EOSE trade ideas

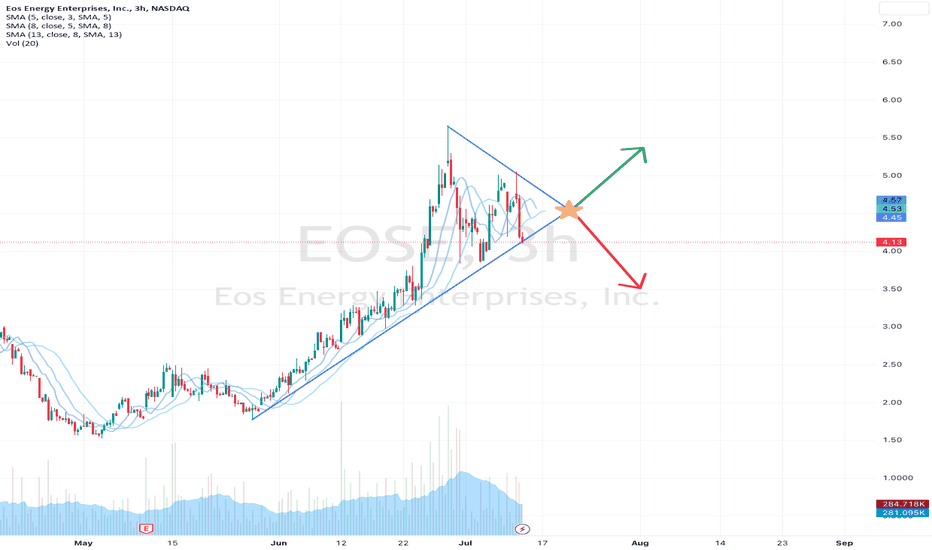

$EOSE heading towards DOE Loan eventIt is widely expected that the Department of Energy will announce conditional approval of a major loan to NASDAQ:EOSE some time this summer. Basic diligence/forensics show that the white house is on a Bidenomics tour, tweets from the head of the DOE loan programs office also indicating big things coming to the rust belt. This seems to be volatility squeeze forming aiming squarely at the late July/Early August event, which could result in a bullish jump if they get the loan.

