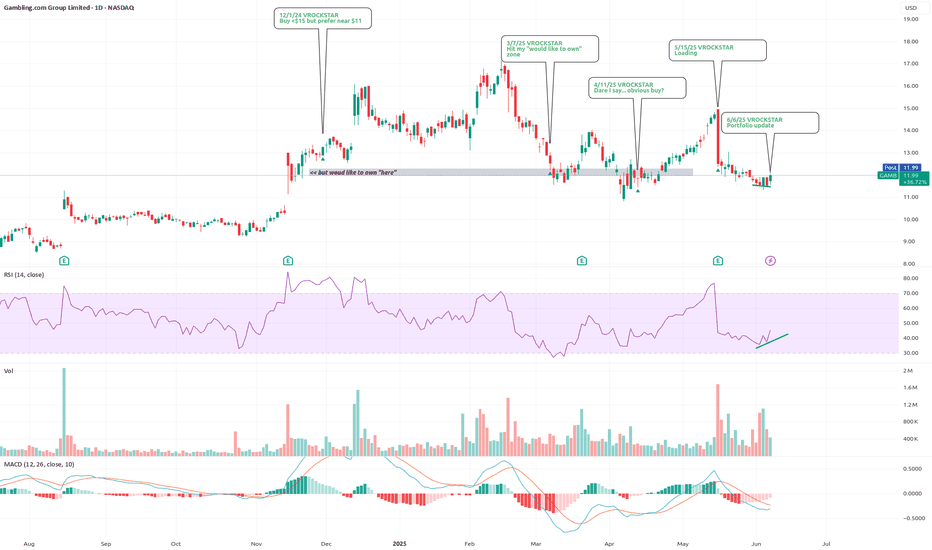

6/6/25 - $gamb - Portfolio update 6/6/25 :: VROCKSTAR :: NASDAQ:GAMB

Portfolio update

- mkt sentiment right now is in twilight zone. ape plays running hard. commodities signs of life. ten year static. and headline drama is informing the sentiment. (remember narrative follows price, not the other way around).

- so i think we enter a period where mkt has recovered. we could run. we could dump. probably still +ve drift all else equal. but there are more things that can go wrong that can go right. ultimately the market will remain bid, however, as that's the trend, until something changes. but the "easy money" (iykyk) is done, for now.

- so i'm structuring my book in a way where i have enough dry powder to chase, deploy strategically, but also have a breath of fresh air. still doing solid 20s % on the year and it's been nuts. summer is coming. nothing too obvious out there.

- OTC:OBTC remains my BTC exposure of choice on trad rails. ended the day at about 15% off spot. that's about 35% of my book. i think the convert or merge into ETF is 90-120 days and so a 20% bump is worth the neck. it's big enough to matter, not big enough to hurt if BTC gives us another dip. and ultimately, the only money i can find that's the best denominator and the best bullchit agnostic.

- NASDAQ:NXT has been working nicely. solar subsidies have been the fly in the ointment, but this team just continues to deliver. regardless of the noise. this is about a 17% position for me, nearly 30% gross (2027 ITM LEAPS) and i'm just going to let it run. i'd like to see it lower. but this has worked. no touch.

