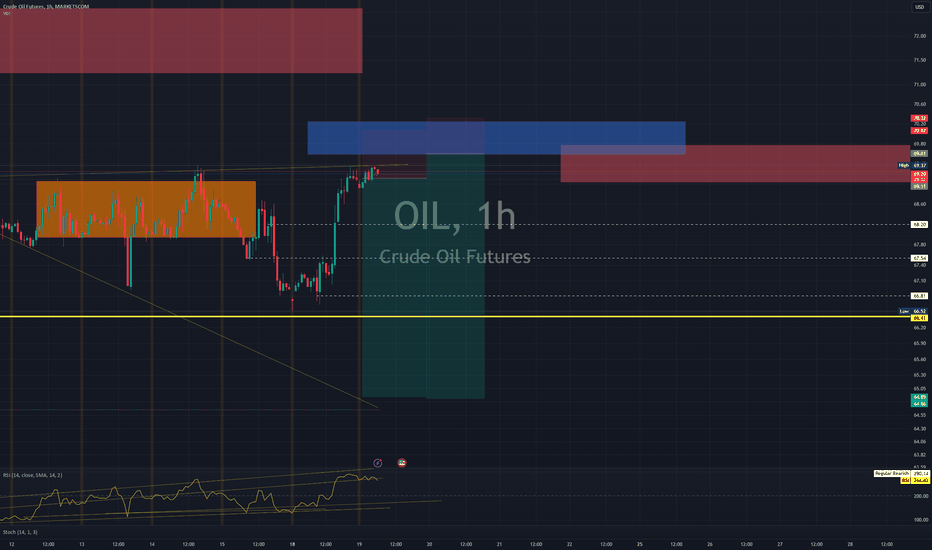

OIL Possible BUYThe market is currently testing the current Weekly area. Based on Daily TF, the market seems to be forming a possible reversal chart pattern.

We could see Buyers coming in strong should the current level hold.

Disclaimer:

Please be advised that the information presented on TradingView is solely intended for educational and informational purposes only.The analysis provided is based on my own view of the market. Please be reminded that you are solely responsible for the trading decisions on your account.

High-Risk Warning

Trading in foreign exchange on margin entails high risk and is not suitable for all investors. Past performance does not guarantee future results. In this case, the high degree of leverage can act both against you and in your favor.

30-mins Crude Oil: Sellers Remain in Control

Oil remains in a strong downtrend, confirmed by the Death Cross, a classic sell signal. This pattern occurs when a short-term moving average (MA) crosses below a long-term MA, signaling accelerating bearish momentum. Earlier this week, buying activity led to a minor pullback, but it failed to sustain recovery. Prices hit resistance at the 38% Fibonacci retracement level and resumed their decline. A triple bottom chart pattern is forming, often a precursor to further downside. For improved risk-reward, short sellers could wait for a retest of $68.90, aligning with the 23% Fibonacci level, before targeting potential drops below $67.90.

