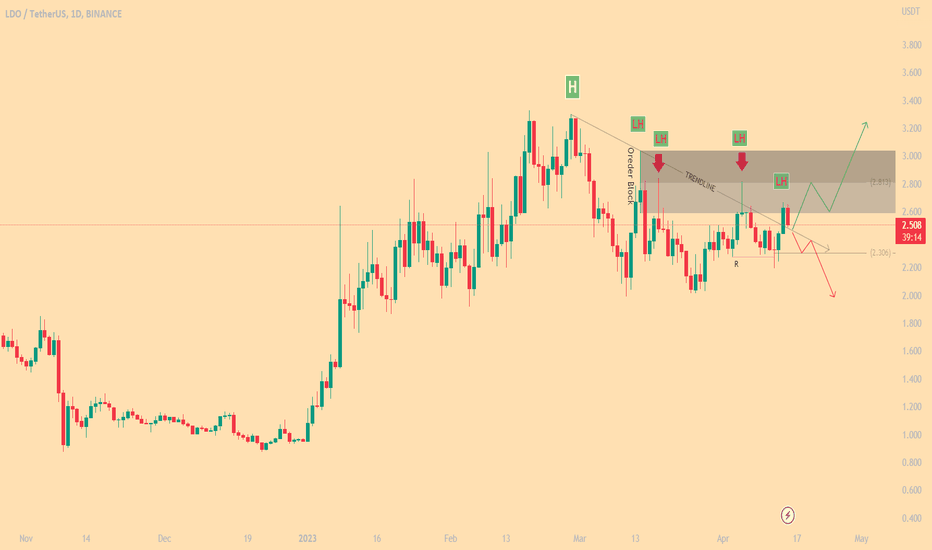

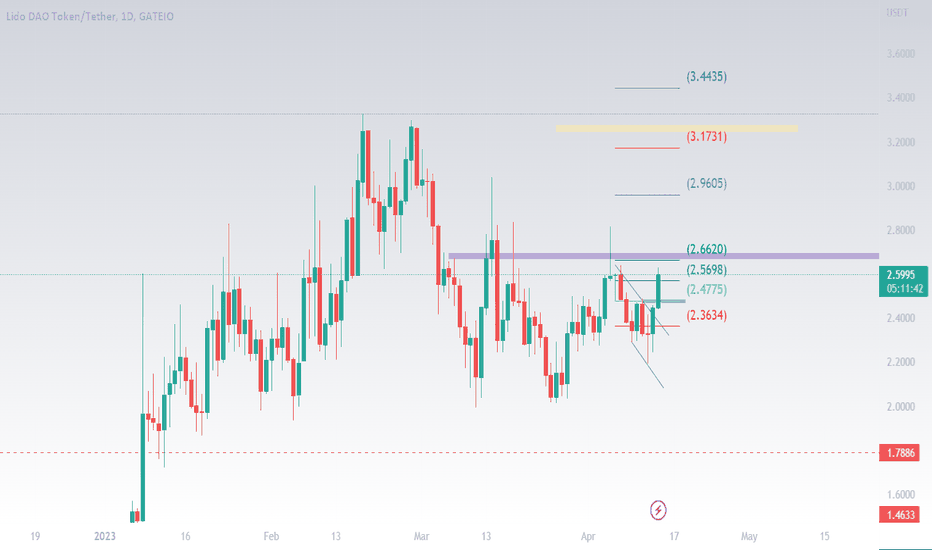

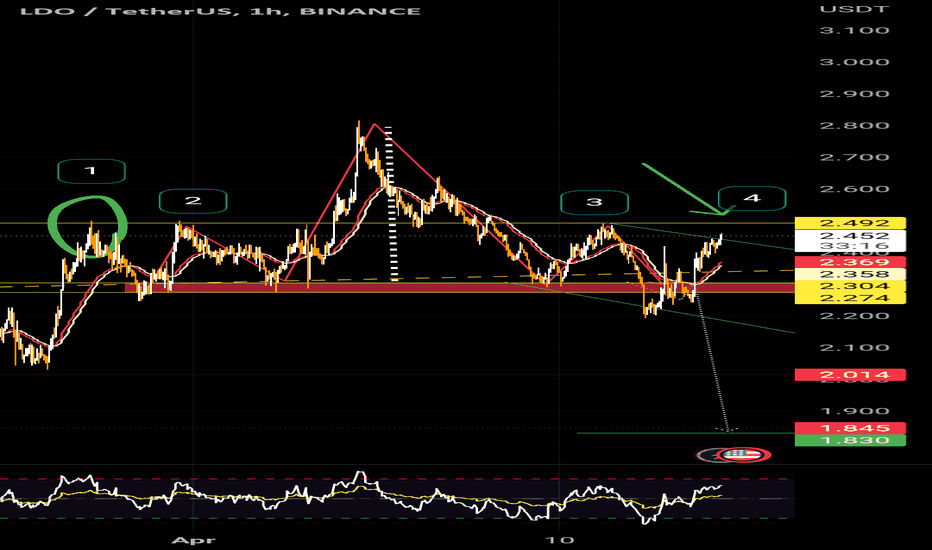

