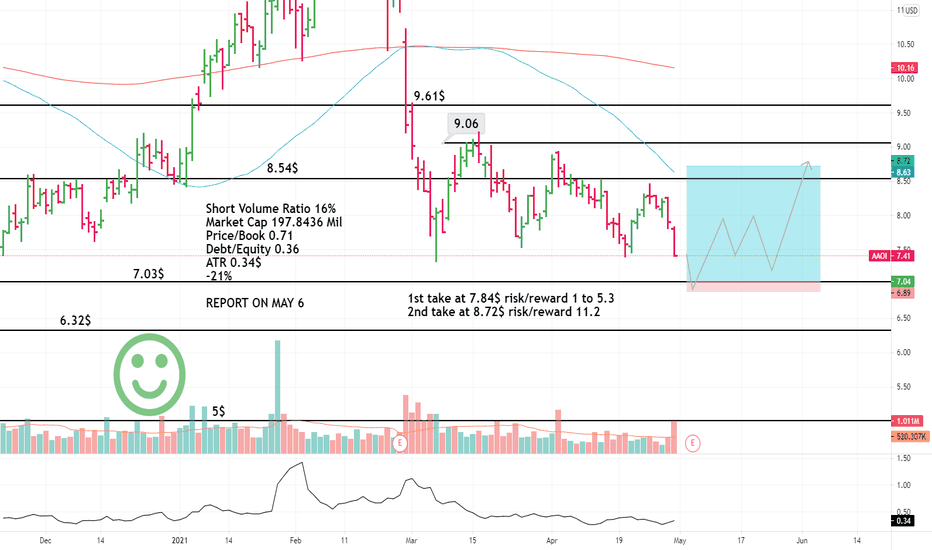

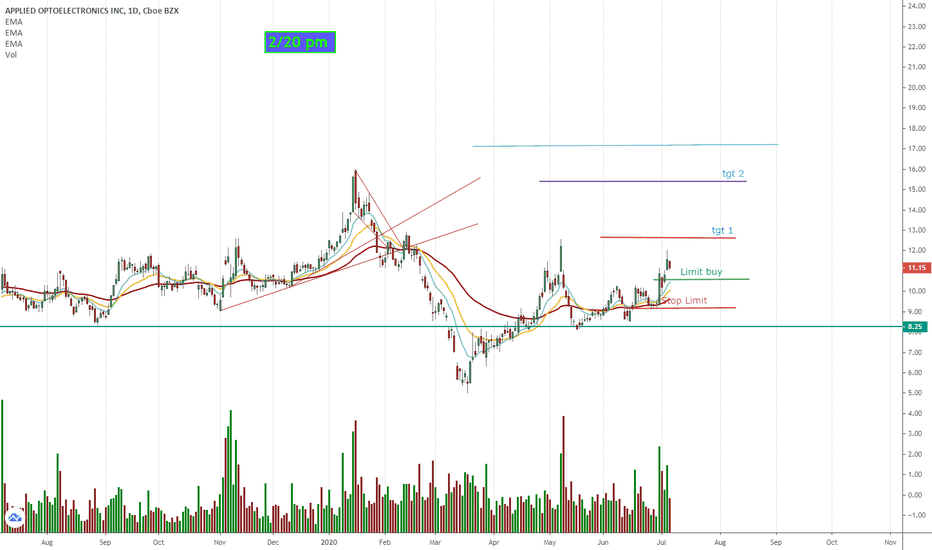

AAOI trade ideas

AAOI | InformativeNASDAQ:AAOI

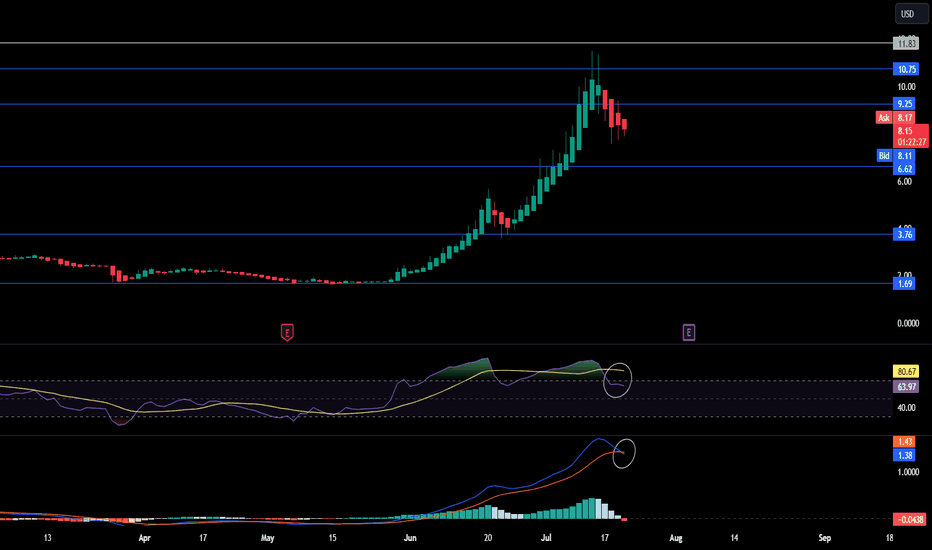

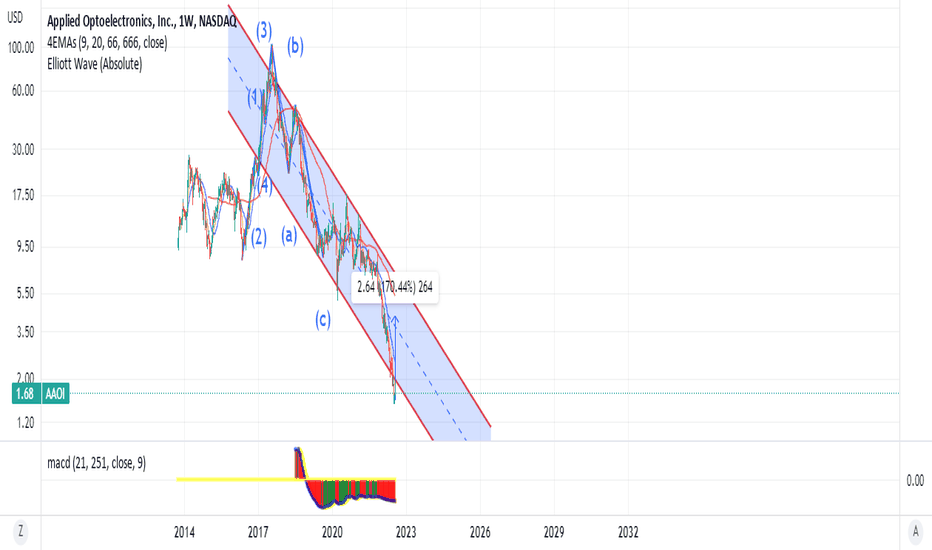

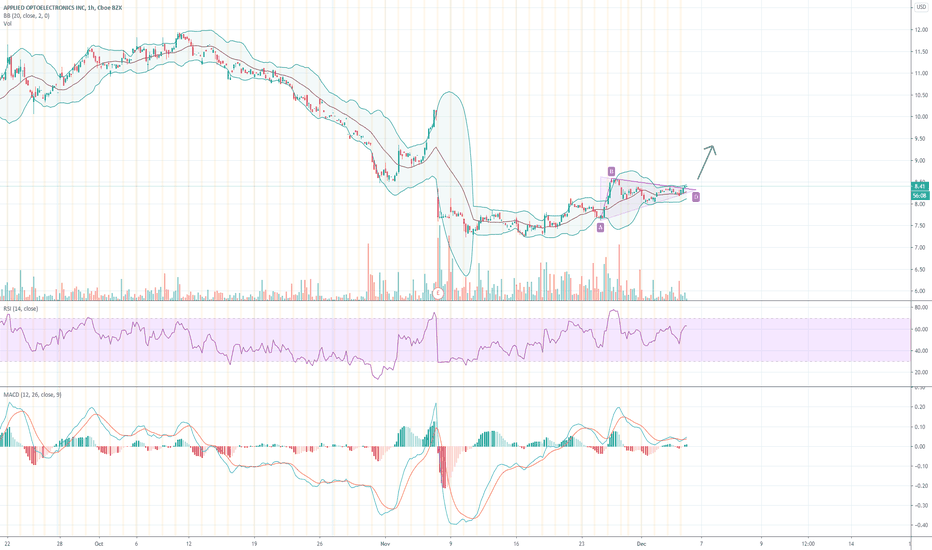

RSI is in the overbought territory, and the price is significantly distant from EMA20, indicating an extended condition. Additionally, we are currently in Wave 3, which suggests the potential for the price to reach $11.30 before a correction. However, considering the risk-reward ratio, it is no longer acceptable. I anticipate a pullback to the range of $6-7 as Wave 4, followed by a subsequent rise to $17 to complete Wave 5.

