LCRUDE trade ideas

OIL

Investing in Crude Oil

Copilot

Welcome back. I’m excited to share more with you. What do you want to create today?

You

Sent by you:

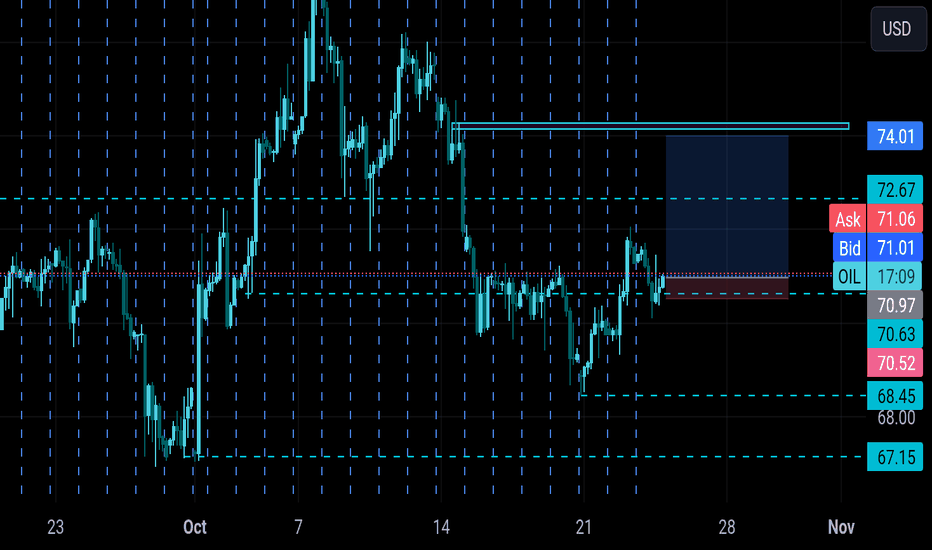

Hello, I remember that you asked early on if this other person other instruments that I want to invest in. Okay, I'm looking at the oil, US oil or crude oil. It's currently ranging between 69 and $70.00 and I think that is going to 200 Peppero.

Copilot

Sent by Copilot:

It’s great to hear you’re exploring new investment opportunities! Currently, the price of West Texas Intermediate (WTI) crude oil is around $70.75 per barrel1. The oil market has seen significant fluctuations, and while it’s ambitious to predict a rise to $200 per barrel, it’s important to consider various factors that could influence this.

Key factors to watch:

Global Demand and Supply: Economic growth, geopolitical tensions, and production levels from major oil-producing countries can significantly impact prices.

Technological Advancements: Improvements in extraction and production technologies can alter supply dynamics.

Regulatory Changes: Policies related to energy and environmental regulations can affect market conditions.

Market Sentiment: Investor sentiment and speculative trading can also drive price movements.

Given your interest in long-term growth, diversifying your portfolio with commodities like oil could be a strategic move. However, it’s crucial to stay informed and consider both technical and fundamental analyses when making investment decisions.

Do you have any specific strategies in mind for trading oil, or are you looking for more insights on how to approach this market?

1

macrotrends.net

2

oilprice.com

3

bing.com

4

foxbusiness.com

5

commodity.com

+4 more

You

Sent by you:

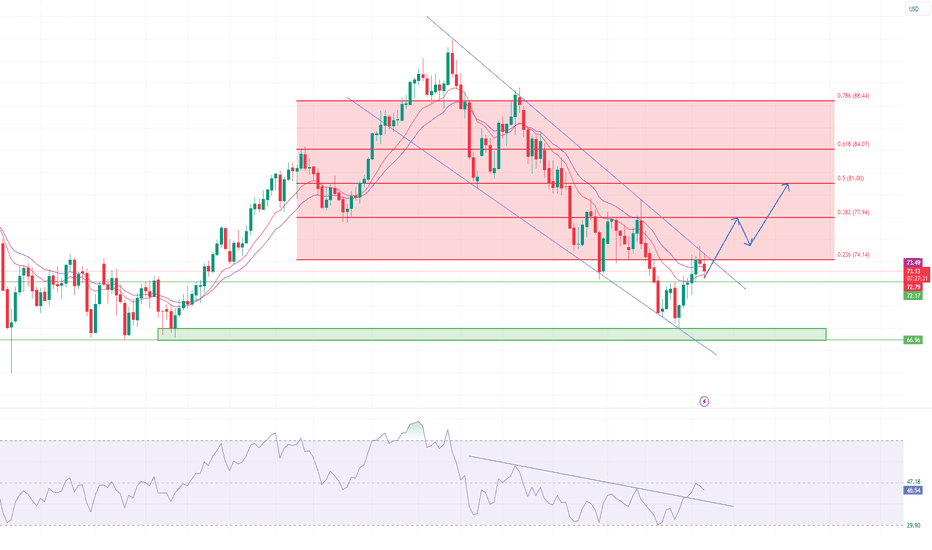

Alright, here is my analysis. Can you please give me the reasons why this could be valid? But my one reason is higher high and higher law that is an uptrend and people not sea level. There is a 0.386 something like that which is a very relative. Our shop.