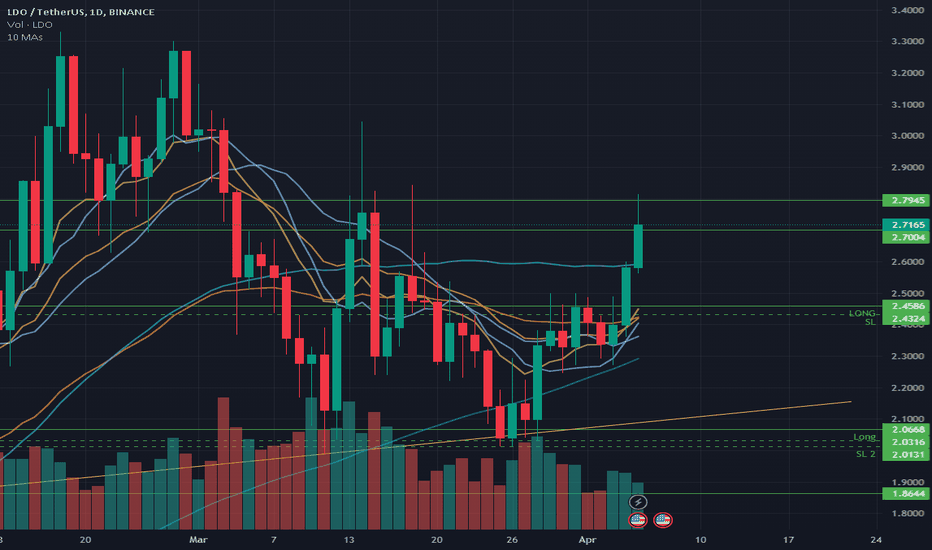

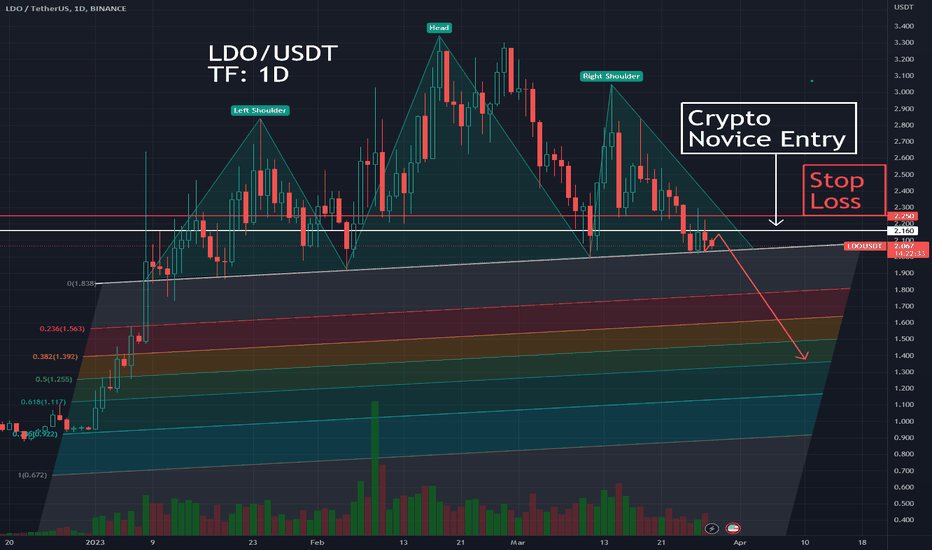

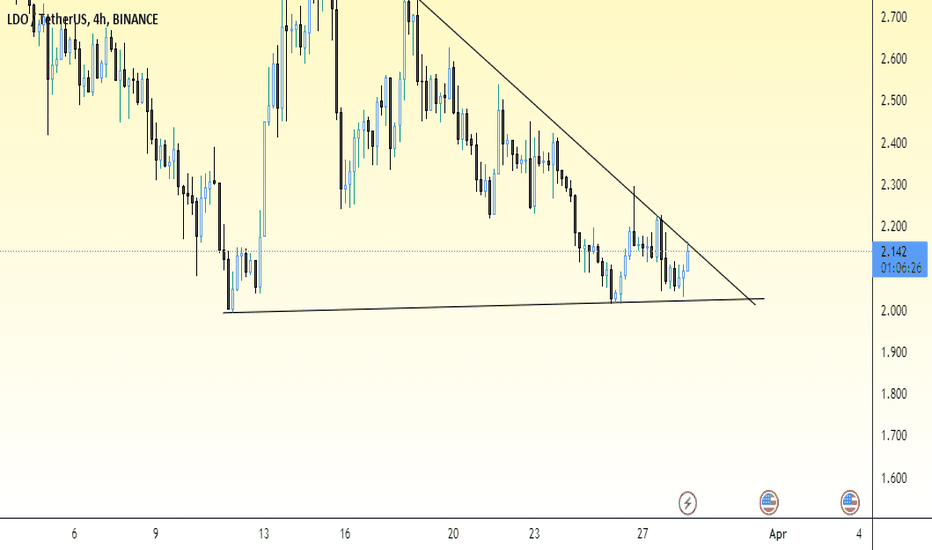

LDOUSDT daily chart

what we have here?

