Amazon ($AMZN) – Bullish Breakout WatchPublished by: Wavervanir_International_LLC

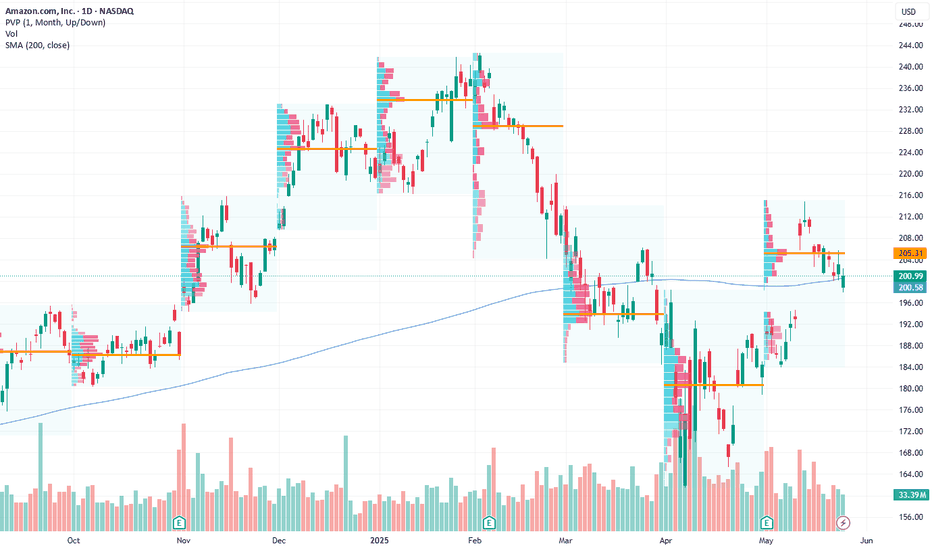

🗓️ May 19, 2025 | 1D Chart

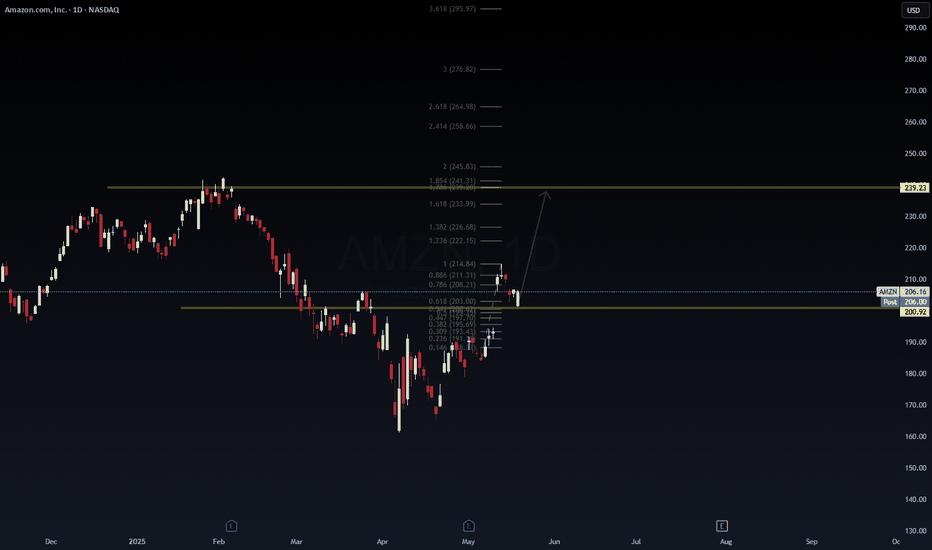

Amazon is showing strong momentum with a confirmed break above the $200.92 resistance zone (now flipped support). The price is currently consolidating around the 0.786 Fibonacci level ($208.21), and a clean daily close above this region could open up an impulsive move toward the 1.618 Fib extension at $233.99 and the key resistance level of $239.23.

🔍 Key Levels to Watch:

🔹 Support: $200.92

🔹 Resistance: $208.21 → $214.84 → $233.99

🔹 Final Target (Short-term swing): $239.23

🎯 Bullish Fib Extensions: 1.618 ($233.99), 2.618 ($264.98), 3.618 ($295.97)

📊 Setup Rationale:

Bullish structure with higher lows forming since May.

Breakout above major supply zone.

Clean Fibonacci confluence for upside targets.

Volume confirmation and market momentum favor upside continuation.

🚨 Disclaimer:

This is not financial advice. Always perform your own due diligence. This chart is for educational purposes under Wavervanir DSS guidance.

1AMZN trade ideas

Shoulders to the Sky: Amazon’s Breakout Journey BeginsOverview

Name: Amazon.com, Inc

Ticker Symbol: AMZN

Exchange: NASDAQ

Founded: 1994

Headquarters: Seattle, Washington, USA

CEO: Andy Jassy (as of 2025)

Sector: Consumer Discretionary / E-commerce & Cloud Computing

About

Amazon is a global e-commerce and cloud services powerhouse. It dominates online retail while also operating AWS (Amazon Web Services), one of the world’s leading cloud computing platforms. Other segments include advertising, logistics, streaming, AI hardware (Alexa), and physical retail.

Fundamentals

Earnings: Amazon has consistently beaten revenue expectations with strong growth in AWS and advertising segments.Revenue: Q1 2025 revenue topped $154.8B, up 13% YoY, with solid margins.Outlook: Management has raised guidance for Q2 citing AI integration in AWS and retail efficiency gains.

