webull buy x robinhood buy webull: 24 million registered users and 4.7 million funded accounts managing $12.6 billion in assets as of Q1 2025

x

Robinhood: recently launched tokenized U.S. stocks and ETFs in Europe, enabling round‑the‑clock 24/5 crypto‑style trading and exposure to private companies like SpaceX and OpenAI : Mizuho raised its price target to $99, Cantor Fitzgerald to $100, and KeyBanc to $110 Q4 2024 EPS estimates up 322% year-over-year, and full-year 2024/25 earnings forecasted to grow by 231%/22%

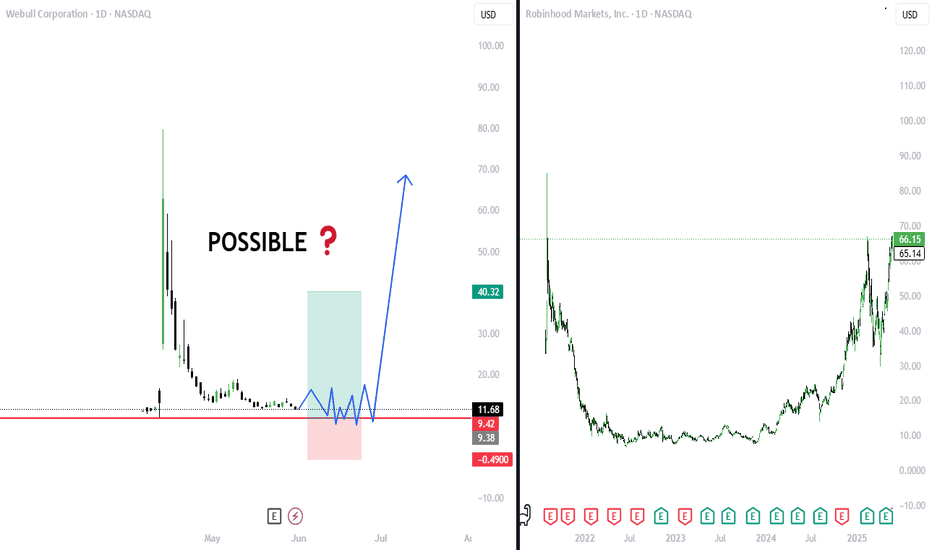

bigger picture

Retail now constitutes roughly 20–21% of daily trading volume

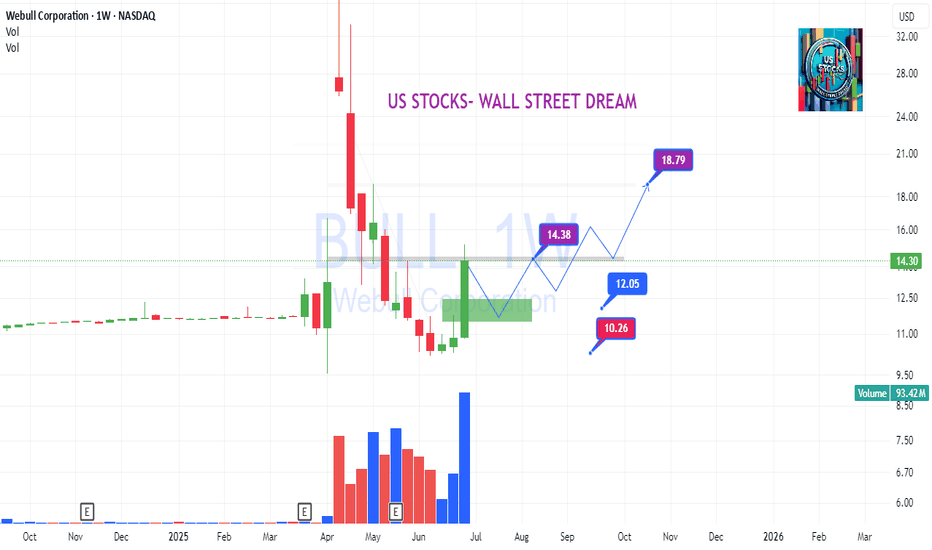

Brokerages like Webull and Robinhood, offering strong margins, advanced tools, and retail accessibility, are driving the new wave of democratized finance empowering traders amid record market participation and innovation. lots of volume here

