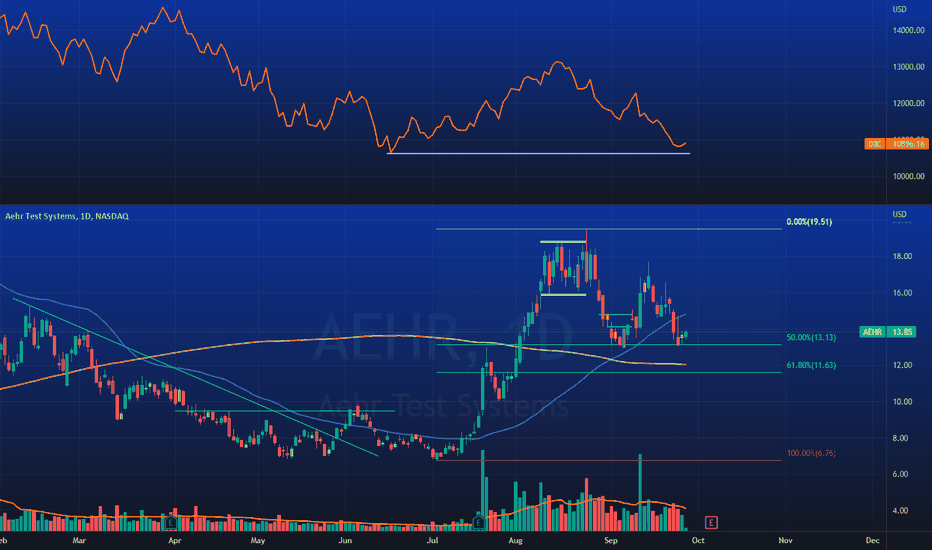

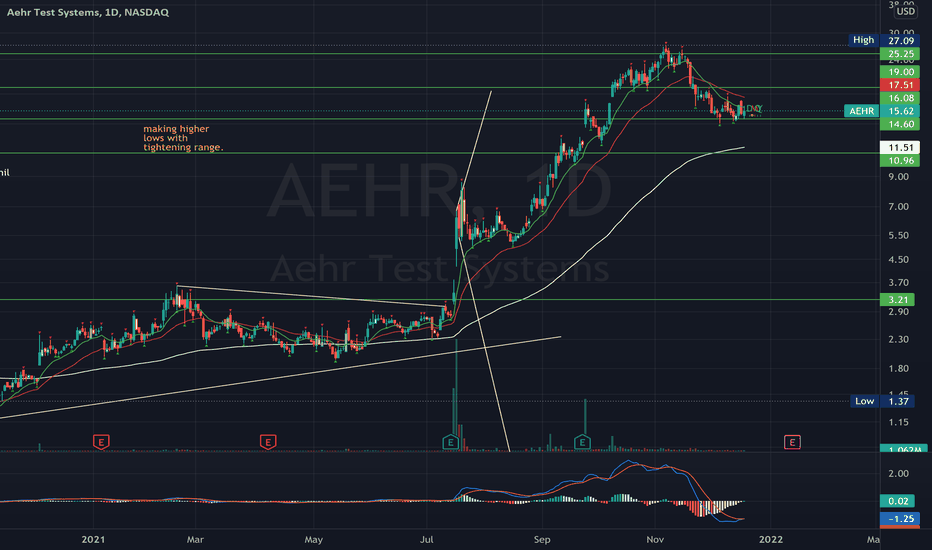

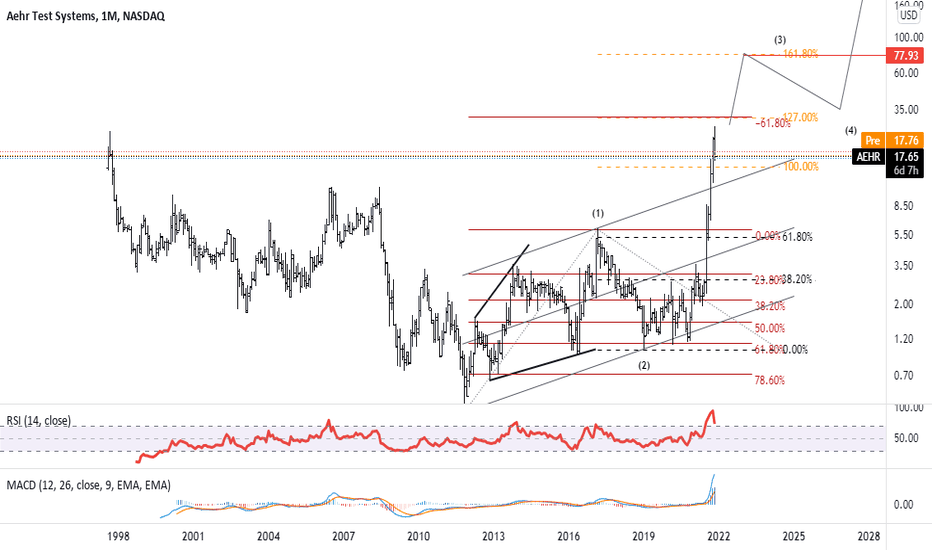

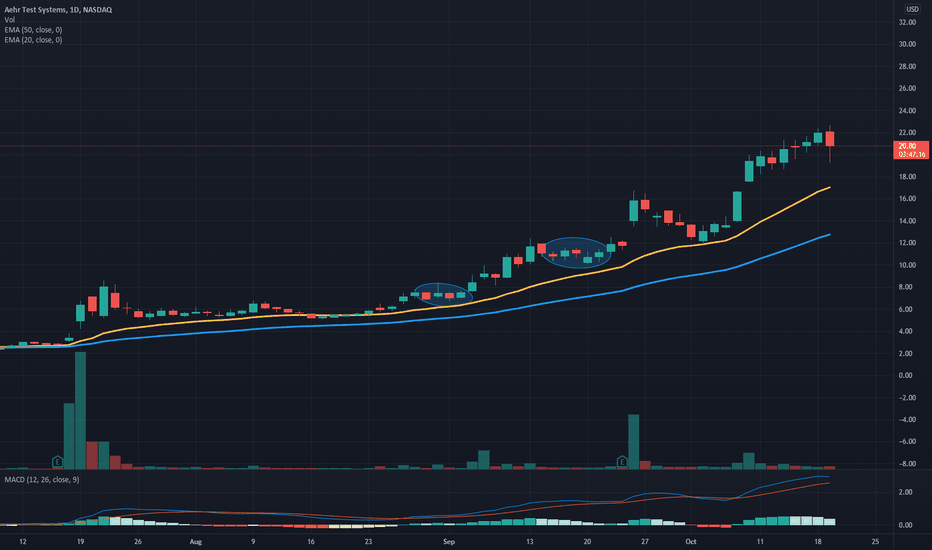

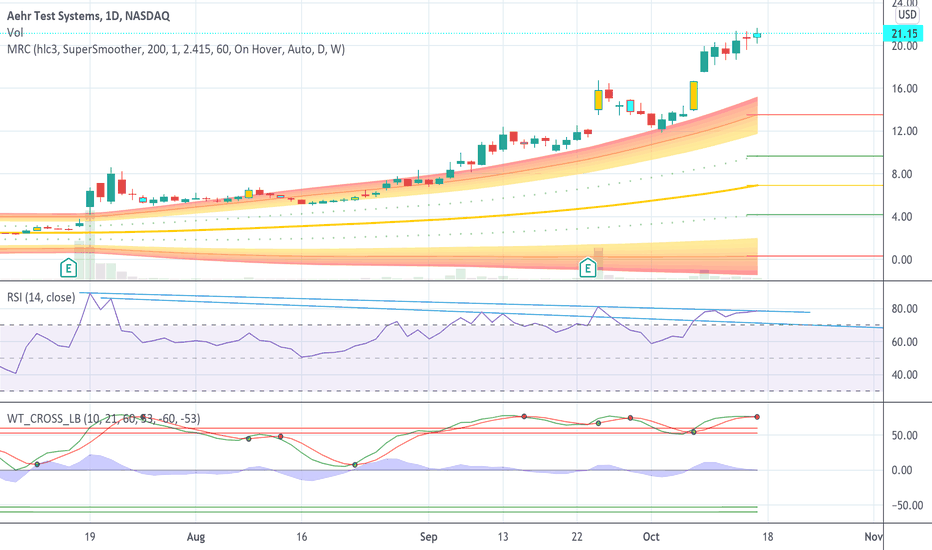

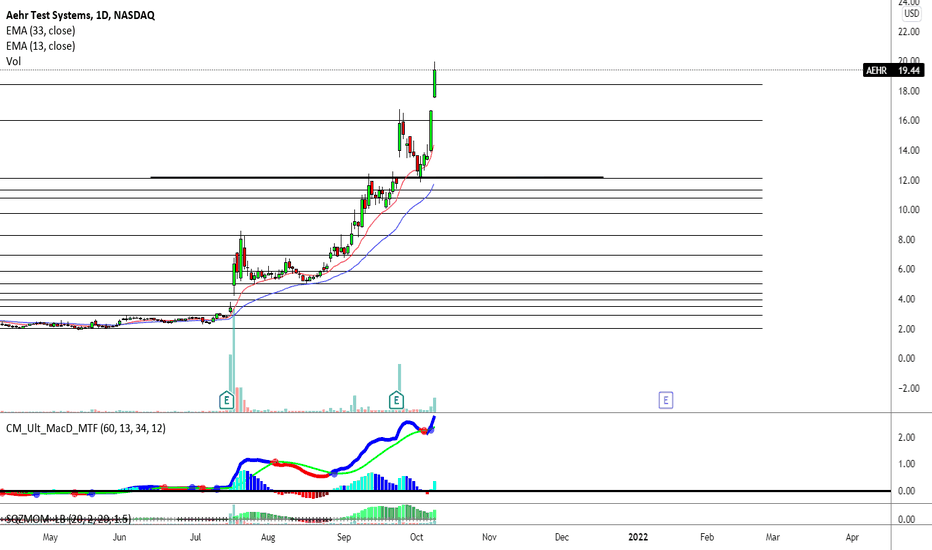

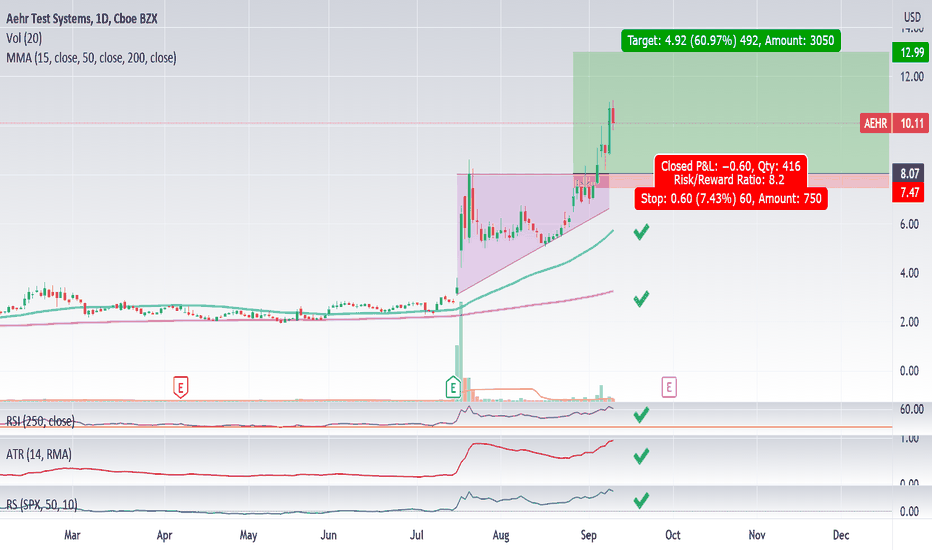

$AEHR Maybe a new leader, will see ! #QQQAEHR Nasdaq Listed manufacturer for the semi conductor industry, holding tight after a almost 200% run.

Looks like a healthy 50% retracement while Nasdaq almost double bottom.

50 MA keep raising up.

Trading above 200 MA.

Fundamentals are in good shape as well, last 5 qtrs. with earnings and sales over 100%

Relative strength of 97.

Won't be surprised if gap up at first market rally attempt.

AEHR trade ideas

The hedged grid trading system experiment The hedged grid trading system uses the principle that one should be

able to cash in at a gain no matter which way the market moves. No

stops are therefore required at all. The only way this is logically possible

is that one would have a buy and sell active at the same time. Most

traders will say that that is trading suicide but let's take some to look at

this more closely.

Let's say that a trader enters the market with a buy and sell active when

a currency is at a level of say 100. The price then moves to 200. The

buy will then be positive by 100 and the sell will be negative by 100. At

this point we start breaking trading rules. We cash in our positive buy

and the gain of 100 goes to our account. The sell is now carrying a loss

of -100.

The grid system requires one to make sure that cash in on any

movement in the market. To do this one would again enter into a buy

and a sell transaction. Now, for convenience, let's assume that the price

moves back to level 100.

The second sell has now gone positive by 100 and the second buy is

carrying a loss of -100. According to the rules one would cash the sell in

and another 100 will be added to your account. That brings the total

cashed in at this point to 200.

Now the first sell that remained active has moved from level 200 where

it was -100 to level 100 where it is now breaking even.

The 4 transactions added together now magically show a gain:- 1st buy

cashed in +100, 2nd sell cashed in +100, 1st sell now breaking even

and the 2nd buy is -100. This gives an overall a gain of 100 in total. We

can liquidate all the transactions and have some tea.

