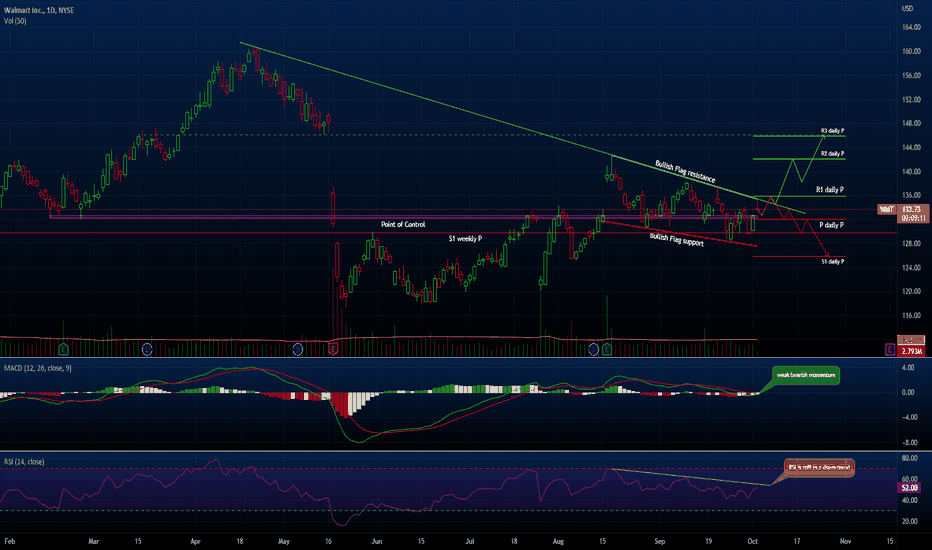

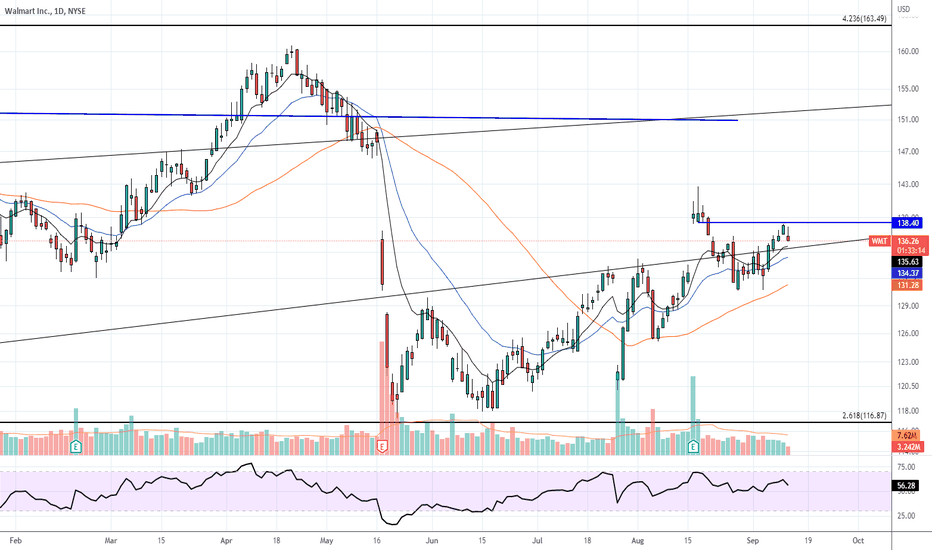

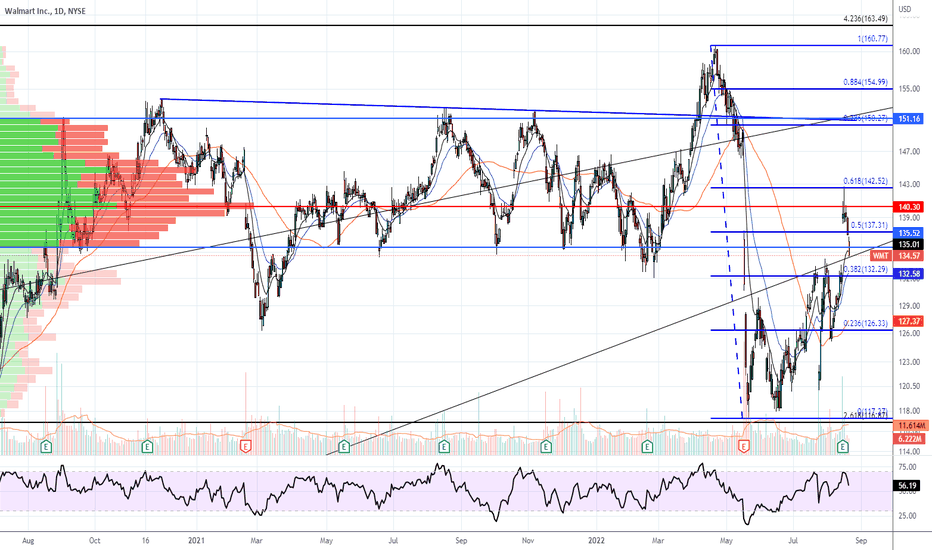

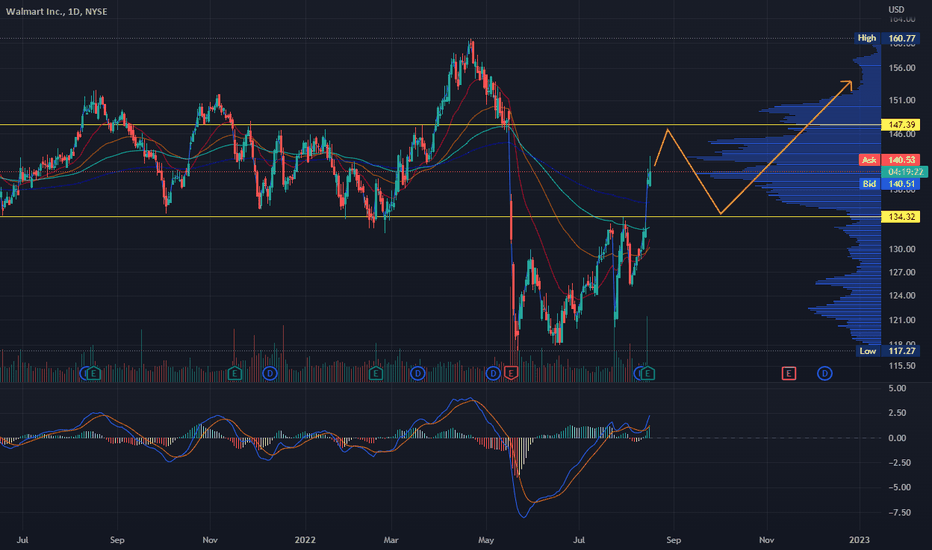

Breakout/false breakout coming?!The WMT has just touched its daily resistance for the fourth time.

Stocks tend to break out shortly after the fourth time.

The fact that the graph shows a "bull flag" strengthens my previous statement.

In addition, the MACD has-had a weak bearish momentum, while the broader market had a big bearish momentum.

However, the RSI continues to show a downward trend.

Moreover, today's candle is weak while the broad market is rising.

It seems to be rejected by the daily resistance.

My assumption is that, there will be a sudden shift in one direction or the other.

It will be due to a breakout or a false breakout.

If you are asking me, a "straddle" might be the best way to play it.