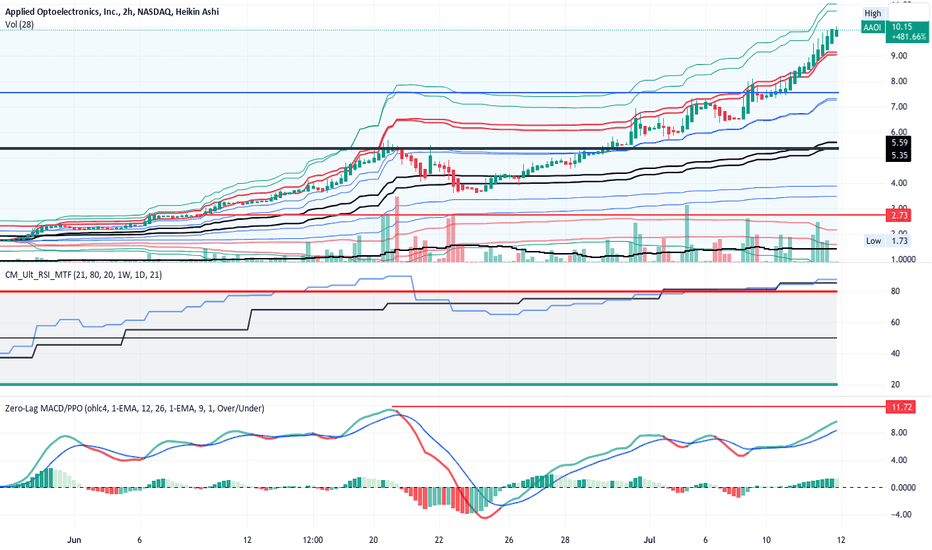

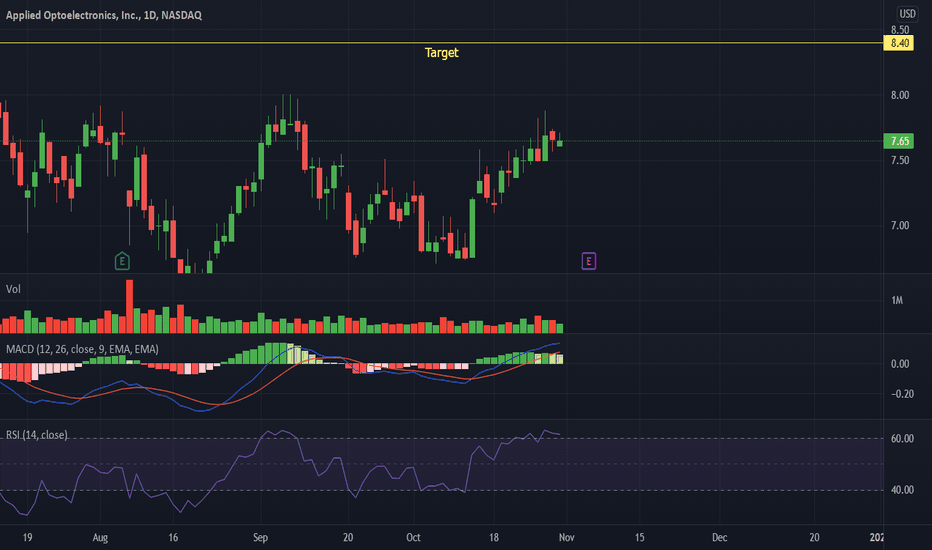

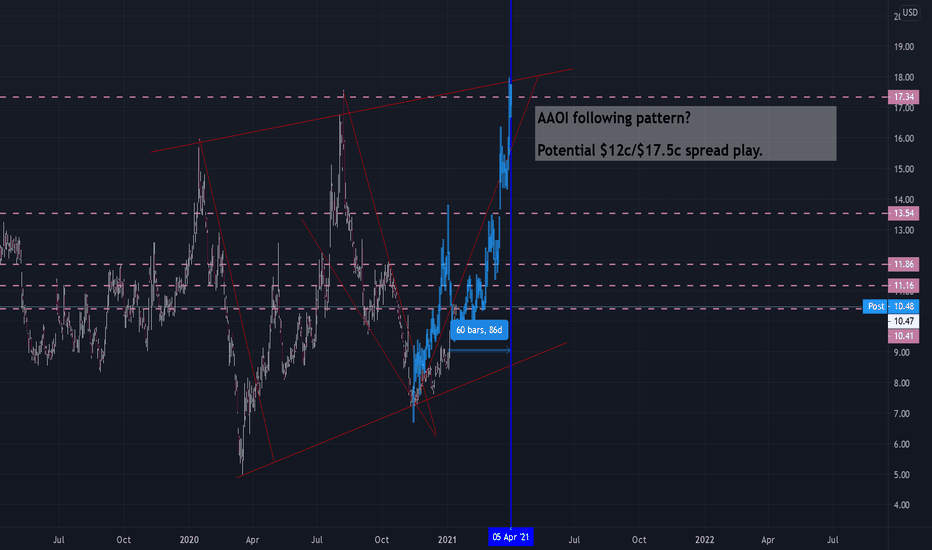

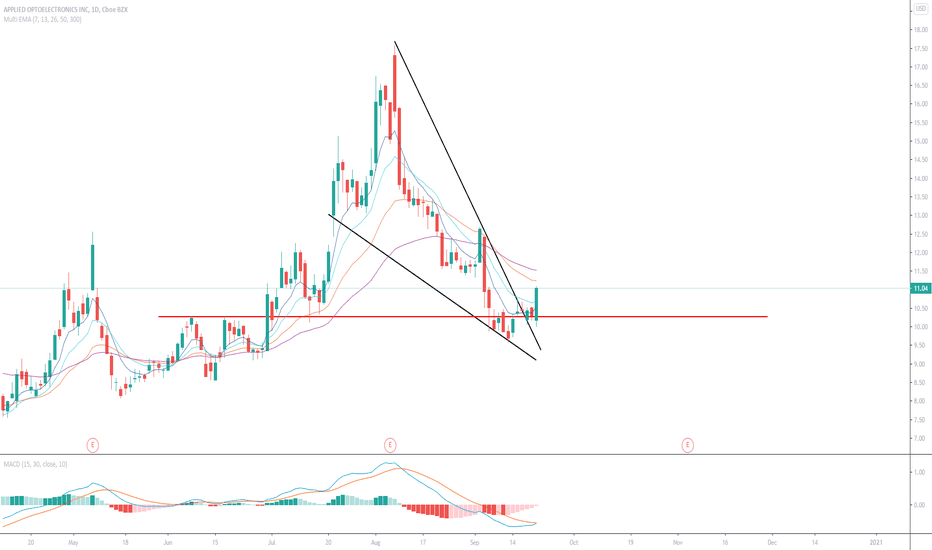

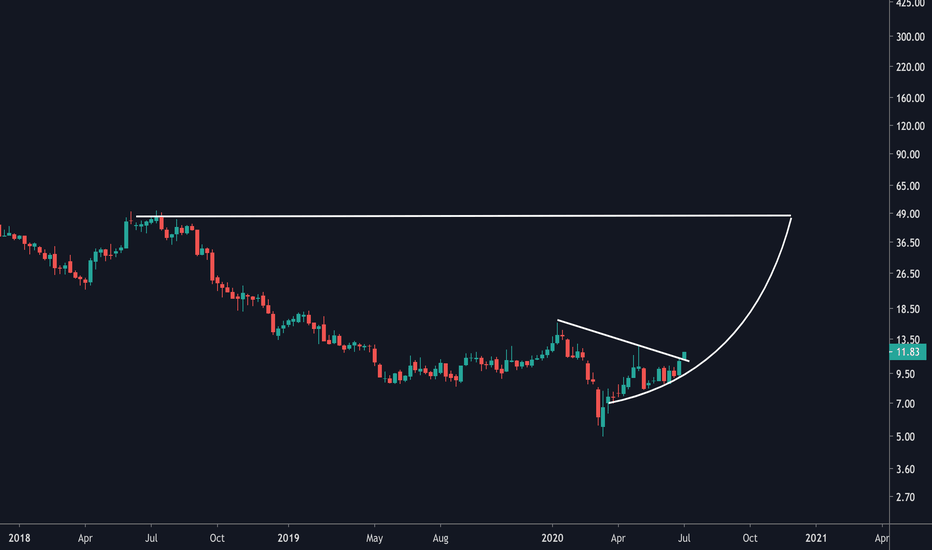

Can AAOI continue a 400% trend up ?AAOI has trended up more than 450% since May 23th. The big question is can it continue?

The factors include:

1 Volume - volume is what causes price action. Here rising volumes above the running mean

suggest that there is plenty of volume support for price action.

2. Anchored VWAP analysis is that after a pullback in VWAP levels in mid June price has been

rising and crossing VWAP levels above it. This is essentially a VWAP breakout. Price is increasingly

overbought and overvalued and perhaps due for another correction.

3. RSI of both the lower and high time frames crossed 80 more than a week ago. Thus far

RSI is stable without any sign of falling into bearish divergence.

4. The MACD lines are parallel and well above the histogram. They are at about the 9 level.

Price reversed on June 20th into the pullback. This is when the lines were at 11.7. This reasonably suggests another pullback or correction when they rise again to 11.7

Given the above, I conclude that AAOI has upside room until divergence is seen or trading volumes change to net selling volume or price outright pivots down from a high.

Accordingly, I will take a long trade expecting to capture the end of this massive trend up.