1-a trendline with 1 fake breakout and a successful break and now price retesting the trend!

2- a order block rejected price 2 time!

but overall LDO is bearish for me. why?

because we have 4 LH ,But on the other side, we have a new structure that has formed a higher LOW. I will remain bearish until a higher high is formed.

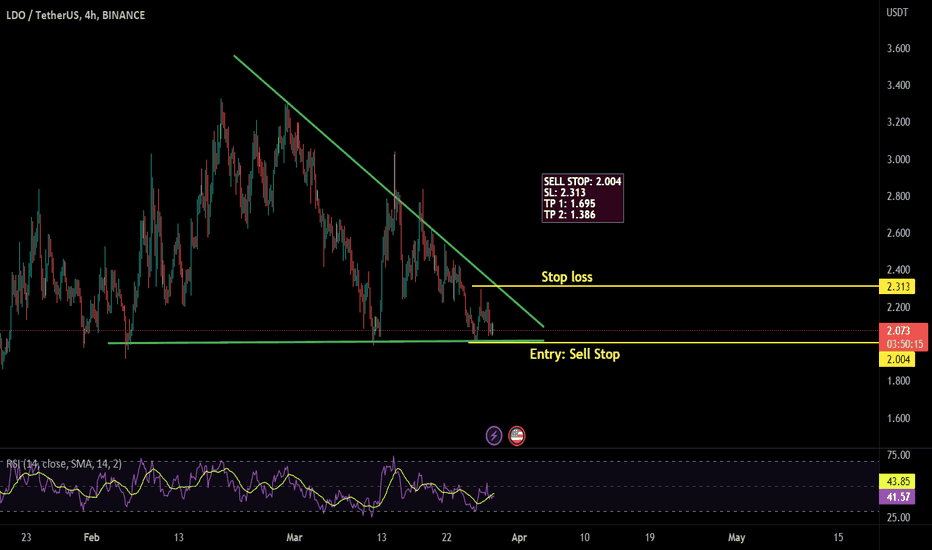

LDOUSDT trade ideas

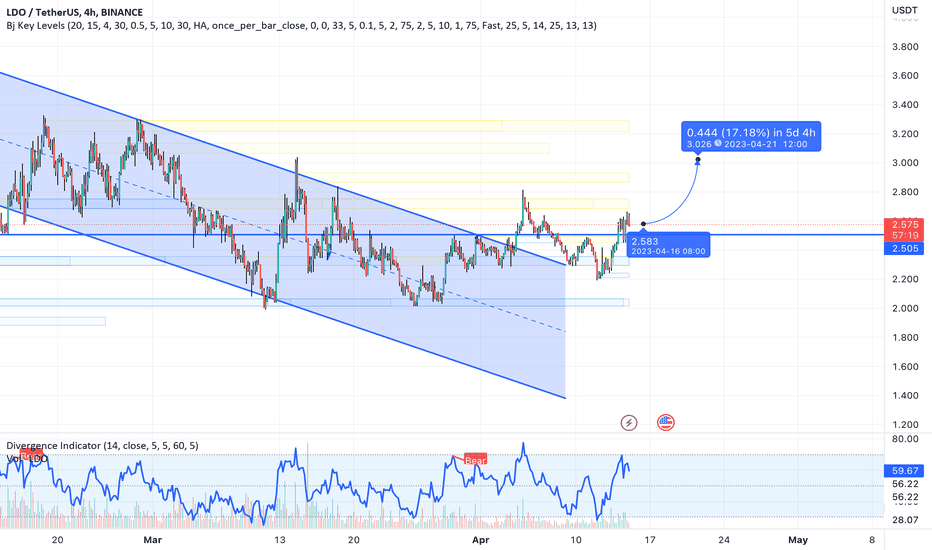