Support: 132.06, 129.79, 125.86

Resistance: 135.88, 142.08, 145.91

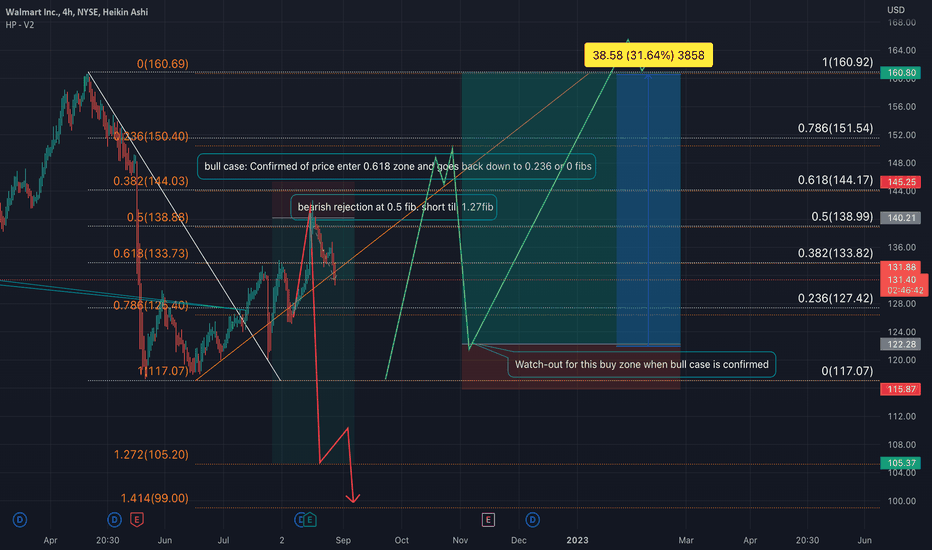

0R1W trade ideas

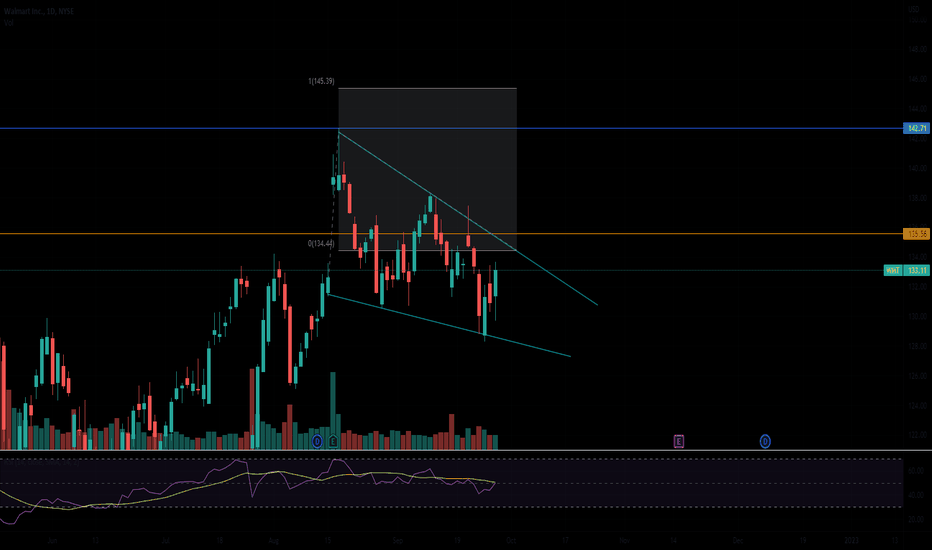

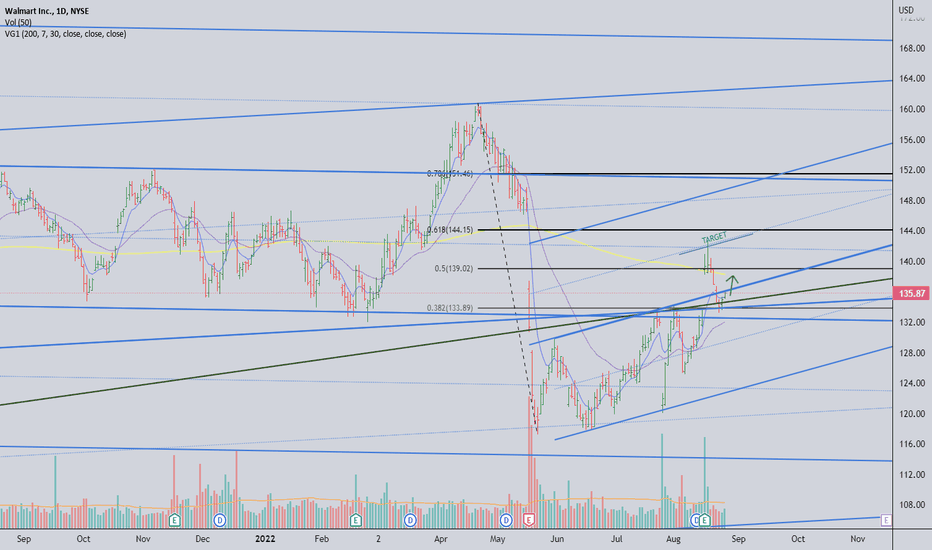

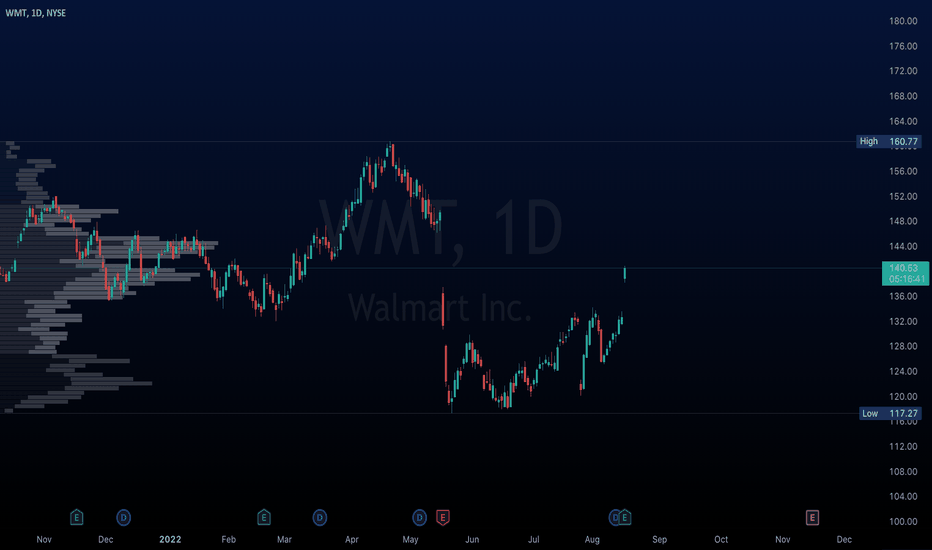

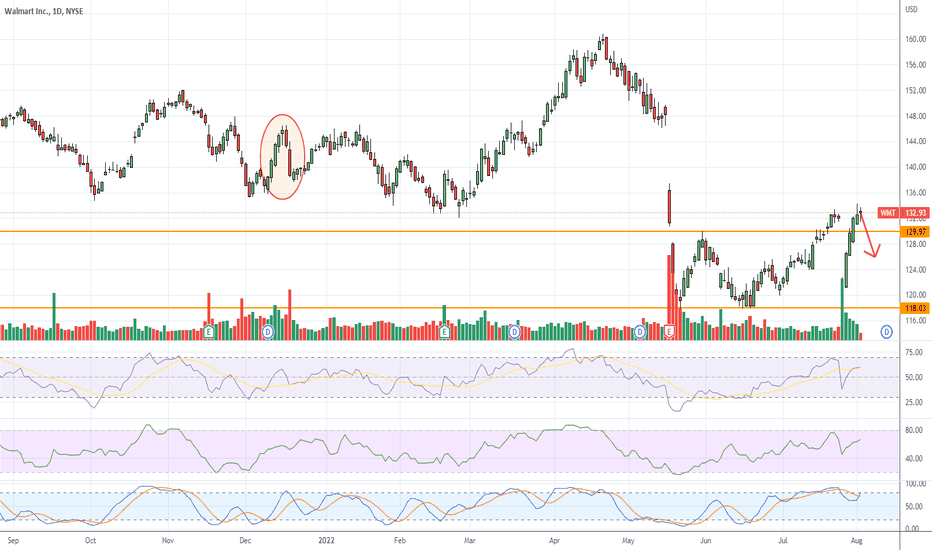

Could WMT be starting its death drop?Here I have market off major zones where price tends to retrace too before a major change of direction. You may also notice the rising wedge headed back that has already started playing itself out. This move will happen over a short period of time. I say this because once enough selling pressure has been established, buyers will fearfully close their longs causing price to move lower which will of course attract more sellers leaving the price only to do one thing...

