Key facts today

Zoom Video Communications has settled a lawsuit with investors for $150 million over claims of misrepresenting encryption strength and user data handling during its rapid growth amid the pandemic.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.02 EUR

975.35 M EUR

4.50 B EUR

259.58 M

About Zoom Communications, Inc.

Sector

Industry

CEO

Eric S. Yuan

Website

Headquarters

San Jose

Founded

2011

FIGI

BBG01K3XLBS0

Zoom Communications, Inc. engages in the provision of a communications and collaboration platform. It operates through the following geographical segments: Americas, Asia Pacific, and Europe, Middle East, and Africa. The company was founded by Eric S. Yuan in 2011 and is headquartered in San Jose, CA.

Related stocks

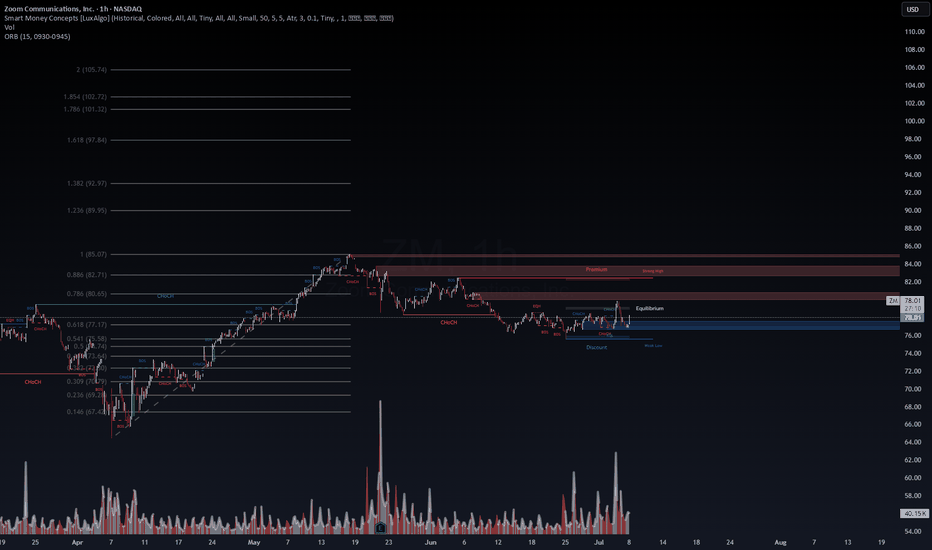

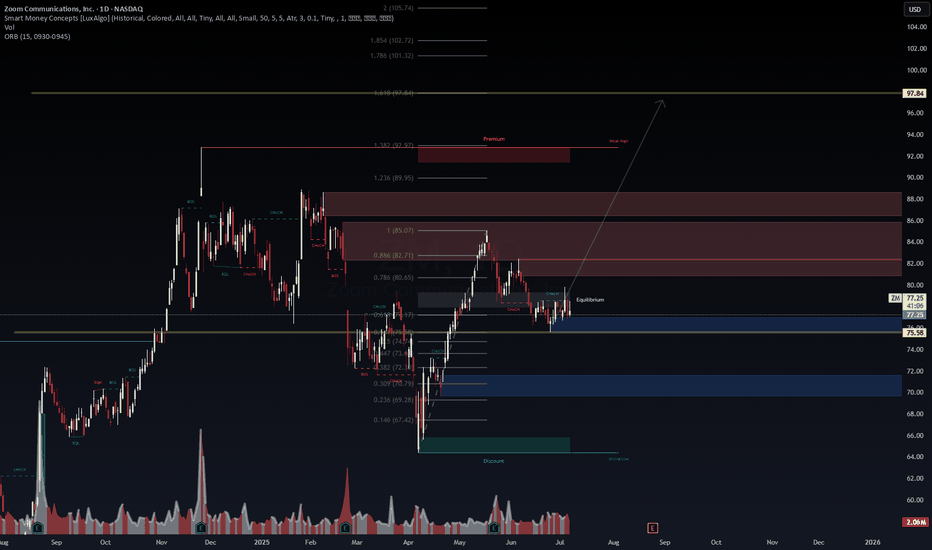

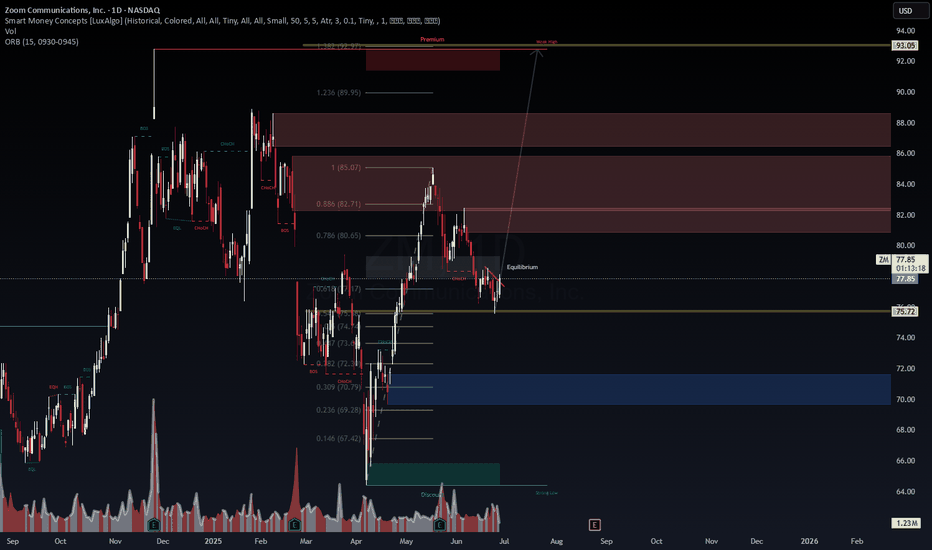

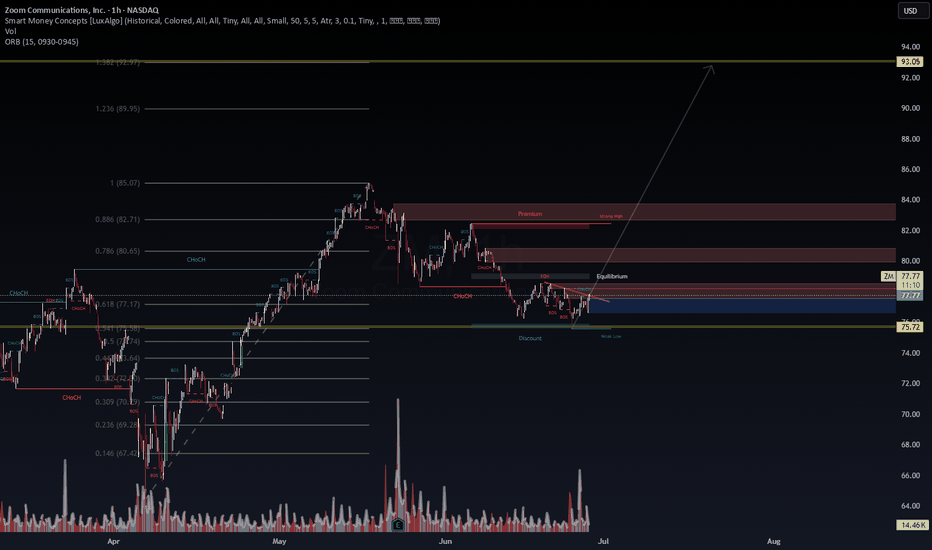

$ZM Long Setup (Probabilistic Bias: Bullish)Chart: 1H | Framework: Smart Money Concepts + Fibonacci + ORB | Date: July 8, 2025

🧠 Technical Insight:

Zoom ( NASDAQ:ZM ) has reclaimed its Equilibrium Zone (around $78) after sweeping liquidity into the Discount Area and tapping a bullish Order Block near $76. A clear CHoCH (Change of Character)