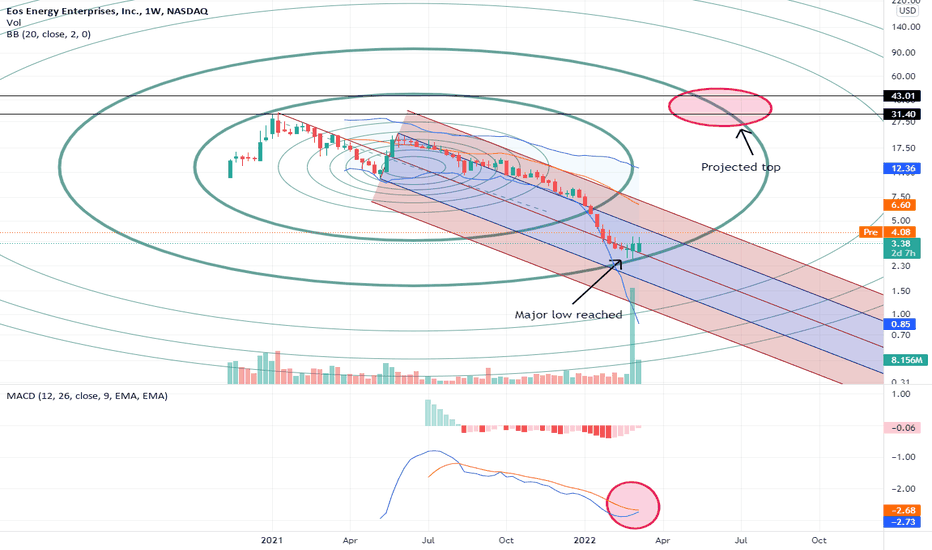

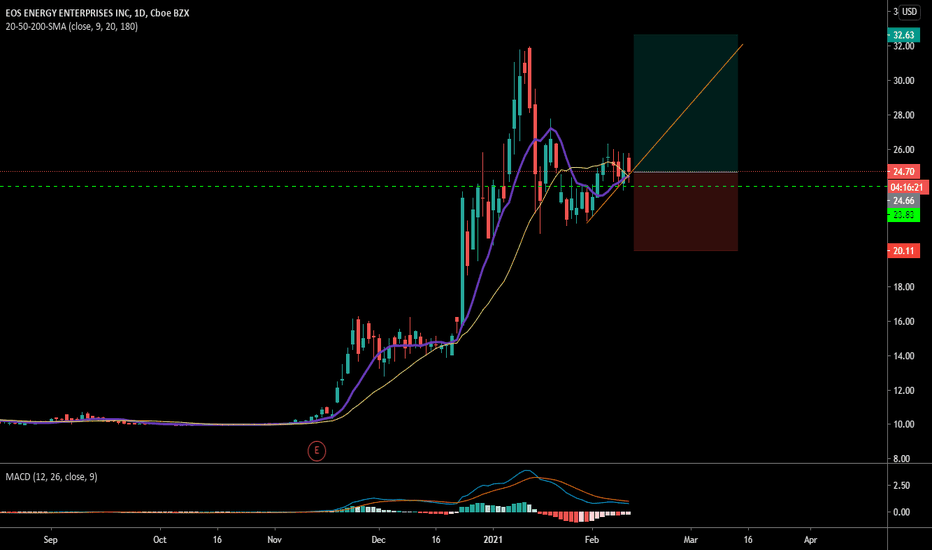

Love EOSE as long-term holdTechnical: Strong breakout on weekly chart. Volume coming in strong the last few weeks.

Fundamental:

EOS Energy Enterprises Inc. (EOSE) is a company that specializes in designing and developing innovative battery storage solutions for various industries. The company operates in the energy sector, which is a rapidly growing and dynamic industry that is constantly in need of advanced and reliable energy storage solutions. EOS Energy's battery storage solutions have garnered a lot of attention and recognition due to their exceptional performance and cost-effectiveness, which is reflected in their financials.

The company's financials are impressive. EOS Energy has shown consistent revenue growth in recent years, with a revenue of $5.6 million in 2019 and $6.5 million in 2020, which is a 16% increase in revenue year-over-year. In addition, the company's gross profit margins have been increasing, from 29% in 2019 to 36% in 2020. Furthermore, EOS Energy has a strong balance sheet, with a debt-to-equity ratio of only 0.06 and a cash balance of $81.5 million as of December 31, 2020. This strong financial position provides the company with a solid foundation to pursue growth opportunities and continue to innovate.

The global demand for energy storage solutions is rapidly increasing, with analysts predicting a compound annual growth rate (CAGR) of 32.7% from 2020 to 2027. This growth is driven by the increasing use of renewable energy sources, which are intermittent and require energy storage solutions to ensure a reliable supply of electricity. EOS Energy's battery storage solutions are uniquely positioned to capitalize on this growth, as they offer a superior product that is both cost-effective and reliable. In addition, the company has established strategic partnerships with leading energy companies such as Siemens Energy and Schneider Electric, which provides further validation of the value of its technology.

EOS Energy has a strong pipeline of projects, which is expected to drive further growth. The company has a backlog of $204 million in signed contracts as of December 31, 2020, which represents a significant increase from the $8.8 million backlog it had in 2019. This backlog includes contracts for both commercial and industrial customers, as well as utility-scale projects. Furthermore, the company has a robust pipeline of potential projects, with a total pipeline of $2.2 billion as of December 31, 2020. This pipeline includes potential projects in various industries, such as healthcare, data centers, and renewable energy.

EOS Energy is a company that is well-positioned to capitalize on the rapid growth of the energy storage industry. The company's strong financials, superior technology, and strategic partnerships provide a solid foundation for growth, while its strong pipeline of projects offers further potential for expansion. Given these factors, EOS Energy is a bullish investment opportunity for investors looking to gain exposure to the energy storage industry