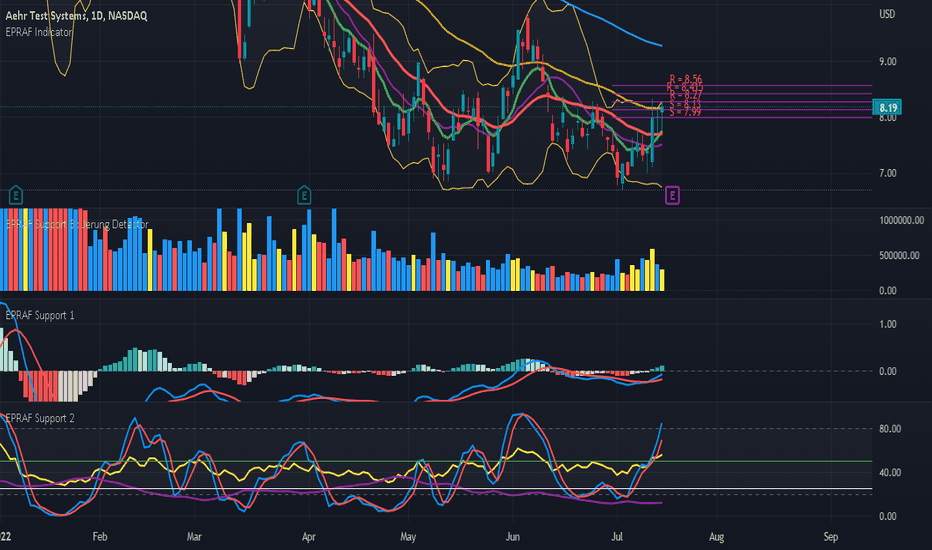

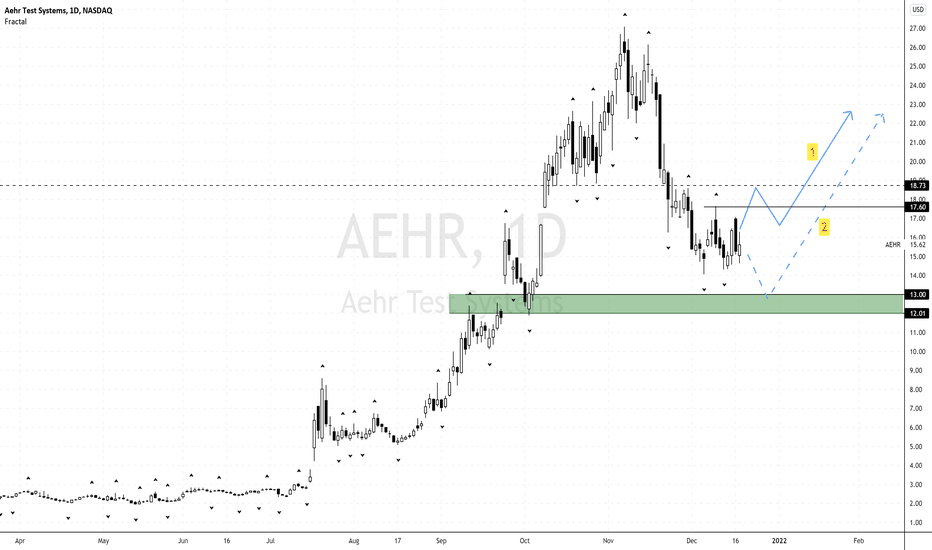

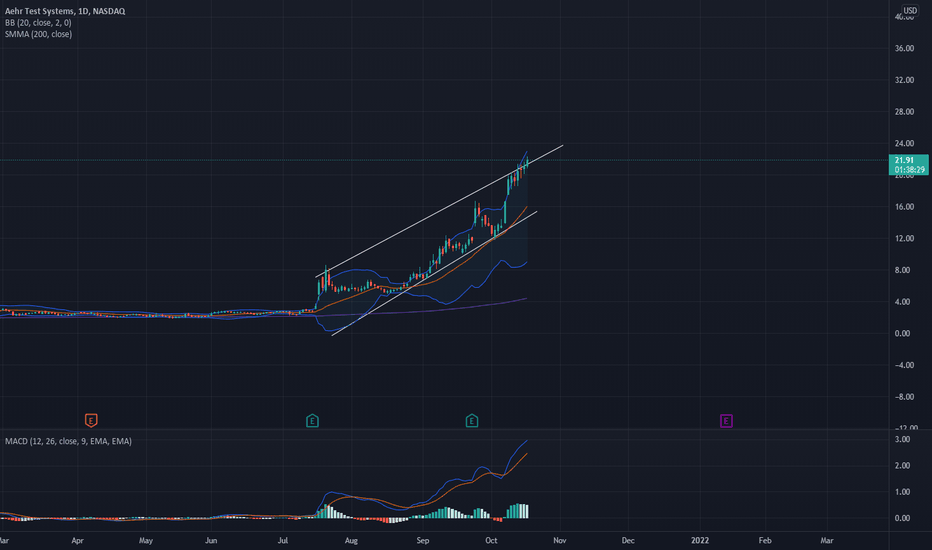

AEHR - ready to fly?15th July 2022, NASDAQ:AEHR based on EPRAF indicator, the green line has crossed over the red line. This marks the beginning of the uptrend phase for the AEHR. With the presence of sharks (yellow bars) detected in EPRAF Support 3, the attractive MACD and Stochastic are a sign of a good start for the AEHR to fly.