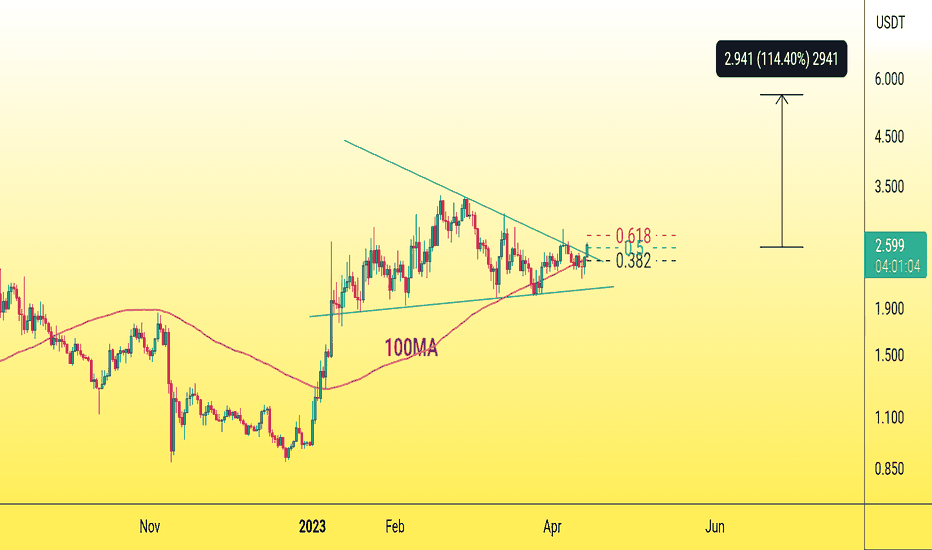

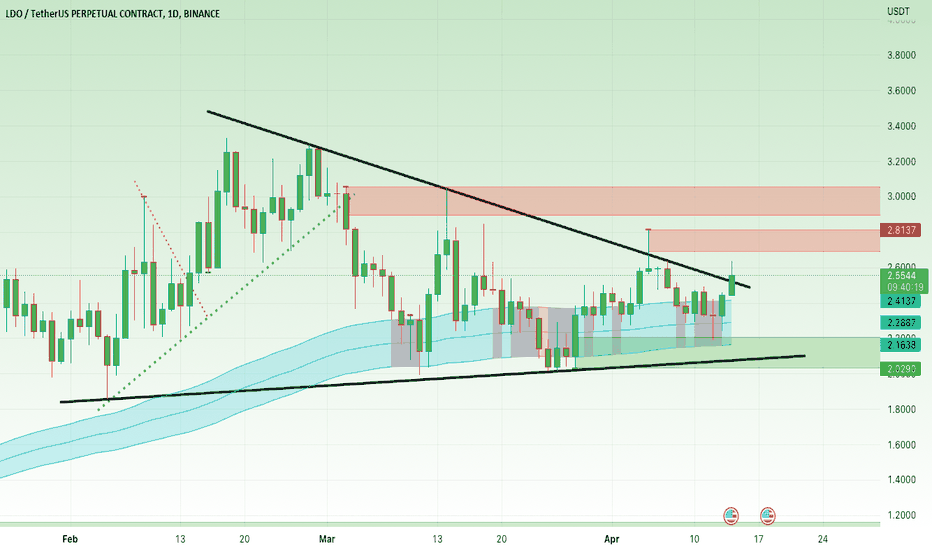

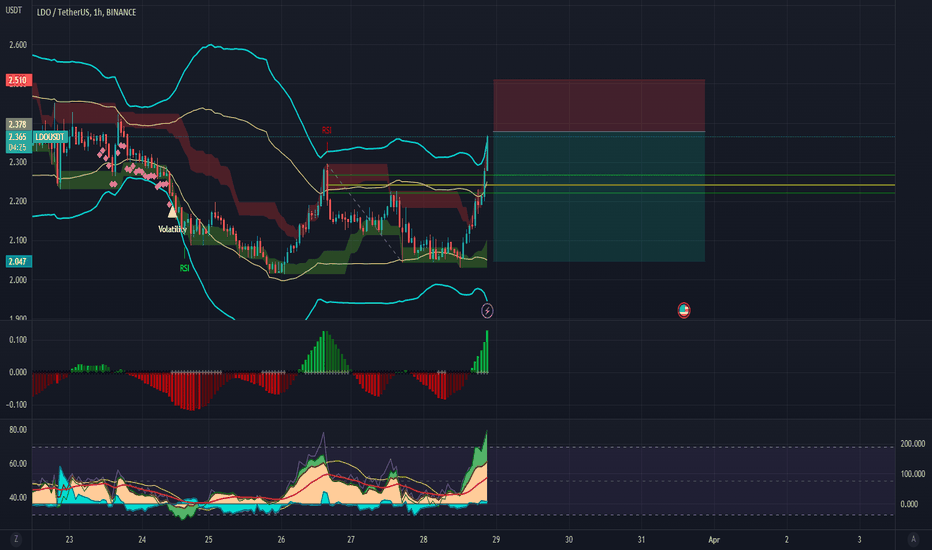

Another bullish rally coming🔸LDO Looks great in 1 D chart

🔸 it breaks the upper side of the bullish pennant which meaning a bullish sign

🔸Besides breaks 100 ma and 0.5 fib level

🔸The most important resistance for now is 0.618 fib level .and it going to be broken soon.

🔸Keep ur eye on LDO u will see it above 5$ in next few weeks.