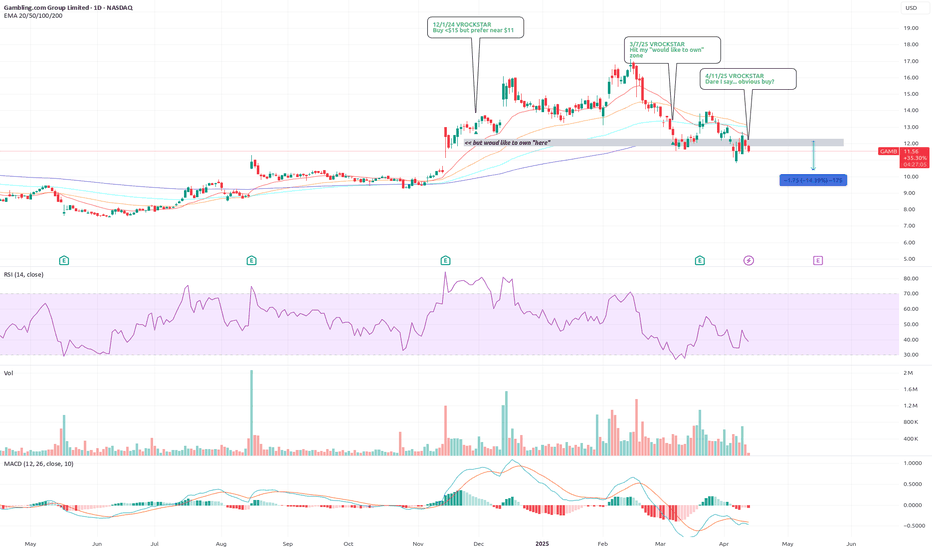

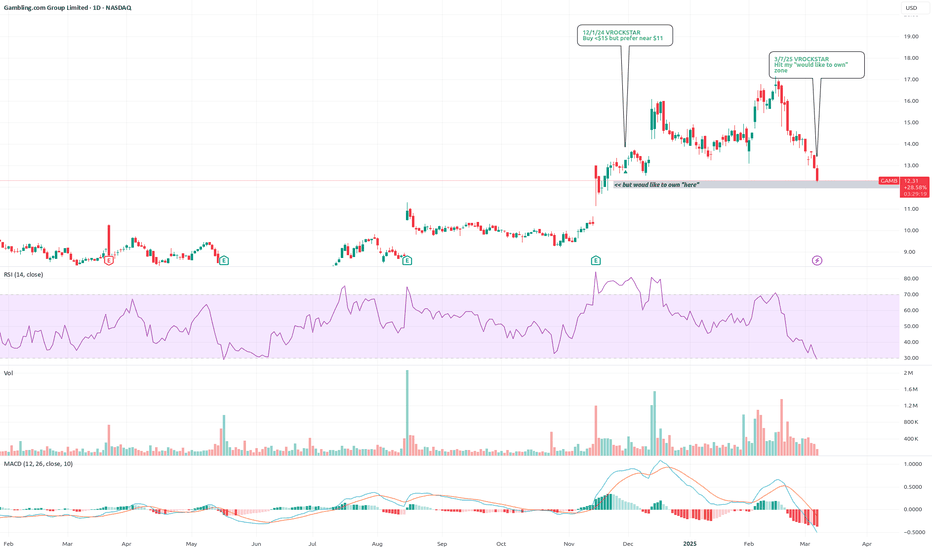

- NASDAQ:GAMB is the new big spot that i've been wrangling since the last (quite good) EPS and the stock did the walk of shame. small caps will be small caps. ppl r concerned that AI demonetizes their currently larger SEO-style biz. that's fair. but data is 25% of rev/ebitda and worth a 2-3x multiple. so as long as they keep growing that in the DD+ the stock will grow into it's natural valuation, anyway, eventually. but i also think the AI concern is overblown and the content/ leads that gamb continues to deliver underscore this. founder led, DD fcf yields. now some good bullish divergence on the daily. you can spot the inverse head and shoulders if u squint hard enough. you know that's not my game. but the setup remains HQ. that's 10% on 4-1 ITM leverage (so 40% gross).

- i necked on NASDAQ:TSLA y day. caught low too. but it's back to a super LEAP position, about 5%. comfy. small enough to not care, large enough to get some juice. still want it lower.

- NYSE:TSM remains 5% (8% gross) LEAPs... again, comfy. want more and will be buying dips. it's too small. but will let it run.

- about 37% gross short on mostly NASDAQ:BUG (i've written about this) thru Dec ATM puts. IV is 20%. seems cheap for the protection it grants for super high multiple stuff which will get dumped first (in profit!) if/as mkt beta turns. for now it's been solid mkt beta. but it's 10-1 for me on about 3%, so 30% ish. and i have some shorts on NYSE:QBTS and NASDAQ:WING , but i trade these around. the main short/ hedge is NASDAQ:BUG

- and about 25% cash give or take.

have a wonderful weekend. <$

V

GAMB trade ideas

Gambling.com GroupI have been watching this company since the start of the year and have been waiting for the right moment to catch this gem.

At the core the fundamentals of this company stand out to me, with the company producing a strong quarter :

Key Highlights Include

Revenue: $40.6M (+39% YoY)

Adjusted EBITDA: $15.9M (+56% YoY)

Adjusted EBITDA Margin: 39% (up from 35%)

Net Income: $11.2M (+54% YoY)

Adjusted Net Income: $16.5M (+78% YoY)

Diluted EPS: $0.31 (vs. $0.19)

Adjusted EPS: $0.46 (vs. $0.24)

Free Cash Flow: $10.3M (+25% YoY)

NDCs (New Depositing Customers): 138,000+ (+29%)