should expect these two to have a good quarter and next

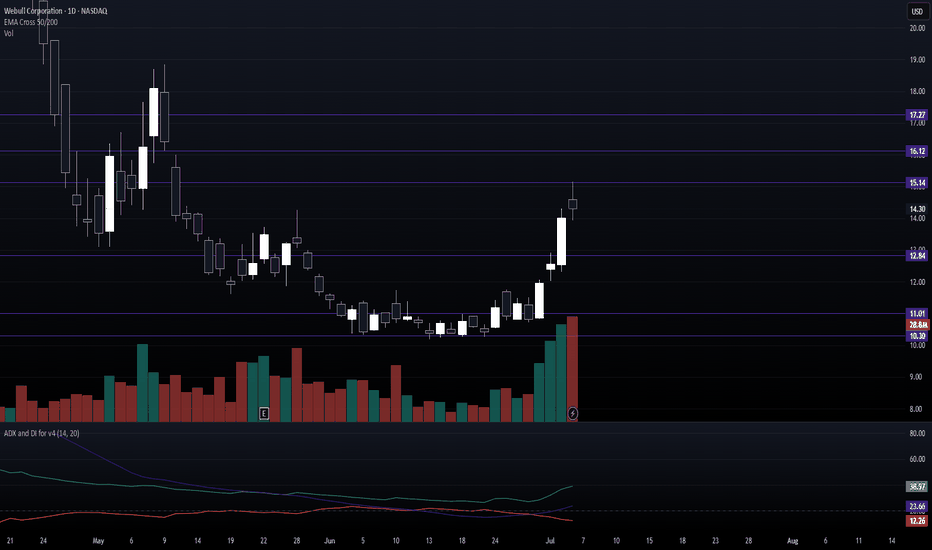

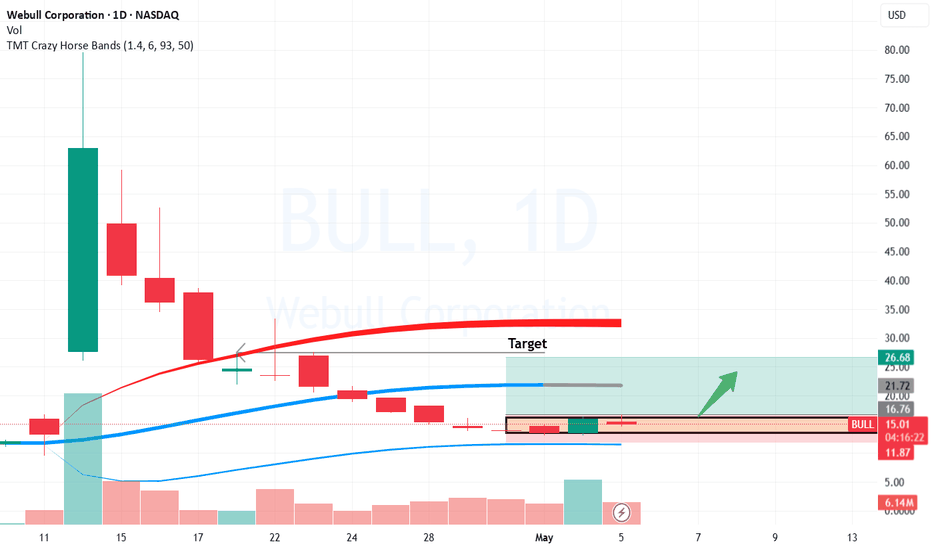

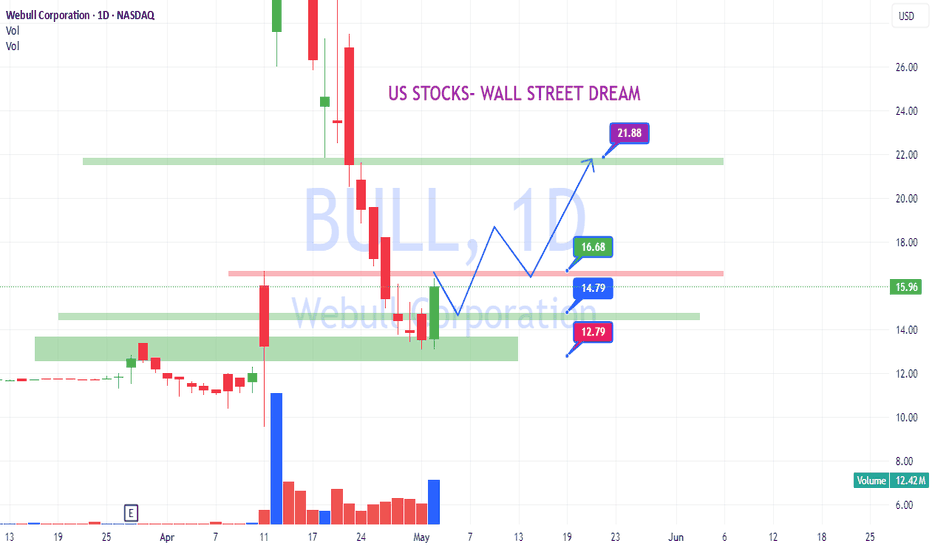

price target by end of july

NASDAQ:BULL 16.00 range

NASDAQ:HOOD 101.00+

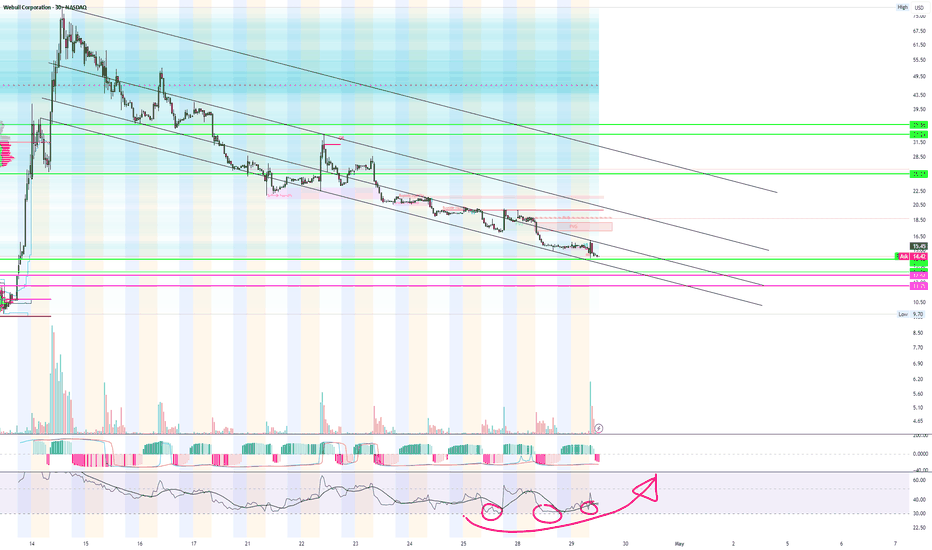

BULL trade ideas

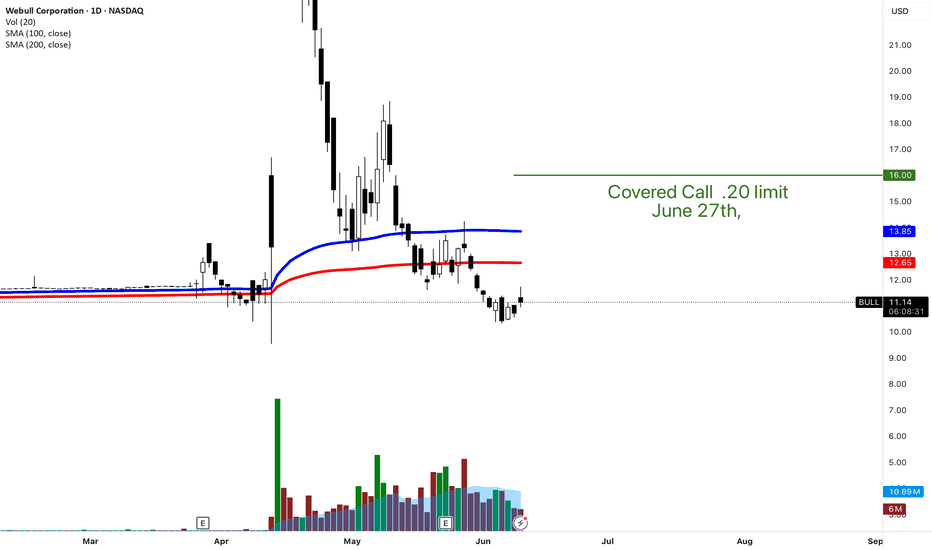

BULL | Robinhood Copy TradeWebull Corporation displays explosive momentum after breaking through former resistance levels, positioning itself for a potential run to higher targets. The stock mirrors Robinhood's exceptional performance, suggesting investors may view it as a strong fintech play-along opportunity.

Key Technical Signals:

Decisive breakout from extended consolidation base

Former resistance now acting as new support

Parabolic price acceleration with strong volume