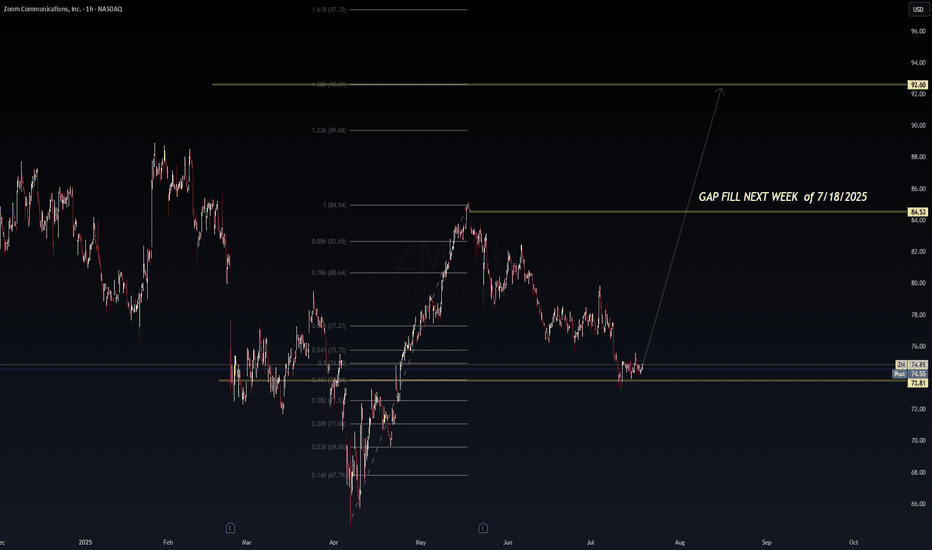

I am starting to think TradingView is Haunted. Anyways... ZM🎯 BOATS:ZM Gap Fill Setup – Targeting $84.53 by Week of 7/22

Zoom (ZM) may be setting up for a bullish gap-fill retracement off strong confluence support near $73.81. After a full fib retrace to the 0.5–0.618 zone, the current candle structure shows potential for a reversal toward the unfilled gap

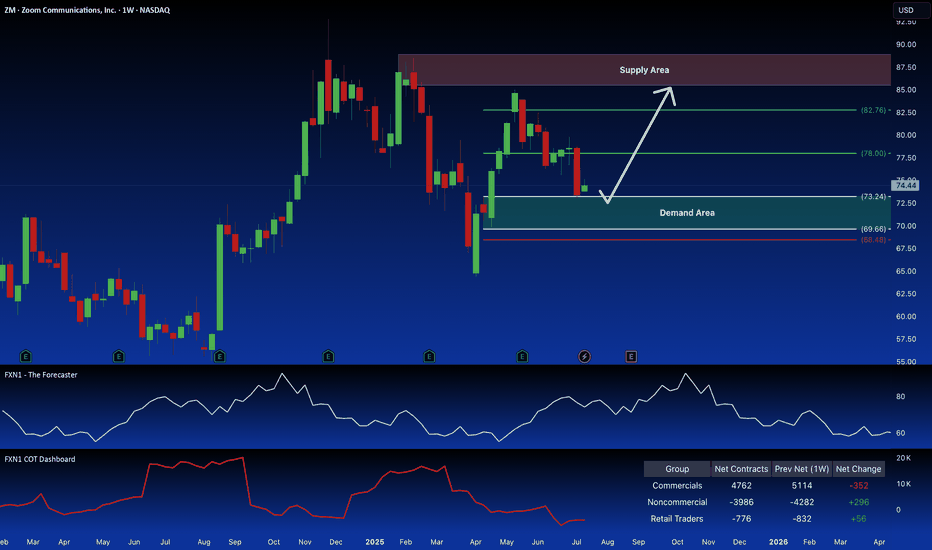

Zoom (ZM): Potential Long Setup at Demand ZoneZoom Video Communications (ZM) recently experienced a rejection at a key demand zone on its weekly chart. Non-commercial traders have increased their long positions, and forecasts suggest a potential upward trend. I'm considering a long trade setup based on a retest of that demand zone. What are

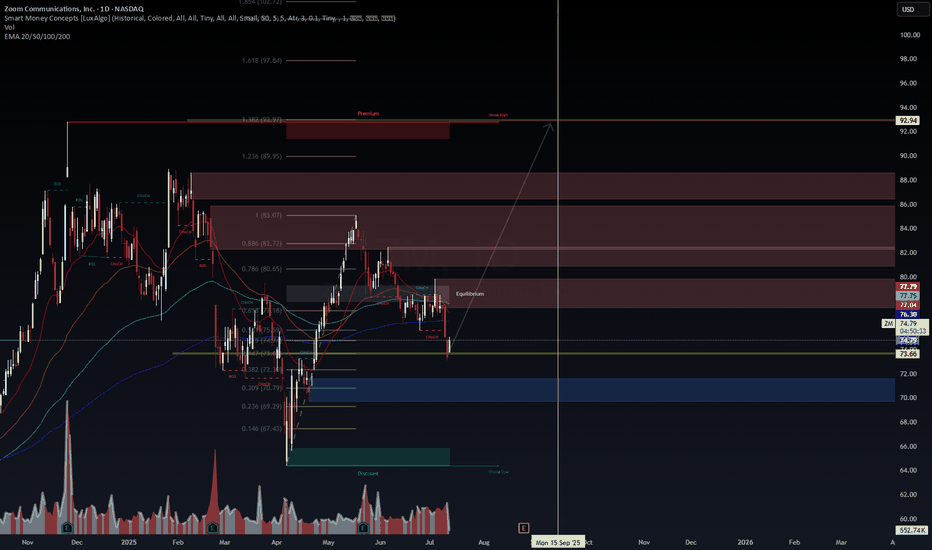

$ZM Ready to Fly — Macro Reversal in Play📈 NASDAQ:ZM Ready to Fly — Macro Reversal in Play

Timeframe: 1D | Date: July 8, 2025 | Powered by WaverVanir DSS + SMC + Fibonacci

Zoom ( NASDAQ:ZM ) is coiled at equilibrium after reclaiming key structure and defending the $75.58 level. We’re now positioned for a potential macro reversal targeti

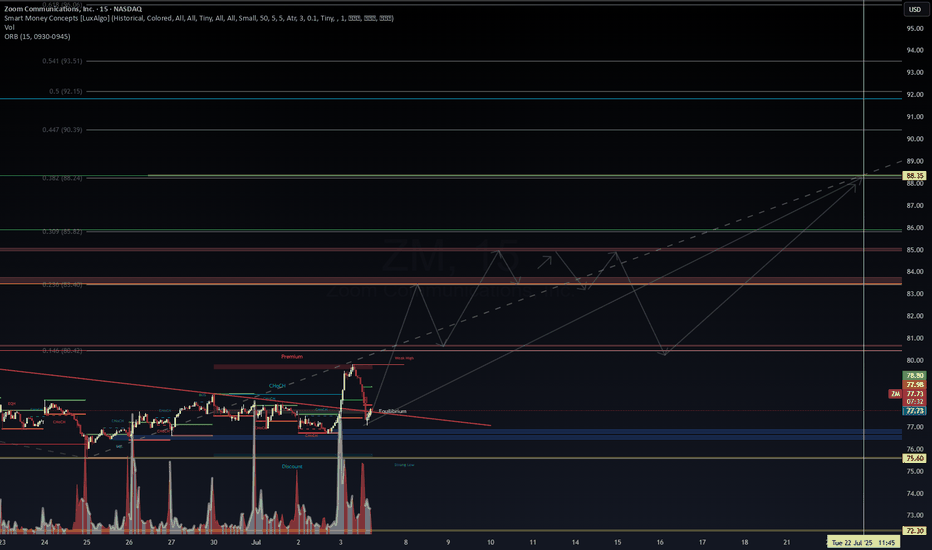

$ZM Bullish Setup — VolanX DSS ProjectionZoom ( NASDAQ:ZM ) has broken above structure with momentum and now retracing to equilibrium zones.

📈 Projected Wave Structure:

Targeting $88.35 (Fib 0.382 + SMC Premium Zone)

Potential pullbacks to $80.42 / $78.60 before continuation

Strong volume at lows signals accumulation

Liquidity sweep u

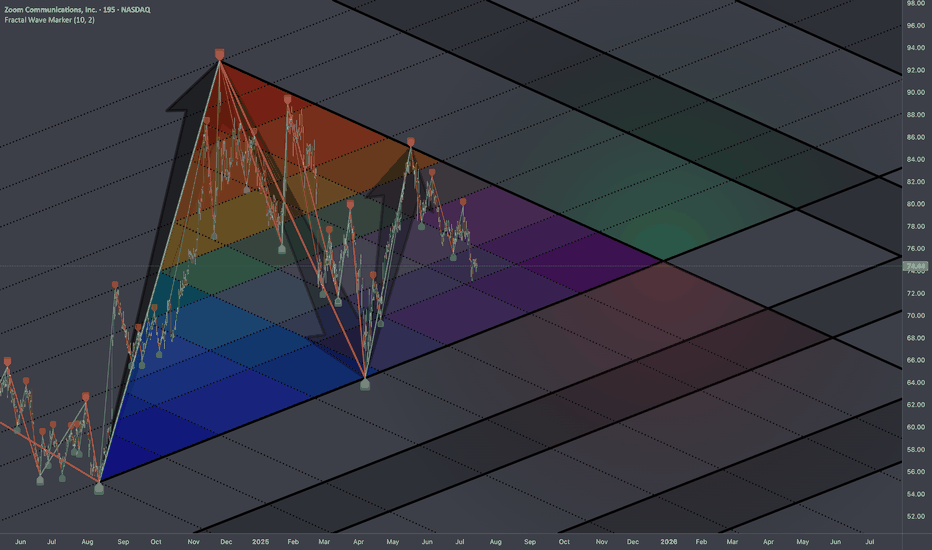

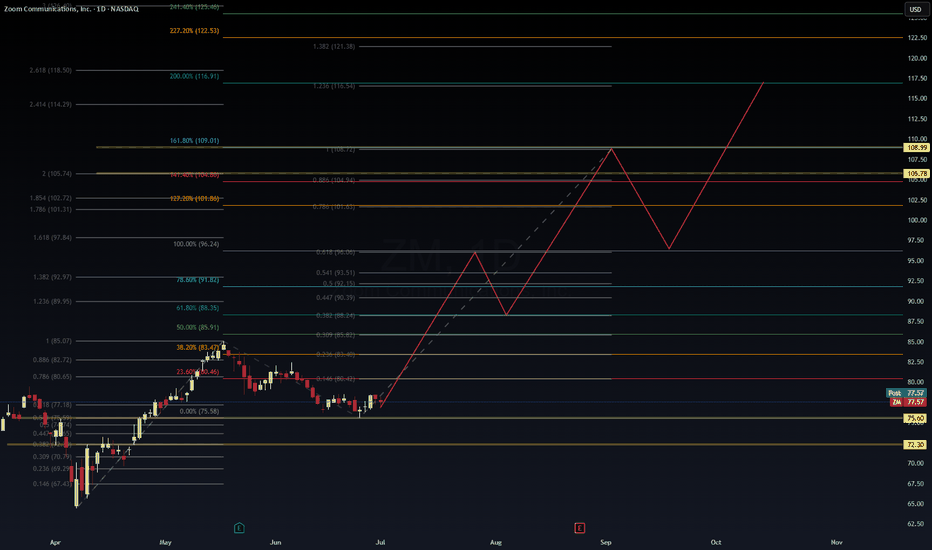

$ZM Swing Setup – Fib Expansion + Recovery Arc🔍 NASDAQ:ZM Swing Setup – Fib Expansion + Recovery Arc

Zoom is entering a Fibonacci golden arc setup, bouncing off key support ($75.60) and aiming for a multi-leg move back toward structural targets.