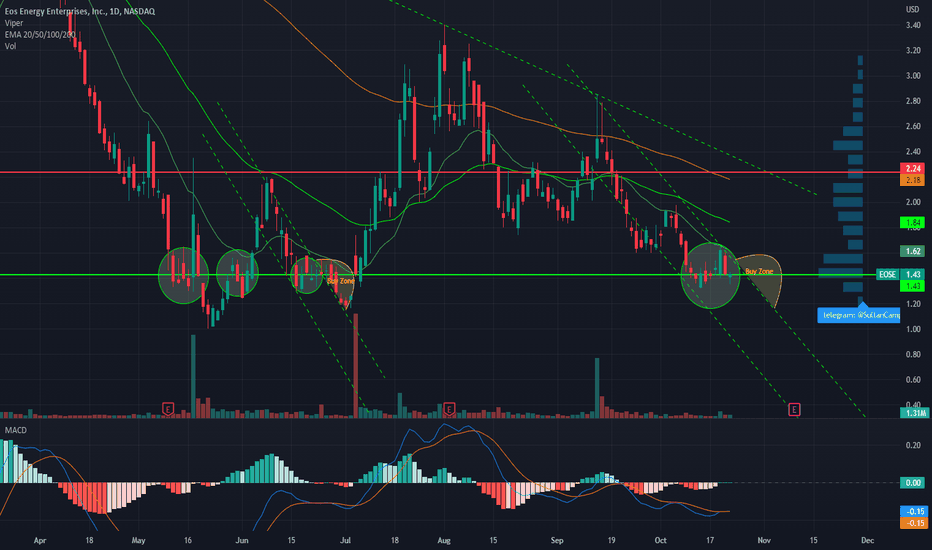

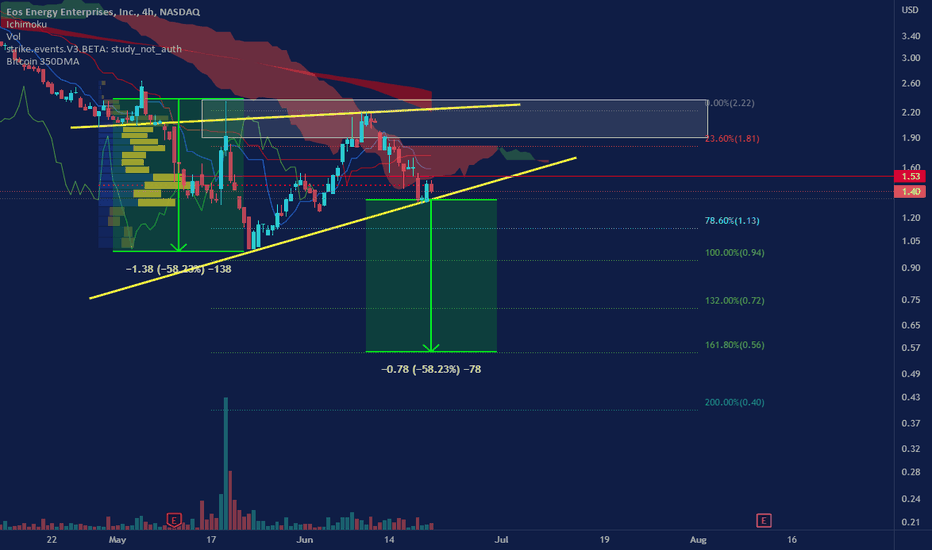

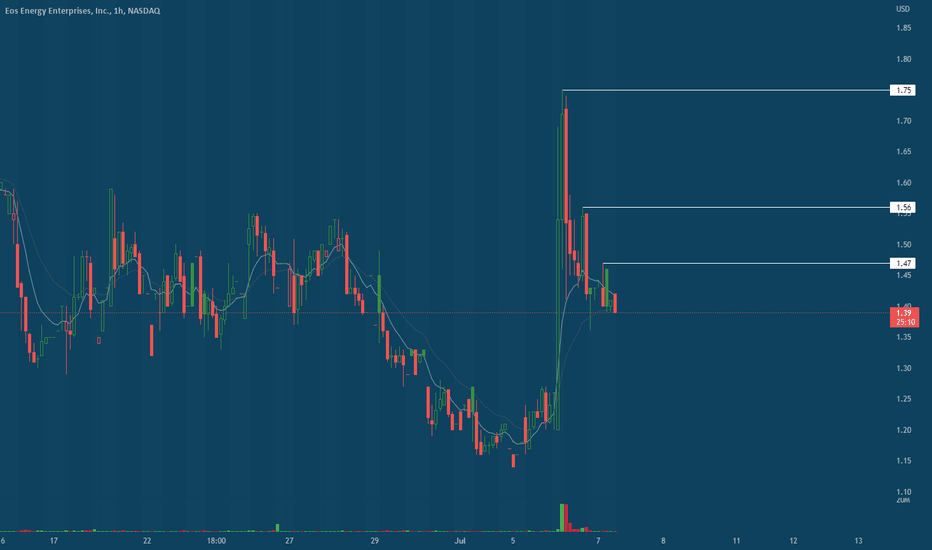

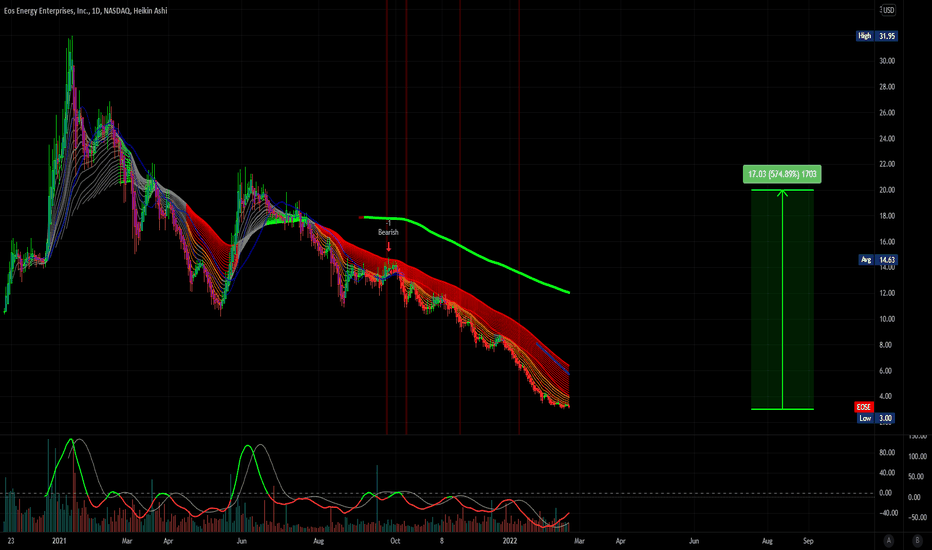

EOSE Long UpdateThere's no doubt the energy sector is hot at the moment. I like EOSE from recent trends. We've seen a considerable pull-back here, under $1.50 could possibly see a nice entry point in the yellow highlighted half-arc. If entering the trade, ideally I'm looking to take profits near the key resistance level noted with a horizontal red line.

As always, would be great to hear your alls thoughts.

KC

EOSE longHi All,

My name's Kyle Ciotti and it's my rookie year with trading as of 9/1/2022. I'm excited to work with Trading View's platform - very high-tech & easy to navigate. My background is in financial planning, currently mainly focused on fixed indexed annuity strategy. I'm 34 years old and after a blown $1,500 account in high school I have never tried to trade in the market again - Until now. I'm 34 years old with an SEC-registered Series 65, 63, 6, and SIE license, but, don't let these certifications fool you. I'm an amateur trader like many of you and looking to level up my skills.

My focus is on penny stocks ranging from roughly $0.80 - $2.00.

