LRCUSDT trade ideas

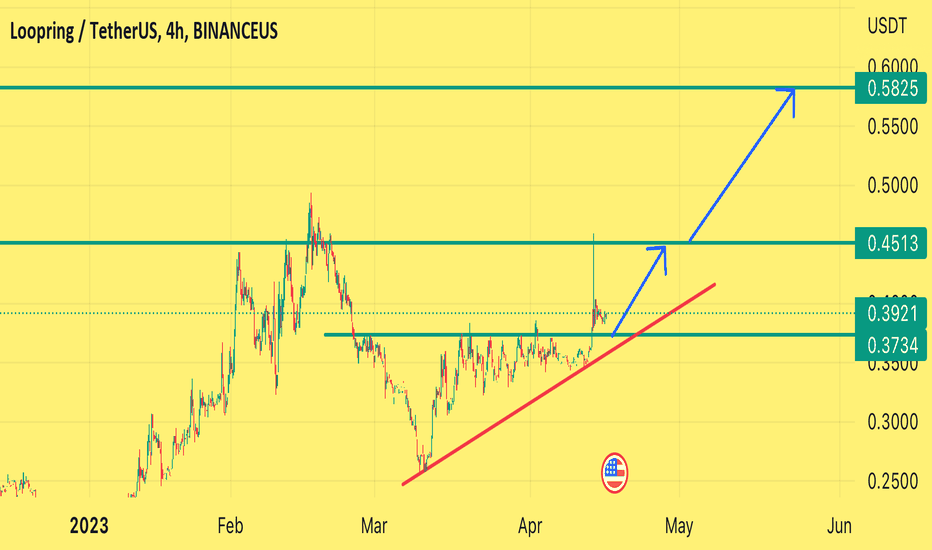

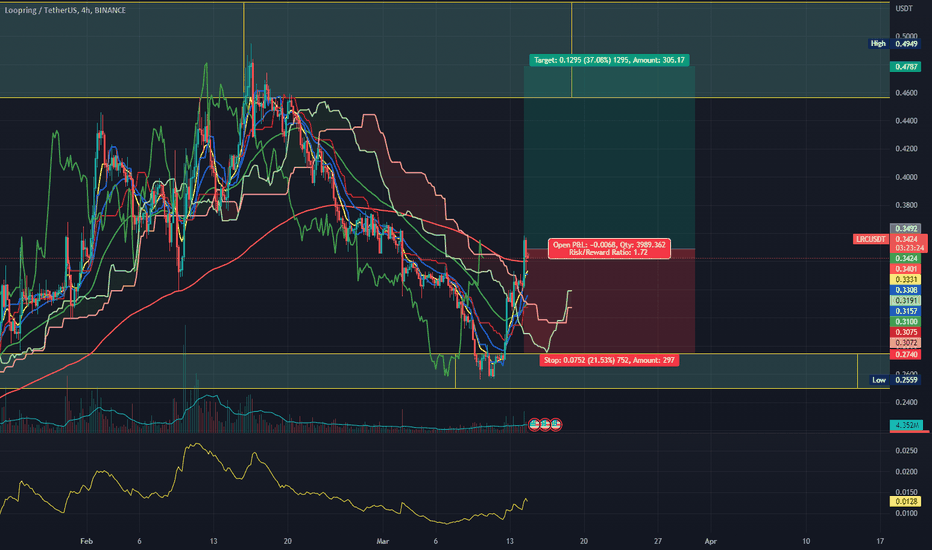

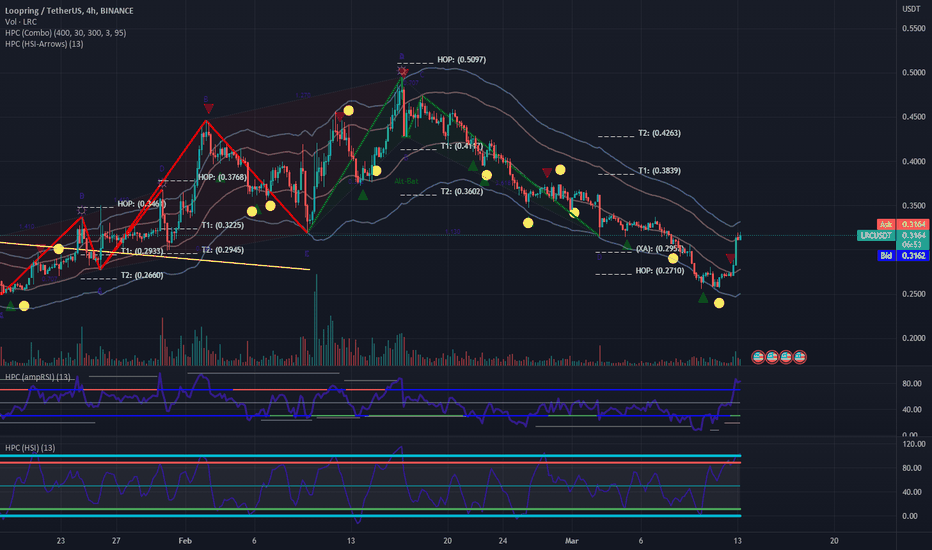

