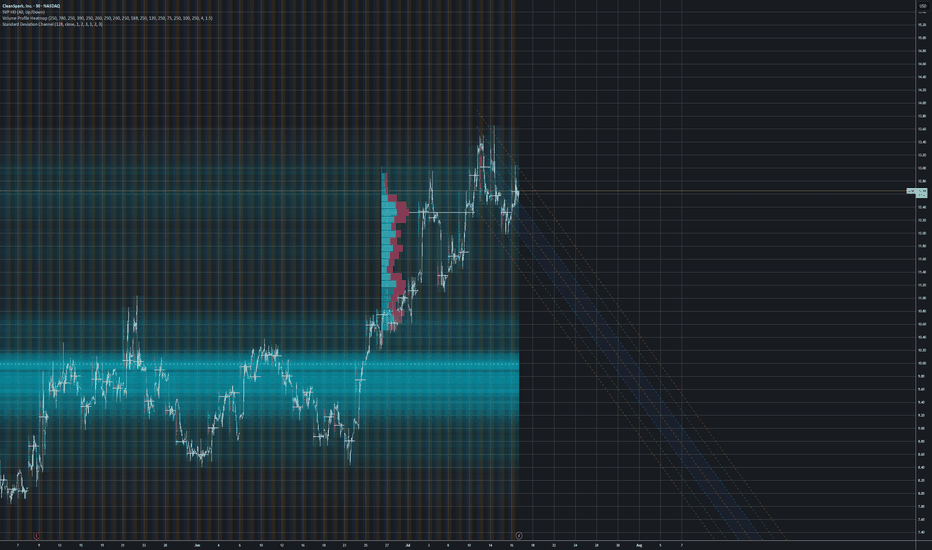

CLSK / 3hNASDAQ:CLSK

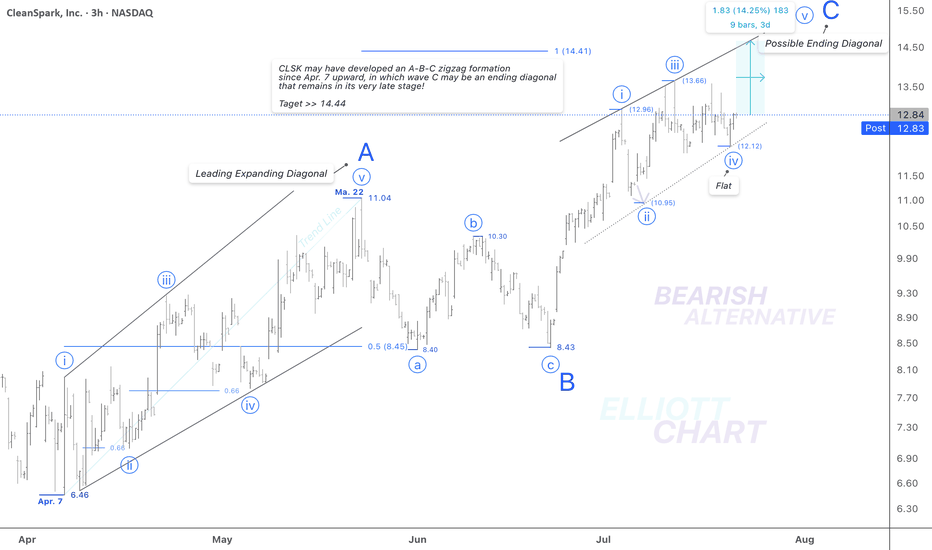

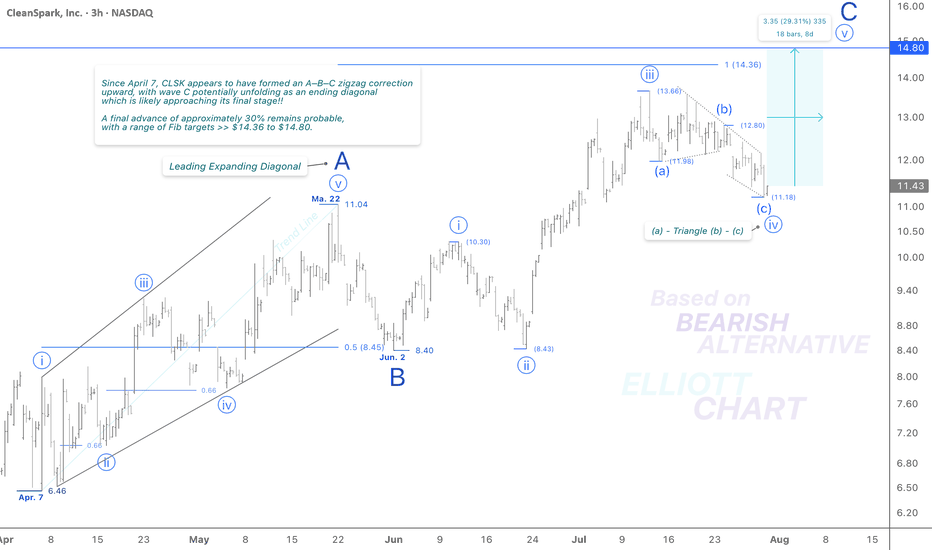

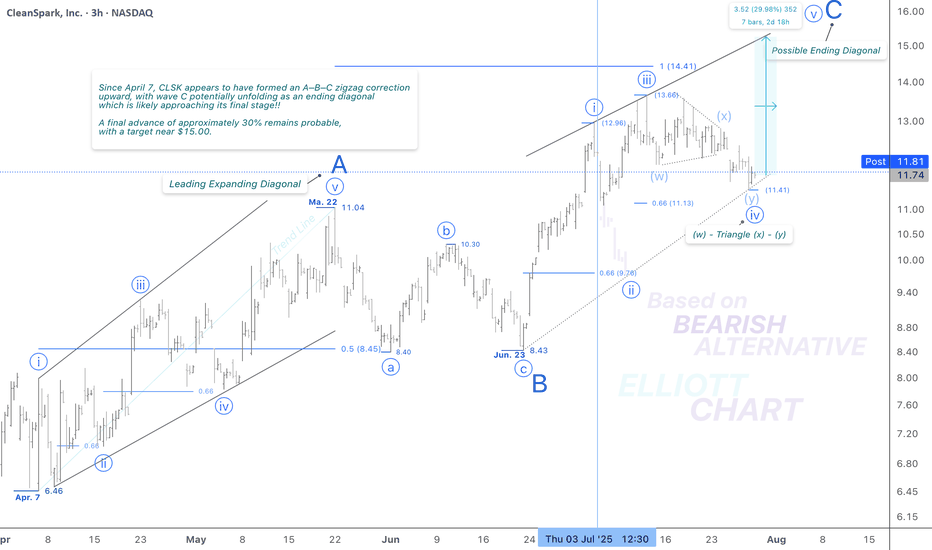

According to the bearish alternative in my weekly frame(not posted!), I'd analyzed the rising wave since April 7 as an A-B-C zigzag formation in correction of the Intermediate degree wave (B) <<. Not shown in this 3h-frame.

Wave Analysis >> As depicted in the 3h-frame above, the Mi

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.91 USD

−145.78 M USD

378.97 M USD

272.89 M

About CleanSpark, Inc.

Sector

Industry

CEO

Zachary K. Bradford

Website

Headquarters

Henderson

Founded

1987

FIGI

BBG001MB89V6

CleanSpark, Inc. is a bitcoin mining technology company, which engages in the management of data centers. Its operations include College Park, Norcross, Washington, Sandersville, Dalton, and Massena. The company was founded by S. Matthew Schultz and Bryan Huber on October 15, 1987 and is headquartered in Henderson, NV.

