DAX: Bulls Are Winning! Long!

My dear friends,

Today we will analyse DAX together☺️

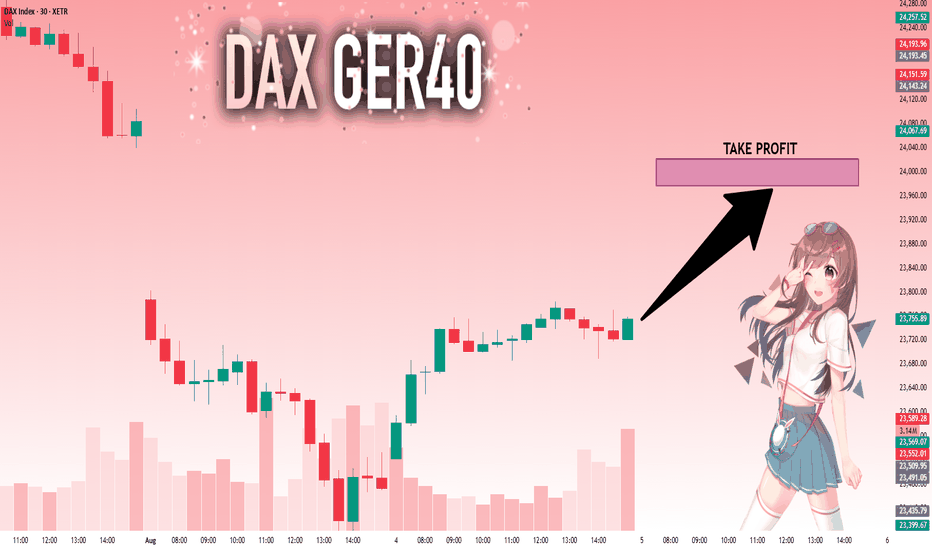

The market is at an inflection zone and price has now reached an area around 23,755.89 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 23,976.72.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

GERMANY40 trade ideas

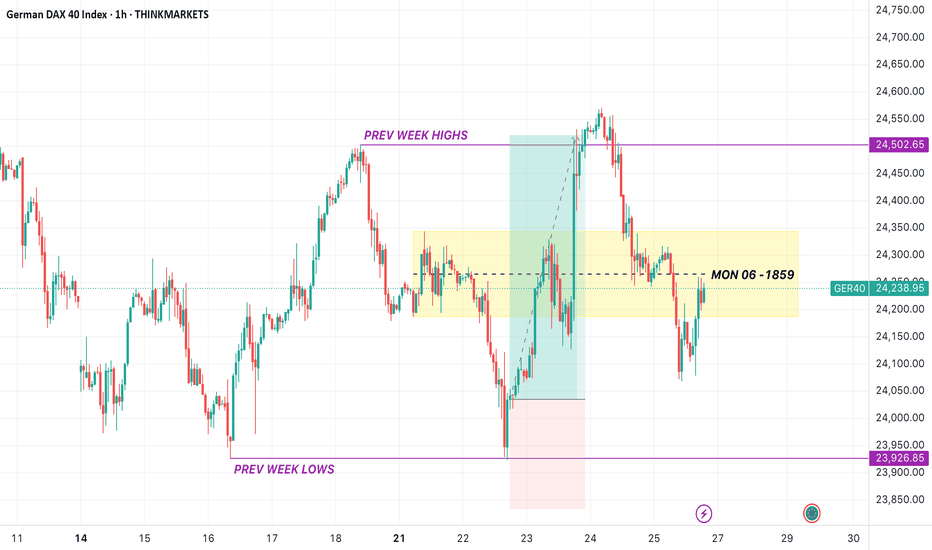

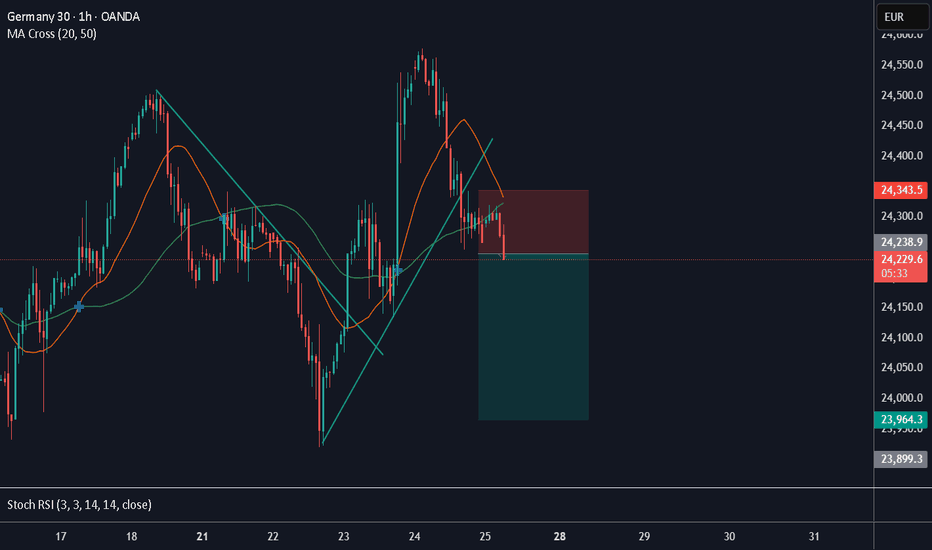

DAX Futures Rebound Amid Shifting US Economic SentimentThe DAX futures are showing a more optimistic tone today, shifting from concerns over weak US labor market data—which initially signaled economic trouble—to a more hopeful outlook that this might prompt the Federal Reserve to consider cutting interest rates, a move that investors see as positive. This shift in sentiment has provided some reassurance as the new week begins.

