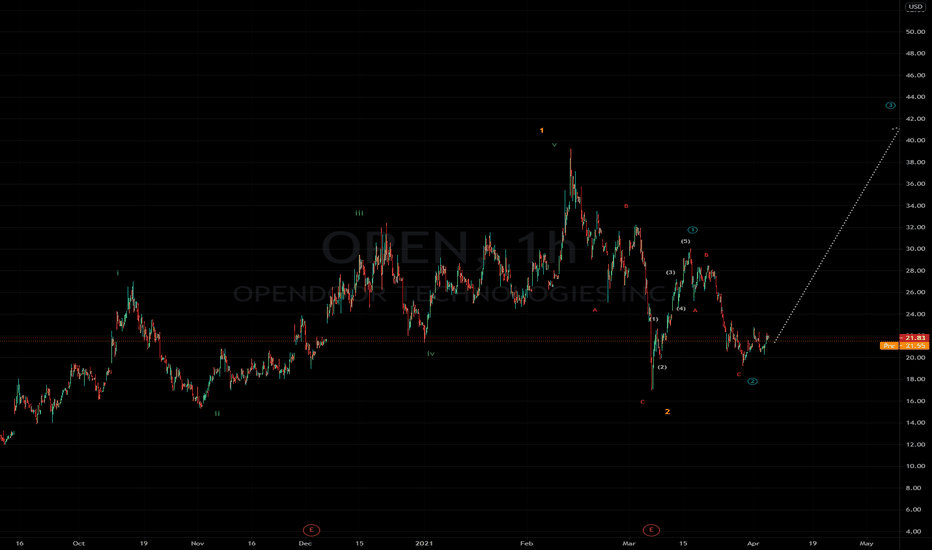

1OPEN trade ideas

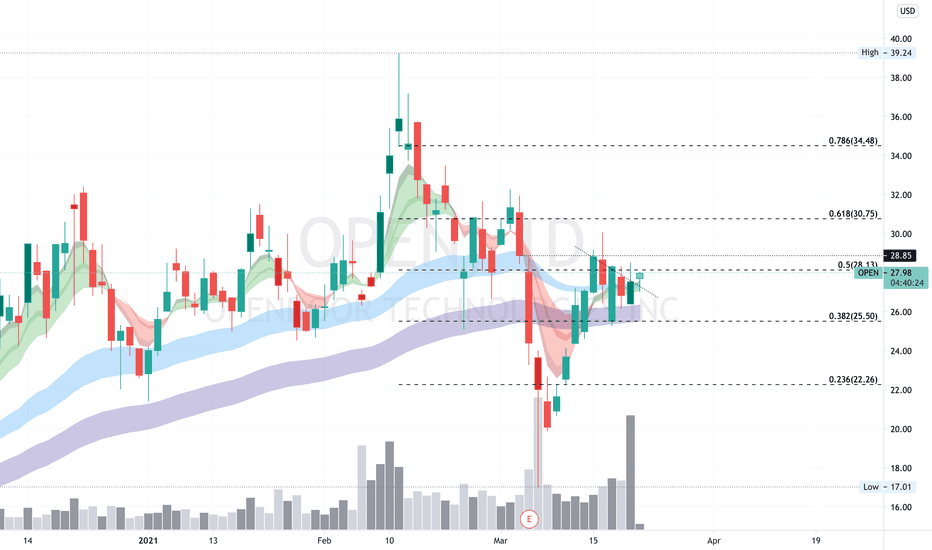

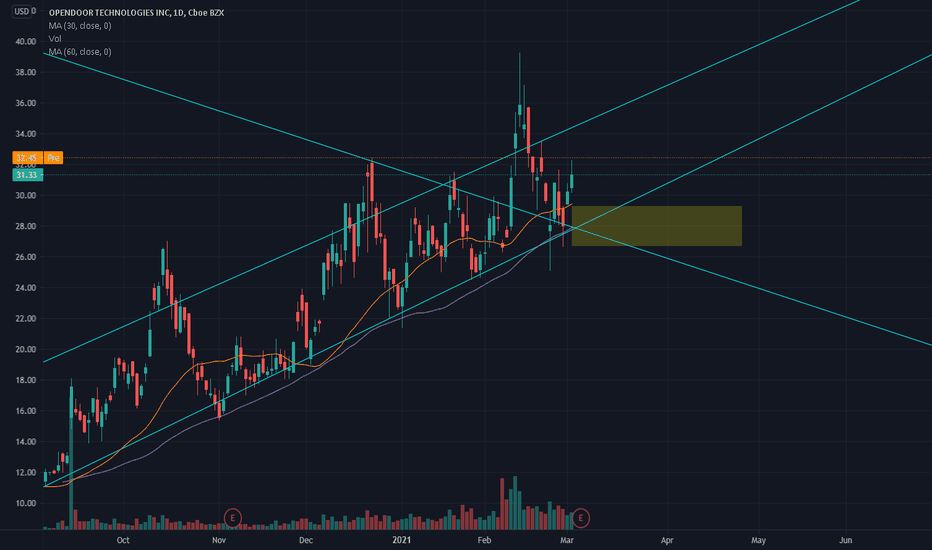

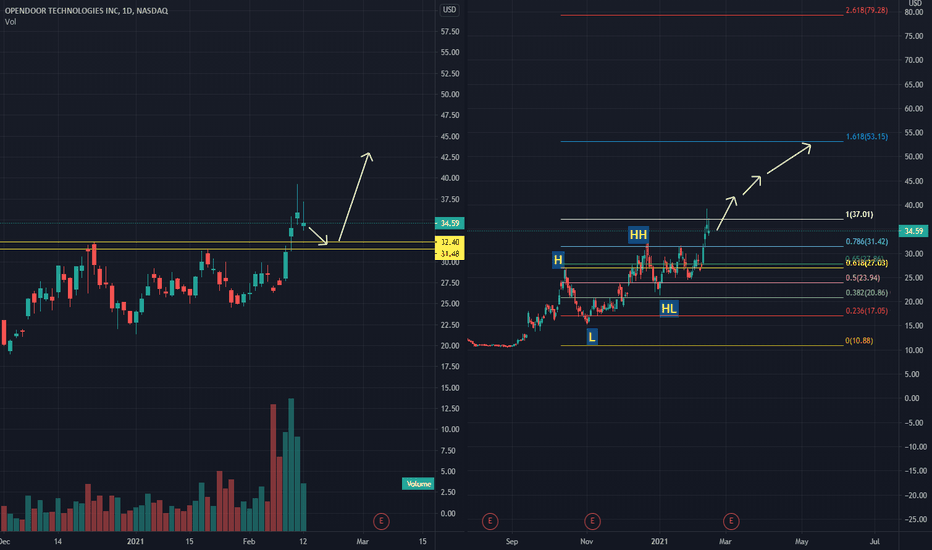

OPEN, BREAKOUT COMING SOON!Hello fellow traders and investors, here's another trade idea.

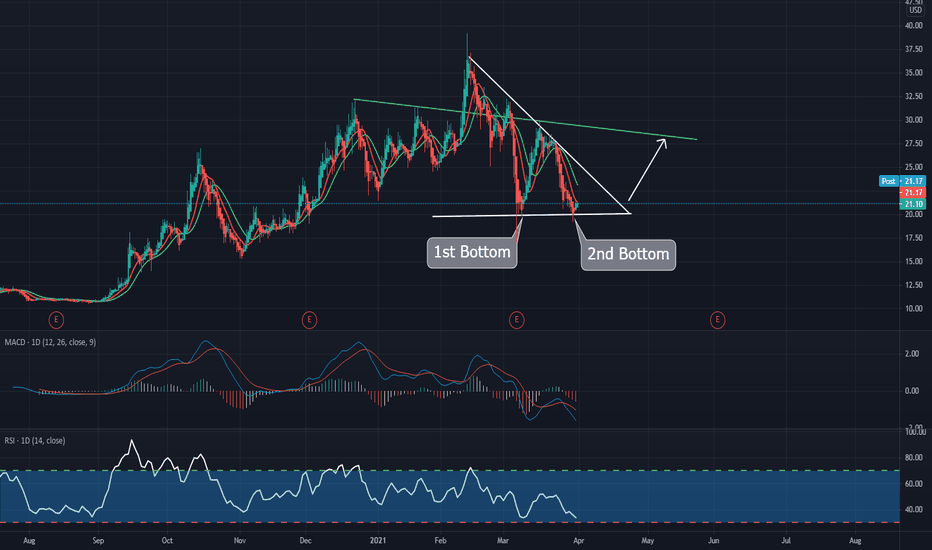

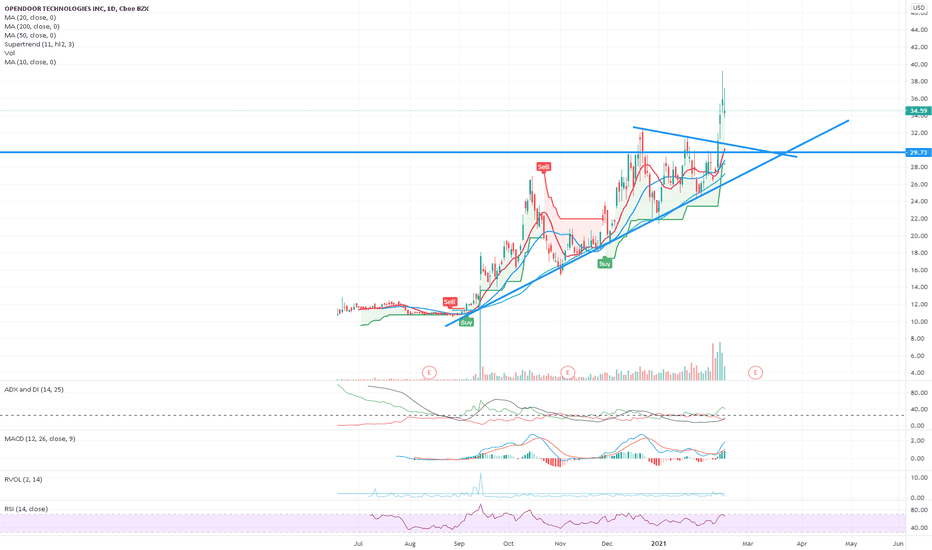

OPEN has recently pulled back tand has made a double bottom and we are now waiting for the breakout of the wedge, if OPEN makes a recovery to the take profit trendline which offers around a 30 to 35% ROI.

Technicals:

The Macd indicates that it's oversold

The EMA's are in a downtrend

The RSI is oversold

When To Buy:

When it breaks out of the wedge.

When To Sell:

I recommend selling at the take profit trendline which offers around a 30 to 35% ROI.

Fundamentals: Opendoor Technologies, Inc. operates as an online platform for buying, selling and trading-in residential properties. OPEN has a debt/equity of 0.30, sales growth of -80% Q/Q, EPS growth this year of -318%, EPS growth next year of 33%, an ROI of -9.5%, a short float of 3% and I must warn that OPEN is a very volatile stock.

Rating: 25/100 the technicals are decent and the fundamentals aren't great but if it meets your criteria feel free to add it to your watchlist.

I hope you enjoyed this quick analysis and many more to come.

If you enjoyed leave a like, follow, comment your thoughts and share this trade idea.

Thanks.

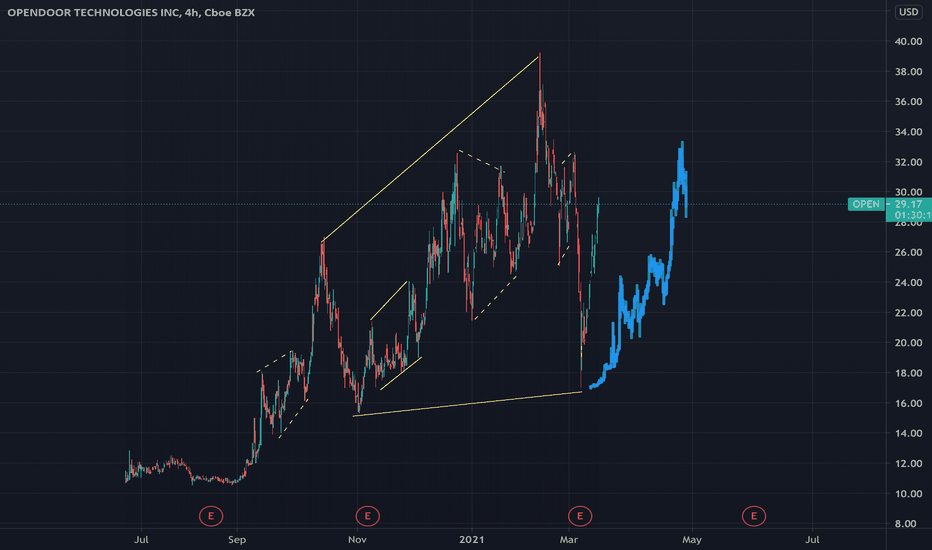

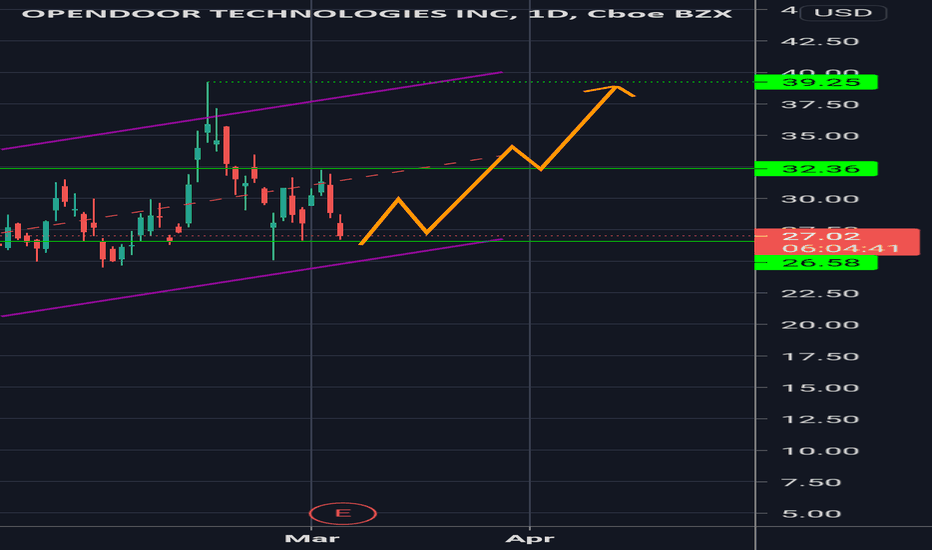

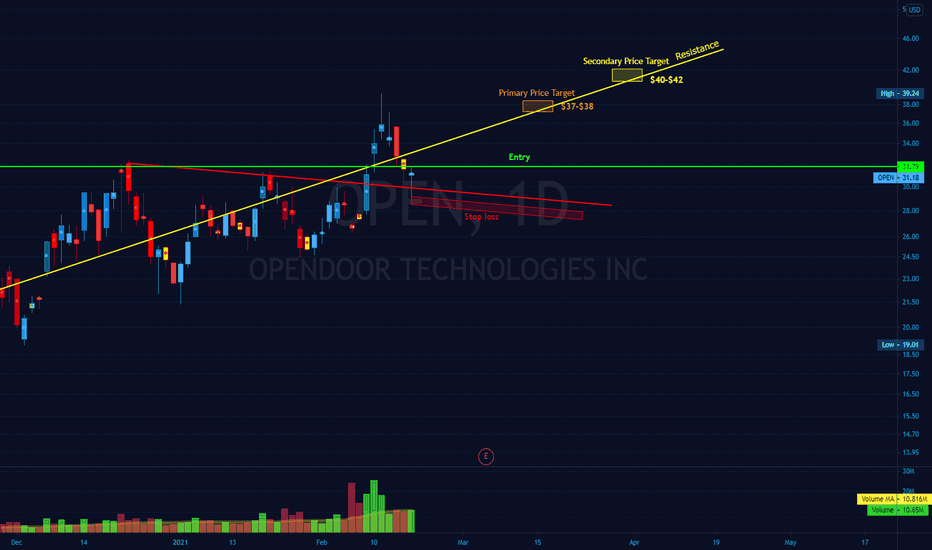

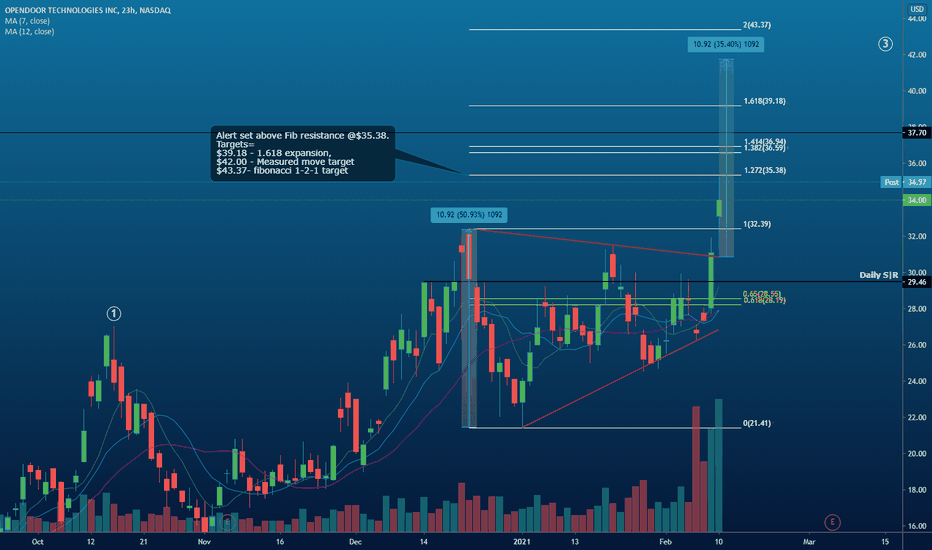

$OPEN, Opendoor Technologies long trade$OPEN just had earnings and beat expectations but is still suffered heavily from the tech selloff. IMO the big selloff is unjustified and the stock held the lower support trendline. This is a great long entry for someone looking to make close to 80% gain to a new ATH.

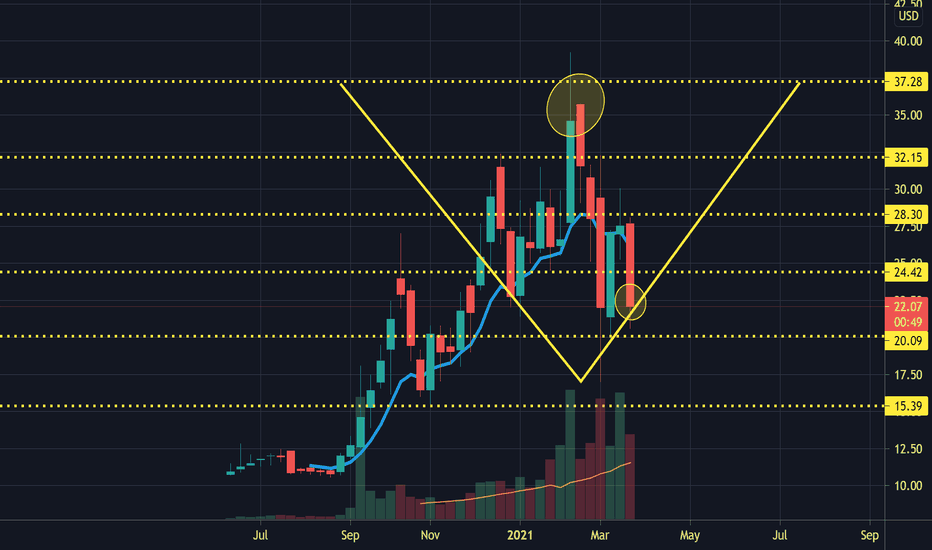

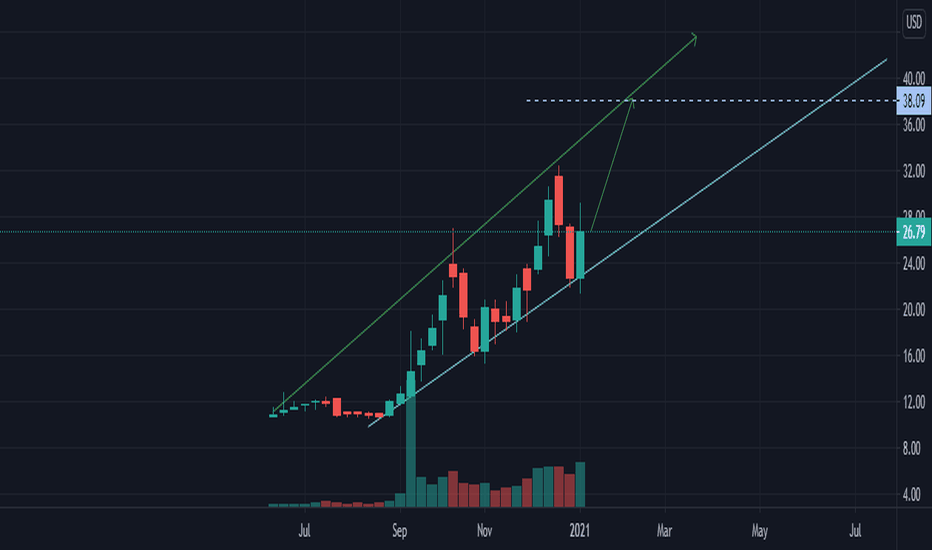

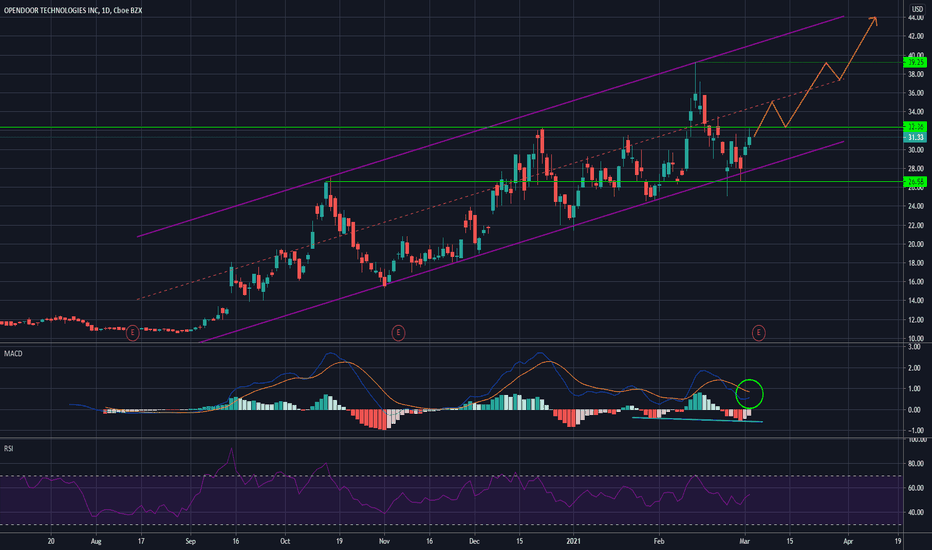

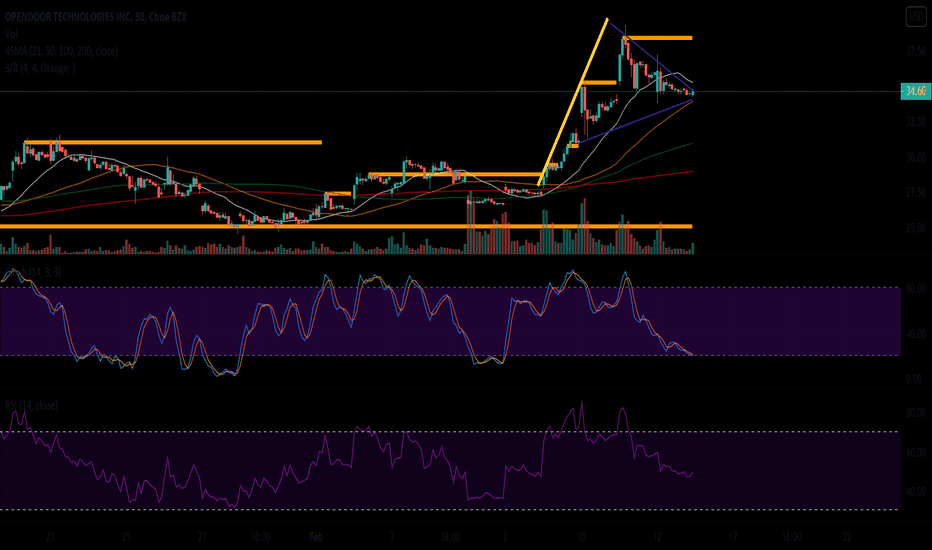

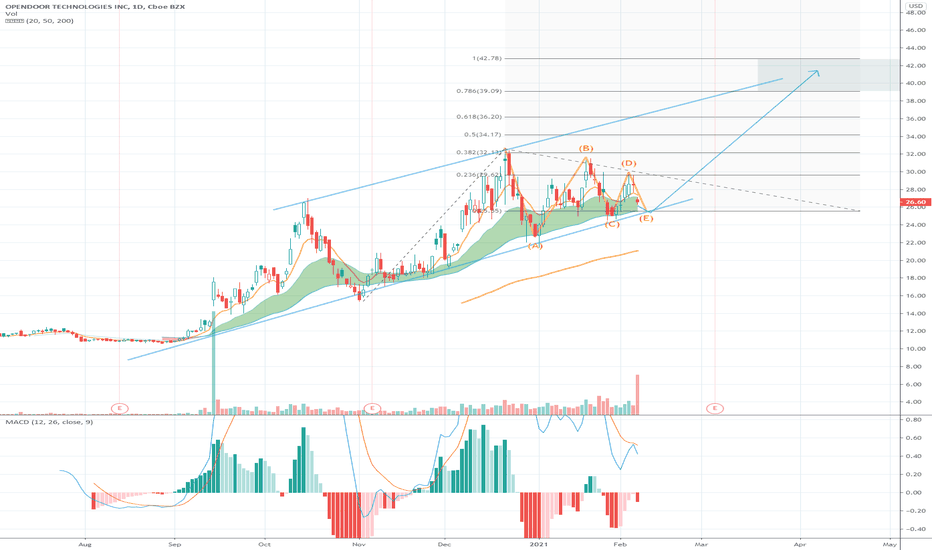

NASDAQ: OPEN Opendoor Technologies Inc.I'm a fan of this stock and their performance so far. This daily chart looks really good, let me explain. We have hidden bullish divergence on the MACD, our moving averages are looking like they might be about to cross (also a bullish sign), and it has been trading within this upwards channel for about 6 months now. I would usually like to use my mic to do this but I'm in the process of getting a new one. Again I like this stock, I think it looks like it has some room to run.

Economy opening up - interest rates slowly rising - Housing boomThe fundamentals and technicals are lining up for this name. This will be an industry disruptor as more consumers will switch to easier methods for buying and selling homes. We are expecting this housing season to be a boon with the rising interesting rates and home buyers scrambling to purchase homes. Price target: $42-45

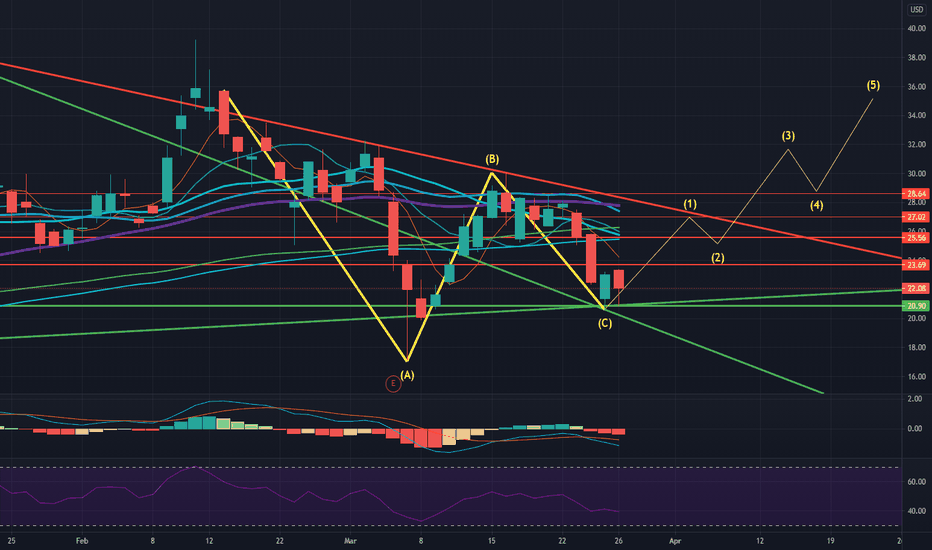

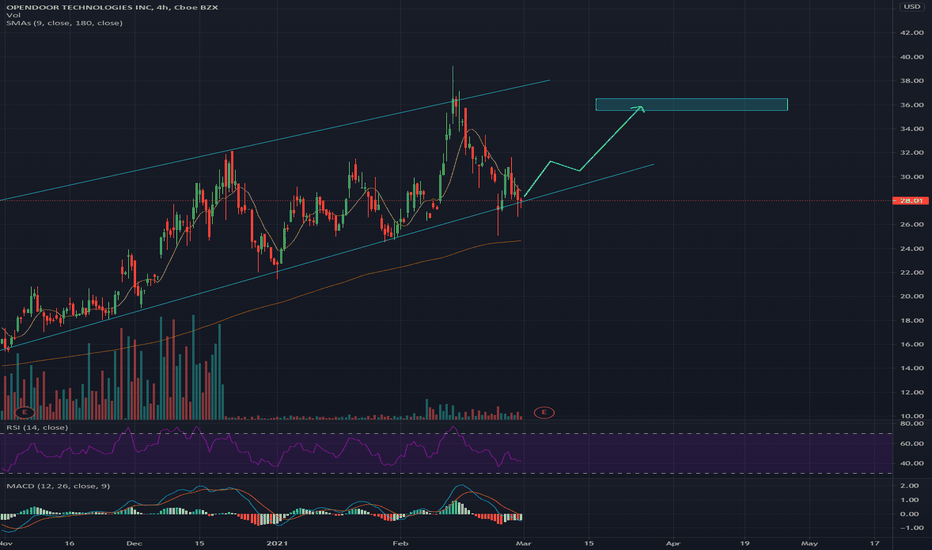

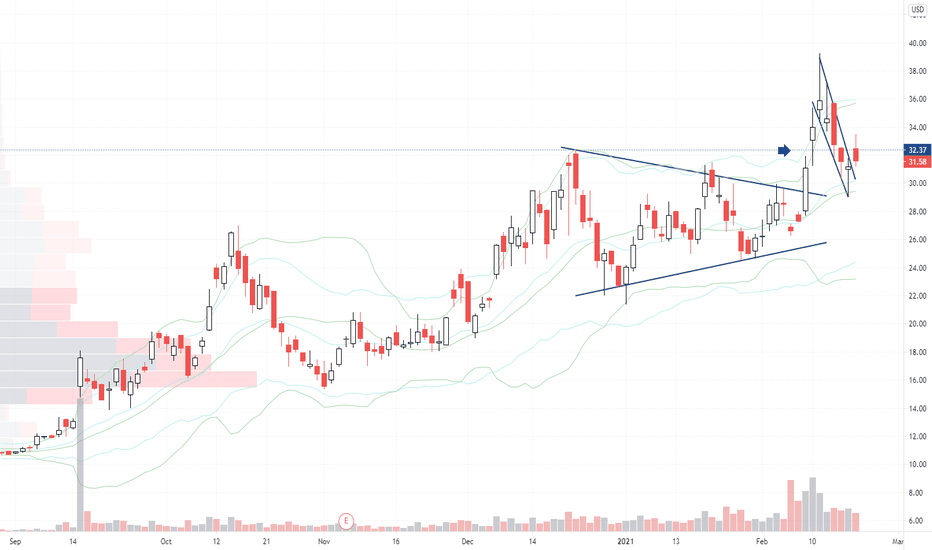

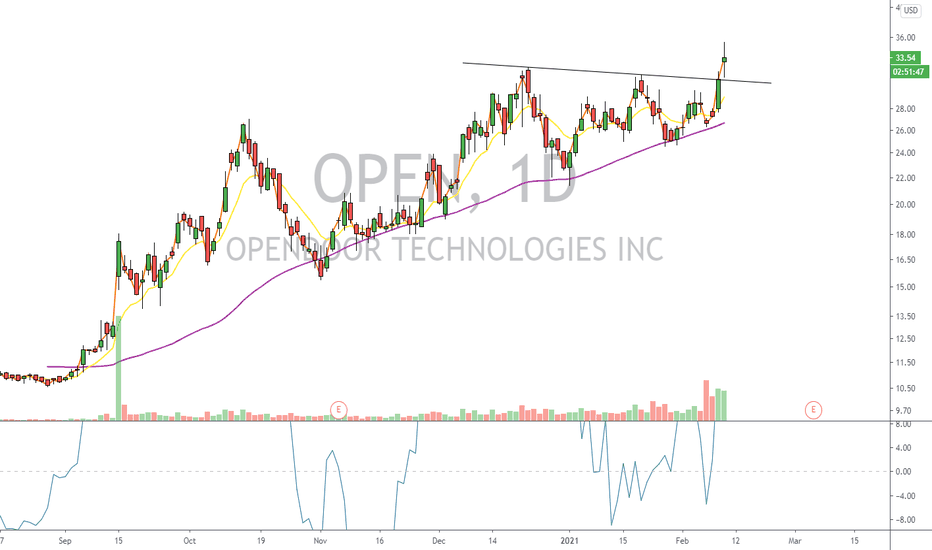

Opendoor Technologies (NASDAQ:OPEN) successful retest?Opendoor Technologies (NASDAQ:OPEN) appears to have successfully retested the recent all-time high breakout in the form of a bull flag continuation pattern. This price