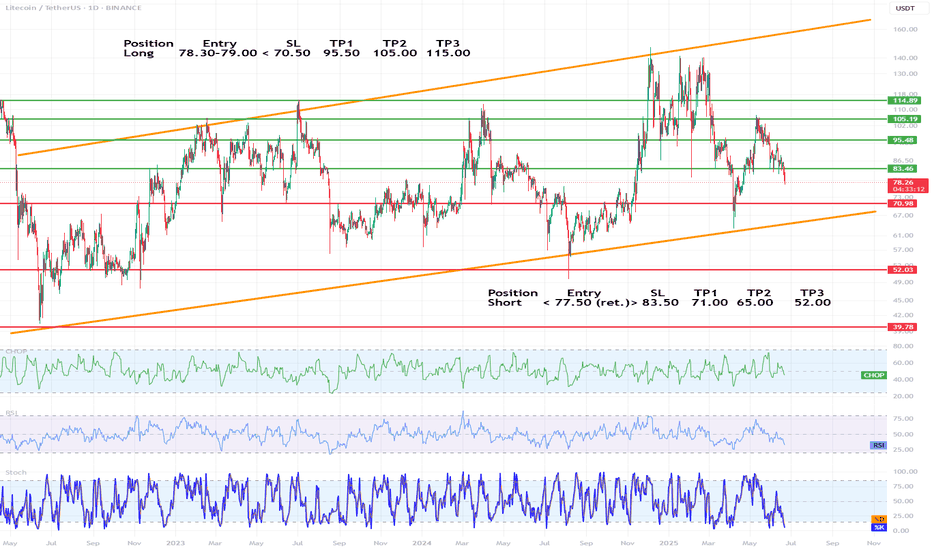

LTC/USDT chart technical analysis (1D)🔷 1. Trend and market structure

🔺 Main channels:

The chart is moving in an ascending channel (orange lines), the lower and upper limits of which have been respected since mid-2022.

The current price (around 78.3 USDT) is in the middle range of the channel, with a downward trend in recent weeks.

🔁

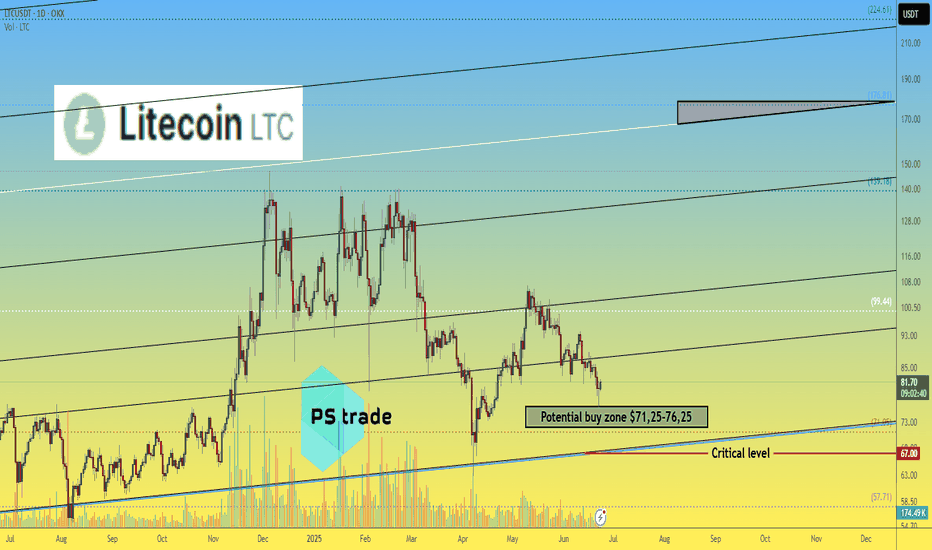

Litecoin LTC price analysisToday we will analyze the third candidate for ETF in the near future is CRYPTOCAP:LTC

An old coin, good fundamentals, 1:1 tokenomics like CRYPTOCAP:BTC but 4 times more coins, untapped potential, and the list goes on...

