Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.98 USD

1.14 B USD

53.11 B USD

165.63 M

About Bunge Limited

Sector

Industry

CEO

Gregory A. Heckman

Website

Headquarters

Chesterfield

Founded

2023

ISIN

CH1300646267

FIGI

BBG01S54C3Z5

Bunge Global SA engages in agribusiness including food and ingredients. It operates through the following segments: Agribusiness, Refined & Specialty Oils, Milling, Sugar & Bioenergy, and Corporate & Other. The Agribusiness segment is an integrated, global business principally involved in the purchase, storage, transportation, processing and sale of agricultural commodities and commodity products. The Refined & Specialty Oils segment includes businesses that sell vegetable oils and fats, including cooking oils, shortenings, specialty ingredients, and renewable diesel feedstocks. The Milling segment refers to the businesses that sell wheat flours, bakery mixes, and corn-based products. The Sugar & Bioenergy segment consists of results from the company’s previously owned 50% ownership interest in BP Bunge Bioenergia. The Corporate & Other segment focuses on the salaries and overhead for corporate functions that are not allocated to individual reporting segments because the operating performance of such reporting segments is evaluated. It connects farmers to consumers to deliver essential and sustainable food, feed and fuel. The company was founded on February 14, 2023 and is headquartered in Chesterfield, MO.

