MOODENGUSDT.P trade ideas

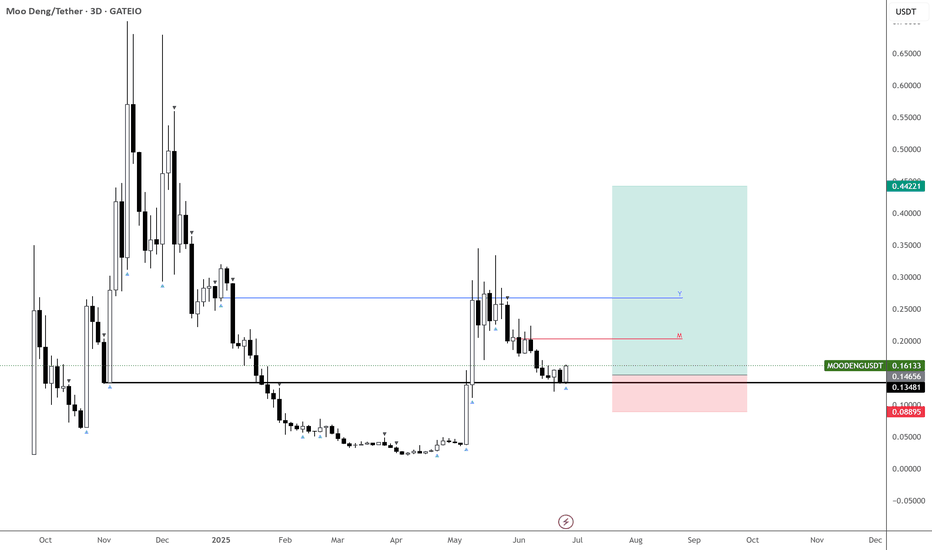

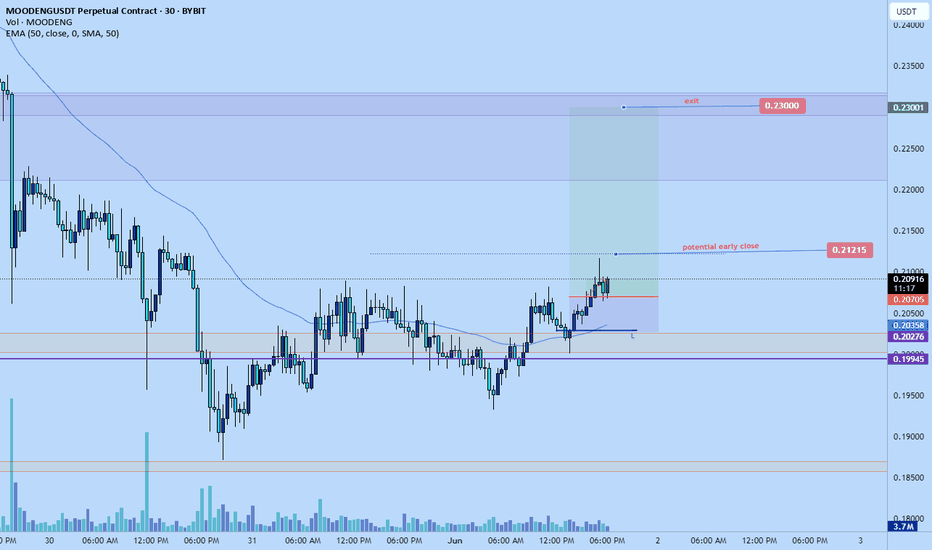

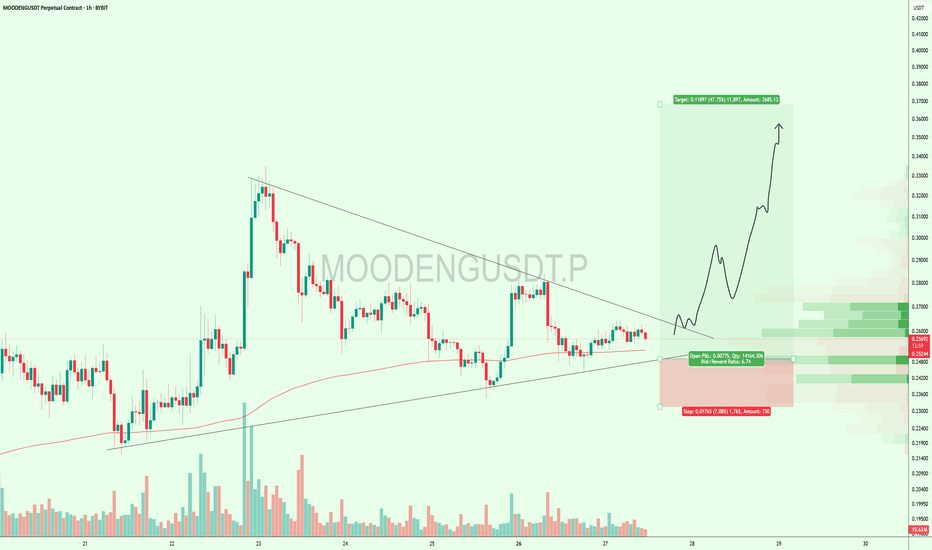

MOODENG – Wave 2 In Play, More Upside Ahead

Might be a bit bold here, but I see OKX:MOODENGUSDT pushing higher as long as it holds the 13c level.