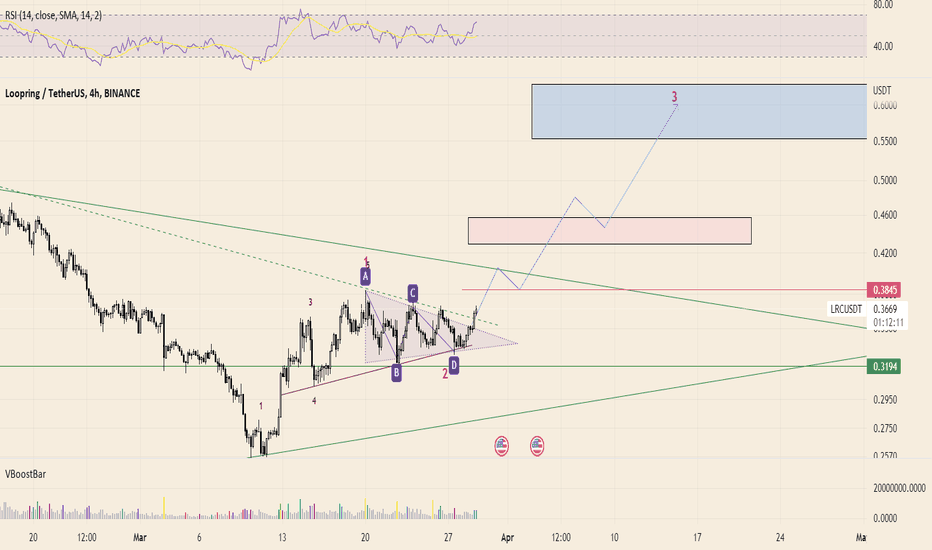

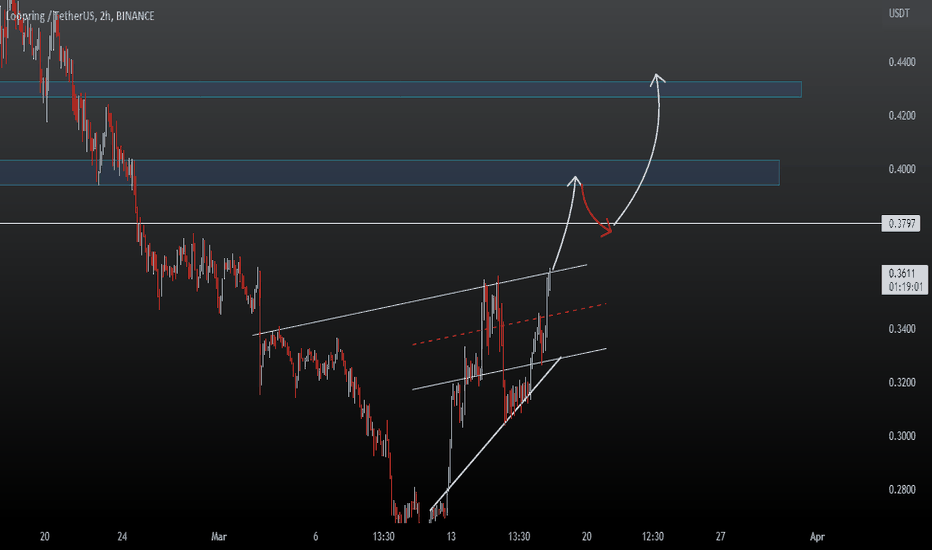

Trend Continuation Idea 🤖 Multi-timeframe Technical Analysis:

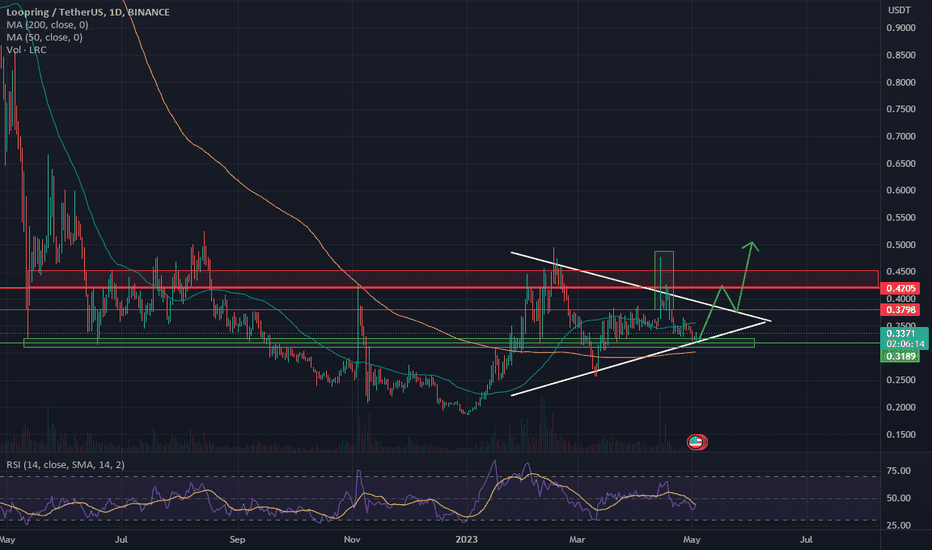

D1 Bounced off strongly from key support level that holds the uptrend within the ranging market.

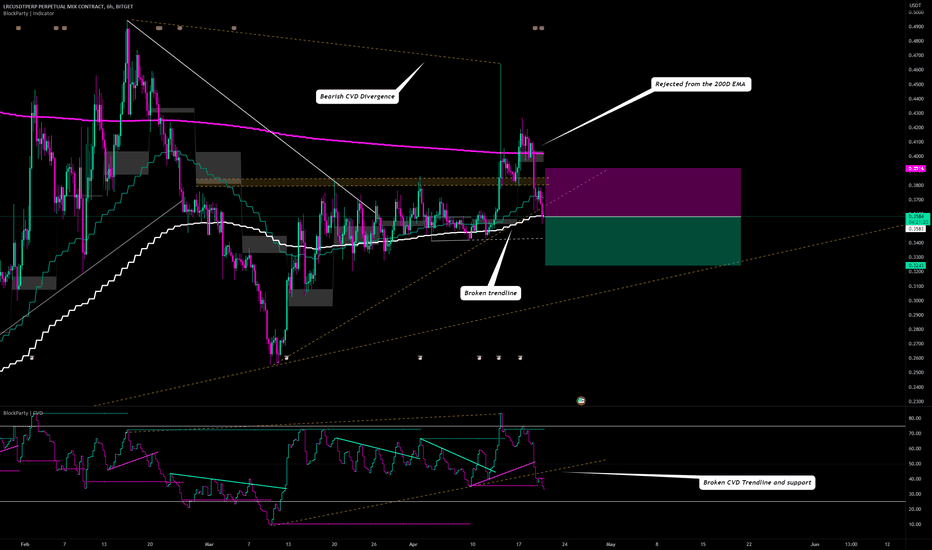

H4 Ichimoku Kumo Breakout destroying downtrend structure signaling the start of a potential reversal to the upside which goes along with Daily Timeframe trend and structure.

Key Areas

Key Support area: 0.2748 - 0.2493 (Potential Entries)

Key Resistance area: 0.4558 - 0.5243 (Potential Targets)

Please make sure to check brokers slippage along with trading fees for you to accommodate if the trading signal is useful for you or not.

Do not risk entire portfolio on a single trade. Remember market is king!

Stay healthy and happy trading!

