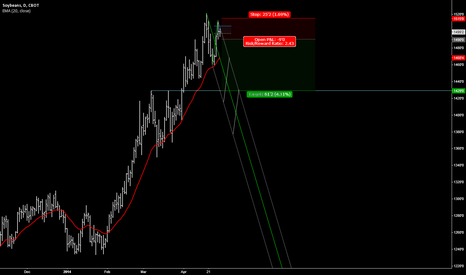

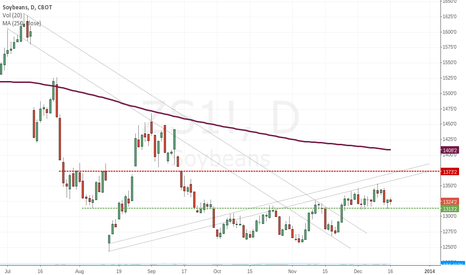

Soybeans breach neckline of Head and Shoulders top.Soybeans, technically, should be heading significantly lower in the short term. With the confirmation today of the head and shoulders top, the market should plummet by 8 - 9% by year end. This will put the soybeans smack down at year lows. The pattern took about a month to develop and should take about that long to fully unfold. However, this is a scared market right now and most of the damage should be done in the next few sessions. Everyone know the fundamental story with beans. Record harvest, perfect crop conditions, too many beans, yadda yadda yadda. The story has been out there and played itself to be true all year. It appeared as the market had finally found a bottom. Not so fast. Shorts have taken control of this market once again. All contracts are under attack as of this writing. The necklines have been breached and settled below in each of the expiring contracts out to Nov '15(that's as far dated as I checked). Here are the target prices for the next six expiring Soybean contracts.

SF15- 914 SH15 - 920 SK15- 930 SN15- 939 SQ15- 949 SU15- 931 SX15- 919

SOY.CME1! trade ideas

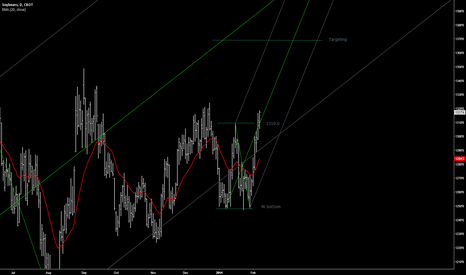

Soybeans (ZS) Bottoming on Weekly ChartZS has found major support at around the 900 level, as seen by the weekly RSI, Stochastics and MACD all turning up from oversold levels. The 900 round figure coincides with major bottoms in 2009 and 2010, along with near bottoming activity in late 2008. ZS appears to want to target roughly 1000 in the near-term where downchannel resistance can be expected to hold initially. Feel free to visit stks.co for today's technical analysis on $ZS_F, $ZW_F, $CT_F, $ZC_F, $NG_F, $SI_F, $EURUSD, $GBPUSD, $USDX, $BUXL, $KC_F, $NFLX.

Website: tradablepatterns.com

FB: facebook.com

Stocktwits: stocktwits.com

Twitter: twitter.com

Linkedin: www.linkedin.com

YouTube: www.youtube.com

Google+: google.com

Email: info@tradablepatterns.com

Favorite patternThis is one of our favorite patterns. It usually suckers people into believing we will see more downside. The larger players will usually dip below the wedge and get new shorts stuck and then squeeze them. (similar to Corn recently) If they break it to the upside we should see a quick move due to weak shorts being stopped. This is high on our watch list.

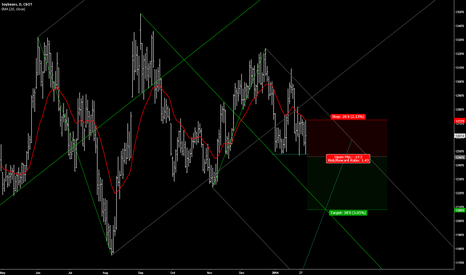

SELL BEANS WEAR DIAMONDS (revised)?Moving to May contract. Beans are at a critical juncture here. A trade below the pivot low posted on the 24jan2014 is going to trigger sell orders and project the price lower. The target is around 1200. where we could post the typical seasonal low.

Educational video

www.youtube.com

A new good entry point for SoybeansA good entry point might develop tomorrow if this prospect confirms.

US soybeans exports shipments have accelerated and to date exceed seasonal pace to hit USDA target by 159 mln bu vs 144 mln previous week. Tomorrow (Dec 10) USDA report is expected to decrease US ending stocks to a even more critical level, and recent price action, especially today, seems to reinforce that. Watch market reaction to the report.

...this added to some technicals, seasonals and fundamentals drivers displayed on the chart.

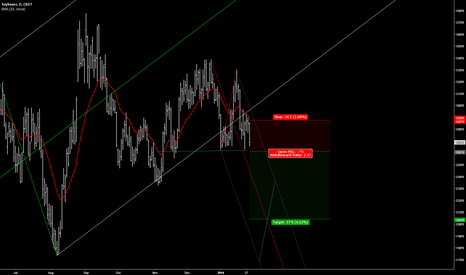

Soybean's harvest low offer potential upsideSoybeans has hold on the bottom of its long term uptrend and now is showing us signs to go long:

Technical Weekly

+ Bullish Engulfing candle pattern

+ MACD bullish crossing (about to happen)

+ RSI bullish divergence

+ RSI Oversold

Technical Daily

+ MACD bullish crossing

+ MACD divergence

+ RSI above 40

+ RSI bullish divergence

+ Stochastics bullish crossing

Fundamentals

+ Good up movement on Friday,November 7th, after a neutral to slightly bullish USDA report

- S.America planting season on perfect situation

- Record S.America crop

Seasonals

+ Soybean's harvest low offer potential upside

+ Oct historically 66% up months; Nov historically 57% up months

Entry point: a daily close above 1318'6

Stop: a daily close below 1296'0

Target: after bearish signals (to be defined)

Any other idea ?

Please, feel welcome to share.