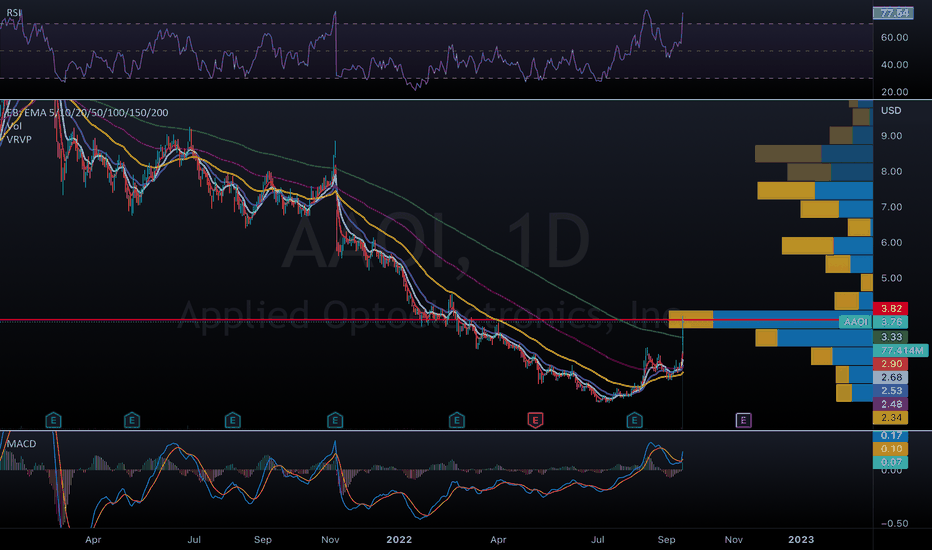

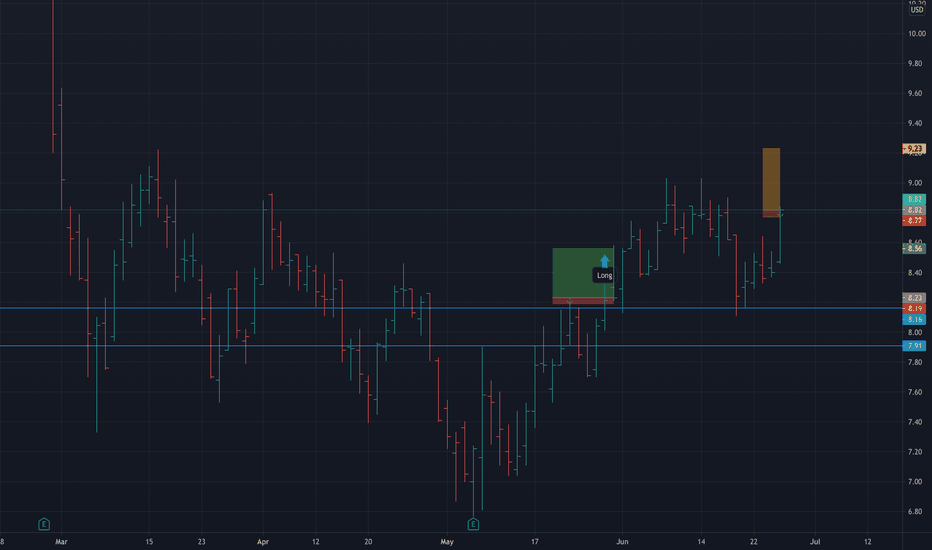

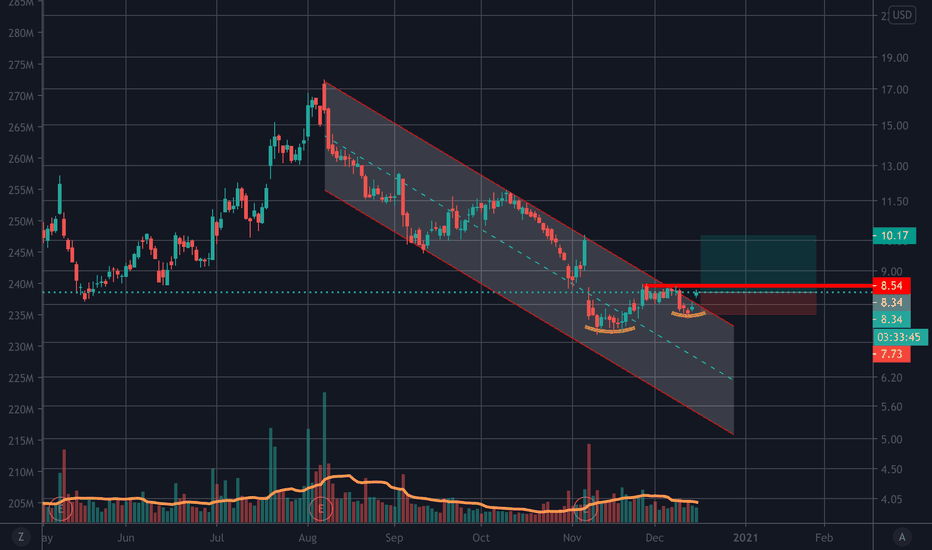

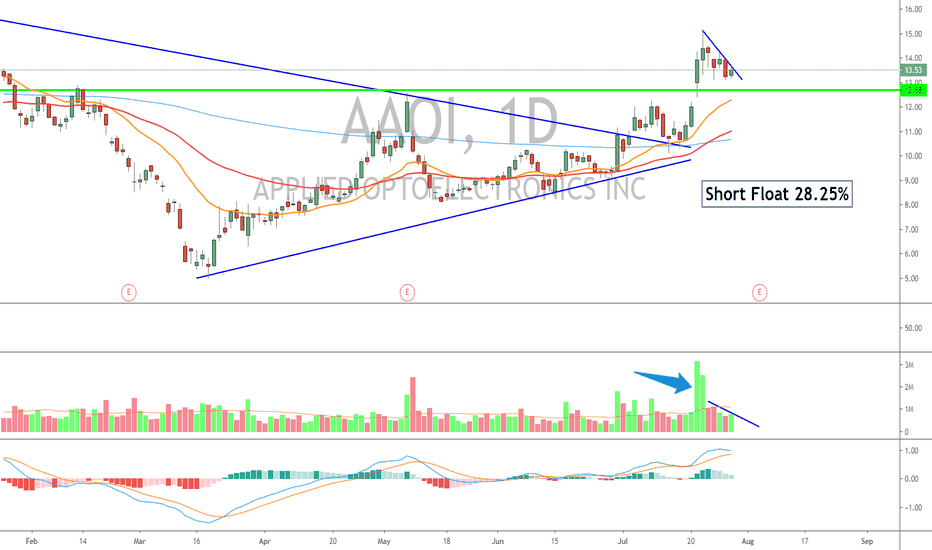

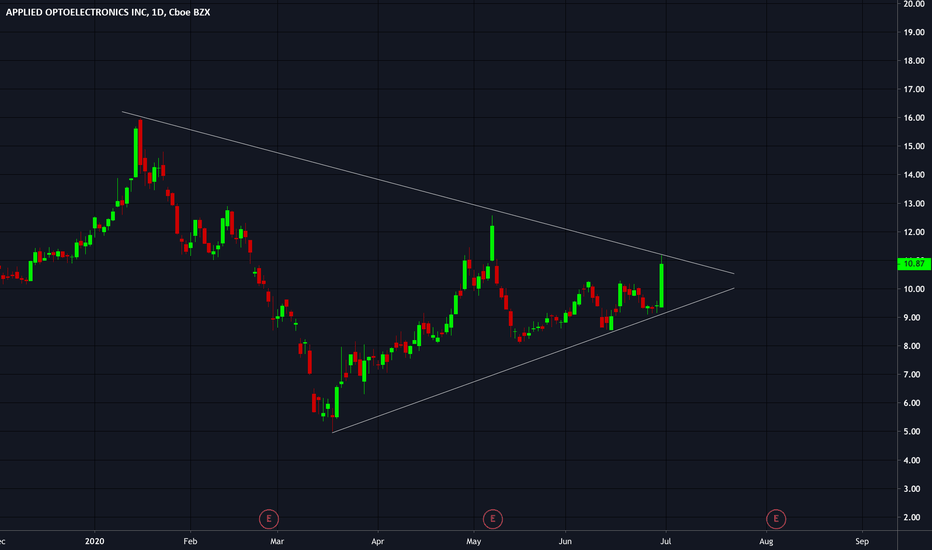

Long game with AAOIThis stock has a nice upward trend since July 2022 when the rest of the market begin cooling off. It has broken through the EMA200 level and has the opportunity to make it to the $5.10 level within the next year based upon fundamentals. With the RSI being above 70, I look for a pull back to the 50 range and then a climb again. There many sellers at the $8.10 range that are locked in at the moment. Let's see how this one does over the coming months.