Related stocks

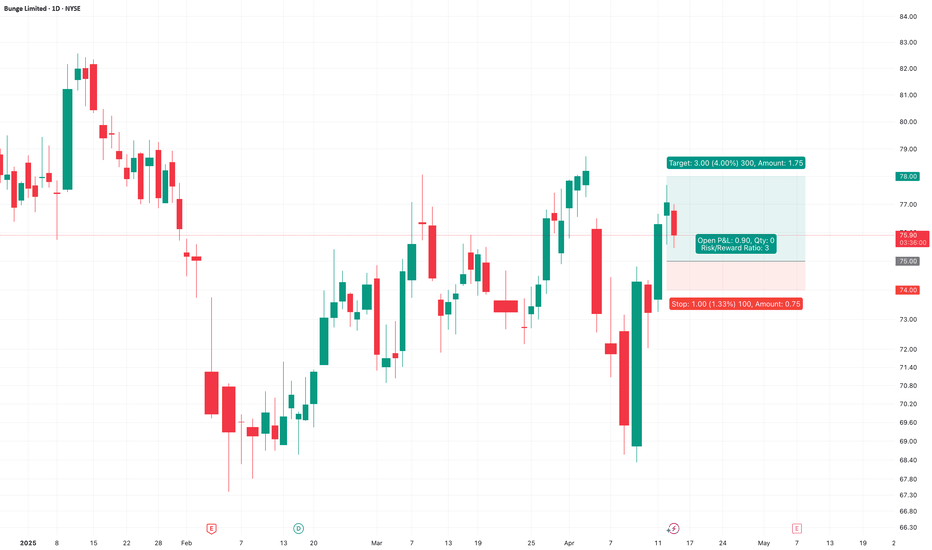

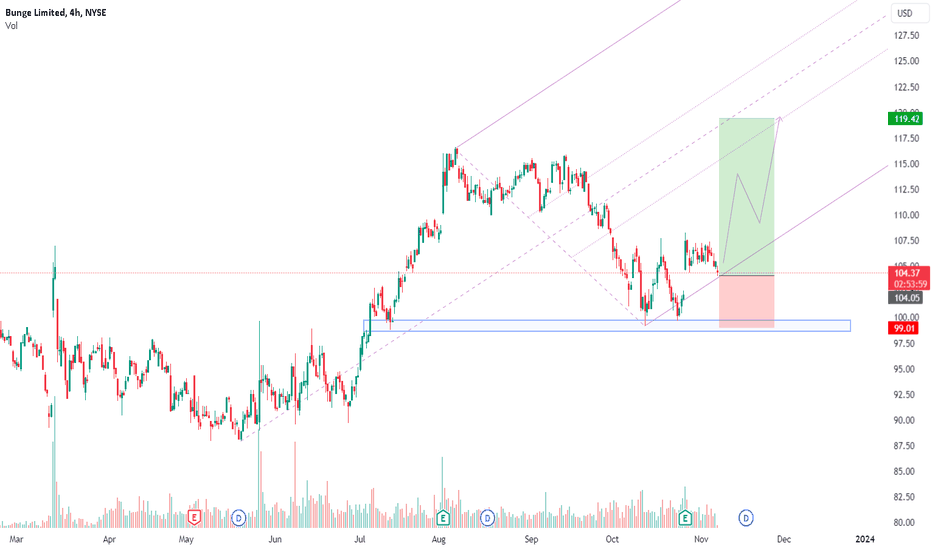

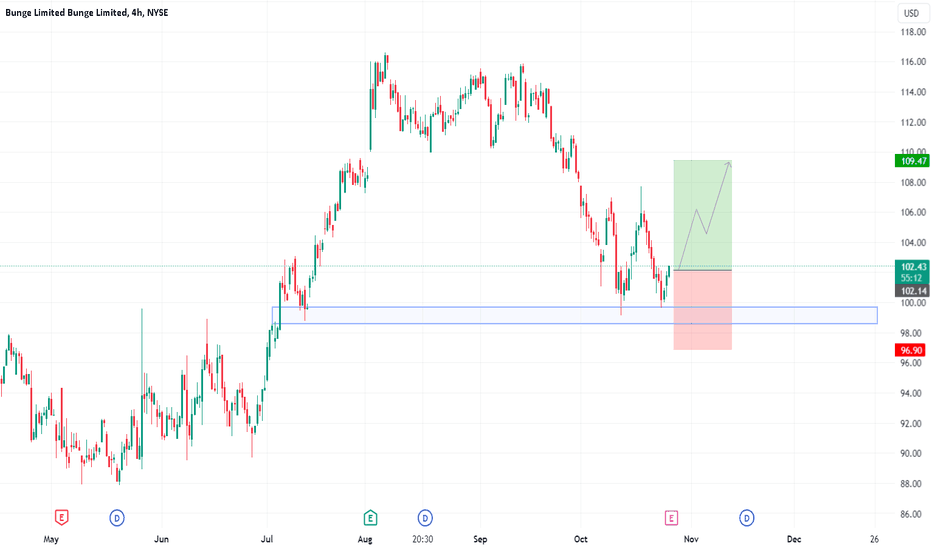

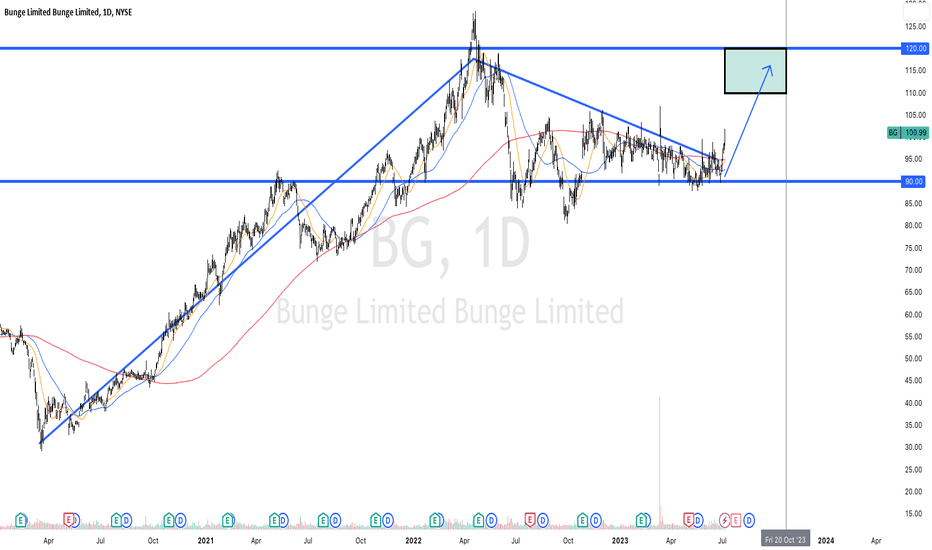

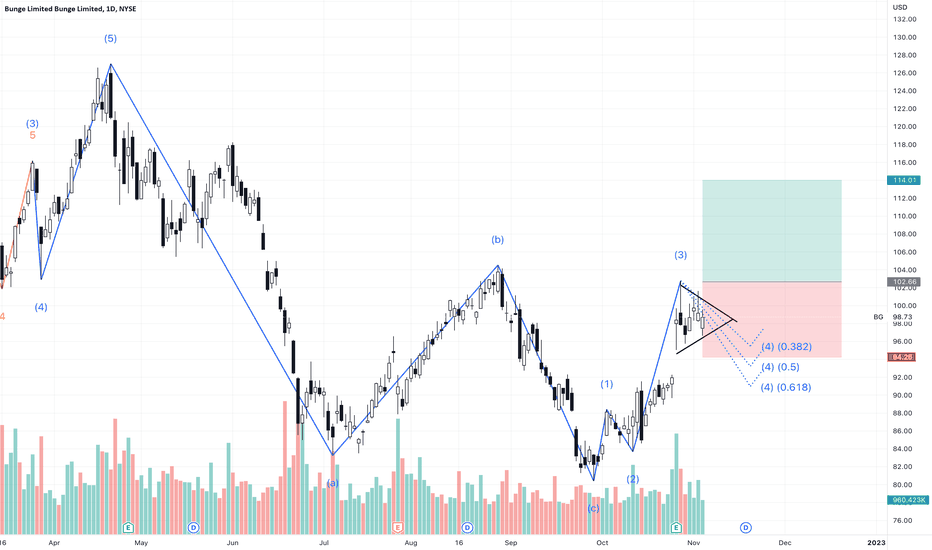

BG - Bunge Limited (Daily chart, NYSE) - Long PositionBG - Bunge Limited (Daily chart, NYSE) - Long Position; short-term research idea.

Risk assessment: Medium {support structure integrity risk}

