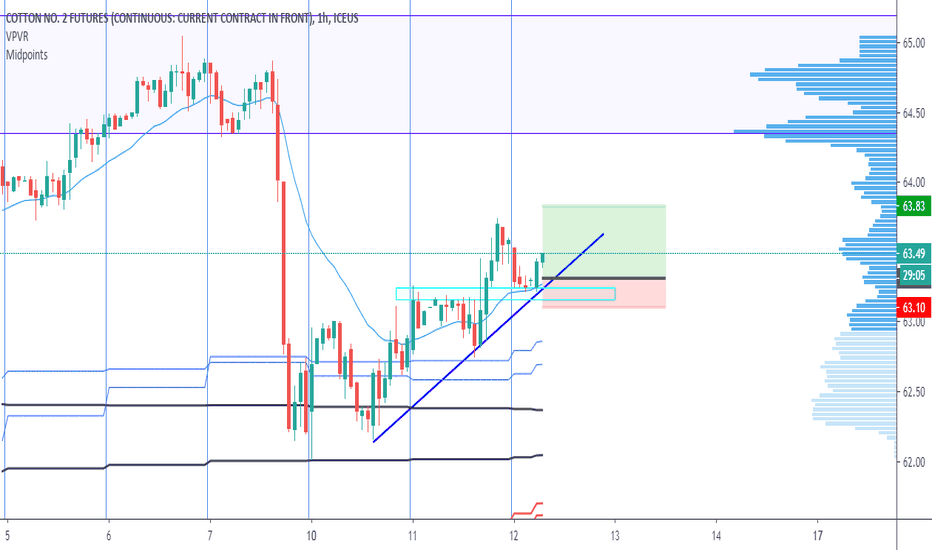

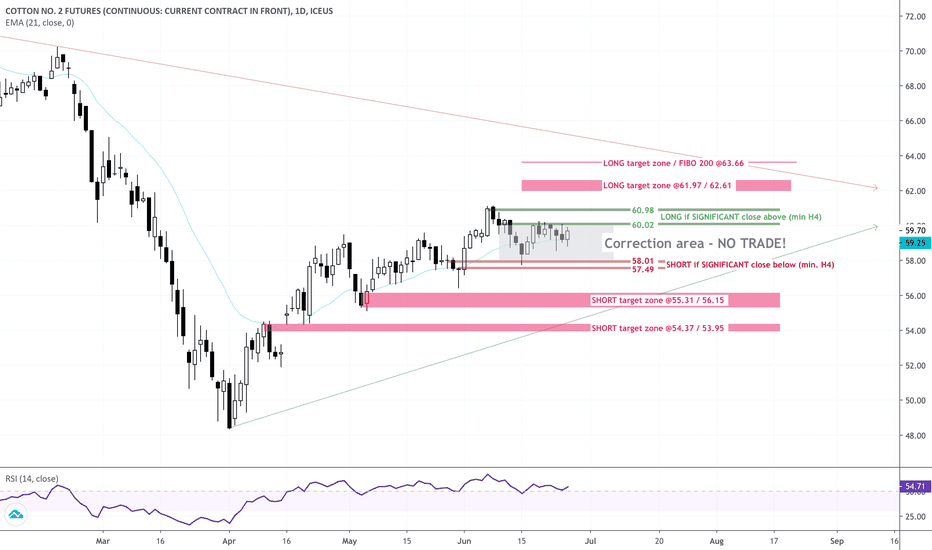

Cotton is still afloatEarlier this Summer, Cotton rallied far above 200 daily (black). It broke down back to this level. When it comes to MA reactions, cotton is a beautiful example of that. It even reacts to 20 daily (blue) which isn't always true on other instruments.