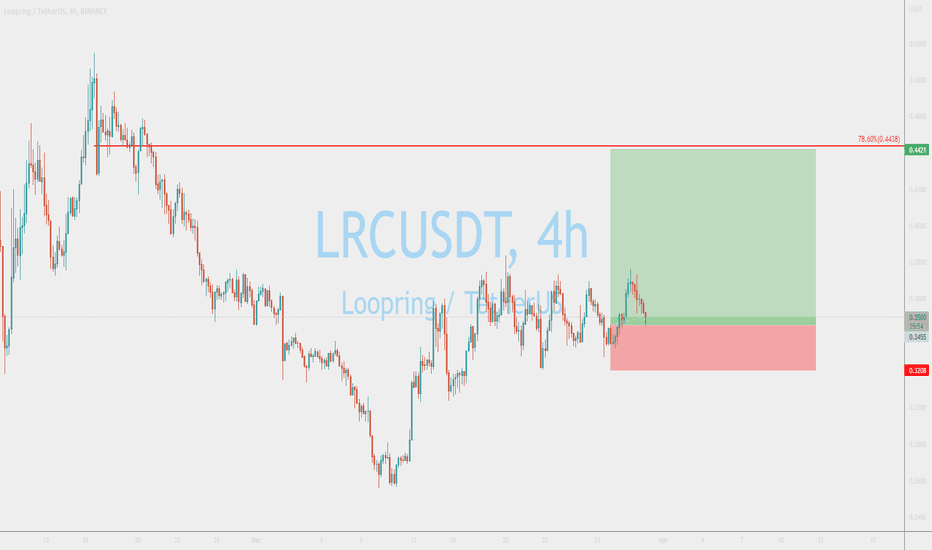

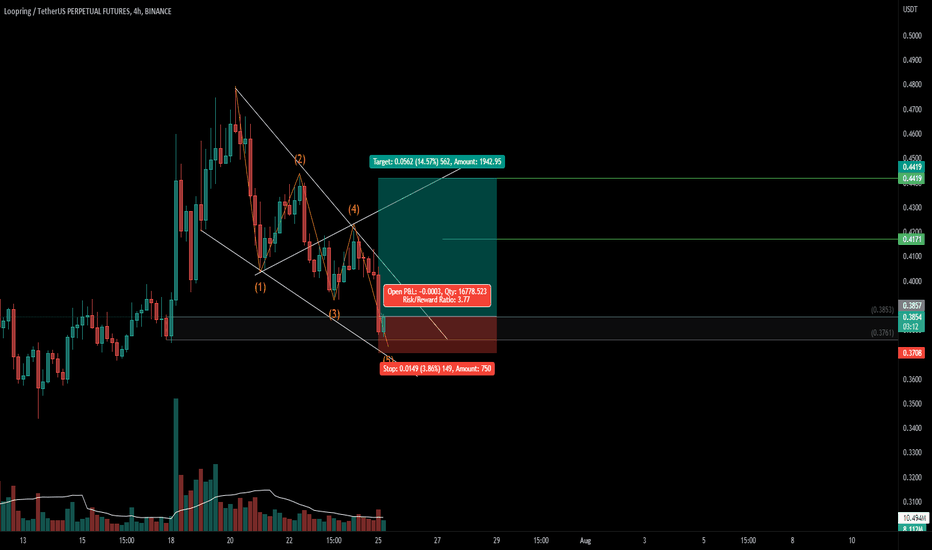

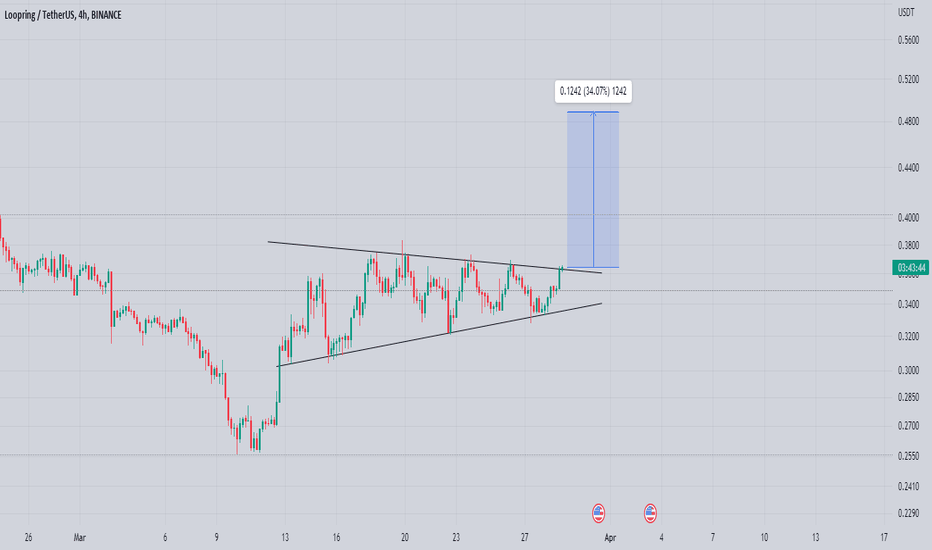

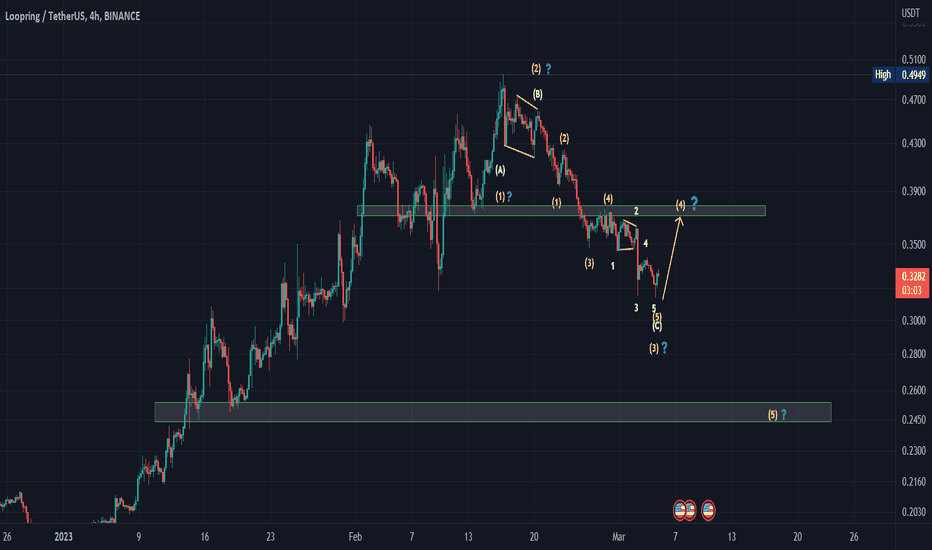

LRC LONG SETUP (HOT PROFIT)Hi, dear traders. how are you ? Today we have a viewpoint to BUY/LONG the lrc symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

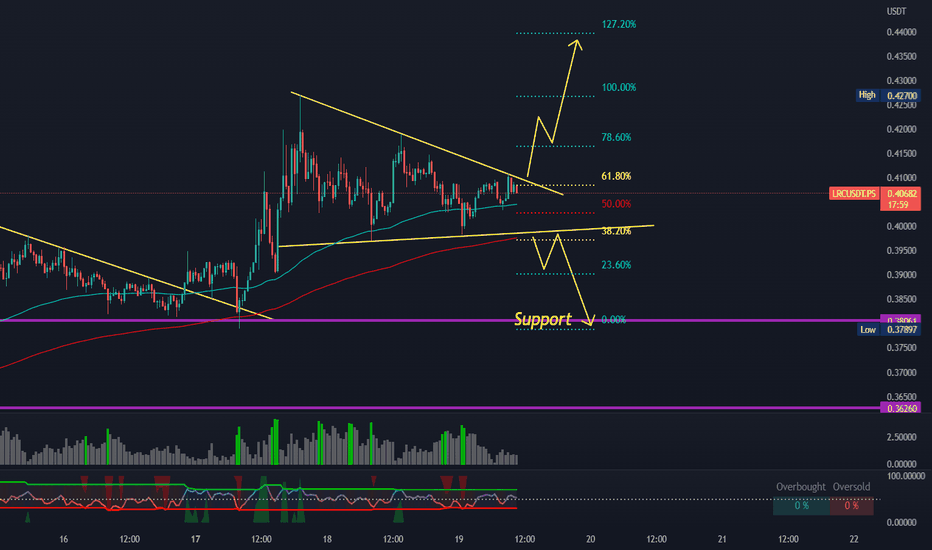

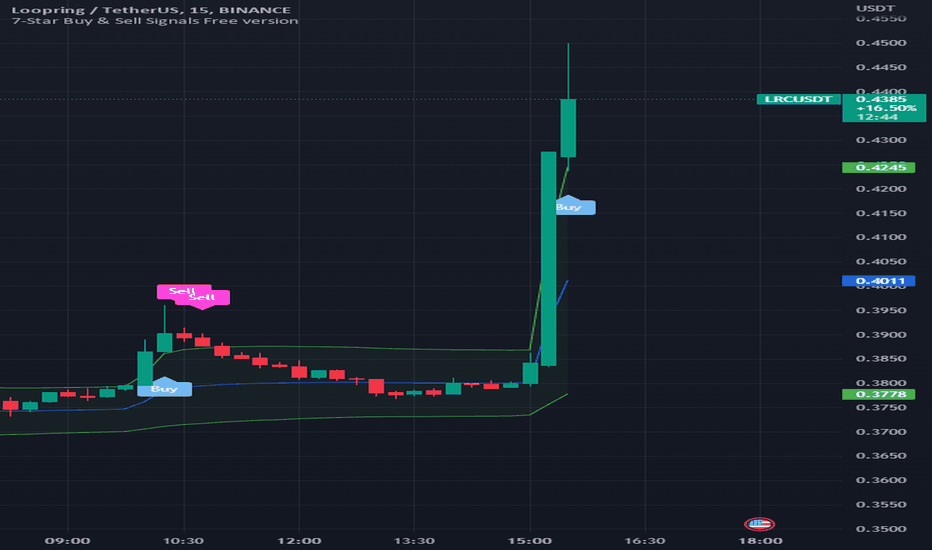

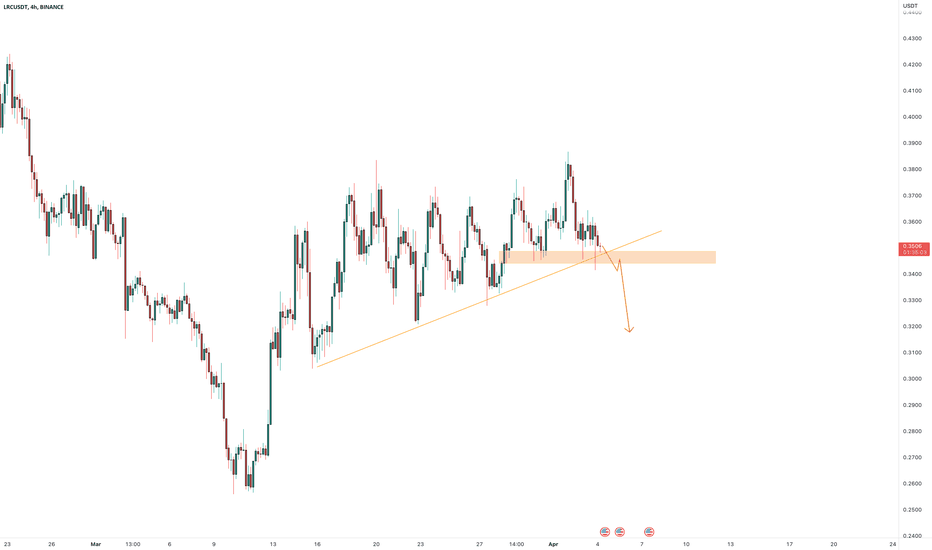

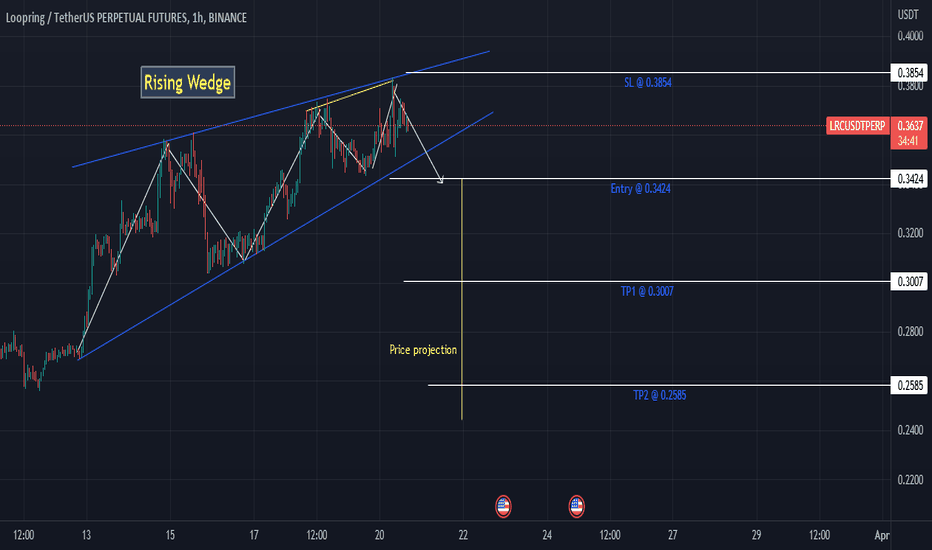

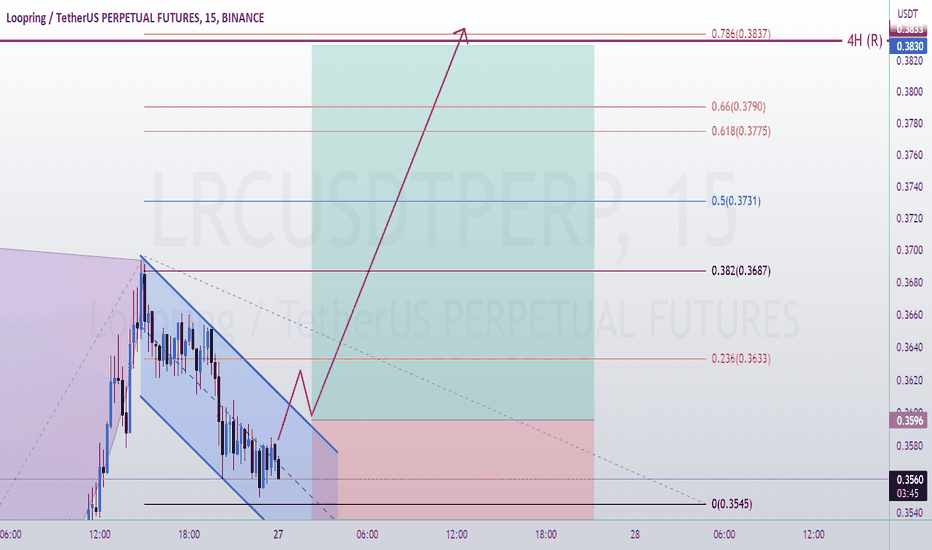

LRCUSDT is testing the supportLRCUSDT has experienced a clear bearish impulse in the past, and is currently in a consolidation phase. The price is now testing a key support level at the $0.35 area, which is an important level to watch for traders.

According to Plancton's Rules, if the price of LRCUSDT breaks below the key support level and starts to trade below it, it could be a signal for new short positions to be initiated.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> <= 1h structure.