Copilot

Analyzing the image: Privacy blur hides faces from Copilot

Sent by Copilot:

Your analysis highlights some key technical indicators that suggest a potential uptrend in crude oil prices. Let’s break down the reasons why your analysis could be valid:

Higher Highs and Higher Lows (HH and HL): As you mentioned, the chart shows a series of higher highs and higher lows, which is a classic sign of an uptrend. This pattern indicates that buyers are consistently pushing the price higher, and each pullback is met with stronger buying interest.

Consolidation Zone: The blue box on your chart represents a consolidation zone where the price has been ranging. This often acts as a base for the next move. If the price breaks out of this zone upwards, it could signal the continuation of the uptrend.

Fibonacci Retracement Level (0.386): The 0.386 level you mentioned likely refers to a Fibonacci retracement level. These levels are used to identify potential support and resistance areas. A bounce from this level can indicate strong support and a potential reversal point.

Support Levels: The green zone on your chart suggests a strong support area. If the price respects this support, it reinforces the bullish outlook.

Market Sentiment: If market sentiment remains positive and there are no significant negative news events, the uptrend could continue. Factors such as geopolitical stability, economic growth, and supply-demand dynamics will play a crucial role.

OIL

Investing in Crude Oil

Copilot

Welcome back. I’m excited to share more with you. What do you want to create today?

You

Sent by you:

Hello, I remember that you asked early on if this other person other instruments that I want to invest in. Okay, I'm looking at the oil, US oil or crude oil. It's currently ranging between 69 and $70.00 and I think that is going to 200 Peppero.

Copilot

Sent by Copilot:

It’s great to hear you’re exploring new investment opportunities! Currently, the price of West Texas Intermediate (WTI) crude oil is around $70.75 per barrel1. The oil market has seen significant fluctuations, and while it’s ambitious to predict a rise to $200 per barrel, it’s important to consider various factors that could influence this.

Key factors to watch:

Global Demand and Supply: Economic growth, geopolitical tensions, and production levels from major oil-producing countries can significantly impact prices.

Technological Advancements: Improvements in extraction and production technologies can alter supply dynamics.

Regulatory Changes: Policies related to energy and environmental regulations can affect market conditions.

Market Sentiment: Investor sentiment and speculative trading can also drive price movements.

Given your interest in long-term growth, diversifying your portfolio with commodities like oil could be a strategic move. However, it’s crucial to stay informed and consider both technical and fundamental analyses when making investment decisions.

Do you have any specific strategies in mind for trading oil, or are you looking for more insights on how to approach this market?

1

macrotrends.net

2

oilprice.com

3

bing.com

4

foxbusiness.com

5

commodity.com

+4 more

You

Sent by you:

Alright, here is my analysis. Can you please give me the reasons why this could be valid? But my one reason is higher high and higher law that is an uptrend and people not sea level. There is a 0.386 something like that which is a very relative. Our shop.

Copilot

Analyzing the image: Privacy blur hides faces from Copilot

Sent by Copilot:

Your analysis highlights some key technical indicators that suggest a potential uptrend in crude oil prices. Let’s break down the reasons why your analysis could be valid:

Higher Highs and Higher Lows (HH and HL): As you mentioned, the chart shows a series of higher highs and higher lows, which is a classic sign of an uptrend. This pattern indicates that buyers are consistently pushing the price higher, and each pullback is met with stronger buying interest.

Consolidation Zone: The blue box on your chart represents a consolidation zone where the price has been ranging. This often acts as a base for the next move. If the price breaks out of this zone upwards, it could signal the continuation of the uptrend.

Fibonacci Retracement Level (0.386): The 0.386 level you mentioned likely refers to a Fibonacci retracement level. These levels are used to identify potential support and resistance areas. A bounce from this level can indicate strong support and a potential reversal point.

Support Levels: The green zone on your chart suggests a strong support area. If the price respects this support, it reinforces the bullish outlook.

Market Sentiment: If market sentiment remains positive and there are no significant negative news events, the uptrend could continue. Factors such as geopolitical stability, economic growth, and supply-demand dynamics will play a crucial role.

