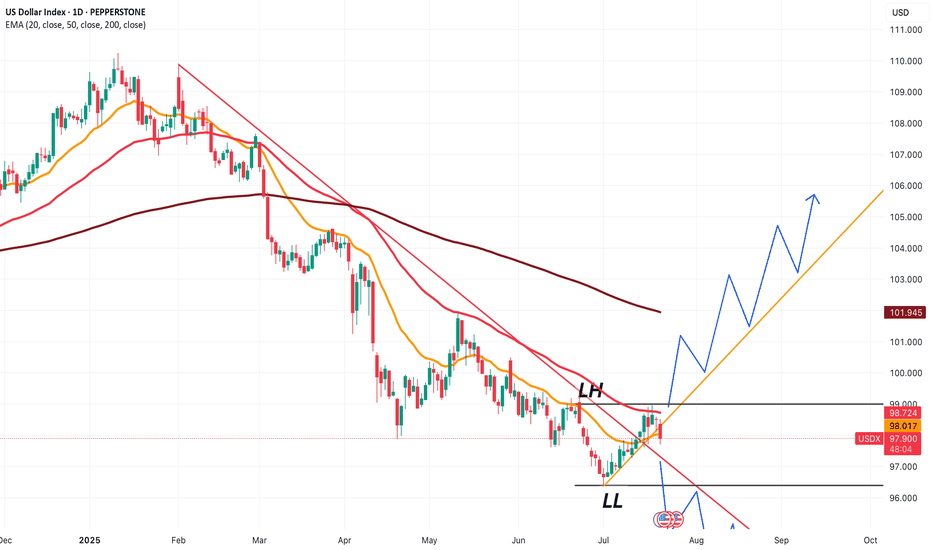

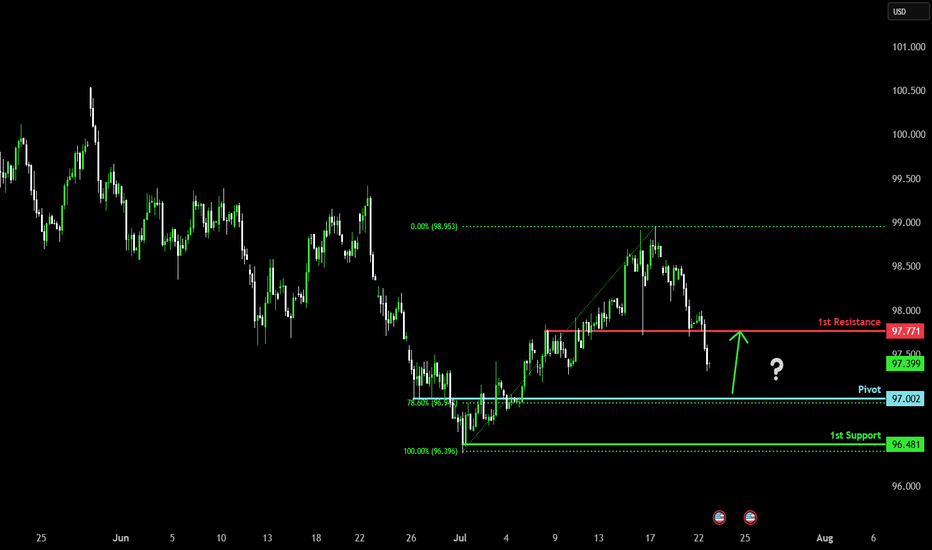

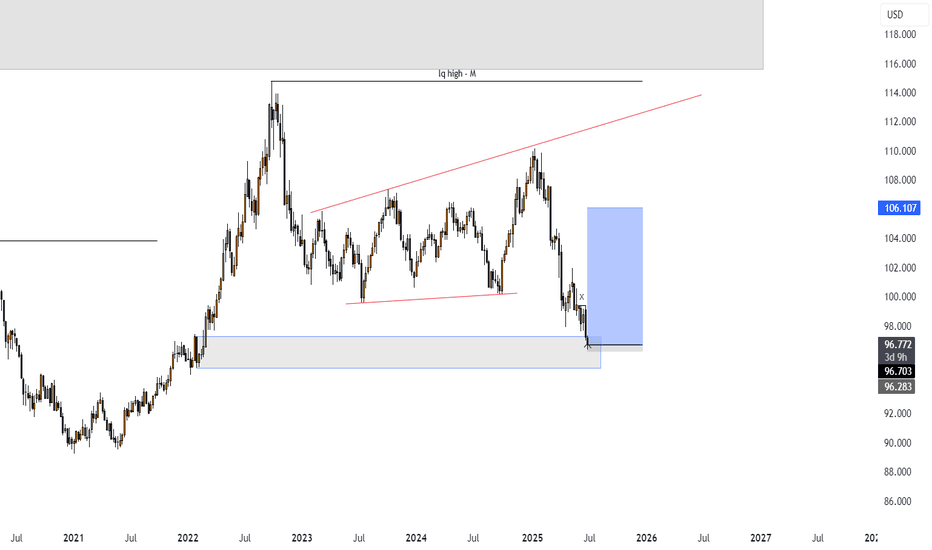

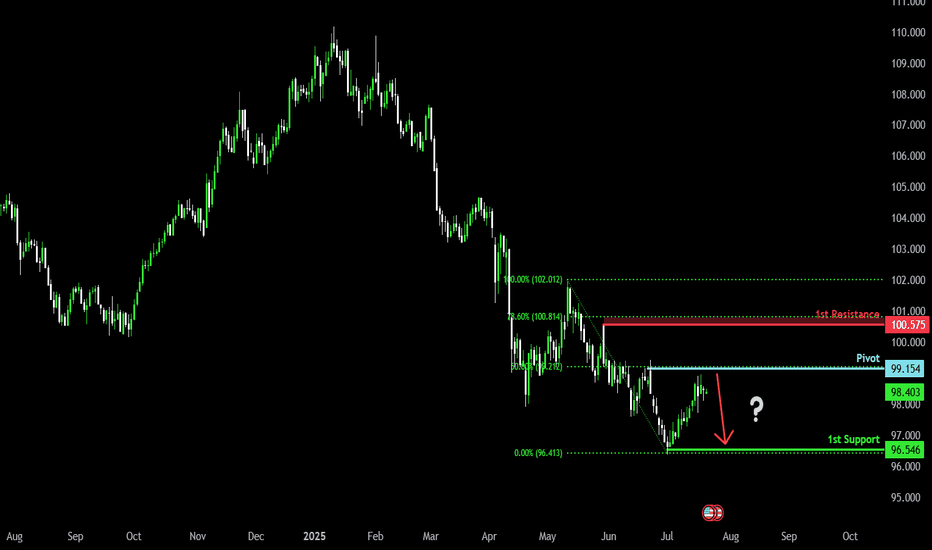

USDX at a crucial price point, which will decide trendThe next few candles for USDX price will be extremely important to understand where the dollar index is headed.