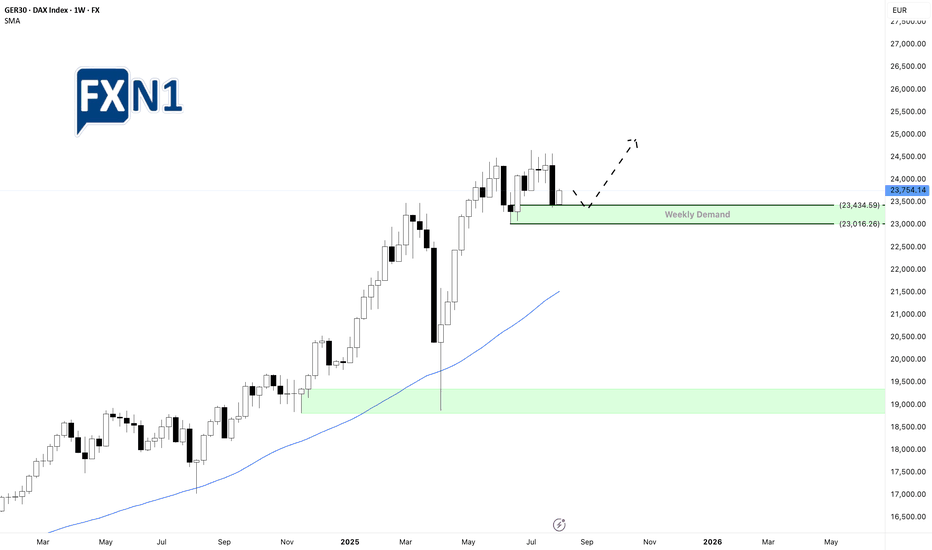

Following a brief decline on Friday, the market experienced a rebound today, supported by a weekly demand zone. We’re now watching for a retest of key levels within this zone, which could serve as a potential entry point for long positions, aiming for a continuation of the upward momentum driven by the weekly support area.

✅ Please share your thoughts about GER30 in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

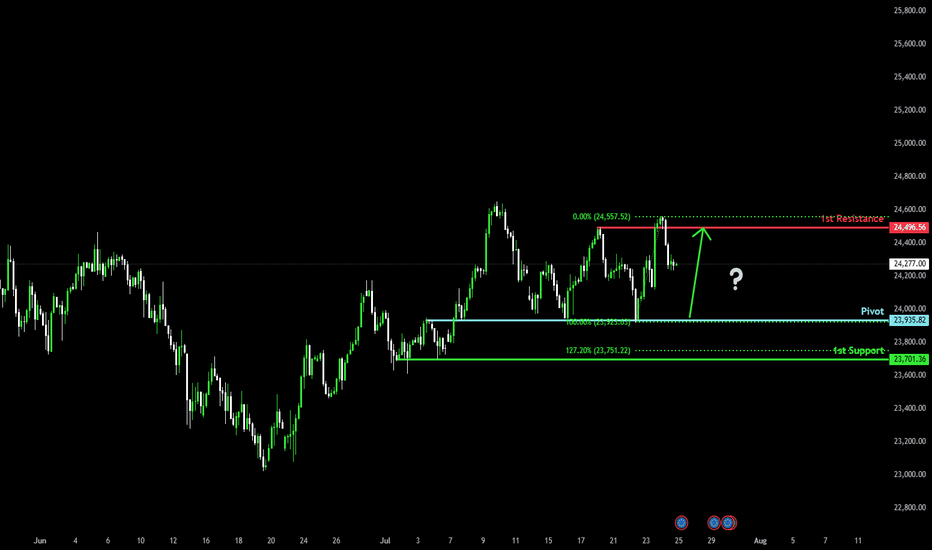

Bullish bounce off major support?DAX40 (DE40) is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 23,935.82

1st Support: 23,701.36

1st Resistance: 24,496.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

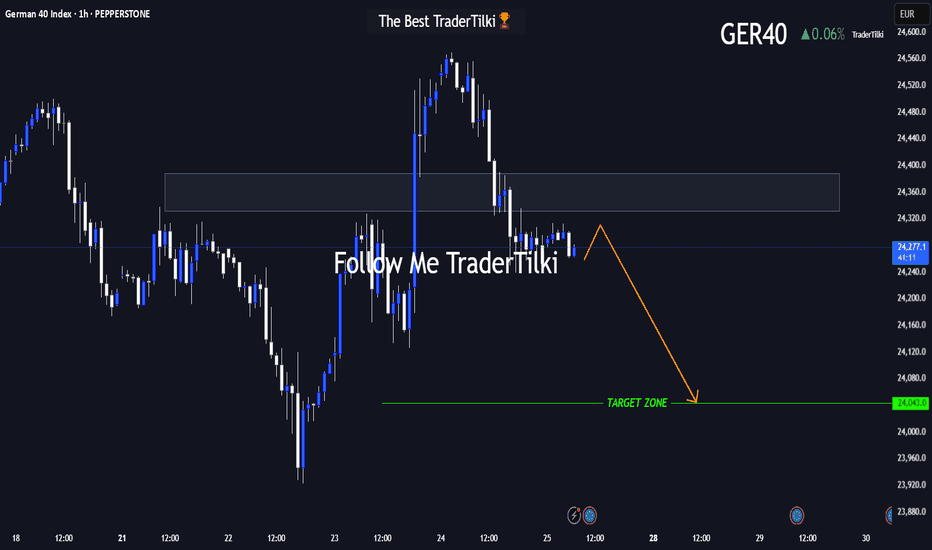

GER40 in Motion: This Setup Speaks Volumes 🌅 Good morning, my friends,

I’ve put together a fresh GER40 analysis just for you. Even if the 1-hour timeframe shows some upward momentum, I fully expect the price to reach my target level of **24,050**.