Subscription Revenue: $9.9M (+405%), 24% of total revenue

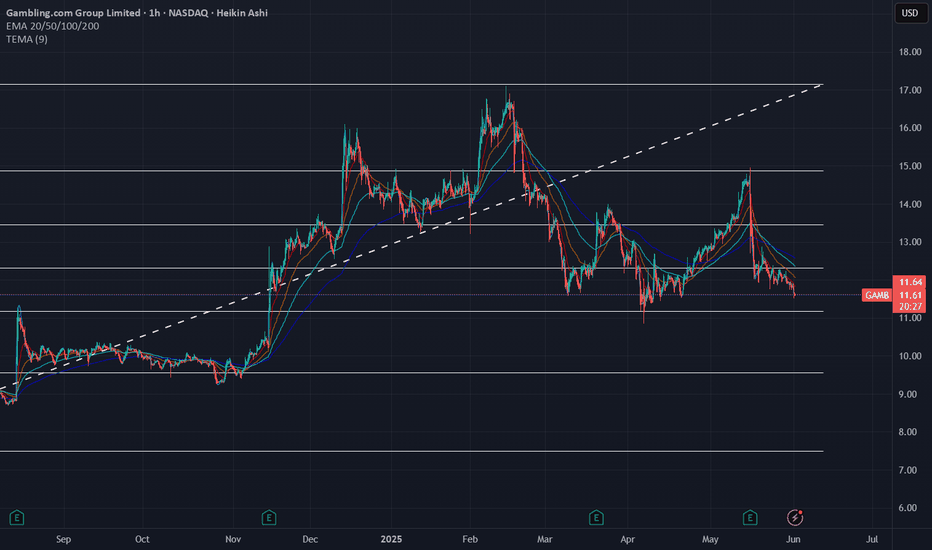

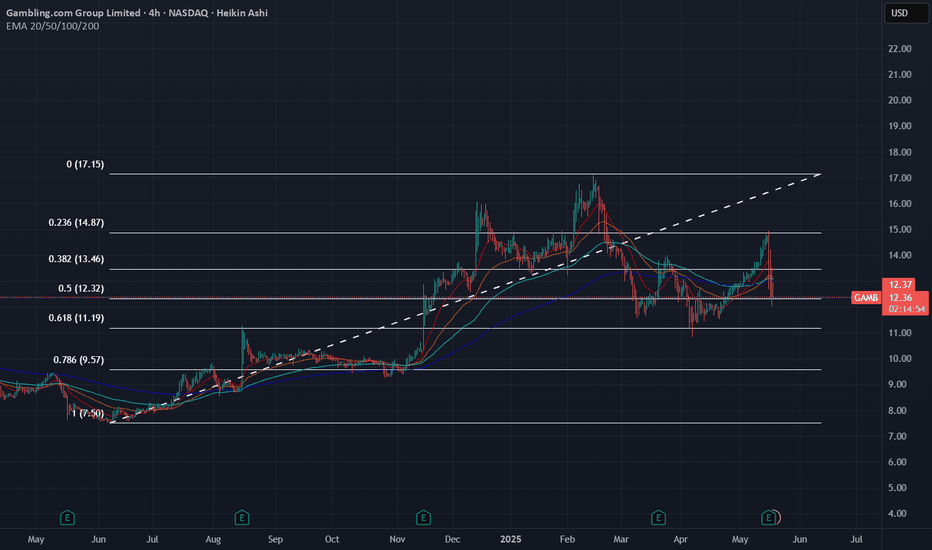

The share price has been slowly declining over the past couple weeks and is nearing my golden Fibonacci zone. I will be looking for a long around the 11.26 zone. A correction of the share price back to its fair value is in order

Stock and options plays Update Market turbulence has been the focal point for any investor/trader with the consistent irrational trade policies enforced by the man himself. Not only has this made it difficult for individuals in the market but also inconvenient for companies to forecast and undertake and sort of consolidation. My recent investigative focus has been primarily on the commodity market and analysis of the supply chain process of major products whether that's ranging from chips, EV batteries and those in-between. I have formulated a list of major stocks i believe are influential and should be known about

- NYSE:TSM current price : 193.92 - KRX:051915 current price : 193,600

- NASDAQ:AMAT current price : 165.06 - NYSE:PAAS current price : 22.72

- NASDAQ:ASML current price : 745.35 - NYSE:ALB current price : 60.04

- NASDAQ:TMC current price : 3.40 - NYSE:SQM current price : 34.26

On another note, due to my focus on derivatives during my Msc course i have been trading options primarily using volatility strategies of long straddles and iron condors on low vol stocks. I am currently attempting to code a volatility surface as project to improve my coding.

Current calls I'm holding

TMC 3 call June 20th (0.55) current price: 0.70 27.27% (underlying rose 15%)

NVDA 135 call May 16th (0.38) current price: 0.98 157.89%

GAMB has plummeted hence the chart, however the financials are impressive and recent acquisitions are proving promising growth.