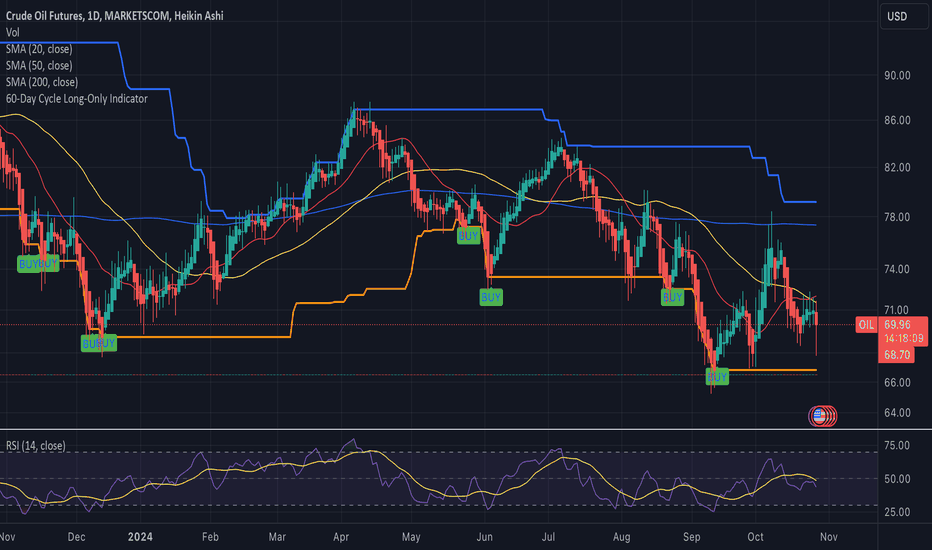

4-hr Oil: Oil Buyers Driving The Price Higher Oil prices have climbed by over $3 per barrel since last week, driven by renewed buyer interest following a period of oversold conditions. This rally reflects a growing confidence among market participants as the asset regains upward momentum. Adding to the bullish sentiment is the imminent formation of a Golden Cross—a widely recognized technical buy signal—where the 20-day moving average is on the verge of crossing above the 60-day moving average. This pattern suggests that there could be significant additional upside potential for crude oil in the near term.

However, before this upward trajectory solidifies, the market may experience a short-term correction. A potential retracement could see prices testing the $68.20 level, which aligns with the 50% Fibonacci retracement of the recent move. This level is a key area of technical support and could offer a strategic entry point for buyers. By waiting for a dip to this level, traders could achieve a more favorable risk-to-reward ratio, positioning themselves for gains as the market resumes its ascent.

30-mins: Oil Broke below Support Over the past couple of weeks, investors have been actively shorting oil, shifting their capital towards Bitcoin and leading tech stocks from the US100 (Nasdaq 100). This capital reallocation has put significant downward pressure on oil prices, which initially found temporary support around the $68 mark. However, this support level failed to hold, triggering a sharp and rapid decline as bearish momentum accelerated.

A notable technical signal has emerged in the form of a "Death Cross," where the 20-period moving average (MA) crossed below the 60-period MA. This crossover is a strong bearish indicator, suggesting that the current downtrend may persist, with sellers firmly in control. Currently, immediate resistance is found at the $67.20 level, corresponding to the 23% Fibonacci retracement, but the downward bias remains strong.

Despite this, the lower price levels might attract short-term buyers looking for value opportunities. However, a more conservative selling point for traders eyeing the ongoing downward momentum would be at the $67.88 level, aligning with the 50% Fibonacci retracement. This level offers a better risk-reward entry for short sellers, allowing them to participate in the trend while managing potential pullbacks.

LCRUDE: Marco Rubio and the New Oil SanctionsPresident-elect Donald Trump's nomination of Marco Rubio as Secretary of State anticipates a tougher foreign policy toward Iran and Venezuela, with potentially significant impacts on the global oil market. Rubio, known for his tough stance on international policy issues, could strengthen existing sanctions, seeking to limit crude oil exports from these countries. However, the risks of retaliation by China and the impact on the international financial system could moderate these initiatives.

Iran: A More Restrictive Approach

During Trump's first term, sanctions drove Iranian oil exports to historic lows. Under Biden, these have increased due to laxer enforcement and growing demand from China, the main buyer of Iranian crude. Rubio could intensify pressure on Iranian exports, especially those destined for the Chinese market, using tools such as the SHIP Act of 2024, which penalizes ports and refineries that process Iranian oil in violation of U.S. sanctions.

Venezuela: Continued Confrontation

Rubio's arrival at the State Department also indicates little chance of improving U.S.-Venezuela relations. His critical stance toward President Nicolás Maduro reinforces the likelihood of maintaining and even tightening sanctions against the Venezuelan oil sector. This approach aligns with a confrontational policy aimed at limiting the South American country's economic options.