Technicals

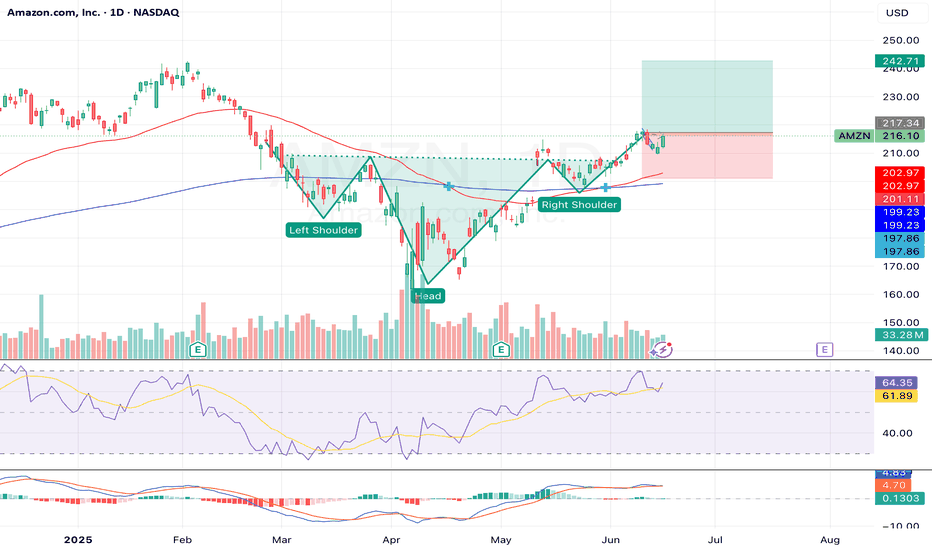

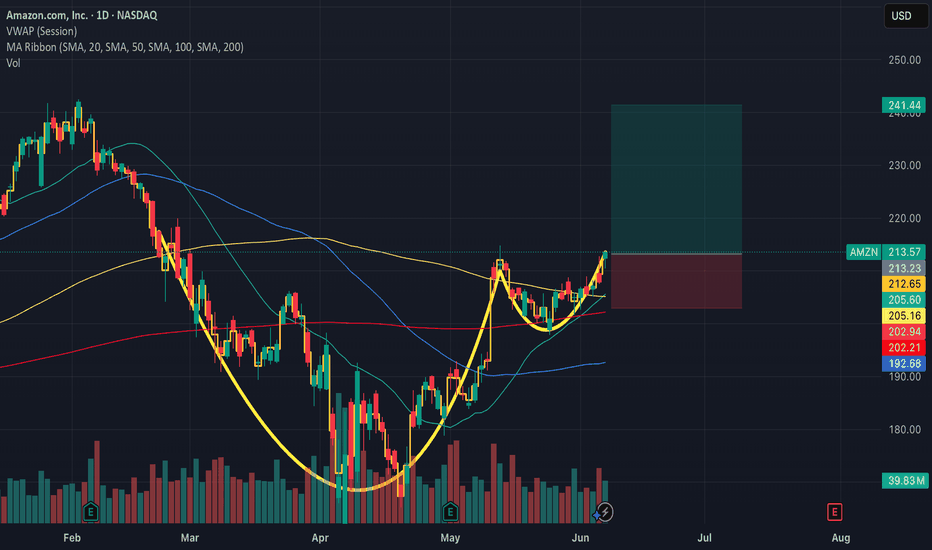

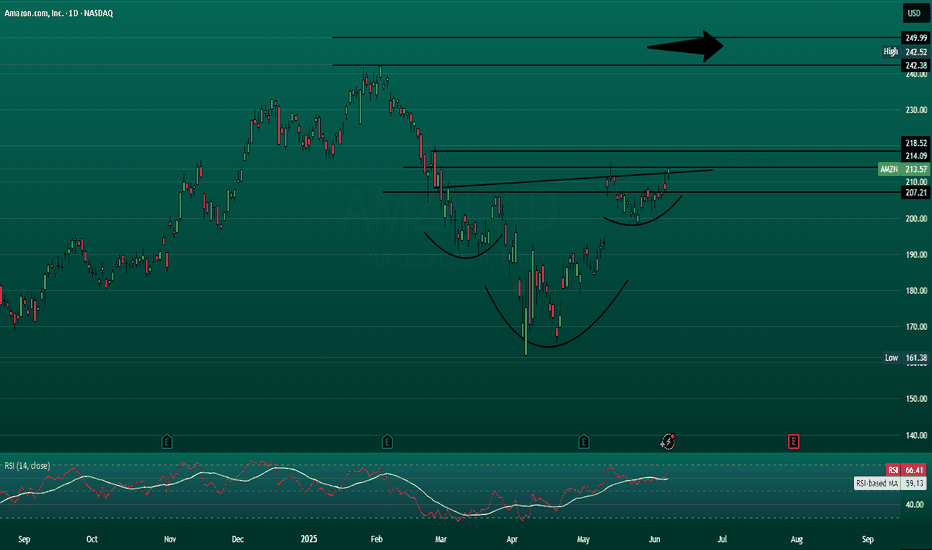

Inverted Head and Shoulders Pattern confirmed on the daily chart — a strong bullish reversal signal.

Price has broken above the neckline (~$213–$215) with volume confirmation.

Golden Cross forming on short-term MAs — bullish signal.

RSI is around 64, suggesting momentum remains but is nearing overbought.

MACD is bullish with widening divergence — supports potential continuation.

📌 Support Zones: $202, $199

📈 Resistance / Target Zones: $217 (short-term), $235 (TP), $242 (extension)

💡 My Take

AMZN is showing bullish continuation out of a textbook inverted head and shoulders — typically a strong reversal setup after a downtrend. We’ve seen the neckline break with follow-through, and volume patterns support the move.

While the RSI shows slight overbought conditions, this could lead to a short consolidation before another leg up toward $235–$242. With macro tailwinds from cloud and advertising sectors, AMZN is positioned well for a strong Q3 rally.

Position

Type: AMZN 235 Call

Expiry: July 11, 2025

Quantity: 7

Average Cost Basis: $1.00

Last Price: $0.69

Purchase Date: June 12, 2025

Total % Gain/Loss: –30%

Despite current drawdown, I remain optimistic about AMZN's momentum. The technical setup is strong, and short-term weakness is likely just healthy consolidation. I'm holding through July with my eyes on the $235 target.

AMZN — Accumulation Zone or Just a Healthy Pullback?📦Amazon (AMZN) is offering an interesting opportunity after a healthy correction from its 2025 highs. With continued AWS expansion and aggressive investment in AI infrastructure, the fundamentals remain solid — but short-term volatility opens the door for strategic entries.

🎯 Entry Points

🔹 $194 – First key support, ideal for early buyers

🔹 $187 – Strong technical congestion zone

🔹 $169 – Deep value zone with higher risk/reward potential

💰 Profit Targets

✅ TP1: $210 – First resistance and psychological level

✅ TP2: $227 – Last swing high area

✅ TP3: $241+ – Full recovery path if momentum holds

🧠 Strategy Insight

This setup suits a swing trade horizon (30–60 days). Scaling into the position and adjusting stops under $160 offers a risk-managed approach. The upcoming earnings on July 31, 2025 could be the trigger for a major move — watch AWS growth numbers and forward guidance closely.

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Always do your own research and manage risk accordingly.