It had a strong impulsive move, and this looks like wave 2 of the current momentum.

Daily downtrend signals from the local high have already expired, increasing the odds of continuation from here.

If momentum picks up, I’m eyeing 40–44c as a potential target zone.

MOODENG isn’t done yet!

MOODENG 100% GAIN ????MOODENG ready to go 0.3000 ??? yes if moodeng hold the bullish ob than possible we will go o.3000 or more moodeng already pump hard now at ob so expecting good gain from here if ob not break here a trade plan mange your risk accourding your captial

entry plan

0.1200_1300

targets

0.2500

0.3000

0.5000

sl

0.1100_0.10000

its NFA DYOR

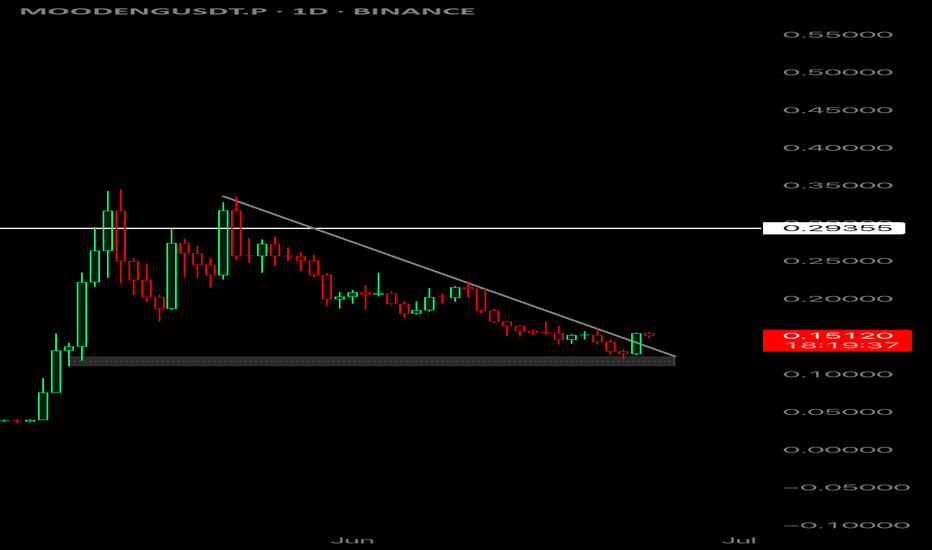

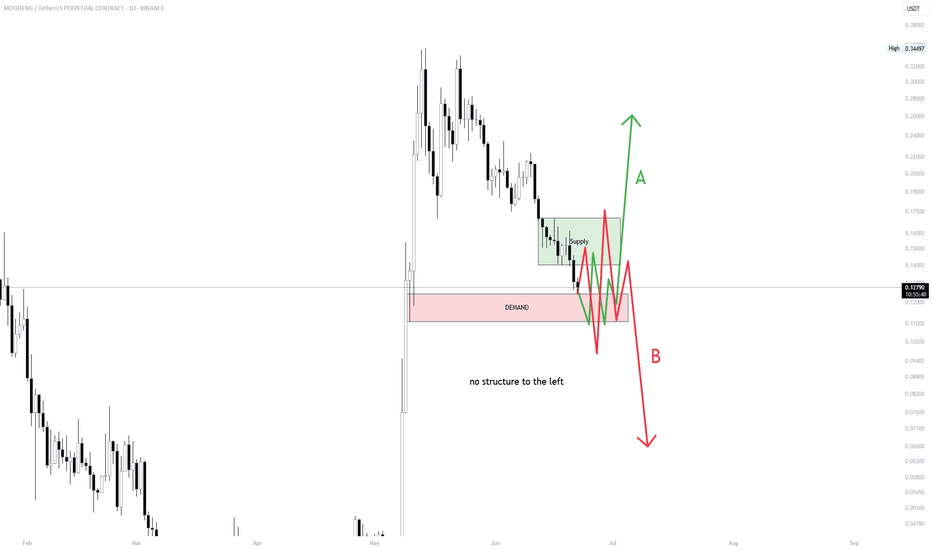

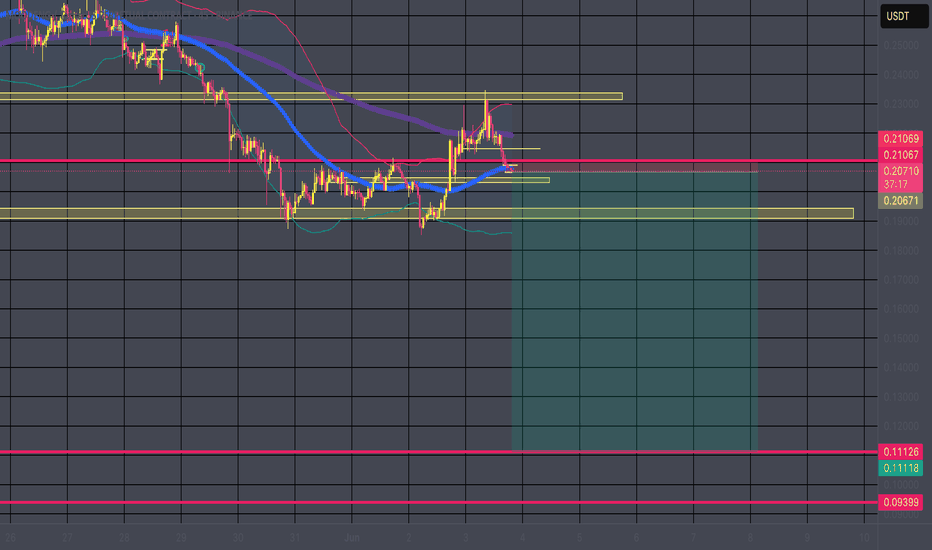

MOODENG CAN GO KAMIKAZE!MOODENG is sitting at a critical decision point — but this small range might not be enough to hold.

The small consolidation above demand is weak, with low conviction from buyers, and it looks more like distribution than accumulation. Any relief from here is likely to be short-lived unless proven otherwise.