WMTNasty close to this week unless something unexpected happens between now & the close to push it up $2. The downtrend in this name began in April/May with the false breakout that ended with a sharp decline. Since then it's been in a bear flag that is breaking down this week. Below $130.50 could get ugly imo. Ultimately looking for sub $90s next year. Remember Waltons sold at $140. If they don't want it, I don't want it.

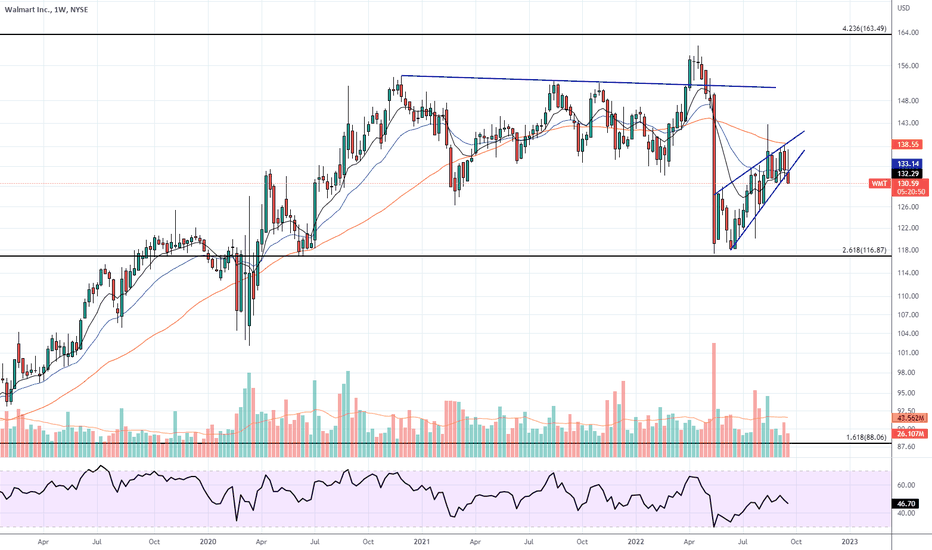

WMT weekly bearish hammer at local high with great volumeWMT weekly bearish hammer at local high, ABC or wave 3 downward doesn't matter at this point. Probably will move stop loss back higher if needed. Pretty confident it goes lower. BE ready to move take profit lower as we go and trend is confirmed. Train your holding muscle.

