Eurasia Mining: A Strategic Opportunity in Precious MetalsExpanding Market Presence with Dual Listing

Eurasia Mining PLC (LON:EUA), a London-based mining company, has established itself in the exploration and production of platinum group metals (PGMs) and gold, recently expanding its reach through a dual listing on the Astana International Exchange (AIX) in Kazakhstan. The accomplishment was achieved in this year's July, builds on its long-standing presence on the London Stock Exchange's Alternative Investment Market (AIM), where it has been listed since 1996. The AIX listing, finalized with the appointment of SQIF Capital as market maker, enhances liquidity and broadens access, particularly in emerging markets. With no new shares issued, the shares remain fully fungible between London and AIX, ensuring seamless trading. Eurasia is capitalizing on growing global demand for critical minerals, driven by automotive and renewable energy sectors.

Diversified Portfolio of Critical Metals

The company’s asset portfolio centers on PGMs - iridium, osmium, palladium OANDA:XPDUSD , platinum OANDA:XPTUSD , rhodium LSE:XRH0 , and ruthenium—alongside gold TVC:GOLD , copper CAPITALCOM:COPPER , and nickel $CAPITALCOM:NICKEL. These metals are integral to technologies like catalytic converters and hydrogen fuel cells, which benefit from tightening emissions regulations and the expanding hydrogen economy. Eurasia’s operations emphasize cost efficiency, with open-pit mining techniques that reduce expenses compared to traditional underground methods. For instance, production costs at its key sites are among the lowest in the PGM sector, approximately $300 per ounce, due to streamlined processes that avoid costly drilling and blasting.

Key Projects Driving Growth

One notable project in Eurasia’s portfolio - the Tylai-Kosvinskoye deposit. It’s one of the world’s largest alluvial PGM and gold reserves. With over 11 tons of PGMs and gold currently estimated, and total resources exceeding 20 tons under JORC standards, this group of 12 assets has seen substantial progress. In 2025, five of these sites entered commercial production, supported by five operational processing plants, with a sixth slated for launch in the second half of the year. Eurasia is capable of scaling up its operations, backed by existing infrastructure such as roads, power lines, and maintenance facilities, which minimizes the need for large-scale capital investment.

Advancing the "Monchetundra" Project

Another crucial component is the so called "Monchetundra" project, a cluster of licenses hosting approximately 60 tons of PGMs and gold, plus 258,000 tons of copper and 390,000 tons of nickel. A contract with Sinosteel for a turnkey processing plant, expected to be completed within two years, also signals further growth potential. These metals are critical for electric vehicle batteries and renewable energy applications, align with global trends toward decarbonization. Eurasia’s diversified portfolio, spanning PGMs, gold, and battery metals, positions it to benefit from both traditional and emerging demand drivers.

Strong Financial and Institutional Support

The company’s financial strategy supports its operational ambitions. In March 2025, Eurasia raised £3.2 million through a private placement of 72 million shares to U.S. and U.K. institutional investors at 4.37 pence per share, reinforcing its capital base. Institutional ownership now accounts for 58% of Eurasia’s shares, a signal of confidence from major investors like BlackRock, often viewed as a marker of asset reliability. The funds are earmarked for maintaining the London listing and supporting the AIX launch, enhancing marketability without diluting existing shareholders. As of August, Eurasia’s market capitalization stands at approximately £140 million, with 80.51% of its stock in free float, reflecting strong liquidity.

Experienced Management and Strategic Partnerships

Eurasia’s management team brings extensive experience in mining, with a track record of advancing projects from exploration to production. Strategic partnerships, such as with Sinosteel, and government-backed incentives like tax breaks and loan subsidies, strengthens the company’s outlook. For example, the Monchetundra project has already received 70% of its required capital investment, reducing future funding needs and accelerating development timelines.

