0.20 USD

280.53 M USD

12.12 B USD

About STEEL AUTHORITY OF INDIA

Sector

Industry

Website

Headquarters

New Delhi

Founded

1954

FIGI

BBG000GB2442

Steel Authority of India Ltd. engages in the manufacture and sale of steel and steel products. It offers flat products such as hot rolled coils, hot rolled plates, cold rolled coils, pipes, and electrical sheets, and long products such as thermo mechanical bars and wire rods. The firm operates through the following segments: BSP, DSP, RSP, BSL, ISP, ASP, SSP, VISL, and Others. The company was founded on January 19, 1954 and is headquartered in New Delhi, India.

Related stocks

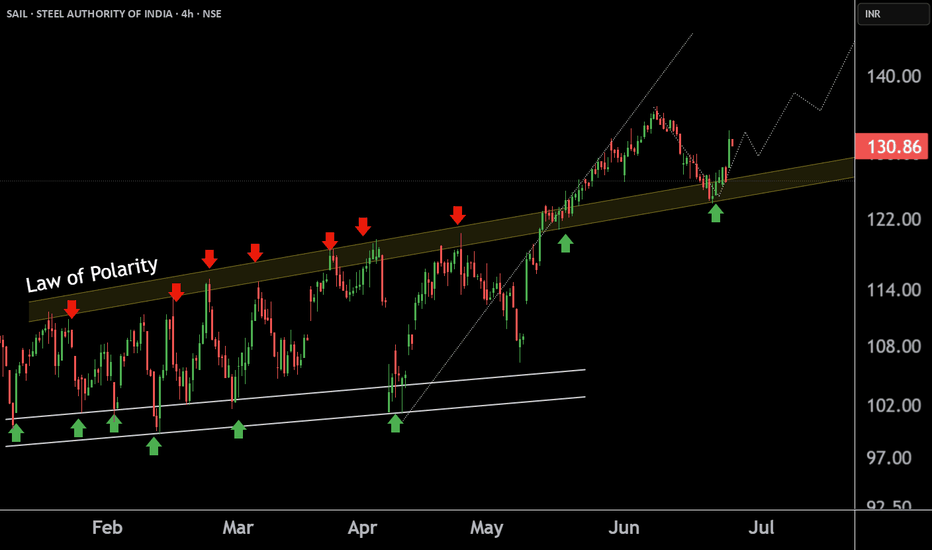

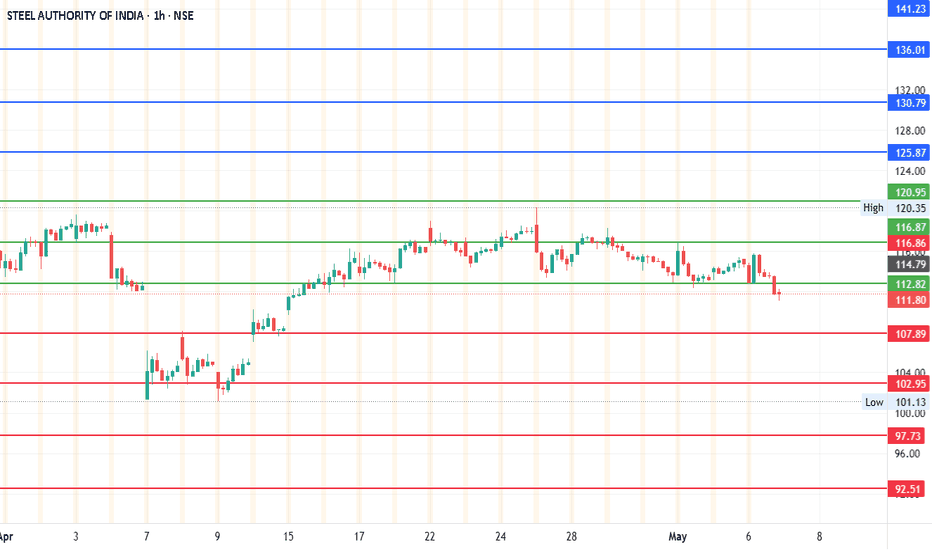

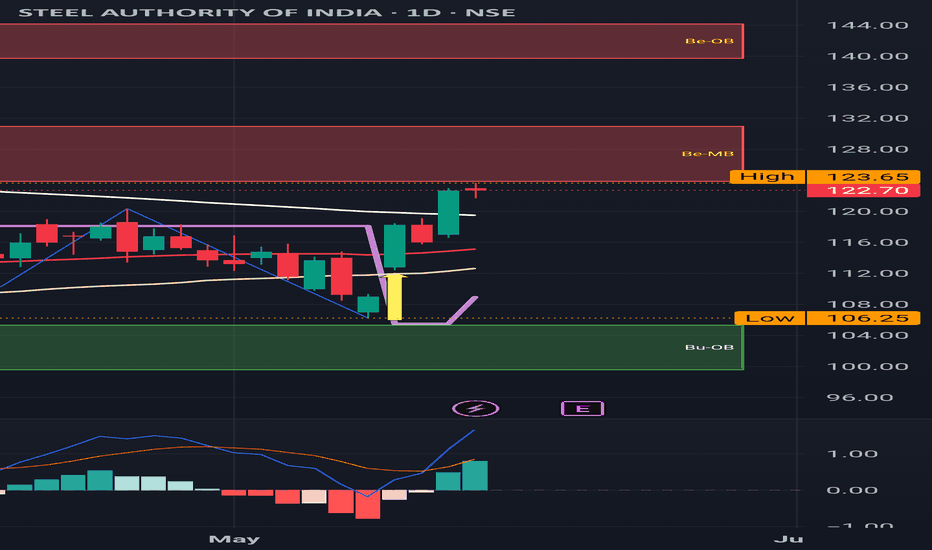

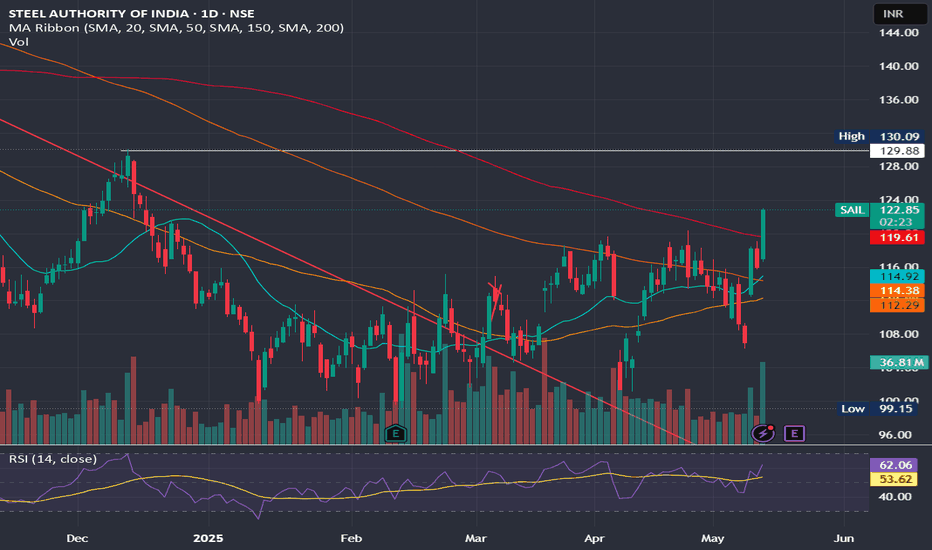

Sail : Approaching Near Resistance Sail : Approaching near Resistance

136 is the first resistance level to be watched out for and than major Red Band Resistance as displayed on the Chart