Scenario A would require a strong reclaim and impulse through the overhead supply zone — a move I’m willing to fade unless backed by volume and broader market strength e.g on Bitcoin.

Scenario B, on the other hand, aligns better with the chart’s context: thin structure, fading demand, and the likelihood of a clean sweep lower if bulls can’t step in aggressively. A breakdown from here could lead to a sharp selloff, given the vacuum to the left.

All of this depends heavily on Bitcoin dominance. If BTC continues to rise, altcoins like MOODENG are unlikely to sustain upward momentum. Risk-off behavior in the market would favor downside continuation, making the bearish setup even more probable.

Be patient, and don’t force big positions in this zones. Let price confirm — or invalidate — the setup for you.

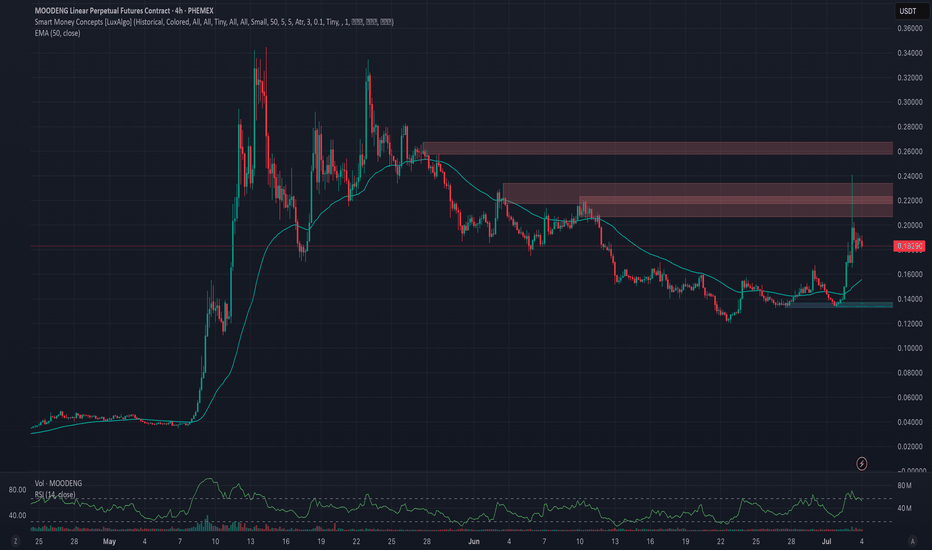

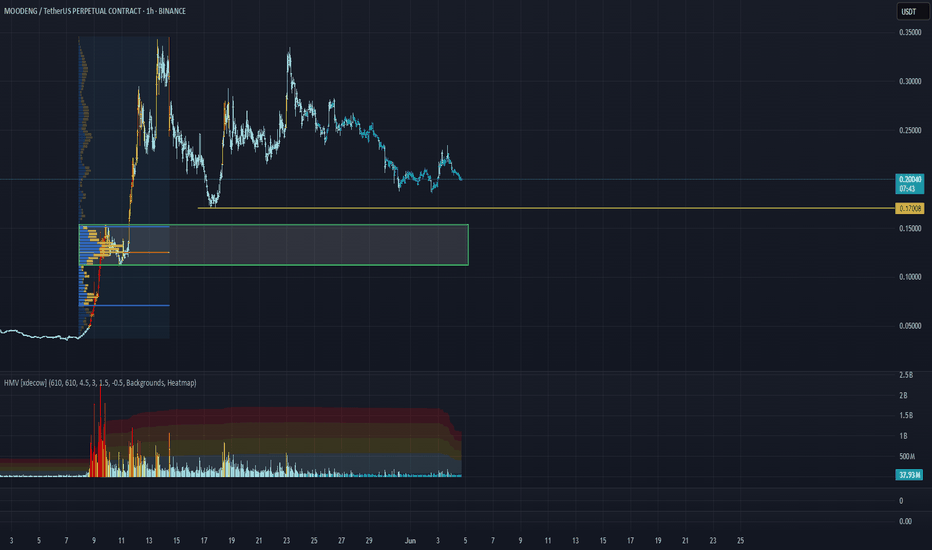

Phemex Analysis #94: Pro Tips for Trading MooDeng (MOODENG)MooDeng ( PHEMEX:MOODENGUSDT.P ) is a playful, Solana-based meme coin inspired by a charming pygmy hippopotamus born at Thailand’s Khao Kheow Zoo. Since its debut in 2024, MOODENG has quickly captured crypto enthusiasts' imaginations, gaining prominence through explosive price surges and a rapidly growing community.

