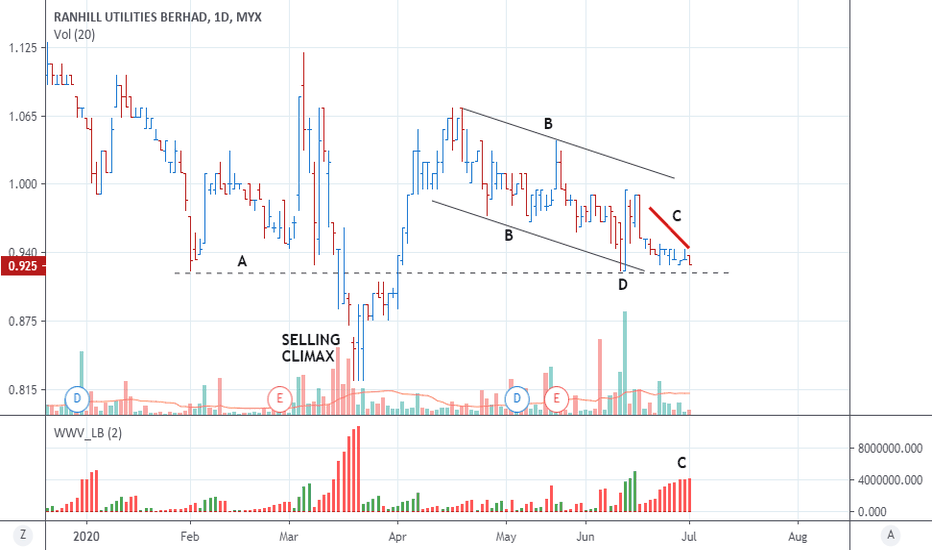

RANHILL - Exhausted selling?HI, my take on RANHILL

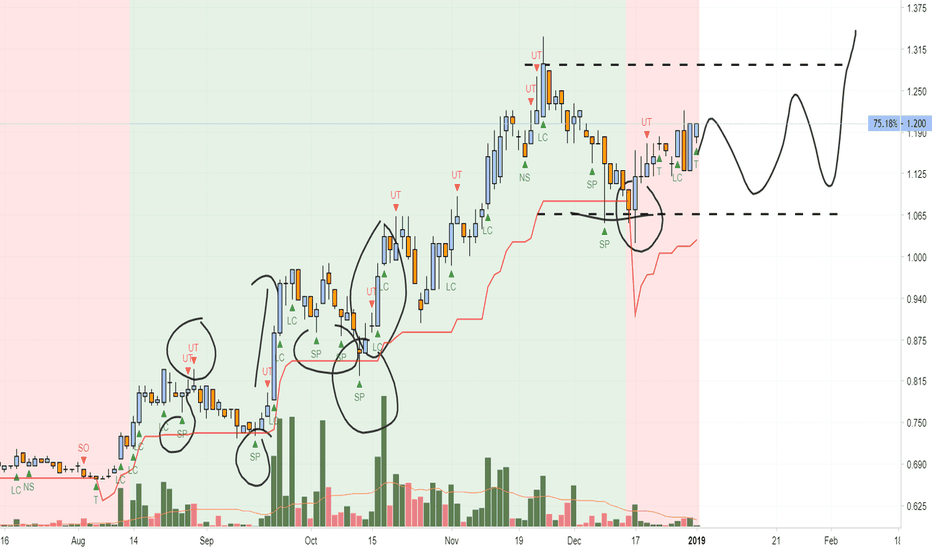

After the selling climax, price rallied up in an impulsive move, followed by correction in the form of a descending channel B. Upon reaching the previous support A, we could see shortening of downward thrust. The last move down (C) is currently still unable to break below the recent low at D. But look at the high cummuative volume of down wave C ( on Weiss indicator). Despite this high down move volume wave , price still unable to penetrate below previous low (high effort but no result) might indicate hidden buyers entering the market, and sellers exhausted.