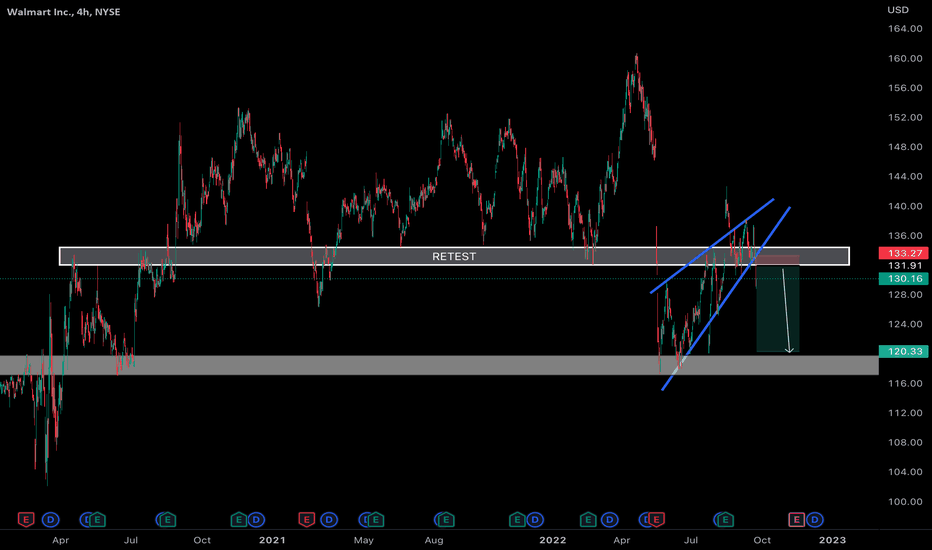

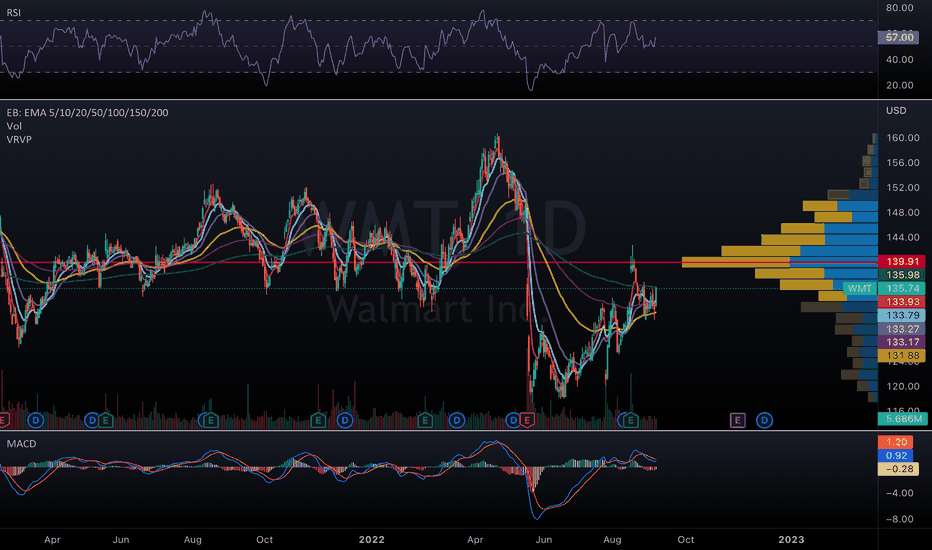

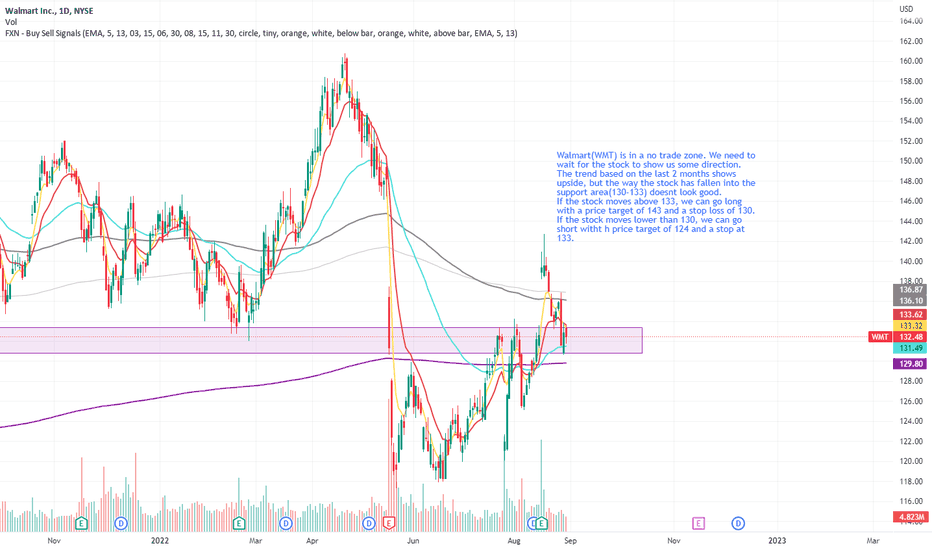

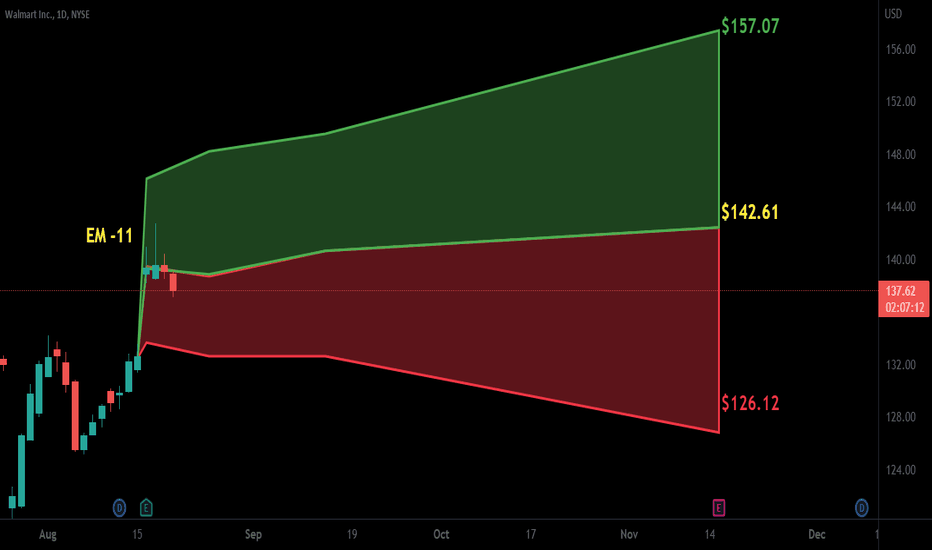

Walmart WMT Trade setup for 31-August-2022 Walmart(WMT) is in a no trade zone. We need to wait for the stock to show us some direction.

The trend based on the last 2 months shows upside, but the way the stock has fallen into the support area(130-133) doesnt look good.

If the stock moves above 133, we can go long with a price target of 143 and a stop loss of 130.

If the stock moves lower than 130, we can go short witht h price target of 124 and a stop at 133.