Clear pathway toward upper resistance zone around $21-24

Trading Opportunity:

The breakout setup suggests continued upside potential as the stock follows the projected bullish path. Market sentiment around fintech stocks remains elevated, providing fundamental tailwinds.

Risk Management:

Overextended RSI levels indicate possible short-term pullback

Profit-taking likely near psychological resistance levels

Stop-loss below the green support zone to protect against reversal

The comparison to Robinhood's success adds conviction to the bullish thesis, but traders should remain disciplined given the stock's parabolic nature and manage position sizes accordingly.

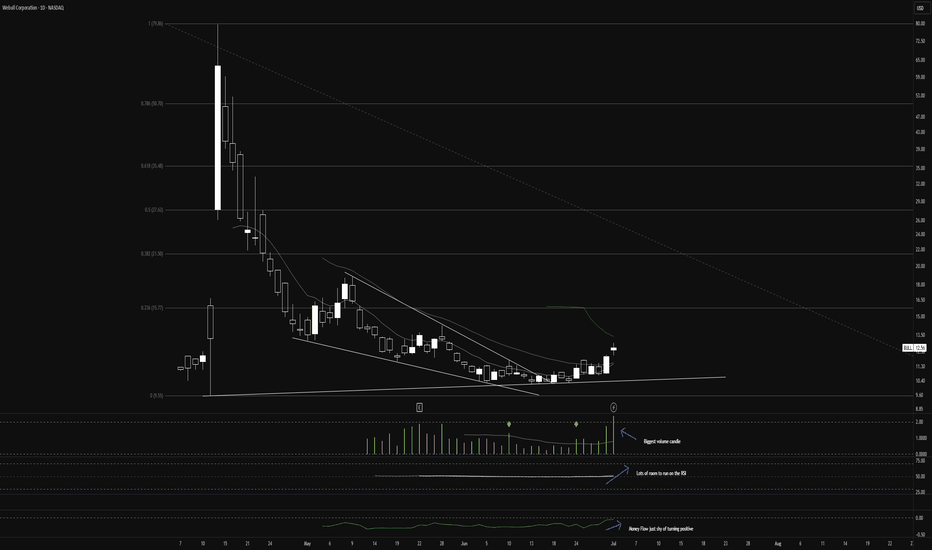

Is the $BULL Ready to Run? A perfect storm of good news here.

June 30 was the last day to redeem $BULLZ warrants. The overhang of insiders dumping shares to arbitrage warrants is gone.

This happened just in time to catch the sector tailwinds from the NASDAQ:HOOD announcement of tokenized public and private assets rolling out in Europe.

WeBull has integrated the NASDAQ:COIN CaaS offering for crypto trading, augmenting its crypto exposure and pairing nicely with Kalshi's integrated hourly crypto contracts. With favorable crypto legislation coming out of the current administration, WeBull is perfectly primed to take advantage of the trend, coupling stock and crypto trading into one neat platform.

Today, July 1, we saw massive volume on call contracts - a 44% increase to average daily volume.

17% YoY growth of user base since Q1 of '24 and a 66% YoY increase in AUM. With revenues on the rise, I would fully expect positive margins this year.

Should be a fun one as we start to catch momentum.