Don't forget to support us with ur like, comment and follow for more ideas like this🎯

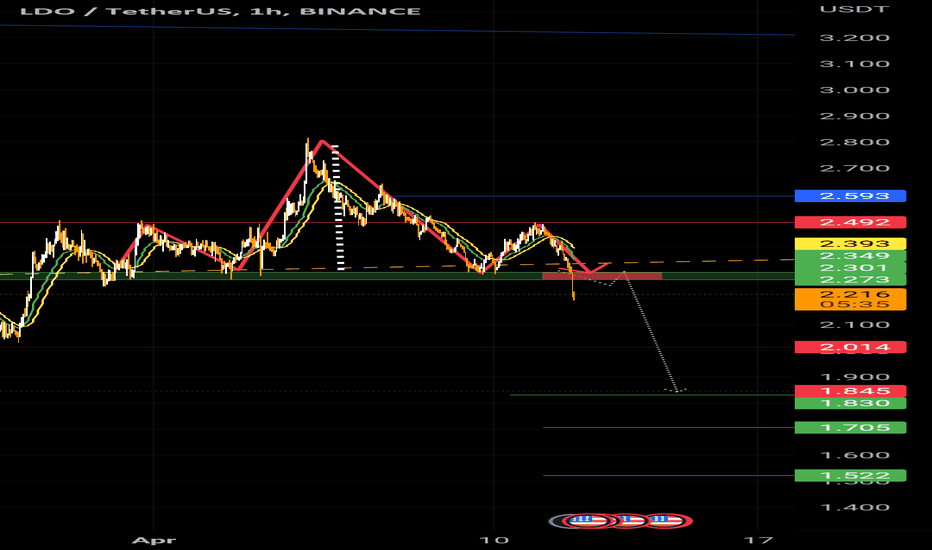

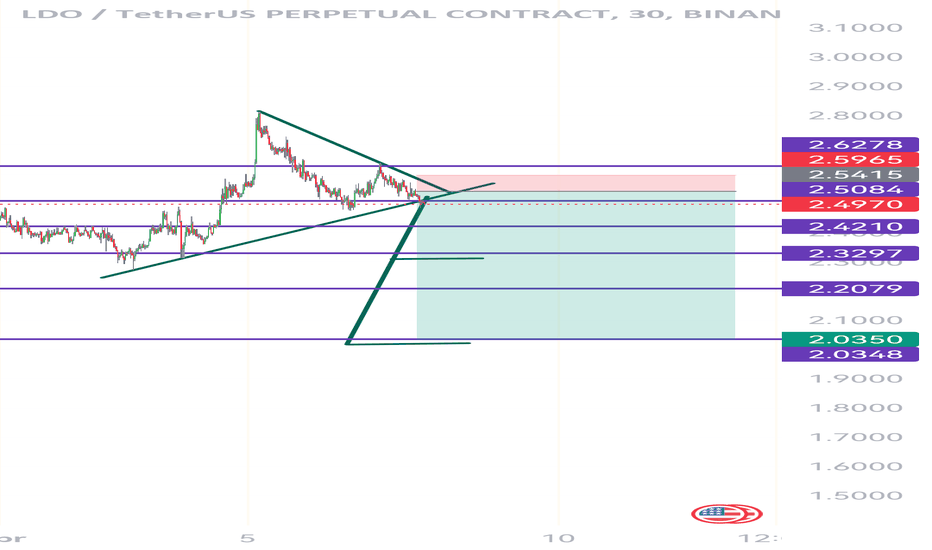

LDO H&S Pattern's>>>>>>>>>>>I Have Tried My Best to Bring the best Possible outcome in this Chart.

LDO after mid-term correction stil have a chance to hit the top of the resistance area.

But it must first reach and stablize above the neckline of head and shoulder pattern's.

We must wait for trading this wave's.

Everything We need's cleared on the chart.

Must important level's marked on the chart.(scroll your mouse on the chart)

It's just an analyze,

Not a financial advise.

PLZ DYOR

With hopping success>>>>>>>>

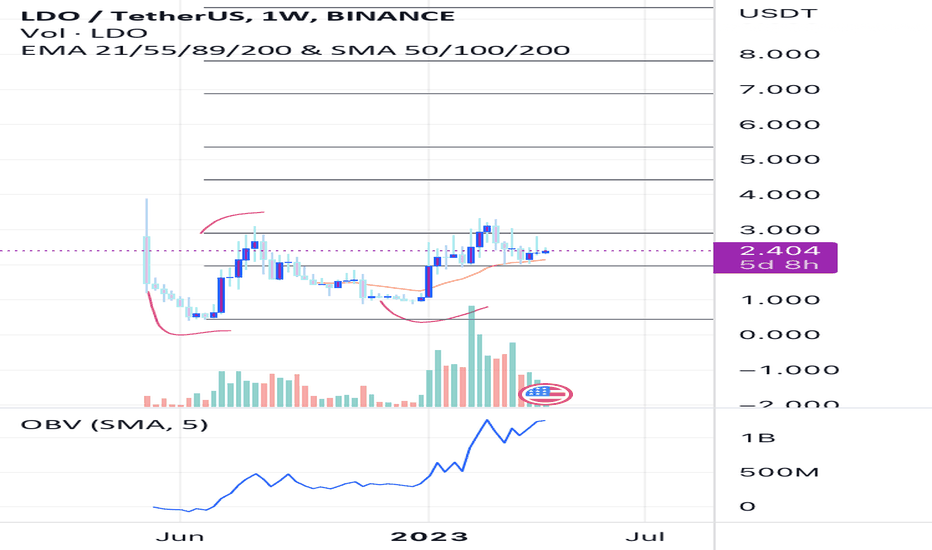

LDOUSD & LDOUSDT IdeaBINANCE:LDOUSDT LDO vs USDT LDOUSD

⚠️🚨 Risk warning, disclaimer: the above is a personal market judgment and analysis based on published information and historical chart data on The trading view,

And only some of these analyzes are my actual real trades.