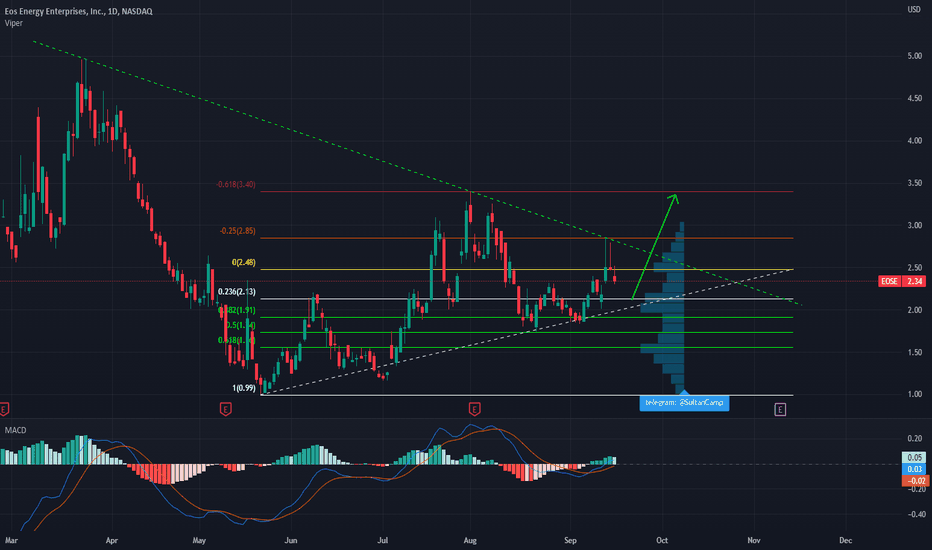

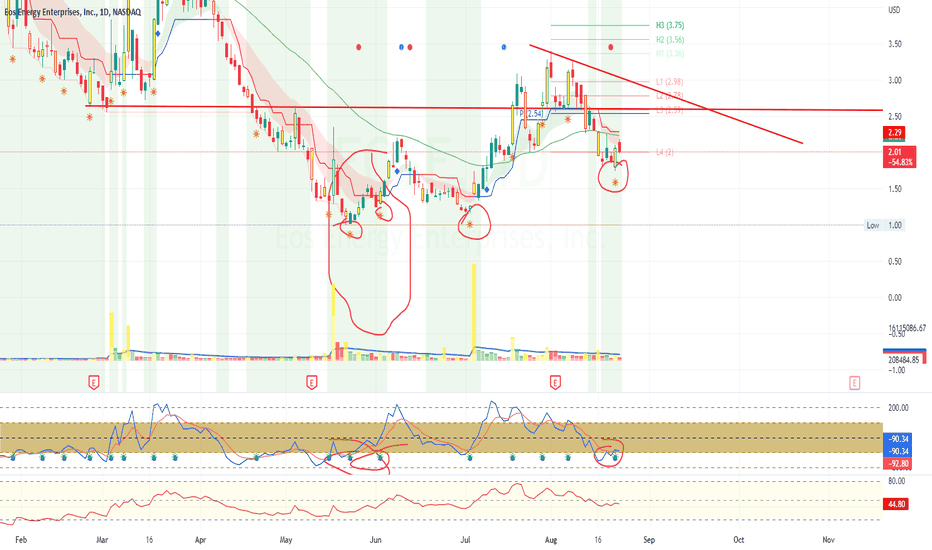

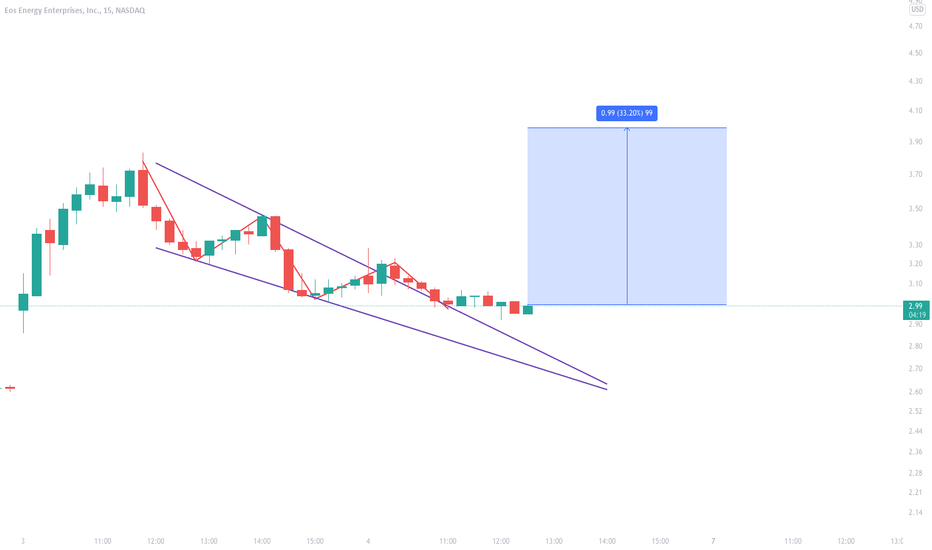

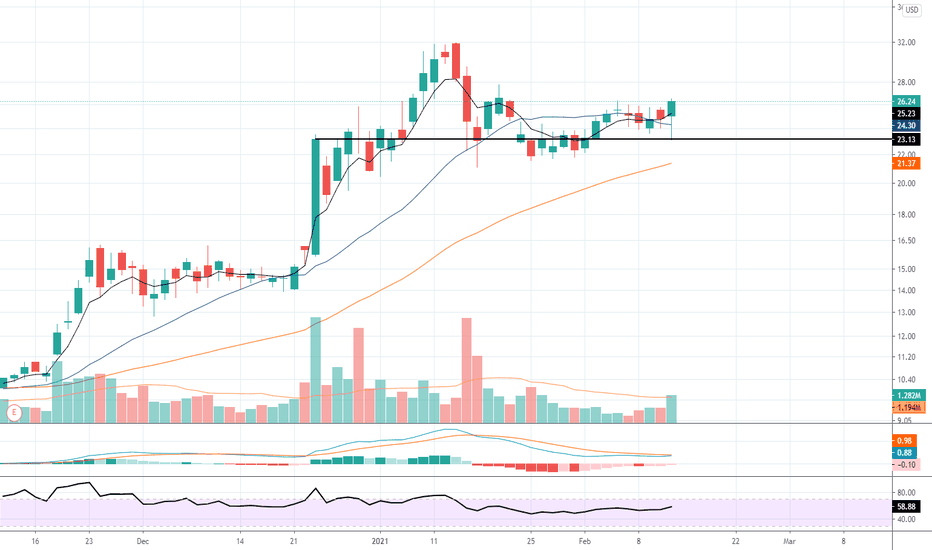

With that said, after reading an article online I was fascinated with Eos Energy (EOSE). After analyzing the charts it looks like it could be set up as a long opportunity. The company is developing battery technology to rival lithium-ion technology. And, with bullish/bearish trendlines converging around $2.30, I think this stock could see some explosive growth.

I set EOSE buy price between $2.10 - $2.15

Target sell price points are between $2.48 - $3.40

I currently set my stop price level at -2.5%. I understand this is an aggressive stop percentage, however, until I have enough data to argue for changing it then it'll stay at -2.5%.

Thanks for stopping by!

KC

$EOSE Description: Eos Energy Enterprises, Inc. designs, manufactures, and deploys battery storage solutions for utility, commercial and industrial, and renewable energy markets in the United States. The company offers stationary battery storage solutions. Its flagship product is the Eos Znyth DC battery system designed to meet the requirements of the grid-scale energy storage market. The company was founded in 2008 and is headquartered in Edison, New Jersey.

Industry: Electrical Equipment & Parts

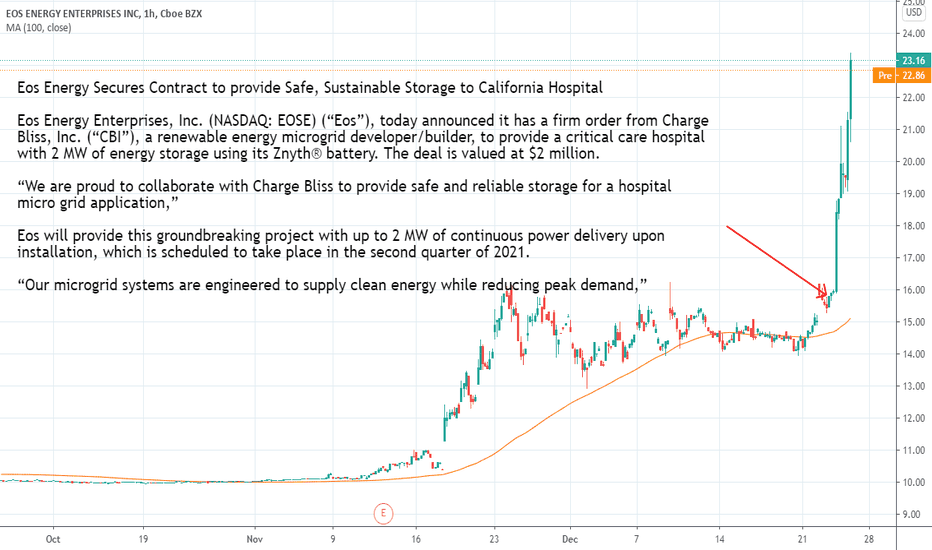

Eos Energy Secures Contract valued at $2 millionEos Energy Secures Contract to provide Safe, Sustainable Storage to California Hospital

Eos Energy Enterprises, Inc. (NASDAQ: EOSE) (“Eos”), today announced it has a firm order from Charge Bliss, Inc. (“CBI”), a renewable energy microgrid developer/builder, to provide a critical care hospital with 2 MW of energy storage using its Znyth® battery. The deal is valued at $2 million.

“We are proud to collaborate with Charge Bliss to provide safe and reliable storage for a hospital micro grid application,”

Eos will provide this groundbreaking project with up to 2 MW of continuous power delivery upon installation, which is scheduled to take place in the second quarter of 2021.

“Our microgrid systems are engineered to supply clean energy while reducing peak demand,”

finance.yahoo.com