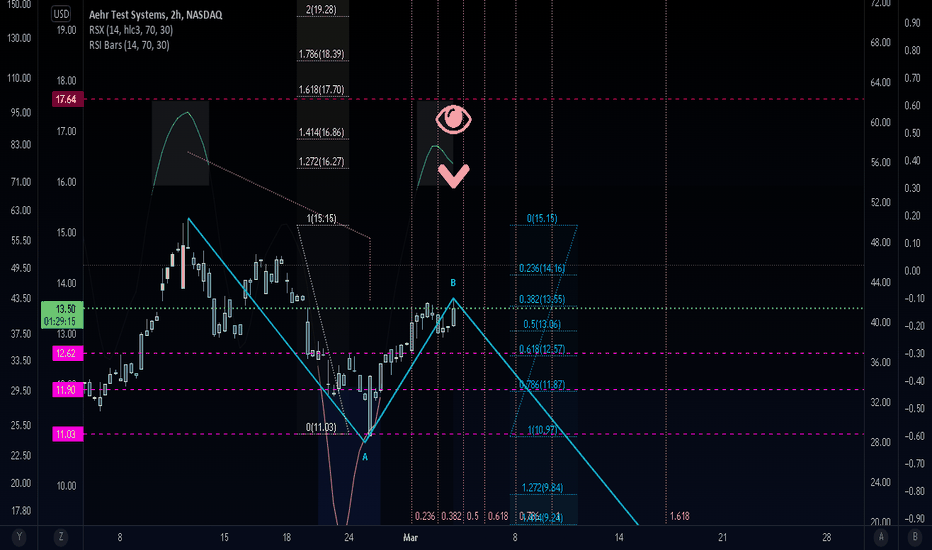

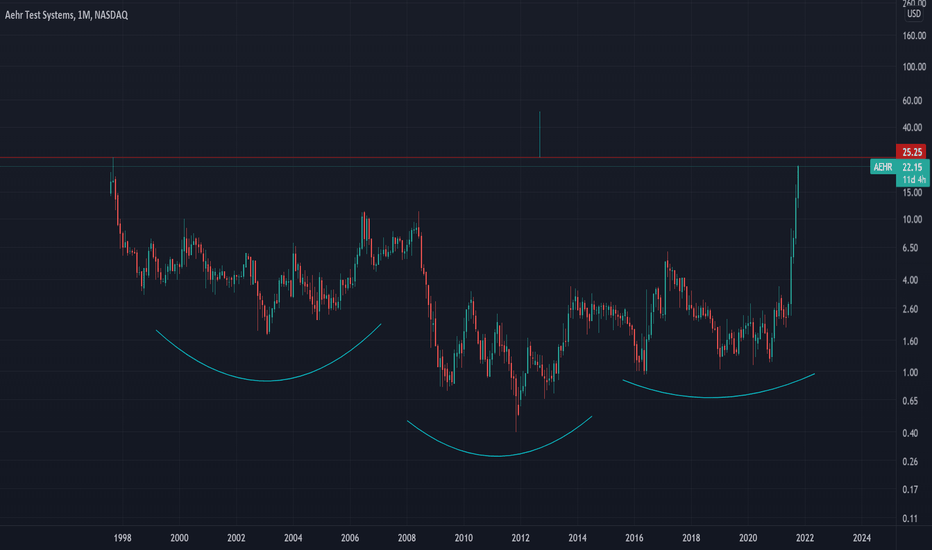

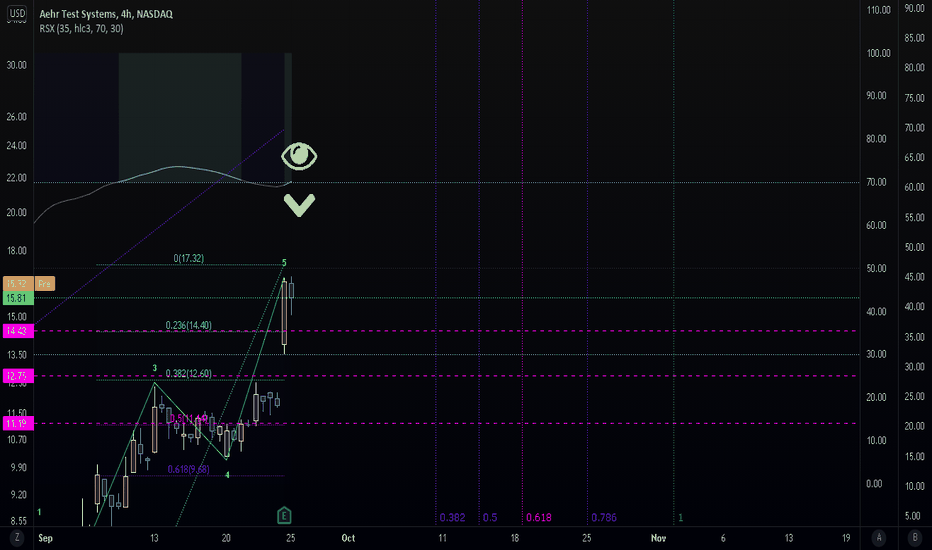

Aehr in the rear. AEHRGoals 12.6, 11.9, 11. Invalidation at 17.64 .