action is bullish and suggests continuation of the uptrend. A protective stop-loss order could be placed right below the recent 29.07 low.

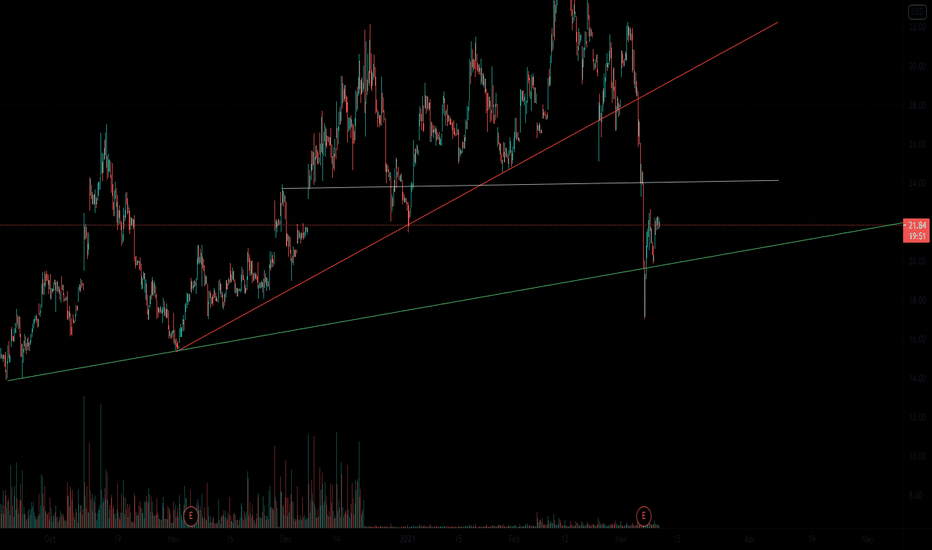

Possible bullish flag pennant forming? Interesting setup at the month view for Opendoor. Looks like a possible bullish flag pennant forming and a symmetrical triangle. Also dipped under 21 EMA and about to touch the 50 EMA. This is a very good sign. Also Stoch is bottoming out and looking to possibly go back up. Bullish setup???

Fundamentally Open just merged through SPAC and has a huge influx of cash to grow into other markets. Looks good to me. This is a Chamath Palihapitiya spac play and ARK invest has purchased a ton of it as well.

Experienced traders please your input is welcome.