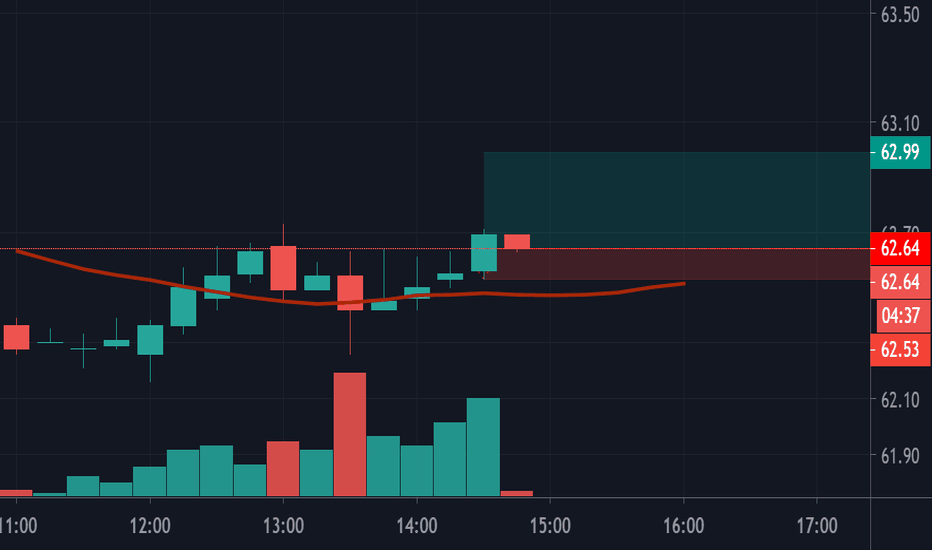

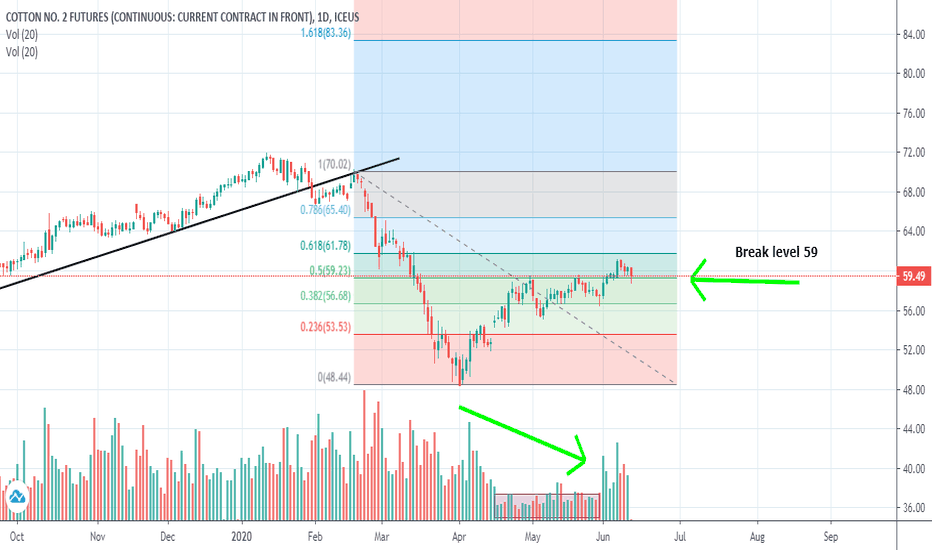

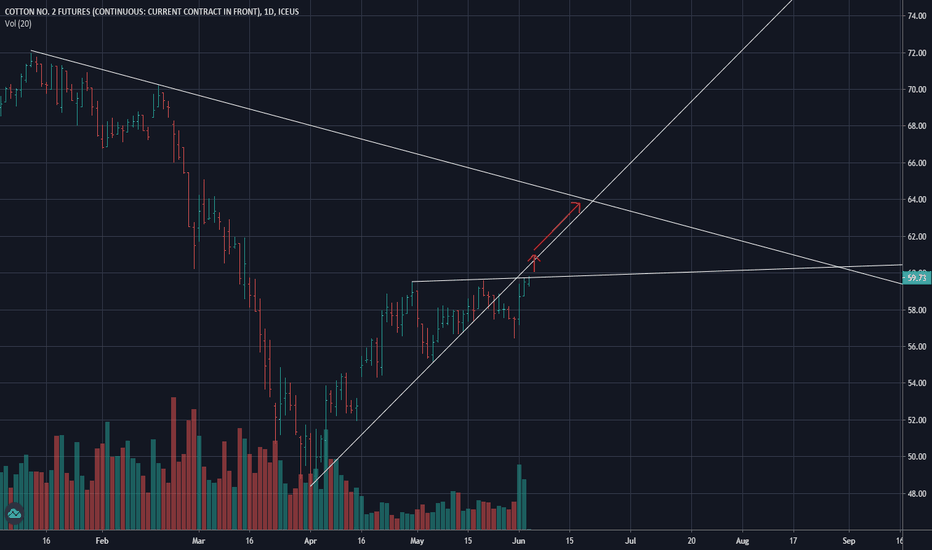

I will be looking to open a long today or tomorrow on the pictured level. SL is below previous consolidation range's top and below 20 MA hourly (blue). If anyone is interested in Fibonacci stuff, take profit is right on 0.6 - 0.7 level.