♎️ The main difference from the previous two candidates is the current mark

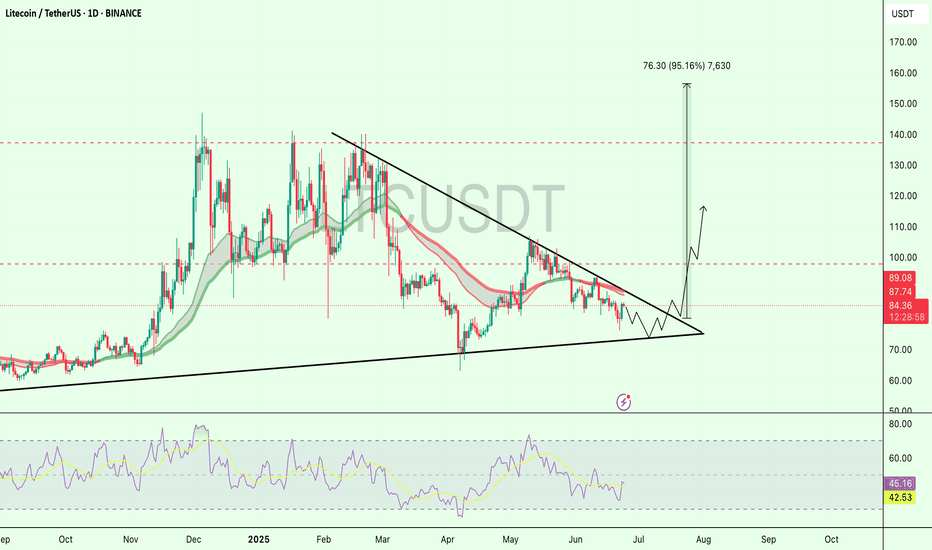

$LTC Coiling Up for a Massive Breakout – 95% Move Loading?NYSE:LTC is consolidating inside a symmetrical triangle and approaching the apex.

Currently holding around the $84 level, showing signs of compression as volatility drops.

If bulls manage to break out above the $89–$90 resistance zone,

we could trigger a strong move toward the $160 zone, that’s ne

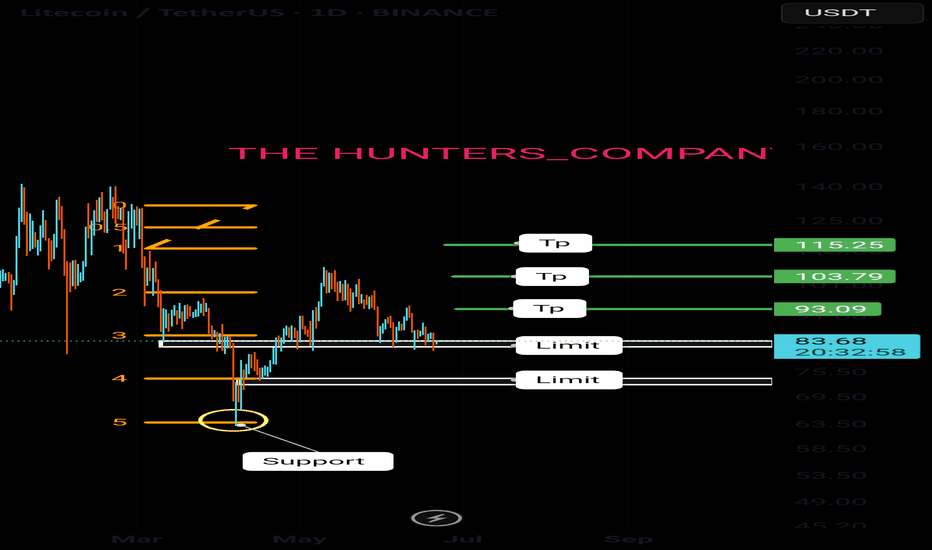

Litecoin:Is the main climb coming?hello friends👋

As you can see, the price, after falling in the support area specified by the buyers, has been supported and returned, forming an upward pattern.