Navigating Market Opportunities and Risks

Market dynamics further enhance Eurasia’s appeal. The PGM market is buoyed by robust demand, particularly for palladium and platinum in automotive catalytic converters and hydrogen technologies. Gold prices, a key component of Eurasia’s portfolio, continue their upward trajectory. Analysts project Eurasia’s share price could range from £0.03 to £0.06 in 2025, potentially reaching £0.08 to £0.15 by 2030, driven by production growth and market trends. However, risks remain. Including commodity price volatility, potential technological shifts reducing PGM demand, and the need for additional financing, which could lead to dilution.

Positioning for Global Investor Access

Eurasia’s dual listing on AIX opens access to a broader investor base, particularly in Central Asia and the Global South, where interest in critical minerals is rising. The company's focus on transparency, backed up by regular updates and resource estimates in line with JORC, should strengthen investor trust. Investors are advised to conduct thorough research, considering both the growth potential and inherent risks of the mining sector, as Eurasia continues to develop its assets and navigate global market trends.

EUA trade ideas

Eurasia Mining - Exploring the Potential in the Stock MarketEurasia Mining - Exploring the Potential in the Stock Market: A Guide for Investors

Eurasia Mining: Navigating the Mines of Stock Market Investment

In the dynamic world of finance, the stock market stands as a beacon of potential returns, enticing investors with the promise of wealth. However, amidst this allure lies a labyrinth of risks, making informed decisions crucial for success. Eurasia Mining (EUA.L) stands as one such investment opportunity, presenting a unique set of factors that demand careful consideration.

Assessing the Buy or Sell Rating

When evaluating Eurasia Mining, a balanced approach is essential. While the company holds promising assets and a strategic focus on exploration and development, its recent financial performance and volatile market conditions warrant a cautious approach. As such, a neutral buy rating is assigned to Eurasia Mining, indicating the possibility of both gains and losses.

Stock Rating

Evaluating Investment Suitability (Neutral - Buy)

Delving deeper into the investment suitability of Eurasia Mining, it's crucial to consider risk tolerance and investment goals. Individuals with a high-risk appetite and a long-term investment horizon may find Eurasia Mining's potential growth prospects appealing. However, those with a conservative risk profile or short-term investment objectives may find the stock's volatile nature and potential for losses unappealing.

Leveraging Call Options for Profit Potential

Call options, a type of derivative instrument, offer a unique strategy for mitigating risk and potentially amplifying profits. By purchasing call options with a 1-12 month expiry, investors can speculate on the future direction of Eurasia Mining's stock price. If the stock price rises above the strike price of the option, the investor can exercise the option and purchase the shares at a predetermined price, generating a profit from the difference. Conversely, if the stock price declines, the option will expire worthless, limiting the investor's losses to the premium paid for the option.

Conclusion: A Calculated Approach

Investing in Eurasia Mining requires a calculated approach, balancing the potential rewards against the inherent risks. While the company holds promising prospects, its volatile nature and recent financial performance demand cautious consideration. For investors with a high-risk appetite and a long-term investment horizon, exploring call options with a 1-12 month expiry can provide a strategic means to potentially amplify profits while mitigating risk. Ultimately, the decision to invest in Eurasia Mining lies with individual investors, guided by their risk tolerance, investment goals, and thorough understanding of the company's prospects.

Risk Warning: Trading is Not for Everyone

It's essential to emphasize that trading stocks and options carries inherent risks. Market volatility, unpredictable events, and human error can lead to significant losses. Therefore, it's crucial to undertake thorough research, understand the underlying risks, and only invest funds that can be comfortably afforded to lose.

Risk Warning

Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses.

Rating: NEUTRAL - BUY

Risk Disclaimer!

The article and the data is for general information use only, not advice!