Recently, MooDeng’s market presence surged dramatically following its listing on Upbit, one of South Korea’s largest cryptocurrency exchanges. Upbit added trading pairs with KRW, BTC, and USDT, leading MOODENG’s price to spike by over 70%, while liquidity and trading volume increased by a staggering 600%, elevating its market capitalization beyond $200 million.

This newfound liquidity and heightened market attention bring exciting yet challenging trading conditions. To navigate these effectively, let’s explore several scenarios that traders should consider in the near term.

Possible Scenarios

1. Bullish Continuation (Extended Rally)

The recent Upbit listing provided significant bullish momentum, which might continue propelling MOODENG’s price upward. If buying pressure remains strong and price confidently holds above immediate support $0.165, the rally could extend toward higher resistance levels.

Pro Tips:

Monitor Key Resistance Levels: Keep an eye on critical short-term resistance zones $0.234 and $0.2676. Consider partial profit-taking at these levels to safeguard gains.

Entry and Risk Management: Look for price consolidations or small retracements as potential entry points. Always set stop-losses below recent support areas to minimize downside risk.

2. Price Consolidation (Sideways Movement)

After substantial upward movement, MooDeng might enter a period of consolidation as the market absorbs recent gains. Consolidation typically involves price fluctuating within a defined range, testing support $0.165 and resistance $0.206 repeatedly before the next significant move.

Pro Tips:

Range Trading: Implement range-trading strategies by identifying clear support and resistance levels, taking advantage of repeated price movements within these bounds.

Volume Analysis: Carefully observe trading volumes during consolidation phases. Declining volumes typically indicate a healthy pause before a potential next leg upward or downward breakout.

3. Bearish Correction (Pullback Scenario)

Following significant rallies, sharp pullbacks can occur as traders take profits, particularly in meme coins known for volatility. If MOODENG breaks below recent key support levels $0.165 with substantial trading volume, it might signal a bearish correction, returning the price toward lower support areas.

Pro Tips:

Identify Support Zones: Carefully monitor established support levels $0.133 or $0.12 for potential accumulation or buying opportunities. Significant pullbacks could present strategic entry points for long-term believers.

Stay Cautious: Avoid hastily entering trades during strong bearish momentum; instead, wait patiently for clear signs of price stabilization before taking new positions.

Conclusion

MooDeng’s recent explosive growth following the Upbit listing presents traders with numerous opportunities. By carefully monitoring outlined scenarios—considering bullish continuation, consolidation, and potential pullbacks—traders can effectively manage risk while capitalizing on MOODENG’s volatility. Stay disciplined, remain responsive to market dynamics, and always practice strategic risk management to maximize your trading success with MooDeng.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