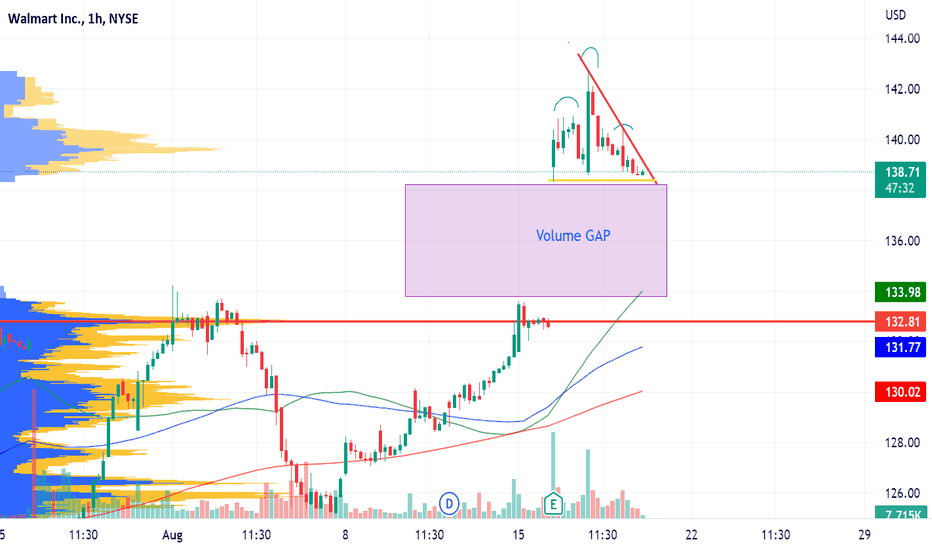

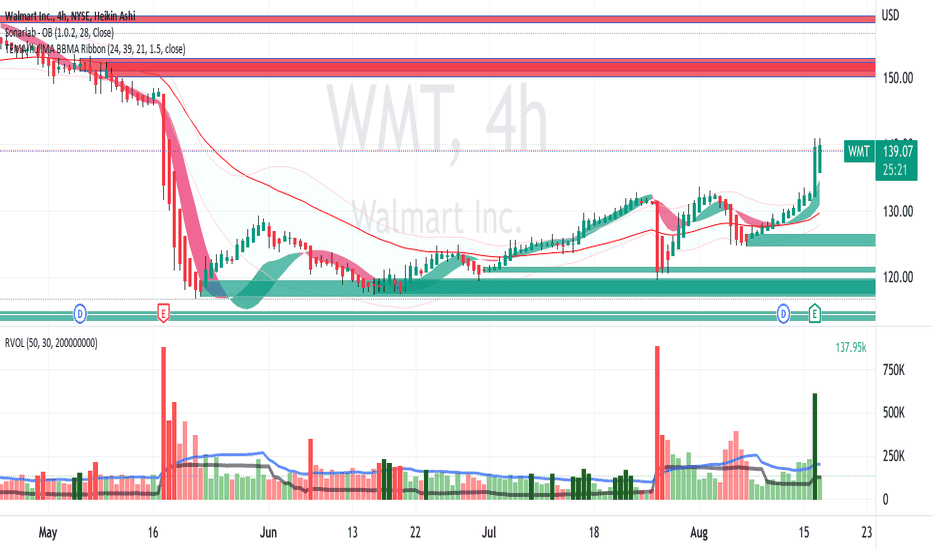

WMT Gap Fill Soon?WMT gapped up after earnings and continued momentum after a couple of other retail earnings beats. It has created quite the gap volume gap below and I think we fill it rather soon. Acting weak relative to the market the past couple days. Volume seems to be dying as uncertainty lingers. WMT in the recent past hasn't reacted bullishly after earnings.

WMT: Post ER Gap FillWMT: Post ER Gap Fill and is leading the market >6% to start the morning session. Price action has developed over KL of 200sma. Intraday opportunities exist as well with the high RVOL for current trading session & relative strength vs indices. On watch for other retail ER that can affect sentiment. Bias: Bullish // ATR: 2.77, Beta: 0.53, IV: 23.62%//

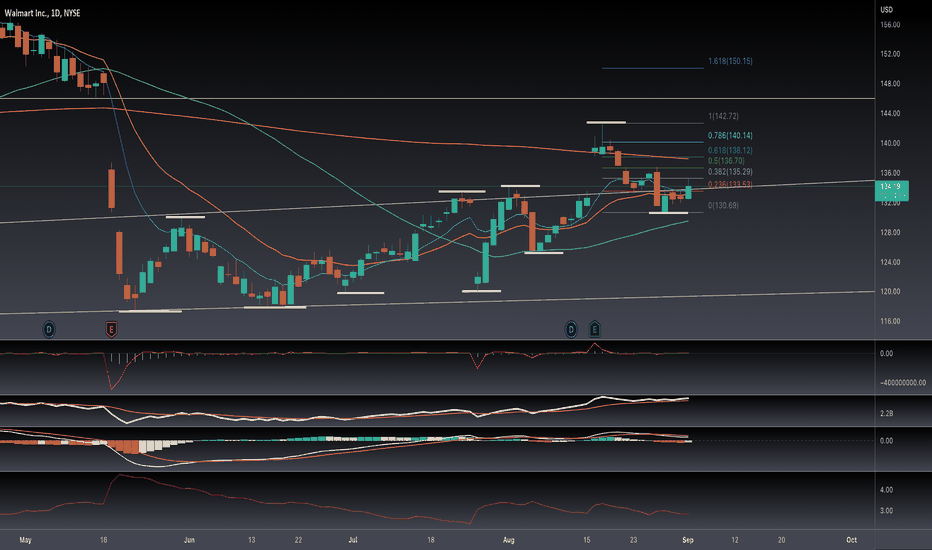

WMT bigger pictureLooks like a typical cup and handle right now. The EA was good, even with this high inflation. If we consider this was really the peak of inflation, the consume will recover then if not we could see another down turn for the retail sector. But even though with high inflation WMT positioned itself in a very good state.

(For example, reducing supplier costs to keep the products as cheap as possible, also they develope the own internet platfomr even more.)

I see a possibility to see the $150+ level again

WMT UpdateProfit warning and now it's higher than where it was before the warning, lol.

I think it's repeating the highlighted pattern, holding puts until EOD Thu, if it doesn't go down by then I'm gonna give up.

Kinda depends on what DJI does since it's a component, but seems a bit strange that DJI and XRT (retail) are down, yet this crap is still green.