Follow the Shrimp 🦐

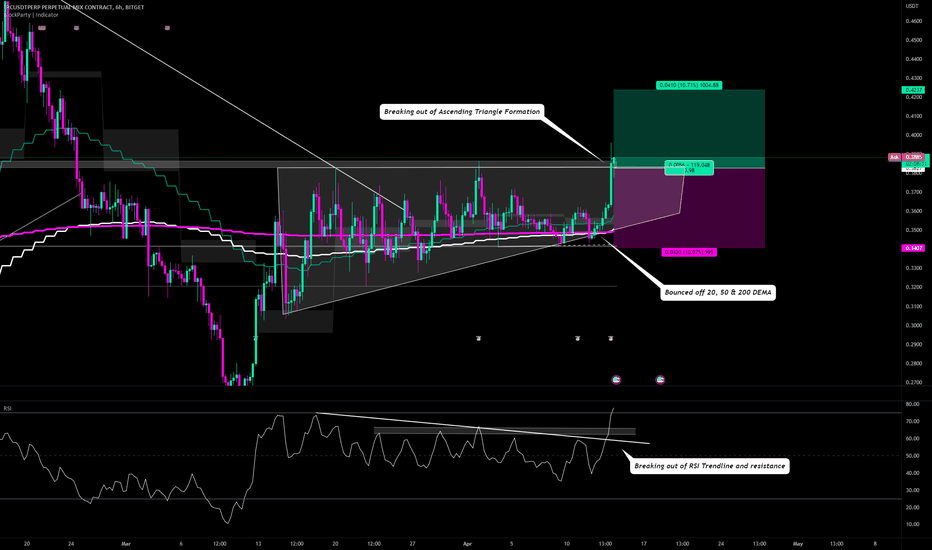

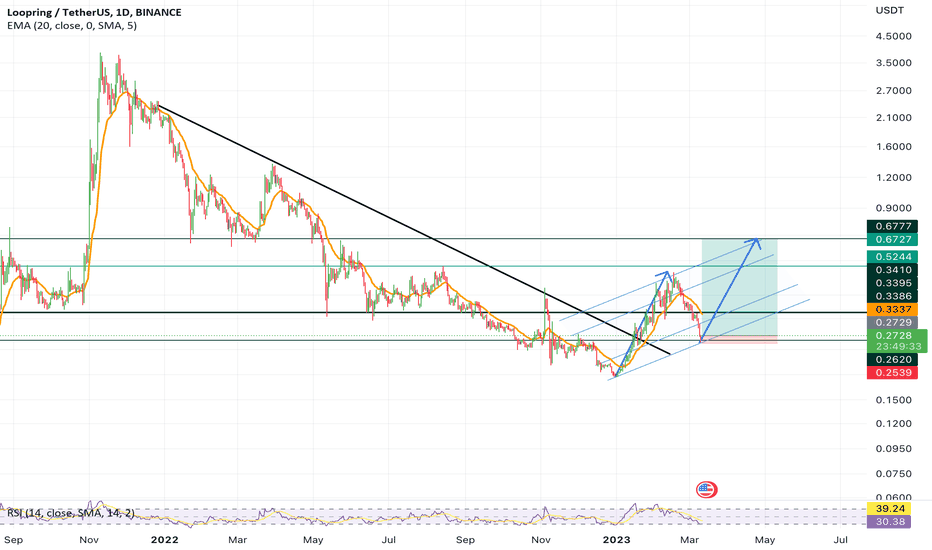

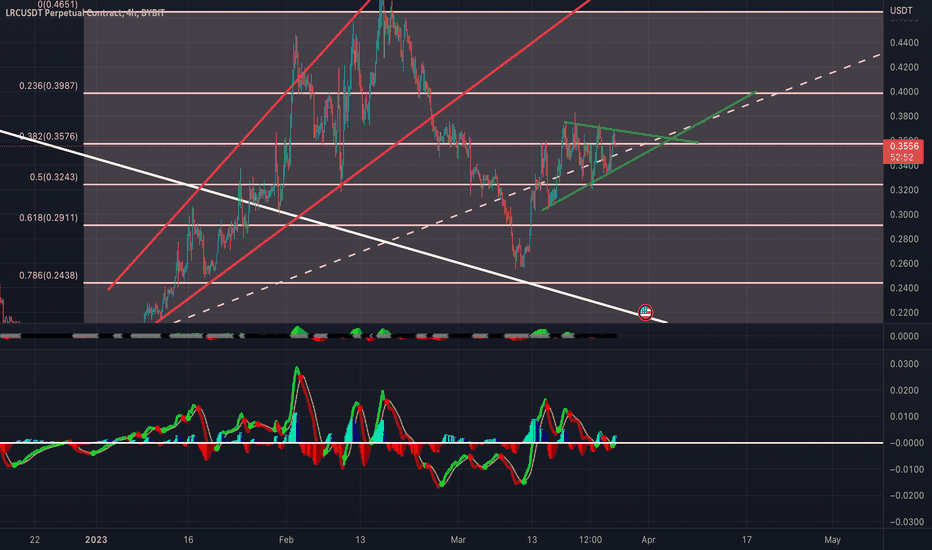

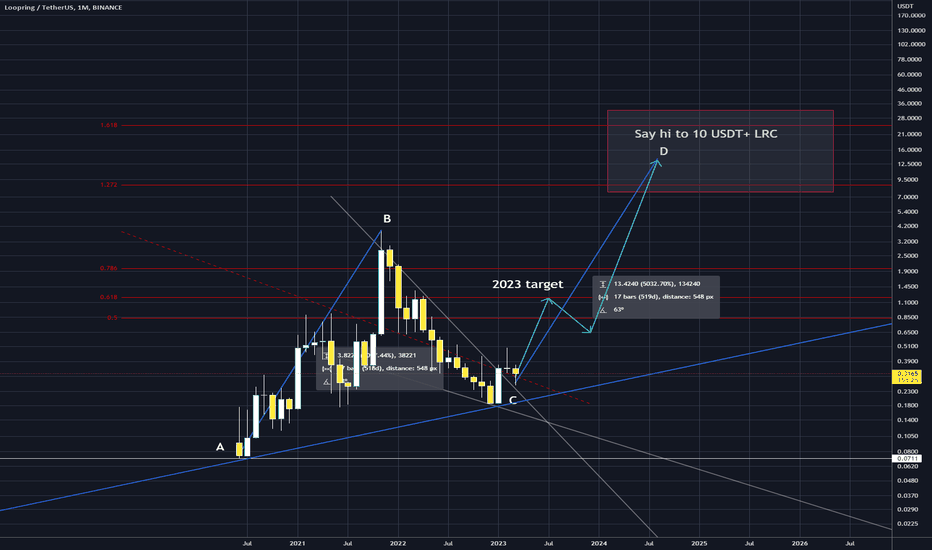

LRCUSDT IdeaPOLONIEX:LRCUSD BINANCE:LRCUSDT

✅ ✅ Risk warning, disclaimer: the above is a personal market judgment and analysis based on published information and historical chart data on The trading view,

And only some of these analyzes are my actual real trades.

I hope Traders consider I am Not responsible for your trades and investment decision.