GC1!

GC1!

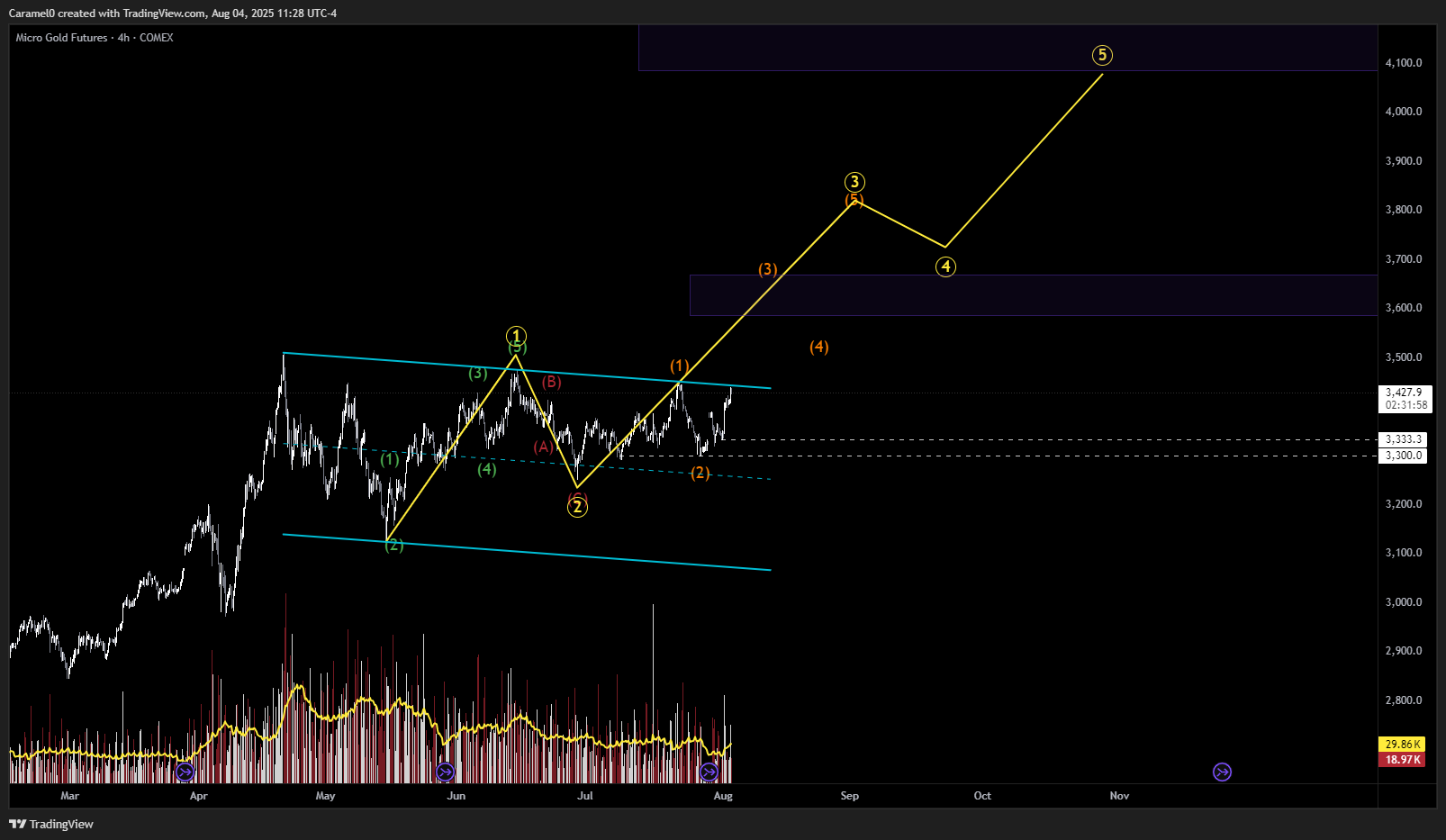

Price lifted through the 3431.5 ceiling with solid delta and follow-through:

• Large green bubbles (aggressive buys) pushed through previous passive ask walls.

