Key facts today

Advanced Micro Devices Inc expects a 27.2% revenue rise to $7.42 billion for Q2 2025, up from $5.84 billion last year, based on 36 analysts' forecasts.

AMD shares fell 3.2% following a disappointing U.S. jobs report and new import tariffs, raising worries about a potential economic slowdown impacting semiconductor demand.

The PHLX Semiconductor Index, including Advanced Micro Devices (AMD), hasn't hit a new high since July 2024, raising concerns about the semiconductor sector's strength compared to Nvidia.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.37 USD

1.64 B USD

25.79 B USD

1.61 B

About Advanced Micro Devices Inc

Sector

Industry

CEO

Lisa T. Su

Website

Headquarters

Santa Clara

Founded

1969

FIGI

BBG000BBQCY0

Advanced Micro Devices, Inc engages in the provision of semiconductor businesses. It operates through the following segments: Computing & Graphics, and Enterprise, Embedded and Semi-Custom. The Computing and Graphics segment includes desktop and notebook processors and chipsets, discrete and integrated graphics processing units, data center and professional GPUs and development services. The Enterprise, Embedded and Semi-Custom segment includes server and embedded processors, semi-custom System-on-Chip products, development services and technology for game consoles. The company was founded by W. J. Sanders III on May 1, 1969 and is headquartered in Santa Clara, CA.

Related stocks

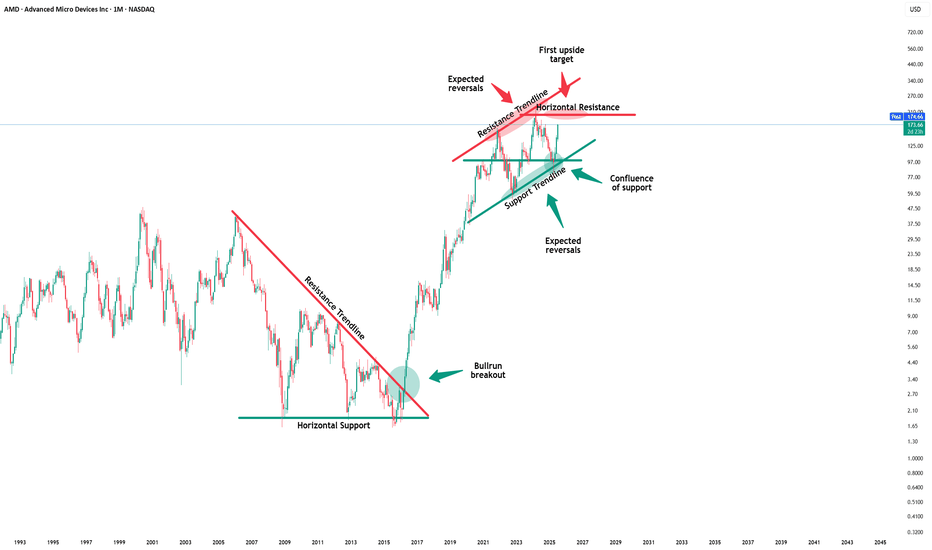

Amd - New all time highs will follow!🪠Amd ( NASDAQ:AMD ) rallies even much further:

🔎Analysis summary:

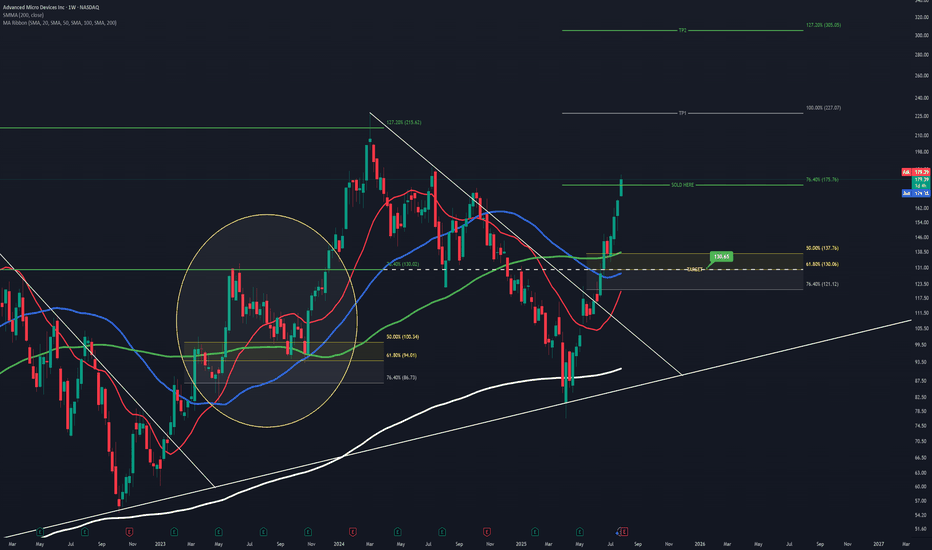

After Amd perfectly retested a major confluence of support a couple of months ago, we saw a textbook reversal. This retest was followed by a rally of more than +100% in a short period of time. But considering all the bullish mo

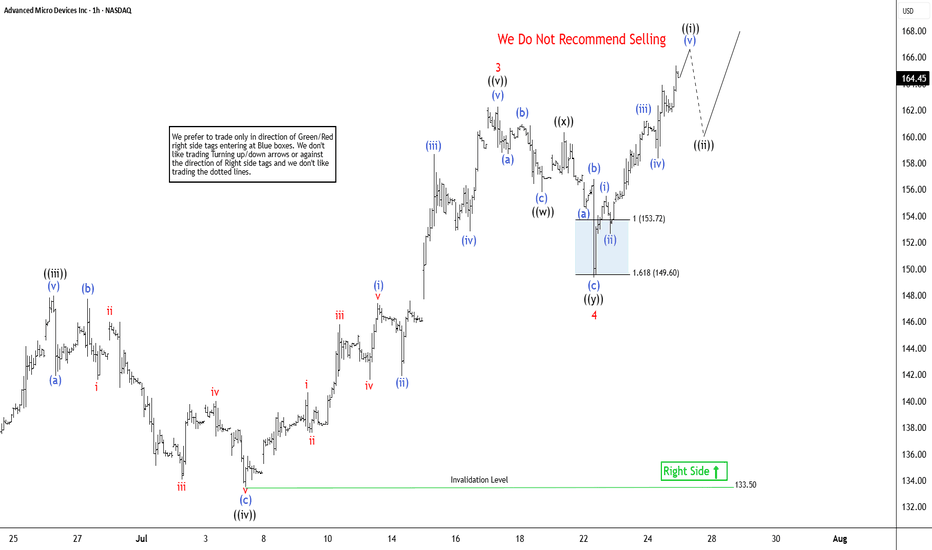

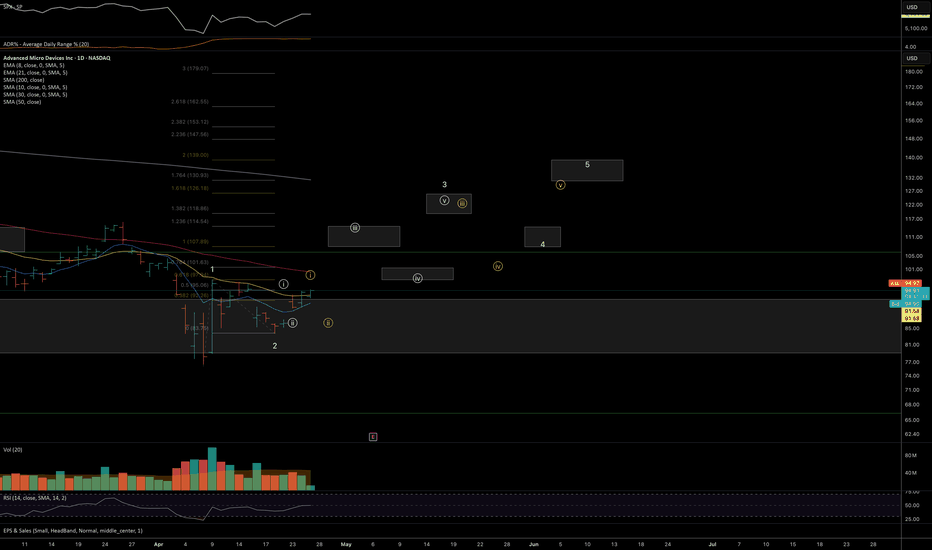

Elliott Wave Outlook: AMD Expects Pullback Soon Before RallyThe Advanced Micro Devices Inc., (AMD) favors rally in impulse Elliott Wave sequence from 4.09.2025 low & expect upside in to 168.36 – 190.36 to finish it. Impulse sequence unfolds in 5, 9, 13, 17…., swings & ends with momentum divergence. In daily, it ended pullback in 3 swings at 75.22 low in blue

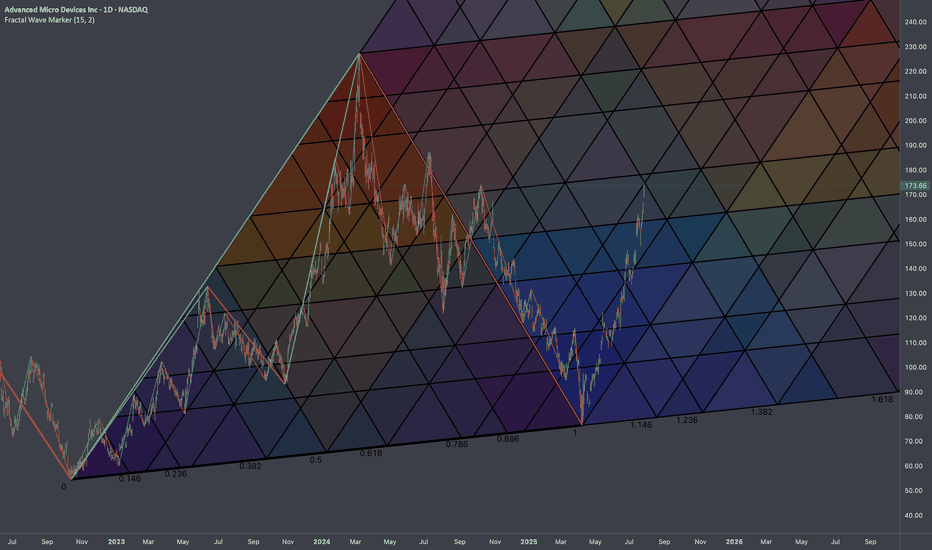

AMD Projection and Entry PointThis is speculation just like before, which played out very well so this is me having another shot at it.

Going off of the prior cycle AMD went through and comparing it to the one it's currently in, you can see a lot of similarities.