I'm holding firm until that level is hit.

Every single like from you is a massive source of motivation for me to keep sharing analysis. Huge thanks to everyone supporting with a tap!

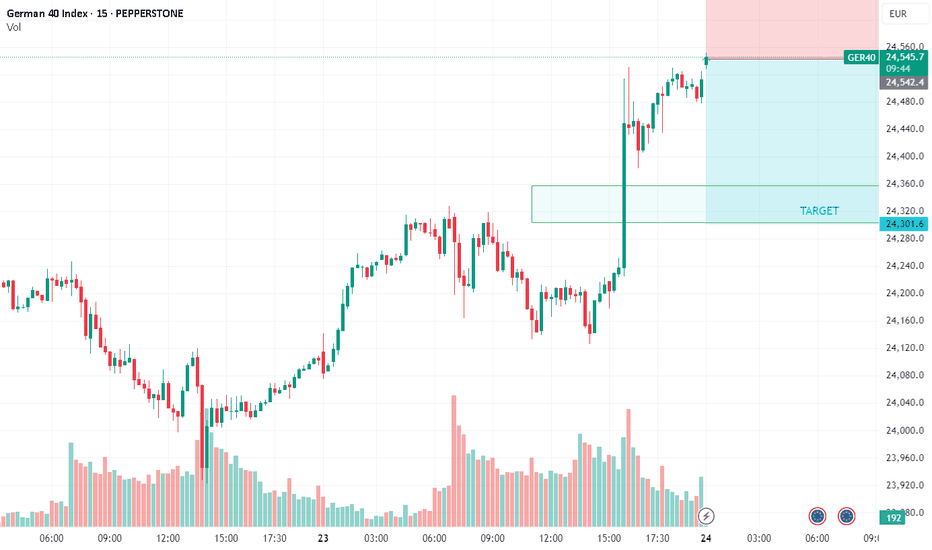

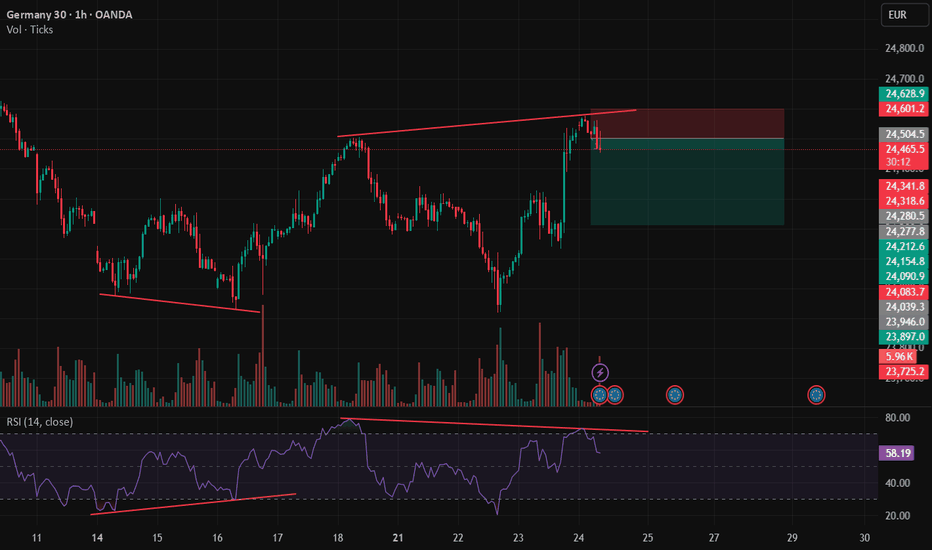

DAX/GER - PREPARE TO SHORT on DAX market opening Team,

We all know that the European Union and the United States agreed on Sunday to a broad trade deal that sets a 15 per cent tariff on most E.U. goods, including cars and pharmaceuticals.

The 27-nation bloc also agreed to increase its investment in the United States by more than $600 billion above current levels.

If the DEAL does not go through, it would be nasty to the market—especially to the Europeans, who are likely to get hurt by the export cost to the United States, especially the Car. The EUROPEAN is currently facing many challenges from Chinese car manufacturing.

We have been trading very well with the DAX in the past. We expect that when the market opens, we should short-range at 24530-60 - GET READY.

Stop loss at 24620-50

Please NOTE: once the price pulls back toward 24475-50, bring our STOP LOSS TO BE (Break even)

Our 1st target at 24425-24400

2nd Target at 24350-24300

Last Friday, in OUR LIVE TRADING, we mentioned that LONG DAX at 24100

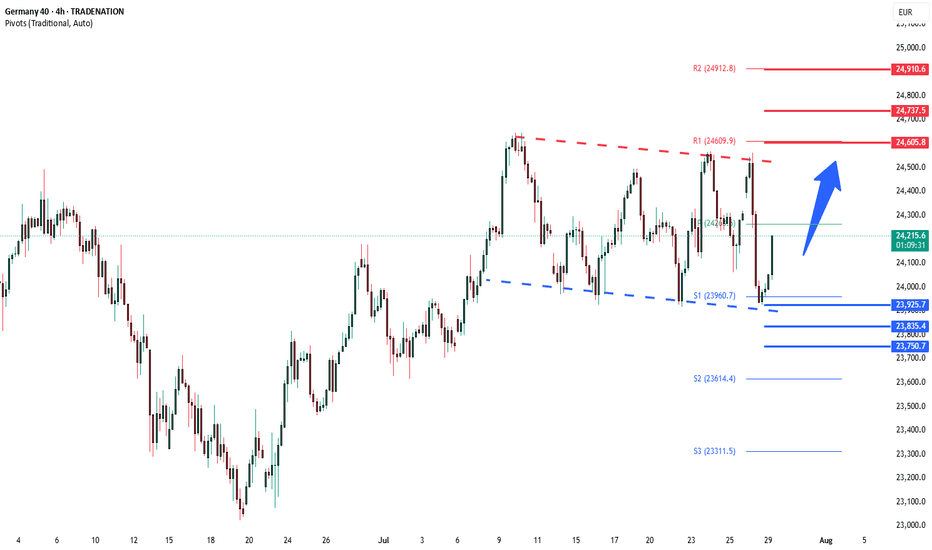

DAX oversold rally support at 23925The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 23925 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 23925 would confirm ongoing upside momentum, with potential targets at:

24605 – initial resistance

24740 – psychological and structural level

24910 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 23925 would weaken the bullish outlook and suggest deeper downside risk toward:

23835 – minor support

23750 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the DAX holds above 23925. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

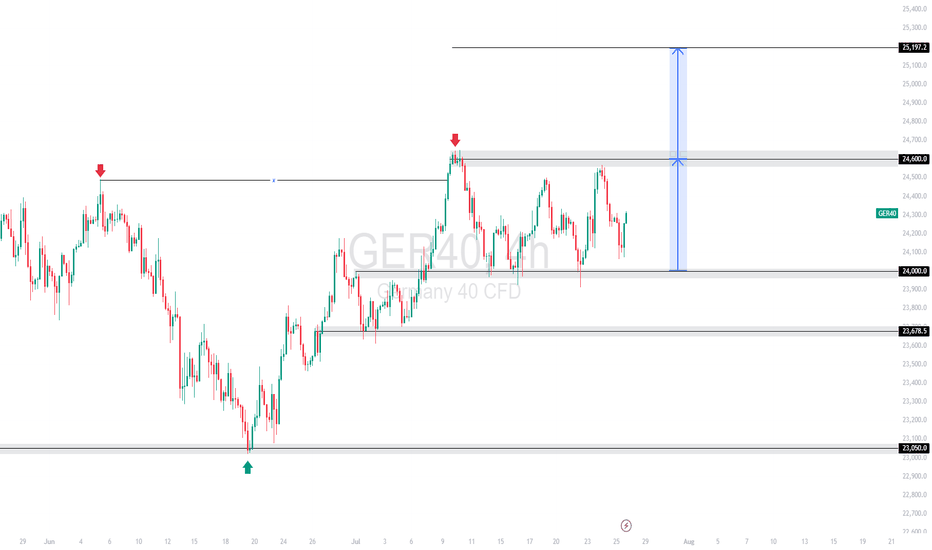

GER40 | Consolidation Range 24,600 – 24,000 With Breakout TargetGER40 is consolidating within a clear range between 24,600 resistance and 24,000 support. The lower boundary (24,000) aligns with the 61.8% Fibonacci retracement from the 23,050 → 24,600 impulse leg. A confirmed breakout above the range projects a measured move target of 25,197.2, which is derived from the 600-point height of the range between 24,000 and 24,600.

Support at: 24,000.00 / 23,678.5 / 23,050.00 🔽

Resistance at: 24,600.00 🔼

Range Target: 25,197.2 🎯

🔎 Bias:

🔼 Bullish: Clean break and hold above 24,600 confirms range breakout with target at 25,197.2.

🔽 Bearish: Break below 24,000 brings 23,678.5 and 23,050 into view.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