Risk/Reward ratio ~ 3

Current Market Price (CMP) ~ 75.80

Entry limit ~ 75.50 to 74.50 (Avg. - 75) on April 15, 2025

Target limit ~ 78 (+4%; +3 points)

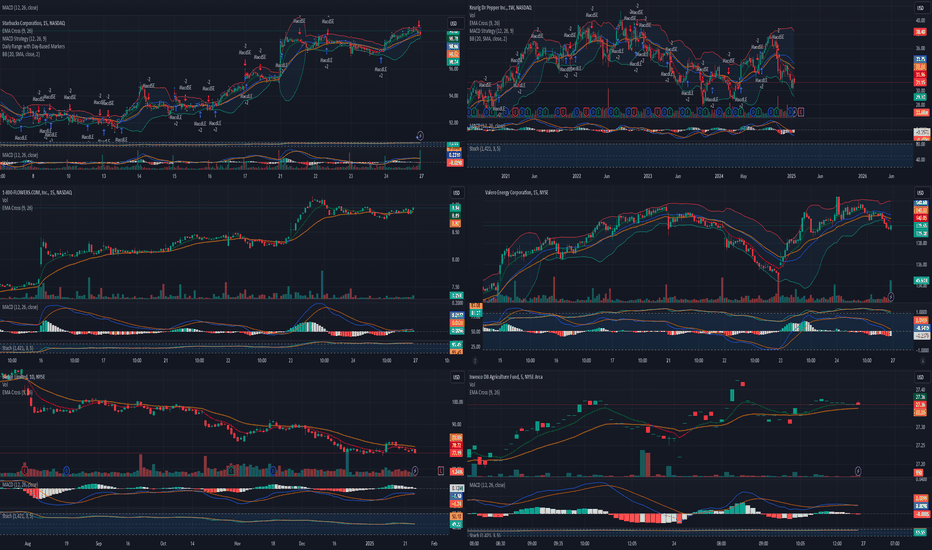

Trade wars begin.The trade war with Colombia will have a ripple effect across several industries, particularly those heavily reliant on imports and exports. Here’s a breakdown of how this could impact sectors and stocks:

1. Coffee Companies (Starbucks, Green Mountain Coffee)

Impact: Coffee prices are likely to rise

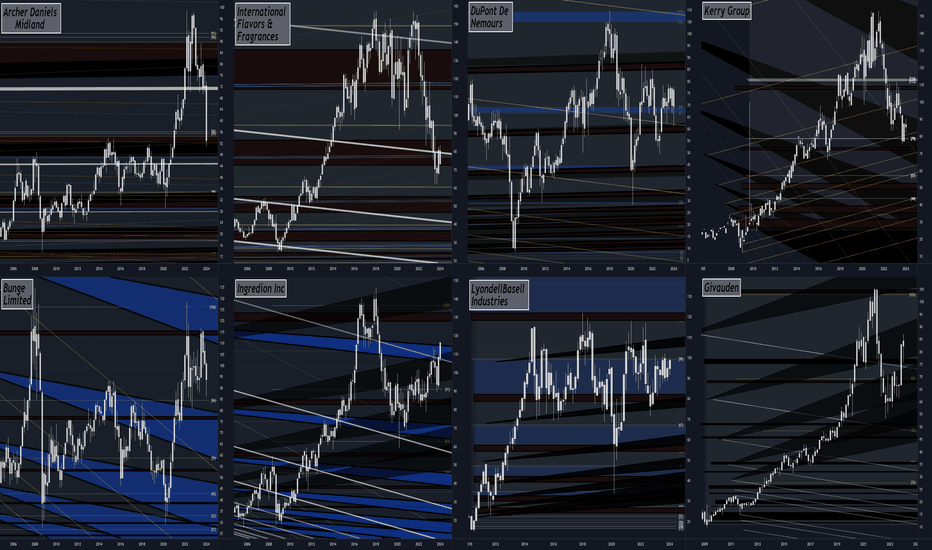

Food Additive Giants: Macro Fib SchematicsThese food additive companies manufacture agricultural ingrediants and additives that nakes its way to prodcust in grocery stores. Archer Daniels Midlands Co, Bunge Limited, International Flavors & Fragrances, Ingredion Inc, DuPont De Nemours, LyondellBasell Industries, Kerry Group, and Givauden are

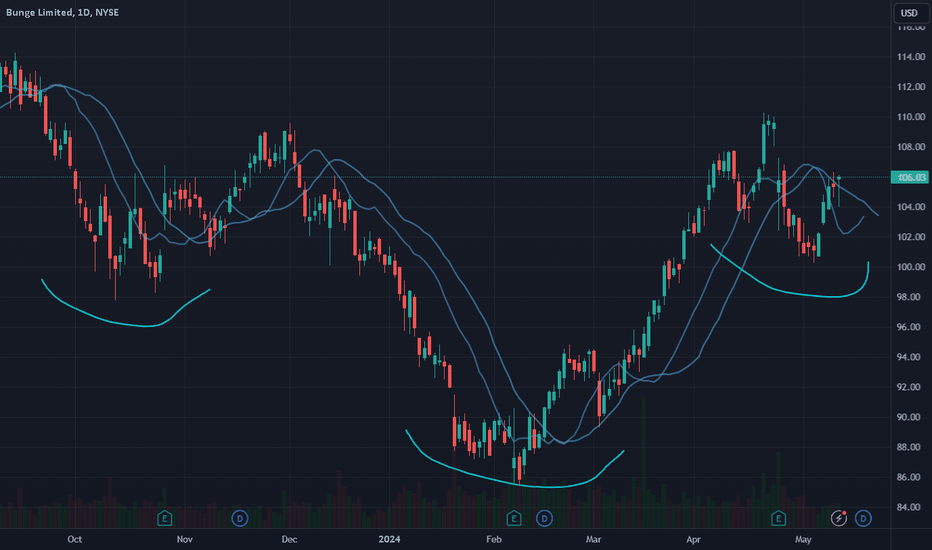

Bunge Limited ($BG) LongBunge Limited ( NYSE:BG ) is an American agribusiness and food company, incorporated in Bermuda, and headquartered in St. Louis, Missouri, United States. As well as being an international soybean exporter, it is also involved in food processing, grain trading, and fertilizer. The daily chart shows