Learning from it's past and seeing how it likes to react to c

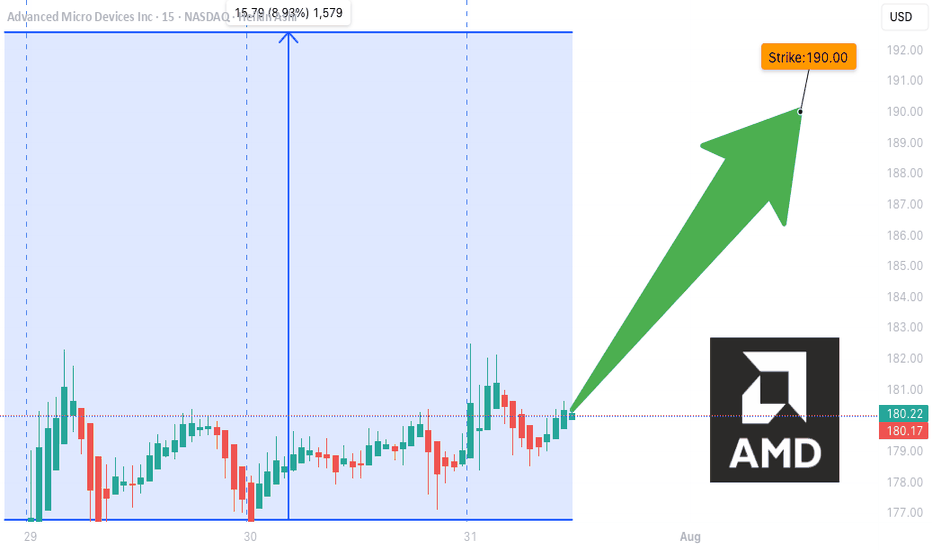

AMD WEEKLY TRADE SIGNAL (7/31/25)

### 🚀 AMD WEEKLY TRADE SIGNAL (7/31/25)

📈 **MARKET SNAPSHOT**

🟢 Daily RSI: **86.0** 🔥

🟢 Weekly RSI: **80.4**

📊 Volume: 🔺 1.5x (Institutional surge)

💬 Call/Put Ratio: **1.90**

🌪 Gamma Risk: **HIGH (1DTE)**

🧠 Sentiment: **Extremely Bullish** across all models

---

💥 **TRADE IDEA**

📍 Ticker: **\ NAS

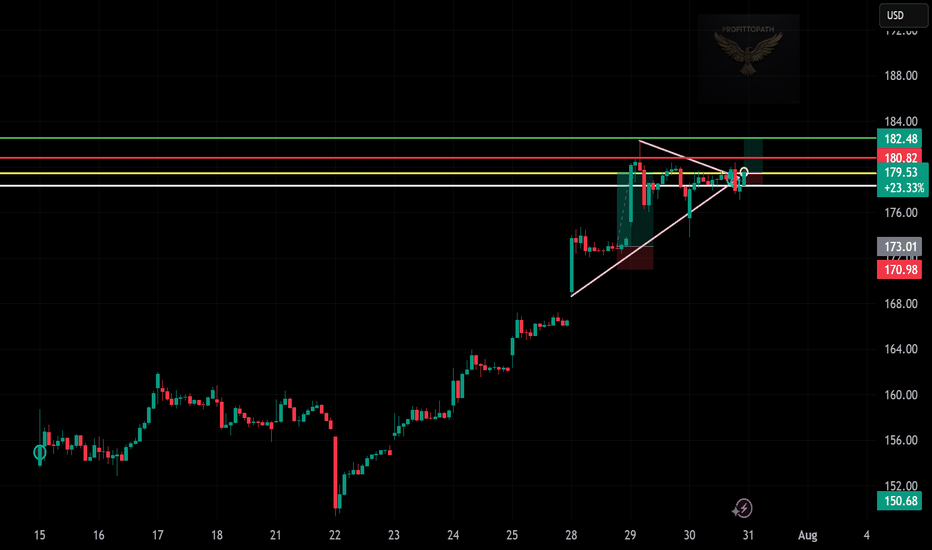

“AMD Breaks Out — Triangle Setup in Action”

📈 Trade Snapshot:

AMD breaks a tight triangle range with momentum. A clean move above $180.82 puts $182.48 in sight.

🎯 Plan:

→ Entry: $179.53

→ SL: ~$173.00

→ Target: $182.48

📌 Clear structure, low-risk entry, breakout confirmed. Let it run.