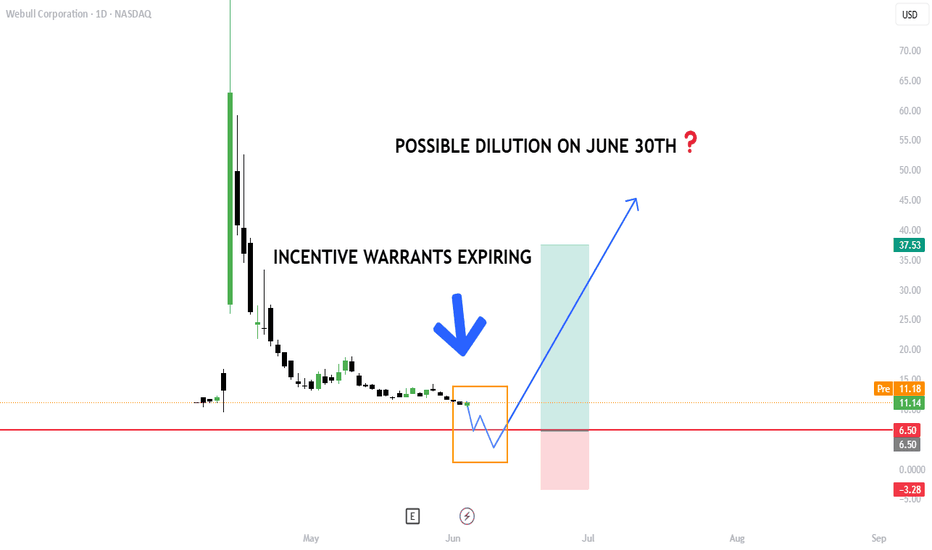

WEBULL possible price dropPotential Dilution Risk from Webull’s Expiring Warrants

Webull has announced that its incentive warrants (NASDAQ: BULLZ) will be redeemed on June 30, 2025. Holders must exercise their warrants by 5:00 p.m. ET on that date — or they will receive only $0.01 per warrant.

How Many Warrants Are Affected?

-Total BULLZ Warrants Outstanding: 20,913,089

-Exercise Price: $10.00 per warrant

-If all warrants are exercised, Webull will issue 20.91 million new shares

Capital Raised if Fully Exercised

If all 20.91 million warrants are exercised:

-Webull will receive $209.13 million in cash

-Total shares outstanding would increase by ~17.3% (from 100M to \~121M shares)

-This creates dilution of ownership and earnings per share for existing shareholders

Will This Cause a Drop in Webull’s Stock Price?

Possibly — but not necessarily. Downward Pressure Factors:

-More shares = dilution, which often triggers a short-term price drop

-Traders may anticipate dilution and sell preemptively

Supportive Factors:

-Webull could raise over $200 million, strengthening its balance sheet

-If investors believe the capital will be used productively, the dilution may be offset by growth expectations

-Not all warrants may be exercised many holders might miss the deadline or find the current share price unattractive

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

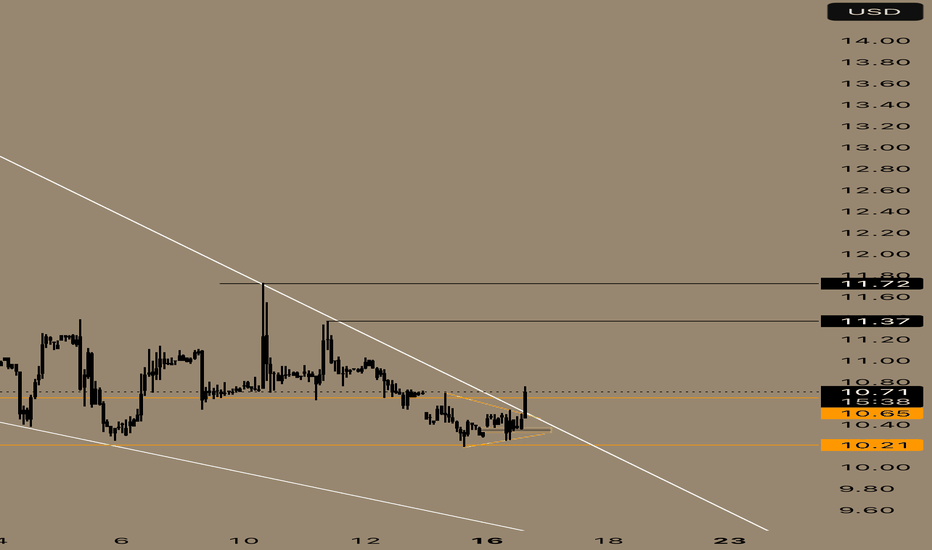

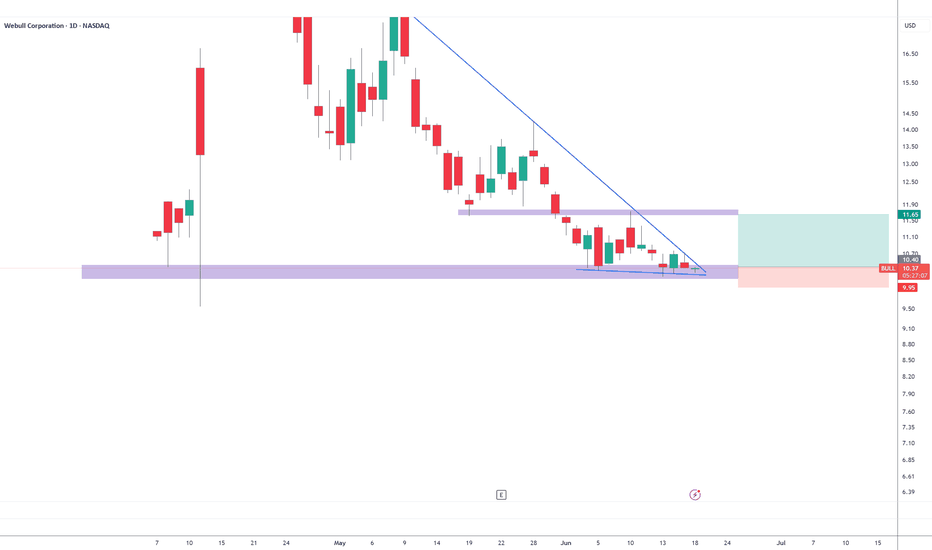

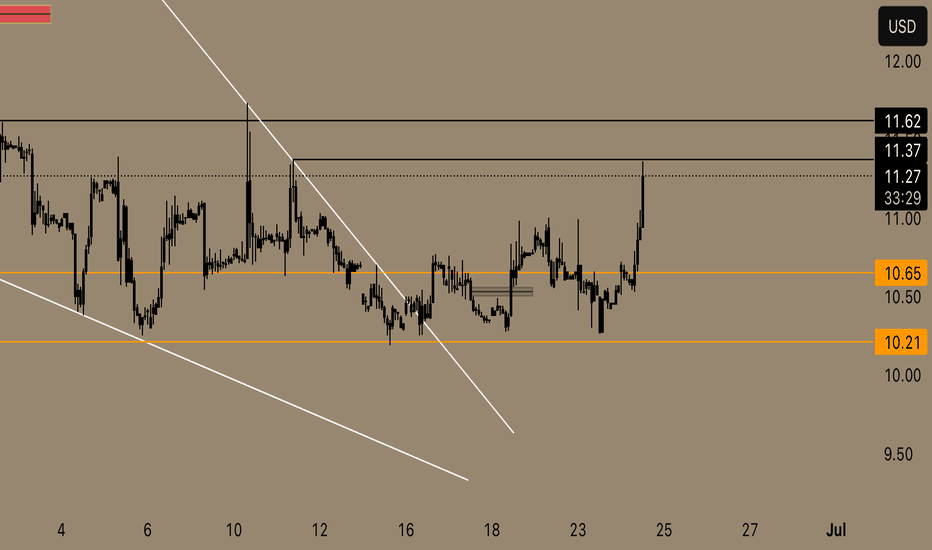

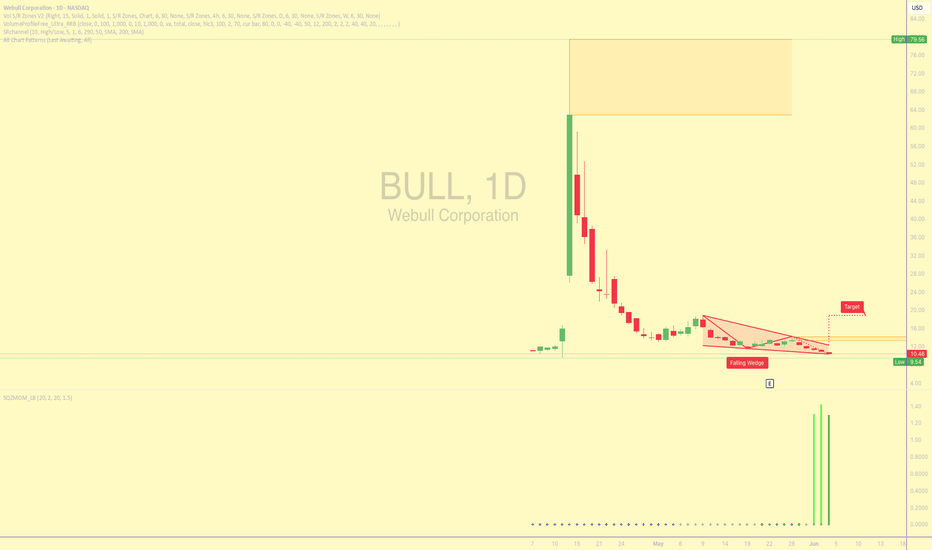

[LONG IDEA] $BULL Falling Wedge - Reversal Any Day Now!!NASDAQ:BULL has been consolidating in a tight bearish range over the past few days. A potential long entry is at $10.47 with a stop loss at $9.00, offering a favorable risk-to-reward setup.

However, if the price closes below $9.50, consider switching bias and taking a short position.

Will Webull replicate Hood's success?IPO Overview

1) Robinhood (Ticker: HOOD)

-IPO Date: July 29, 2021

-IPO Price: $38 per share

-Initial Valuation: Approximately $32 billion