I hope Traders consider I am Not responsible for your trades and investment decision.

✅ Please write any advice or suggestions.

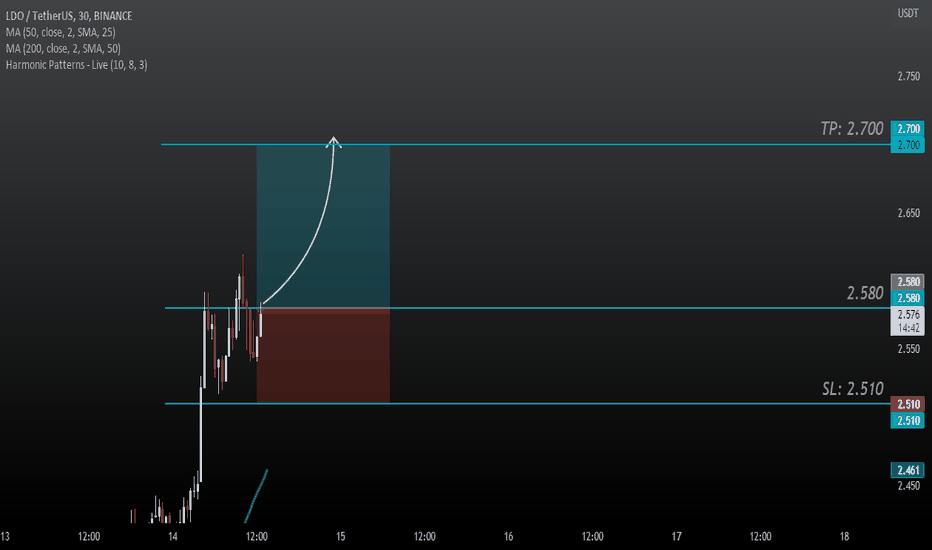

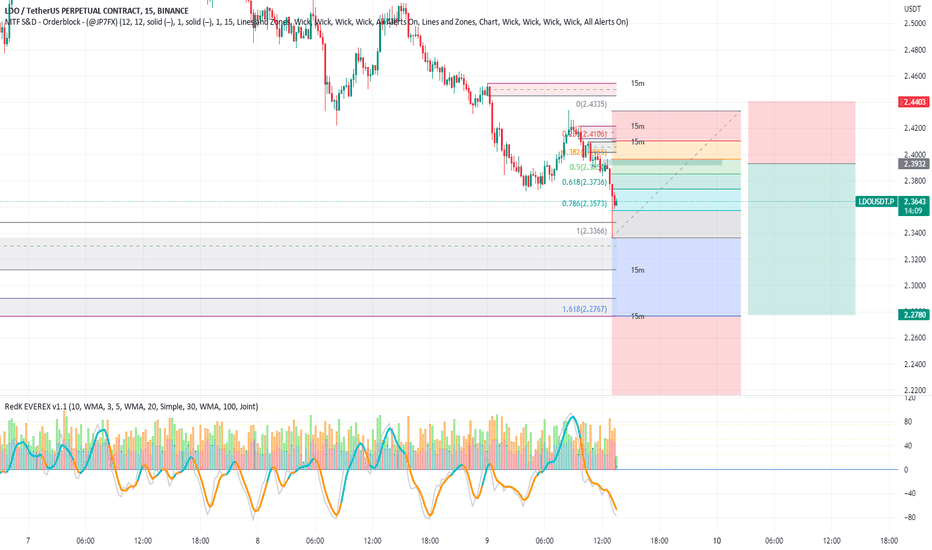

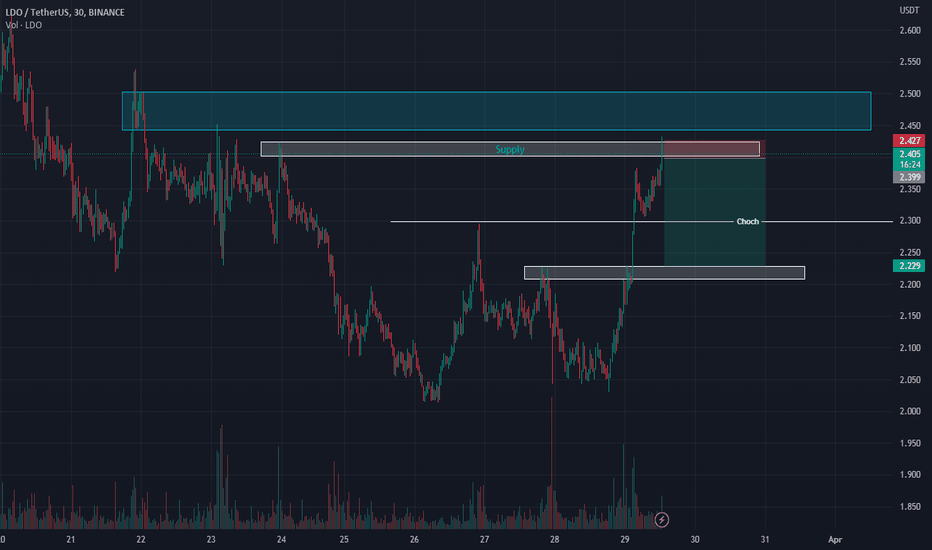

LDO 🔥🔥 Head and two shoulders

Head and two shoulders pattern ,,,,,,,,

I will wait for a test of the neckline to enter a short position ,,,,,,,

