LINK MARINES are becoming a dwindling force.It was likely a fabricated tag solely for Crypto Twitter, conceived by early ICO investors. Something to rally a war cry behind.

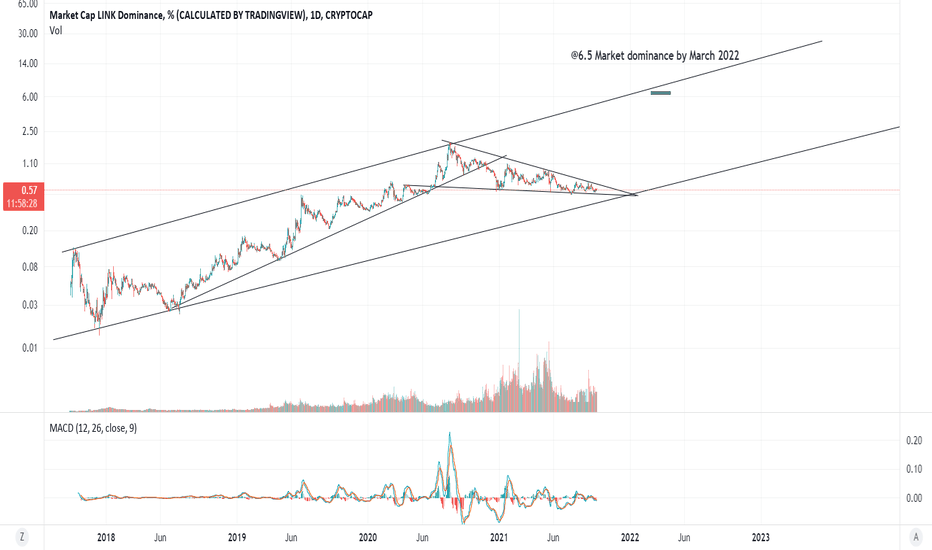

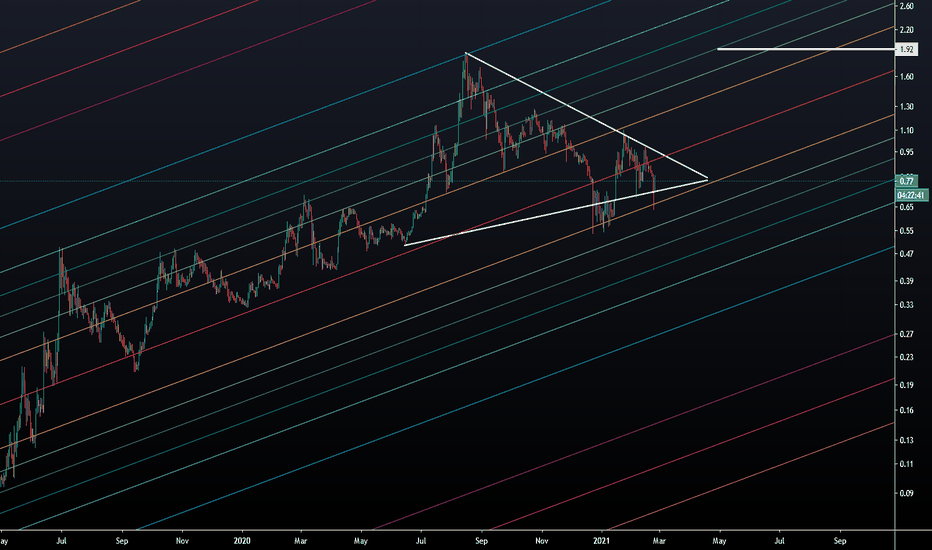

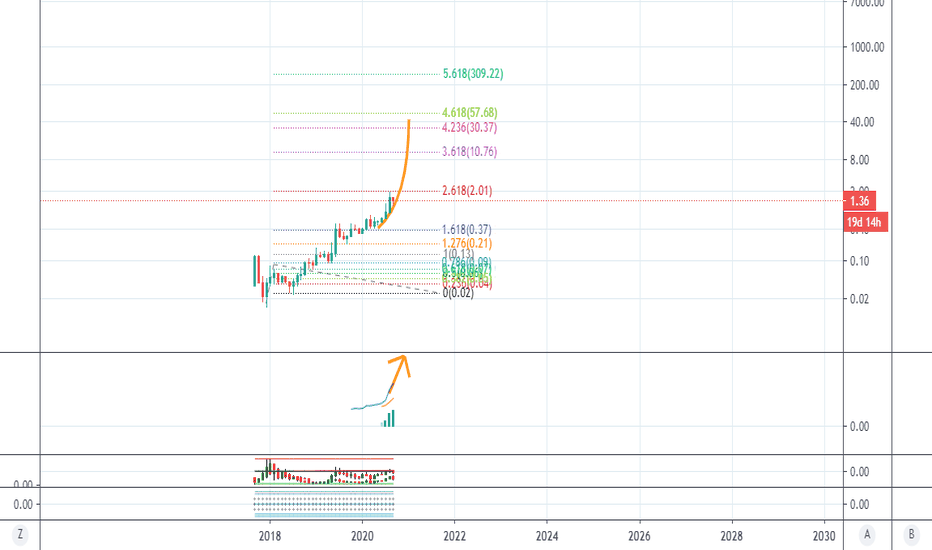

Similar to the LINK Crypto dominance chart.

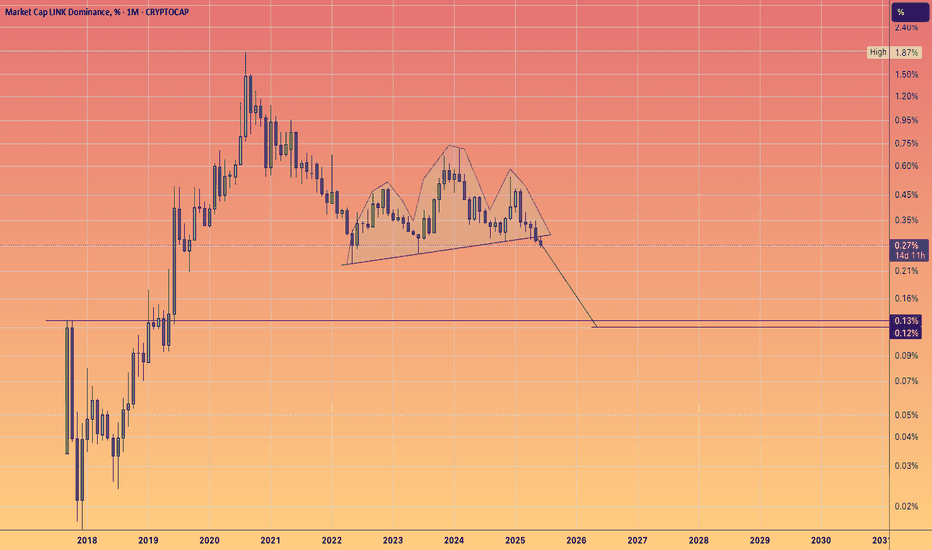

There’s a continuation head & shoulders pattern with a logarithmic target indicated.

Indeed, the token might increase in dollar value.

However, with 700 employees to compensate through token sales,

The salaries are excessive given the stagnant growth of token holders, and I must say, the decline in holders over the years makes it difficult to sustain the price/valuations.

If a #DEFI season was to occur, I would probably take advantage and unload old bags into the pumps.

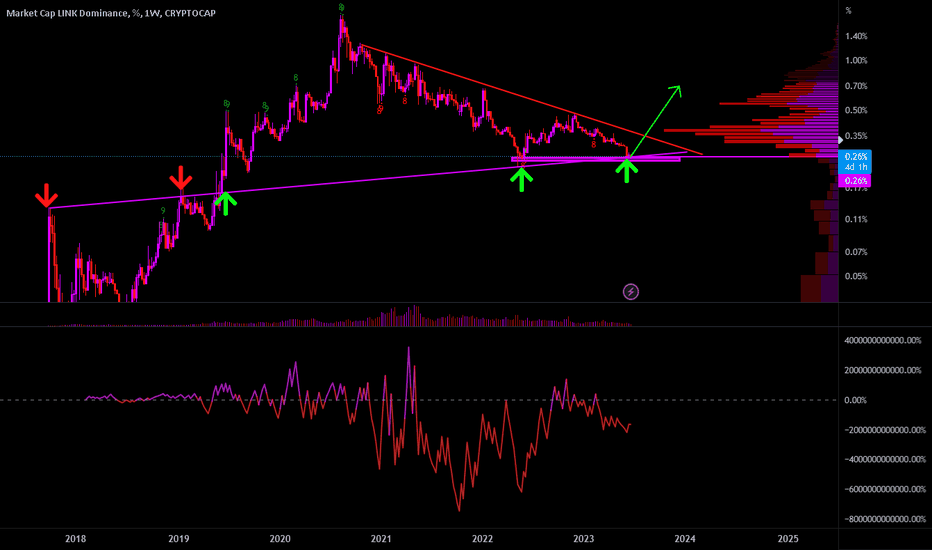

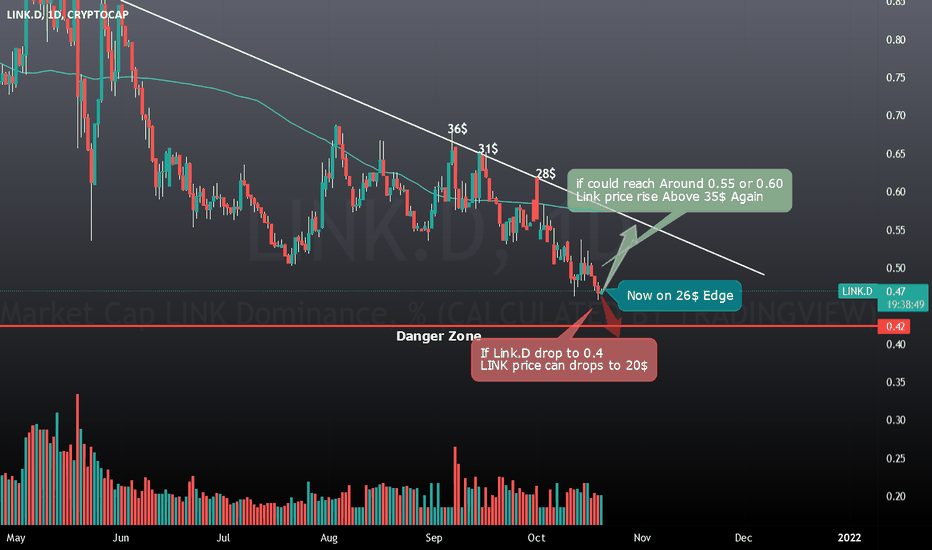

LINK.D trade ideas

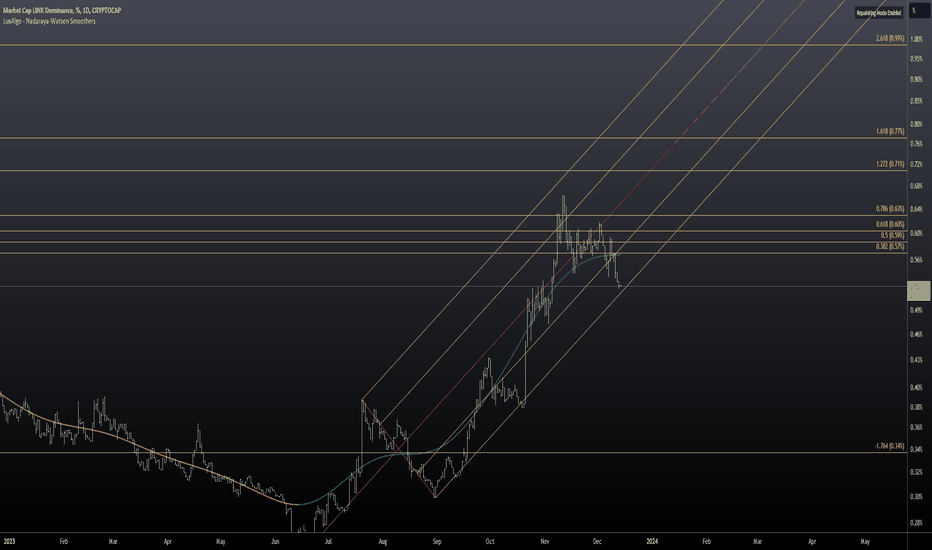

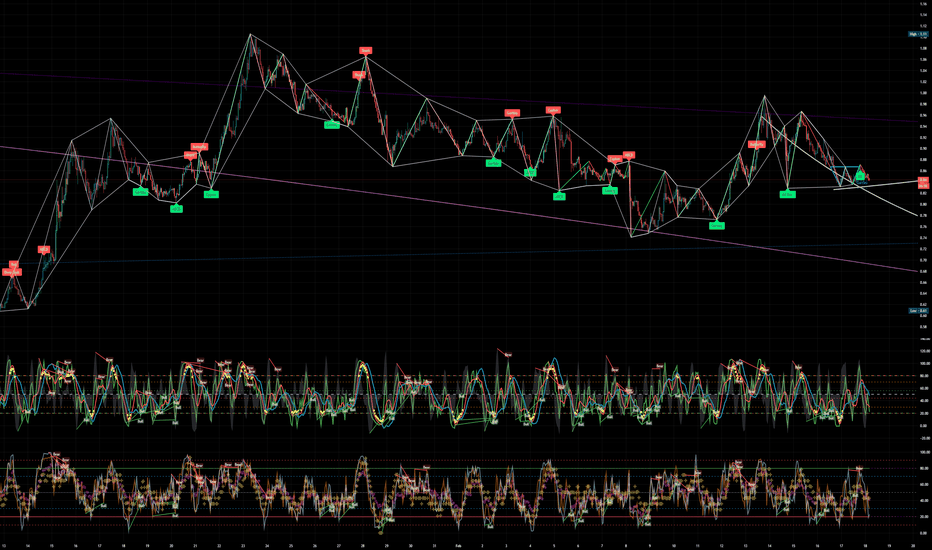

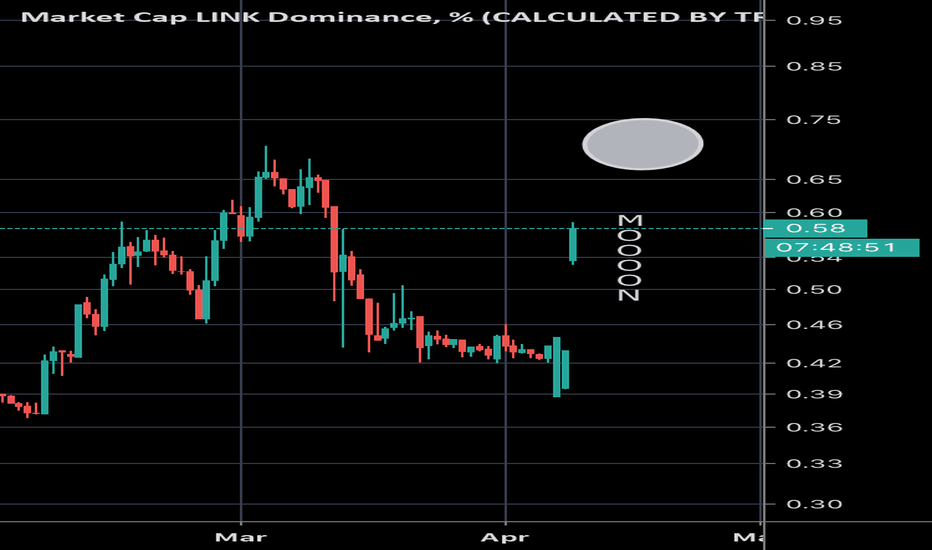

Chainlink analysis.... to look at the other charts Chainlink looks a lite bit confusing.

Against ETH and BTC is very undervalued. This is the only chart that makes sense. Falling wedge on a Dominance.

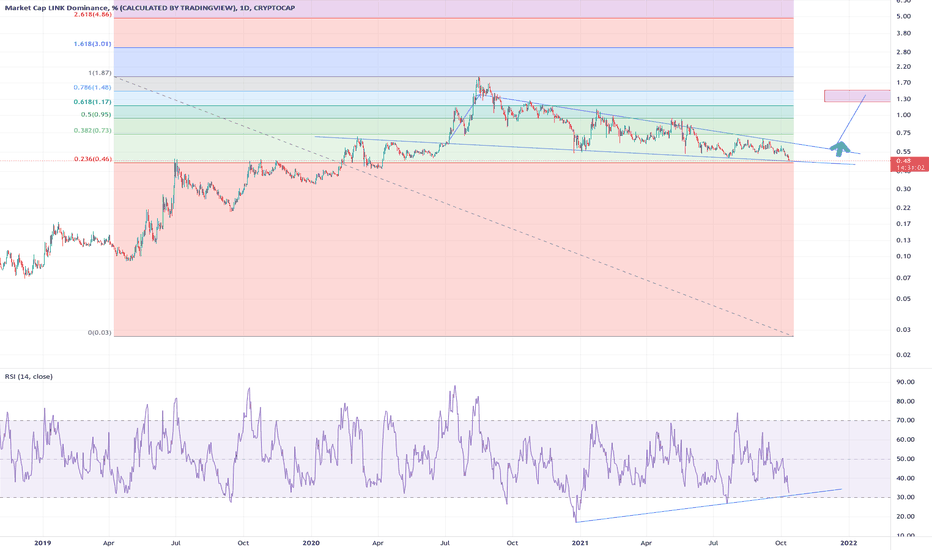

I think, that we are in a final squeeze for chainlink. Everybody speaks about how undervalued it is.

We see a clear signal on RSI higher lows with a lower low on a chart.

Let me know what you think in a comment section.

Thank you

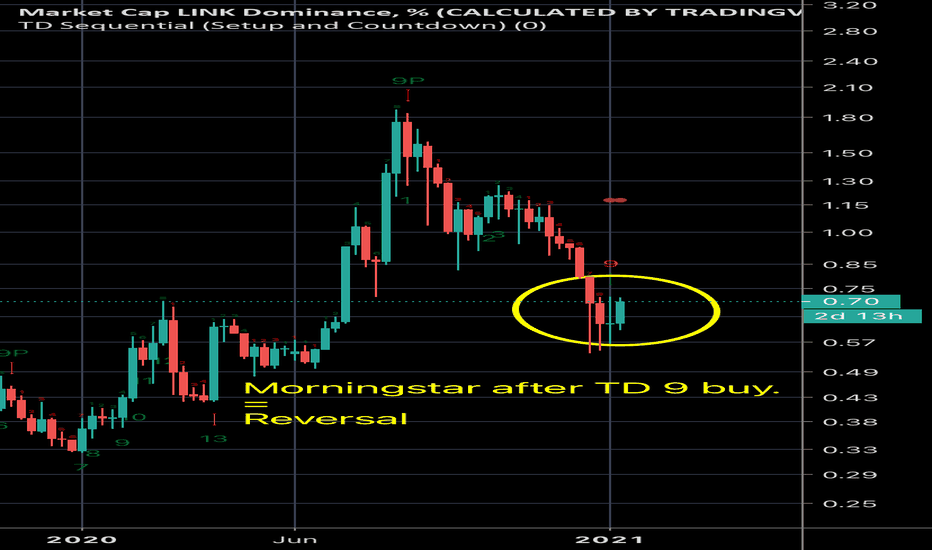

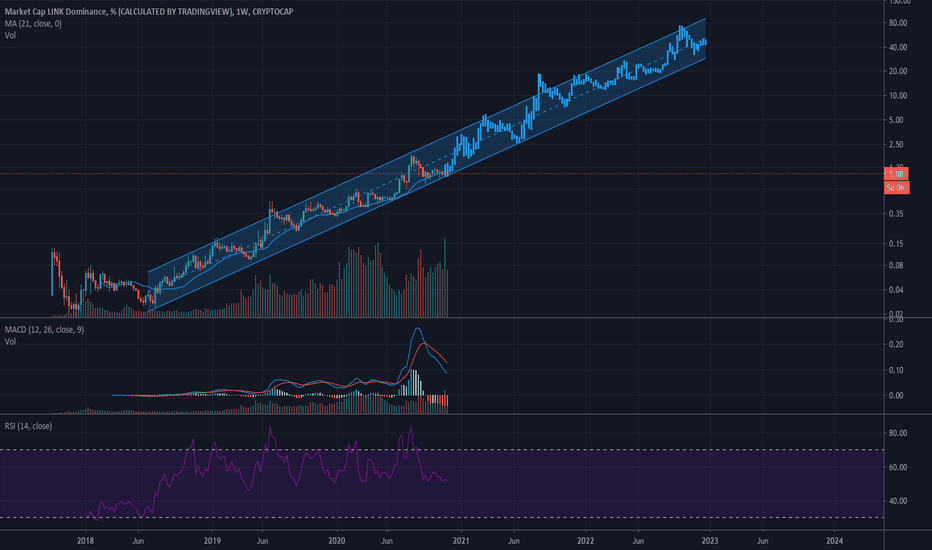

LINK.D in short term falling wedgeTruly I have no idea if charting dominance charts works, but I have been following LINK for a long time and the dominance has been growing exponentially for a few years. The link/btc chart is sort of trash at the moment, I’m not sure what will change the narrative. The fundamentals are solid, top 1% of wallets continue to accumulate, coins leaving exchanges, etc..... I think the problem is no one truly understands the Oracle problem, no one understands what Chainlink is, and people still believe they are “dumping.” We need to remember the average crypto investor is just trying to get rich overnight and probably can’t comprehend the importance of technologies like bitcoin, ethereum, chainlink...

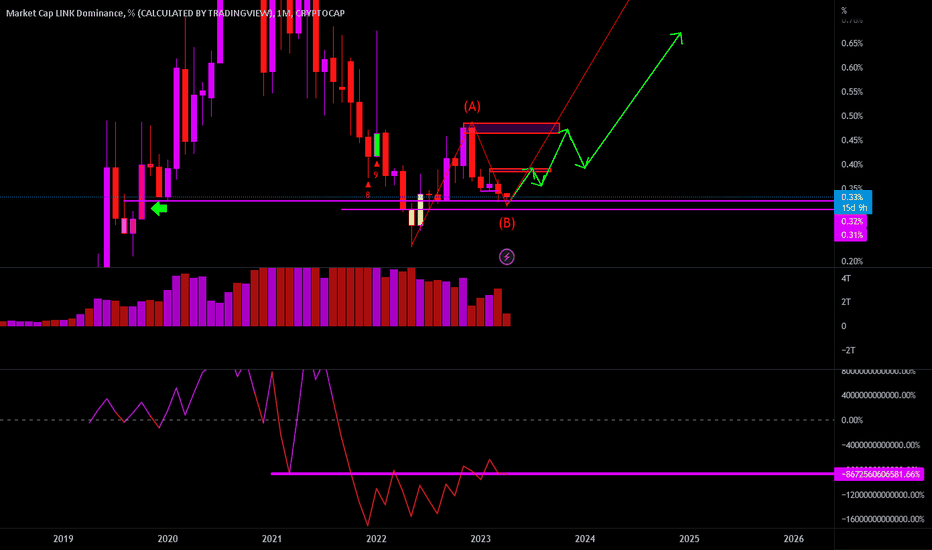

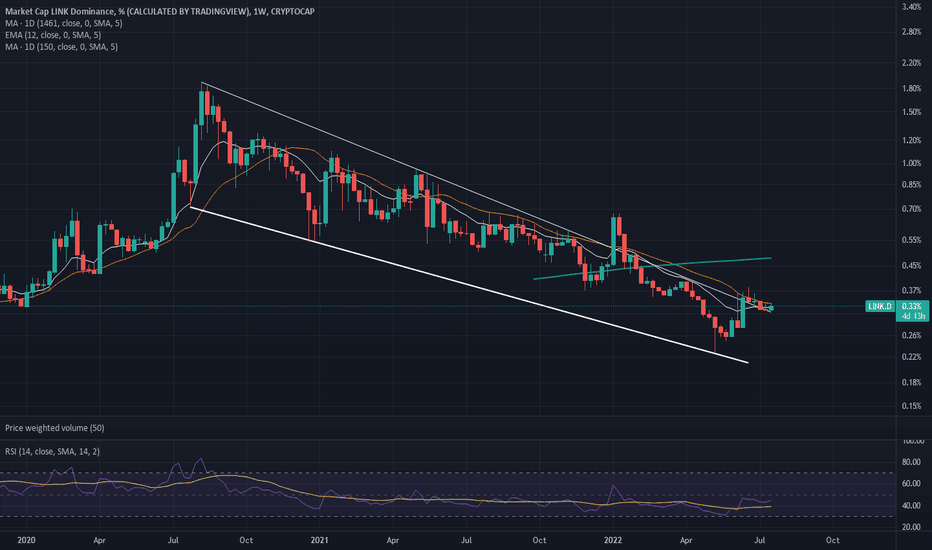

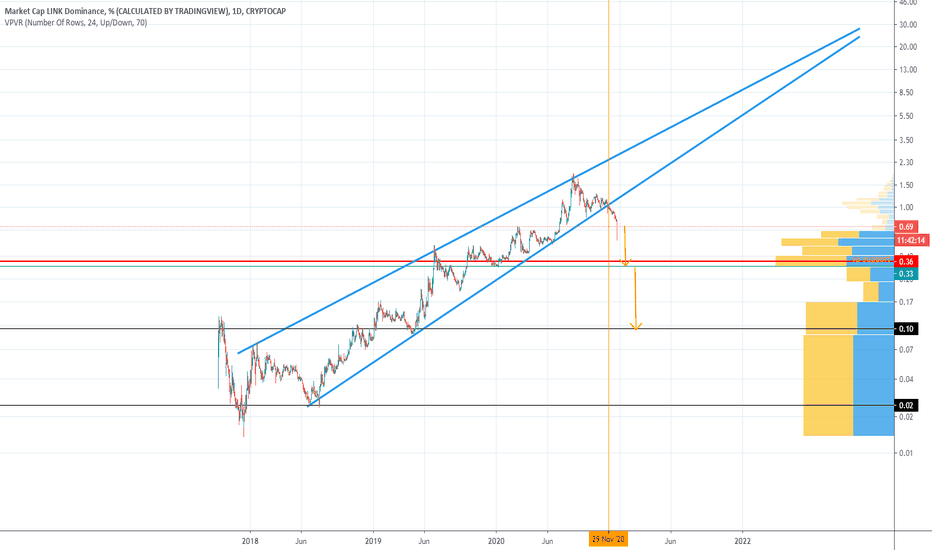

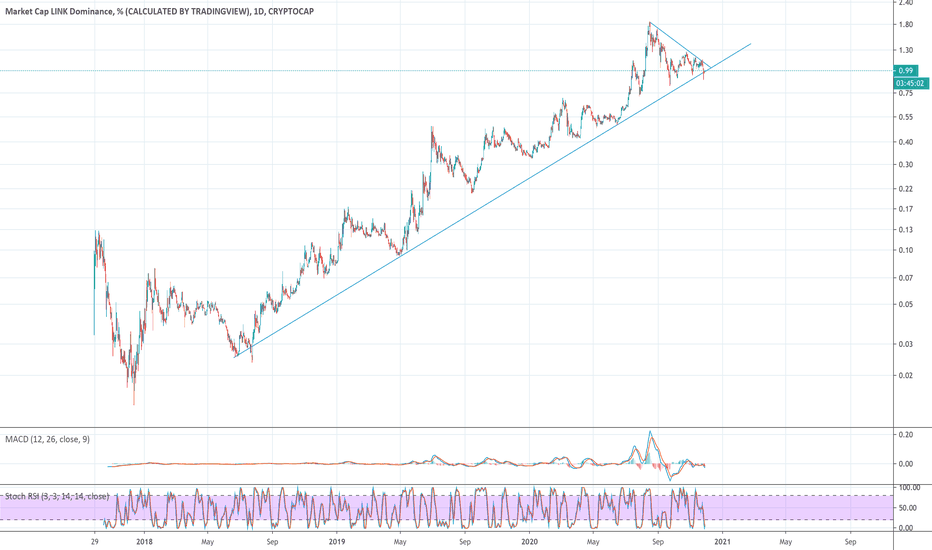

Link.d lost its parabolaOn the log scale a parabola is a straight line, and Link.d was in a rising wedge . The parabola was lost on November 29th when dom dropped out of the rising wedge . The first target for now is the POC at around 0.33%, followed by the rising wedge target at 0.1%.

There was hope that link will surpass major caps, it remains to be seen if in next year, capital will flow back in, forming another parabola.