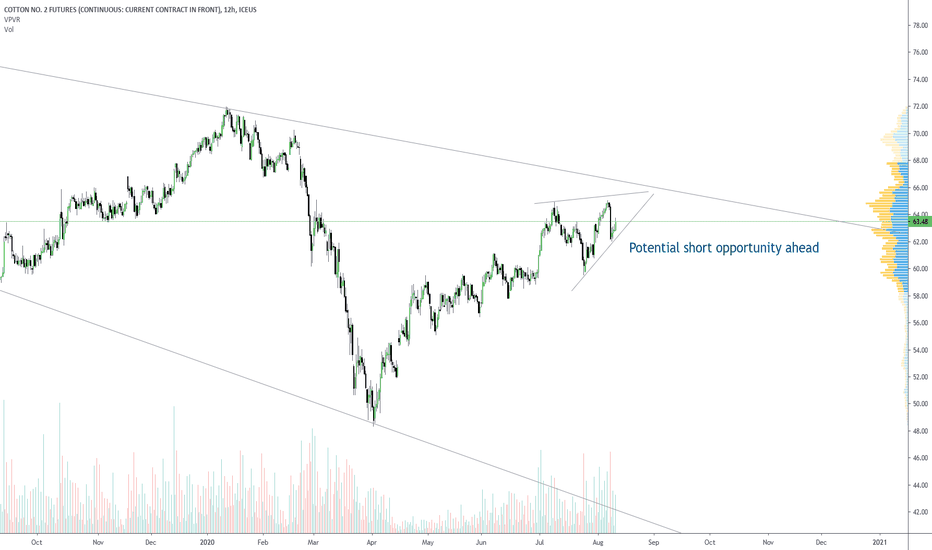

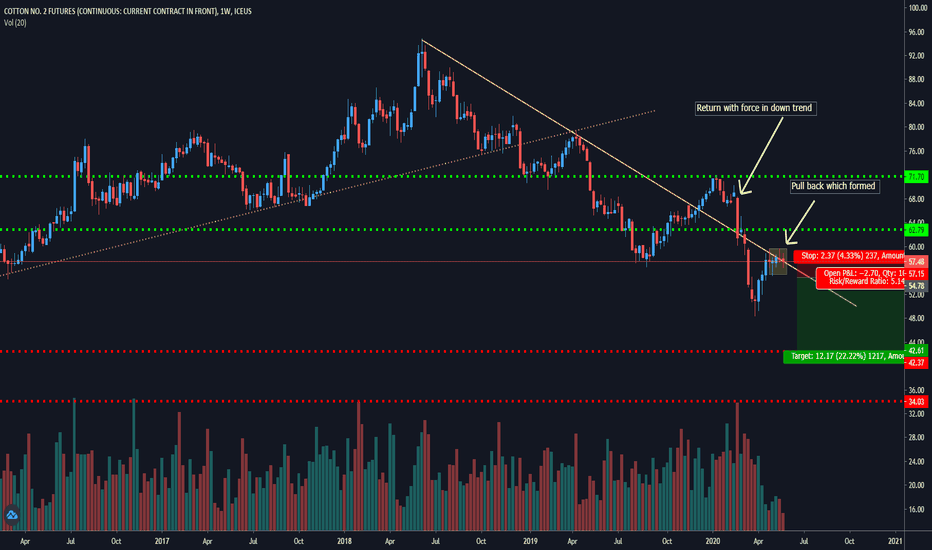

Eventually, it will be wise to short with seasonality in mind. It points downwards for the later part of the year.