📋 Hashtags:

#AMD #BreakoutTrade #ChartSetup #Technica

Quick draw upI did quick and simple T/A and in my opinion seems to be the likely outcome. EMA lines are about to cross, it has made a lower low, which has now flipped the Fibonacci and likely to get rejected at the 61.80% - 50% range. The path lines aren't placed specific to the timeframes so ignore that it stre

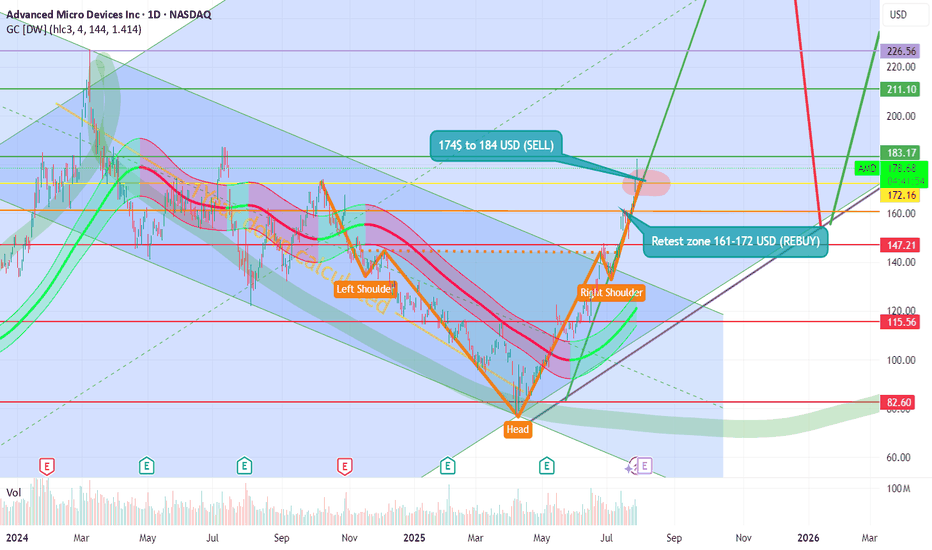

AMD we have made it at 170 USD guys! TSXGANG! 📊 AMD Stock Technical Analysis

🧠 Head and Shoulders Pattern

- This chart shows a classic head and shoulders formation:

- Left Shoulder: First peak around ~$172

- Head: Highest peak near ~$183

- Right Shoulder: Second peak returning to ~$178

🔎 This pattern often signals a potential reversal in an u

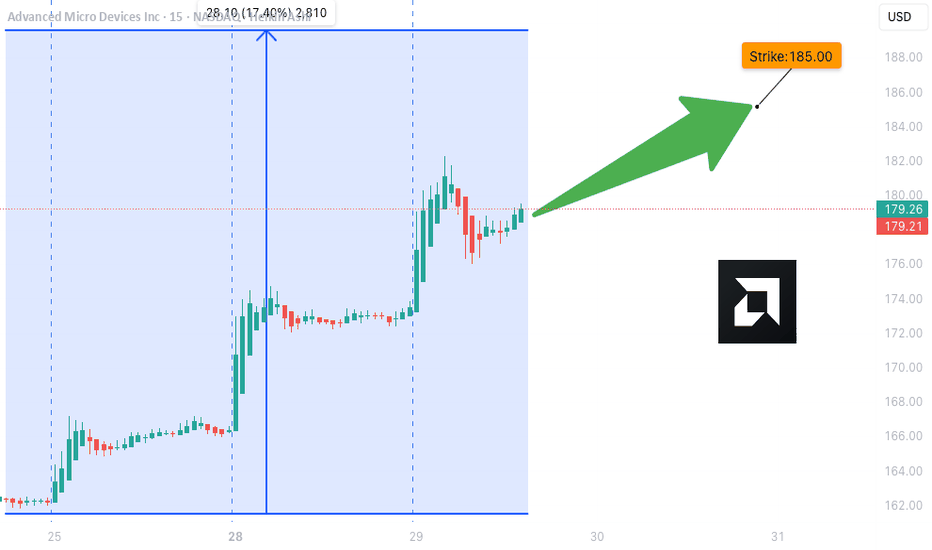

AMD Weekly Trade Alert (2025-07-29)

**🔥 AMD Weekly Trade Alert (2025-07-29) 🔥**

💹 *Momentum Confirmed. Calls Loaded. Let’s Ride.*

📈 **Key Bullish Signals**

✔️ Daily RSI: **83.2** (Rising)

✔️ Weekly RSI: **79.9** (Rising)

✔️ Call/Put Ratio: **2.03** 🧨

✔️ Volatility: Low (VIX = 15.2)

⚠️ Volume Weak (0.9x) – But not a dealbreaker.