Trade Thesis: A successful reclaim of $85–88 range can propel NASDAQ:ZM to $105–109 with a fin

ZM: Uncanny Feeling this is going to explodeStrategy Type: Debit Call Spread (defined risk, favorable skew)

Thesis: Price moving from $77 toward the $85–$93 liquidity zone

🧾 Setup Details (as of $77.76 spot)

📅 Expiry:

August 16, 2025 (standard monthly expiration – gives time for move to unfold post-earnings and macro catalysts)

⚙️ Structure

Zoom Communications ($ZM) – Discount Demand Zone Reversal in ProAfter an extended corrective move, NASDAQ:ZM has tapped into the 0.618–0.786 discount Fib zone around $75.72, aligned with BOS (Break of Structure) and CHoCH (Change of Character) signals. Price structure suggests a bullish reversal with upside targets of $87–$93 over the coming weeks.

🔍 Technica

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 1ZM is featured.

Frequently Asked Questions

The current price of 1ZM is 64.02 EUR — it has decreased by −1.85% in the past 24 hours. Watch ZOOM COMMUNICATIONS stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange ZOOM COMMUNICATIONS stocks are traded under the ticker 1ZM.

1ZM stock has risen by 1.52% compared to the previous week, the month change is a −5.70% fall, over the last year ZOOM COMMUNICATIONS has showed a 17.66% increase.

We've gathered analysts' opinions on ZOOM COMMUNICATIONS future price: according to them, 1ZM price has a max estimate of 97.62 EUR and a min estimate of 55.18 EUR. Watch 1ZM chart and read a more detailed ZOOM COMMUNICATIONS stock forecast: see what analysts think of ZOOM COMMUNICATIONS and suggest that you do with its stocks.

1ZM stock is 1.89% volatile and has beta coefficient of 0.87. Track ZOOM COMMUNICATIONS stock price on the chart and check out the list of the most volatile stocks — is ZOOM COMMUNICATIONS there?

Today ZOOM COMMUNICATIONS has the market capitalization of 19.46 B, it has increased by 2.43% over the last week.

Yes, you can track ZOOM COMMUNICATIONS financials in yearly and quarterly reports right on TradingView.

ZOOM COMMUNICATIONS is going to release the next earnings report on Aug 25, 2025. Keep track of upcoming events with our Earnings Calendar.

1ZM earnings for the last quarter are 1.26 EUR per share, whereas the estimation was 1.16 EUR resulting in a 9.22% surprise. The estimated earnings for the next quarter are 1.19 EUR per share. See more details about ZOOM COMMUNICATIONS earnings.

ZOOM COMMUNICATIONS revenue for the last quarter amounts to 1.04 B EUR, despite the estimated figure of 1.03 B EUR. In the next quarter, revenue is expected to reach 1.03 B EUR.

1ZM net income for the last quarter is 224.81 M EUR, while the quarter before that showed 355.16 M EUR of net income which accounts for −36.70% change. Track more ZOOM COMMUNICATIONS financial stats to get the full picture.

No, 1ZM doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 19, 2025, the company has 7.41 K employees. See our rating of the largest employees — is ZOOM COMMUNICATIONS on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ZOOM COMMUNICATIONS EBITDA is 930.86 M EUR, and current EBITDA margin is 26.11%. See more stats in ZOOM COMMUNICATIONS financial statements.

Like other stocks, 1ZM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ZOOM COMMUNICATIONS stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ZOOM COMMUNICATIONS technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ZOOM COMMUNICATIONS stock shows the strong sell signal. See more of ZOOM COMMUNICATIONS technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.