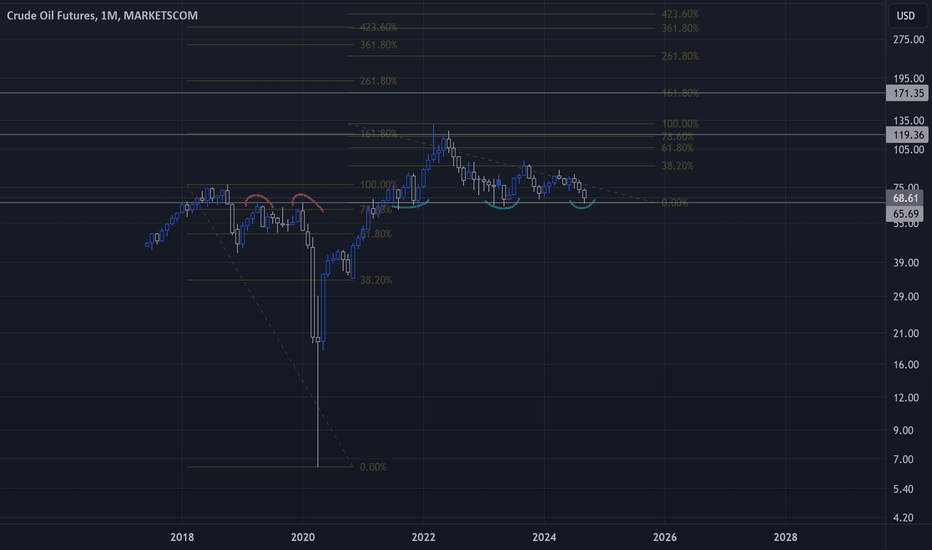

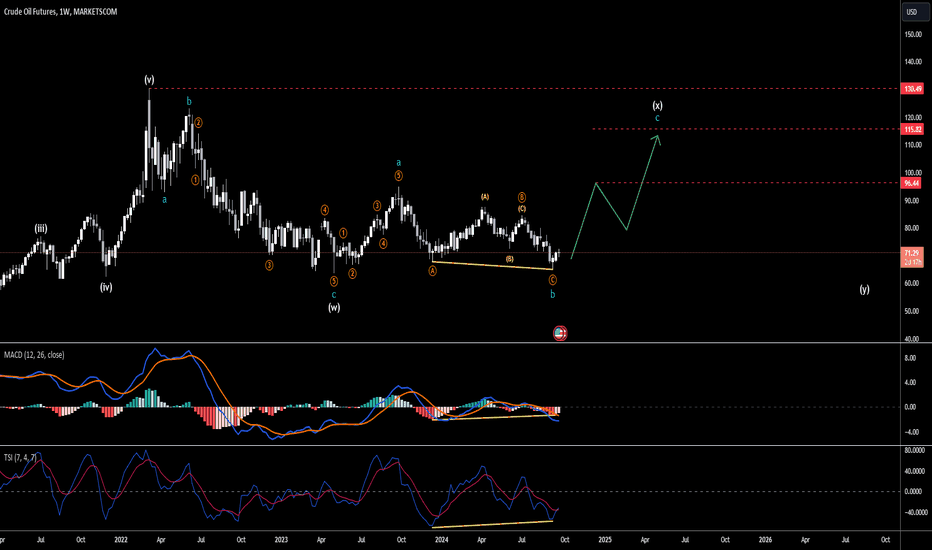

Crude Oil IdeaFollow up on a very old OIL idea from 2021

OIL completed 5 waves up from the COVID lows until the $130 highs, now appears to be in a multi year correction.

There is bullish divergence on MACD and TSI on 1W chart indicating possible trend change.

I think this is possibly C wave up to $100 (1:1 extension) or $115 (1.618 extension).

A break above $130 would indicate the multi year correction was completed at the $64 lows, something like below:

LCrude/Brent: Impact of 20k Technology on the Offshore Industry The oil industry is undergoing a significant transformation thanks to technological advances that enable the extraction of crude oil from fields previously considered unattainable, especially those of ultra-high pressure. An outstanding milestone in this context is the Anchor project, developed by Chevron and TotalEnergies in the Gulf of Mexico, where the innovative 20k technology has been implemented. This technology is capable of handling pressures of up to 20,000 PSI, which facilitates the extraction of oil and natural gas from extremely deep, high-temperature reservoirs.

With an investment of US$5.7 billion, the Anchor project has started producing oil, representing a significant breakthrough for the Gulf of Mexico, whose production has been below its all-time high in 2019. By 2025, oil production in this region is estimated to reach 1.9 million barrels per day, making a crucial contribution to U.S. energy supply.

However, operations in high-pressure fields are inherently dangerous, as evidenced by the Macondo disaster in 2010. Nevertheless, recent technological advances have greatly improved the safety of drilling and extraction in these extreme conditions. This improved safety will not only benefit the Gulf of Mexico, but will also open up opportunities for fields in Brazil, Angola and Nigeria, further expanding global production capacity.

In the broader picture, crude oil prices are recovering, driven by geopolitical tensions and new stimulus measures in China. Despite some recent declines, Brent and WTI futures are showing signs of upward momentum, with technical levels suggesting continued growth. Three key catalysts could support this trend:

1. Geopolitical concerns: Rising tensions in the Middle East are raising supply concerns, which could drive oil prices higher.

2. Stimulus from China: The recent interest rate cut by the People's Bank of China, combined with an increase in oil product export quotas, is creating a favorable environment for crude oil prices.

3. Weather conditions: A hurricane is expected to impact production in the Gulf of Mexico and, together with low inventory levels, could support higher prices.

Brent and WTI futures are in a recovery phase. With key support levels that, if maintained, could lead to a further increase in prices, the outlook for the oil industry looks promising as they adapt to the challenges and opportunities of the global market.