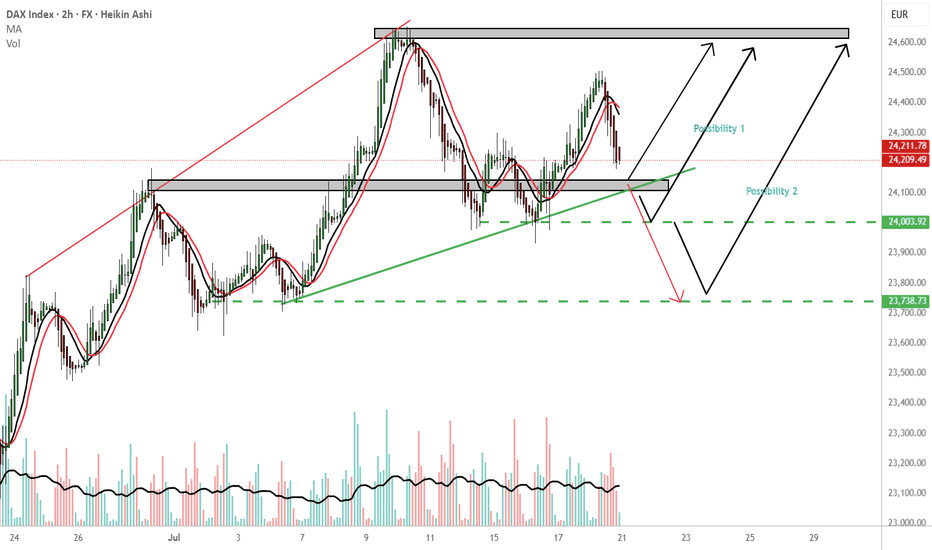

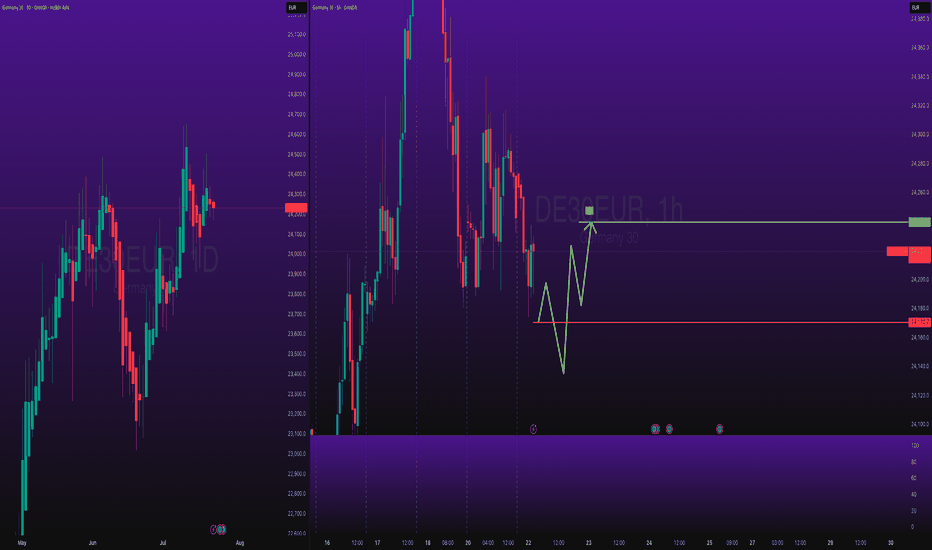

GER 30 endless possibilitiesMy most immediate outcome is reversal 24,140 price area. TP:24,600

Possibility 1: If Ger 30 holds the 24,000 price area i would consider a buy to 24,600.

Possibility 2: If Ger30 holds the 23,730 price area that would be another possibility for a buy. TP 24,600.

WCS: Worst case scenario, continuation downwards from the 24140 PL. Consider the red arrow. The 24,140 is a important price area please wait for confirmation

Please follow your trading plan.

THOUGHTS????

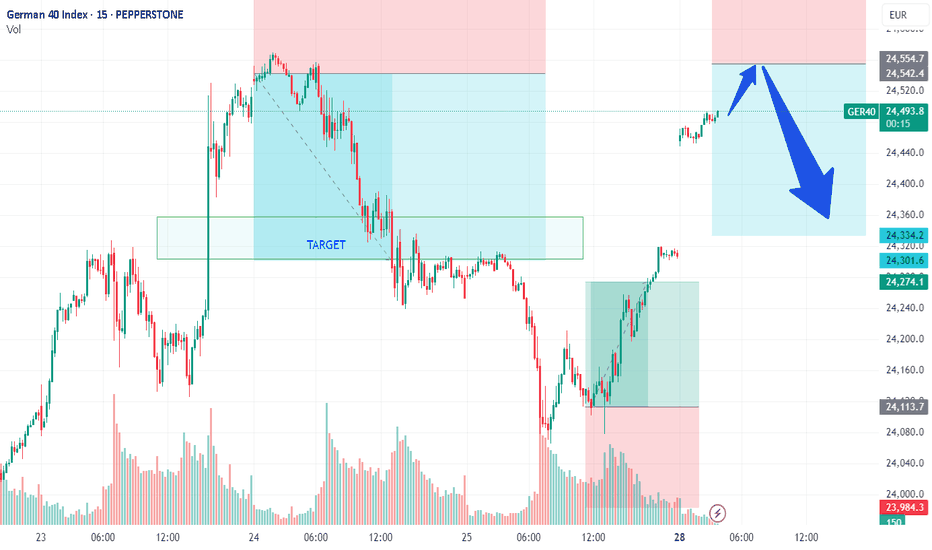

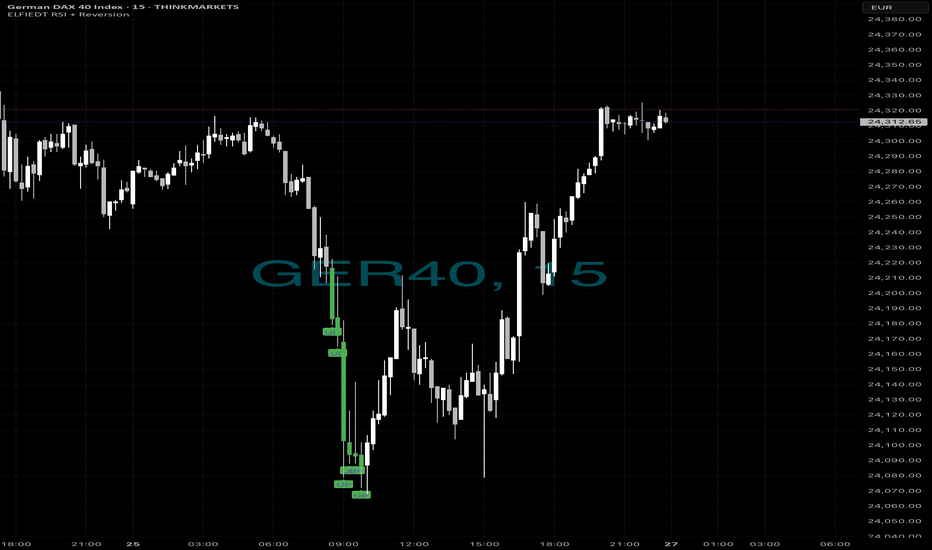

Same as always….📈 The Market Crashed. We Bought the Bottom. Again. 💥

Just another 15-minute chart… or is it?

While panic hit the DAX this morning, ELFIEDT RSI + Reversion was calmly printing BUY after BUY at the dead low. No guessing. No hype. Just precision.

✅ 5 Buy signals within minutes

✅ Picture-perfect mean reversion

✅ Price soared right after

✅ ZERO lag. ZERO repaint.

If you missed this move, don’t worry — this is what my system does.

🧠 Want to learn the logic behind this?

💰 Want to use it live on your own charts?

👉 Drop a 🔥 below if you want access.

👉 DM me “ELFIEDT” to test it out.

👉 Follow for real, repeatable setups.