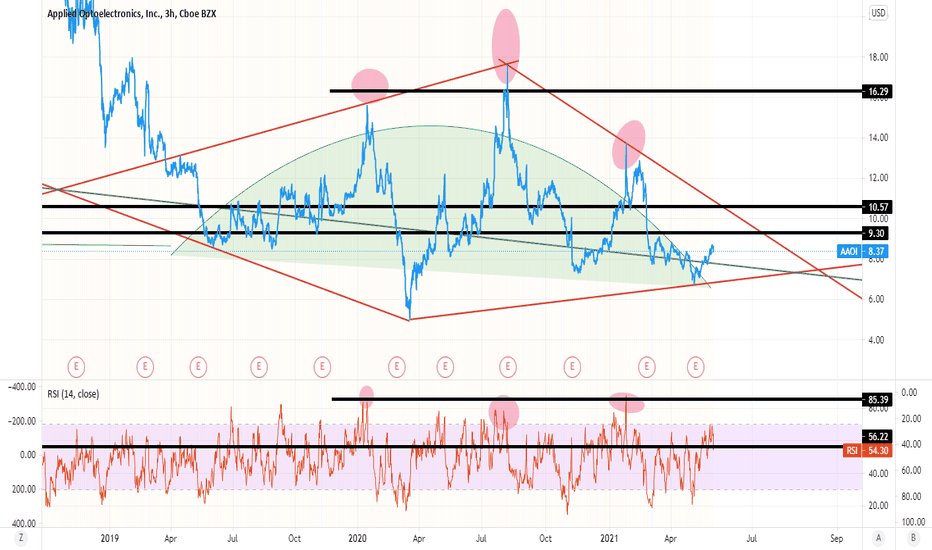

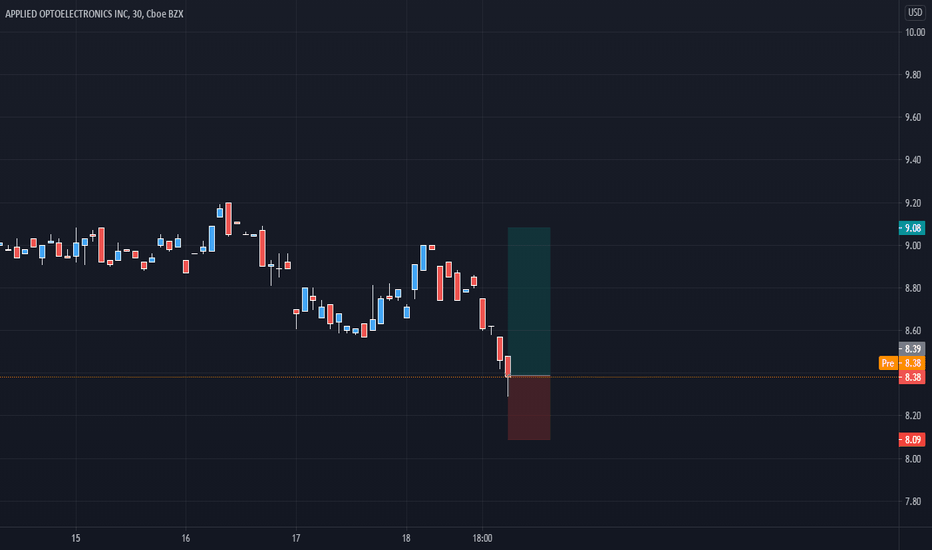

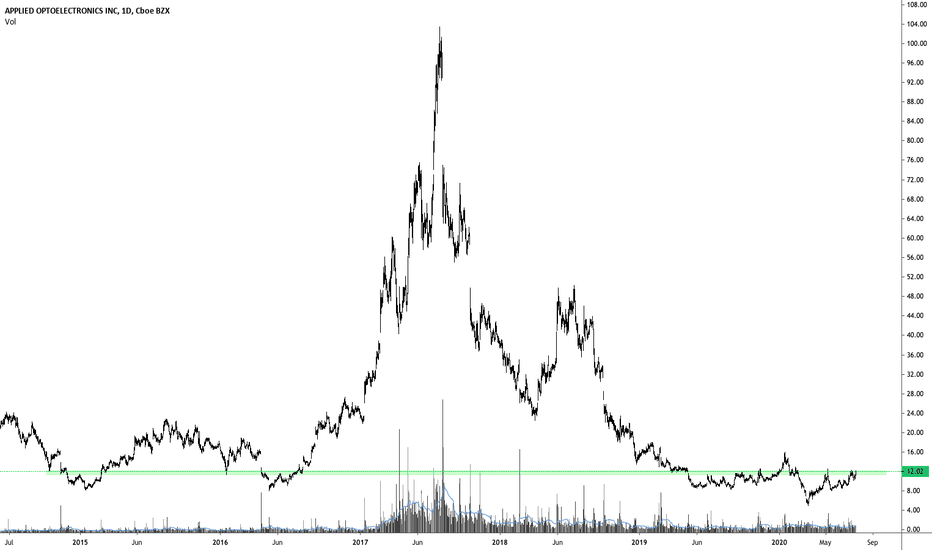

Applied Optoelectronics Inc 🧙Applied Optoelectronics Inc is a provider of fiber-optic networking products, primarily for the Internet data center, cable television, and fiber-to-the-home end markets. The company focuses on designing and manufacturing a range of optical communication products from components, to subassemblies, and modules to complete turn-key equipment. Demand for Applied Optoelectronics is driven by bandwidth demand in end markets. Through direct sales personnel, and manufacturing teams in the United States, China, and Taiwan, the company coordinates with customers to determine product design, qualifications, and performance.

If you want more trading ideas like this one ,🎯 press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!