Geopolitical Challenges: The Role of China

A tightening of sanctions could generate tensions with China, which has increased its dependence on Iranian crude. As a major buyer, China could respond by reducing the use of the dollar in oil transactions, weakening its global primacy and complicating U.S. foreign policy objectives.

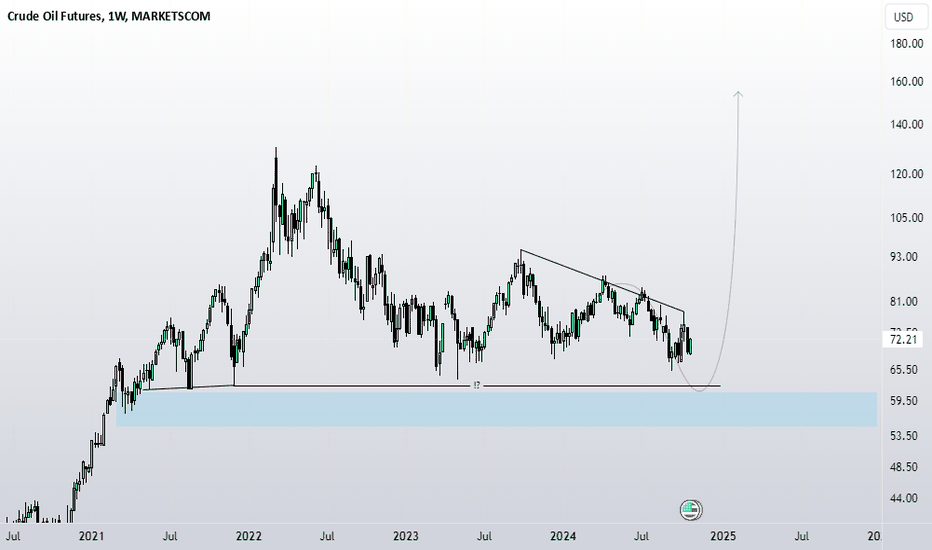

LCRUDE Technical Analysis

The value of crude oil reached several downward ceilings, the first in March 2017, the second in June 2022, the third in September 2023, and the last April 2024. From that point on the trend on crude has been downward regardless. Focusing the chart on the last period from September to this part, crude oil has had several attempts without much strength to return to the Checkpoint value around $78.00 in October. The crossover of averages indicates a bearish continuation with the 50-average below the 100 and 200. So this only presents a confirmation to the shoulder head shoulder we have before us and could generate the price to test the minimum resistance at $64.72, and if the market does not support a price recovery the price of oil could continue to depreciate irretrievably. The strategy of lowering crude oil prices in general seems more of a political move than a healthy market correction. The volume average appears to be slightly below 126k. The RSI is oversold at 41.46% so this could be a further confirmation of the bearish continuation. Looking at the chart the resistance zone tested for the third time today is at $66.77 if the low is reached as we say, we could see a stronger price drop.

Final Reflection

The Trump administration, with Rubio at the helm of diplomacy, faces the challenge of balancing its strategic objectives with the economic and geopolitical risks of a more aggressive sanctions policy. This approach will set the tone for international relations in a context where the energy market and global dynamics are more interconnected than ever.

Ion Jauregui - ActivTrades Analyst

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

30-mins Crude Oil: Short Term Bearish Momentum Oil is showing a strong bearish momentum on the 30-mins chart, with a Death Cross MA crossover of the 20 period MA dropping below the 60 period MA. Should the price pull back, possible resistance levels could be $71.00 (38% Fib) and $71.34 (50% Fib). If these levels hold, further drop below $70 seems plausible.