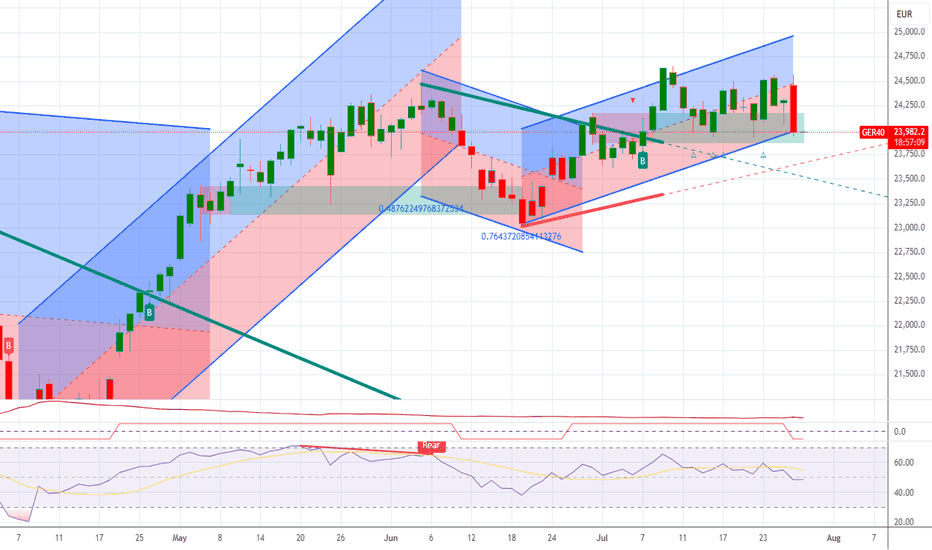

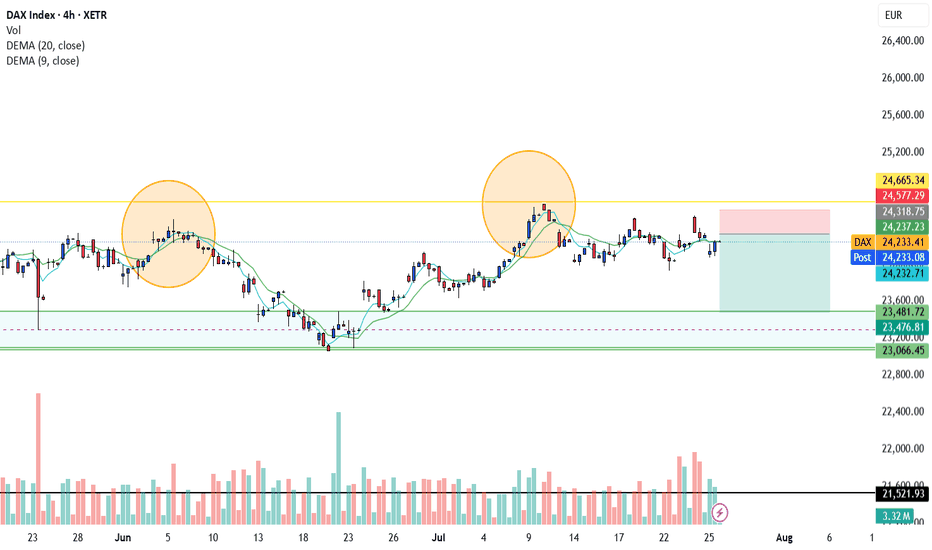

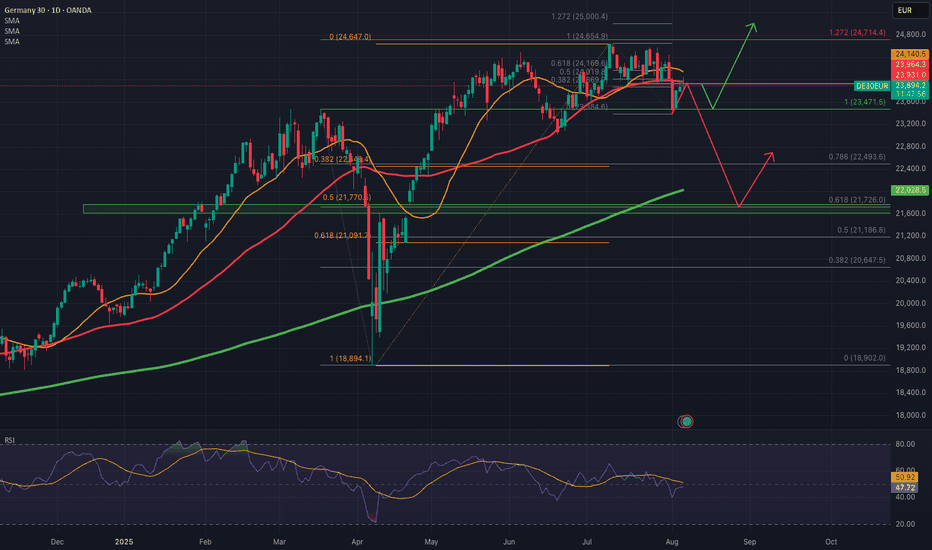

The DAX Index Is Losing Its Bullish MomentumThe DAX Index Is Losing Its Bullish Momentum

At the end of May, we noted that the German stock index DAX 40 was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone.

Two months have passed, and the chart now suggests that bearish signals are intensifying.

From a technical analysis perspective, the DAX 40 formed an ascending channel in July (outlined in blue). However, each time the bulls attempted to push the price above the 24,460 level (which corresponds to the May high), they encountered resistance.

It is worth noting the nature of the bearish reversals (indicated by arrows) – the price declined sharply, often without intermediate recoveries, signalling strong selling pressure. It is likely that major market participants used the proximity to the all-time high to reduce their long positions.