You can watch a test neckline on a small frame , like 30m or 15 ,,,,,,,,,

Wait for the neckline to be tested ,,,,,,

When it starts to drop after the test , Enter directly ,,,,,,,,,

I will not give you a stop loss or entry price ,,,,,,

(( Manage your wallet )) ,,,,,,,,,,,

,,You can enter from anywhere in the red zone,,

🤠🏹

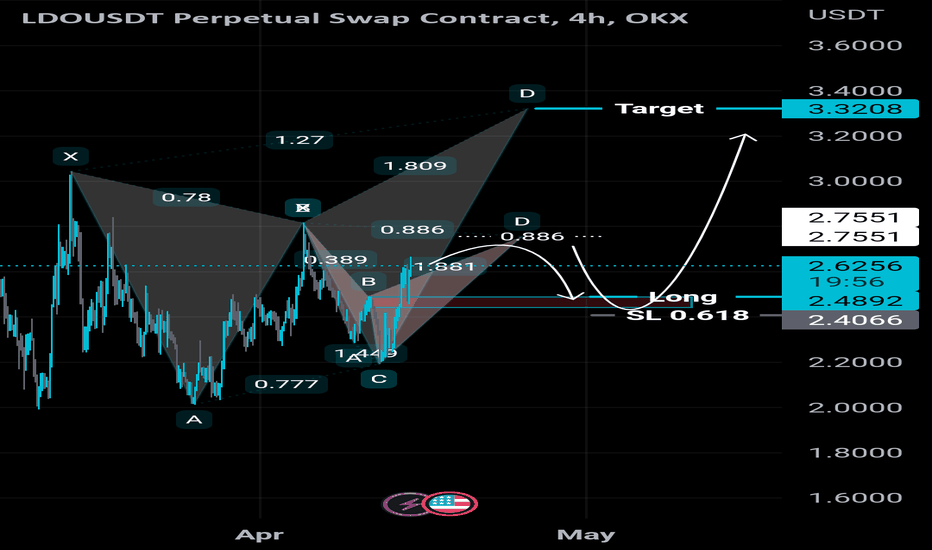

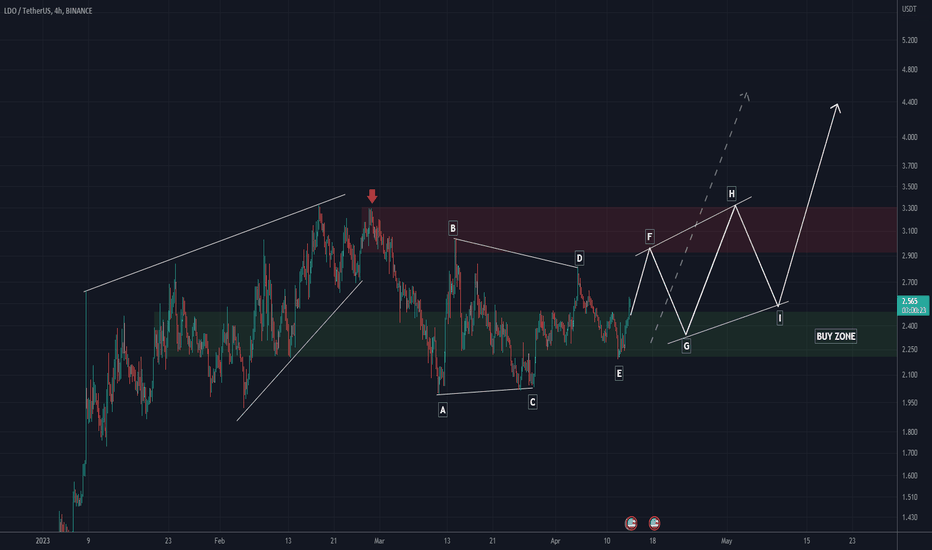

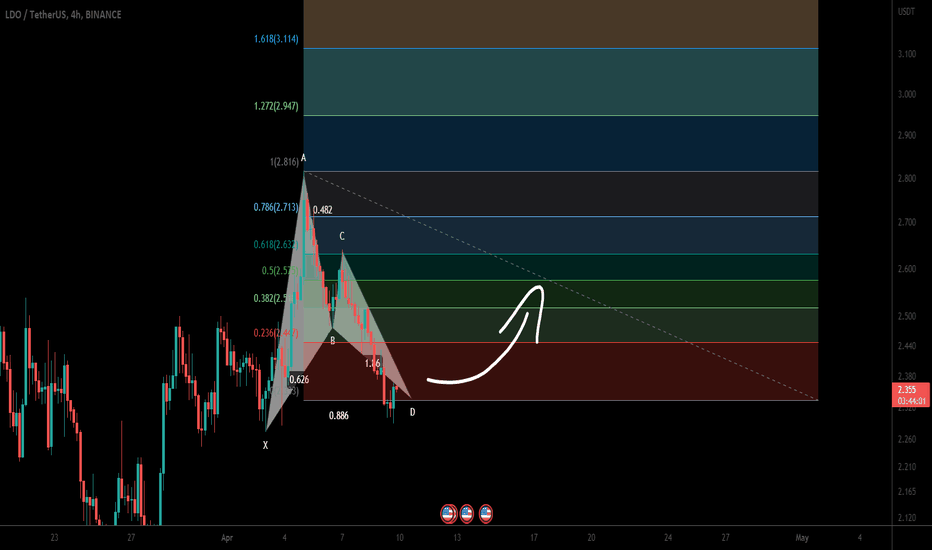