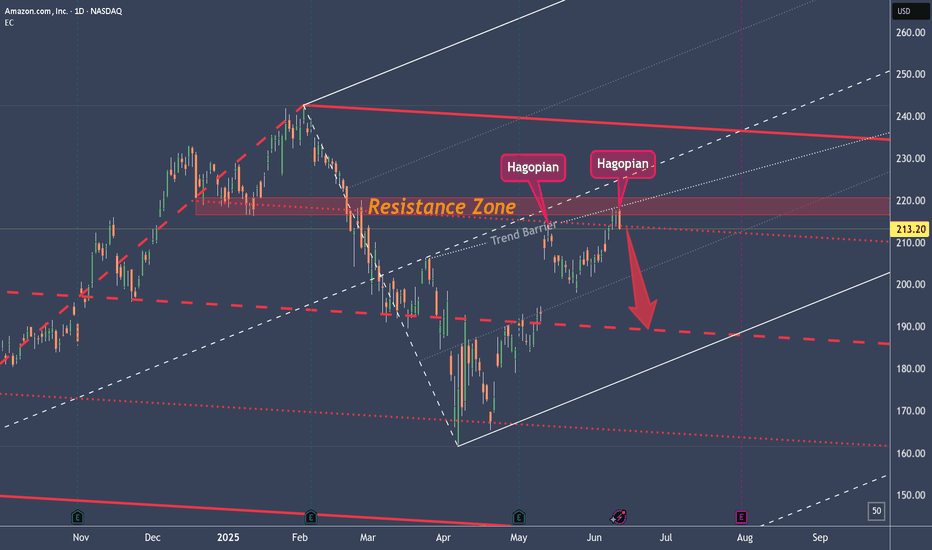

AMZN Struggles at Trend-Barrier and ResistancePrice is still in upward mode.

Why am I bearish?

1. Rejection in the Resistance Zone

2. Second Hagopian

3. Close below the Red Forks 1/4 Line

PTG1 is the Center-Line.

Potential further PTG's below at the 1/4 Line and then of course the L-MLH.

Playing it with Options which give me much more leeway. For a hard Stop I would put it right behind the last high above the TB.

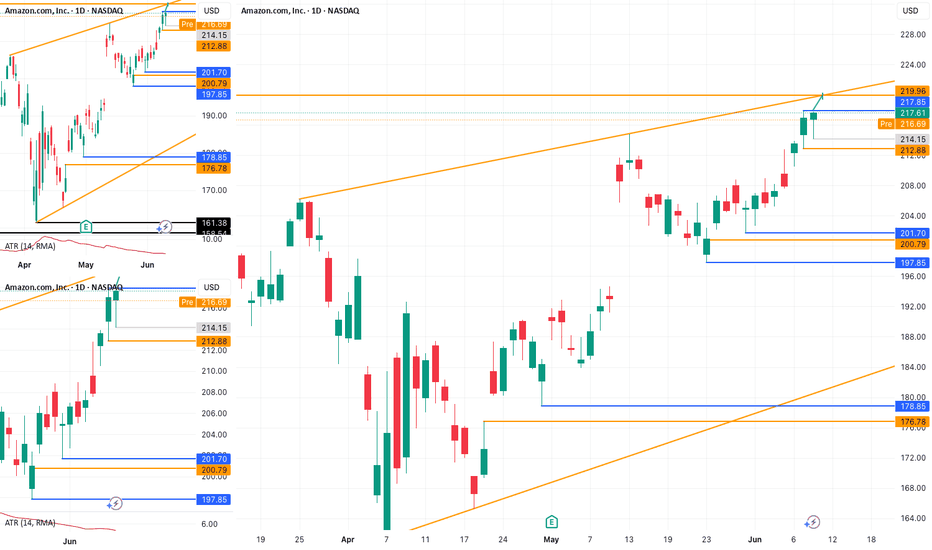

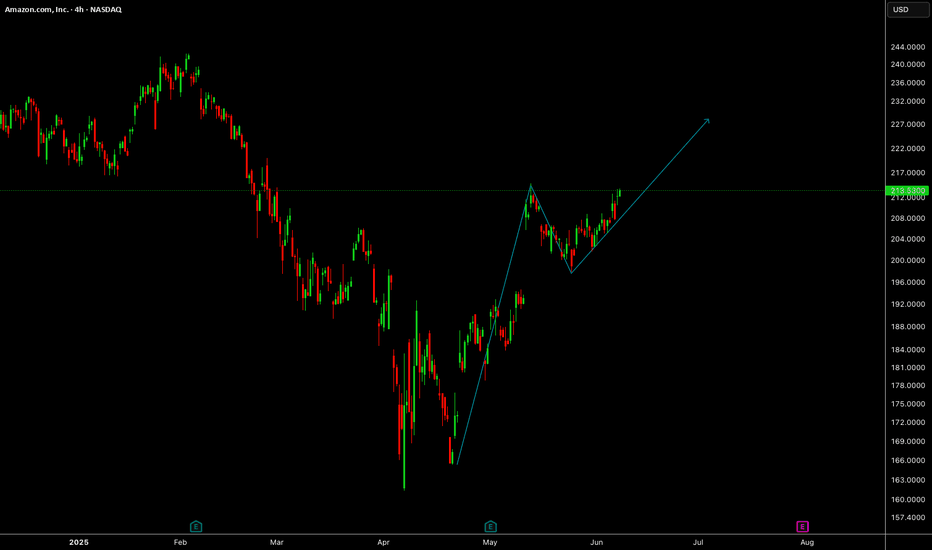

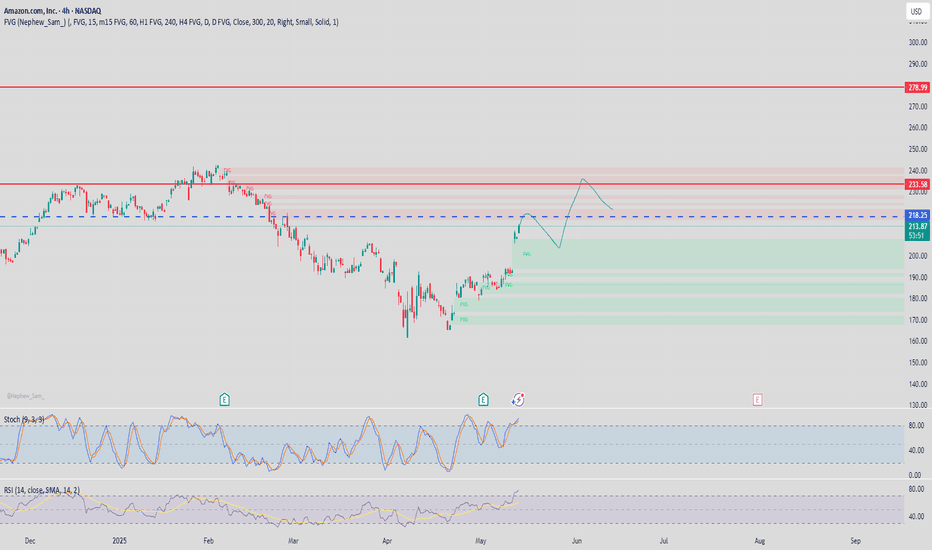

AMZN: Watch for a Break Above 218.00If NASDAQ:AMZN manages to push above 217.85 , there's a strong chance we’ll see a move toward 219.96 . However, caution is advised around the 218.00 level – both premarket and postmarket sessions showed hesitation and failed to hold above that resistance.

A more conservative approach would be to wait for a clean break above 218.00 before entering.

🔍 Context:

We’re currently in a solid uptrend. On the daily chart, we’ve seen a rejection of the downside, marked by an inside bullish candle with a notable wick – suggesting upward pressure that the market may try to release. Given recent premarket activity, the 218.00 area remains a key battleground for bulls and bears alike.

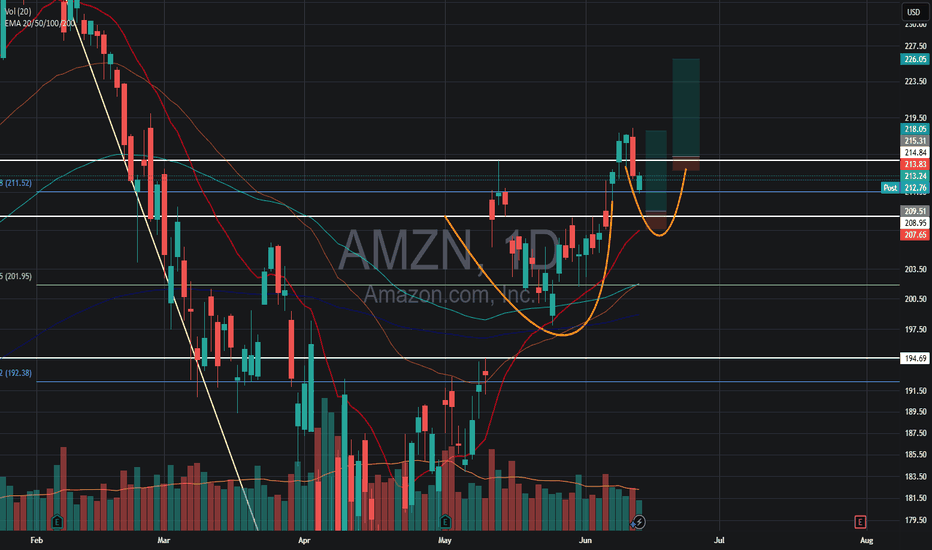

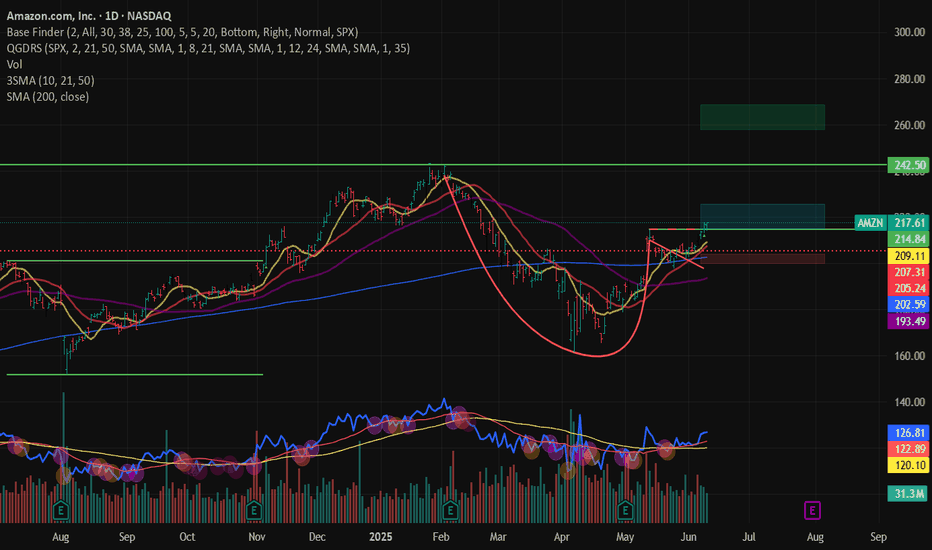

AMZN – Breaking Out From Handle in Cup & Handle BaseAmazon ( NASDAQ:AMZN ) is breaking out from the handle of a well-formed cup and handle base, offering a defined, low-risk entry with a strong technical structure.

📈 Entry Zone: 214.84 – 225.25

🛑 Stop Range: 203.88 – 197.23 (5–8% below entry, based on risk preference)

🎯 Target: 242.50

📌 Will consider adding above all-time highs if momentum builds

Price is riding above all major moving averages (10, 21, 50, 200), with bullish alignment across the board. The handle showed tight price action before this breakout, a constructive sign for continuation.

Relative strength is not leading, but it's starting to slope upward — signaling early participation. In a market where growth stocks are volatile, names like AMZN provide a more stable trend with potential for measured upside.

Fundamentally, Amazon continues to deliver across AWS, logistics, and advertising — with consistent earnings growth backing the technical picture.

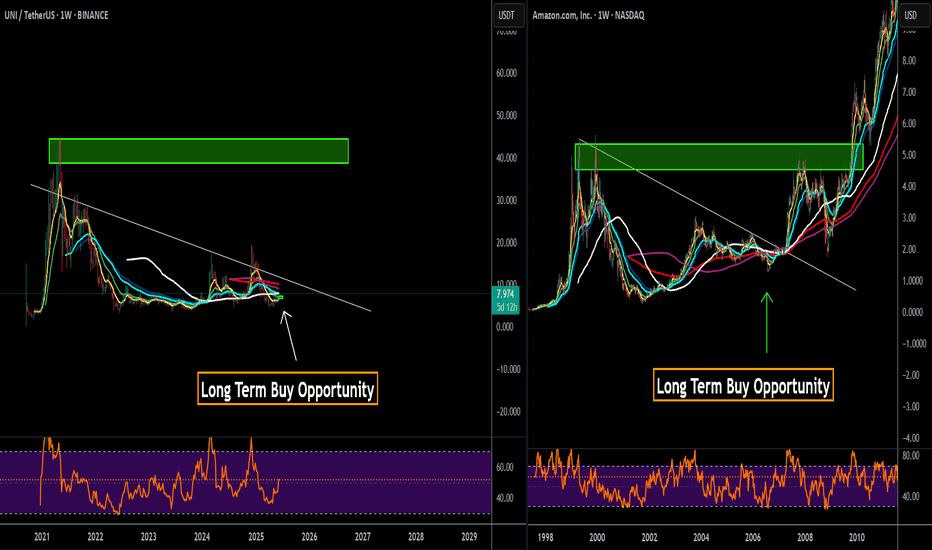

UNISWAP - Long Term Buy Opportunity 🚨MartyBoots here , I have been trading for 17 years and sharing my thoughts on UNI here.🚨

UNI vs ETH | Why Uniswap Deserves a New All-Time High

In this video, we dive deep into the fundamentals of Uniswap (UNI) and explore its close relationship with Ethereum (ETH)—the blockchain it’s built on. While ETH has regained massive attention with its expanding ecosystem and institutional adoption, UNI is still massively undervalued in comparison, despite powering one of the largest DeFi protocols in the world.

⸻

Fundamentals Breakdown:

• Uniswap is the backbone of decentralized trading, facilitating billions in volume without intermediaries.

• Fee switch mechanics and upcoming v4 upgrades have the potential to drive real yield to UNI holders.

• Unlike ETH, which serves as a Layer 1 gas token, UNI represents governance and future revenue potential over a growing protocol.

⸻

Why UNI Has Upside:

• UNI still trades far below its all-time highs—even as Ethereum ecosystem activity rebounds.

• ETH has already made major recovery moves, but UNI hasn’t caught up yet—creating a bullish divergence.

• With the rise of on-chain liquidity, tokenized real-world assets, and institutional DeFi, Uniswap is positioned to be a key infrastructure layer.

⸻

My Thesis:

• ETH = Base Layer | UNI = DeFi Rail

• As ETH grows, Uniswap scales alongside it—capturing more swap volume, TVL, and governance power.

• If Uniswap activates protocol revenue, UNI transitions from a governance token to a yield-bearing asset, giving it real valuation metrics and long-term investor interest.

⸻

Watch to see my full breakdown, including:

• UNI vs ETH price chart comparison

• On-chain stats, dominance shifts, and upcoming catalysts

• Why I believe UNI is set for a breakout back toward new all-time highs

⸻

Like, comment, and follow for more deep-dive crypto breakdowns and technical setups.

#Uniswap #UNI #Ethereum #ETH #CryptoAnalysis #DeFi #TradingView #AltcoinSeason #PineScript #FundamentalAnalysis

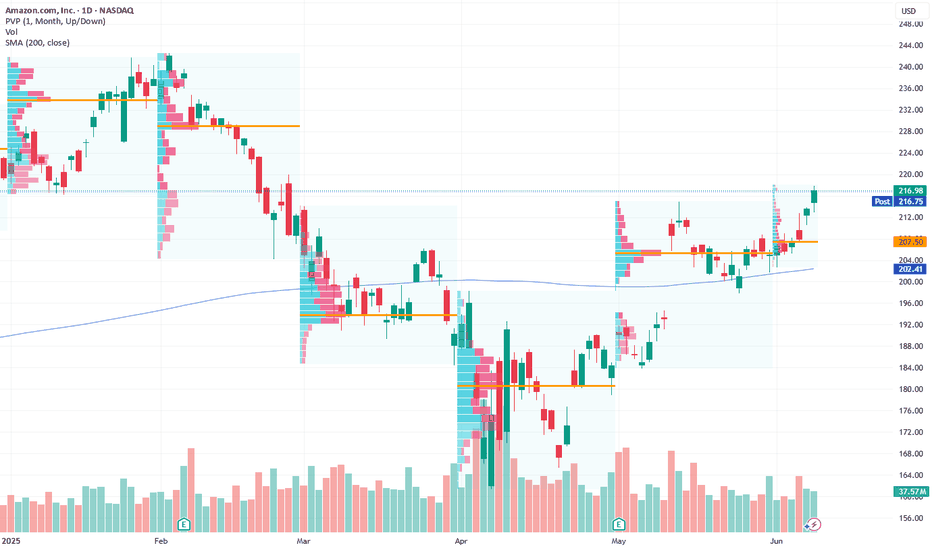

Amazon Breakout Signals Bullish Momentum — Eyeing $220 Target

Current Price: $213.57

Direction: LONG

Targets:

- T1 = $217

- T2 = $220

Stop Levels:

- S1 = $208

- S2 = $204

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in AMZN.

**Key Insights:**

Amazon continues to stand out among technology stocks due to its consistent performance and strong technical indicators. The company's breakout pattern aligns with sector-wide momentum, suggesting further upward potential. Analysts note the $206-$220 price range as having significant activity, where resilient support levels provide a foundation for continued bullish sentiment. Trader consensus highlights Amazon's strategic positioning against competitors, leveraging its robust e-commerce and cloud operations to boost investor confidence.

**Recent Performance:**

Amazon has experienced steady gains over the past few weeks, maintaining solid support above its 50-day moving average. Recent trading activity indicates high interest from institutional investors, with the stock showing clear signs of an upward trend. After testing resistance at $215, AMZN's inverse head-and-shoulders pattern indicates further upside potential. As part of the MAG 7 (tier of top-performing tech stocks), AMZN continues to outperform competitors amid sector-wide market strength.

**Expert Analysis:**

Technical analysts point to strong accumulation phases during dips, signaling confidence in the stock's ability to deliver further upside. Amazon shows a clear pattern of higher lows, with medium-term upward momentum aligning with sector-wide bullish trends. Experts also highlight volume surges at key support levels, further reinforcing the bullish outlook. AMZN's price movement shows a correlation with broader indices, suggesting continued alignment with macroeconomic conditions favoring technology.

**News Impact:**

Recent easing of trade tariff concerns related to US-China negotiations has indirectly boosted sentiment within the technology sector. Amazon’s diversified revenue streams and growing dominance in e-commerce and cloud technology provide resilience against market fluctuations. Favorable developments in global trade discussions continue to lower uncertainty, enhancing overall attractiveness for long-term positions.

**Trading Recommendation:**

Amazon's technical setup and broader sector strength make it a compelling choice for a long position. Investors should consider entering near current levels, with a target range of $217-$220. Stops should be placed below $208 to manage risks effectively. With expert consensus favoring accumulation on dips, AMZN represents an opportunity grounded in both technical and fundamental strengths.