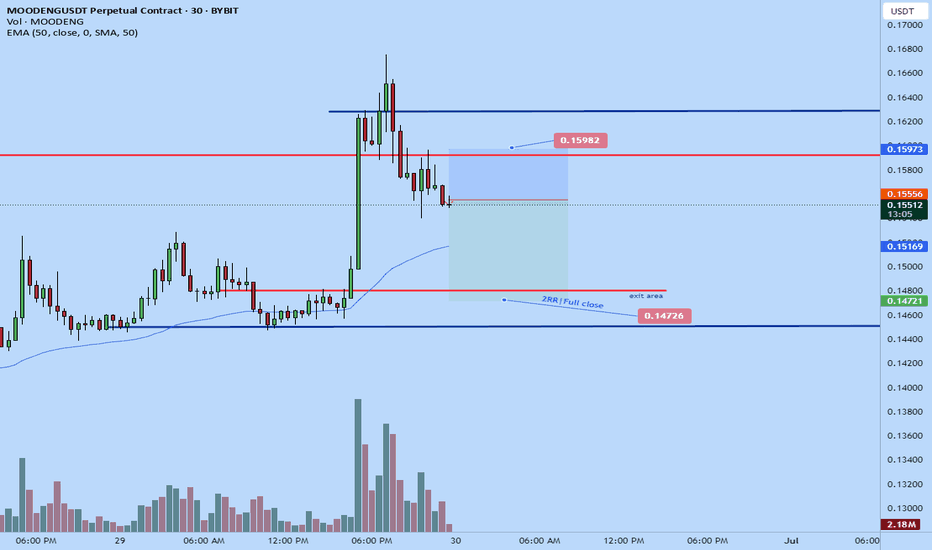

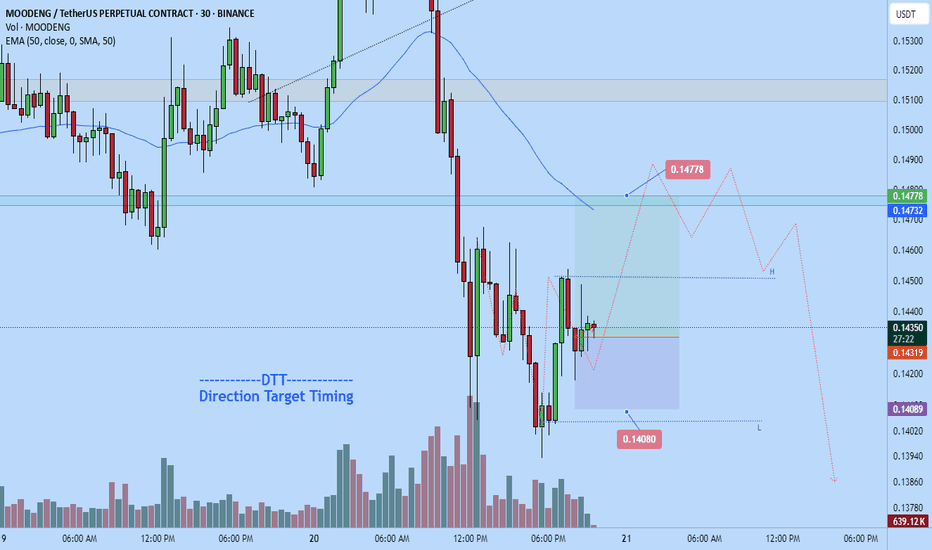

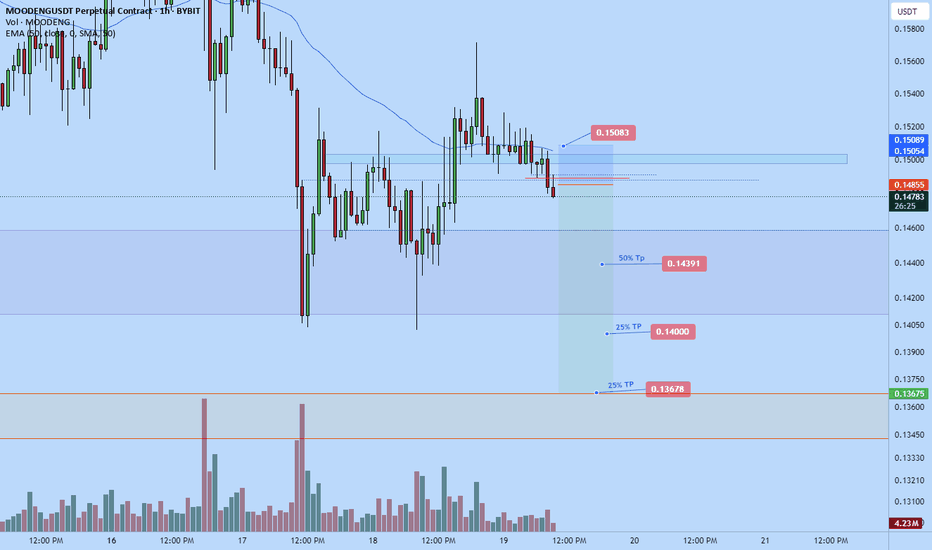

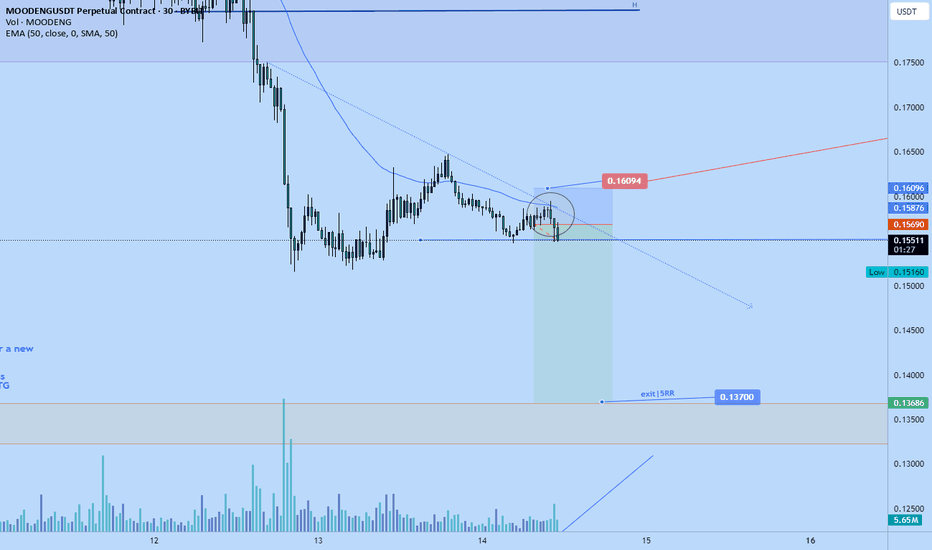

Moodeng short back to 0.14Recently opened a new short position on moodeng.

Looking to scale out of this one gradually all the way down to $0.13678 area.

Time sensitive.

Stop: $0.15083 or higher

should be able to get 2.5R+ on this trade.