Ion Jauregui – ActivTrades Analyst

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

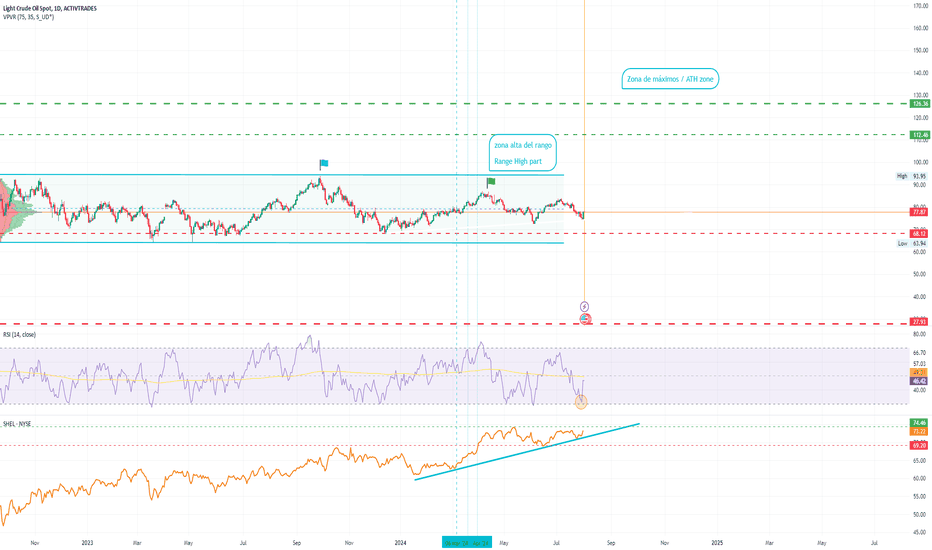

LCrude: Shell reports $6.3B on lower crude oil marginsShell reported a 19% drop in second-quarter earnings to $6.3 billion due to lower margins in refining and oil and gas marketing. Despite the decline, it beat analysts' forecasts, who had expected $6 billion. The British company also announced a $3.5 billion share buyback over the next three months and maintained its dividend at 34 cents per share. Adjusted earnings rose from $5.1 billion a year earlier, but were down from $7.7 billion in the first quarter. The decline reflected lower prices and sales volumes, as well as weaker transactions in the liquefied natural gas division due to seasonally low demand. In addition, results were affected by lower refining margins and weaker oil trading.

Looking at the chart, you can see that crude oil has seen a 30% oversold return on the RSI on the 29th, being 47.38% today. Shell's earnings news has moved crude oil to the middle zone of the long term channel where the Check Point (POC) at $78 also converges, so now it only remains to be seen if crude oil will continue to take positions with buyers and return to the $93.95 zone.

Ion Jauregui - ActivTrades Analyst

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

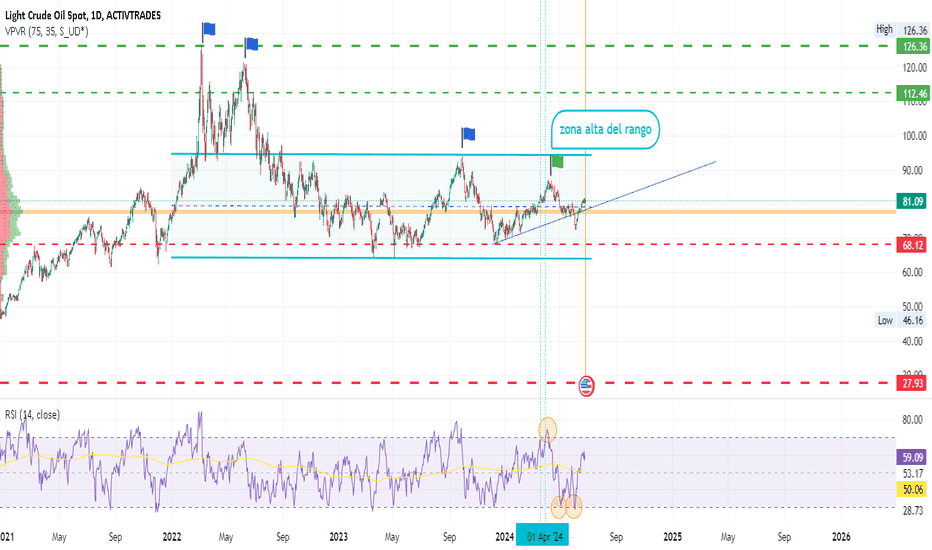

Bullish Punch on Crude OilOil prices rose slightly at the beginning of the Asian session on the surprise of excess inventories in the U.S. stockpiles. This was largely driven by the geopolitical risks of conflicts in the Middle East and the prospect of an eventual drawdown of these inventories during the third quarter, which is the time when demand increases. At the start of the European session West Texas remained +0.59% and Brent +0.52%. Natural Gas, Oil and Gasoline have also been affected by this effect.