Based on that, we'll be able to choose 'which' Forex pairs we can trade, and more importantly 'how' we can trade them.

If price starts to follow the green line, and takes out 99.000, we'll be in an uptrend.

If price goes back to the red line and eventually goes below 96.400, we'll be in a downtrend.

Hopefully price won't consolidate too much, and trend in a particular direction.

DOLLARINDEX trade ideas

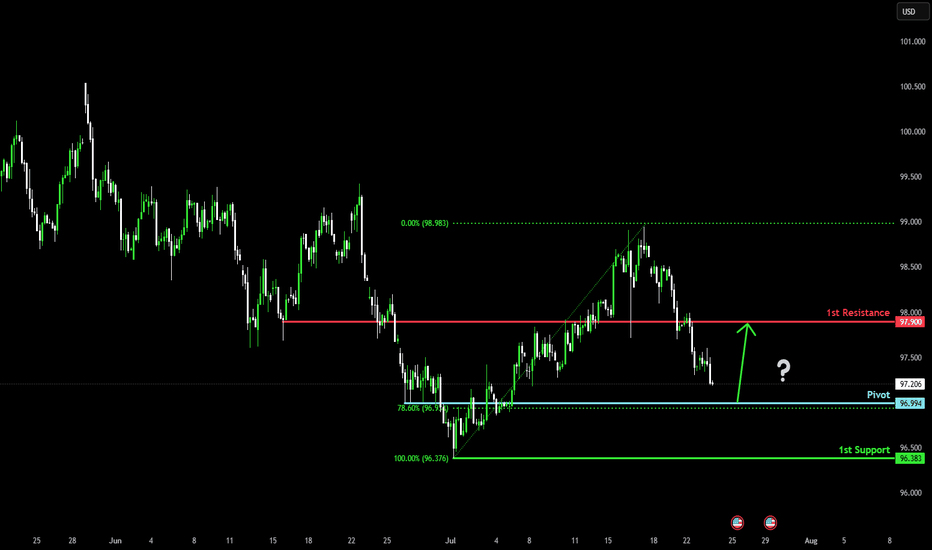

Bullish reversal?US Dollar Index (DXY) is falling towards the pivot and could bounce to the 1st resistance, which is an overlap resistance.

Pivot: 96.99

1st Support: 96.38

1st Resistance: 97.90

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

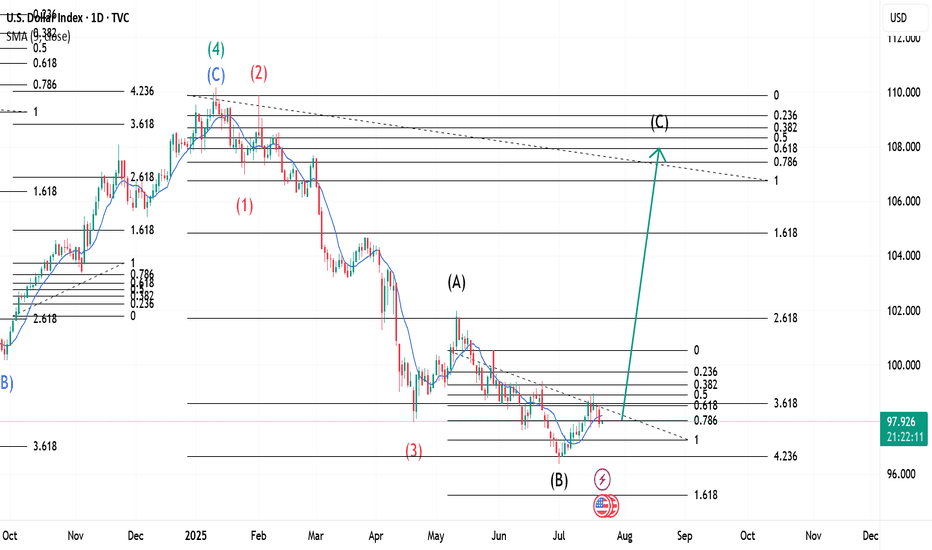

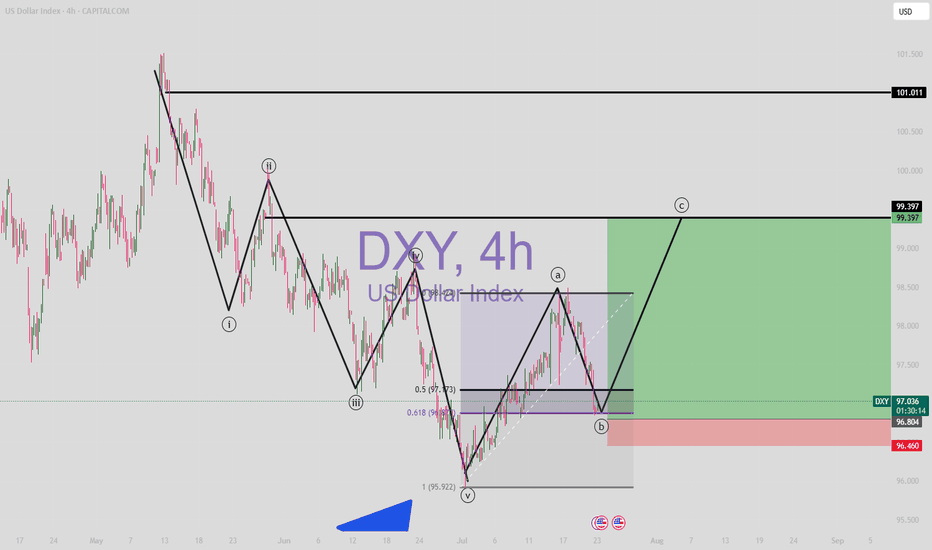

The $ Index ~ Elliott Wave Theory in real time.This is an update of a previously uploaded Dollar index Chart. Analysis remains the same and a confirmation at its current location would trigger continuation of the upward move as analysed on the first chart I had posted. Theoretically, the pullback on Monday, 21st July 2025 could be our Wave 2 with Wave 1 being on Thursday, 17th July 2025.