AMZN ATH or what???AMZN ATH or what?

optimism coming back or no? Chyna CHyna CHyna? or no CHyna? let us know~~

we caught april bottom now run ATH?

🐉We value full transparency. All wins and fails fully publicized, zero edit, zero delete, zero fakes.🐉

🐉Check out our socials for some nice insights.🐉

information created and published doesn't constitute investment advice!

NOT financial advice

AMZNThis is a company I believe can become one of the most valuable companies by market cap I think they have a toe in every sector at this point. AI is a massive one and robots also them just possibly replacing all employees with AI and robots. That could make them extremely efficient and profitable short term target of 250 with longer term targets of 300. Not a professional and this is not financial advice just what I am speculating.

AMAZON Resistance Ahead! Sell!

Hello,Traders!

AMAZON keeps gaining

Bullish momentum so we

Are bullish biased mid-term

However it will soon hit a

Horizontal resistance of 219.00$

From where we will be expecting

A local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

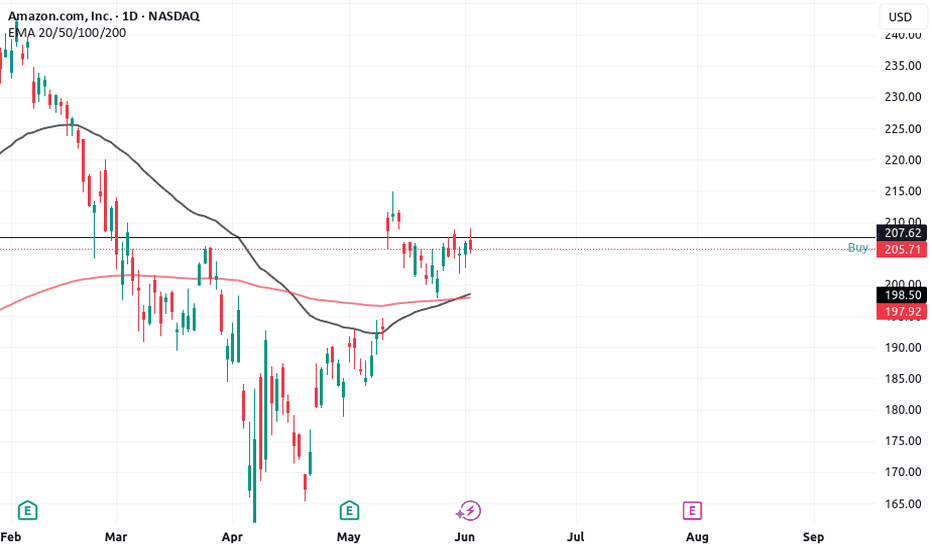

The 3 Step Rocket Booster StrategyOn this trade we are looking at the NASDAQ:AMZN

trade.Now the special thing

about this trade is that instead of focusing on

the daily chart we are focusing on the weekly chart.

You may be thinking

“Why are we focusing on the weekly chart?”

Well this is because you have to be ahead of the crowd nd see

the coming trend.

If you want to do your own trading strategy

thats okay but if you want

to learn more about the Rokcet booster strategy

Then you need to follow these 3 steps

• The price has to be above the 50 EMA

• The price has to be above the 200 EMA

• The price should gap up in an uptrend

This is the rocket booster strategy

In order to learn more

Rocket boost this content

Disclaimer:Trading is risky you will lose money

so please use a simulation trading account

before you trade with real money.Also learn

Risk management and profit taking strategies.

AMZN BUYBUY AMZN at 182.00 to 173.00, riding it back up to 240.00 to 255.00 as Profit Targets, Stop Loss is at 161.00!

If anyone likes mumbo jumbo long useless analysis,

than this is NOT for you.

Also, if you are afraid of risk, failure, and want only a 100% sure thing, than...

run as fast as you can from here and from the markets,

because it is definitely NOT for you.

WARNING: This is just my opinion of the market and its only for journaling purpose. This information and any publication here are NOT meant to be, and do NOT constitute, financial, investment, trading, or other types of advice or recommendations. Trading any market instrument is a risky business, so do your own due diligence, and trade at your own risk. You can loose all of your money and much more.

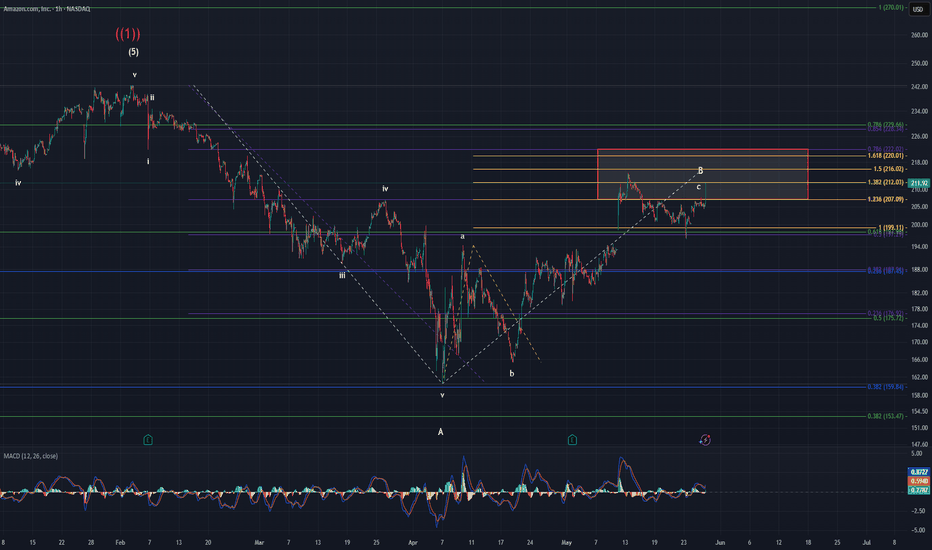

Amazon UpdatePrice has re-entered the target box. I mentioned last week that price could still try to target the 1.618 @ $220.01. Judging by the ES, I think it is highly likely that is what is going on. We're still currently trading on hidden bearish divergence which doesn't bode well for a sustained move higher. I think it more likely that we make another slight high towards the 1.618 on neg div setting up the larger move lower for minor C.

The key support price we need to breach that will point us lower is $196. If we can get below that, the momentum will change to the downside. First, we will likely make OMH though. We manage to breach $196 though, and sub $140 comes into view. This will take time. Don't think that it will happen tomorrow or even next week. Minor C will take weeks if not months to complete.

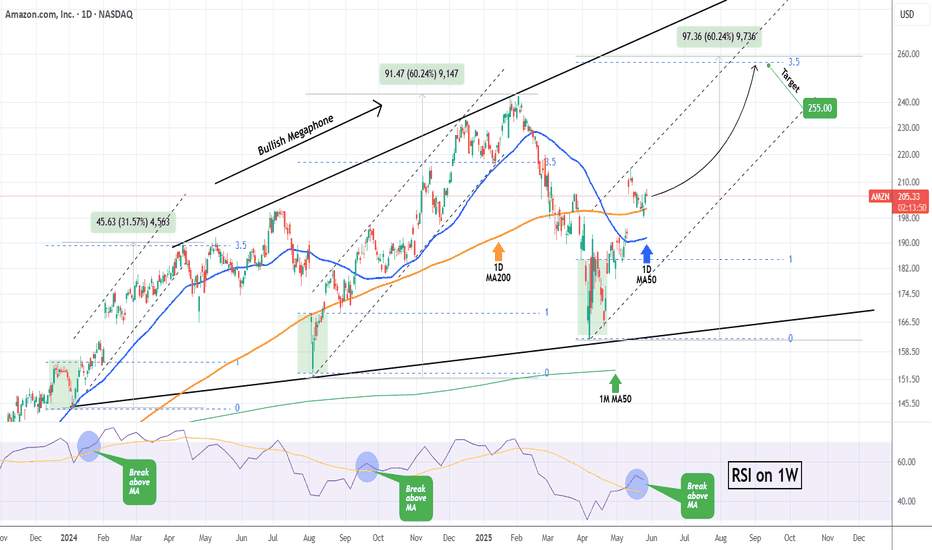

AMAZON eyes $255 on the 3rd such buy signal in 18 months!AMAZON Inc. (AMZN) has been trading within a 18-month Bullish Megaphone pattern whose latest bottom was on the April 07 2025 Low. Since then, the pattern has started its new Bullish Leg, which has been confirmed by the break-out above its 1D MA50 (blue trend-line) and the 1W RSI's above its MA.

The previous two Bullish Legs hit at least their 3.5 Fibonacci extension levels and the 2nd Bullish was +30% more than the 1st. If the stock achieves a +60% gain from its April bottom again, it will be almost exactly on its 3.5 Fib ext.

As a result, we believe that a $255 Target (on the 3.5 Fib), is more than realistic to be achieved by September.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

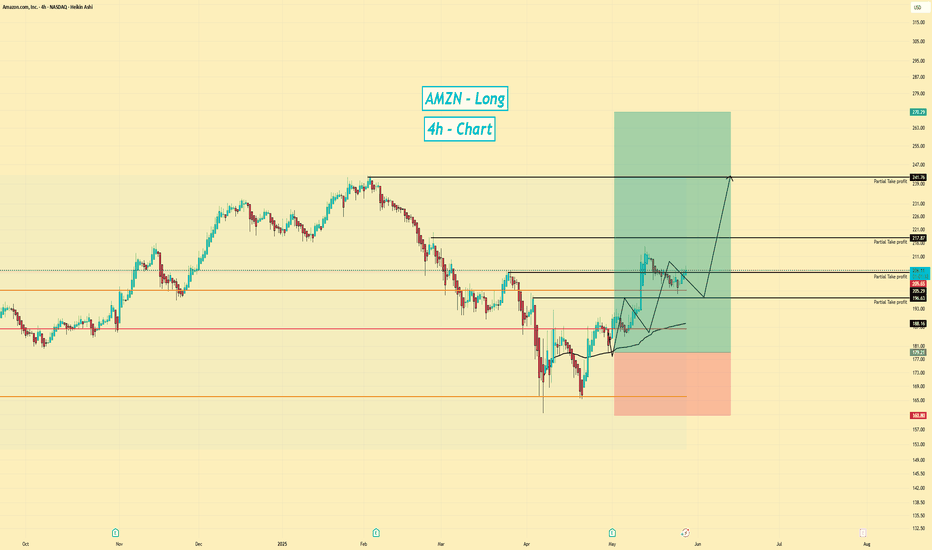

AMZN | Long | Strong Earnings Momentum | (May 28, 2025)AMZN | Long | Strong Earnings Momentum + Structural Breakout | (May 28, 2025)

1️⃣ Quick Recap: We're in a long trade on Amazon (AMZN), and the setup is unfolding well. TP1 and TP2 have already been hit after flipping key resistance into support. The trend is intact, and we're now aiming for higher levels as long as the structure holds. 💪📊

2️⃣ Trade Parameters:

Bias: Long

Entry: Previously established

Stop Loss: Moved to Entry (risk-free position)

TP1: ✅ Hit

TP2: ✅ Hit ($201)

TP3: $217

TP4: $241

Partial Exits: Ongoing — looking to scale out at remaining targets

3️⃣ Key Notes:

✅ Amazon continues to show strong growth fundamentals:

– Revenue: $637B

– Net Income: $60B

– Market Cap: $2.18T

– EPS: 6.26

– PE Ratio: ~33

✅ Strong employee growth (+31K, a 2% increase), signaling continued expansion

✅ Financial forecasts suggest solid growth for the next 4 quarters and full-year estimates — with a potential slowdown only beginning Q1 2026

✅ The technical structure flipped resistance into support, confirming a bullish continuation

❌ A deeper macro slowdown or disappointing forward guidance in late 2025/early 2026 could pressure valuations — monitor this closely

4️⃣ Follow-Up: As long as price holds above our entry zone, we’ll keep managing this trade toward $217 and $241. If momentum continues, we may revisit the setup for potential re-entries or compounding opportunities.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not a financial advise. Always conduct your own research. This content may include enhancements made using AI.