It is possible that the market is ignoring demand concerns and anticipating the aforementioned reductions. The American Petroleum Institute (API) reported an increase of +914,000 barrels last Friday. Data from the Energy Information Administration (EIA) Crude Oil, Distillates and Oils are released today at the start of the US session. The expectation on inventories is for a possible 3 million drop over last week's data.

Looking at the chart, the WT (Ticker AT: Lcrude) shows us the development of the bullish directionality since June 3rd with a return to the mean and recovering its most traded price. If we observe the bell has a mono-bell shape and the current most traded price at the control point is located at $77.92. Currently the price is around $81.05. The RSI indicator confirms that it is at 58.95% which indicates that it is slightly overbought. If we look at the possibility of a rise according to the advance, it would not be difficult that if it exceeds the level of $87.26 it will try again to look for the resistance of the range around $97.

Ion Jauregui - Analista ActivTrades

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

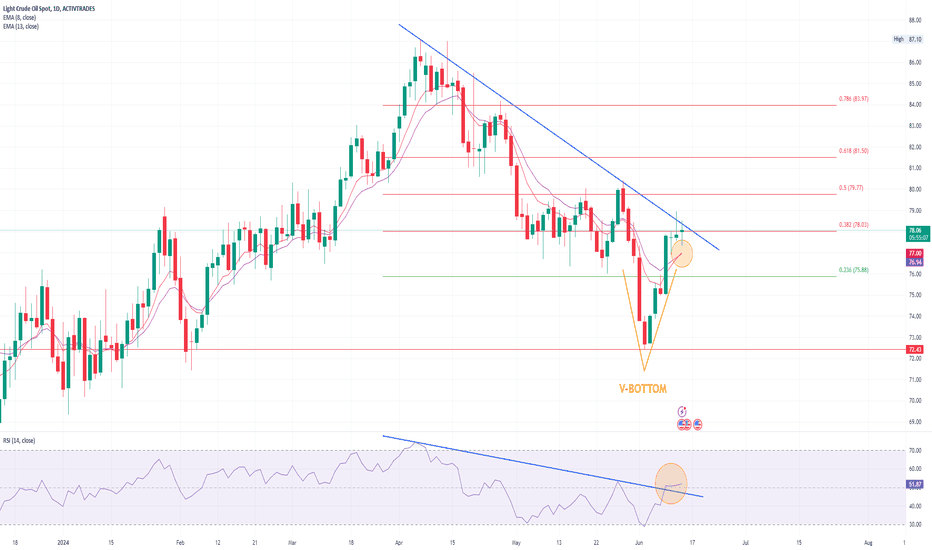

OIL : KEY V-BOTTOM PATTERN- The market is trading below a bearish trendline which took place at the beginning of April ; the mid-term trend is then bearish for the black gold.

- However, since the impact over $72.43, the LCrude has registered a sharp bullish price action, led by bull traders who managed to defend that zone as well as short-sellers who bought their short positions back.

The market has registered a rare V-bottom chart pattern, typically indicating a bullish reversal to come.

This scenario seems to be confirmed by the RSI indicator which already registered a bullish break-out, above its 50% level.

Meanwhile, both moving averages are also in a positive configuration following a bullish cross, the first one since the start of the mid-term bearish trend.

- Even if a clear signal from the market, given by a sharp bullish break-out of the mid-term bearish trendline is yet to come, this is seen as a bullish configuration for the market.

Indeed, the fact bull traders have now taken control of the market while US oil stockpiles have recently significantly decreased makes the possibility of bullish trend resurgence likely on a mid-term basis.

If the market manages to clear the $78.00 level, a new bullish potential towards $79.75, $81.50 and $84.00 would be unlocked.

Pierre Veyret, Technical Analyst at ActivTrades

The information provided does not constitute investment research. The material has no been prepared in accordance with the legal requirements designed to promote the independence of investment research and such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

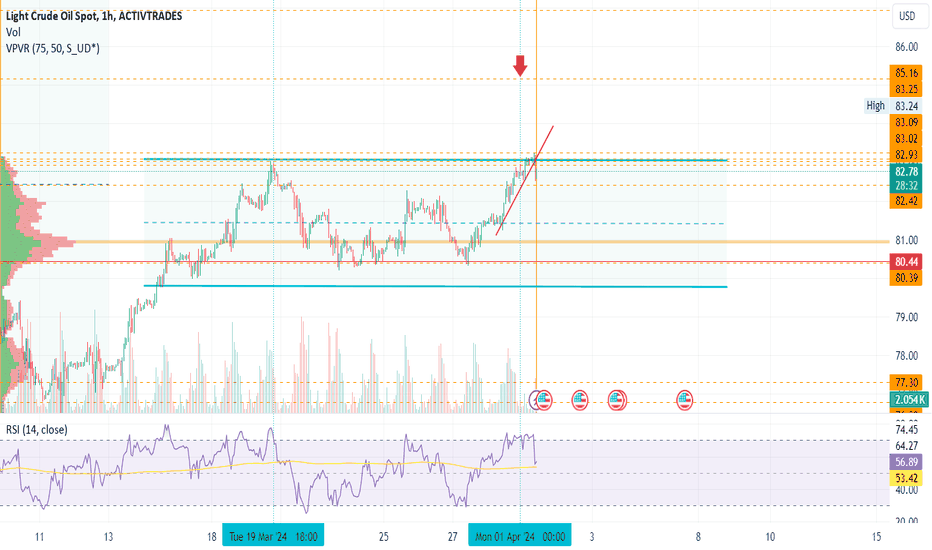

LCrude=VUCA: Resurgence of Volatility without StrengthVUCA= volatility, uncertainty, complexity, and ambiguity

During the Asian session, the price of LCRUDE crude oil experienced fluctuations, ranging between $82.93 and $83.05, with a slight decrease of -0.45%. However, with the opening of the European market, the price began to recover. Factors such as expectations of cuts from the Organization of the Petroleum Exporting Countries and its allies (OPEC+), attacks on Russian refineries and relatively positive Chinese manufacturing data boosted the price of crude oil, as well as gold, during the start of the European session.

With several markets closed due to the Easter holidays, low trading volume is expected. Both West Texas and Brent have seen increases for the third consecutive month, with Brent rising above $85 a barrel since mid-March. This is partly due to OPEC+'s commitment to extend production cuts until the end of June, which could reduce crude supply in the northern hemisphere during the summer. Already on Friday, Russia's Deputy Prime Minister Alexander Novak stated that its oil companies will focus on reducing their production rather than expanding exports during the second quarter of the year, in order to share those cuts evenly with other member countries.

On the technical side, the price of crude oil has shown an upward trend since the end of March, driven by divergences in Russian production caused by the Ukrainian conflict and the demand for U.S. reserves. At the European opening, the price has turned around, devaluing to $82.68 per barrel. Certainly crude oil is in a trading zone frequented on several occasions this year. At the moment the chart is trying to pierce the top of the current range, and with such a low trading level, there could be a lackluster rally due in part to the impact of news, just as it did during the Asian session. Conversely, the price bell is showing a control price (POC) at $81.04 which could represent that inability to move higher due to the lack of strong hands pushing the "Bulls" in the market during the holidays. suggesting that crude oil could continue to fluctuate in a range between $83.08 and $79.80. We will have to be vigilant, as although the news presents a theoretical bullish pressure, the technical elements show us a strong bearish pressure that seems to prevent the effect of the news from materializing.

Ion Jauregui - AT Analyst

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

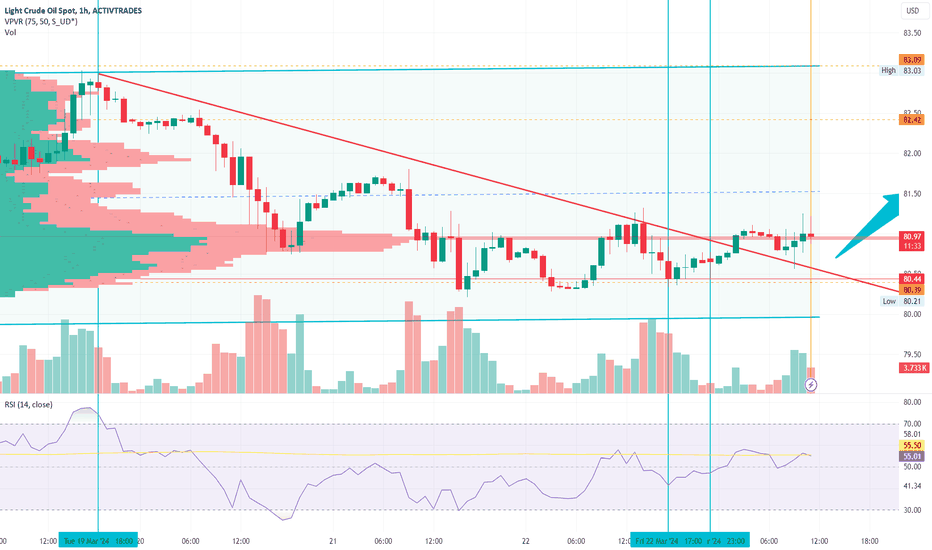

Oil Resurgence: Conflicts Boost PricesIn today's oil market, we have witnessed a strong bullish rally after a -3.37% drop last week between Tuesday and Friday. This momentum is due in part to increased conflicts in the Middle East and on the Ukraine front with Russia. The disruption created in Russian refineries with Ukrainian attacks by fighter drones throughout the month have created geopolitical pressure in the region that may facilitate upward price stress from buyers looking to secure demand, as 12% of Russian production capacity has been affected according to ANZ Research. In addition, the decline in the number of oil rigs in the United States has put upward pressure on prices. Disruption at Russian refineries due to drone strikes by Ukraine has created geopolitical pressure that could increase demand and, as a result, prices. Recent conversations between Antony Blinken, US Secretary of State, and Israeli Prime Minister Benjamin Netanyahu have highlighted the risk of global isolation if attacks in the Gaza Strip continue. In the Middle East, US forces on Saturday responded by shooting down six Huties strikes south of the Red Sea aimed at destroying a Chinese oil tanker, adding to volatility in both regions.

