Ferro-Alloy and Eurasia Mining:High-Potential Mining InvestmentsIn the volatile world of mining, where geopolitical risks and market fluctuations often overshadow opportunities, two companies stand out for their potential to deliver significant returns: Ferro-Alloy Resources and Eurasia Mining. Both are focused on critical minerals-vanadium and platinum group metals (PGMs), respectively-that are essential for the global energy transition. With ambitious projects, strong financial backing, and strategic positioning in emerging markets, they offer investors a unique chance to capitalize on the growing demand for these resources. However, their path to success is fraught with challenges, including regulatory hurdles and operational risks. I suggest exploring the investment potential of these companies, including their strengths, opportunities, and risks, of course. Because where can we step without potential risks today?

Ferro-Alloy Resources: A Rising Star in Vanadium

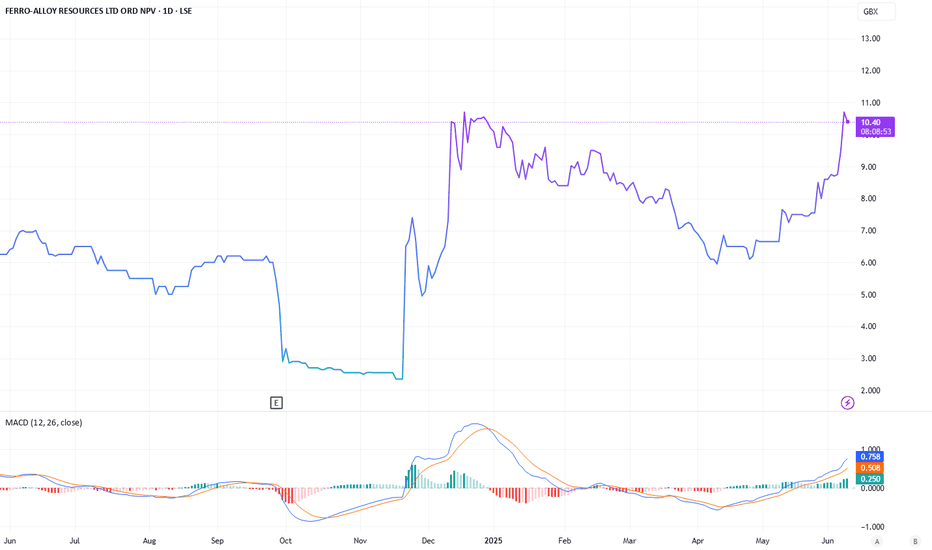

Ferro-Alloy Resources (FERRO-LSE:FAR), dual-listed on the London Stock Exchange (LSE) and the Astana International Exchange (AIX), is developing the Balasausqandiq vanadium deposit in Southern Kazakhstan. With a market capitalization of $66 million and net debt of $13 million, Ferro-Alloy is well-positioned to benefit from the rising demand for vanadium, which is used in energy storage and steel production.

The Balasausqandiq project is unique due to its potential for the lowest cash-cost vanadium production in the industry. A phased development plan, supported by a robust financial model, promises an impressive internal rate of return (IRR) of 30%. This high return is driven by low operating costs and vanadium’s strategic importance to the renewable energy transition. Specifically, vanadium redox flow batteries (VRFBs) are expected to see exponential growth as large-scale energy storage becomes critical for integrating wind and solar power.

The company’s shareholder base includes Vision Blue Resources with a 22.9% stake, providing capital and strategic guidance from industry veterans. Leadership, including CEO Nicholas Bridgen, brings decades of experience in mining and finance. However, the project’s location in Kazakhstan, while relatively geopolitically stable, carries risks of regulatory changes and infrastructure development. Additionally, reliance on external financing could expose the company to market volatility.

Nevertheless, Ferro-Alloy’s potential is clear. As vanadium demand is likely to outstrip supply by 2030, the Balasausqandiq project could position the company as a key player in the global market. For investors willing to embrace the risks, Ferro-Alloy offers an attractive opportunity to invest in a critical mineral with a bright future.

Eurasia Mining: A Future Leader in PGM Extraction

Eurasia Mining LSE:EUA , listed on London’s AIM market, focuses on a portfolio of PGM and nickel projects in the Arctic region. With a market capitalization of around $100 million, the company has garnered attention for its plans to revive the Monchetundra and NKT projects, which together hold over 184.6 million ounces of platinum equivalent.