Related stocks

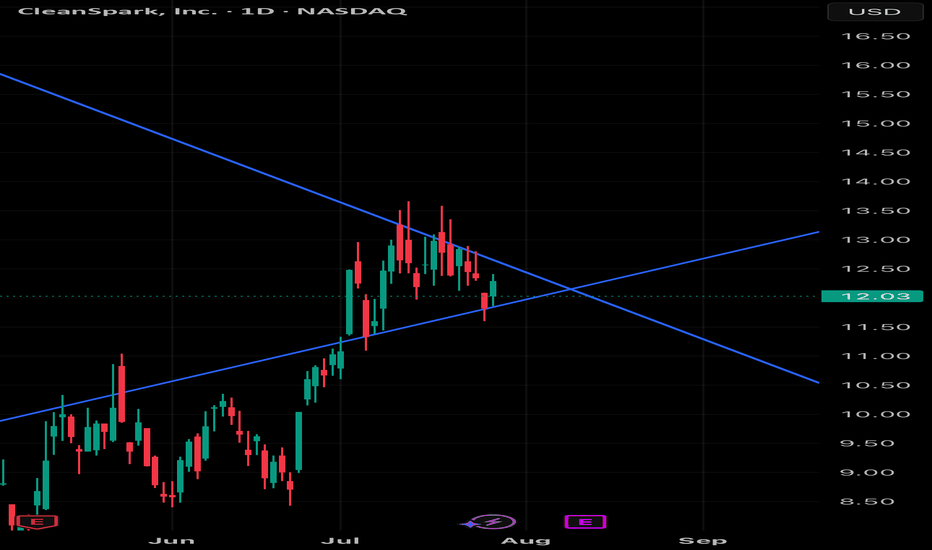

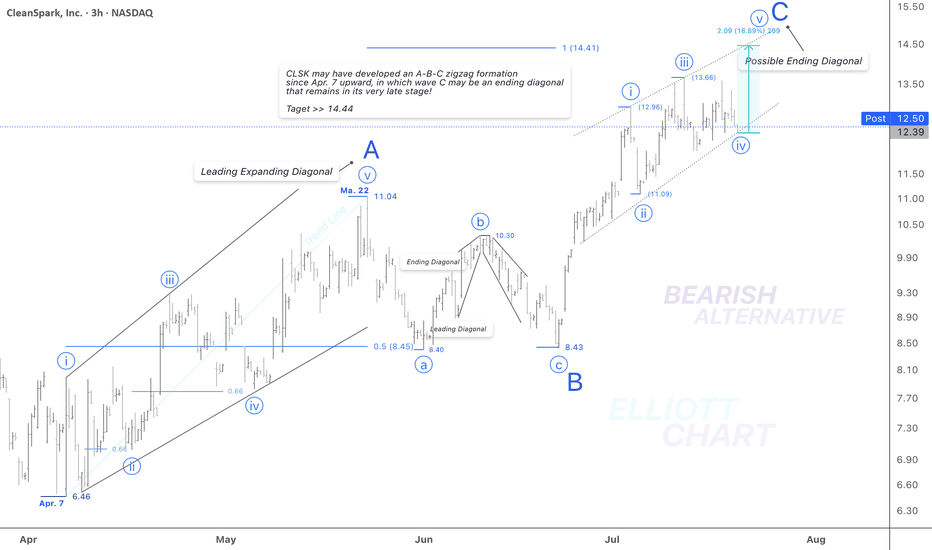

CLSK / 3hToday’s unexpected 2.6% decline, along with the continued development of an ending diagonal in the final leg of the correction, supports a reversion to the previously considered structure: an formation for wave iv (circled). This revised interpretation aligns more closely with the current price ac

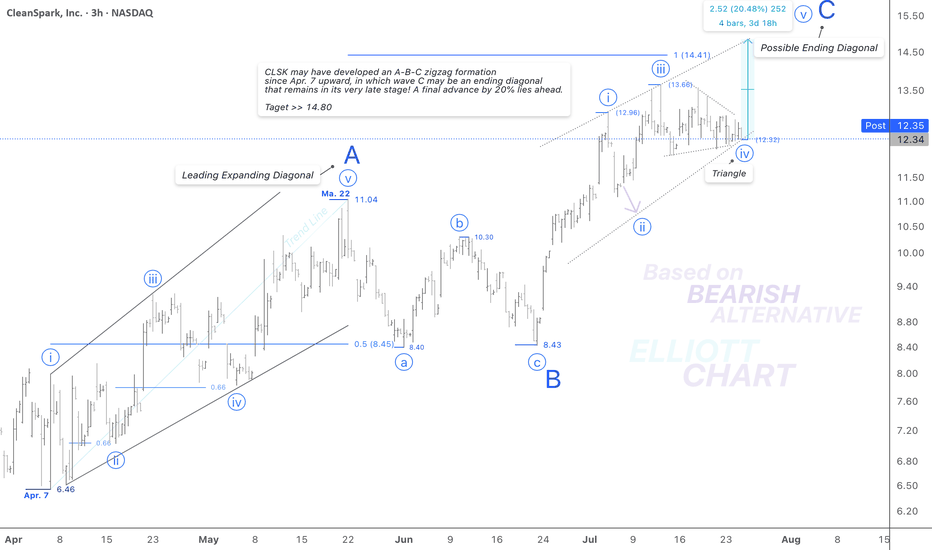

CLSK / 3hThe modest and unexpected 2.5% decline in NASDAQ:CLSK today suggests a potential shift in the wave iv (circled) corrective structure—from the previously identified to a more complex combination.