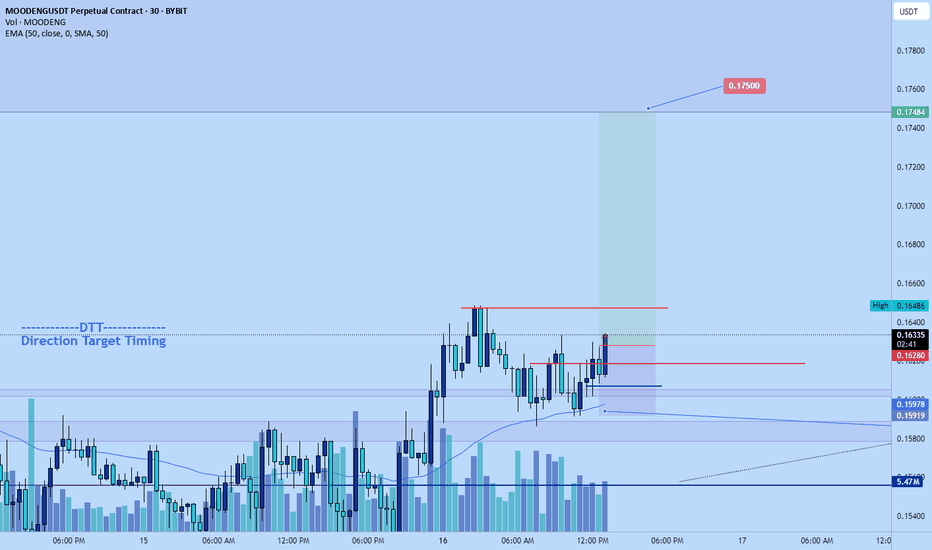

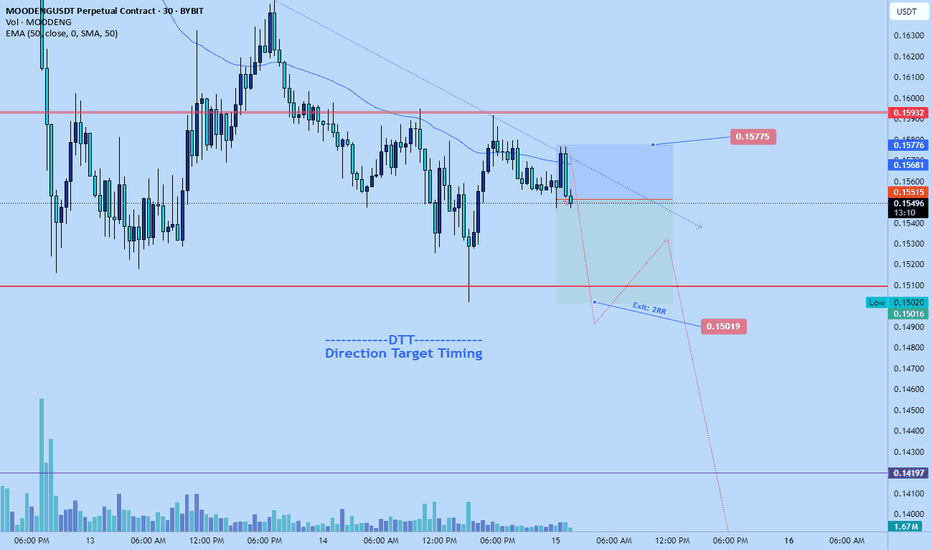

DTT strategy applied.

Market still not at weekly potential HL area, likely will continue to trend down until we reach there- around $0.13678- That's where I anticipate enough demand might come in to reverse the market to the upside

