0HL1 trade ideas

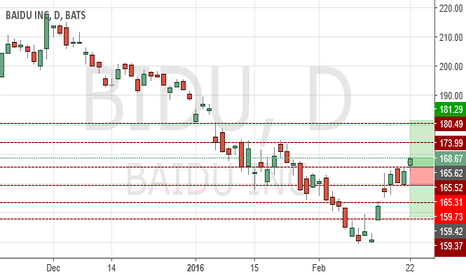

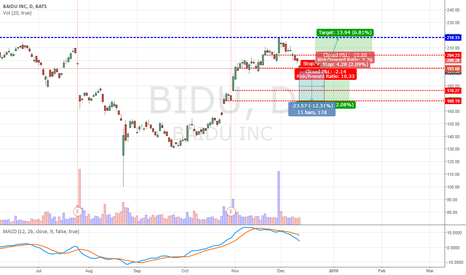

16.03.27 - BIDUPrice > 20EMA: yes

Price > 50EMA: yes

Price > 200EMA: yes

20EMA x 50EMA: yes

50EMA x 200EMA: -

Price resting at 200EMA

P3

HH HL

Retrace to S for entry TP at current pricing level above 200EMA

Earning are on the horizon (just like BABA and AAPL) i.e., more potential for volatility and momentum

TP: 188.07

Entry: 179.2

SL: 174.77

2RR

BOUGHT TO CLOSE BIDU MAR 18TH 152.5/157.5/180/185 IRON CONDORClosed this setup at 50% max profit (for the rolled setup) ($62.58/contract).

It doesn't entirely make up for my early bobble of BIDU's earnings announcement date (first they said it was 2/10; then it was 2/25), but I'll take it here going into Draghi/FOMC.

Here's the entire chain:

2/25 Sold March 8th 132/137/177.5/182.5 iron condor for a $131 credit

2/26 Bought the 132/137 short put vert back for a $9 debit (post earnings announcement; near worthless)

2/29 Rolled the 177.5/182.5 short call vert to the March 18th 180/185 short call vertical for a $17 credit (price too close to short call strike with limited DTE)

2/29 Sold the March 18th 152.5/157.5 short put vertical for a $48 credit (this wasn't strictly necessary, since I received a credit for the roll of the short call side; I just wanted some protection there if price continued to shoot off into the ether).

3/9 Bought to close the March 18th 152.5/157.5/180/185 Iron Condor for a $106 debit.

Total credits minus total debits minus fees and commissions = $62.58/contract, not quite 50% max profit of the original setup, but close enough considering that I had to roll and that it was supposed to be one of those ideal "inzee/outzee" earnings plays ... .

BIDU EARNINGS: MARCH 4TH 136/141/185/190 IRON CONDORBIDU announces earnings after tomorrow's close, so look to put a setup on in the waning hours of the NY sesh.

Now that I've got the earnings date correct (they previously "tentatively" announced a 2/10 earnings release -- sooooo annoying), here's the metrics for the setup:

BIDU Mar 4th 136/141/185/190 iron condor

Probability of Profit: 70%

Max Profit: $125/contract

Buying Power Effect: $375/contract

Notes: Naturally, you may need to tweak the setup given the underlying's price movement during the session ... .

BIDU EARNINGS PLAYSBIDU announces earnings "some time tomorrow", so it could be either before or after market; if you want to play it, look to put on a setup before today's market close. One thing I would note is that the bid/ask spreads aren't that great, implying that the options' liquidity isn't the best in the world, so I would look to put on a play at the mid price, but not to chase price ... . In any event, here are the setups:

For the folks who like to "go naked":

Feb 19th 124/157.5 short strangle

Probability of Profit %: 72%

Max Profit: $225/contract

Buying Power Effect: Undefined

For those who are "more shy" or of a defined risk bent (I've gone out a little farther in time because I can't get the long option strikes I want for a symmetrical setup in the Feb 19th expiry):

Feb 26th 115/120/165/170 iron condor

Probability of Profit %: 70%

Max Profit: $117/contract

Buying Power Effect: $382

Look to take off the entire setup at 50% max profit or a single side nearing worthless. In the event a side is tested, look to roll that side out to a later expiry and sell and oppositional side against the rolled out option(s) for a credit that exceeds the cost of the roll of the tested side.