Eurasia Mining UK Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

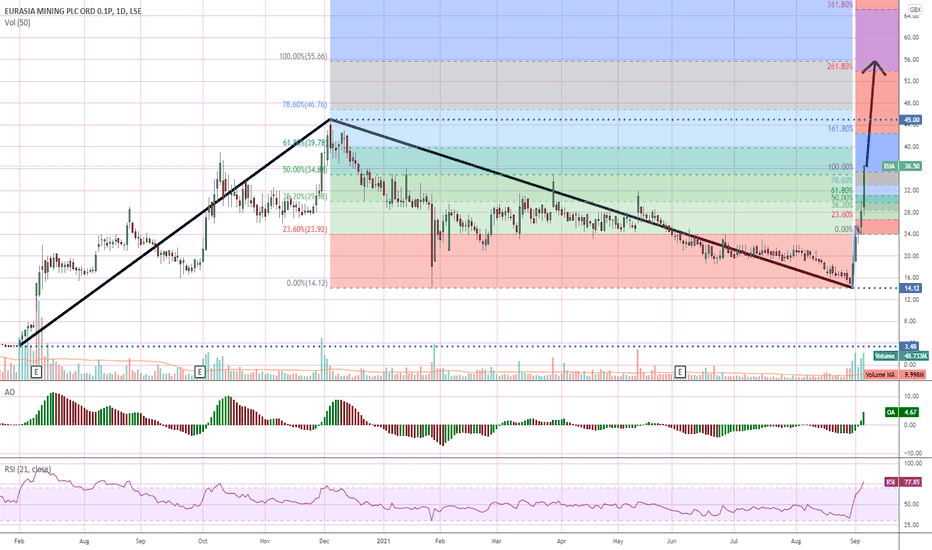

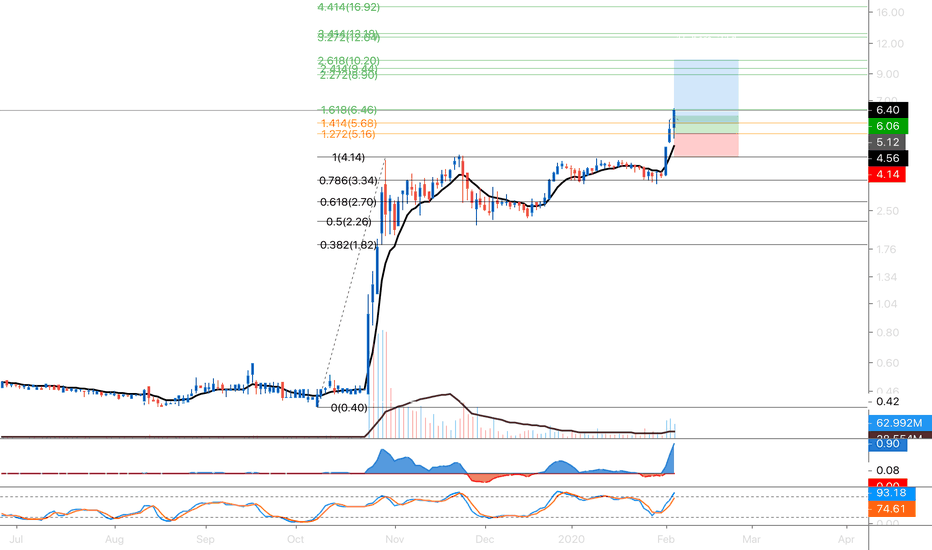

Forward trend Fib Analysis - can 100% gain be repeated.Long term forward Fibonacci trend analysis based on the rise from 3.5p and the retracement from intraday ATH 45p down to 14p floor.

Similar analysis on a bull flag that recently emerged 14 > 25.5 > 23 has so far yielded 100% on the fib scale.

Awesome Oscillator and vanilla RSI showing that this rally has some longer legs and has momentum to continue.

If the long term trend follows the shorter term bull flag scenario, 100% fib gives a target of 55.66p

Not investment advice - always do your own research.

Thanks for reading. I welcome your thoughts.