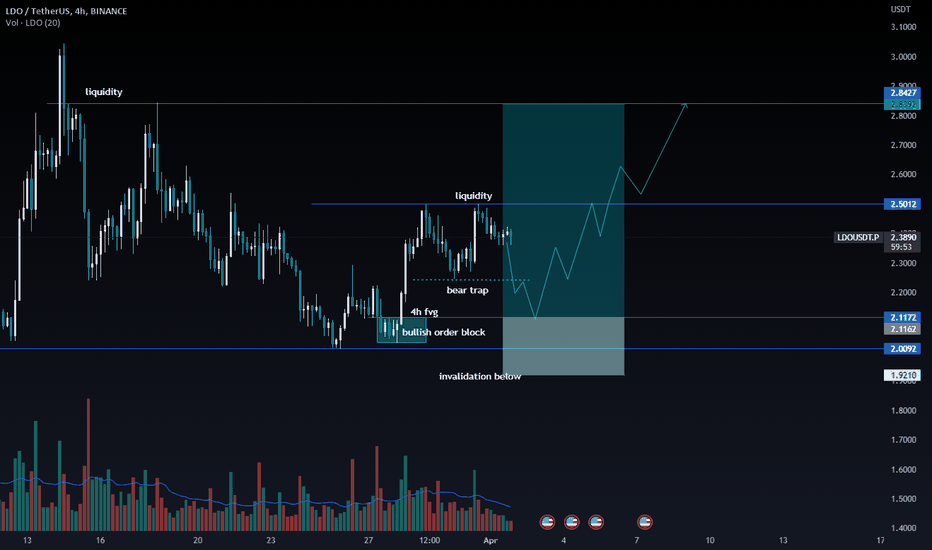

Lido DAO (LDO) formed bullish BAT for upto 19% pumpHi dear friends, hope you are well and welcome to the new trade setup of Lido DAO (LDO) with US Dollar pair.

Recently we caught more than 31% pump of LDO as below:

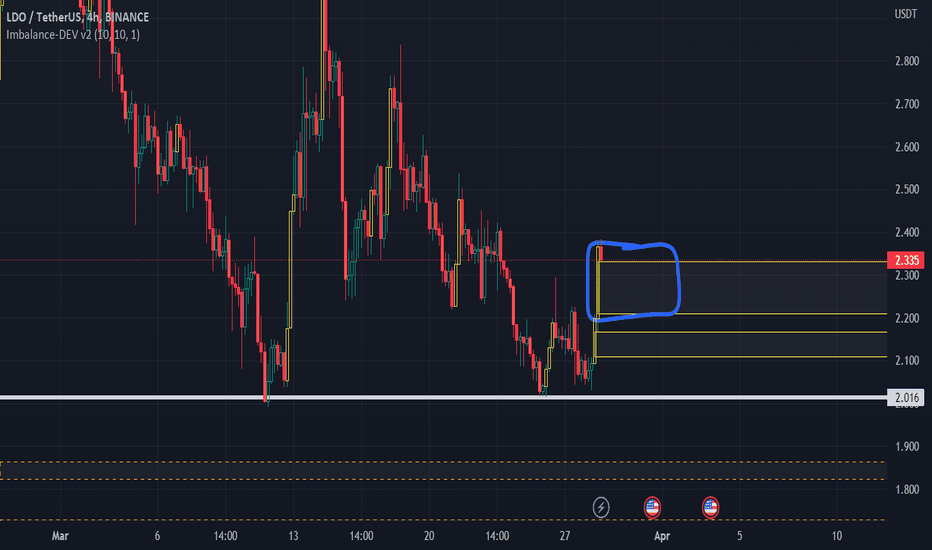

Now on a 4-hr time frame, LDO has formed a bullish BAT move for another price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade