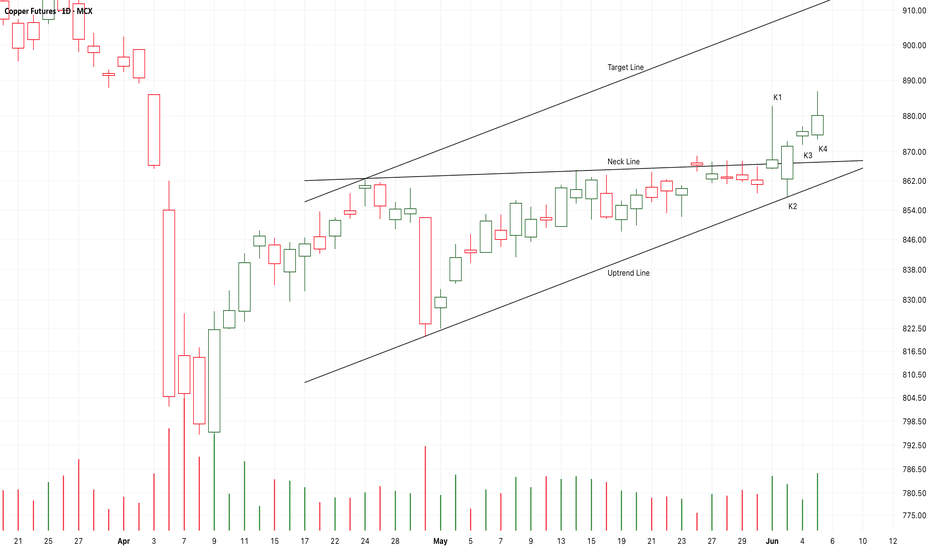

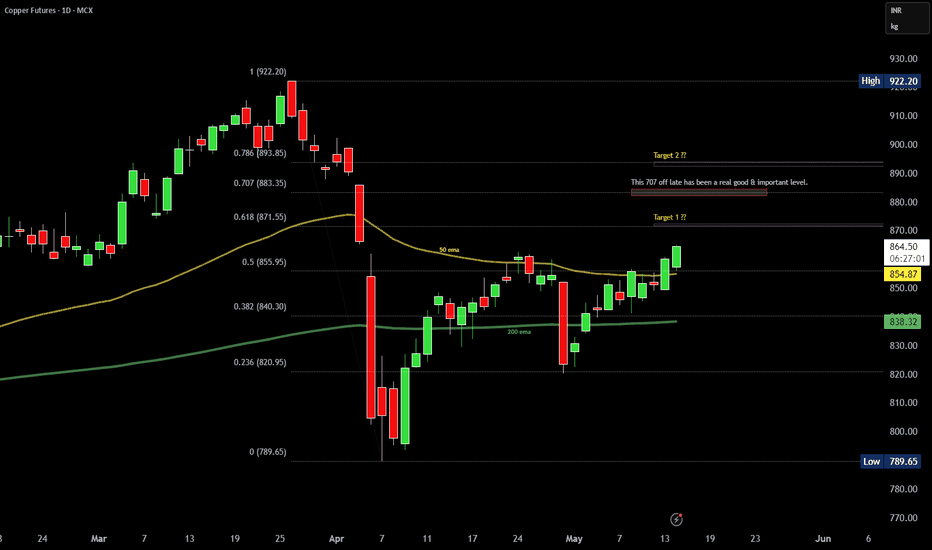

Chart Pattern Analysis Of Copper.

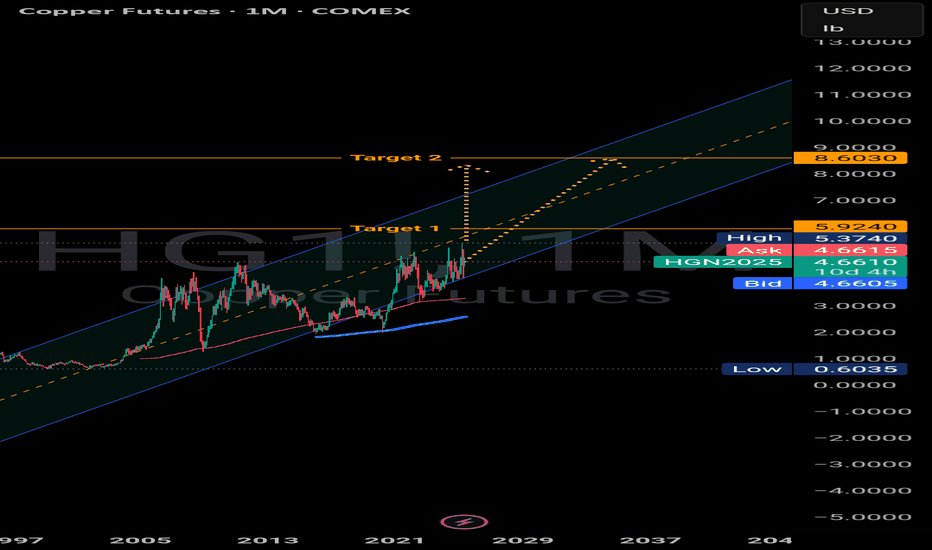

There are 4 candles close upon the neckline of a potential bullish triangle pattern,

It seems that another bull run will start here.

I am expecting an accelerate motive wave to touch or break up the target line.

On the other hand,

If K4 couldn’t close upon K1 to verify the strong bullish momentum

Price correction and re-increase in copper prices1.Growing Global Demand: Rising infrastructure projects and renewable energy initiatives (like EVs and energy storage systems) are boosting copper demand.

2.Supply Constraints: Declining reserves in major mines, production disruptions in key producers (e.g., Chile, Peru), and limited new investme

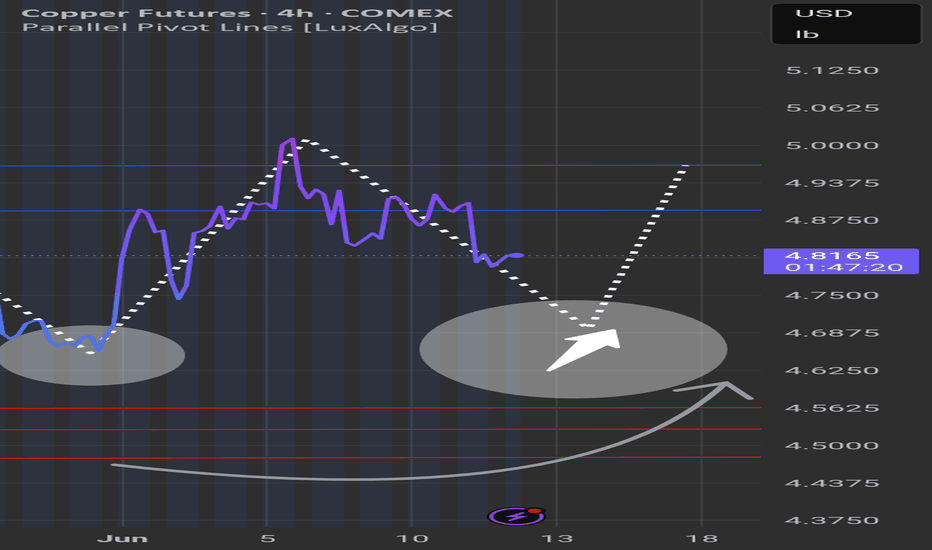

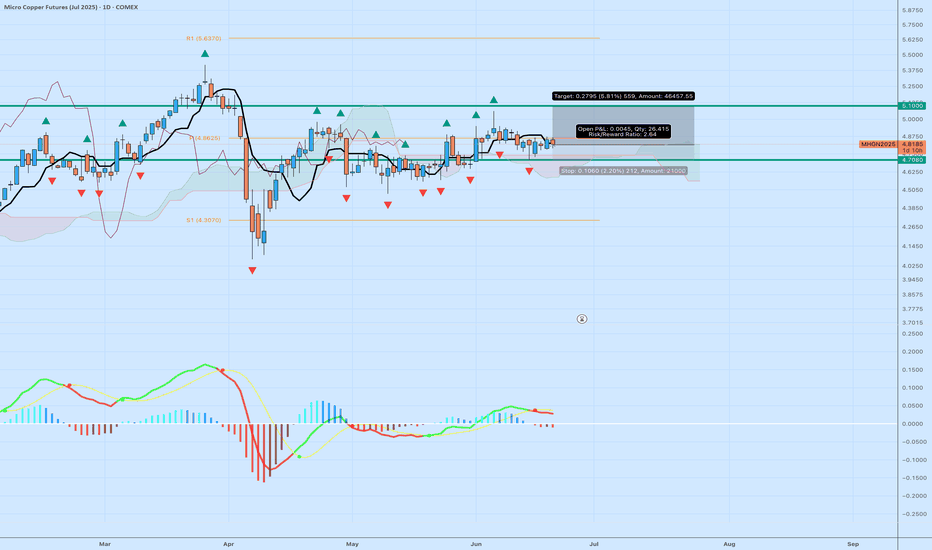

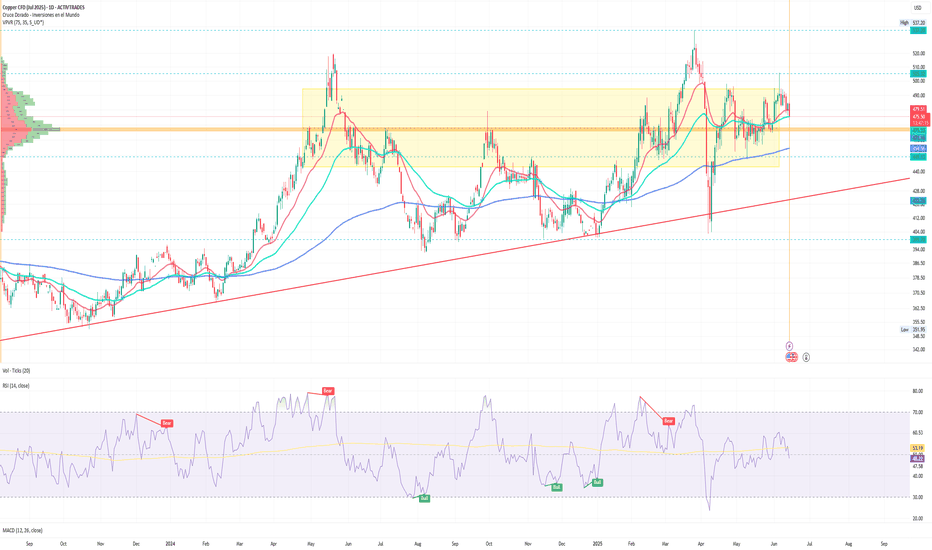

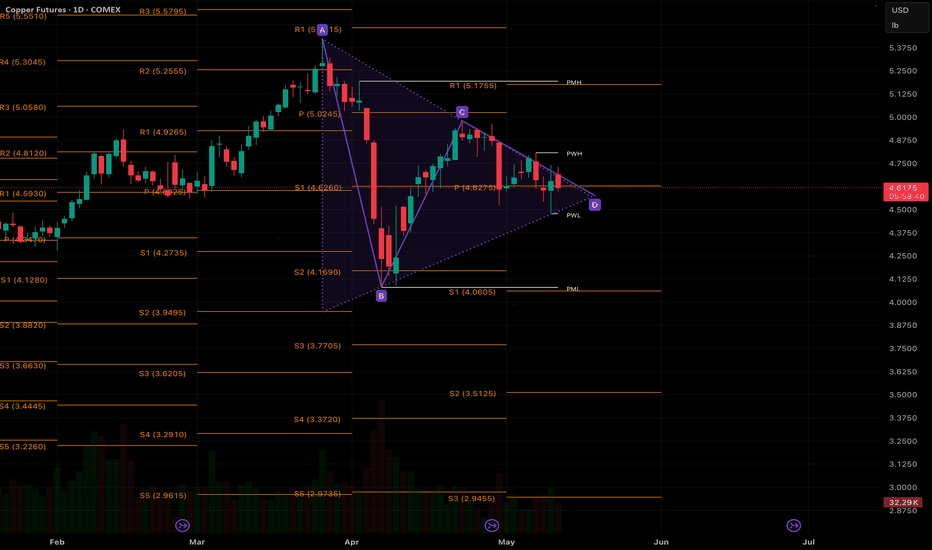

Long Setup: Micro Copper Futures (Jul 2025)While U.S. equity markets are closed in observance of Juneteenth, traders in the futures markets still have opportunities to position ahead of broader market moves. One such opportunity is forming in Micro Copper Futures (MHGN2025), which continues to consolidate in a tight range near key technical

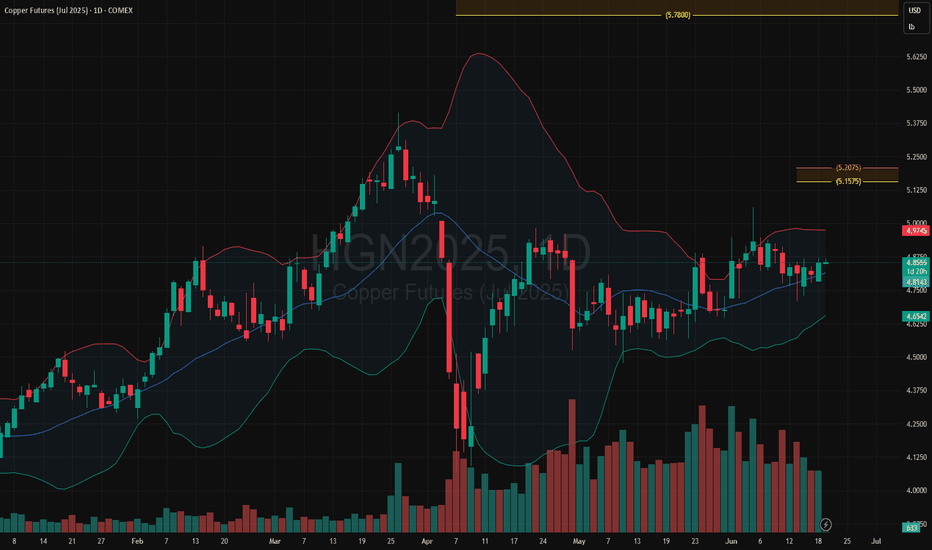

Bullish Reversal Builds in Copper: Eyes on $5.20 Resistance

The current price has closed above the Bollinger Band middle line (20-day SMA), indicating short-term upward momentum.

A sustained close above 4.90–4.95 could open the way to challenge the psychological level of 5.00 and possibly 5.20.

Immediate resistance: 4.95 → 5.00 → 5.20

Support zones: 4.7

Copper Nears Annual HighCopper Nears Annual High, Driven by Trade Optimism and Falling Inventories

By Ion Jauregui – ActivTrades Analyst

The copper market is once again in the spotlight. The metal is currently trading at around USD 9,756 per tonne on COMEX futures at the London Metal Exchange (LME), approaching its annual

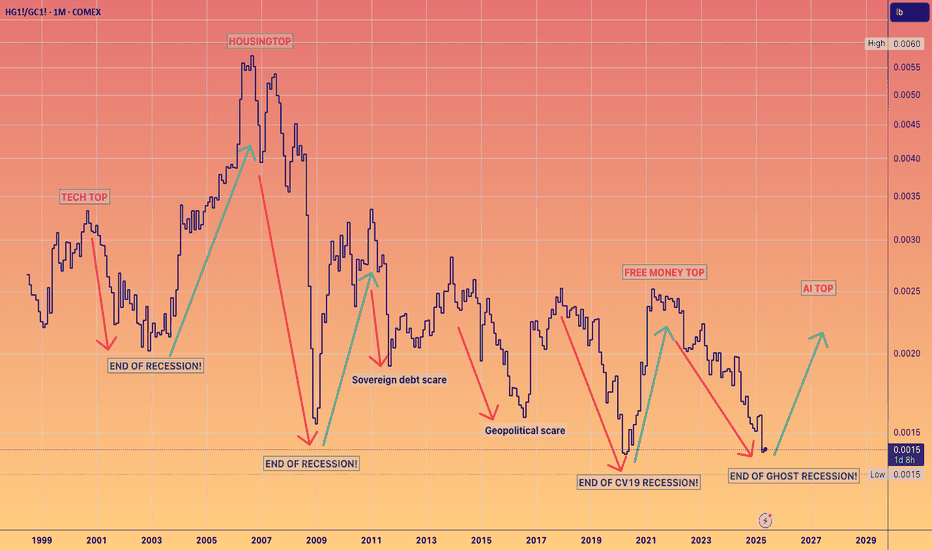

DR COPPER vs GOLD as a Safe HavenAn enlightening ratio provides additional proof that 2026 is set to be a remarkable year of economic growth, propelling us into the upcoming peak of the #AI cycle.

A key indicator of the AI peak is the initial public offering (IPO) of Open AI on the stock market. This is a definitive signal to capi

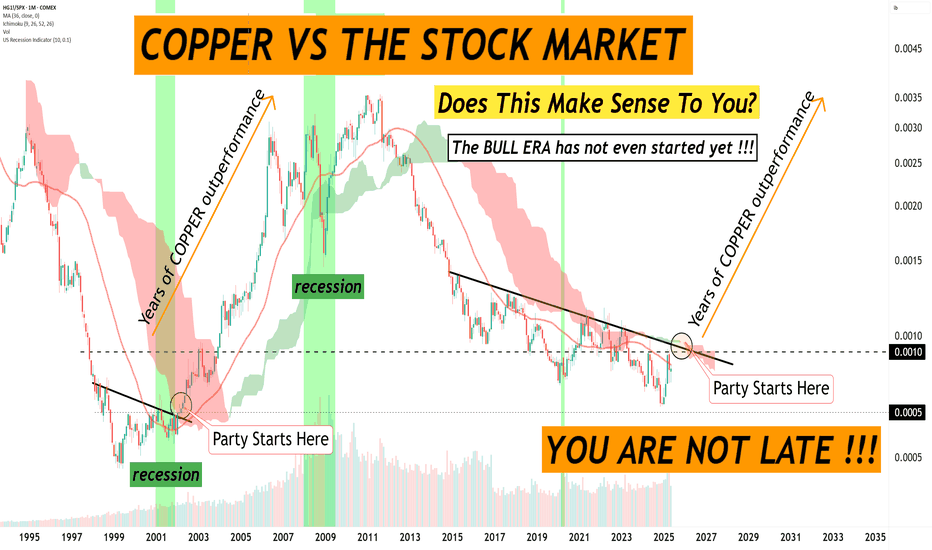

How can I be late to the copper bull era?How can I be late to the copper bull era when the party hasn’t even started?

The rocket-ship moments for copper lie ahead—not behind us.

There’s no need to front-run anything.

No pressure. No rush. Just readiness.

Wait.. where did I read something similar before... Mmm

Copper to Pump soon, W formation and small cap rumblingsIf you look closely there's a beautiful W formation that has been tested numerous times and has passed. This is high time frame and inconsideration of goals massive run, market makers are going to be looking into smaller cap assets this time of year. Small cap accumulation will last about 2 years. T

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Related commodities

Frequently Asked Questions

The current price of Grade A Copper Futures (Jun 2030) is 9,711.47 USD / TNE — it has risen 0.66% in the past 24 hours. Watch Grade A Copper Futures (Jun 2030) price in more detail on the chart.

Track more important stats on the Grade A Copper Futures (Jun 2030) chart.

The nearest expiration date for Grade A Copper Futures (Jun 2030) is Jun 19, 2030.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Grade A Copper Futures (Jun 2030) before Jun 19, 2030.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Grade A Copper Futures (Jun 2030) this number is 0.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Grade A Copper Futures (Jun 2030) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Grade A Copper Futures (Jun 2030). Today its technical rating is strong buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Grade A Copper Futures (Jun 2030) technicals for a more comprehensive analysis.