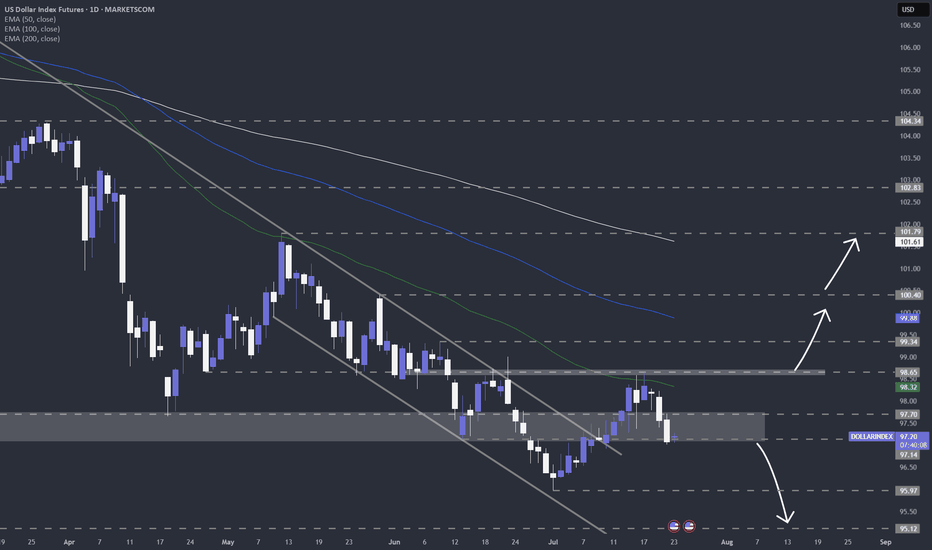

US dollar index (DXY) still looks weakAfter finding resistance near my 50-day EMA on the daily chart, TVC:DXY is now showing signs of continued weakness. Let's dig in.

MARKETSCOM:DOLLARINDEX

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

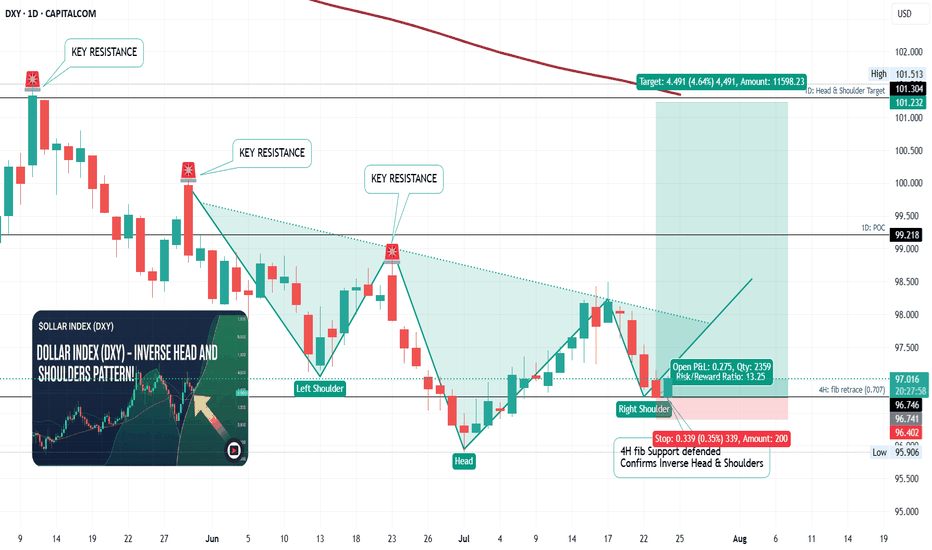

Dollar Reversal? Inverse Head & Shoulders Spotted!Is the Dollar Index bottoming out? I break down a potential Inverse Head and Shoulders pattern forming on the DXY chart — a classic reversal setup that could signal a major trend change. See as I analyze the key neckline breakout zone, potential upside targets and golden zone fib support defended confirming the pattern.

I hope you find this informative. Thank you for the boosts, comments and discussions of the idea. Cheers and best wishes on every trade

# USDCHF, #AUDUSD, #USDJPY, #EURUSD, #GBPUSD Forex pairs

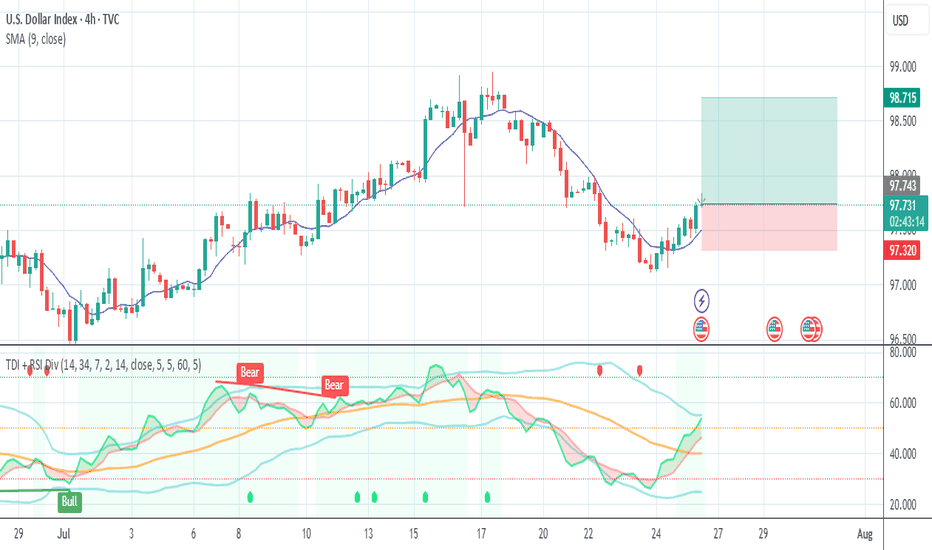

Bullish bounce?US Dollar Index (DXY) is falling towards the pivot which aligns with the 78.6% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 97.00