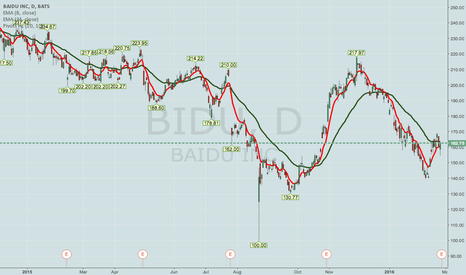

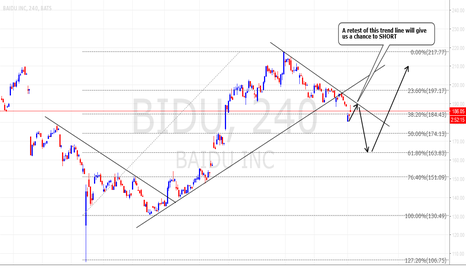

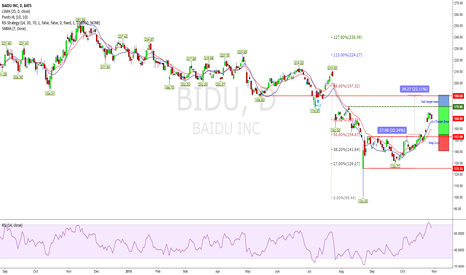

Recent Selloff May Provide Good Entry11-days ago we suggested short position with target price 250 still that remains valid but 170/163 also provide strong rebound back to 194 before earning. Now if u are in this trade you are sitting on 10% and good to protect the gain and flip the trade. Real-time alerts go www.2waytrading.com

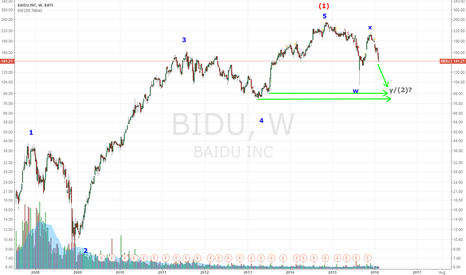

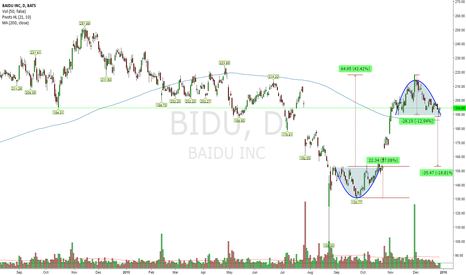

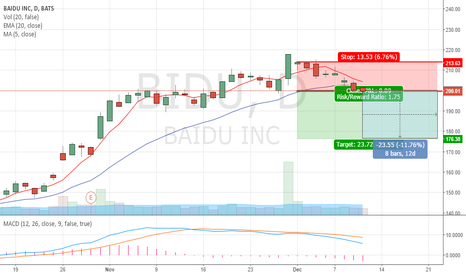

Daily short in BIDUAfter gapping and holding below 2 earnings levels, I will take this 2R short.

3 primary reasons I'm bearish:

1. RgMov is in a downtrend, with 5/13 MA clearly bearish

2. Price is expanding range lower on both a daily and weekly scale

3. Price is right below two key earnings levels that will act as resistance

GL!

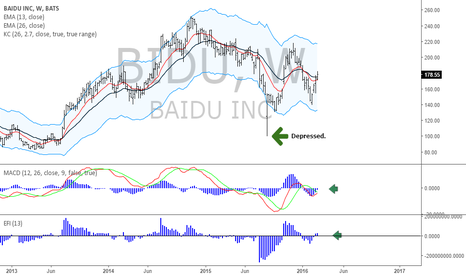

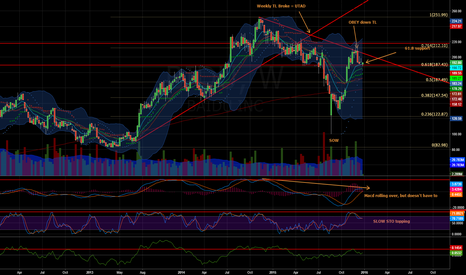

$SPY $BIDU - Bounce or tank?Interesting here. Looking at weekly, macd rolling over. I can see sow before UTAD to create the apex with support found a the 61.8. Tough, that could be UTAD with LPSY set for FTI or Sow about tag UTAD. CMF virtually flat. My bias has a hard time being long this market. Short term, can it rip to new highs? Yes, possible, I would be waiting there short.

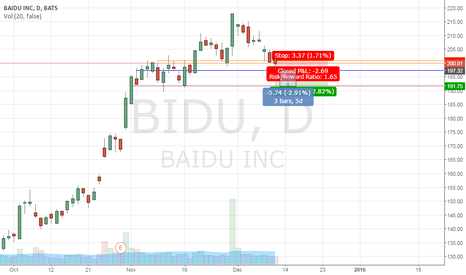

BIDU Bearish SignalTF Day on uptrend, but after hit 52 weeks high, candle stick indicated bearish pattern. If the price break out the SL @ $200 and not pull back within 3 days, potentially to reverse to down trend, then open PUT. If price spike up break out $213.6, its trend may be back to up trend, close PUT position and consider to open LONG.

Strong Earning Expect Strong Price ActionLast recommendation was to enter $140 if price holds and it did indeed. Though price appreciated a lot before earnings, the good news was more of expected and they delivered now. First, price overcame $154 level and gaped up with good news last week. We expect now price to enter next few sessions or weeks into the second profit zone. Try www.2waytrading.com