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

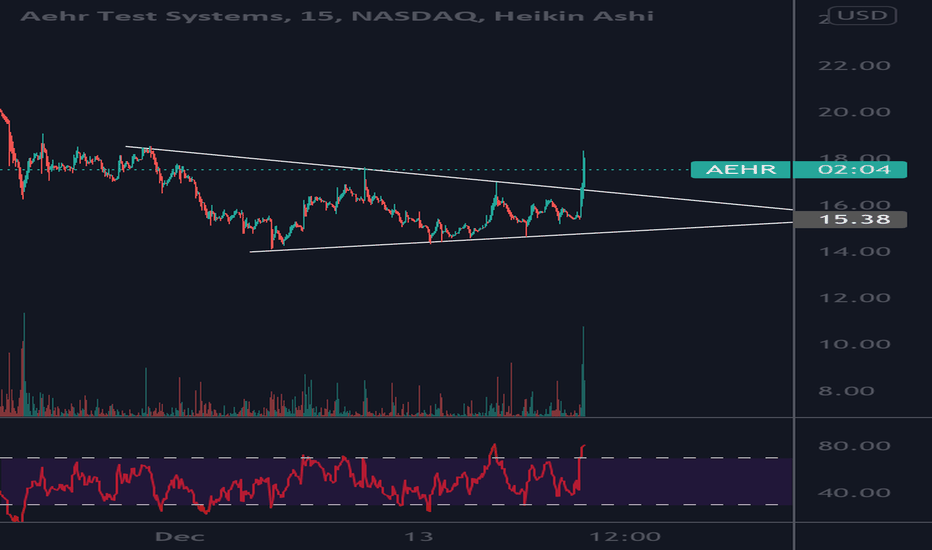

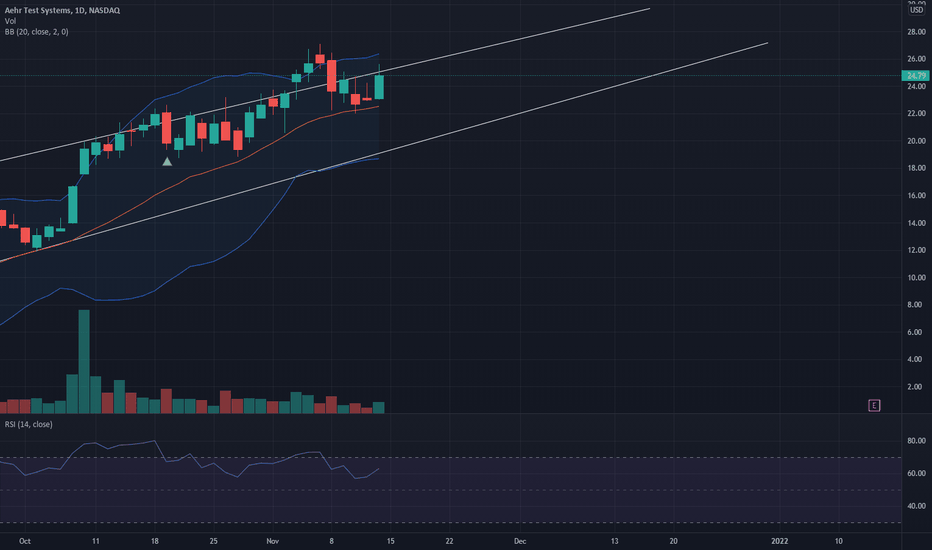

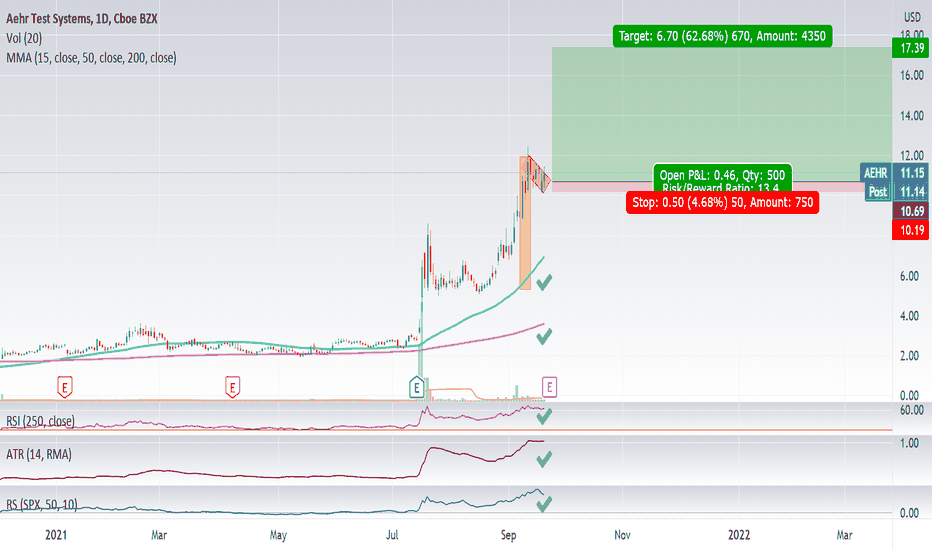

AEHR Test System With A 1:2 Risk/Reward Ratio PotentialAEHR has been on a massive uptrend from July, but currently consolidating. A further pullback towards $12 will give a better R:R (2). However, if price close above 17.60, more highs are expected...

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Management In Your Trades

Stocks To Watch This WeekThe Market's longer term uptrend still intact. These names have shown good relative strength and accumulation volume and most are in the growth sector. This may give good risk/reward entries on some of the best names. Some of these charts still need to confirm their price action. This video is my watchlist. Most of these names are at or near all time highs or multi year highs. There are 20 total stocks on this list Many of these have IPO'd in the last few years and still have a growth story ahead of them. Know your time frame and risk tolerance. Know your earnings dates! I go through these quickly so grab a pencil and paper and jot down the names that look interesting to you and then make the trade your own. Good Luck!