1st Support: 96.48

1st Resistance: 97.77

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

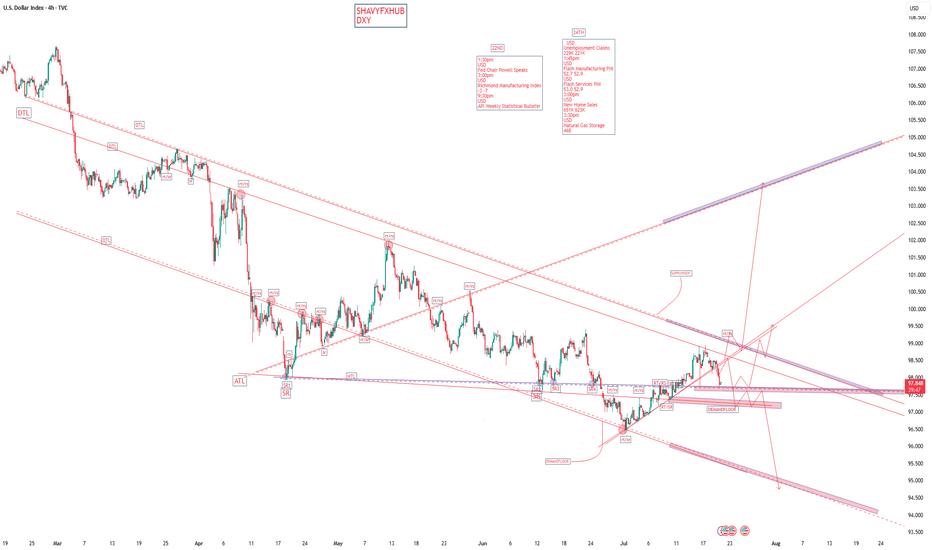

DXYTHE DOLLAR INDEX .

key data report ,22nd the fed chairman Powell speaks and on 24th we are expecting Unemployment Claims.

watch this data as they will shape the trade directional bias.

Key Factors Behind Today's Drop

1. Rising Global Risk Appetite and Strong Foreign Currencies

Investors are showing increased appetite for non-dollar assets today. The euro, yen, and pound have all strengthened—most notably, the dollar fell nearly 1% against the yen after political developments in Japan and a positive outlook in Europe.

European optimism was boosted by encouraging business survey results, while political clarity in Japan lifted the yen and added further selling pressure on the dollar.

2. Lower U.S. Treasury Yields

Softening U.S. yields contributed to the dollar’s weakness. Lower yields typically make the dollar less attractive relative to other currencies, further encouraging outflows.

Investors are reassessing Federal Reserve rate cut odds and show caution ahead of the July 31 Fed meeting.

3.Uncertainty Over Tariffs and U.S. Policy

Heightened anxiety around upcoming U.S. tariffs (with an August 1 deadline) and erratic policy signals are dampening confidence in the dollar as a safe haven.

Speculation over Fed independence, including market chatter about potential challenges to Chair Powell’s role, has hurt trust in U.S. monetary policy stability, fueling additional dollar selling.

Conclusion

The dollar index’s drop from its ascending trend line today is the result of a perfect storm of increased foreign currency strength, risk-seeking investor sentiment, declining U.S. yields, persistent policy and tariff uncertainty, All of these factors have combined to drive sellers selling momentum ,they will continue to push the index to its lowest levels and my structure is giving me 94-94.5 level.

trading is 100% probailty,trade with caution.