-First Day Performance: Shares closed down over 10%, reflecting investor concerns over valuation and regulatory scrutiny.

2) Webull (Ticker: BULL)

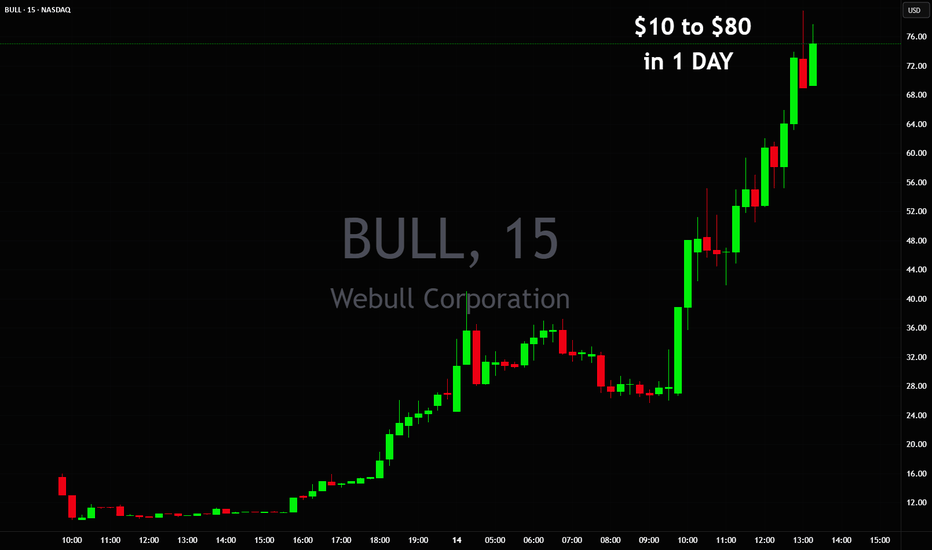

-IPO Date: April 2025 (via SPAC merger with SK Growth Opportunities)

-Initial Trading Price: $13.25 per share

-First Day Performance: Shares surged up to 500%, reaching an intraday high of $79.56, with a market cap nearing $30 billion.

Financial Metrics Comparison

1) Robinhood (2021)

-Q2 Revenue: $565 million (131% YoY growth)

-Net Loss: $502 million

-Monthly Active Users: 21.3 million

-Assets Under Custody: $102 billion

-Average Revenue Per User (ARPU): $112

-Primary Revenue Sources: Payment for order flow, interest on cash balances, and cryptocurrency trading.

2) Webull (Q1 2025)

-Revenue: $117.4 million (32% YoY growth)

-Adjusted Operating Profit: $28.7 million

-Net Profit Margin: 11.1%

-User Base: Approximately 24.1 million

-Revenue per Trade: Increased from $1.37 to $1.47

-Primary Revenue Sources: Commissions, interest-related income, and trading fees.

Valuation Metrics

1) Robinhood

-Current Market Cap: Approximately $36.85 billion

-P/E Ratio: 23.18

-EPS: $1.75

2) Webull

-Post-IPO Market Cap: Approximately $29.6 billion

-Enterprise Value/Revenue: 19.67

-Enterprise Value/EBITDA: 445.91

Challenges and Controversies

1) Robinhood

-Regulatory Scrutiny: Faced fines and investigations related to payment for order flow practices and outages during high-volatility periods.

-User Trust Issues: Criticized for gamifying trading and for its role in the GameStop trading halt.

-Security Breaches: Experienced data breaches affecting millions of users.

2) Webull

-Regulatory Concerns: Scrutinized for its ties to Chinese parent companies, raising data privacy and national security concerns.

-FINRA Fine: Fined $3 million in 2023 for inadequate due diligence in options trading approvals.

-State-Level Actions: Banned on government devices in Tennessee due to data security concerns.

Future Outlook

While both companies have achieved significant user growth and market valuations, their paths diverge in several ways:

-Profitability: Webull has demonstrated profitability with a positive net profit margin, whereas Robinhood faced substantial losses post-IPO.

-Regulatory Environment: Robinhood's challenges have been primarily domestic, focusing on its business practices, while Webull faces international scrutiny due to its ownership structure.

-Market Positioning: Robinhood has diversified its offerings, including retirement accounts and cash management, aiming for a broader financial ecosystem. Webull's focus remains on active traders, which may limit its market expansion.

- Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions.

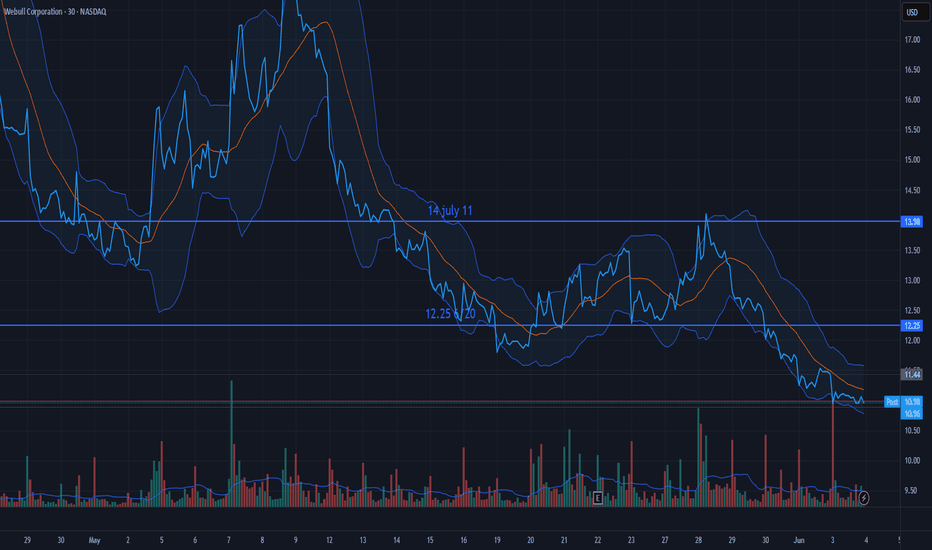

Wow, Id be dumping my life savings into this.First target is $25 and the $30 once we start to see price move closer to its volume profile gap down at my pink lines.

The key price level I see for support is 12.62$ but honestly, this looks like it could rip any day now.

Im longing until we break below $12

$10 to $80 in 1 day $BULL$10 to $80 in 1 day 💣 How do you know market is in a bubble?

When NASDAQ:HOOD valuation is so high their competitor NASDAQ:BULL decides to do IPO to catch some of the makert delusion going on and they fit right into all of it with their value going from $260 Million to $2 Billion in a day