Key stats

About Leverage Shares 3x Square ETP

Home page

Inception date

Dec 5, 2017

Replication method

Physical

Dividend treatment

Capitalizes

ISIN

XS2675718139

The objective of the ETP Securities is to provide 3 times the value of the daily performance of the Square, Inc. equity security, net of fees and expenses

Related funds

Classification

What's in the fund

Exposure type

Commercial Services

Stock breakdown by region

Top 10 holdings

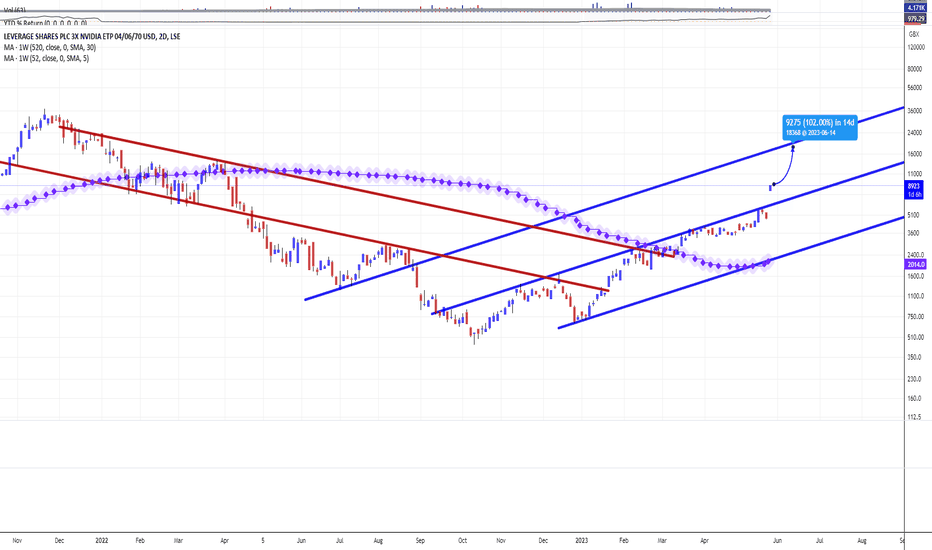

#3NVD Leveraged 3x Long with Nvidia Corporation StocksAll the World chipmakers are on the rush this night, due to Nvidia ( NASDAQ:NVDA ) Q1'23 Earnings Report.

LSE:3NVD is the Leverage Shares 3x Nvidia ETP Securities that seeks to track the iSTOXX Leveraged 3x Nvidia Index, which is designed to provide 3x the daily return of Nvidia stock, adjus

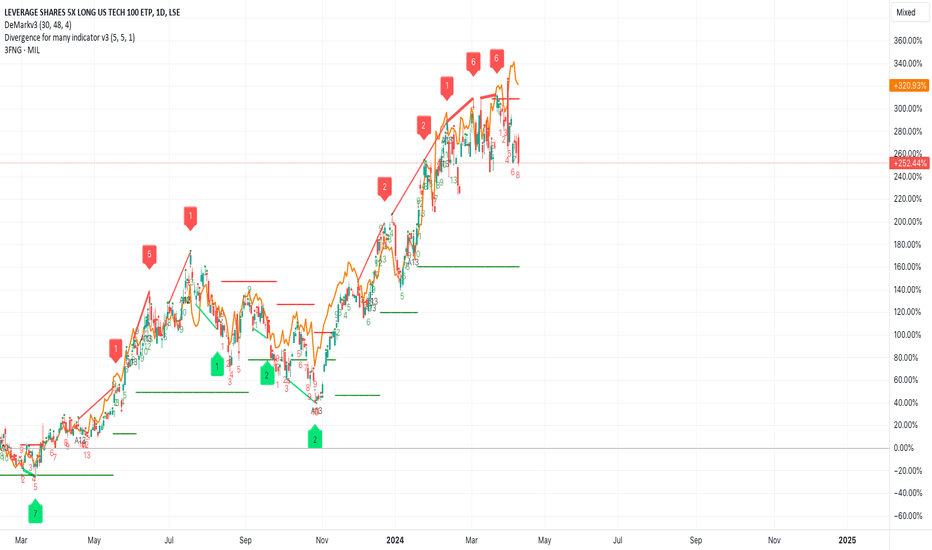

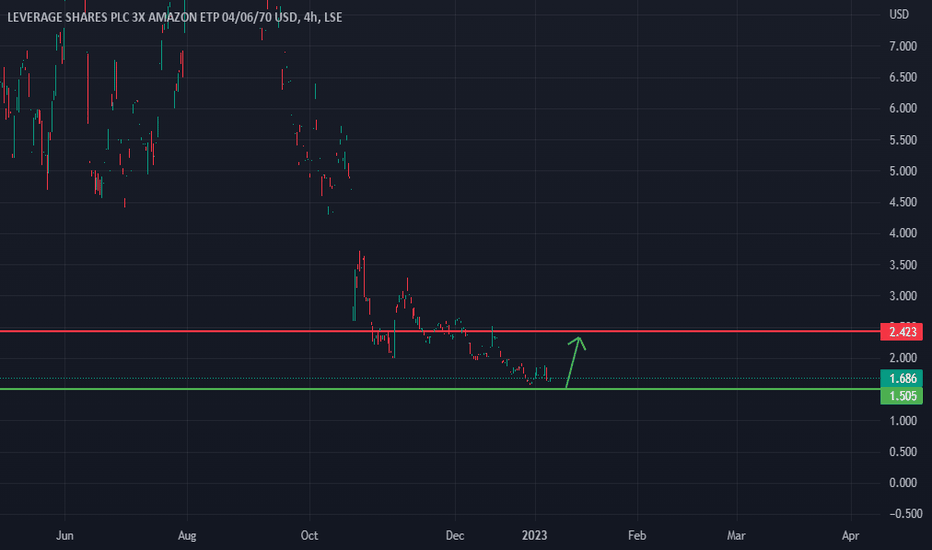

Amazon 3x Shares, Long OpportunityHi Traders, I hope you're all killing it in the markets, I'm looking at a potential long opportunity here on AMZ3. I am looking to capitalise on a what I believe to be a probable support area at the 1.5 significant number. This not purely a TA based trade, I have looked at Amazon from a fundamental

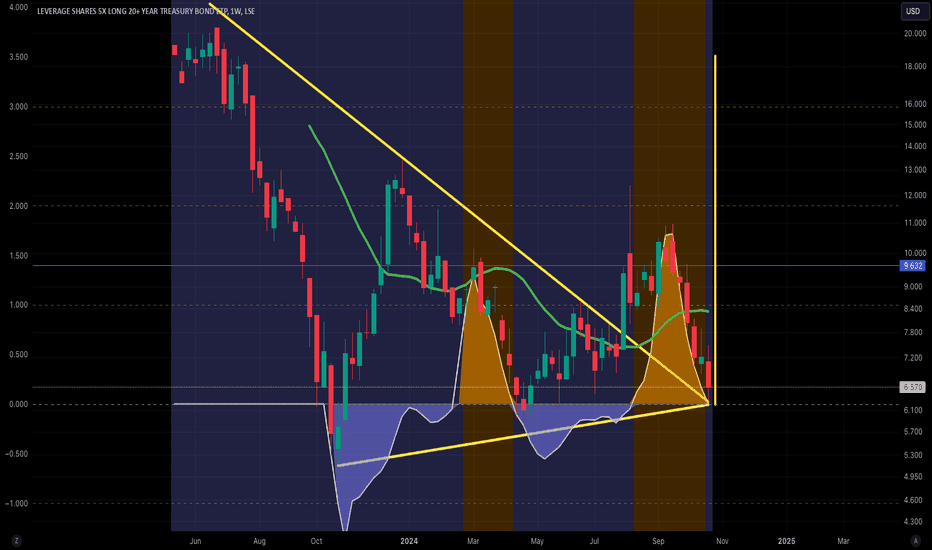

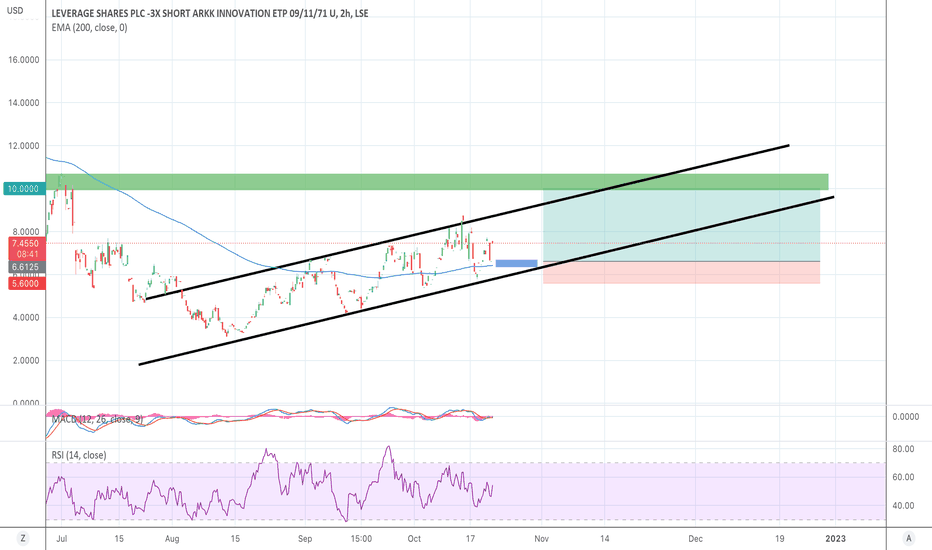

-3x Short ARKK ETP -> Santa Claus RallyGet on the sled of Santa Claus for your end of year rally. Take a look at Cathie Wood her picks in the ARKK ETF one more time and decide for yourself.

SARK has made some gains the past weeks, but now it's time to leverage this baby.

Buy in: 6.4 - 6.7

Target: 10.00

Stop-loss: 5.5

Not financial

I wish this fund would be made available on a US exchange.AAP3 is an absolutely wonderful investment opportunity. I just can't get in on it because I live in the US. Hopefully, this fund will be expanded to the US market. Those who live in the UK have a marvelous chance to make some very serious gains.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

SQ3 trades at 5.06 USD today, its price has fallen −1.55% in the past 24 hours. Track more dynamics on SQ3 price chart.

SQ3 net asset value is 5.18 today — it's risen 28.12% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

SQ3 assets under management is 871.22 K USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

SQ3 price has risen by 23.30% over the last month, and its yearly performance shows a −73.87% decrease. See more dynamics on SQ3 price chart.

NAV returns, another gauge of an ETF dynamics, showed a −23.72% decrease in three-month performance and has decreased by −74.65% in a year.

NAV returns, another gauge of an ETF dynamics, showed a −23.72% decrease in three-month performance and has decreased by −74.65% in a year.

SQ3 fund flows account for 390.26 K USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

SQ3 invests in stocks. See more details in our Analysis section.

SQ3 expense ratio is 3.78%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

Yes, SQ3 is a leveraged ETF, meaning it uses borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, SQ3 technical analysis shows the neutral rating and its 1-week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SQ3 shows the sell signal. See more of SQ3 technicals for a more comprehensive analysis.

Today, SQ3 technical analysis shows the neutral rating and its 1-week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SQ3 shows the sell signal. See more of SQ3 technicals for a more comprehensive analysis.

No, SQ3 doesn't pay dividends to its holders.

SQ3 trades at a premium (0.46%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

SQ3 shares are issued by Leverage Shares LLC

SQ3 follows the iSTOXX Leveraged 3X SQ (USD)(NR). ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Dec 5, 2017.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.