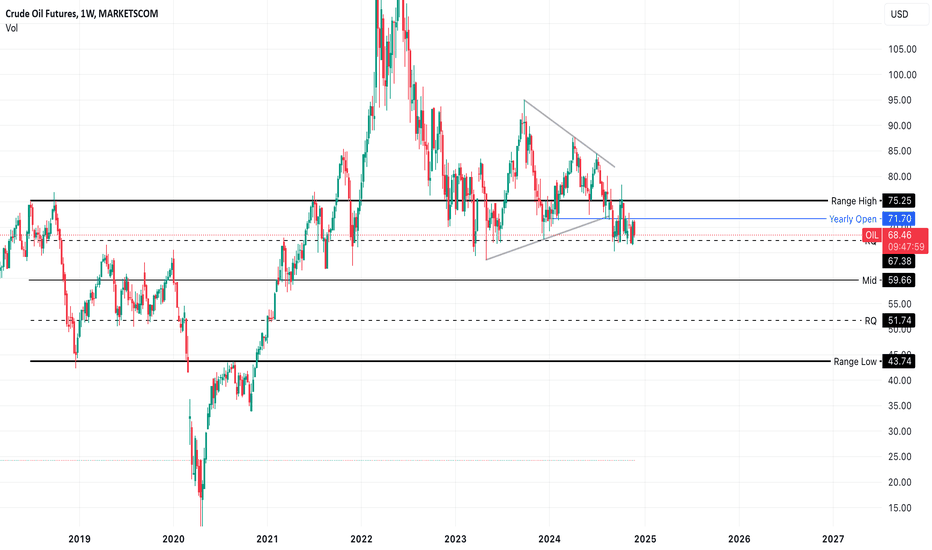

Oil Price Forecast 2024-2030: Will Oil Prices Fall in 2025?Since reaching multi-year highs in Q1 2022 following Russia’s invasion of Ukraine in late February, oil prices have gradually retreated. Slowing economic growth, with looming recession due to central banks’ aggressive interest rate hikes to tame decades-high inflation, has capped oil prices. In 2023, crude oil prices dropped by more than 10%, essentially erasing their previous gains.

As 2024 progressed, oil prices faced another year of volatility. Uncertainty over when the US Fed would initiate its rate-cutting cycle pressured oil prices and other commodities in the first nine months of this year, pushing them below $80 per barrel (bbl).

In the first week of October, oil briefly hit $80 as the conflict between Israel and Iran escalated, raising concerns about supply disruptions. However, the gain was just a blip, and oil tumbled back down to below $80.

So, what’s in store for oil prices for the remainder of 2024 and beyond in 2025 and 2030? Let’s dive into our oil price forecast.

2024

Brent: $72.118 to $81

WTI: $$68.672 to $80

OPEC+ output policy

Wars: Hamas-Israel, Russia-Ukraine

Global economic slowdown

The Fed’s rate cut

2025

Brent: $70 to $78

WTI: $65 to $75

Fed continues the rate-cutting cycle

OPEC+ supply returns to market

Higher output from non-OPEC countries

Demand recovery

Global economic uncertainty

2026-2030

Brent: $65 to $77 (2026 to 2028)

WTI: $60 (2026-2027)

General sentiment: neutral to bearish

Wider adoption of EV, clean energy

De-dollarization

OPEC+ role to regulate supply

Decreasing demand among developed nations

Increasing demand from emerging nations

OIL Futures Buy 30/10Price is at historically significant level, daily made higher highs and currently respecting the swing low at 66.255. Mentions in the middle east as well as election uncertainty in the US may push price higher. There is also the gap down from weekly open that is likely to be filled. Any major escalation between Iran and Israel may cause a spike up in price. If the oil supply chain is disrupted price could hit 110.00 long term.

Oil's Well That Ends Well: Riding the Wave "OIL"Oil's technical picture is looking increasingly bullish. A recent bounce off a key support level has formed a compelling inverted head-and-shoulders pattern on lower timeframes. This classic reversal signal, combined with a series of higher highs in recent weeks, points to a strong uptrend in progress. According to my Elliott Wave analysis, we are currently in the impulsive phase, heading towards the 5th wave target of $75.00. This confluence of technical indicators suggests that oil is poised for further gains.