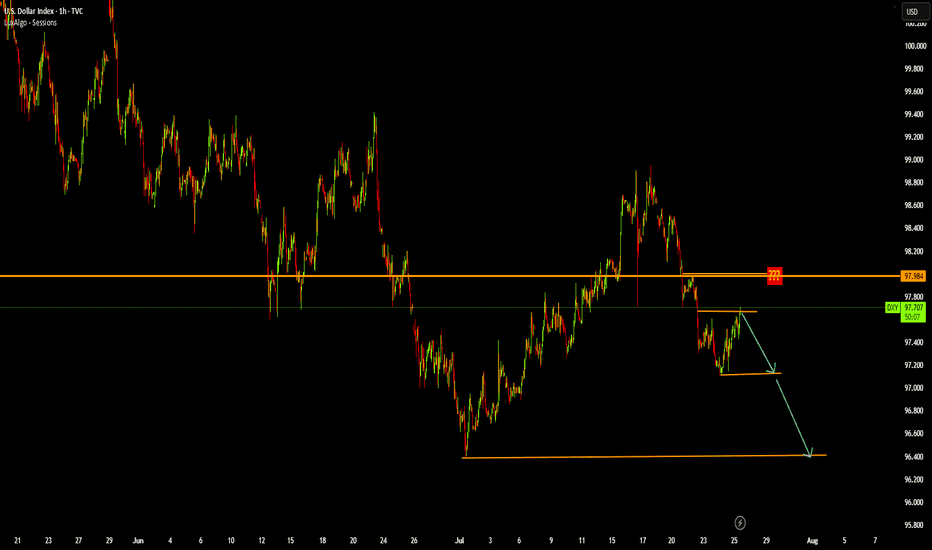

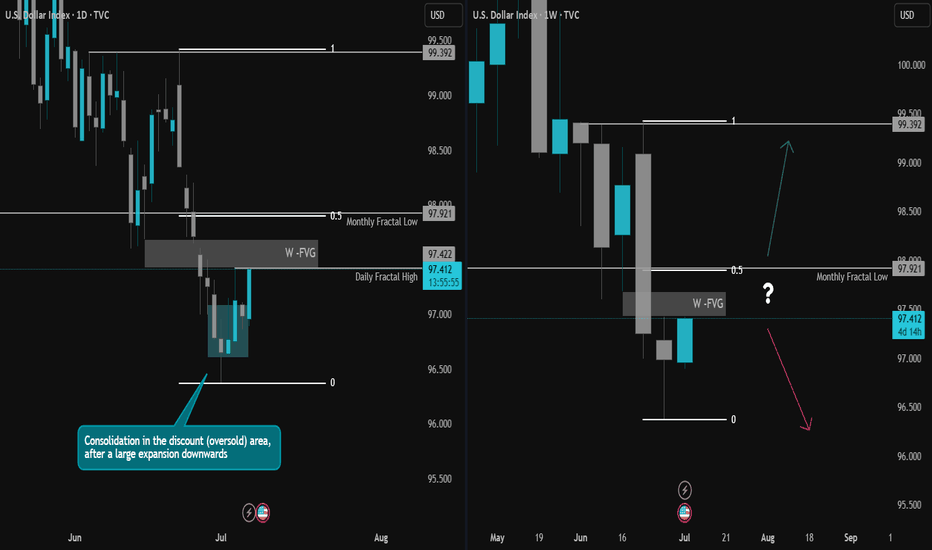

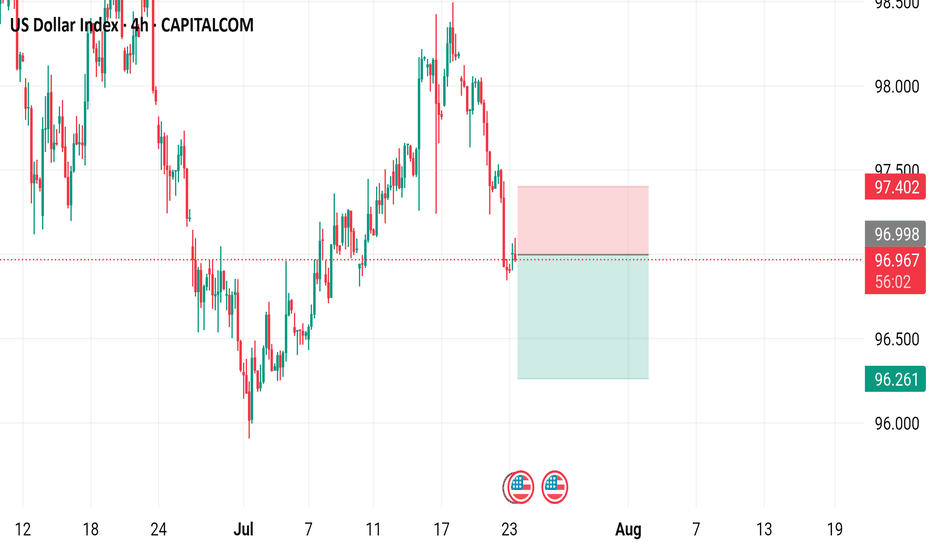

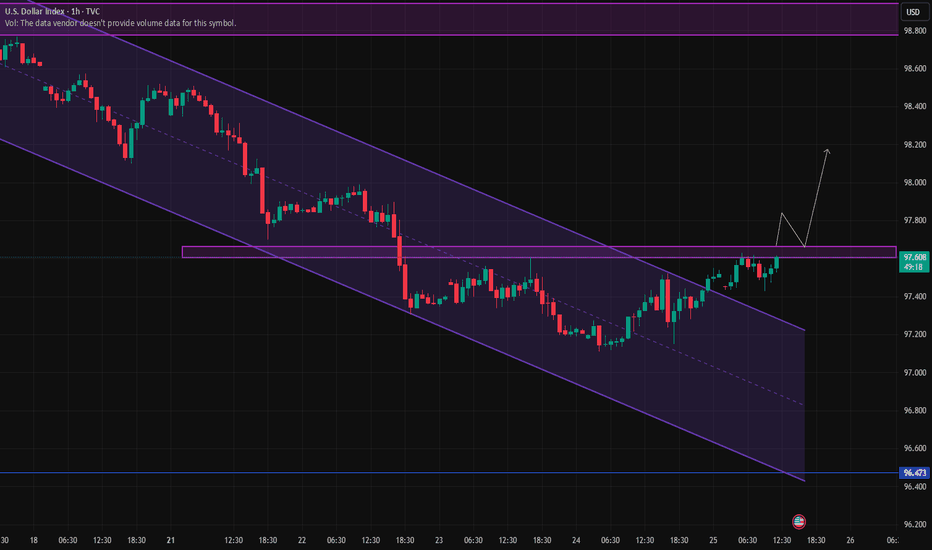

Decision Zone for DXY This Week: Around 97.600After a significant downward expansion in DXY, we observed a consolidation around last week's low. This week, the market opened with a pullback.

The first stop for this pullback appears to be the current daily fractal high candle and the weekly bearish FVG on the chart. We can assess potential selling pressure from this area on lower timeframes. We'll be monitoring the wicks within this zone, along with any newly forming FVGs.

If the price breaks above this area, our next points of interest will be the gaps within the zone above the 0.5 swing level, and ultimately the swing high itself as the final target.

Given the current setup, we believe there are promising trading opportunities on EURUSD.

Take care until the next update!