---

AMD: Potential Mid-Term Reversal from Macro SupportPrice has reached ideal macro support zone: 90-70 within proper proportion and structure for at least a first wave correction to be finished.

Weekly

As long as price is holding above this week lows, odds to me are moving towards continuation of the uptrend in coming weeks (and even years).

1

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMD5426832

Advanced Micro Devices, Inc. 4.393% 01-JUN-2052Yield to maturity

5.84%

Maturity date

Jun 1, 2052

AMD5426831

Advanced Micro Devices, Inc. 3.924% 01-JUN-2032Yield to maturity

4.48%

Maturity date

Jun 1, 2032

AMD6026360

Advanced Micro Devices, Inc. 4.319% 24-MAR-2028Yield to maturity

4.04%

Maturity date

Mar 24, 2028

AMD6026359

Advanced Micro Devices, Inc. 4.212% 24-SEP-2026Yield to maturity

4.02%

Maturity date

Sep 24, 2026

See all AMD bonds

Curated watchlists where AMD is featured.

Frequently Asked Questions

The current price of AMD is 171.70 USD — it has decreased by −2.61% in the past 24 hours. Watch Advanced Micro Devices Inc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Advanced Micro Devices Inc stocks are traded under the ticker AMD.

AMD stock has risen by 5.01% compared to the previous week, the month change is a 26.69% rise, over the last year Advanced Micro Devices Inc has showed a 18.41% increase.

We've gathered analysts' opinions on Advanced Micro Devices Inc future price: according to them, AMD price has a max estimate of 223.00 USD and a min estimate of 111.00 USD. Watch AMD chart and read a more detailed Advanced Micro Devices Inc stock forecast: see what analysts think of Advanced Micro Devices Inc and suggest that you do with its stocks.

AMD stock is 5.69% volatile and has beta coefficient of 2.04. Track Advanced Micro Devices Inc stock price on the chart and check out the list of the most volatile stocks — is Advanced Micro Devices Inc there?

Today Advanced Micro Devices Inc has the market capitalization of 278.39 B, it has increased by 11.04% over the last week.

Yes, you can track Advanced Micro Devices Inc financials in yearly and quarterly reports right on TradingView.

Advanced Micro Devices Inc is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

AMD earnings for the last quarter are 0.96 USD per share, whereas the estimation was 0.94 USD resulting in a 1.64% surprise. The estimated earnings for the next quarter are 0.48 USD per share. See more details about Advanced Micro Devices Inc earnings.

Advanced Micro Devices Inc revenue for the last quarter amounts to 7.44 B USD, despite the estimated figure of 7.12 B USD. In the next quarter, revenue is expected to reach 7.41 B USD.

AMD net income for the last quarter is 709.00 M USD, while the quarter before that showed 482.00 M USD of net income which accounts for 47.10% change. Track more Advanced Micro Devices Inc financial stats to get the full picture.

No, AMD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 28 K employees. See our rating of the largest employees — is Advanced Micro Devices Inc on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Advanced Micro Devices Inc EBITDA is 5.98 B USD, and current EBITDA margin is 20.11%. See more stats in Advanced Micro Devices Inc financial statements.

Like other stocks, AMD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Advanced Micro Devices Inc stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Advanced Micro Devices Inc technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Advanced Micro Devices Inc stock shows the strong buy signal. See more of Advanced Micro Devices Inc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.