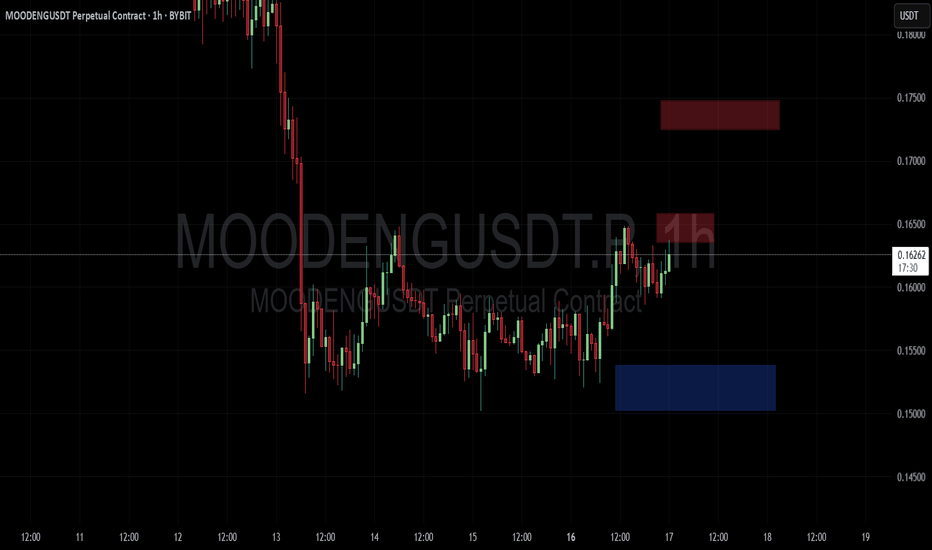

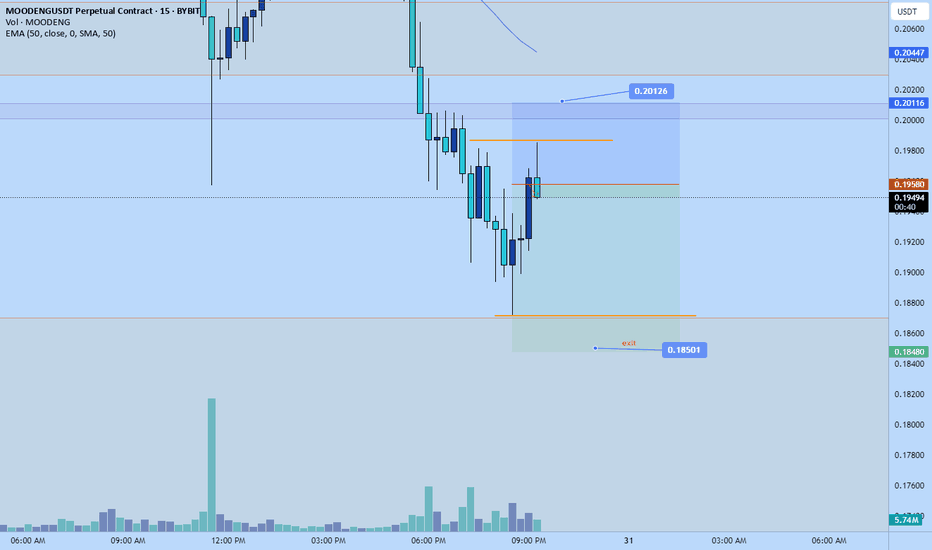

Moodeng big short opportunityMoodeng is currentl falling impulsively, it pause a bit but I believe it will continue down now. I recently entered a position

Stop is : $0.16094

Tp is $0.137

Roughly 5R from. If you just seeing this maybe 3.5RR for you or so.

Time sensitive.

Setup matches up with my DTT strategy , plus correlating with btc, as I anticipate btc to fall back to lower targets around $102,500-$98300..plus bearish war FUD from IsraelvsIran