From a fundamental standpoint, several factors are weighing on the DAX 40:

→ Ongoing uncertainty surrounding the US–EU trade agreement, which has yet to be finalised (with the deadline approaching next week);

→ Corporate news, including disappointing earnings reports from Puma, Volkswagen, and several other German companies.

Given the above, it is reasonable to assume that bearish activity could result in an attempt to break below the lower boundary of the ascending blue channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DAX/GER30 - TIME TO SHORT AT CURRENT PRICETeam, great win for the US30 on trade surplus 26 billion last month

expect to have great trade surplus over 300 billion

the Japanese went crazy 3.5% due to tariff drop from 25% down to 15%

The whole market has been pumping

We find an opportunity to SHORT THE DAX/GER 30 at the current level 24543-24556

STOP LOSS AT 24650

WITH TARGET at 24360-24320

PLEASE NOTE: once the price drop below 24500, bring stop loss to BE to protect your trade.

STICK TO THE PLAN.

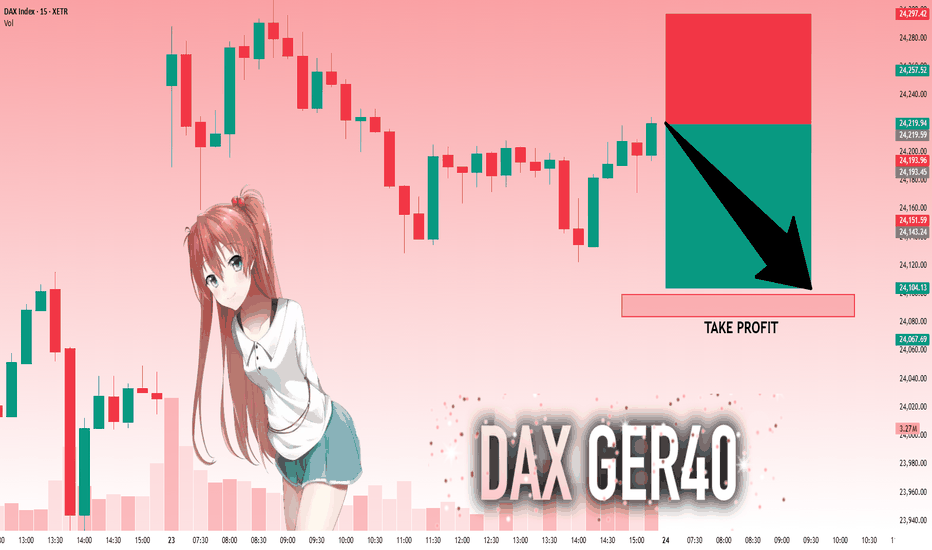

DAX: Target Is Down! Short!

My dear friends,

Today we will analyse DAX together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 24,219.59 will confirm the new direction downwards with the target being the next key level of 24,099.27.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

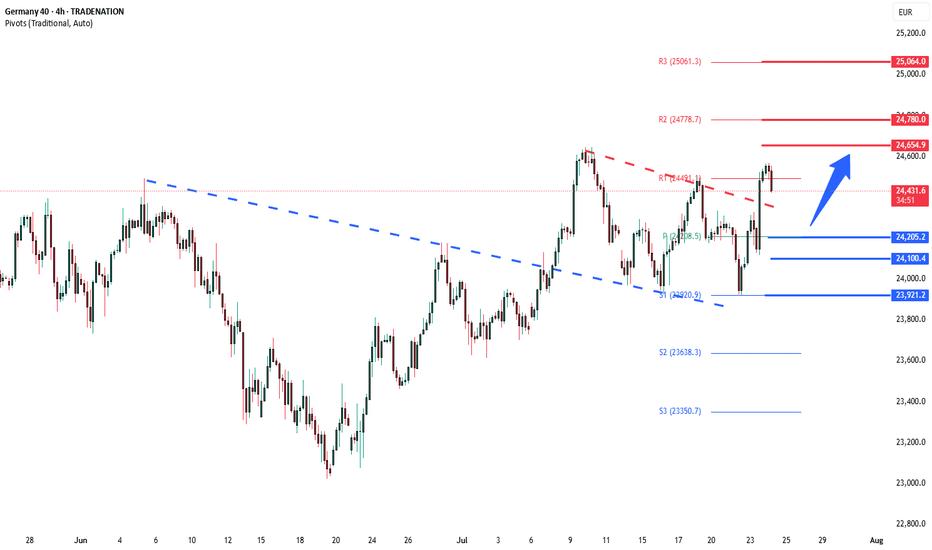

DAX40 Bullish breakout retest support at 24205The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 24205 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 24205 would confirm ongoing upside momentum, with potential targets at:

24655 – initial resistance

24780 – psychological and structural level

25064 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 24205 would weaken the bullish outlook and suggest deeper downside risk toward:

24100 – minor support

23921 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the DAX40 holds above 24205. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GER40 - the way forward uncertainMain German Index has always had an excellent reputation of ever-gainer.

Now however, German economy has been slowing down for years and the outlook is far from bright. At least in my view.

The price has reached the technical resistance at FR 127.2 and reacted to it. It has been consolidating in between FR 127.2 and FR 100 since June 5th, and on July 31st it broke the SMA 50 with a strong move down. Now the price is testing the SMA 50 from below. If it holds and price breaks down below FR 100, we may see a significant correction on this instrument.

Just my humble opinion.