We are at a time o f high volatility and systemic risks in these regions , which could further boost crude oil prices in the short term in what could be a change of uptrend for the long term. The price has recovered part of its price during the Asian session due to the aforementioned conflicts and also at the beginning of today's European session, the continuation of this upward pressure is clearly being perceived.

At the opening of the Asian session, prices started at $80.44 and are currently at $81.12, with a high for the day of $81.32, thus fracturing the bearish pennant figure that has been forming during the previous week's sessions. Technical analysis shows a possible bullish continuation towards $83.03 if the price manages to break above the $81.50 mark, which is the middle zone of the channel. However, it is important to note that trading volumes are not particularly strong at the moment and the trading bell marks us $80.96 as the most preponderant value at the checkpoint (POC). The RSI is slightly overbought at 61.21%, while the 200-day moving average is at 55.52%. These signals could indicate a possible pullback if the price fails to maintain its momentum towards the middle zone generating a rebound to the direction of the current checkpoint.

OIL : 50% REACHED- The market still trades inside a bullish channel started at the end of December 2023, the long-term trend is bullish for the black gold.

- Since beginning of February, and the fourth impact on the lower bound of the bullish channel, the market has accelerated towards the 50% retracement of the sell-off which took place during Q4 2023.

The long-term moving averages have already reversed to the upside long ago, before registering a bullish cross.

The DMI indicator shows an increasing bullish environment within a more and more directional price action.

- Considering all of the above, it is hard to qualify the current situation as bearish or threatening for black gold.

This increased appetite for oil came along rising tensions in the middle east, with bets on disrupted supply chain in the red sea, as well as fears of a widening conflict to other nations such as Iran.

Technically speaking, there is however not much more short-term bullish potential for the market. Prices have already reached a significant resistance level (50% Fibonacci at 81.00$) and now trade close to the upper bound of their bearish channel.

But considering the importance of the geopolitical developments in the price action, no scenario should be off the table, and an acceleration above 81.90$ and the 83.40$/84.00$ zone could still be possible.

Pierre Veyret, Technical Analyst at ActivTrades

The information provided does not constitute investment research. The material has no been prepared in accordance with the legal requirements designed to promote the independence of investment research and such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

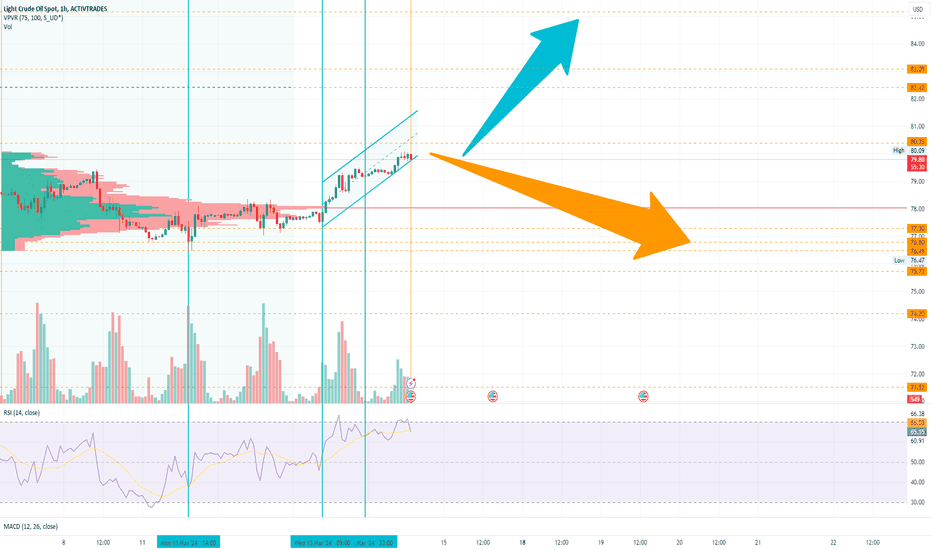

Oil on the Edge! Key Data in the American Session today The crude oil market has experienced a reduction in demand this week, holding prices steady since Monday, after weeks of losses in value due to a decrease in demand, especially from the main importer, the Chinese market which put the price on Monday at $76.49. During today's Asian session, crude oil has shown a 3.62% increase from Wednesday's European open to the current high of $80.31.

Although Chinese buying data increased in the first two months of the year compared to the same period last year, being lower than previous months. This day's American session will be influenced by key data such as manufacturing production, retail sales and the US unemployment rate, which will determine the evolution in the demand for oil and its derivatives and will present us whether the US economy is robust enough to sustain current prices in an environment of slowing global productive demand.

From a technical perspective, the RSI shows a highly overbought level of 70.44%, with weak trading volumes, and a marked checkpoint at $78.09 represented in a mono-bell. This presents us with three possible scenarios:

- If expectations are positive for the non-U.S. market, prices could reach $85, a significant price barrier since last November.

