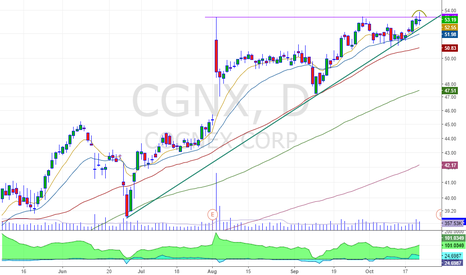

CGNX call debit spreadCGNX has been underperforming while billions seem to be pouring into the market of late. Once a darling, and with a big nasty double top on the chart I am thinking of getting long. US markets seem to be manipulated and have painted themselves into a corner where everything MUST go up. I am making another non-Tasty Trade in my smaller reg-T account because volatility is low and I need better risk/rewards to grow a small account. Volatility rank is 19.5% (and that with the skew from the Feb sell off) Anyways I am going to buy the Nov 50 call and sell the Nov 55 call for $1.46 ..... basically risking 1.50 to make 3.50. This gives me 158 days to be right but with earnings on July 30 may be basically an earnings trade. This is my way of adding positive deltas (FOMO) with a risk/reward ratio that may pay enough to offset my other non-neutral trades. With Cognex currently at 46 this trade has considerably less probabilities of being successful (42% if you use the delta of the 50 strike as probability of expiring in the money, which it needs to be considerably higher than -----55 is quite far and only a 25 delta) I had a few underperforming stocks to choose from ANET, MMM, NTES, HON, CBM, AMWD.....but chose CGNX for the 5 wide strikes and overall non-correlation to SPY. Wish me luck!

CGNX trade ideas

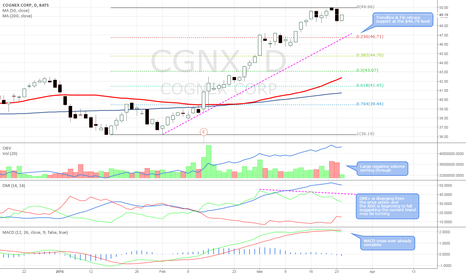

CGNX Parabolic TrendInvest in CGNX until the the price breaks out of the parabolic trend. Exceptionally large preceding green bar, then <= red bar with high volume will be the indicator for exiting.

There is current somewhat concerning drop with a fair amount of volume, so wait for confirmation of low volume and regression to middle of trend prior to entry.

ADX turning, DMI+ diverging, MACD cross and large negative volLarge negative volumes in CGNX coupled with divergence in the DMI+ line may indicate the trend is beginning to turn.

This is further confirmed with the presence of a crossed MACD and large negative volume indicating distribution from large holders. Stop above the psychological $50 level which is also a new high. Target of $46.70. At current prices this is an attractive risk/reward proposition.