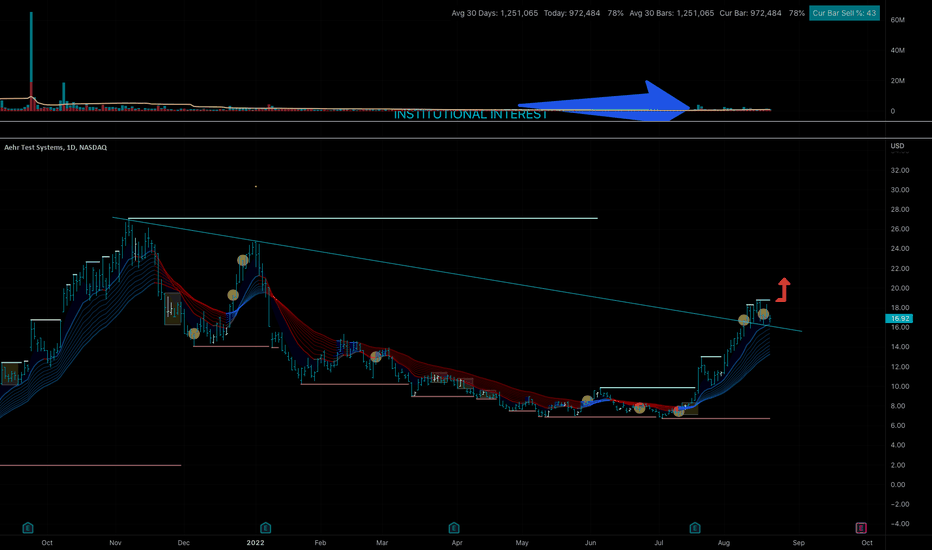

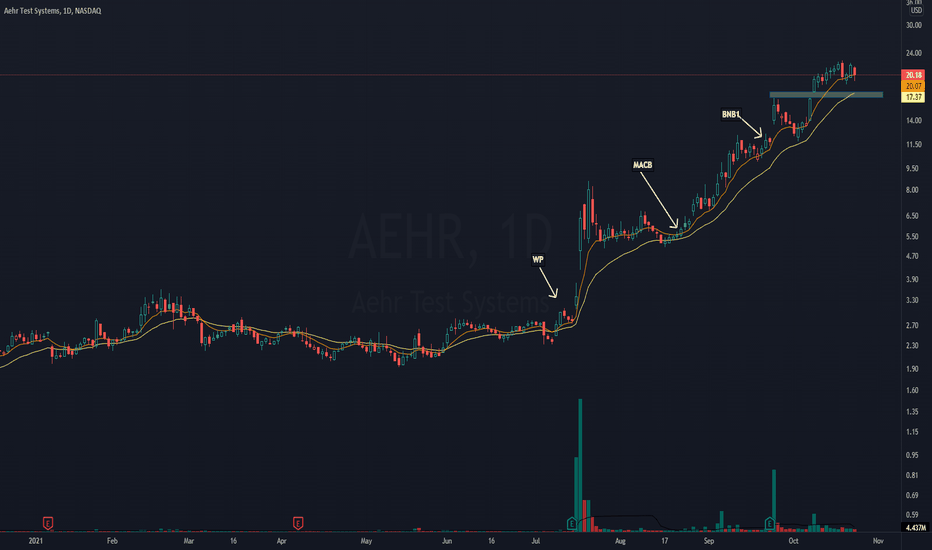

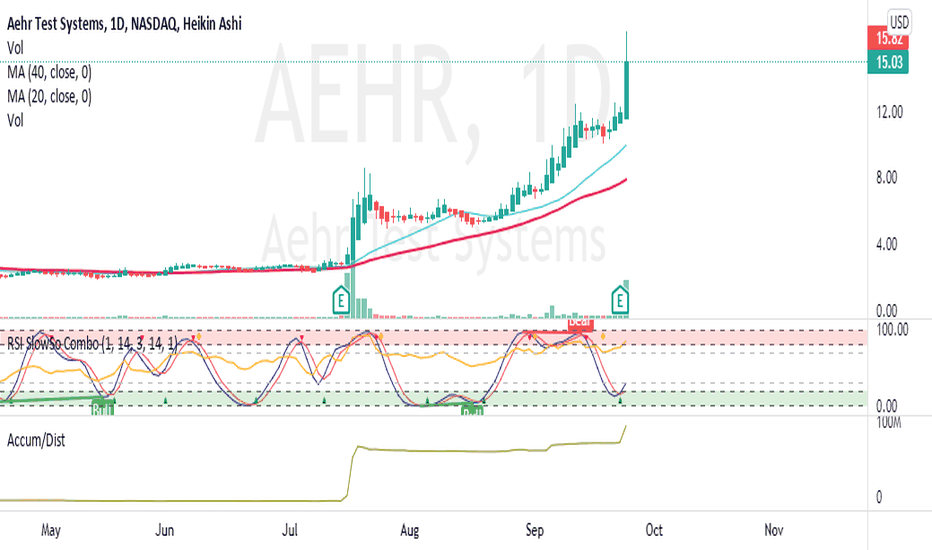

Dissecting a winning trade in $AEHR. What went wrong?Admittedly, not all of my trades will be correct. Even if they are correct, I will never be able to trade them perfectly. What I strive for is to be better than yesterday.