I'm looking forward to see price move up again.

Trade at your own risk. Comments are welcomed

RANHILL trade ideas

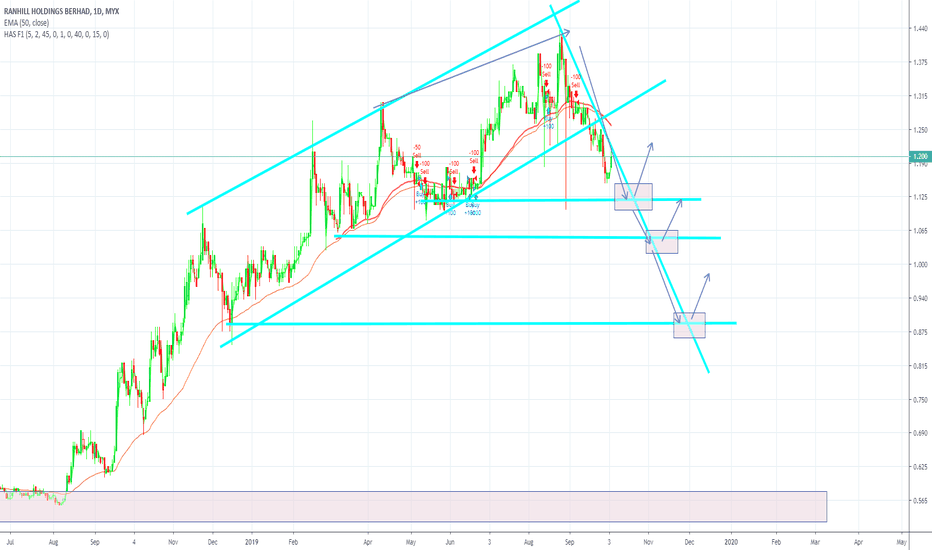

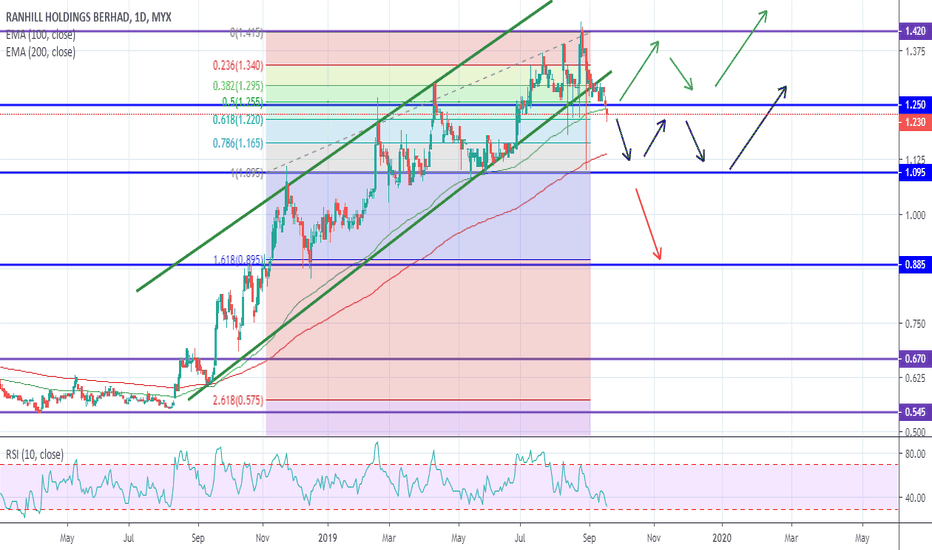

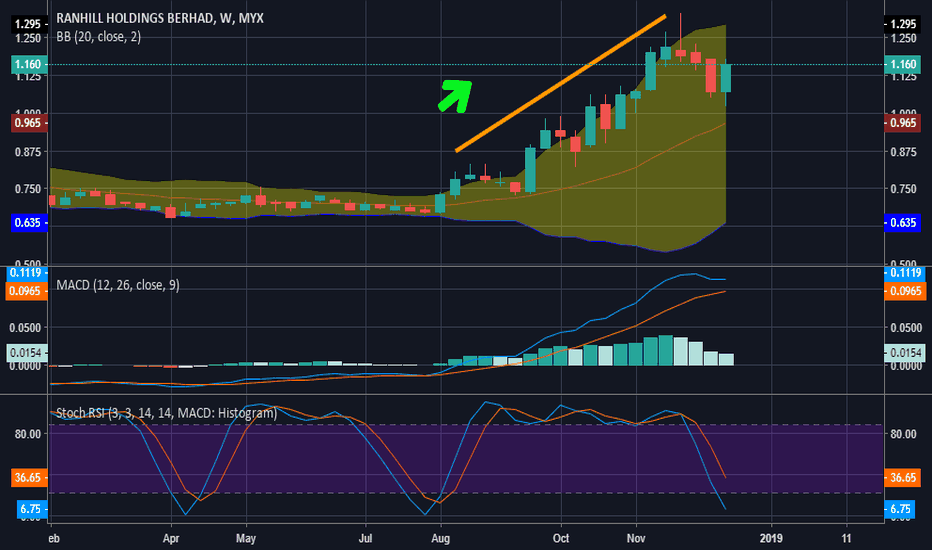

LOOKING FOR DISCOUNTED PRICE.Notes:

1.)Break below the trend line.

2.)Break below support line.

3.) Price at 0.68 fibo retracement area.

Assumption:

1.)Price may continue to shoot up after a pullback.

2.)Price may consolidate before going up.

3.)Price may going down for a downtrend.

As global supply for water plummeting and the demand for water skyrocketing,I'm looking forward to find opportunity to go long for stocks that related to water supplies.

www.unesco.org

Disclaimer: Everything are just based on my research,my opinions and for education purposed only.