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

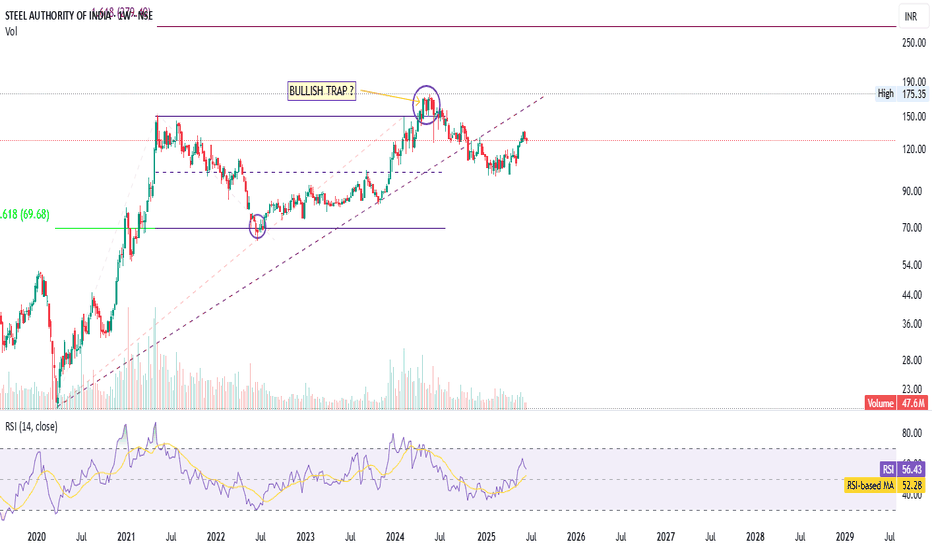

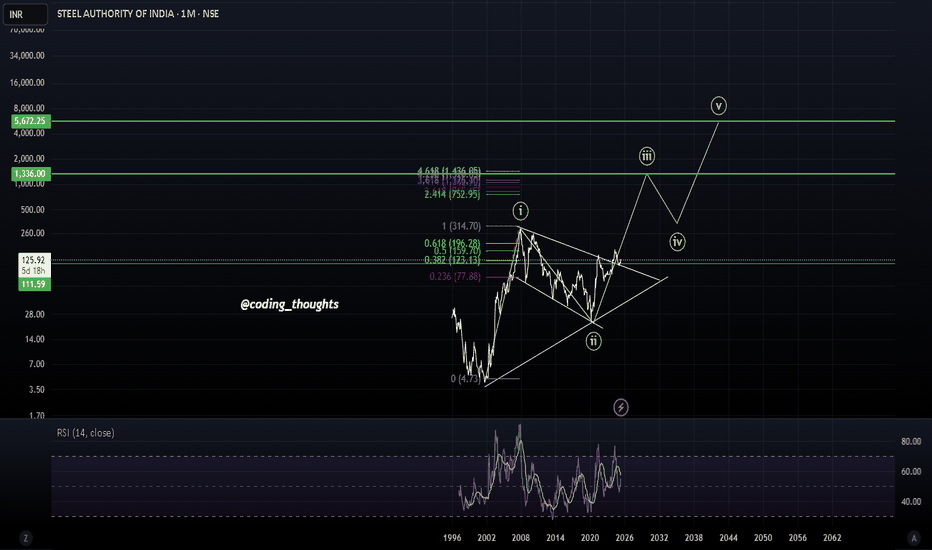

SAIL-Post-Bull Trap Recovery, New base forming!High at ₹175.35 marked — confirmed historical resistance.

Fibonacci 0.618 retracement level at ₹69.68 — acted as a key support in the past.

Important demand zone retest (marked in purple) was successful and led to the current uptrend.

