Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−3.15 M GBP

8.74 M GBP

317.07 M

About CloudCoCo Group Plc

Sector

Industry

Website

Headquarters

London

Founded

2004

ISIN

GB00B8GRBX01

FIGI

BBG000QMBWN4

CloudCoCo Group Plc provides information technology (IT) and communications solutions. It operates through the following segments: Product, Recurring Services, and Professional Services. The Product segment comprises the resale of solutions such as hardware and software from technology vendors. The Recurring Services segment consists of continuing IT services which have an ongoing billing and support element. The Professional Services segment offers resources to consult, design, install, configure, and integrate IT technologies. The company was founded on October 14, 2004 and is headquartered in Warrington, the United Kingdom.

Related stocks

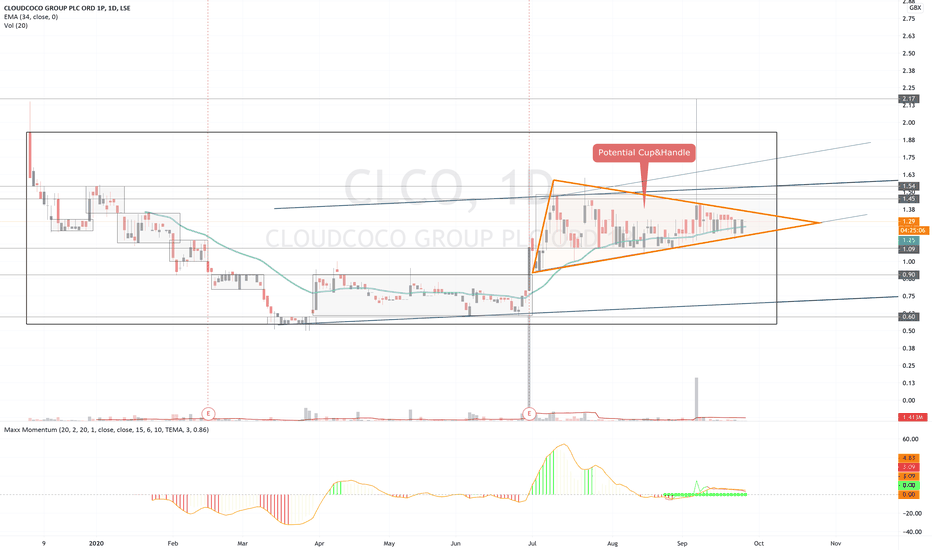

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of CLCO is 0.260 GBX — it has decreased by −8.77% in the past 24 hours. Watch CloudCoCo Group Plc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange CloudCoCo Group Plc stocks are traded under the ticker CLCO.

CLCO stock has fallen by −18.75% compared to the previous week, the month change is a −6.14% fall, over the last year CloudCoCo Group Plc has showed a 50.99% increase.

CLCO reached its all-time high on Nov 15, 2021 with the price of 2.290 GBX, and its all-time low was 0.072 GBX and was reached on Apr 16, 2025. View more price dynamics on CLCO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CLCO stock is 37.39% volatile and has beta coefficient of 5.88. Track CloudCoCo Group Plc stock price on the chart and check out the list of the most volatile stocks — is CloudCoCo Group Plc there?

Today CloudCoCo Group Plc has the market capitalization of 1.84 M, it has increased by 0.00% over the last week.

Yes, you can track CloudCoCo Group Plc financials in yearly and quarterly reports right on TradingView.

CloudCoCo Group Plc is going to release the next earnings report on Feb 23, 2026. Keep track of upcoming events with our Earnings Calendar.

CLCO net income for the last half-year is −788.00 K GBP, while the previous report showed −1.08 M GBP of net income which accounts for 27.10% change. Track more CloudCoCo Group Plc financial stats to get the full picture.

No, CLCO doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 7, 2025, the company has 82 employees. See our rating of the largest employees — is CloudCoCo Group Plc on this list?

Like other stocks, CLCO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CloudCoCo Group Plc stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CloudCoCo Group Plc technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CloudCoCo Group Plc stock shows the neutral signal. See more of CloudCoCo Group Plc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.