Such is the case for my $AEHR trade.

The marked areas are what I used to enter this stock, usually when volatility has died down.

Tried to be as patient as I could by trailing my profit with 5 Day Moving Average. It worked for a time but my ride got cut short, leaving me in the dust at $13.50ish

Maybe it was too tight of a trail profit to use. Nonetheless, that strategy has proved its worth in the past already.

Currently missing out on a lot of gains from this. Will use this experience to improve my strategy further.

This trade has made me around $30k. It's good but still a lot more to be improved.

Thanks and good luck out there!

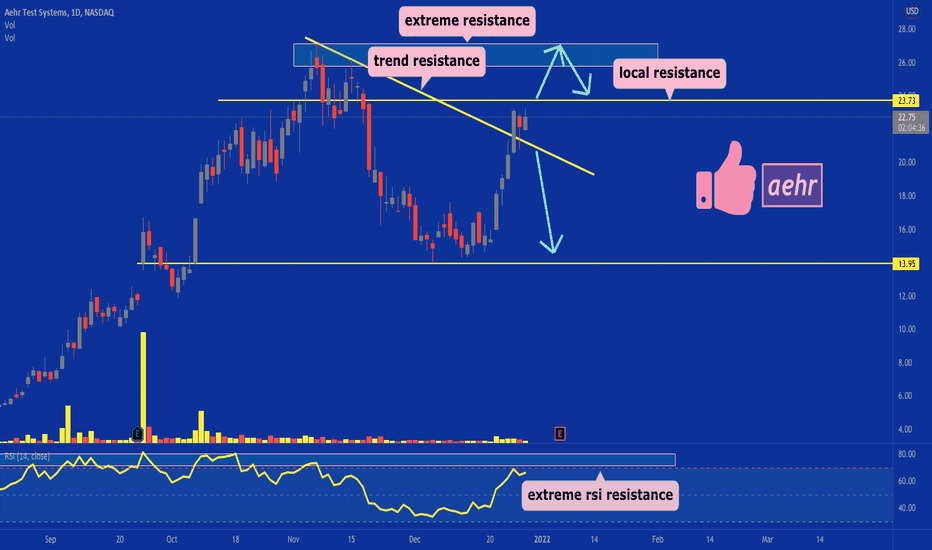

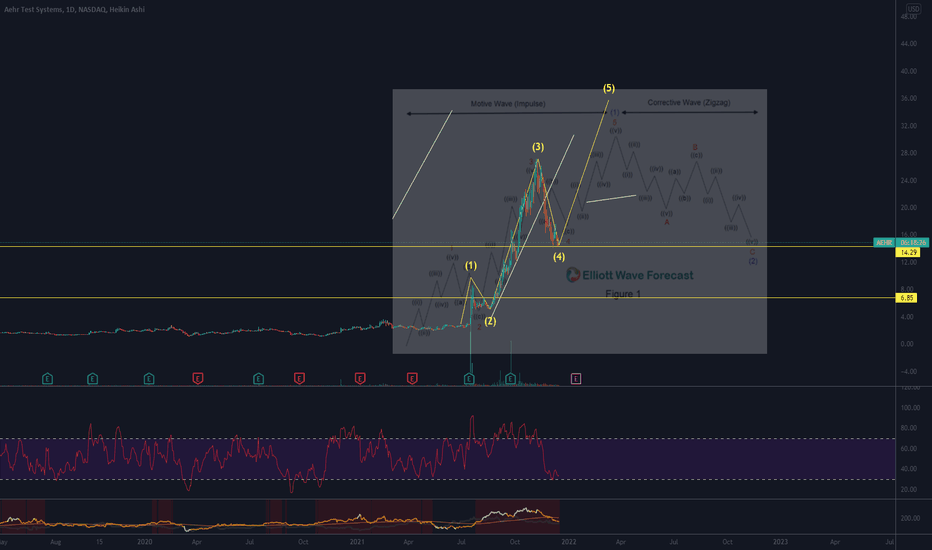

Shorting AEHR Testing Systems. AEHRImpulse finished locally here, awaiting confirmation of a pivot but seemingly confident that it will be confirmed. See my rants on how fractals never lie. We are going down and fractally determined targets are on the board.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

AEHR BreakoutI predicted that the breakout would be ~$6.49 and it happened a couple of days ago. Since then it's been climbing with good volume. I have my next targets set at $8.9 and $11.30, but I'm really LONG on this stock as I think they have a unique solution for testing IC wafers, which will cut manufacturing costs significantly for all vendors who use it. Their solution allows manufacturers to test the silicon before they're integrated into components - where a failed unit costs a lot. This is especially important since there's a chip shortage, and the last thing you want to do is to wait until final burn-in to realize it was bad from the start.