COTTONCNDY Futures

COTTONCNDY1! trade ideas

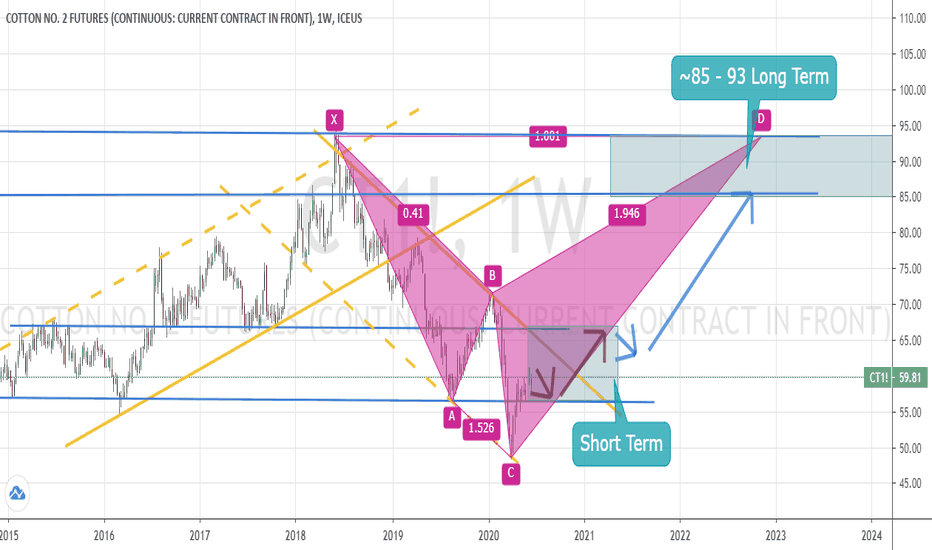

Cotton in demand?

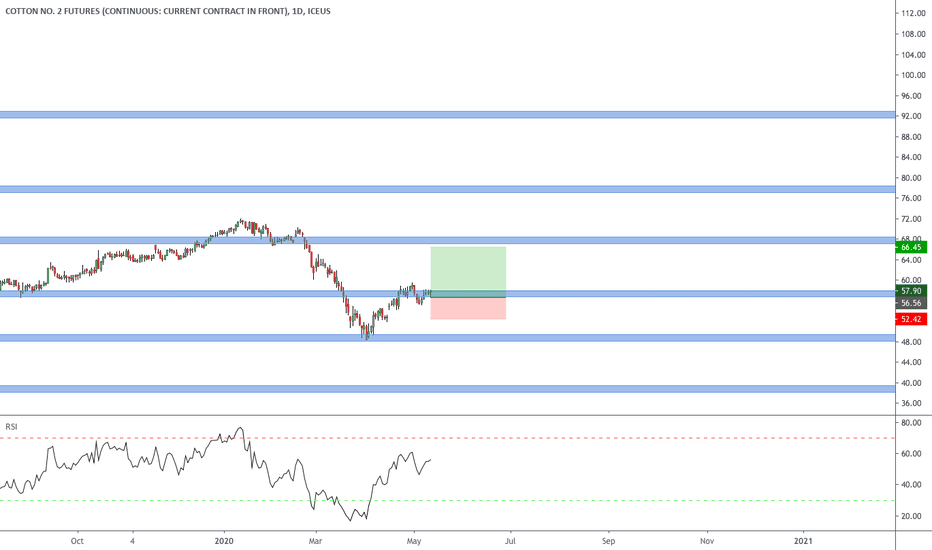

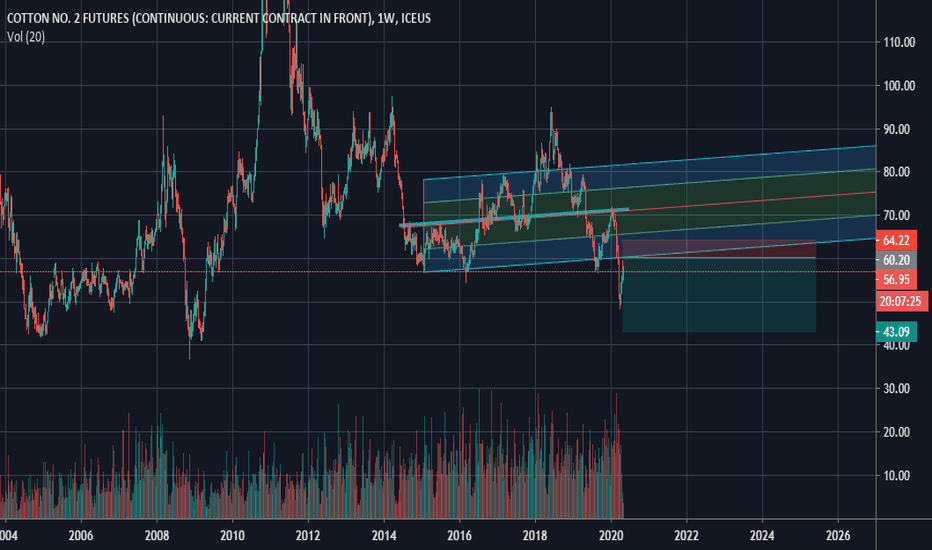

Cotton is a member of the Soft Commodities sector and is one of the more volatile commodities in its group. Weather conditions in producing countries, along with supply and demand are the main drivers behind the volatility. Since the coronavirus pandemic, demand has evaporated as factories and outlets cease to work and the ongoing feud between the U.S. and China isn’t helping matters for the lightweight fibre.