Now we don't enter into a transaction with just one pattern, we also check the entry of buyers and the amount of currency and other facto

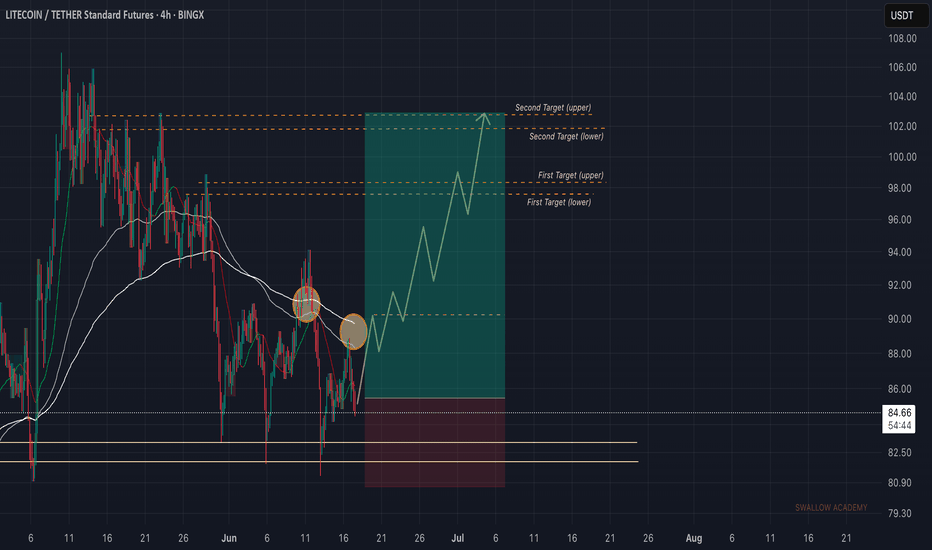

Litecoin (LTC): Looking Bad Now, But Has Good Potential Litecoin is in bad shape, where sellers are showing pressure, which could lead to bigger downward movement.

Despite that, we are still above the local neckline area, so we are still bullish, for now!

More in-depth info is in the video—enjoy!

