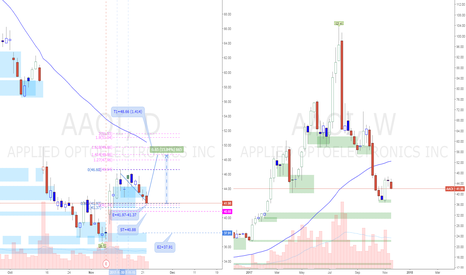

AAOI trade ideas

AAOI: Fool Me Twice? Ignore The Hype, Wait For Trust (PT $24.50)The recent run up in AAOI stock price is a familiar story if you've been tracking or involved in the company since last year. What was once a glorious shining star from a parabolic blowout, quickly became a bubble of sorts and collapsed. The stock is tainted because of leadership's comments and weak guidance last quarter. The only reason to run the stock up is to profit and then watch it come back down, which I believe it most likely will. This is a volatile market full of excuses to bring any and all names down and AAOI is a very, very easy target.

I personally took a $70k loss last quarter on an investment I started back on 9/19/2017. I'd averaged down and waited for news and the tide to turn. A nice chunk of my portfolio ended up being allocated within the position, so it was dead money just sitting there for over 4 months. I think the company's technology, manufacturing capabilities and products (margins) are phenomenal. I think their execution to leverage their strengths and positions within the industry, plus their credibility, are found wanting though, and that's the real killer holding the stock back.

AAOI was dead money until the recent run-up. It's not going to grow back into the $40s without some serious and flawless momentum. You have an insanely high amount of short interest always playing against you. No matter what gains the price makes, they'll bring it back down. On top of that, ANY bad news will just send the stock down even further. It's already hit the mid $20s. People have been calling for prices into the teens without hesitation. I'm inclined to believe they'll push it down there if they want to on a bad, upcoming call.

The volatility in both the price and management's lack of transparency is not good for anyone seeking stability or trying to recoup money lost within the stock. Again, any good news will be processed and then cast aside because of the short interest. Any bad news will be magnified and blow the price down. Management made some really weird comments in their last call that make the specter of dishonesty rear its head. A lot of people already don't trust what they say, so you're playing against that as well. Leadership in ANYTHING has to be solid for any entity to move forward.When that starts getting questioned, it does not bode well for results or for participants.

Guidance for Q1 was terrible. Almost all the commentary and other positive catalysts for the company are taking place in the second half of 2018. June is about where the stock will finally start to test whether it can go back up, and that's assuming nothing crazy or weird hits the company again. My thoughts are that this quarter will meet expectations and guide for some growth, but it will only keep the stock back in the $30s. Anything less and it'll be back down to $24.50, maybe less if sh*t hits the fan. The short interest is just so brutal and easy for people to hold down that it's a struggle. If the stock starts to rebound, stabilize and hold, positive news starts rolling in (FB extends their contract into Year 2) and the short interest starts to decrease after June, I'll look at possibly buying again. That's a ton of 'ifs' and a great company shouldn't have to instill that kind of hesitation in investors.

It'll be another year before the stock even tries touching back to the $40s or $50s. Management has to rebuild trust, their execution has to blow the competition away and they have to chase out the massive short interest. Please be careful with this one. The risk is extremely high. Don't bother "hoping" for some quick cash. Find the stability and begin a position then if guidance is promising.

Demonstrating some nice trading activity..Although i'm not much of a bottom picker, i think this one has declined enough to a point where it looks interesting (especially with the recent trading activity). I'd like to get on this action and throw in some starter positions and will add to my trades if i'm correct. #datacenters

Need another continuation day tomorrowNeed to continue past 26. Could backtest 25. Once past 26, little resistance until 27.5-28. Volume should begin to pick-up in the next week. I expect at a minimum RSI on the daily to reach it's last high point at 54. It should really reach to 58+ and at that point, very likely to get to 70+. People who are shorting the stock down at this price level are crazy. The only way they win is if AAOI has bad ER and horrible forecast.

Retest of 25 Tomorrow Coming?!Seems like stars aligning with ST and LT, ascending triangle on 30 min, with contracting volume, break above 25 would break LT descending wedge as well as ST resistance. Buys today into the ask were also 15k+ and sells into the bid were 2-3k.

Let's see if someone invalidates this in the next 10 minutes or tomrorow AM. Someone is walking this up since last week and quickly picked up the dips. Shorts need to invalidate this quickly before LT descending wedge gets invalidated. Need to get below 24.35ish and then 24 tomorrow or UH OH!!

Entering the long term support zone... (Buy around 19 - 20 USD)...hence we are entering the buy-zone.

Support zone: 19 - 27 USD

Target price range: 37 - 55 USD (Long term)

Buy: 19 - 20 USD

Current: PEG 0.52

Current: PE 8.00

Positive revisions of EPS/ revenues

This is just my personal opinion and not an advise.

AAOI $28 Short Bottom towards EC; $45/$55/$60 EC Results SpikeBetween what OCLR and LITE reported, the sector looks good. MACOM reported and got caught with their pants down. Sector took a huge hit as a result. Their call bodes very well for AAOI though. They described what I saw at CES and are at least a full quarter behind AAOI. People took their results as a negative, but didn't bother to read everything I suppose. AAOI is in full control of 100G CWDM that they're just now realizing is what everyone wants. Stock will hit its 52-week low I'm sure. February 21 can't come soon enough for the added clarity. 9 days for shorts to cover. Time to grab some popcorn after next week for sure.

AAOI will eventually recover but bottom hasn't arrived yetCurrently a falling knife while its sector is suffering cyclicality. AAOI will need to come clean on whether AMZN and FB have been lost. Chinese competition is pulling the sector down with possibly more supplies than demand. Add to that the weakened investor confidence in AAOI management. My suggestion is that you either short this or stay on the sidelines until after next ER. If ER disappoints, this will bleed to $25 if not below. Also, looks like institutions are dumping this since the beginning of December: fintel.io

AAOI - Falling wedge breakoutStochastic divergence at the breakout point of a falling wedge. 3 days late, but there is more upside. The stochastic is at 63.6517 so we still have some upside before completing the rotation and ending the signal. Combined with the falling wedge pattern, I expect a move up to the 200ema (red).

Buy: 46.48

Target: 49.50 - 52.52 (6.50% - 13.00%)