2. Bullish Trap Highlighted:

The marked "Bullish Trap?" zone s

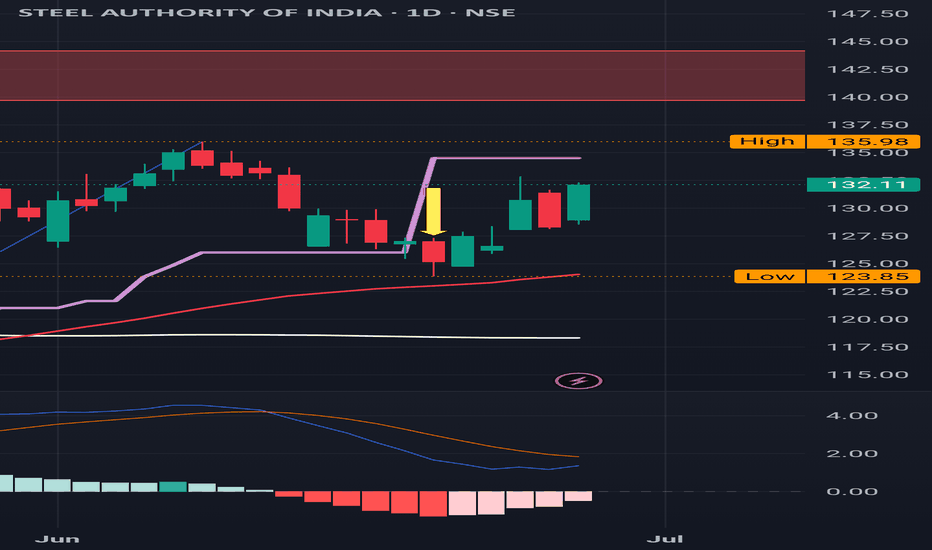

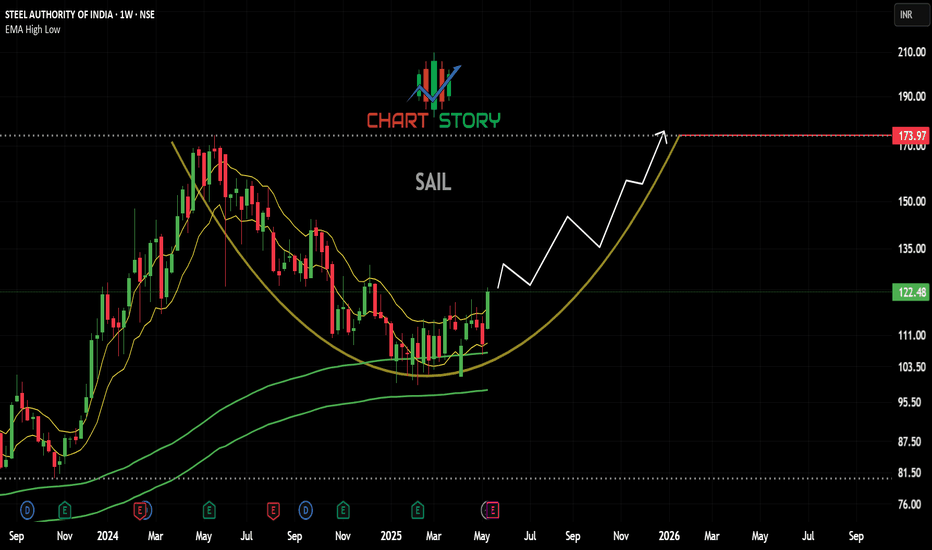

Sail BullishAfter a long consolidation at the bottom Sail has formed a Bullish engulfing candle at the bottom and giving a breakout of the resistance level.

Entry- 111-112

Support- 107.5-107

Target- 120, 125

Disclaimer- This is just for educational purpose please take advice from your financial advisor before

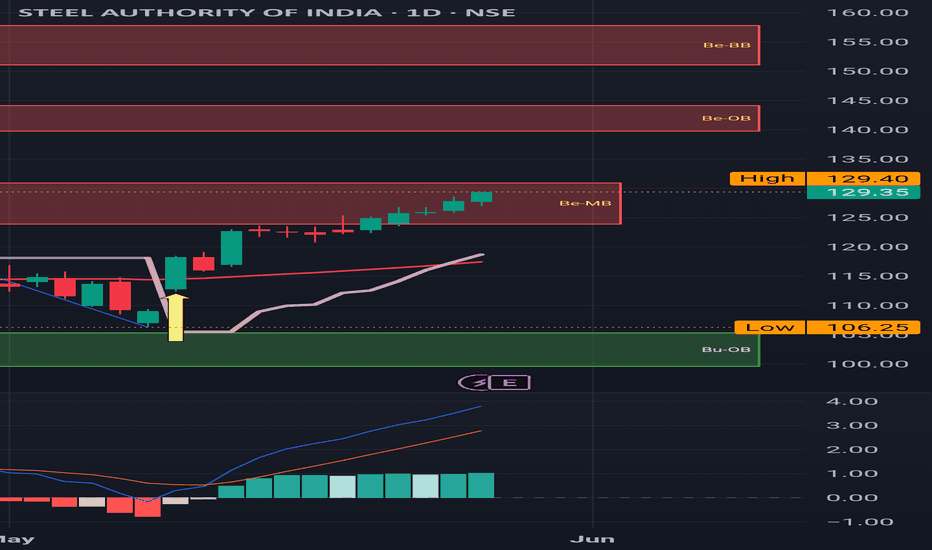

SAIL : After a fantastic Buy Signal ,sitting at a Red band SAIL : After a fantastic Buy Signal ,sitting at a Red band resistance as displayed in the Chart

Closed above 200 SMA with a nice green Candle .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Sail is sailing higher Here's a quick analysis of SAIL (Steel Authority of India Ltd.) stock:

Technical Overview

- Current Price: ₹122.61 INR

- Market Cap: ₹479.14 billion

- P/E Ratio: 22.56 (Moderate valuation)

- Dividend Yield: 1.72% (Stable returns)

- 52-Week Range: ₹99.15 - ₹175.35

Recent Trends

- The stock has been i

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where SAUD is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks