EV stocks hype -BUT not enough focus on the Charging side!

So we are looking at an overdue EV full force entry in the market - seems like every day we have a new reverse merger with a SPAC company to IPO another EV maker we never heard of ....but the main focus is missed by many investors - Charging stations and Battery makers.

Here we will discuss the two companies currently in the lead of the EV charging race.

First we have Charge Point -established in 2007 and currently owns 73% of market share of EV charging ! that’s big ! imagine Gas stations 70 years ago, estimations are we are looking at a 25 Billion $ market size by 2025.

Their CEO of Charge Point expects over 190 Billion by 2030, and to stay the biggest player in the EV charging game.

Charge Point currently has over 80 million charging systems and hundreds of thousands of users, and a very user friendly in house app that helps the user locate the nearest charging station near him.

The acquisition of SBE on Charge point will be finalized in the next few weeks, SBE stock already made a tremendous jump the last 2 weeks, nearly DOUBLING the value.

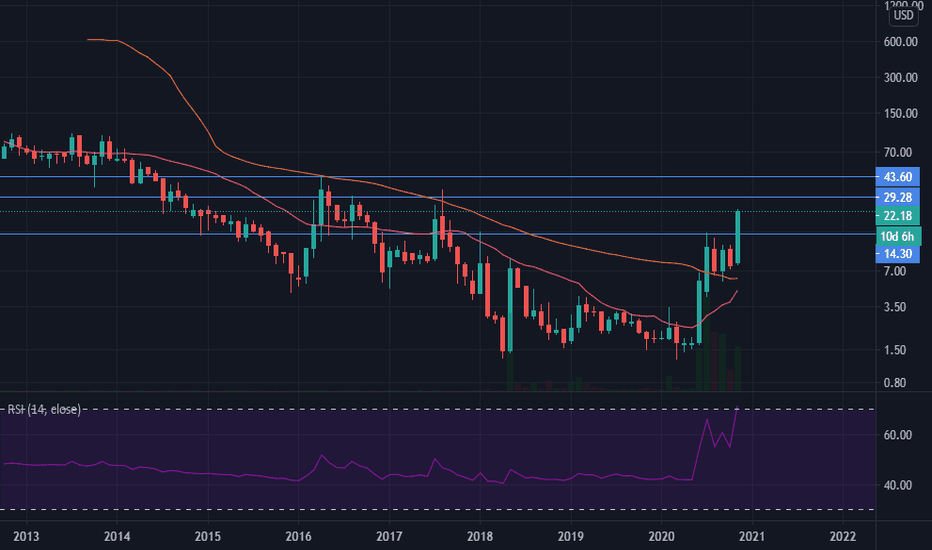

Lets look at the Technical:

Stock broke resistance level on the 9th of sept and in less than 2 weeks nearly doubled its value from -15$ to28.6- major rally up.

Both RSI and Stoch are showing us overbought along with a huge rise in market cap but if investors have 2% of common sense i would expect a stock that holds 3/4 of the EV charging market in the US to keep rallying and pass most EV makers by a mile.

The second stock on the chart and the one that gets most of the attention is Blink Charging.

Founded in 1998 and reported revenue growth of 84% to $3.8 Million in the last 9 month, and sold about 700 charging units its seems Blink is on FIRE!

After browsing in their products catalog I was officially impressed, their products are well branded easy to use and very intelligent – they even sell a mobile emergency charger that can be stored in your trunk!

The other good news is Apple announced they will add Blink chargers on apple maps and allow the driver to easily locate a suitable charging system to his vehicle nearby.

One thing we should remember about blink is the big drop the stock experienced in august, following the analyst Culper’s Research which claimed company had less than 2.5k chargers and not 15k as they initially claimed.

With much less market cap the Charge point buy more years in the game and better known brand it seems as Blink will definitely fight charge point for the massive market share that is expected to be 14% of the total market value in the USA.

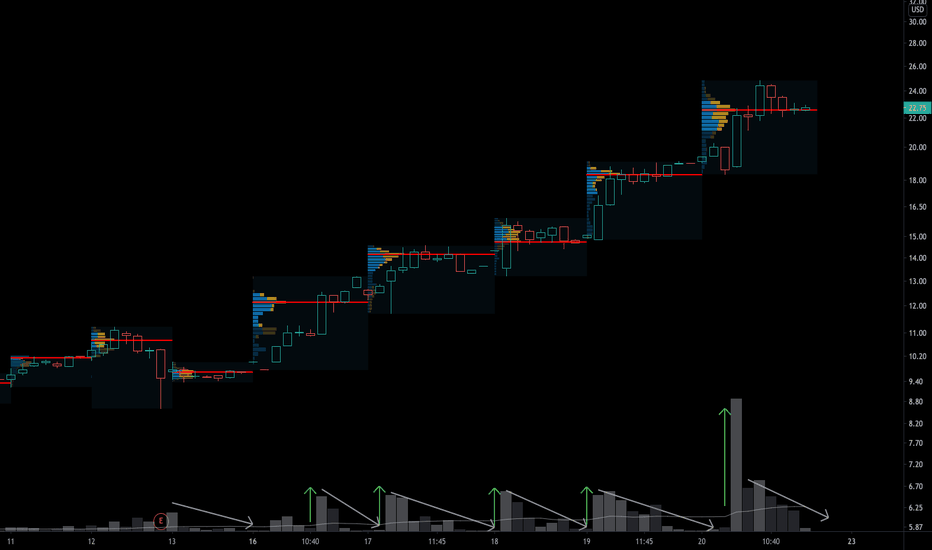

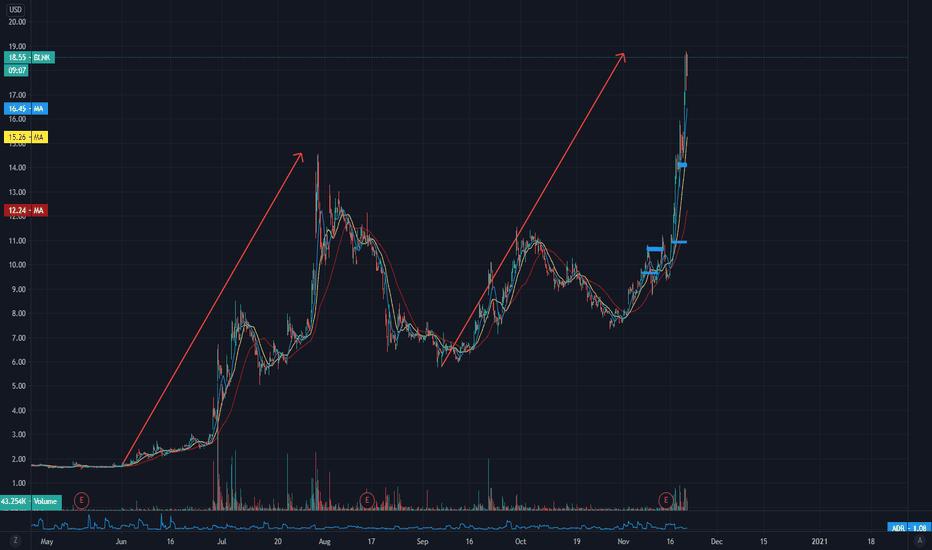

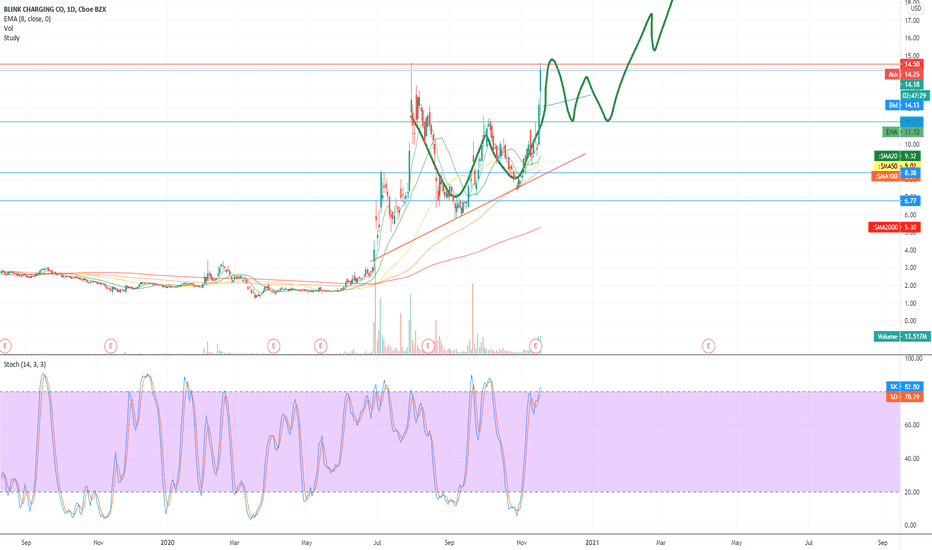

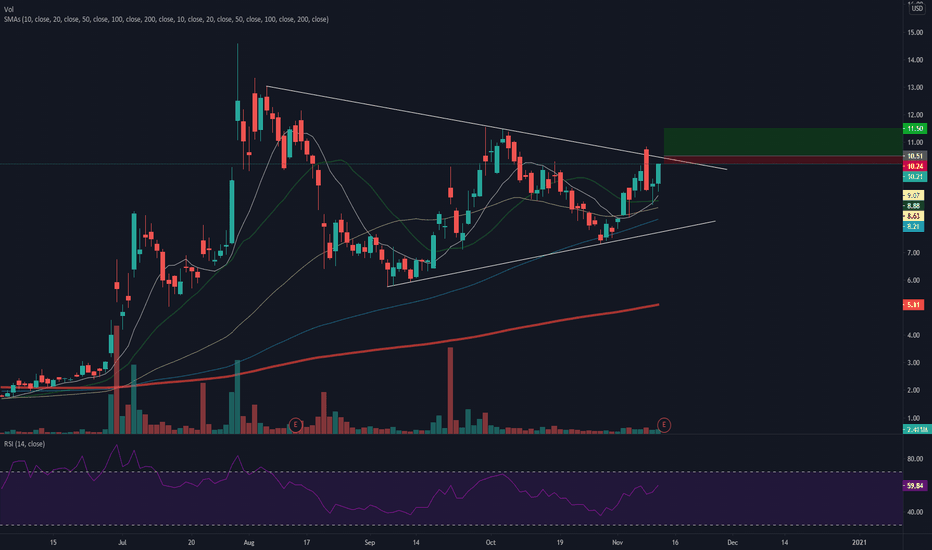

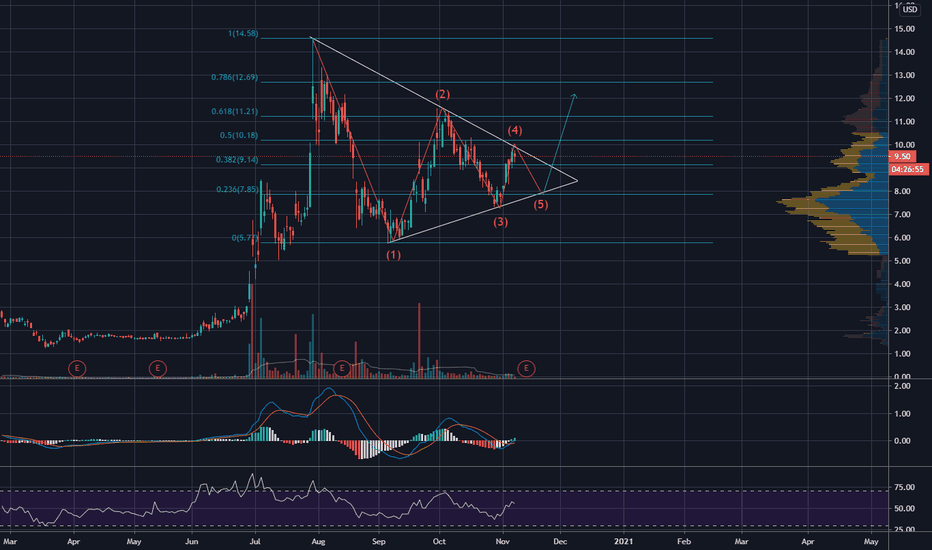

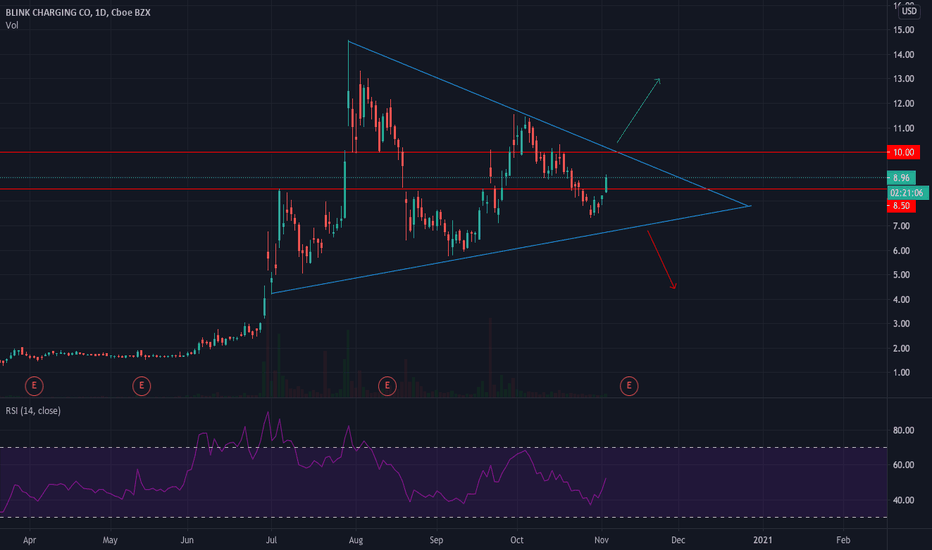

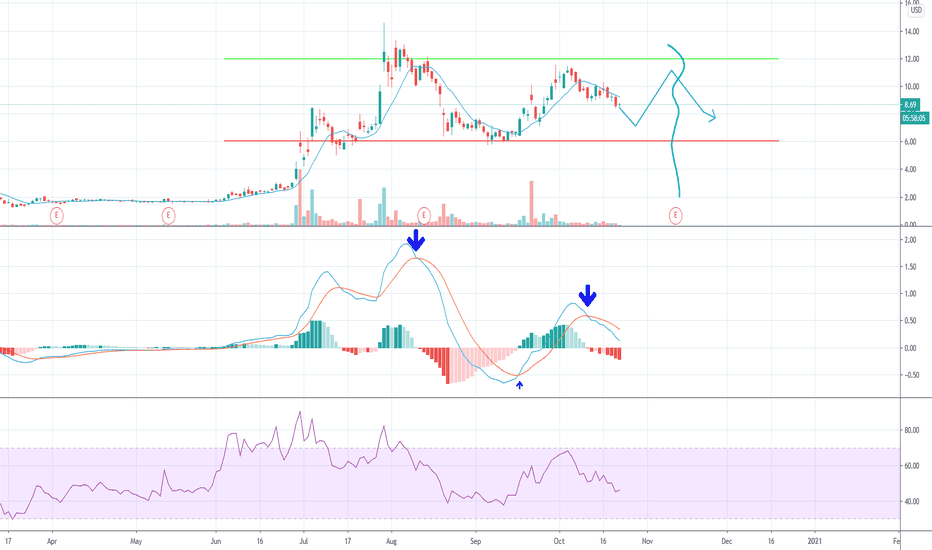

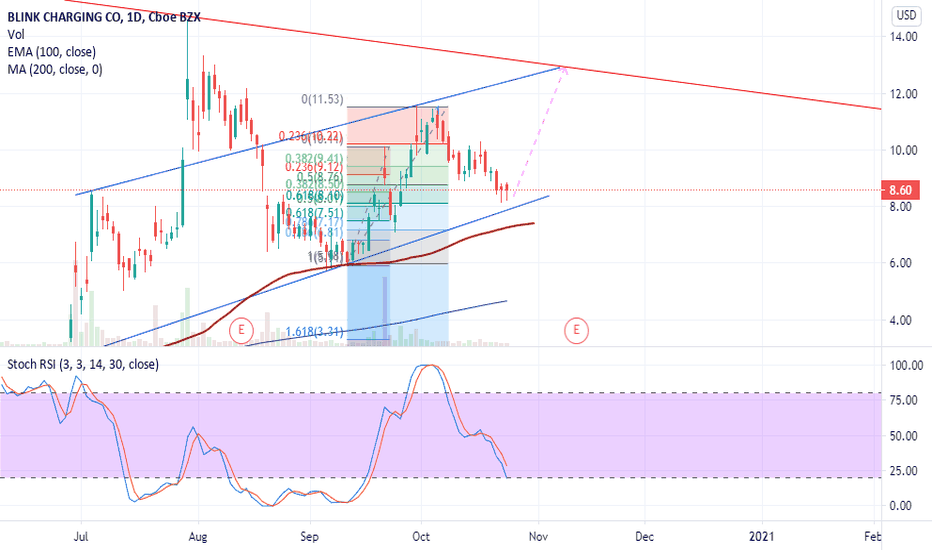

Blink Technical overview:

So very similar to SBE the jump Blink did is purely massive! RSI and Stoch are over bought - RSI candles through the whole rise showing us there is a lot of volume and drive behind this rise -but I am stating the obvious.

Blink stock couldn’t break through the 11$ line till the 16th of Nov and from there gave a +230% rise - expect a correction but I wouldn’t expect it now, as the EV market is still rallying massively. if analyzing the impulse wave the stock is experiencing at the moment, I would say this stock will rally all the way to 30$ mark and from there will give a 2-3$ correction before going further

one thing is sure -the EV charging market is huge and must be seen as one of the biggest opportunities we as investors are experiencing and shouldn’t be missed !

if you would like me to cover another EV charging stock please send in comments

Trade safe and invest smart!

BLNK trade ideas

BLNK Blink Charging Co LONG$1,000 Into 5Mil 11/19/20 Day 236

Total:$4,327,266.63 Today: $47,329.67

$NAKD $BLNK $FUV $AYRO $SOLO

Today was full of good opportunities, the theme has been, Cam is up big early and then he fades his gains midday and end of day. Working on this currently to keep the momo going

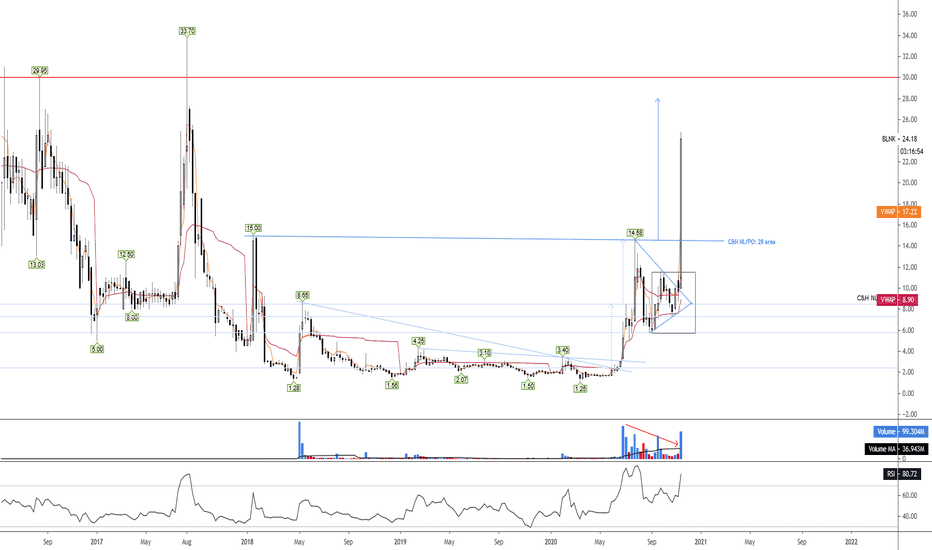

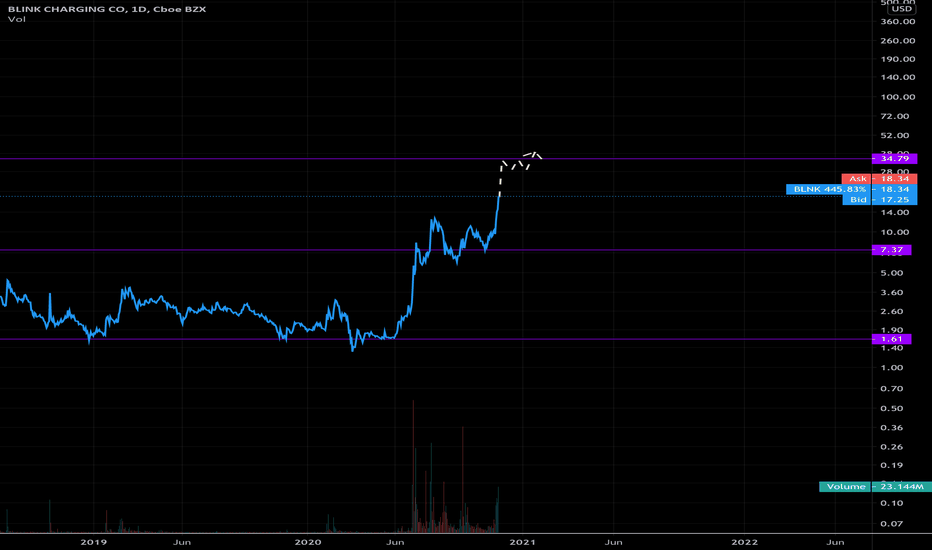

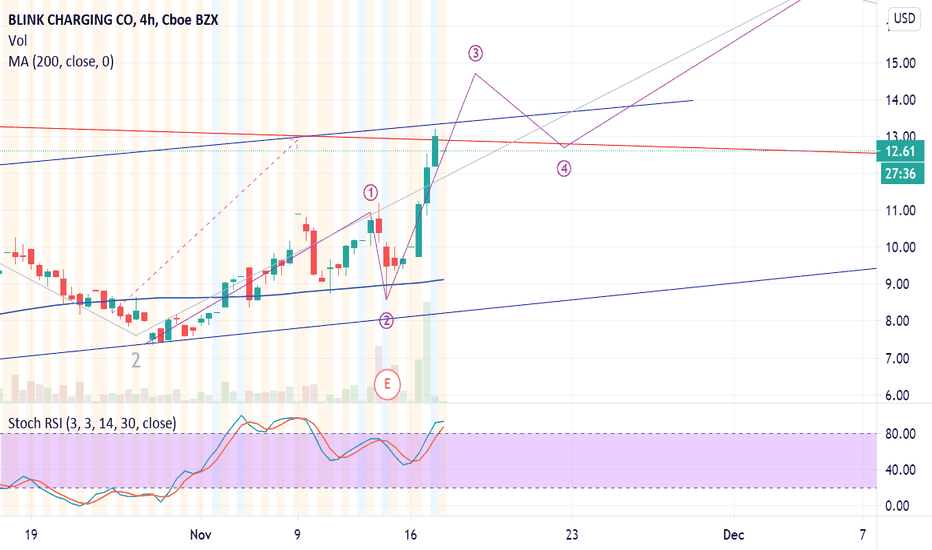

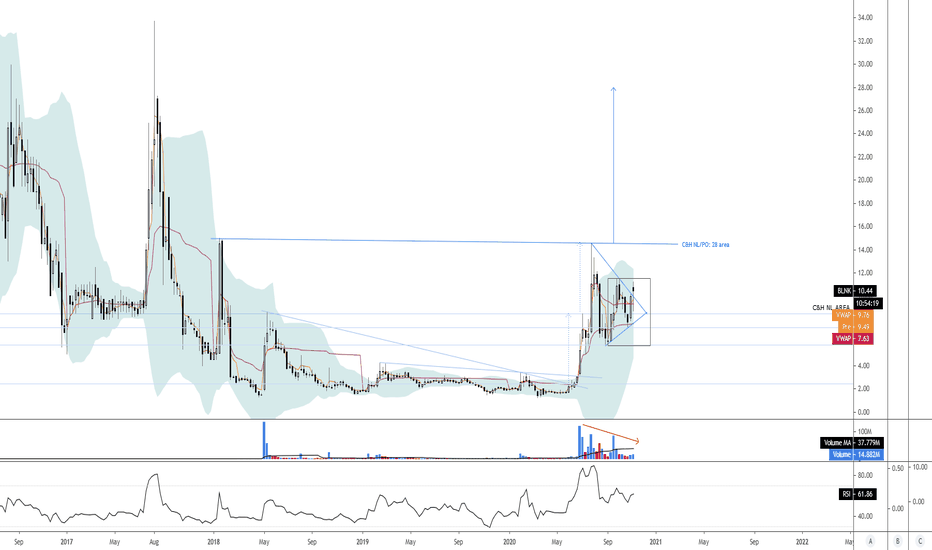

BLINK to test $15 then $35 by Year-End 2020Technicals and Fundamentals have been coinciding nicely and it is looking that BLINK is setting up nicely to re-test the $15 price target set back in January 2018.

After $15, BLINK will test $34, set back in August 2017.

Earnings are announced today - could it be they are bullish or some new insight will be offered by the C-suit? We are indeed in the midst of an EV and Green revolution.

Don't be surprised if this opens up tomorrow at $20

RSI is currently only at 61 and the pitchfork shows that the bull-trend could be retaken and price could be in the $40 dollar range by December 2020.

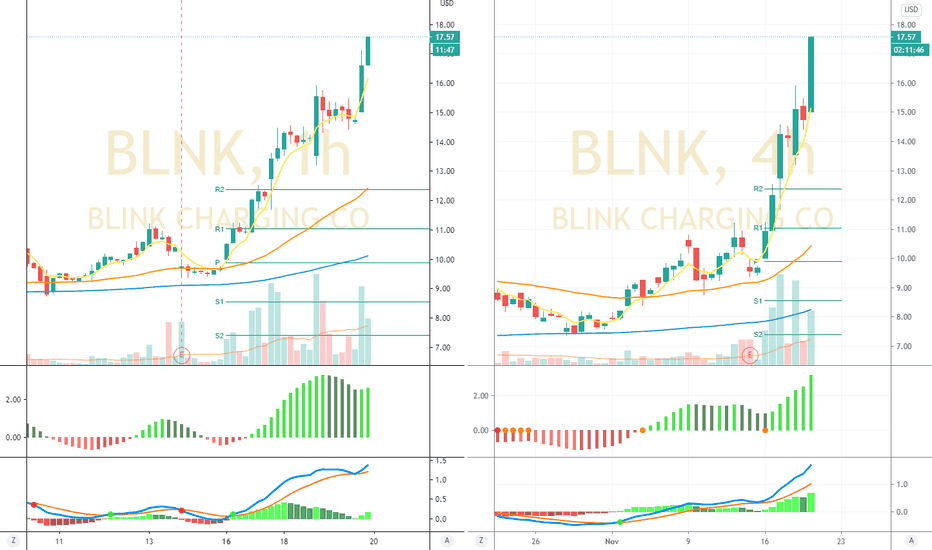

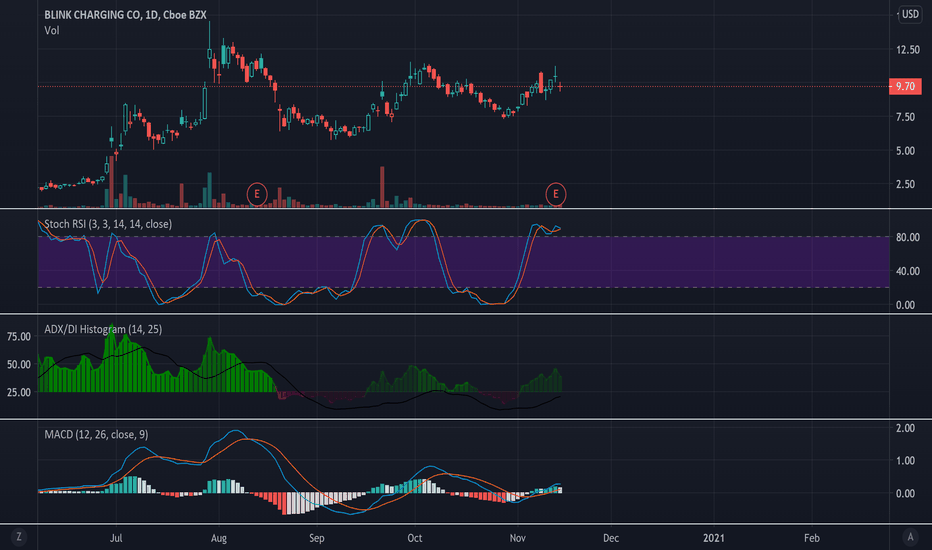

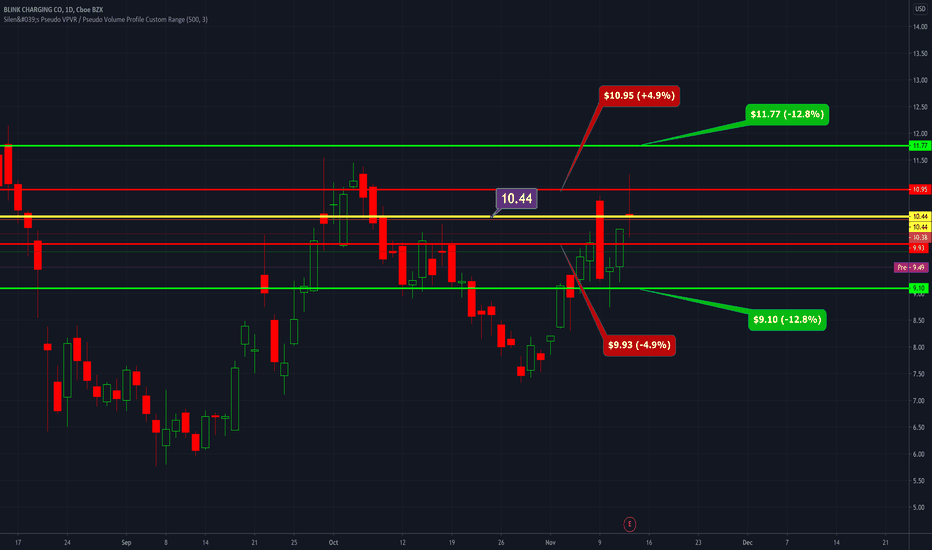

BLINK option pricing day after earningsHot Potato Trader here, whats up fellow trader!

Earnings move range on BLINK suggests we could see a volatile swing .

BLNK is going to report earnings on Nov 12, 2020 (THURSDAY) after market close .

Key Points :

- A single earnings report can bring volatility , volume , and interest to an asset.- The options market overestimated BLNK stocks earnings move 89% of the time in the last 9 quarters.

- The predicted move after earnings announcement was ±12.8% on average vs an average of the actual earnings moves of 4.9%

- Blink was up yesterday in after hours +2.84% after an impressive 7.59% to the upside on the day .

Last Close Price: S10.21 (GOLDMAN SACS PINS 10 minutes into the close)

KEY LEVELS :

Approx Close price last price: $ 10.44

Predicted move $1.33 ( ±12.8% )

Actual move $0.51 ( ±4.9% )

Predicted Average: ± 1.33 ( ±12.8% )

upside move: $ 11.77

downside move: $ 9.10

Actual Average move: ± 0.51 ( ±4.9% )

upside move: $ 10.95

downside move: $ 9.93

BLINK is expected to stay within $9.10 and $11.77 , giving me a confidence level of 8/10.

Note: A potential catalyst such as recent news could take BLINK outside the range. In this event, the catalyst would be considered significant. And identified as an outlier will be identified as bullish or bearish .

Thanks for reviewing my idea and constructive criticism is welcome.

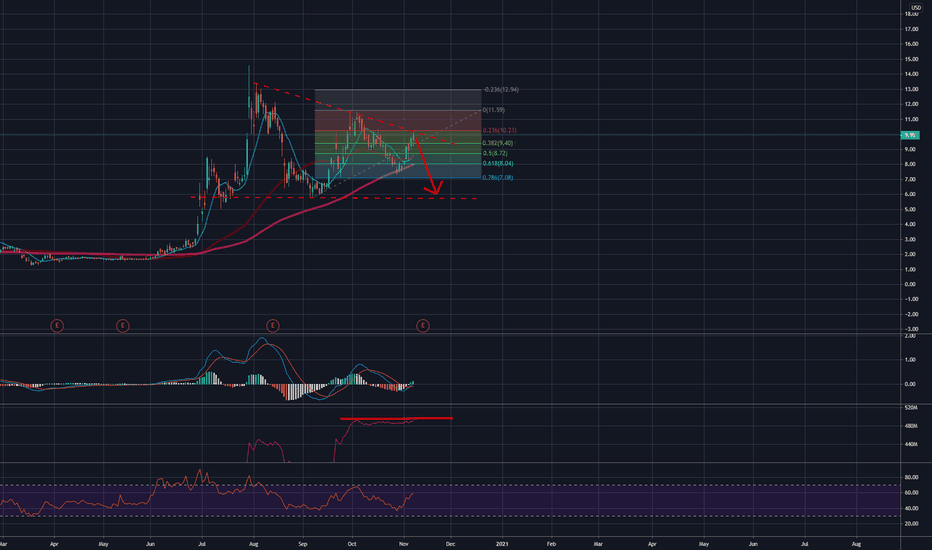

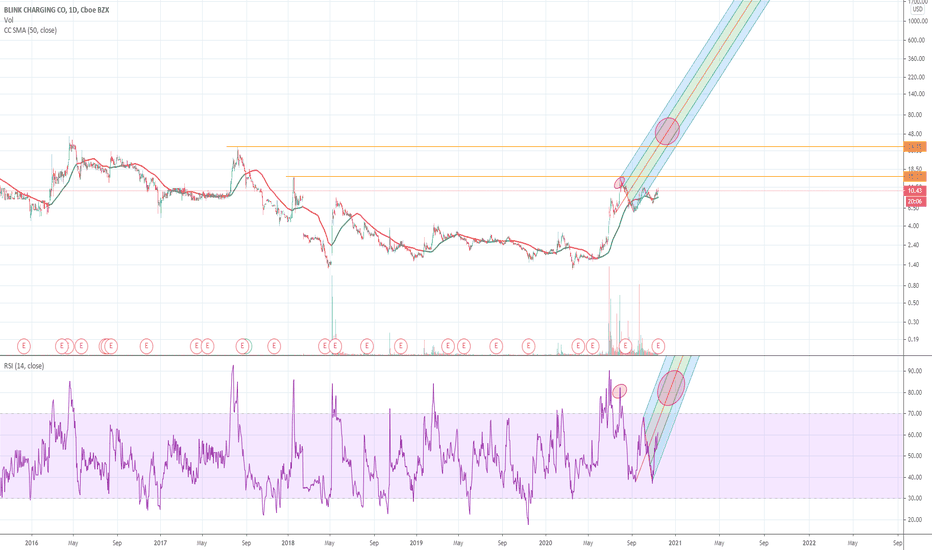

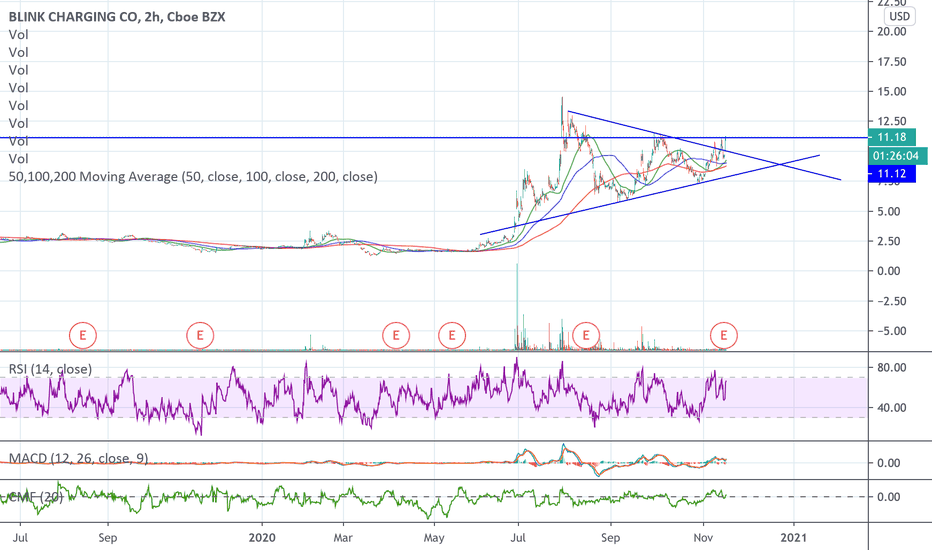

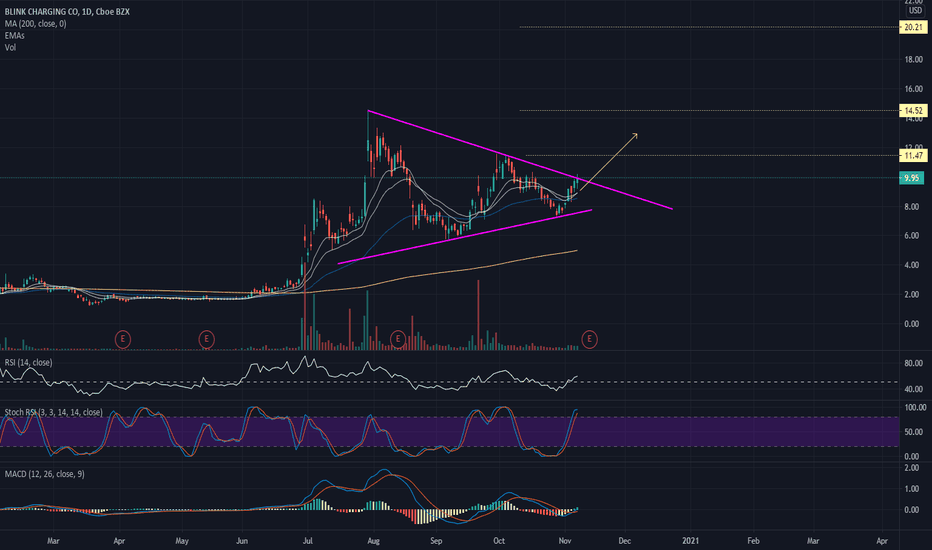

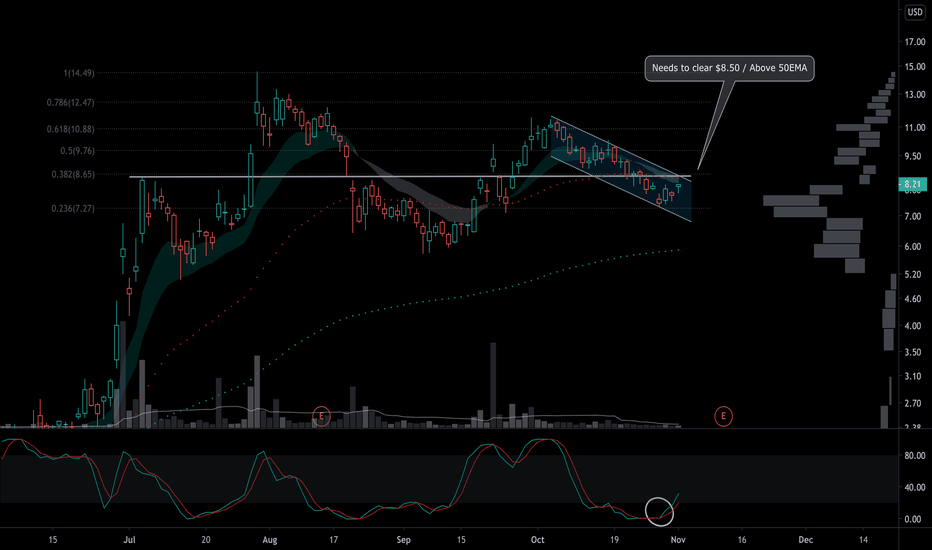

BLNK General look (not ready for a trade yet) I am down on my position in BLNK, I am looking at what scenarios might be good for averaging down or getting in. BLNK is a 'tech' and 'electric car' play. They provide charging stations for electric cars and generate revenue in a variety of ways.

I think this is a long term good option. I think a Joe Biden win would greatly benefit BLNK as well, as it is part of the renewable energy movement, etc...

I am looking at what earnings play might exist. But truthfully, I don't think this is a stock with earnings related plays. Historically the price movements were not associated with earnings.

Uniquely, it is very compliant with a MACD strategy.

I am looking at some of the following conditions to create a good time to enter:

- Stock consolidates at previous support levels

- MACD rolls over to the bullish upside at around the same time

- Market conditions are somewhat positive, which lately had been changing very constantly.

Some time next week we could be looking at an opportunity. Some good news can be really helpful as well.