The company’s strategy has shifted toward selling these assets - a process initiated in 2020. Recent geopolitical developments have rekindled interest in Eurasia’s projects. According to Oak Securities , the target price for the company’s shares is six times the current level, reflecting their immense potential.

The flagship NKT project is a Tier-1 nickel sulfide deposit with a net present value (NPV) ranging from $1.2 to $1.7 billion (per a 2021 report). The project benefits from proximity to a major processing plant, reducing capital expenditures. Additionally, the West Kytlim project in the Urals is already operational and generating cash flow.

However, investing in Eurasia Mining comes with risks. The company’s assets are located in a region with geopolitical challenges. Despite signs of potential collaboration on critical minerals, the situation remains unstable. Potential regulatory changes, international trade restrictions, or political upheavals could derail the company’s plans. Price volatility in commodities and operational complexities also pose challenges.

Despite these hurdles, Eurasia’s growth potential is pretty promising. A dual listing on the AIX in Kazakhstan opens access to investors from various regions, potentially boosting liquidity and valuation. For investors with a high risk tolerance, Eurasia Mining offers a rare opportunity to tap into the PGM and nickel markets.

Balancing Risks and Opportunities

Both Ferro-Alloy Resources and Eurasia Mining present compelling investment prospects, but with several notable risks, of course. Ferro-Alloy’s success hinges on widespread VRFB adoption, while Eurasia Mining must navigate Russia’s geopolitical challenges. For people, whose attention has been caught by these companies, the key to success lies in understanding these risks and balancing them against potential rewards. Diversification, thorough analysis, and a long-term perspective are essential when investing in mining companies, especially in emerging markets. But for those, willing to take the leap, these companies may offer unique opportunities in the critical minerals sector.

FAR trade ideas

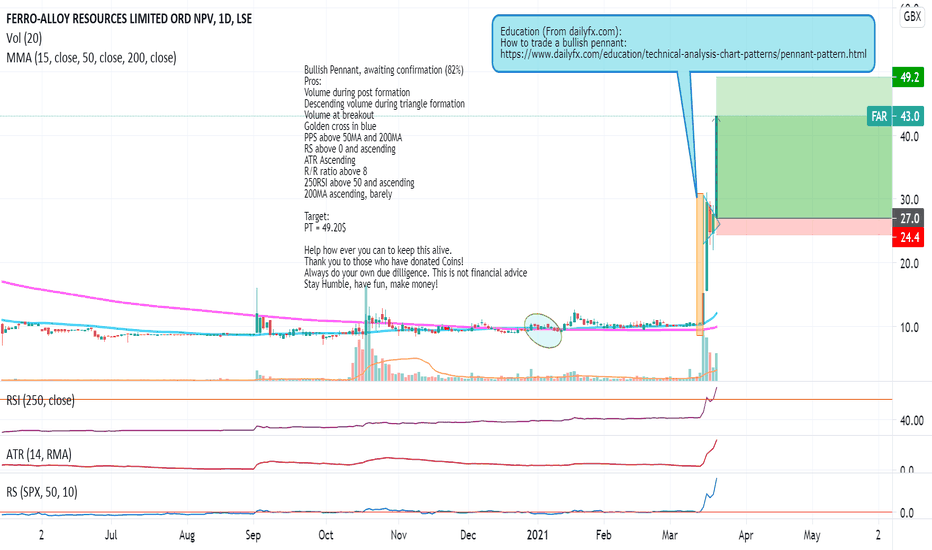

FAR.GB: Bullish Pennant, awaiting confirmation (82%)Bullish Pennant, awaiting confirmation (82%)

Pros:

Volume during post formation

Descending volume during triangle formation

Volume at breakout

Golden cross in blue

PPS above 50MA and 200MA

RS above 0 and ascending

ATR Ascending

R/R ratio above 8

250RSI above 50 and ascending

200MA ascending, barely

Target:

PT = 49.20$

Help how ever you can to keep this alive.

Thank you to those who have donated Coins!

Always do your own due dilligence. This is not financial advice

Stay Humble, have fun, make money!

Education:

www.dailyfx.com