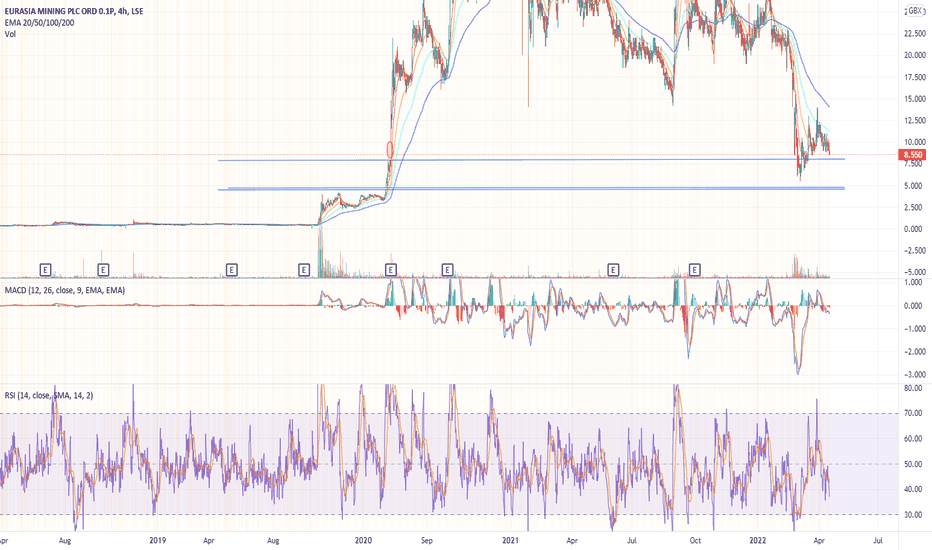

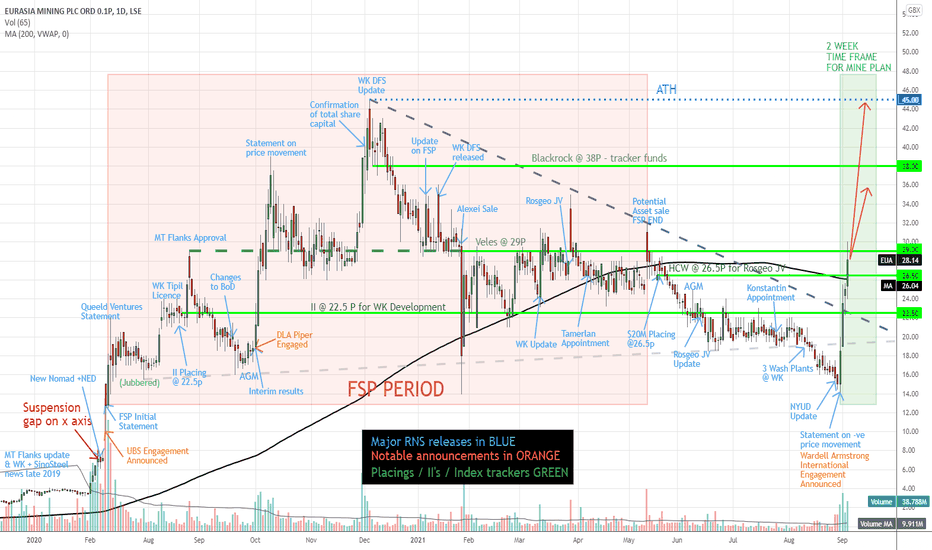

Is EUA poised to bounce on the PGM/battery-metals super cycleA huge amount of news, operational progress and institutional buying into EUA over the last 12 months has been coiled up into a highly depressed share price. The chart analysis details the dates and summary all of the announcements and the effect they have had on trading patterns, volume and prevailing SP. The bottom was reached at 15p on 1st September 2021 but has been on a near vertical rise back to early II placing prices since. Significantly, it is back to a level above a recent private placing worth $20m at 26.5p

Hints of a super cycle forming in PGM group and battery metals has dovetailed with EUA's positive turnaround. Platinum, Palladium and Rhodium are all in EUAs basket and showing positive sentiment. Outages in other PGM producing hotspots and the anticipation of exponential demand for green technology are leading to a potential global supply squeeze situation. The wider market fundamentals are very supportive from lots of angles. A perfect storm one might conclude - augmented by EUA's well documented plan to sell off some assets and/or enter long term JV's with partner industries.

The recent rise from 1st September has lead to both the 200 day VWAP MA (black curve) and the descending wedge line (purple dashed line established 3rd December) being breached with significant momentum. The money flow and increased volume point towards this rally having further to run and that it has justified market support behind it.

Is a further re-rate is on the cards? Quite likely IMO the question is at what level does it top out..... mid 30's, closer to the ATH of 45p or beyond?

I welcome the Trading View communities thoughts on this from a technical perspective - especially someone with Fib retracement skills.

Thanks for reading.

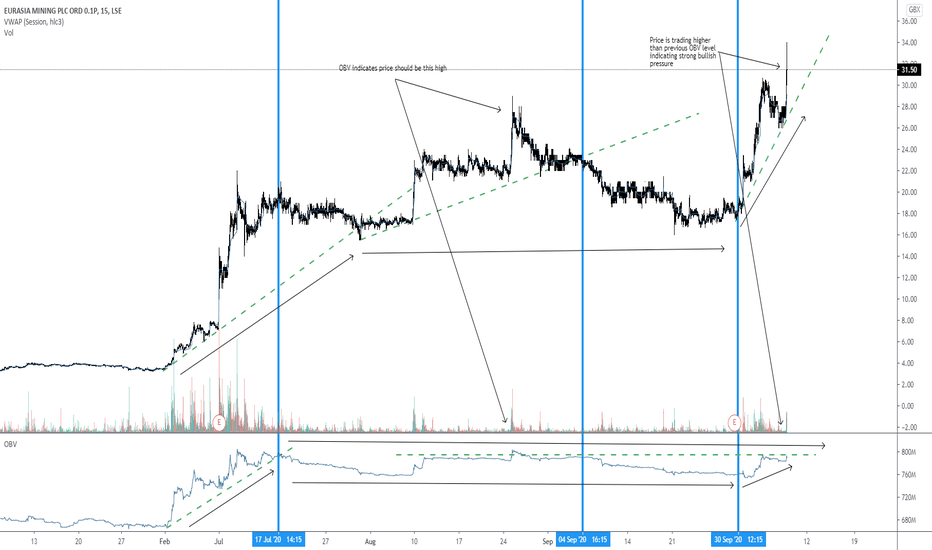

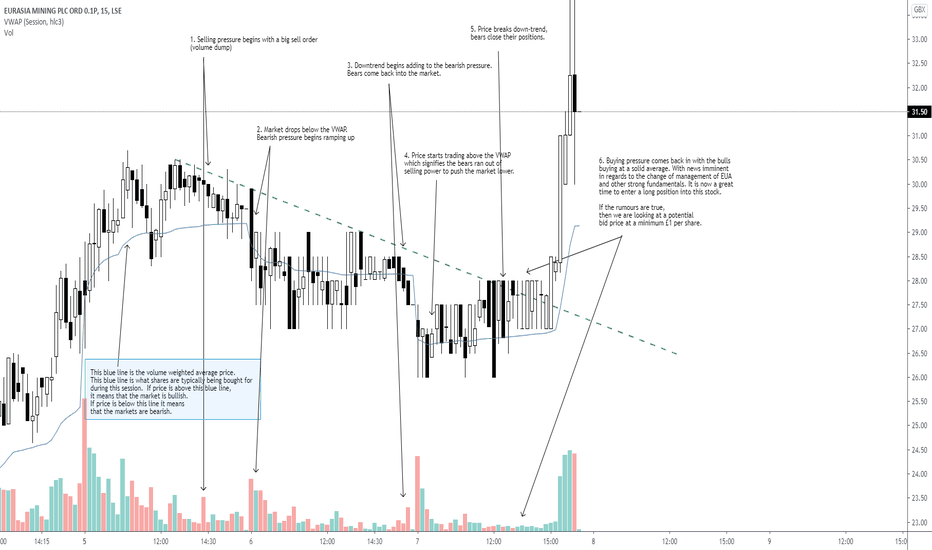

Time to go long on Eurasia Mining Company PLC.Now is a great opportunity to enter a long position into EURASIA MINING COMPANY PLC (EUA).

I have been in this company since January at 3p per share with an average share price of 18p per share.

I see nothing now but a green light to really ramp up on my long positions.