• Liquidity at 3431–3431.7 got absorbed cleanly.

• Next supply layer: 3433.5 and especially 3435.0 (thick COB), then 3437–3438 as potential exhaustion zones.

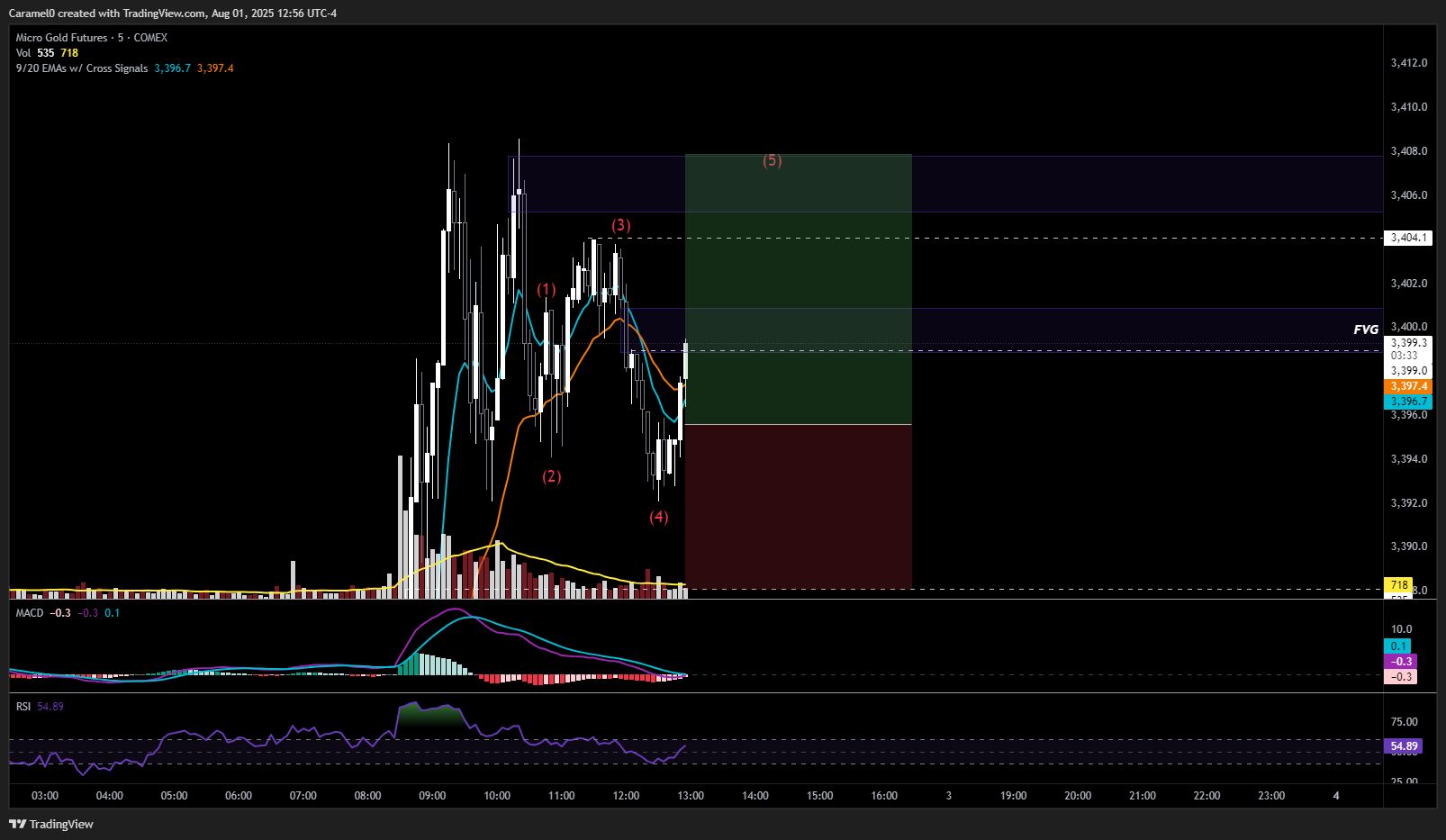

GC1! Entry sell now 3429

GC1! Entry sell now 3429

target 1 3420

target 2 3410

target 3 3400

sl 3440

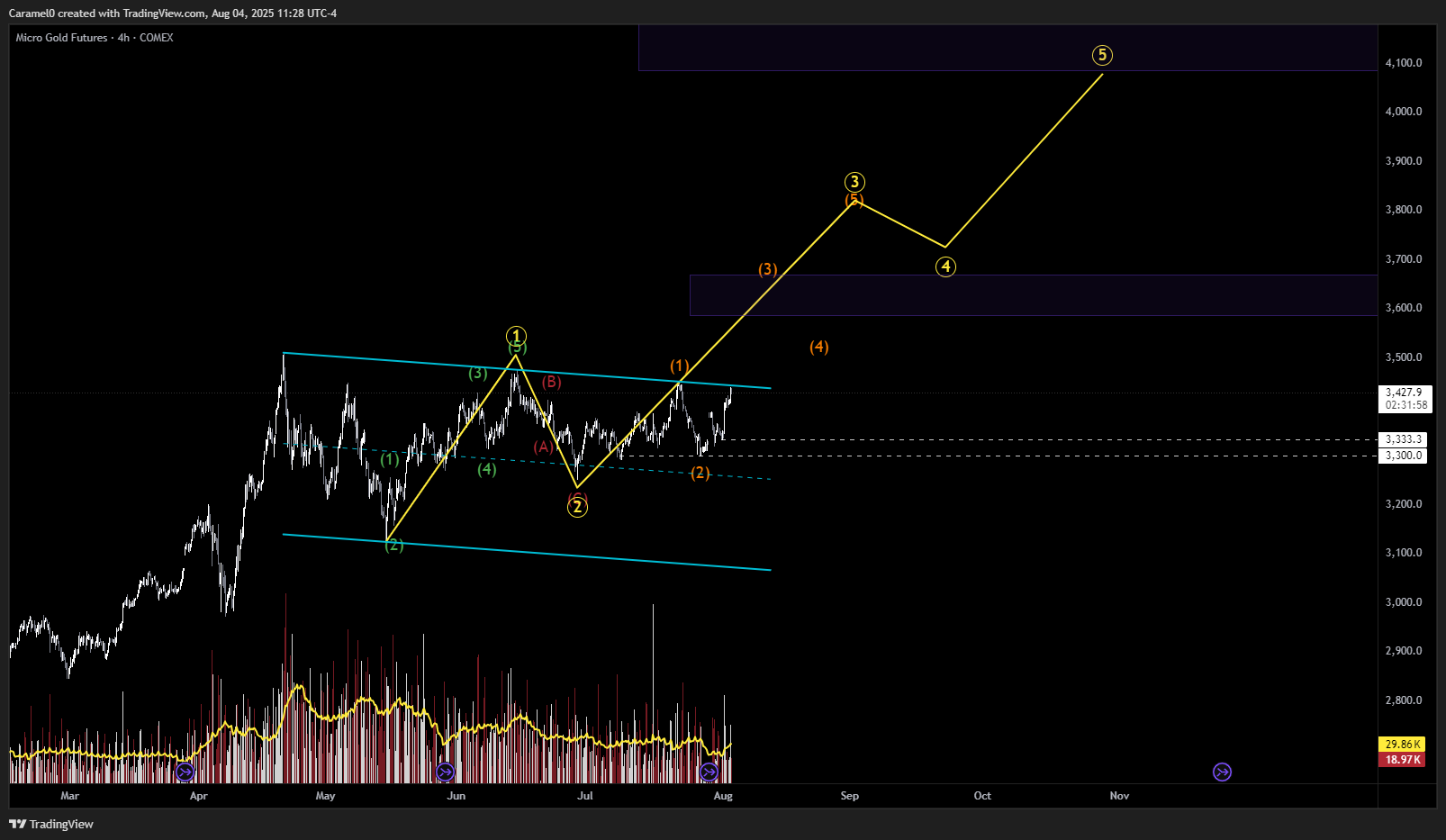

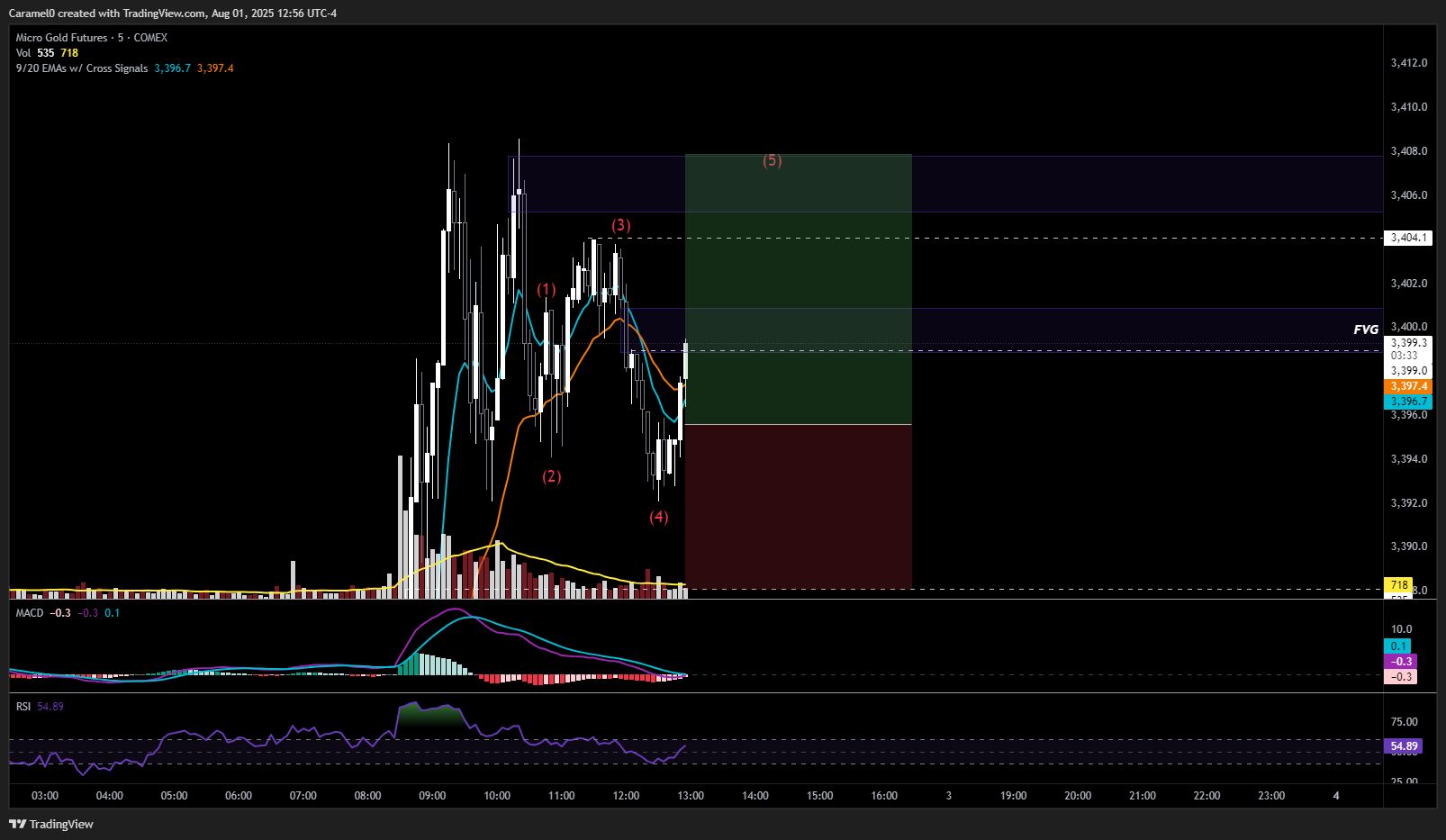

MGC1! Hi y'all,

MGC1! Hi y'all,

With increasing signs of a potential rate-cut by September, we're looking bullish for the long-term. I think the market is slowly going to start pricing that in, so expect us to climb. CPI data is coming in next Tuesday. If that's favorable, we're going to breakout past the 3500 current ATH. If not, we're likely going to be stuck within the 3500-3350 range until the end of the month. China and India trade deals are also key events here to keep an eye out for. Bullish bias overall because of the increased rate cut probability, but keeping an eye out for impulses off of news.

MGC1! We're currently at a resistance level so a pullback would be normal.

MGC1! We're currently at a resistance level so a pullback would be normal.

In my bullish scenario, my next target is around 3600, but for that, we need to breakout from this bearish parallel channel.

If the pullback goes lower than 3333.3 - 3300.0, we could go towards the mid-line of the channel, and if broken we could retrace towards 3000

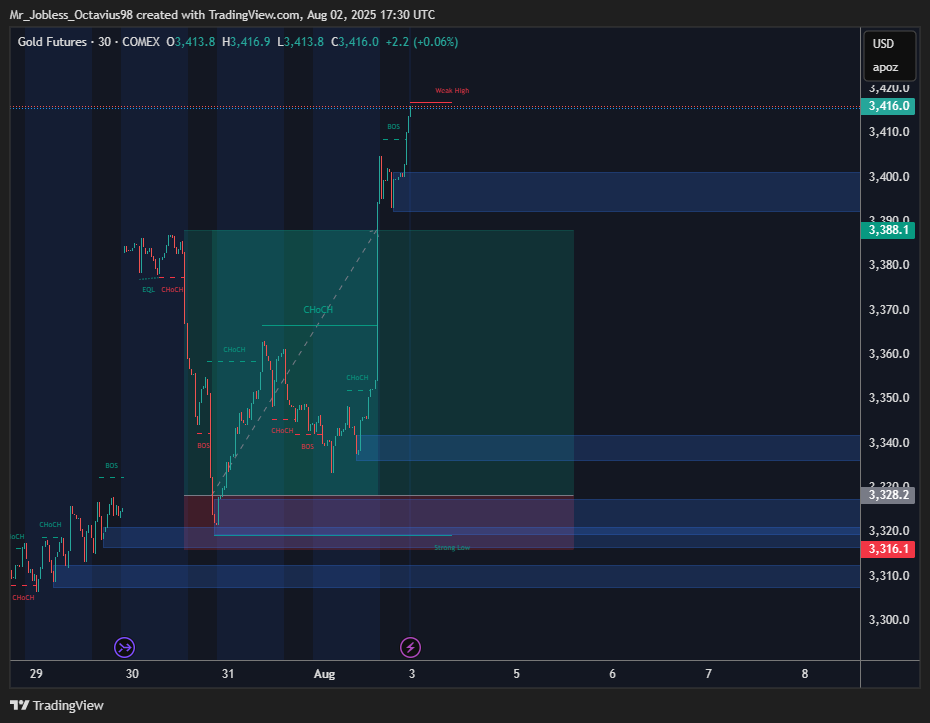

GC1!

GC1!

Entry: Long at 3418-3423 (rejection confirmed via pinbar & +delta on Bookmap).

SL: 3408 (below swing low, ~15 pts risk).