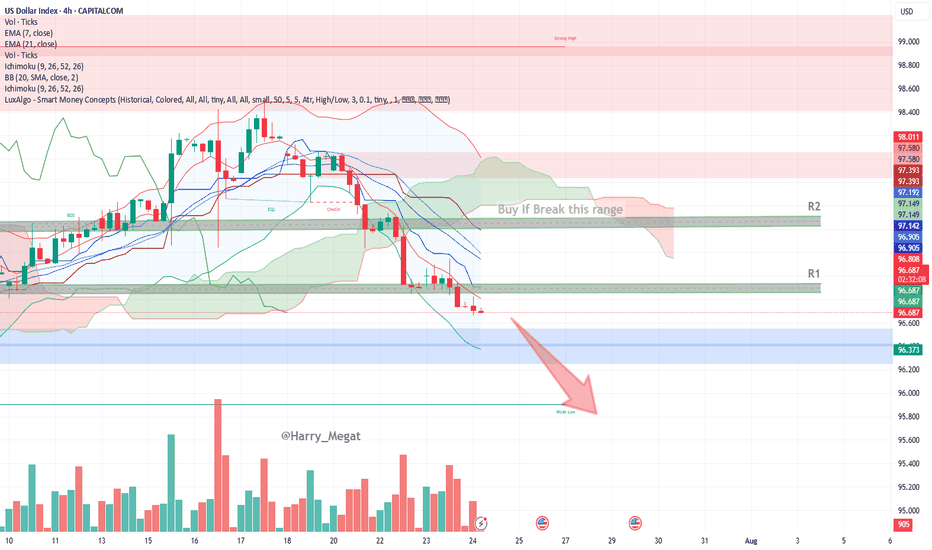

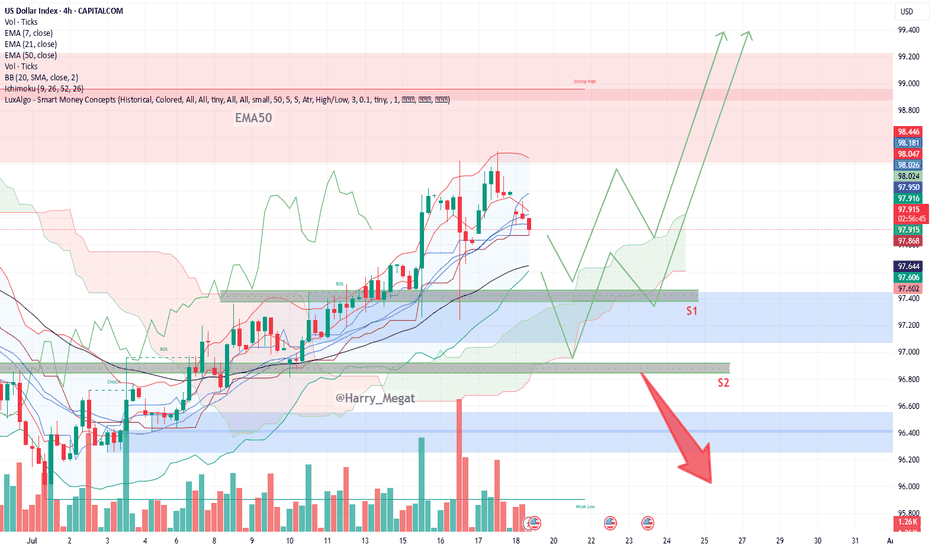

US Dollar Index (DXY) – 4H Chart AnalysisUS Dollar Index (DXY) – 4H Chart Analysis

**Current Trend:** Bearish

Price trades below EMAs, Ichimoku Cloud, and within a bearish channel.

#**Bearish Scenario (Favorable)**

* **Conditions:**

* Price remains below EMA 7 & 21

* Stays under Ichimoku Cloud and 96.812 resistance (R1)

* Lower lows forming, bearish momentum increasing

* **Confirmation:**

Break below **96.37 (blue zone)**

* **Target:**

* TP1: 96.00

* TP2: 95.60 (next weak support)

**Bullish Scenario (Reversal)**

* **Conditions:**

* Price must break above **96.81 (EMA 7 + resistance)**

* Break above **R1 → 96.90**, and then above **R2 → 97.14–97.19**

* Bullish candles close above the Ichimoku cloud

* **Confirmation:**

Break and retest of **97.20**

* **Target:**

* TP1: 97.39

* TP2: 97.58 (key structure)

* TP3: 98.00 (major resistance)

**Bias:** Bearish unless DXY breaks above **97.20** with strong volume and bullish structure.

Bearish drop off 50% Fibonacci resistance?The US Dollar Index (DXY) is rising towards the pivot which acts as a pullback resistance and could drop to the 1st support.