This adjustment still fits within the context of the ending diagonal pattern in Minor wave C and re

Bullish Flag Formation - Short term upside to $14 - BTC ATHIn the interim, the bull flag pattern can be delineated as follows based on the uploaded chart: The flagpole is represented by the upward surge from approximately $113,332 (near the green label at the chart’s lower left) to around $121,351 (inferred from the upper candlestick highs and the red label

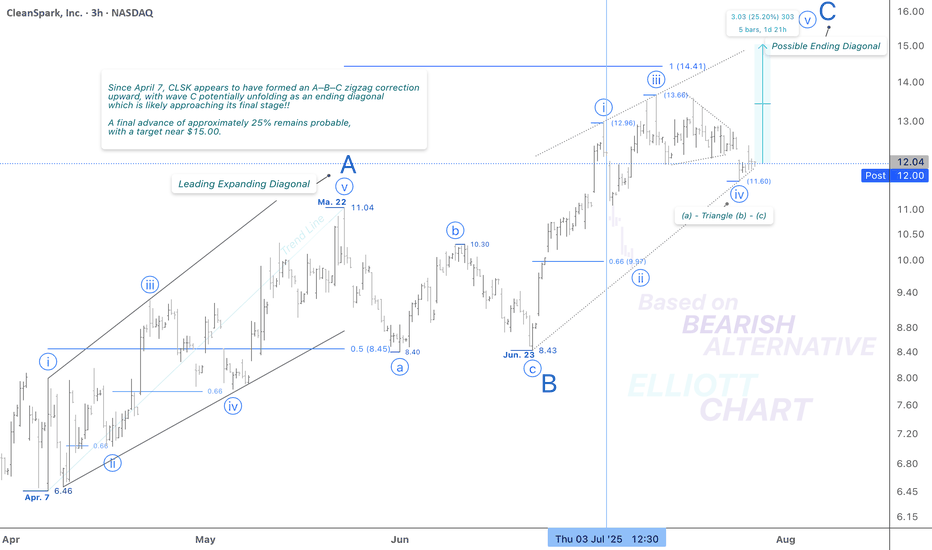

CLSK / 3hNASDAQ:CLSK has been trading with a slight upward bias ahead of a potentially final advance, projected to gain approximately 25% with a target near $15.00.

Wave Analysis >> As illustrated in the 3h-frame above, Minor wave C—completing the corrective upward move of wave (B)—appears to be unfoldin

$CLSK / 3hNASDAQ:CLSK

According to the bearish alternative in my weekly frame(not posted!), I'd analyzed the rising tide since April 7 as an A-B-C zigzag formation in a correction of the Intermediate degree wave (B) <<. Not shown in this 3h frame.

Wave Analysis >> As illustrated in the 3h-frame above, t

CLSK / 3hAccording to a bearish alternative in my weekly frame(not posted!), I'd analyzed the rising wave since April 7 as an A-B-C zigzag formation in correction of the Intermediate degree wave (B) >> Not shown in this 3h-frame.

Wave Analysis >> As depicted in the 3h-frame above, the Minor degree wave

[$CLSK] CleanSpark Inc. - Farming [$BTC] LongNASDAQ:CLSK

no finanical advice

📑market outlook

+ Fed rate cut priced in --> short term risk-on environment

+ total FIAT-debasement in motion --> Precious &Crypto are poomping

- geo-political risk can drag down the 'weaker ANTI-Fiat' risk-on positions

💡idea

we want to farm BTC indirectly by selli

[$CLSK] CleanSpark Inc. - Farming [$BTC] Long[ NASDAQ:CLSK ]