- If the market remains stable, prices are likely to remain sideways with no major movements moving between $77 and $80.

- If the U.S. outlook is negative, price is likely to retreat back toward $76, an area of strong trading since mid-February.

This afternoon's news will be crucial for the evolution of the crude oil market, so it is recommended to stay tuned.

Ion Jauregui - AT Analyst

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

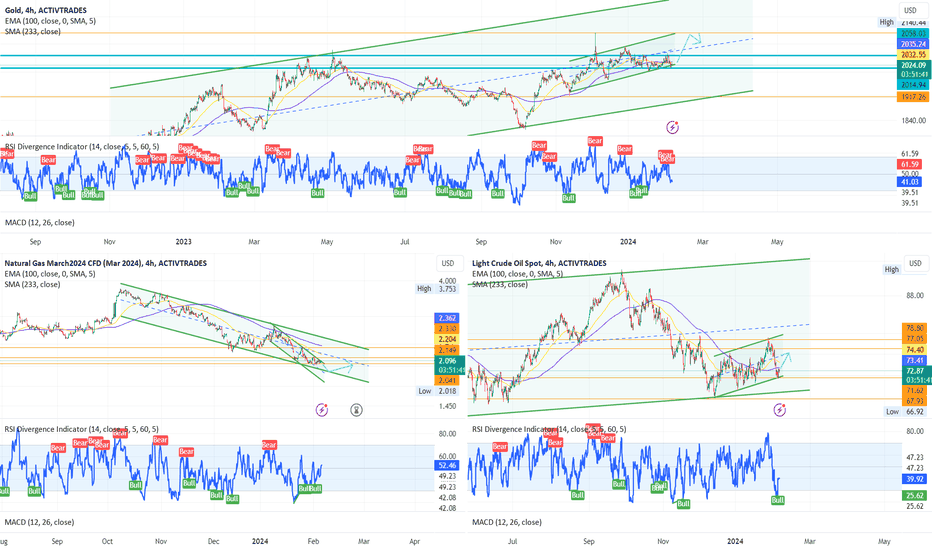

Revolutionizing Markets:Gold-Oil Correlate,Gas on a Tightrope

Today we delve into the analysis of three key assets: Gold (GOLD), West Texas oil (LCrude) and gas futures (NGasMar24). At first glance, it may appear that these assets are unrelated, however, since 2020, Gold and Oil have experienced a de-correlated relationship. Gold, despite reaching highs in December, has experienced a de-escalation within a bullish channel, with notable bounces, such as yesterday's bounce to the $2,014.76 area. This suggests price consolidation in this area and a possible upward direction towards $2,087 and possibly $2,139.

On the other hand, crude oil showed a rebound on January 26, further strengthening its uptrend. It is expected to return to the $75 levels and, depending on the news, could reach $79.60. In contrast, Gas has maintained a sideways trend, hovering between $3.747 and $2.055 in recent weeks. In summary, we observe a definite correlation between Gold and Oil, which had faded in 2020 but has recently re-emerged the Gold Gold Gold/Black Gold pair. Gas, on the other hand, has not followed the line of its jet cousin, and shows signs of price exhaustion and a possible bearish continuation decline, generating a plunge.

According to the TV candlestick measurement rule, crude oil's performance since January 29 has been about -10.5%, while gas has experienced about -14%, and Gold a modest 0.60%. The Volume Profile Visible Range Indicator notes that the current Most Traded Price or POC is $72.70 for Lcrude, $2.094 for gas and $2029.92 for Gold, highlighting the stability of Gold in this upward move compared to crude. In relation to the RSI divergence, all three assets show a neutral position, with a possible sideways for crude oil and gold. Gas appears undervalued currently given market conditions. Despite technical analysis is showing sell trend, if the right conditions are given a potential opportunity for buyers may arise.

Although for that it is important to see the right oversold signals on the RSI, which at this time, have not yet occurred in any of the three assets.

Ion Jauregui - AT Analyst

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

OIL : A BULLISH POTENTIAL FOR THE BLACK GOLD?- The market has been trading inside a bearish wedge since the end of September 2023, registering lower highs and lows. The medium-term trend is therefore bearish.

- In the shorter term, prices have registered a sharp rebound since their impact on their annual low around $68. This rebound led the market the upper limit of its wedge, below the 23.6% Fibonacci, above the two exponential moving averages at 21 and 34 periods.

The RSI indicator has shown a clearing of its bearish trendline, a phenomenon that generally occurs in ahead of the market.

- Although still in a downward trend, technical indicators tend to show that the buying appetite for black gold is only just beginning. A clearing of $74.15 (23.6% Fibonacci) would therefore open the way to a resumption of the bullish trend towards $78.00, $81.00 and even higher by extension.

In the very short term, a pull-back towards the last support above $72.17 also remains a possibility. If this level does not hold, the entire bullish scenario previously mentioned could well be invalidated.