Pivot: 99..15

1st Support: 96.54

1st Resistance: 100.57

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

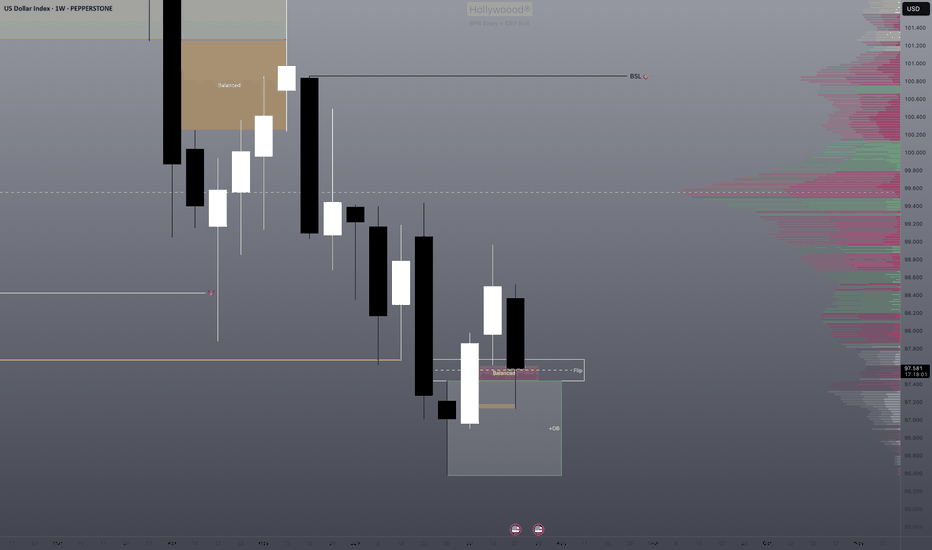

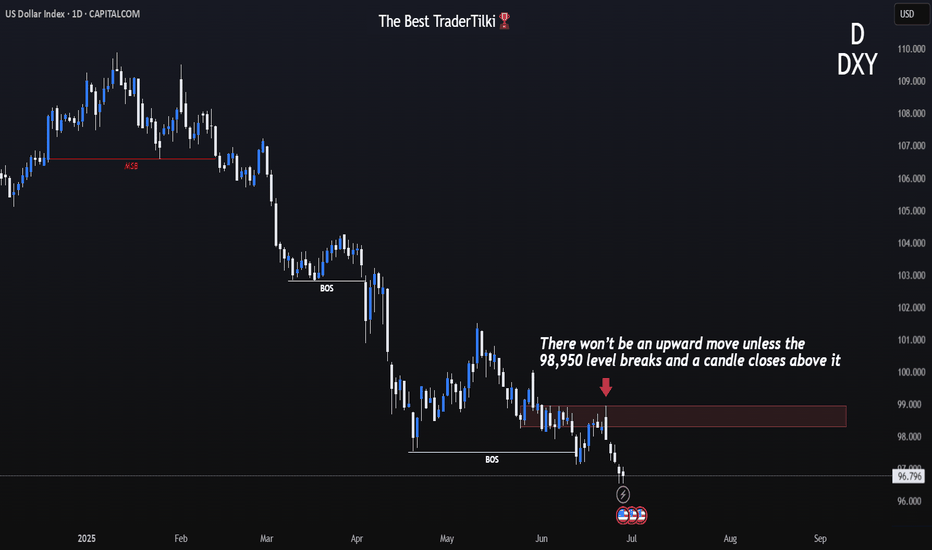

DXY 1D – Tipping Point: News or Price Action?Hey Guys,

The DXY index is currently moving within a downtrend. This trend is unlikely to reverse unless it breaks above the 98.950 level.

Sure, key fundamental data could shift the trend, but without those news catalysts, a reversal at this point doesn’t seem realistic.

Don’t forget—98.950 is a critical threshold for the DXY.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

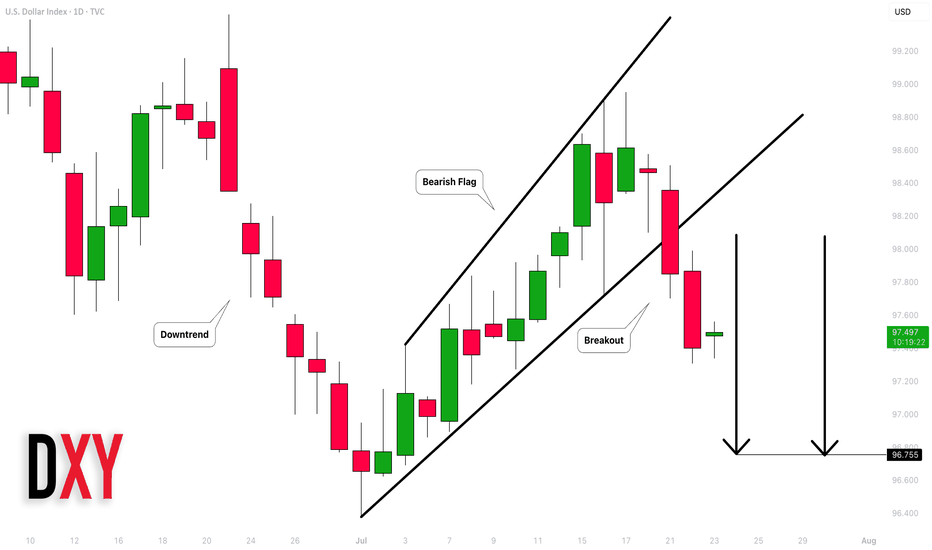

Dollar Index (DXY): Strong Bearish Price Action

Dollar Index broke and closed below a support line

of a bullish flag pattern on a daily.

Because the market is trading in a bearish trend,

this violation provides a strong bearish signal.

I expect a bearish movement to 96.75

❤️Please, support my work with like, thank you!❤️

US Dollar Index - 4h Chart (CAPITALCOM)4-hour chart of the US Dollar Index (DXY) from CAPITALCOM shows the index's recent price movements. The current value is 96.955, with a slight increase of 0.054 (+0.06%). Key levels include a support at 96.413 and resistance at 97.554. The chart highlights buy signals at 97.012 and sell signals at 96.958 and 96.955, with a notable downward trend breaking below a support zone around 97.150.

DXY Chart Outlook: Trend, Support, and Price Objectives**DXY Chart Outlook: Trend, Support, and Price Objectives (Reworded Analysis)**

**Trend Overview**

* The DXY chart reflects a **clear upward trajectory**, characterized by a sequence of **ascending highs and higher lows** — a classic sign of bullish momentum.

* Currently, the price is **retracing toward the 50-day EMA**, which appears to be holding as **dynamic support**.

* Two important **horizontal support zones** are marked:

* **Support 1 (S1):** \~97.400 (aligned with EMA-50)

* **Support 2 (S2):** \~96.800 (a deeper correction level)

**Projected Price Zones**

* **Near-Term Objective:** **98.800 to 99.000**

* A rebound from the EMA or S1 could send price higher toward this zone, continuing the current bullish structure.

* **Mid-Term Target:** **99.200 to 99.400**

* If the price successfully clears the 99.000 resistance, further bullish continuation could aim for this intermediate target range.

* **Extended Target:** **100.000+**

* A sustained breakout beyond 99.400 could open the path toward **psychological resistance at 100.000**, possibly higher on strong momentum.

**Support Zones to Watch**

* **S1 (97.400):** This level coincides with the 50-day EMA and represents a **first line of defense**.

* **S2 (96.800):** Should the price fall below S1, this secondary level could provide **stronger support** and potential bounce opportunity.

**Risk Management**

* Consider placing a **protective stop** just below S2 — around **96.500** — to safeguard against a potential trend reversal or deeper correction.

**Summary**

* The DXY remains **technically bullish**, with potential upside targets at **98.800**, **99.400**, and eventually **100.000+**.

* Traders can monitor **S1 and S2** for potential entries or trend confirmation.

* A **breakdown below 96.500** would invalidate the bullish setup and warrant caution.