no finanical advice

📑market outlook

+ Fed rate cut priced in --> short term risk-on environment

+ total FIAT-debasement in motion --> Precious &Crypto are poomping

- geo-political risk can drag down the 'weaker ANTI-Fiat' risk-on positions

💡idea

we want to farm BTC indirectly by s

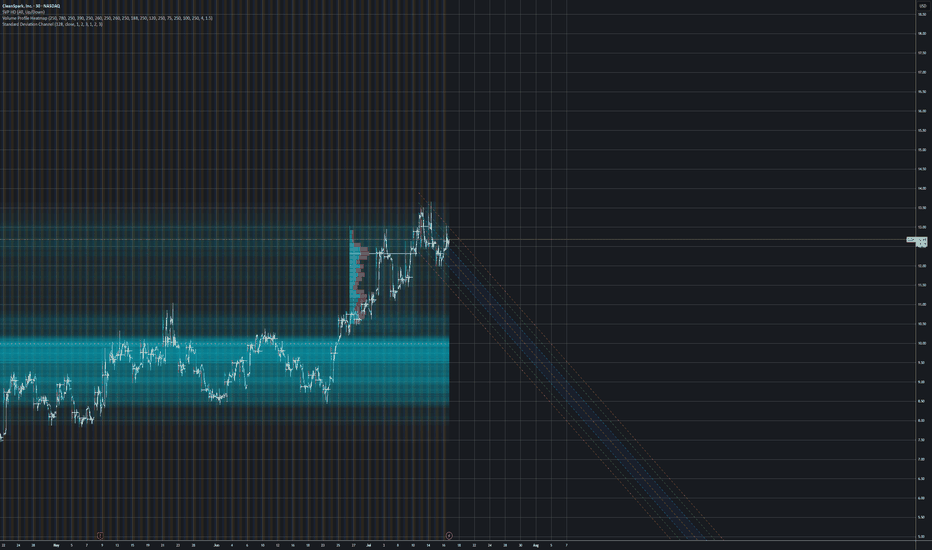

$CLSK Trapped between Critical Resistance and Support?NASDAQ:CLSK Shot through the weekly 200EMA and hit the weekly pivot resistance and was rejected into the High Volume Node (HVN) just below.

If the count is correct we should see price breakthrough in wave 3 after some consolidation and continue up after wave 2 tested the .618 Fibonacci retracement

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CLSK is featured.

Cryptocurrency stocks: Stacking satoshis

17 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of CLSK is 10.44 USD — it has decreased by −7.96% in the past 24 hours. Watch CleanSpark, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange CleanSpark, Inc. stocks are traded under the ticker CLSK.

CLSK stock has fallen by −13.41% compared to the previous week, the month change is a −8.04% fall, over the last year CleanSpark, Inc. has showed a −34.75% decrease.

We've gathered analysts' opinions on CleanSpark, Inc. future price: according to them, CLSK price has a max estimate of 33.00 USD and a min estimate of 15.00 USD. Watch CLSK chart and read a more detailed CleanSpark, Inc. stock forecast: see what analysts think of CleanSpark, Inc. and suggest that you do with its stocks.

CLSK reached its all-time high on Sep 19, 2018 with the price of 150.10 USD, and its all-time low was 0.97 USD and was reached on Mar 17, 2020. View more price dynamics on CLSK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CLSK stock is 11.14% volatile and has beta coefficient of 3.61. Track CleanSpark, Inc. stock price on the chart and check out the list of the most volatile stocks — is CleanSpark, Inc. there?

Today CleanSpark, Inc. has the market capitalization of 2.93 B, it has decreased by −2.56% over the last week.

Yes, you can track CleanSpark, Inc. financials in yearly and quarterly reports right on TradingView.

CleanSpark, Inc. is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

CLSK earnings for the last quarter are −0.49 USD per share, whereas the estimation was −0.11 USD resulting in a −344.39% surprise. The estimated earnings for the next quarter are 0.30 USD per share. See more details about CleanSpark, Inc. earnings.

CleanSpark, Inc. revenue for the last quarter amounts to 181.71 M USD, despite the estimated figure of 188.42 M USD. In the next quarter, revenue is expected to reach 198.86 M USD.

CLSK net income for the last quarter is −138.79 M USD, while the quarter before that showed 246.79 M USD of net income which accounts for −156.24% change. Track more CleanSpark, Inc. financial stats to get the full picture.

No, CLSK doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 270 employees. See our rating of the largest employees — is CleanSpark, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CleanSpark, Inc. EBITDA is 144.24 M USD, and current EBITDA margin is 25.16%. See more stats in CleanSpark, Inc. financial statements.

Like other stocks, CLSK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CleanSpark, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CleanSpark, Inc. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CleanSpark, Inc. stock shows the neutral signal. See more of CleanSpark, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.