ServiceNow Is Our Top Tech Compounder PickIn a tech world often driven by hype and speculation, ServiceNow NYSE:NOW stands out as a reliable growth engine—a true compounder. Unlike flashier tech names, ServiceNow delivers steady revenue growth and expanding margins, all while offering mission-critical software to businesses.

📈 What’s a

Key facts today

Deutsche Bank anticipates ServiceNow's Q2 results on July 23 will show strong performance, driven by diverse business and growth factors, with positive partner feedback indicating a solid June.

BofA Securities has raised its price target for ServiceNow (NOW) shares to $1,100 from $1,085 while maintaining a 'Buy' rating.

ServiceNow is set to gain from the Trump administration's AI Action Plan, releasing July 23, which aims to simplify data center construction permits and boost research for AI and software firms.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.9 EUR

1.38 B EUR

10.61 B EUR

206.28 M

About ServiceNow, Inc.

Sector

Industry

CEO

William R. McDermott

Website

Headquarters

Santa Clara

Founded

2004

FIGI

BBG01K3WYVY7

ServiceNow, Inc. engages in the provision of an end-to-end workflow automation platform for digital businesses. Its Now Platform is a cloud-based solution embedded with artificial intelligence (AI) and machine learning (ML). The company was founded by Frederic B. Luddy in June 2004 and is headquartered in Santa Clara, CA.

Related stocks

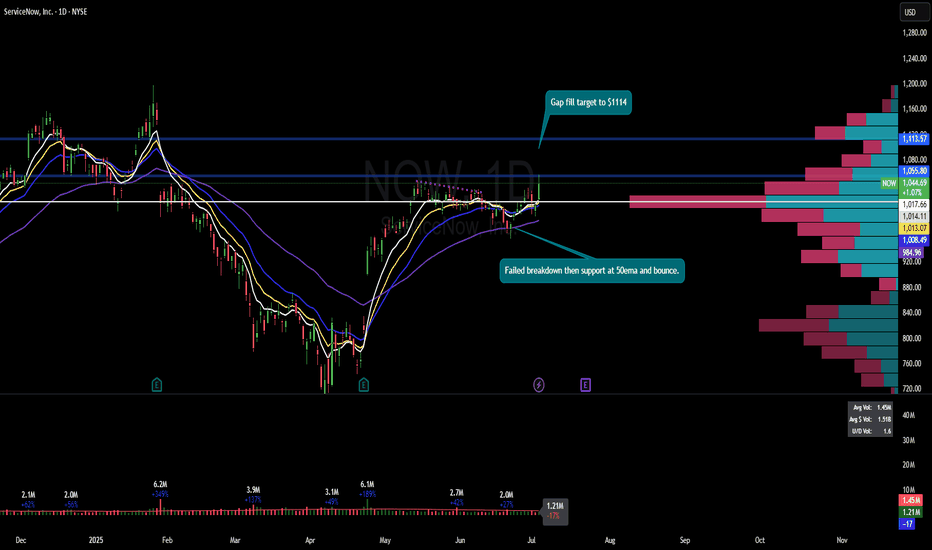

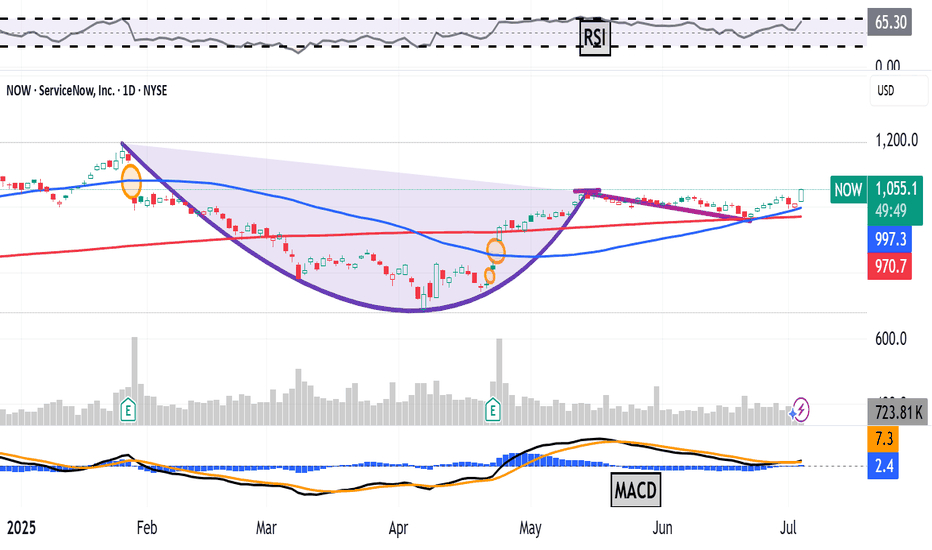

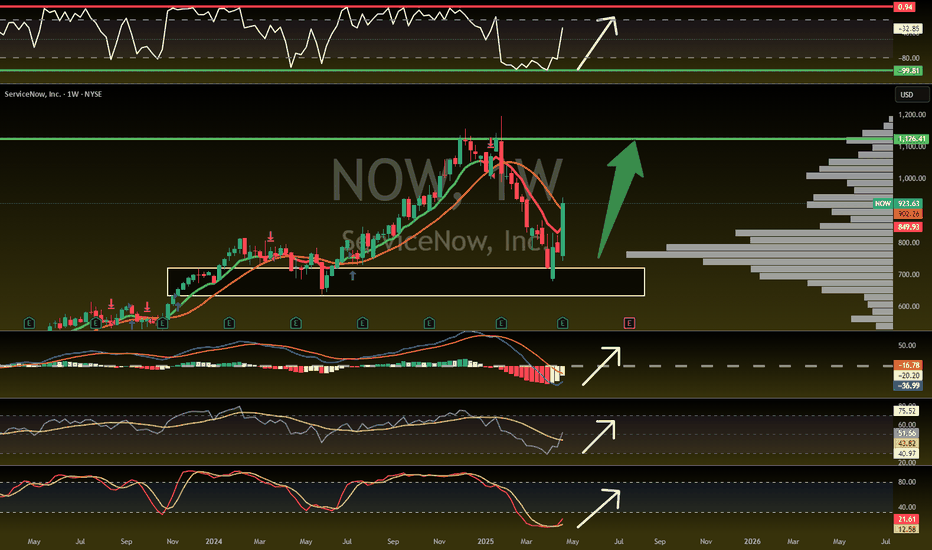

ServiceNow Is Up Some 55% Since April. What Might Happen Next?ServiceNow NYSE:NOW has risen nearly 55% in the past three months as the AI-focused business-management firm and member of the S&P 500 SP:SPX gained ground ahead of and following its well-received Q1 earnings. With Q2 earnings due out later this month, what does the stock's fundamental and techn

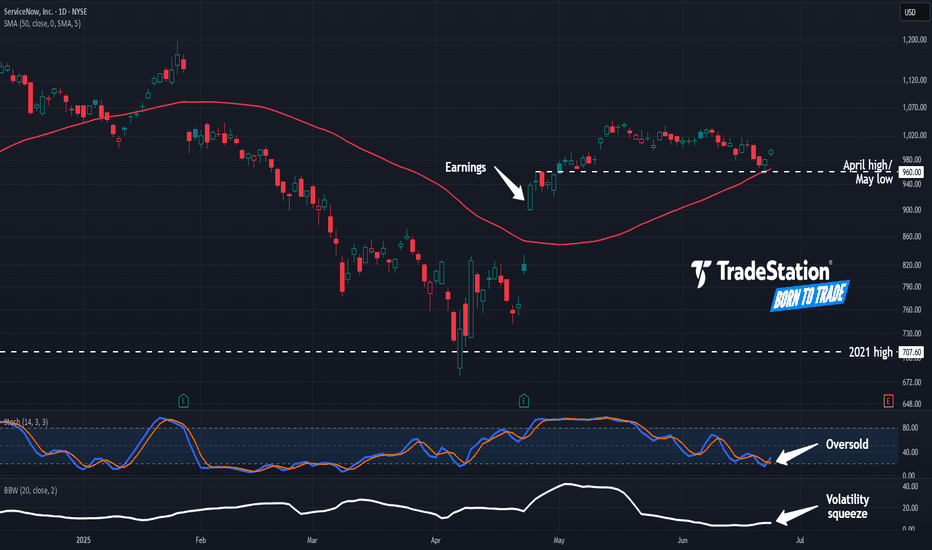

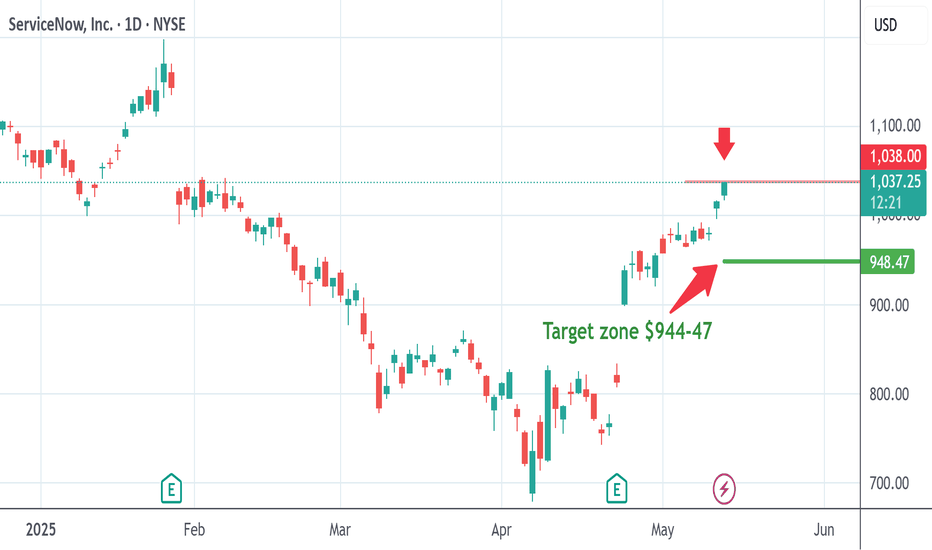

ServiceNow Has Been RestingServiceNow has been resting for months, and now some traders may think the software company is ready to move again.

The first pattern on today’s chart is the price area around $960. It was the peak in late April and the low early last month. NOW pulled back to hold that level yesterday and bounced.

Intuition stock: NOW shortI navigate markets by using my dowsing skills, and sometimes, intuitive hits. I actually have to sit still & ask for the intuitive stocks, however, & I don't often do it - even though I've had some remarkable results.

I did take a shot this morning though & heard or received, "NOW". Unsure if it was

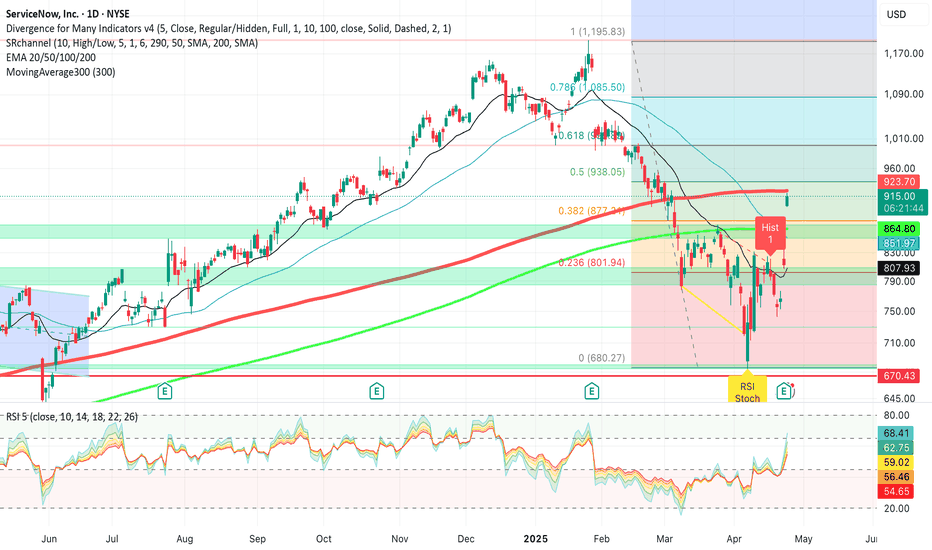

ServiceNow Surges 15%+ on Strong Earnings and Analyst UpgradesServiceNow (NYSE: NOW) soared 15.2% to $934.16 by late morning Thursday after releasing strong Q1 2025 results. At the same time, the S&P 500 gained 1.2% and the Nasdaq Composite rose 1.7%. The company posted adjusted earnings per share of $4.04, outperforming analysts’ forecast of $3.83. Revenue ca

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 1NOW is featured.

Frequently Asked Questions

The current price of 1NOW is 821.9 EUR — it has decreased by −1.15% in the past 24 hours. Watch SERVICENOW stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange SERVICENOW stocks are traded under the ticker 1NOW.

1NOW stock has risen by 0.60% compared to the previous week, the month change is a −6.26% fall, over the last year SERVICENOW has showed a 21.19% increase.

We've gathered analysts' opinions on SERVICENOW future price: according to them, 1NOW price has a max estimate of 1,121.05 EUR and a min estimate of 624.34 EUR. Watch 1NOW chart and read a more detailed SERVICENOW stock forecast: see what analysts think of SERVICENOW and suggest that you do with its stocks.

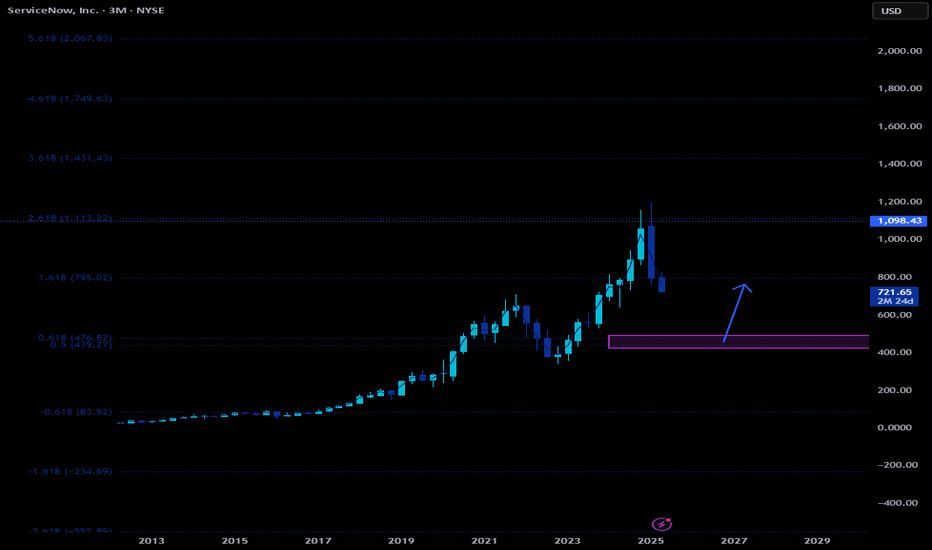

1NOW reached its all-time high on Jan 28, 2025 with the price of 1,144.4 EUR, and its all-time low was 587.6 EUR and was reached on Nov 13, 2023. View more price dynamics on 1NOW chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1NOW stock is 1.17% volatile and has beta coefficient of 1.47. Track SERVICENOW stock price on the chart and check out the list of the most volatile stocks — is SERVICENOW there?

Today SERVICENOW has the market capitalization of 171.34 B, it has increased by 2.97% over the last week.

Yes, you can track SERVICENOW financials in yearly and quarterly reports right on TradingView.

SERVICENOW is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

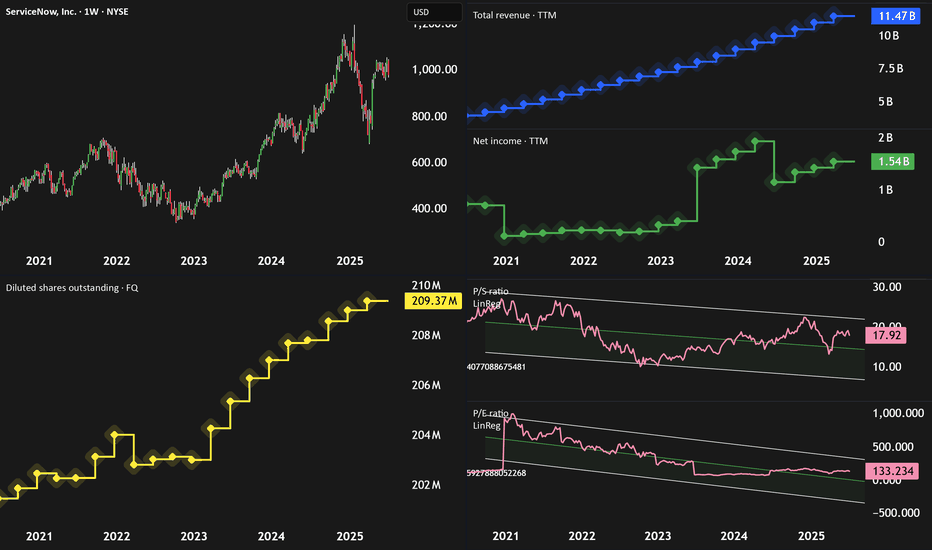

1NOW earnings for the last quarter are 3.73 EUR per share, whereas the estimation was 3.54 EUR resulting in a 5.47% surprise. The estimated earnings for the next quarter are 3.03 EUR per share. See more details about SERVICENOW earnings.

SERVICENOW revenue for the last quarter amounts to 2.85 B EUR, despite the estimated figure of 2.85 B EUR. In the next quarter, revenue is expected to reach 2.65 B EUR.

1NOW net income for the last quarter is 425.20 M EUR, while the quarter before that showed 370.94 M EUR of net income which accounts for 14.63% change. Track more SERVICENOW financial stats to get the full picture.

No, 1NOW doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 19, 2025, the company has 26.29 K employees. See our rating of the largest employees — is SERVICENOW on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SERVICENOW EBITDA is 1.85 B EUR, and current EBITDA margin is 16.65%. See more stats in SERVICENOW financial statements.

Like other stocks, 1NOW shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SERVICENOW stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SERVICENOW technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SERVICENOW stock shows the sell signal. See more of SERVICENOW technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.