Definitely high probability, still manage risk to what you can afford to lose

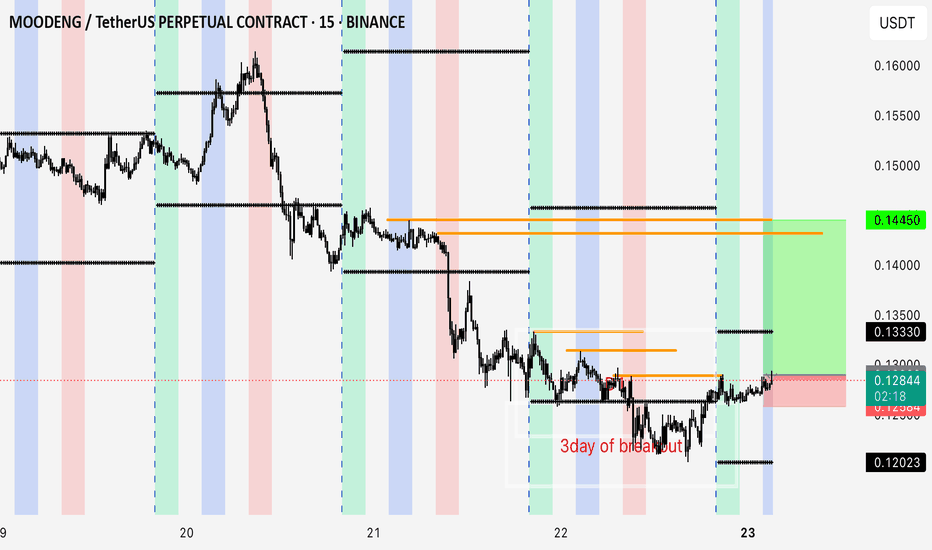

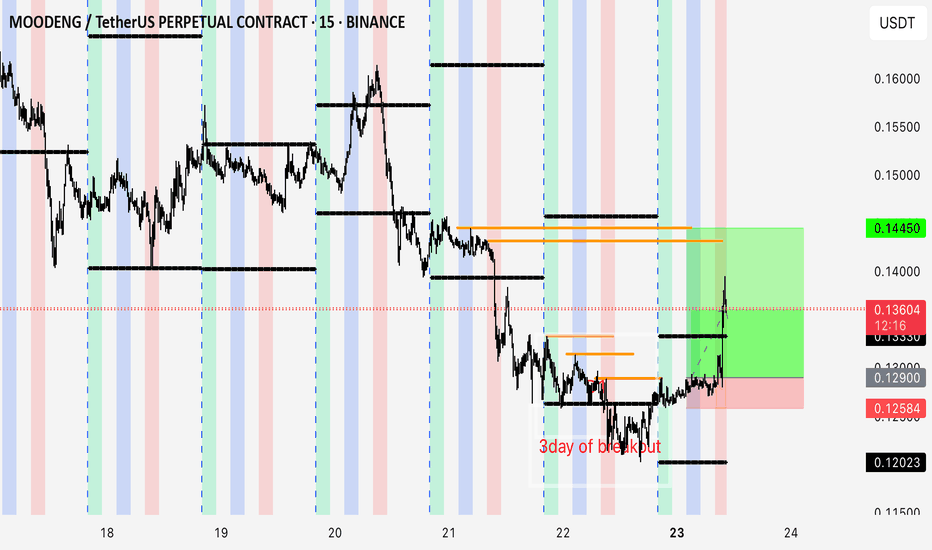

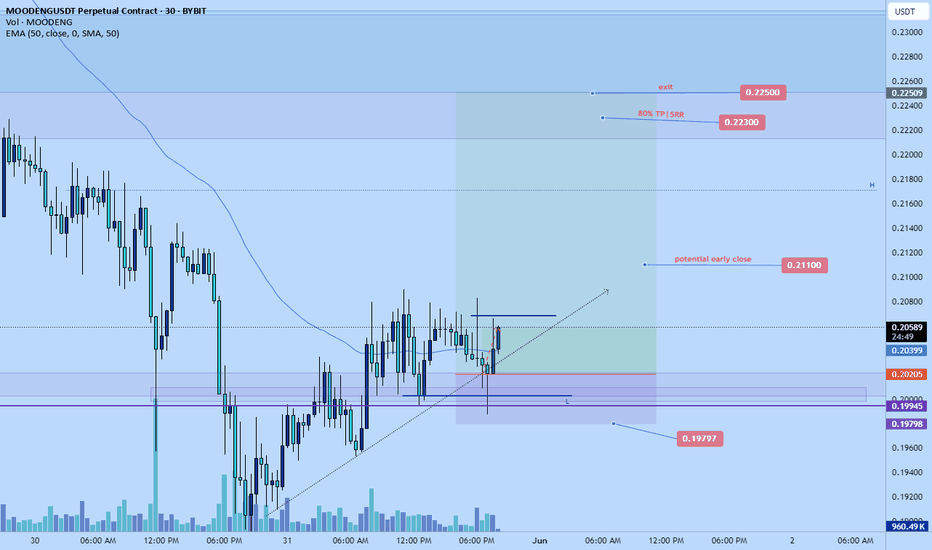

$MOODENG Go Bearish on Timeframe 15MStrong bearish - Price continues to print BOS (Break of Structure) down consistently, no significant higher high is formed.

Estimated Time of Potential Movement :

A potential move towards TP could occur in the next 2-4 hours, depending on the strength of the rejection on retest.

Advanced Scenario :

If TP is reached :

There could be further downside to 0.16700 (next liquidity zone)

Re-enter if pullback to 0.17300-0.17450 and validation rejection candle (SL: 0.17750, TP: 0.16700)

If SL is reached :

Backup setup: wait for price reject from the upper supply area (0.18800 - 0.19000), then re-enter short with SL: 0.19300 and TP: 0.17650

MOODENG/USDT Analysis: Long Setup

Following strong growth last month, a significant support zone has formed at $0.15–$0.11, which has not yet been tested.

A false breakout below the $0.17 low is quite possible, followed by a quick move to the mentioned support zone and a return above $0.17.

This publication is not financial advice.

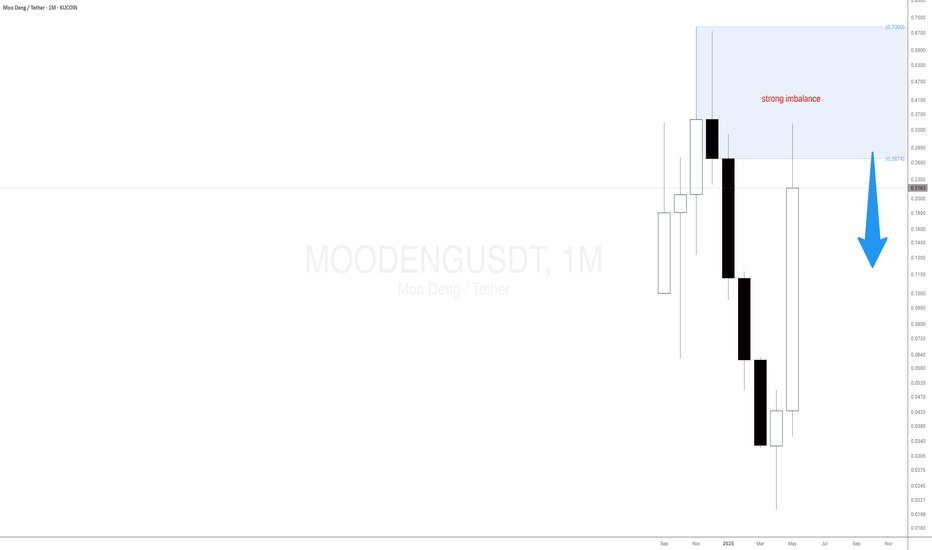

Beginners Guide To Winning Memecoin Trades! Moo DengMeme coins have taken the cryptocurrency world by storm, often starting as jokes but evolving into high-volatility assets that attract crypto traders seeking quick gains. From Dogecoin to Shiba Inu and now Moo Deng, these so-called useless meme coins can offer trading opportunities—if you know where to look.

In this updated crypto analysis, I will build on our previous analysis where I identified a strong monthly supply zone for Moo Deng meme coin at $0.26. If you're wondering how to trade meme coins like Moo Deng, even with little experience, this supply and demand analysis breaks it down using simple supply and demand concepts on larger timeframes.

The sell-off is trying to happen.