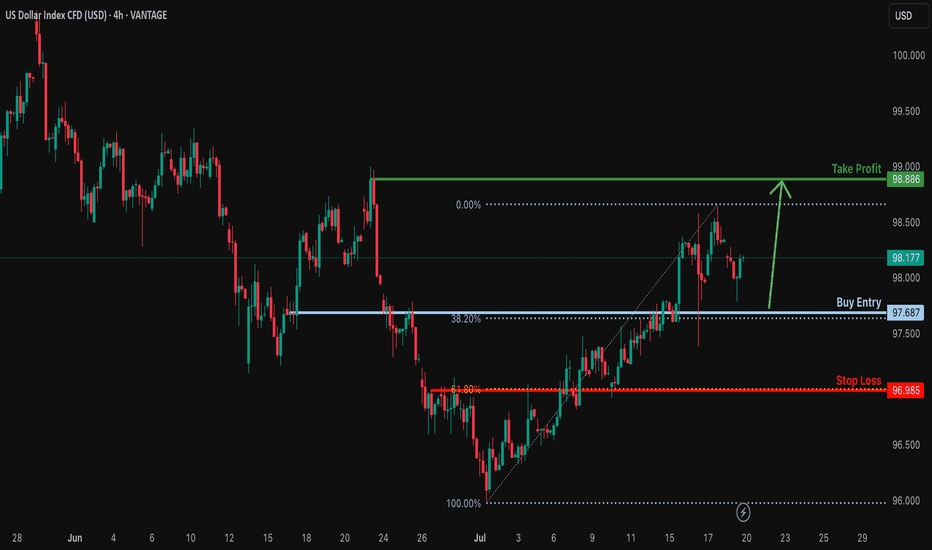

Bullish continuation for the Dollar?The price is falling towards the support level which is a pullback support that lines up with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 97.68

Why we like it:

There is a pullback support that aligns with the 38.6% Fibonacci retracement.

Stop loss: 96.98

Why we lik eit:

There is an overlap support that aligns with the 61.8% Fibonacci retracement.

Take profit: 98.88

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

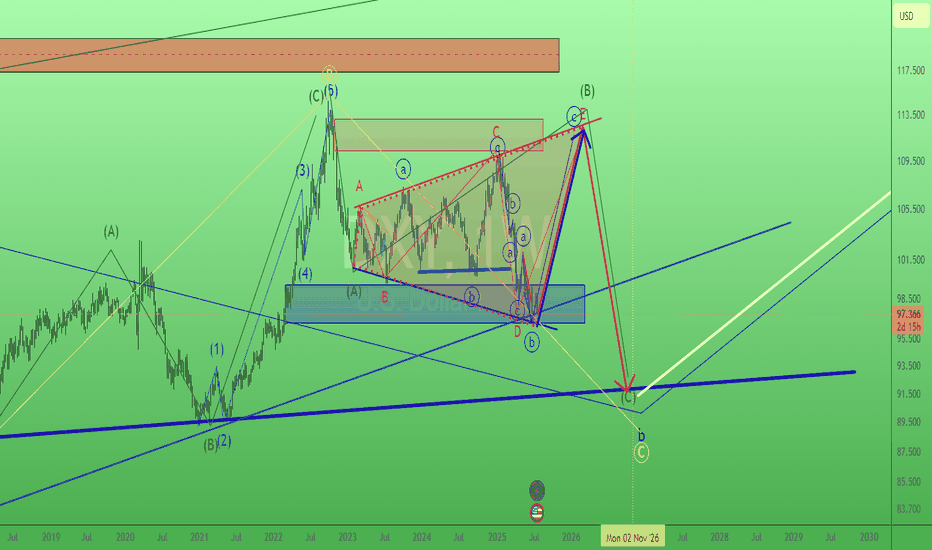

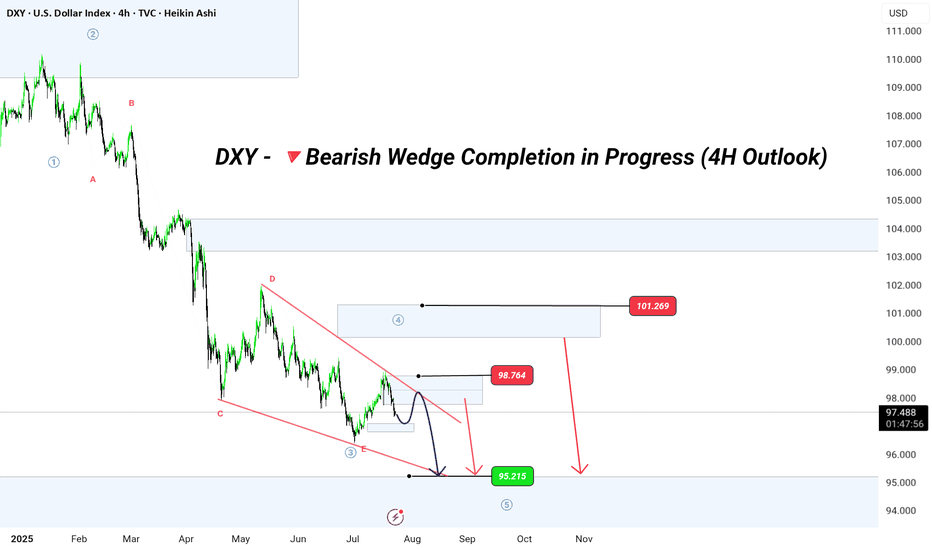

DXY – The Trap Is Set. The Drop Is Coming.Wave structure complete.

Retail thinks we’re going up. I know where it’s really going.

This is GreenFire Execution, not prediction.

🧠 Final liquidity hunt possibly toward 98.76 or even 101.40, then lights out.

Targeting the big liquidity pocket at 95.215

That’s where legends buy while the crowd panics.

📐 Elliott Wave | Wedge Mastery | Market Psychology

If you understand this chart — you don’t need signals. You need silence and execution.

#DXYSetup | #Wave5Ready | #SmartMoney | #ForexMillionaire | #TradingViewElite