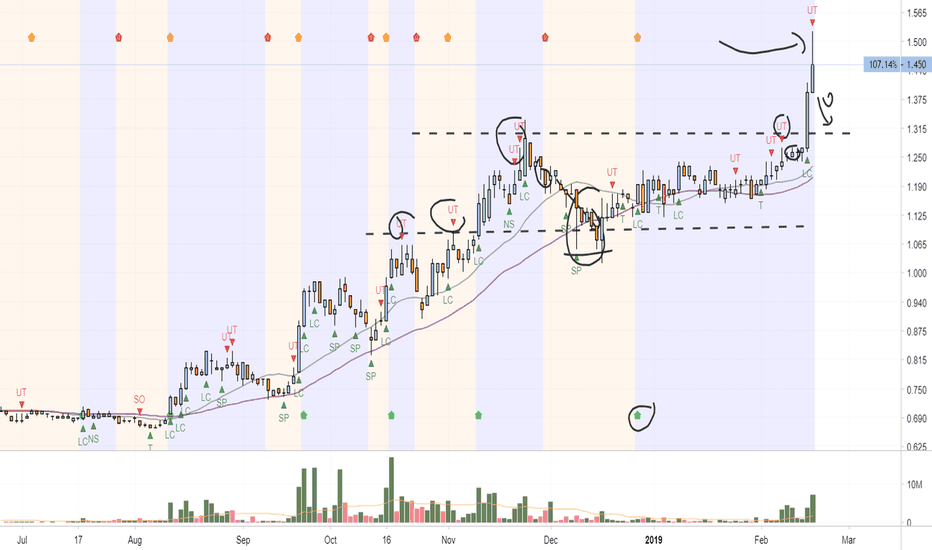

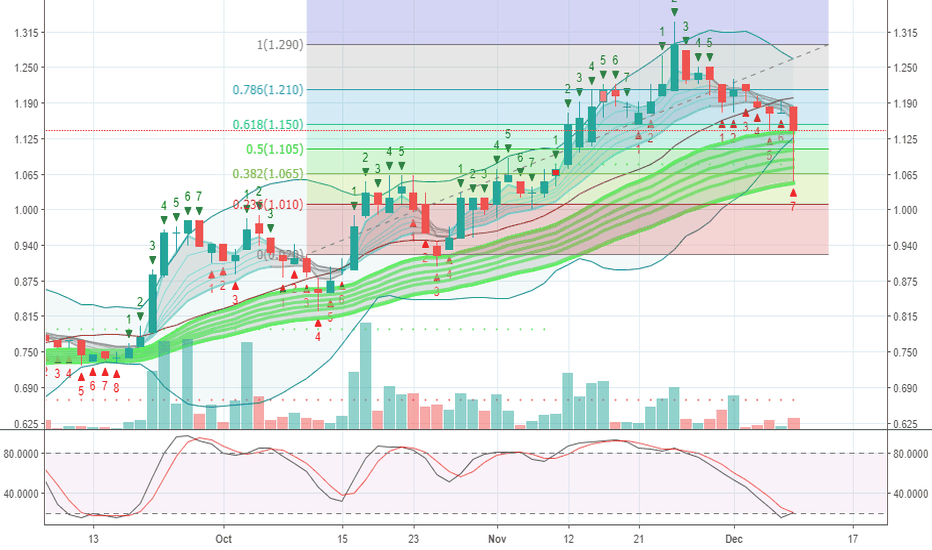

Who have the best setup? Inari, CCK, CCM or Ranhill4 Stock Review based on Volume Spread Analysis.

Send us your preference stock to review based on TradeVSA chart by comment at below.

Disclaimer

This information only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock

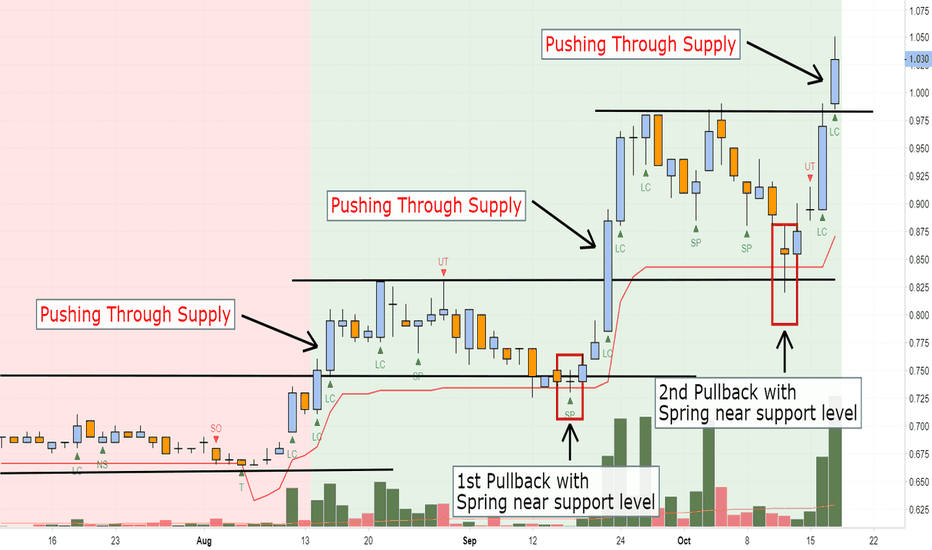

Potential Low Risk Stock Trade Idea – RanHill (5272.KL)Smart Money is flushing out the weak-hand holders out of RanHill again. Notice the bar on 24 Occtober, the price broke below support at RM0.985 and subsequently close above the support level on 29 October.

Based on the daily chart, Smart Money still interested to support and push the price above resistance level despite bearish market for last 3 weeks in KLCI. Smart Money is ready to re-test the resistance level at RM1.06 by pushes above the UT (sign of weakness) bar.