TPs:

TP1: 3443 (50%, 2R partial)

TP2: 3463 (25%)

TP3: 3503+ (25%, trail on BOS)

thanks Forex

#GOLDIE_LOCKS

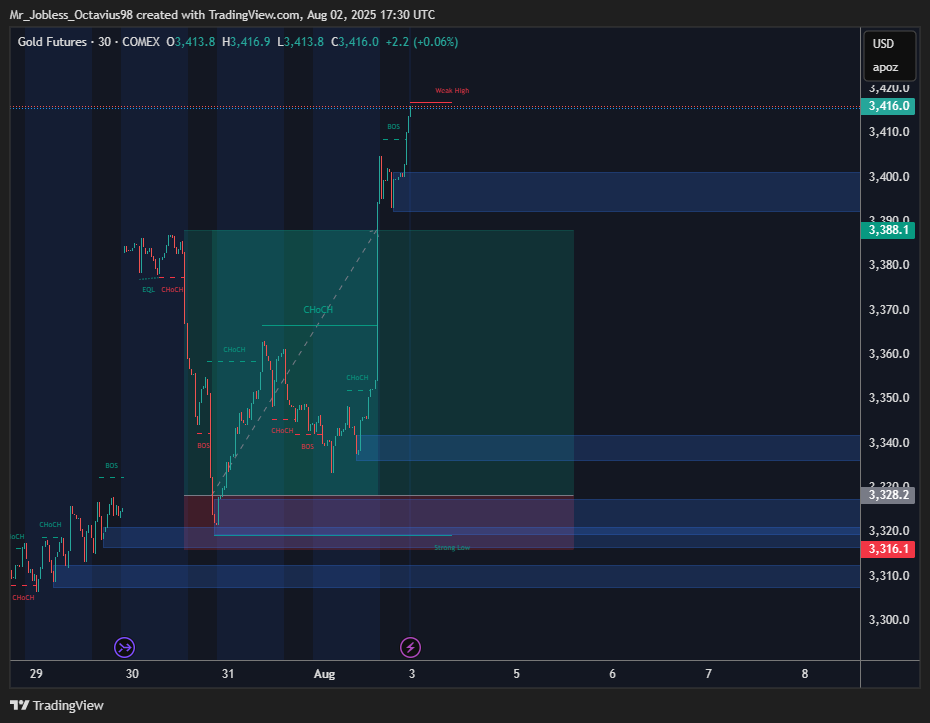

MGCZ2025 im feeling a pull back by EOD to cool off the 1HR

MGCZ2025 im feeling a pull back by EOD to cool off the 1HR

MGC1! We need a break of this fvg, A rejection can mean a retracement towards 3377

MGC1! We need a break of this fvg, A rejection can mean a retracement towards 3377

MGC1! if we reverse now, we might be testing 3408 again, possibly going higher.

MGC1! if we reverse now, we might be testing 3408 again, possibly going higher.

GC1!

GC1!

• Price had a strong impulsive breakout above the 3354–3360 zone during the 8:30 AM news, followed by range compression under the 3398–3401 supply zone (premium).

• On the 1-min, price printed LHs just under supply and failed to break 3401.

• On the 5-min, price is holding a series of HLs with EMAs stacked bullish, but struggling to reclaim HHs.

Two Scenarios for A++ Setup

1. Short Setup (More likely for now)

• Trigger: Rejection and failure to hold above 3398–3401, especially on a liquidity sweep.

• Entry: Ideally on a sweep of 3401 with absorption or bearish engulfing candle.

• TP Zones:

• First target: 3388–3386

• Final target: 3380–3375 (low-volume area)

Avoid shorting early — need clear failure or rejection + weakness.

⸻

2. Long Setup (If breakout occurs)

• Trigger: Break and close above 3401 with strong volume and continuation structure.

• Entry: Pullback to 3398 or 3401 (flip level).

• TP Zones:

• 3410 minor extension

• 3416–3420 strong imbalance from July