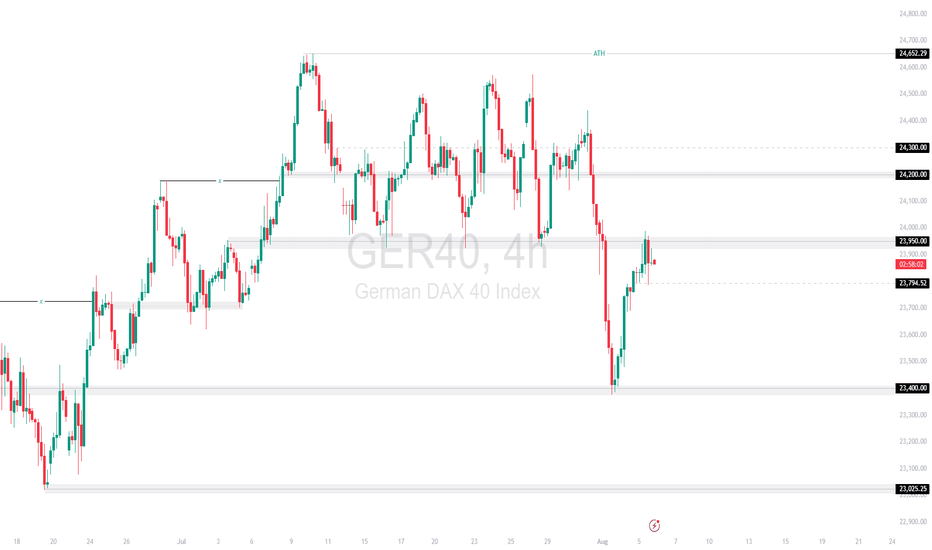

GER40 – Rebounds Into 23,950 ResistanceFollowing a sharp selloff, GER40 found support near 23,400.00, triggering a strong recovery. Price is now reacting to the 23,950.00 resistance zone, a prior structure level.

Support at: 23,794.52 🔽 | 23,400.00 | 23,025.25

Resistance at: 23,950.00 🔼 | 24,200.00 | 24,300.00 | 24,652.29 (ATH)

🔎 Bias:

🔼 Bullish: Break and close above 23,950.00 opens room for 24,200.00 and higher.

🔽 Bearish: Failure to hold 23,794.52 may expose 23,400.00 and 23,025.25.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

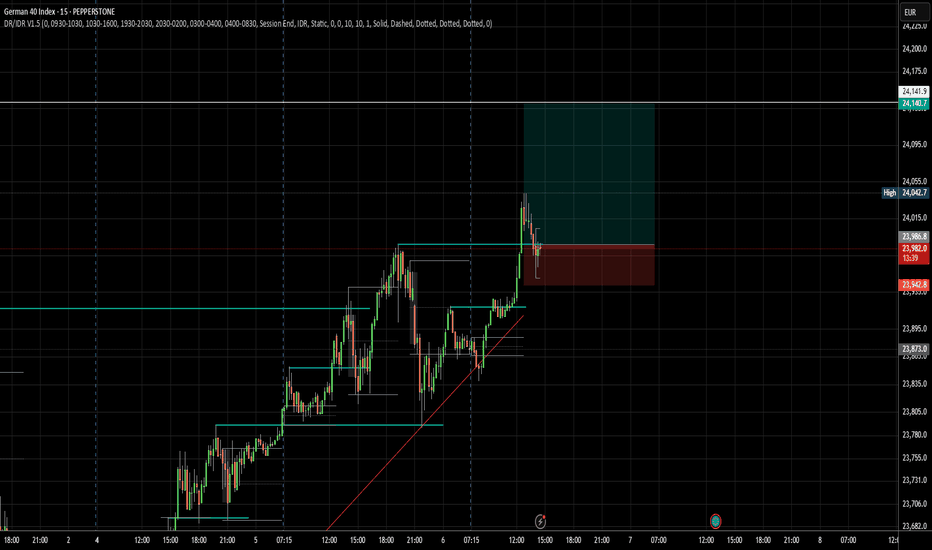

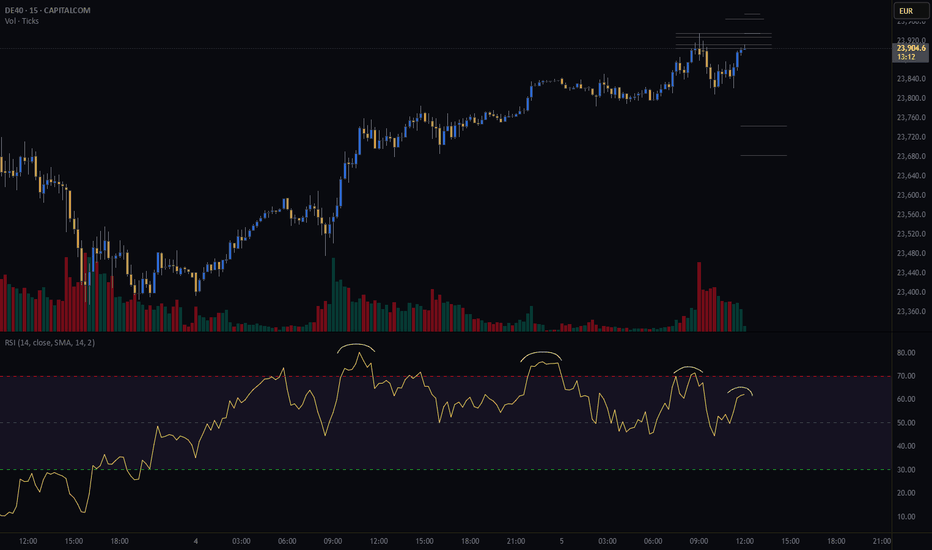

GER40 (DE40) SHORT - Double top 15minPotential short on GER40 with a double top on the 15min.

There is negative rsi divergence which is one of the indicators I use to look for double tops.

Still waiting on further confirmation before I take the trade.

Risk/reward = 3.2

Entry price = 23 905

Stop loss price = 23 965

Take profit level 1 (50%) = 23745

Take profit level 2 (50%) = 23684

What do you guys and girls think the GER40 is going to do from here?