See all ideas

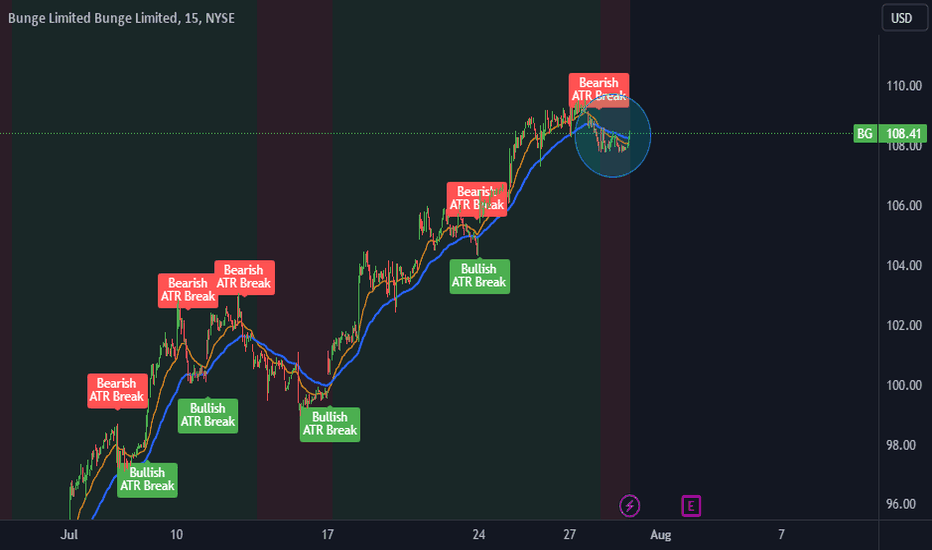

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where 0ADJ is featured.

Frequently Asked Questions

The current price of 0ADJ is 73.26 USD — it has decreased by −1.22% in the past 24 hours. Watch BUNGE GLOBAL SA COM USD0.01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange BUNGE GLOBAL SA COM USD0.01 stocks are traded under the ticker 0ADJ.

0ADJ stock has fallen by −3.04% compared to the previous week, the month change is a −10.73% fall, over the last year BUNGE GLOBAL SA COM USD0.01 has showed a 4.55% increase.

We've gathered analysts' opinions on BUNGE GLOBAL SA COM USD0.01 future price: according to them, 0ADJ price has a max estimate of 105.00 USD and a min estimate of 74.00 USD. Watch 0ADJ chart and read a more detailed BUNGE GLOBAL SA COM USD0.01 stock forecast: see what analysts think of BUNGE GLOBAL SA COM USD0.01 and suggest that you do with its stocks.

0ADJ reached its all-time high on Jun 17, 2025 with the price of 87.22 USD, and its all-time low was 67.48 USD and was reached on Feb 6, 2025. View more price dynamics on 0ADJ chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0ADJ stock is 2.12% volatile and has beta coefficient of 0.30. Track BUNGE GLOBAL SA COM USD0.01 stock price on the chart and check out the list of the most volatile stocks — is BUNGE GLOBAL SA COM USD0.01 there?

Today BUNGE GLOBAL SA COM USD0.01 has the market capitalization of 14.60 B, it has decreased by −6.87% over the last week.

Yes, you can track BUNGE GLOBAL SA COM USD0.01 financials in yearly and quarterly reports right on TradingView.

BUNGE GLOBAL SA COM USD0.01 is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

0ADJ earnings for the last quarter are 1.81 USD per share, whereas the estimation was 1.28 USD resulting in a 41.27% surprise. The estimated earnings for the next quarter are 1.12 USD per share. See more details about BUNGE GLOBAL SA COM USD0.01 earnings.

BUNGE GLOBAL SA COM USD0.01 revenue for the last quarter amounts to 11.64 B USD, despite the estimated figure of 13.02 B USD. In the next quarter, revenue is expected to reach 12.24 B USD.

0ADJ net income for the last quarter is 201.00 M USD, while the quarter before that showed 602.00 M USD of net income which accounts for −66.61% change. Track more BUNGE GLOBAL SA COM USD0.01 financial stats to get the full picture.

Yes, 0ADJ dividends are paid quarterly. The last dividend per share was 0.70 USD. As of today, Dividend Yield (TTM)% is 3.75%. Tracking BUNGE GLOBAL SA COM USD0.01 dividends might help you take more informed decisions.

BUNGE GLOBAL SA COM USD0.01 dividend yield was 3.50% in 2024, and payout ratio reached 34.02%. The year before the numbers were 2.59% and 17.56% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 17, 2025, the company has 23 K employees. See our rating of the largest employees — is BUNGE GLOBAL SA COM USD0.01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BUNGE GLOBAL SA COM USD0.01 EBITDA is 1.85 B USD, and current EBITDA margin is 4.11%. See more stats in BUNGE GLOBAL SA COM USD0.01 financial statements.

Like other stocks, 0ADJ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BUNGE GLOBAL SA COM USD0.01 stock right from TradingView charts — choose your broker and connect to your account.