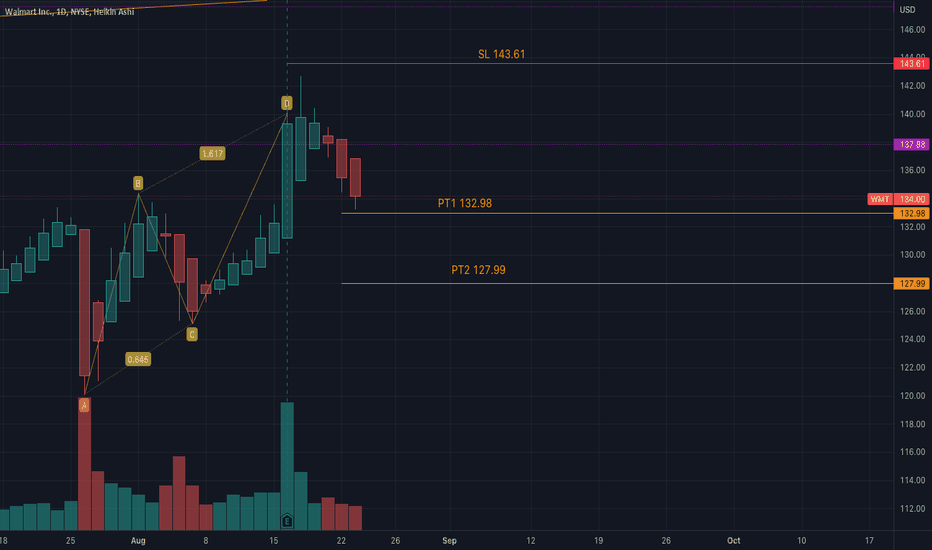

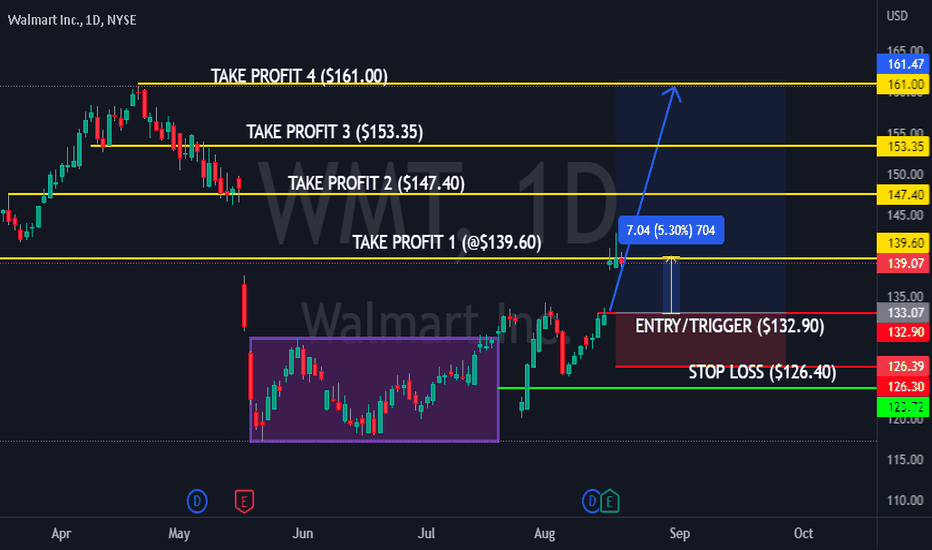

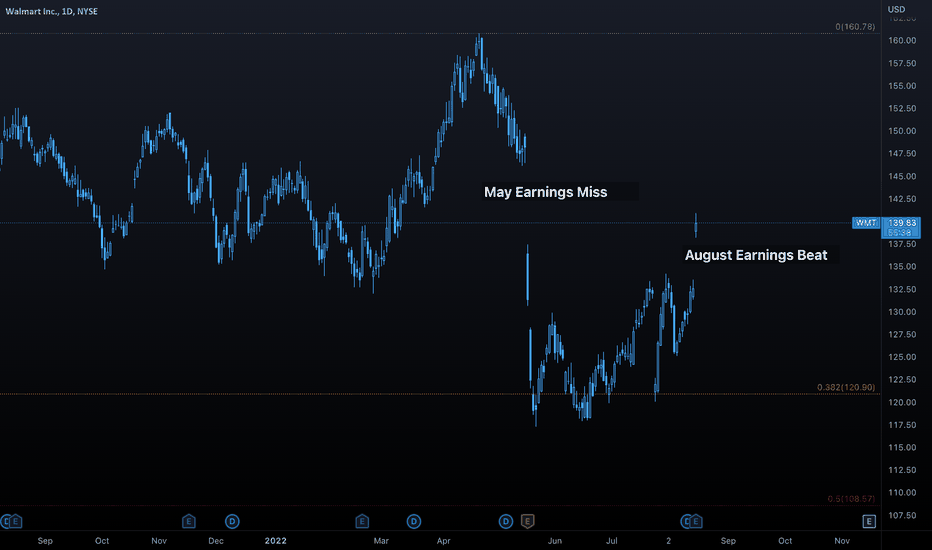

WMT Walmart LONG Swing TradeWMT beat earnings by 10% and has been upgraded for targets as a result.

The chart shows heavy relative volume ( 4X the running average) reacting to the earnings.

WMT has a 10% upside to the resistance of sell order blocks above.

WMT is now set up for a long swing trade with either the stock or call options at

an expiration a bit before the next earnings.

Walmart WMT Beats Earnings - Walmart beats on earnings estimates.

- Technically: price gapped up to begin to close the gap that was create with the profit miss on Earnings in May (Gap started at $147)

- Analysts price targets sit around $145 (median).

- Price got to a high of $140 today.

- From what many are calling a potential bottom for WMT, the stock is up 19%~