As the US Dollar continues to show signs of further weakening, we could expect to see commodities such as Cotton consolidate around these current levels or perhaps rise for the medium term. As of today, the Cotton index is currently trading at 63.84 per pound.

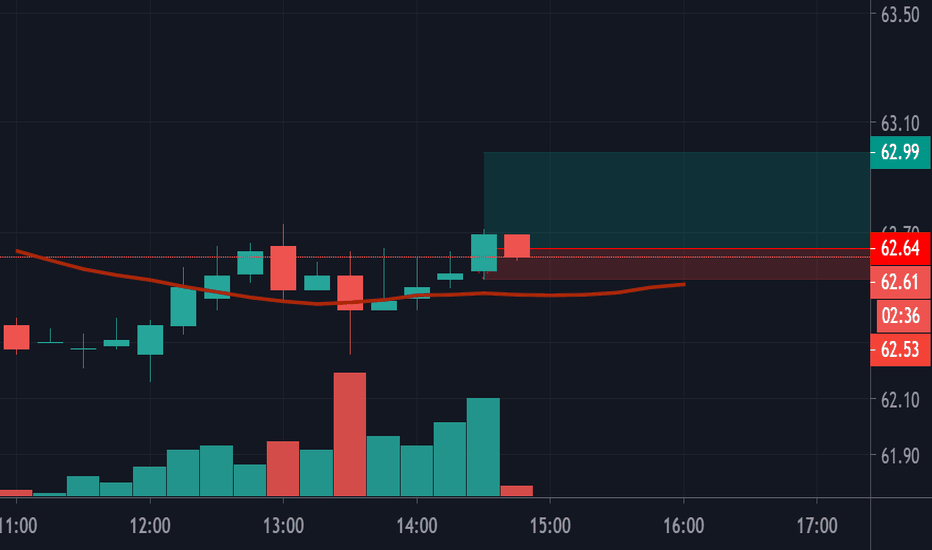

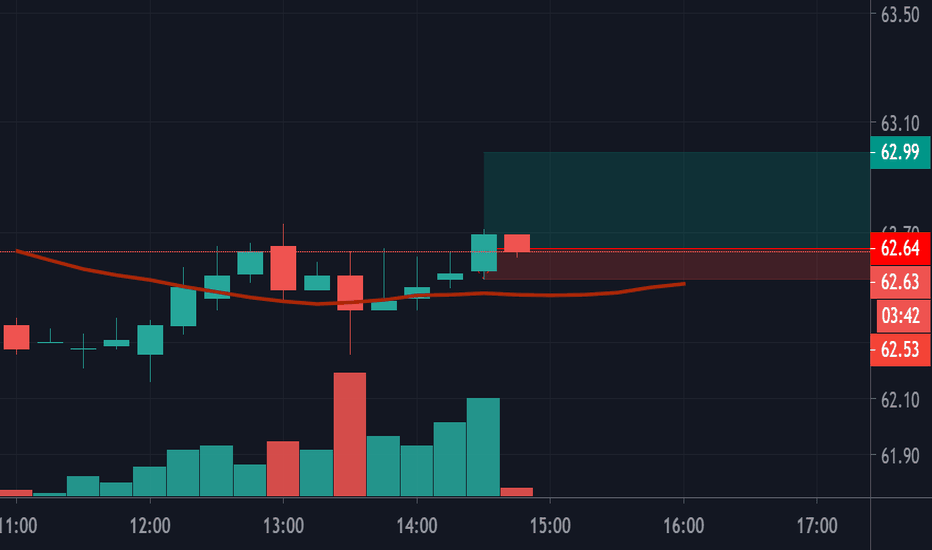

According to last week’s Commitment of Traders (COT) data. Large speculators reduced their bullish exposure from the previous week by -4,797 contracts totalling 42,055 contracts, short positions totalled 18,340 contracts a reduction of -668 contracts from the week starting on the 21 July ‘20

Commercial hedgers are currently short 102,907 contracts a change of -4,653 contracts from the week prior, 1,309 contracts were added to their bullish exposure this week totalling 25,386 contracts.

Non-Reportables (aka small participants) are holding 15,703 contracts long and 3,460 short, an increase of 363 contracts from the week prior.

What happens at (1) could pave the way for the short-medium term.