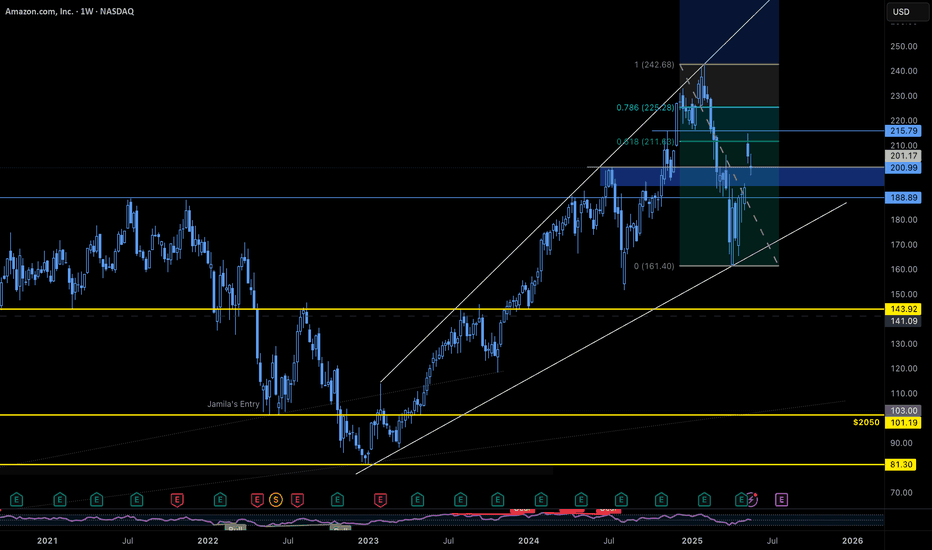

$AMZN Weekly Setup – Watch the $193 GapHere's what we're seeing on the weekly chart:

Price recently hit the 61.8% fib retracement from the all-time high to the April 2025 low

Sitting on strong support from the July 2024 high

A gap at $193 is just below current levels

If the gap closes and holds, we could see a continuation of the recent move higher — setting up a powerful weekly higher low. This could offer broader momentum in the large-cap tech space.

NASDAQ:AMZN

Steady Support at $200: Is It a Prime Opportunity to Go Long?

Targets:

- T1 = $209.00

- T2 = $215.00

Stop Levels:

- S1 = $198.00

- S2 = $193.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in AMZN.

**Key Insights:**

Amazon's current price of $200.99 represents a strong psychological and technical support level. The stock has shown resilience despite headwinds in the broader market and competitive pressures in the technology sector. Its focus on integrating advanced AI technologies throughout its operations provides a solid growth narrative going forward. Analysts widely view its cloud computing arm, AWS, as a pillar for consistent revenue generation despite seasonal fluctuations. Additionally, Amazon continues to innovate in retail dynamics, sustaining its relevance in a matured e-commerce market.

However, potential risks to the bullish outlook include heightened regulatory scrutiny from the FTC and evolving antitrust laws, along with increasing competition from peers adapting to AI and cloud innovations. The stock’s ability to break through short-term resistance near its 50-day moving average could signal stronger upward momentum.

**Recent Performance:**

Throughout the past month, AMZN has experienced moderate volatility, dipping below its 50-day moving average while testing its yearly support levels. A brief consolidation showed improved buying interest, indicating that market participants may see the current price as undervalued relative to future prospects. Despite setbacks from heightened inflationary pressure on discretionary spending, Amazon’s diversified revenue stream continues to support overall stability.

**Expert Analysis:**

Many technical analysts are bullish on AMZN's trajectory, particularly with its RSI trending upward from oversold levels, suggesting strong internal momentum for a reversal. Fundamental experts highlight Amazon's robust financial flexibility to reinvest in growth areas and innovation platforms such as logistics automation and AI-enhanced advertisement solutions. Breaking resistance above $202 will likely be pivotal, unlocking upward potential toward the $209-$215 range.

**News Impact:**

Recent headlines around Amazon include ongoing FTC antitrust investigations, which may result in heightened legal risks in the future. However, the company's approach to expanding its AI investments, particularly through AWS, has garnered positive media attention. These developments underscore Amazon's resilience in balancing regulatory challenges with sector-leading innovation, which bodes well for its long-term prospects.

**Trading Recommendation:**

Amazon’s current setup presents an opportunity for long traders willing to absorb near-term risks while capitalizing on the stock’s bullish potential. Buyers should watch for a decisive break above $202 as confirmation for upward momentum. With strong support at $200 and a favorable growth outlook, AMZN is poised to deliver attractive returns over the coming weeks. The recommended stop levels provide a prudent risk management framework to safeguard against unexpected downside risks.

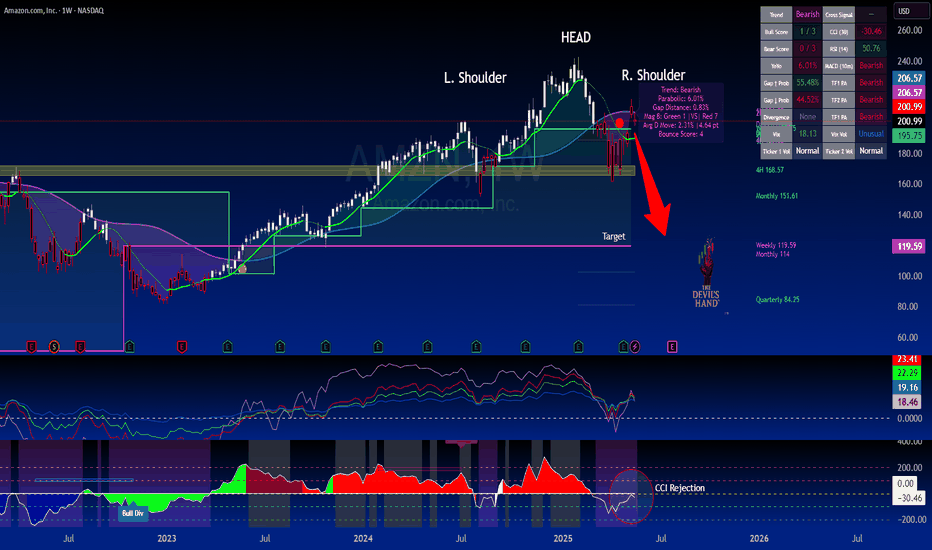

$AMZN Cracks Once AgainIt should be no surprise that after massive gains such as we have seen lately, stocks tend to retrace 60-70% or more back to the origin from whence they came.

This is largely due to the Market Maker "Making a Market" for everyone to play in, but mostly so they don't loose any money.

The Tech space in general and Especially names like NASDAQ:TSLA , NASDAQ:AMZN , and NASDAQ:NVDA are flashing warning signs. A Major pullback event is coming.

Likely the second wave down to our first tariff wave seen earlier in march.

The CCI is rejecting on the High time frame, along with a rather lartge Head and Shoulders Pattern forming.

Some may call it a Double Bottom. Truth be told it's not fat a booty unless it worth slapping, and at these prices, she's all dried up.

Target 119 to close the Weekly box then accumulate with caution.

Amazon should be closely look for resistanceAmzon has importance resistance to be break at 218.25 USD with closed candle above 218.25. if it not close over 218.25 after it test this resistance. it might have a chance for dropped by 10%++. However, if it closed above 218.25 and stay drop for time frame 240 min. this is a chance for long to test 233.58 resistance.