Swallow Academy

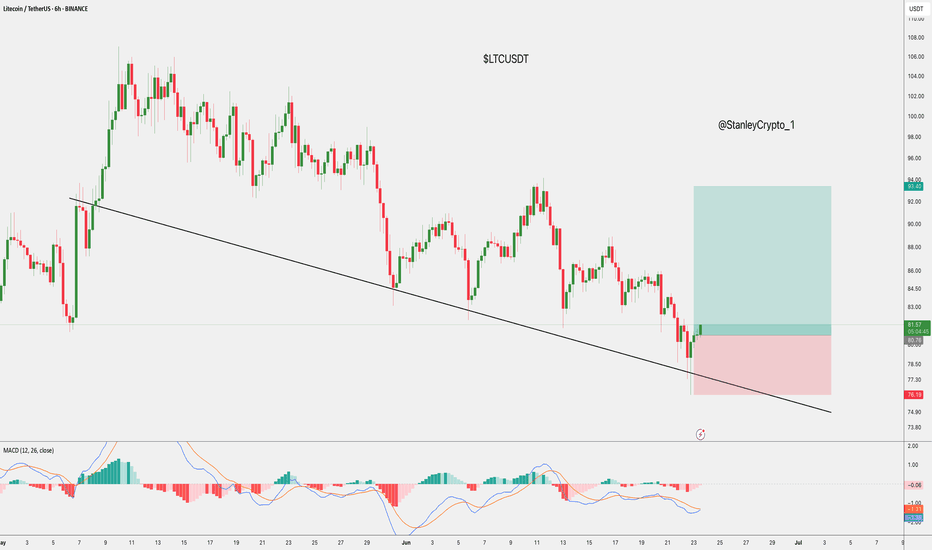

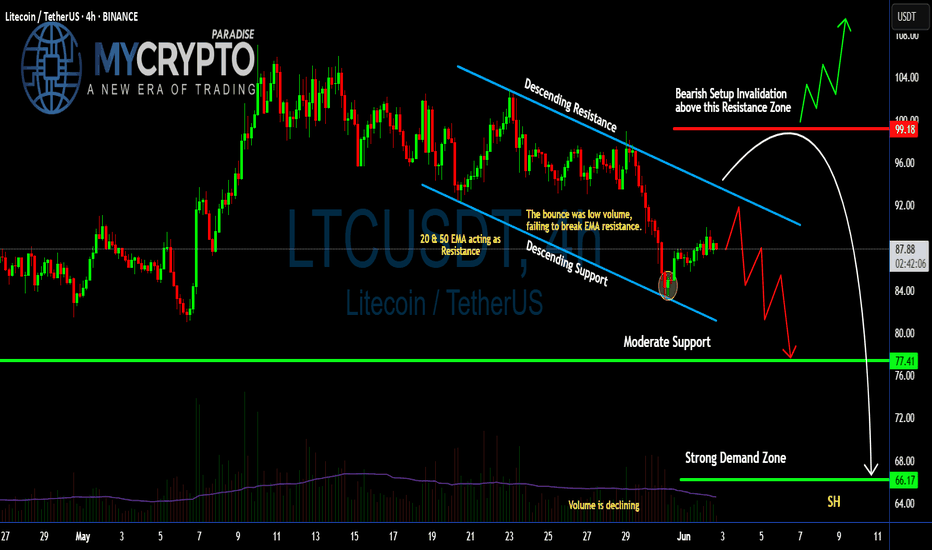

Can #LTC Bulls Make Recovery or Bears will Continue to Dominate?Yello Paradisers! Are you ready for the next wave of #LTC that can catch many traders off guard? Let's see the latest setup of #Litecoin and what can happen next:

💎#LTCUSDT is currently trapped inside a descending channel, signaling sustained bearish pressure. The most recent bounce came with decli