The company is currently under negotiations in a possible buy out with suspicions of a bid per share of 75p being declined. The deal is suspected to be in the final stages.

Level 2 data suggests that the current price action and volume is ahead of a possible news announcement or leak with over 1,689,984 shares exchanged in the last hour of trading.

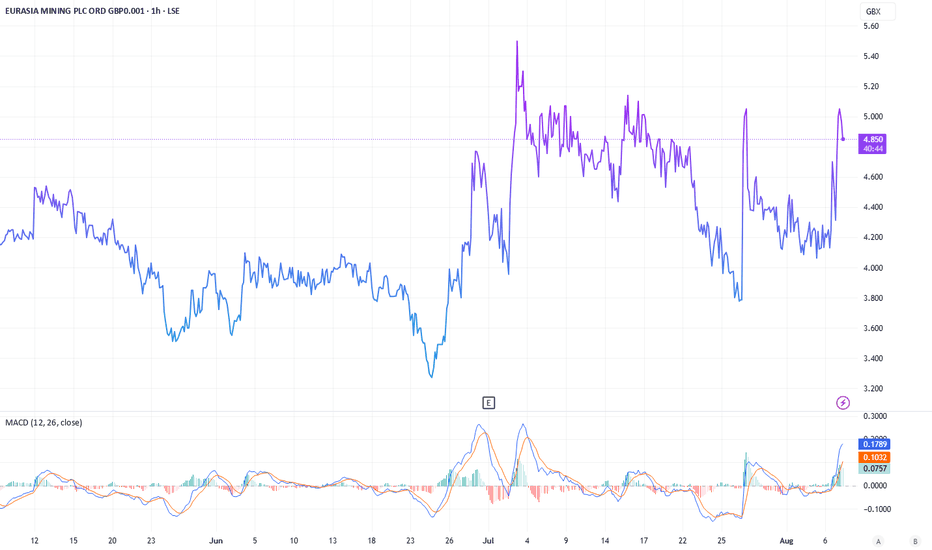

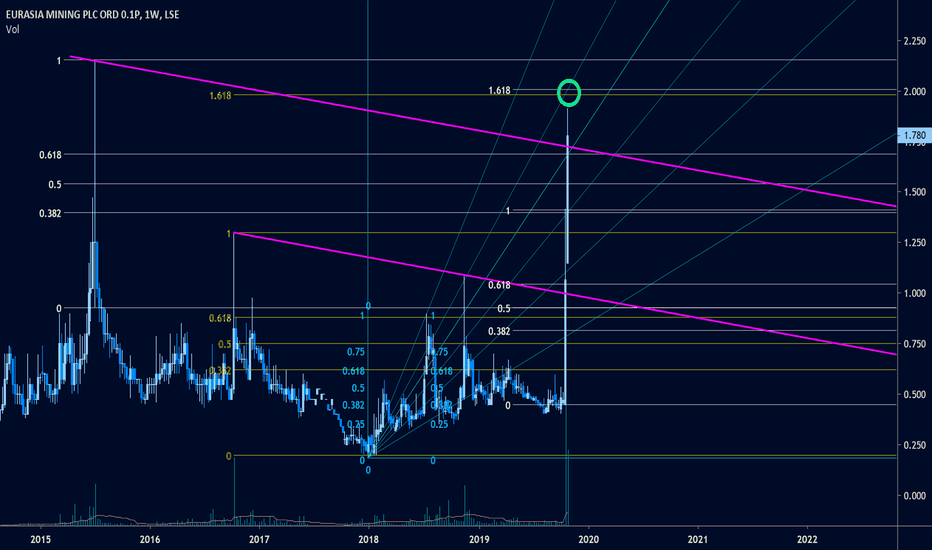

200% spike on 14x average volume!Eurasia Mining has spiked over 200% on almost 14x average volume. This is a huge move with a lot of momentum behind it. That being said, there is likely a lot of profit taking to come.

The market has strong potential resistance at 1980-2005. Will it be strong enough to trigger a reversal? Maybe. It is the confluence of two 1.618 Fibonacci projections. If the market reaches that level this week, as it is close to doing, it will also coincide with a 0.75 Speed fan trend line. This stock has a history of being spikey. Watch out, it can fall through the floor very quickly.

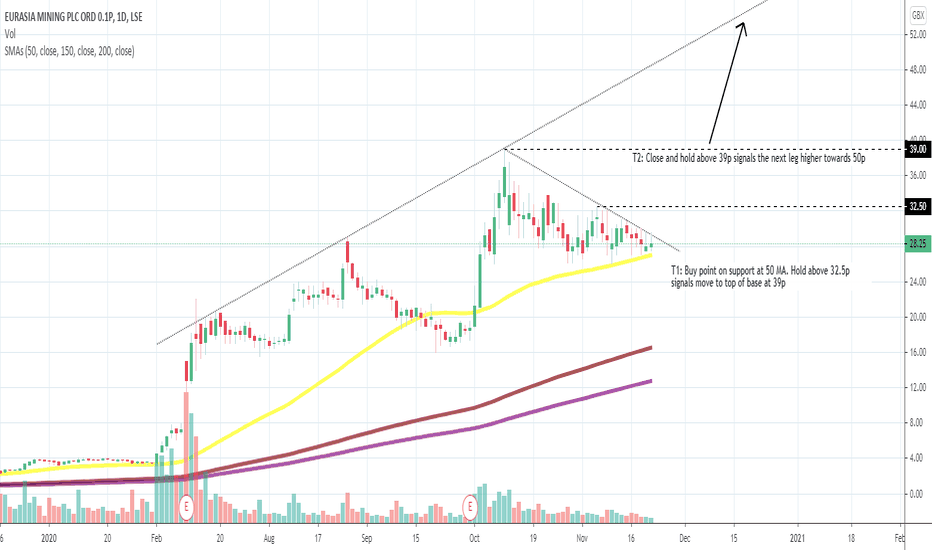

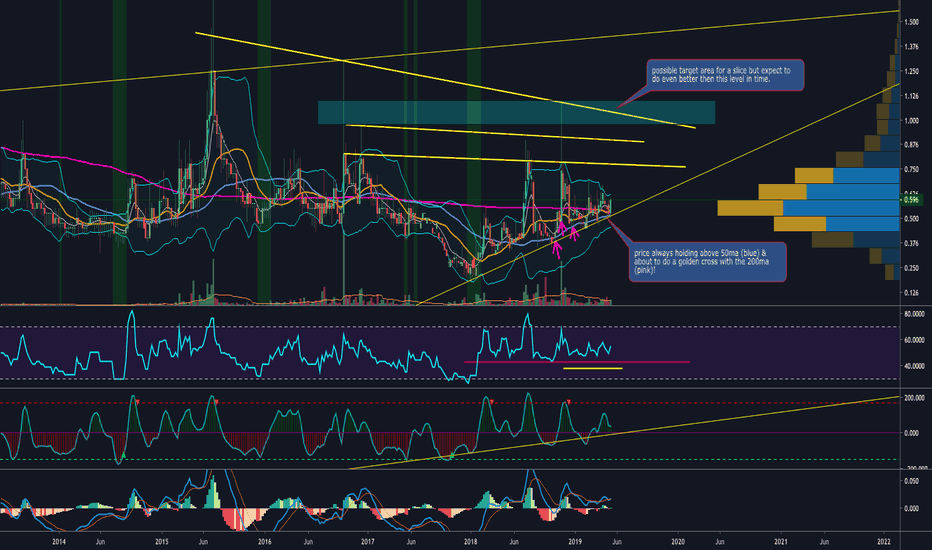

Holding 50ma - Bullish trend - 1p-1.50p target - Golden cross!Golden cross incoming.

Amazing results & increase of revenue.

Outlook very promising

BoD massive skin in the game

Palladium, Platinum & Gold mining operation.

1p-1.5p 1st target (Expect more in time as company ramps production)

50ma holding very well

Just to become... the largest alluvial platinum globally (from RNS)! Nobody says that lightly!