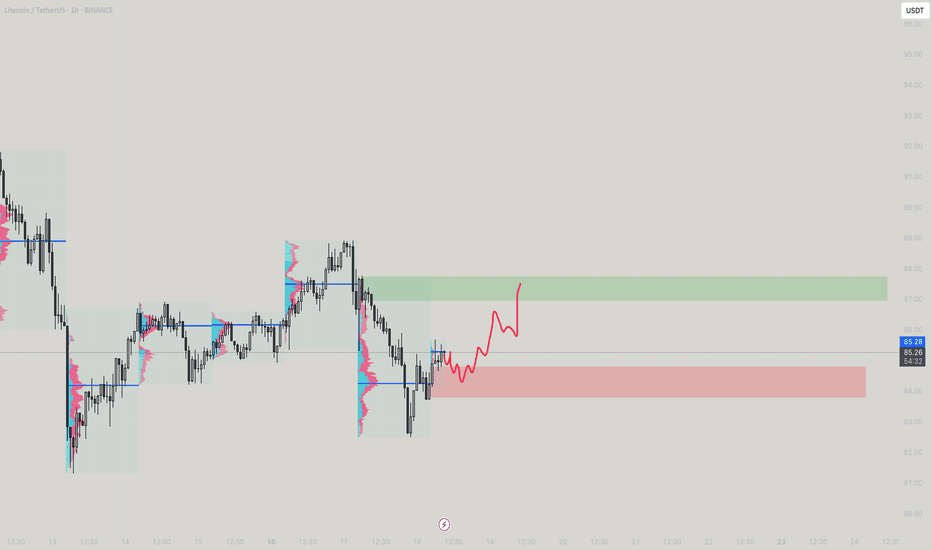

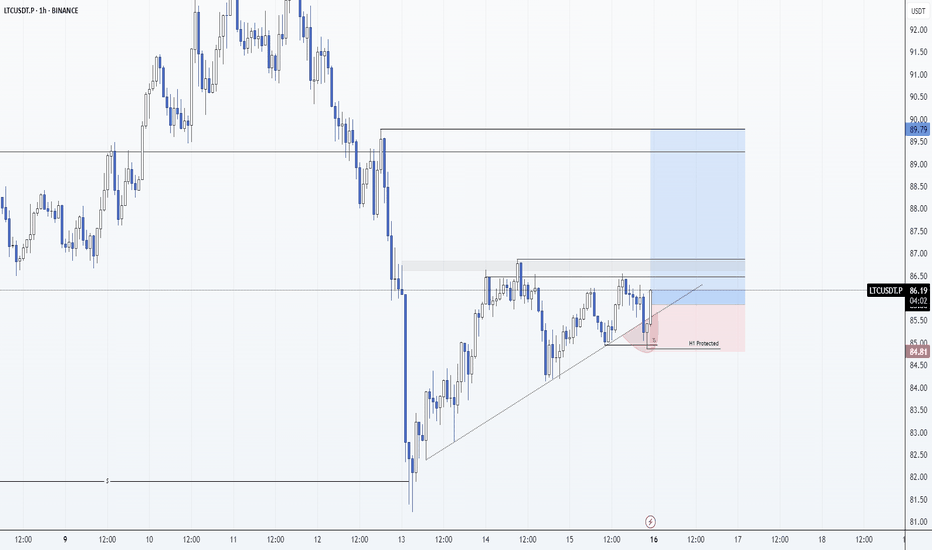

LTC: Long 15/06/25BINANCE:LTCUSD.P

Trade Direction:

LTC Long

Risk Management:

- Risk halved as weekend

- Risk is 0.5%

- Stop loss placed below recent swing low / invalidation level

Reason for Entry:

- H1 bullish divergence teasing. Not yet confirmed but I received a alert for its potential formation

- Trendline

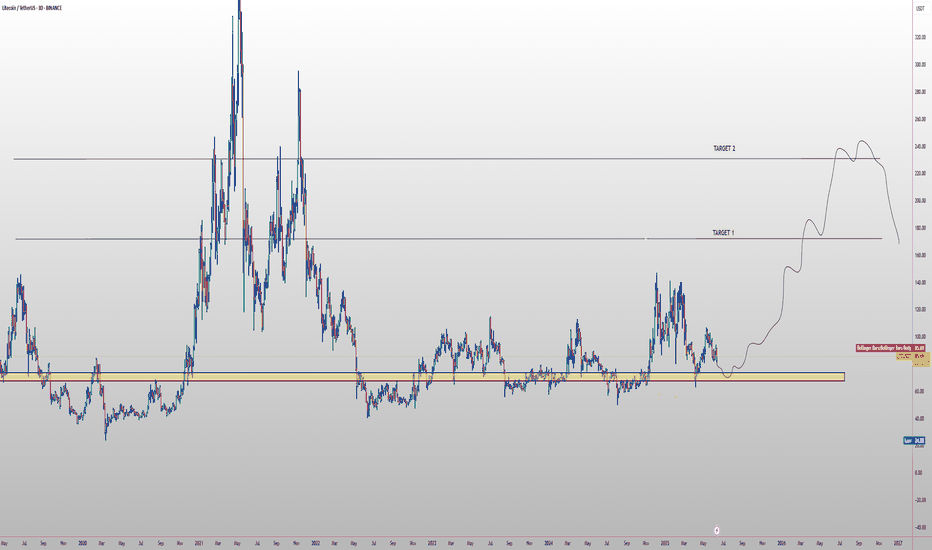

LTC TARGETS FOR Q3🔥 CRYPTOCAP:LTC swing setup (3D) 🚀

✅ Entry Zone: $70 – $77 (multi-year demand)

🎯 Targets

• TP-1: $180 (2021 breakdown line)

• TP-2: $240 (2020-21 pivot)

⛔ Stop-Loss

3-day close < $66

📊 Thesis

• #1 payment coin on BitPay in 2024-25 (201 K tx > BTC & ETH)

• Active addresses +28 % YoY; reco

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.