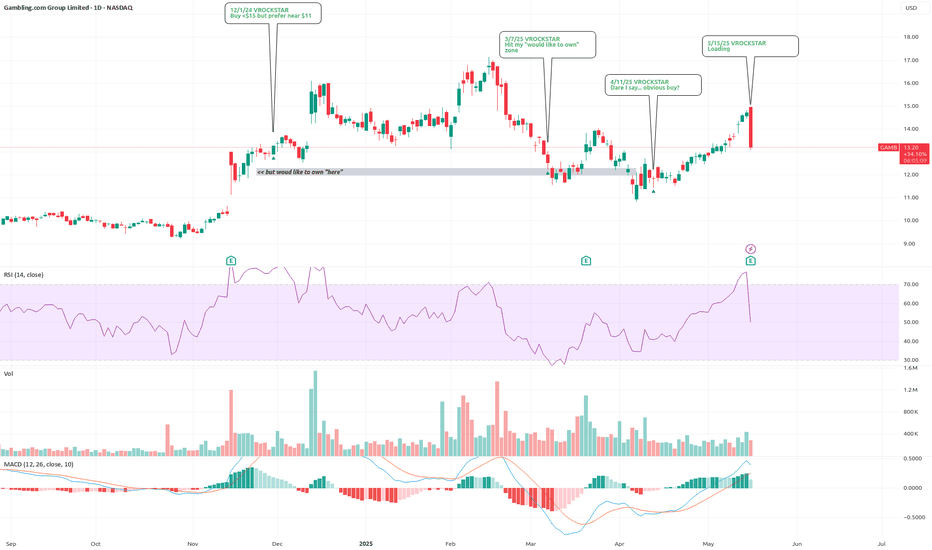

5/15/25 - $gamb - Loading5/15/25 :: VROCKSTAR :: NASDAQ:GAMB

Loading

- great results

- highest growth, roic and cash gen if you can stomach owning a gambling funnel

- stock should be up, not down

- small cap, low flows, weird expiry 5/16 stuff in mkt generally

- 20% position and my goal is to take it to 25% if we see mid 12s again and 30 if we get low 12s (unlikely IMVHO)

- put this on high alert watch list.

V

4/11/25 - $gamb - Dare I say... obvious buy?4/11/25 :: VROCKSTAR :: NASDAQ:GAMB

Dare I say... obvious buy?

- as the 10Y is begging for YCC or some sort of YELP! from the money changers and mouth breathers this weekend...

- here's a name that makes money in a non-tariff exposed way. "yuh but V ppl r poor". yes. and sadly, many ppl will gamble more. it's just what happens.

- FCF yields are in the TEENS here. even in a '26 normalized situation (and the money printers WILL go burr at that pt), really? 17% FCF yield? if they execute let's say that gets priced at 10% FCF yield (nevermind the cash that's produced in '25)... that's a stock that's 50-100% higher, simplistically. even let's discount the next 12 mo at 50%.... so 25-50% higher?

- it's a smaller cap. so clearly subject to factor flows in a tide/ liquidity go out situation. big gap in the high $10s and even the one right below $9/shr not lost on me.

- but at the current valuation, cash generation/ margin execution, founder led.. M&A oppty etc. etc. I think i'm already buying a dollar for 50c and i'd love for that risk/reward to get improved.

- it's also a pretty rentable stock as the stock waffles. i've now rented a pile of the $12.5 strike calls twice (4/17 will be my next "dividend"). and i intend to continue doing this not because i enjoy leaving what i think are massive upside potential on the table, but just because i gotta play defense (unfortunately) in this current environment.

- 12% position for me on this one today. i'd love to make it 15-20% if we go another leg down in risk in the coming weeks/ months ahead.

minimally put it on your radar. i'd love to hear the opposite POV or any pushback (please!)

have a good weekend.

V

3/7/25 - $gamb - Hit my "would like to own" zone3/7/25 :: VROCKSTAR :: NASDAQ:GAMB

Hit my "would like to own" zone

- we're in the hand grenades and not sniper market

- cash gen here great. good mgns.

- small cap, good growth

- like the CEO

- hit my "would buy" zone today

- i'm allocating about 20% of my book to 1-2.5% positions this year that i plan to rent out (covered calls) when the mkt finds some form of bottom/ move

- even tho "everything" has 20-30% downside potential, the goal is to avoid the -50% + type names and know what i own

- for that reason my book remains

- OBTC 40%, NXT ITM LEAPS 35%, i keep bouncing between NVDA/TSM... but think TSM keeps me more protected on downside magnitude w/ clear visibility for upside (avgo result highlights why... "unlimited" demand for this fab)

- lmk if u see differently on $GAMB. I still like OTC:EVVTY more, but don't like the fact that i can't sell calls on it.

V

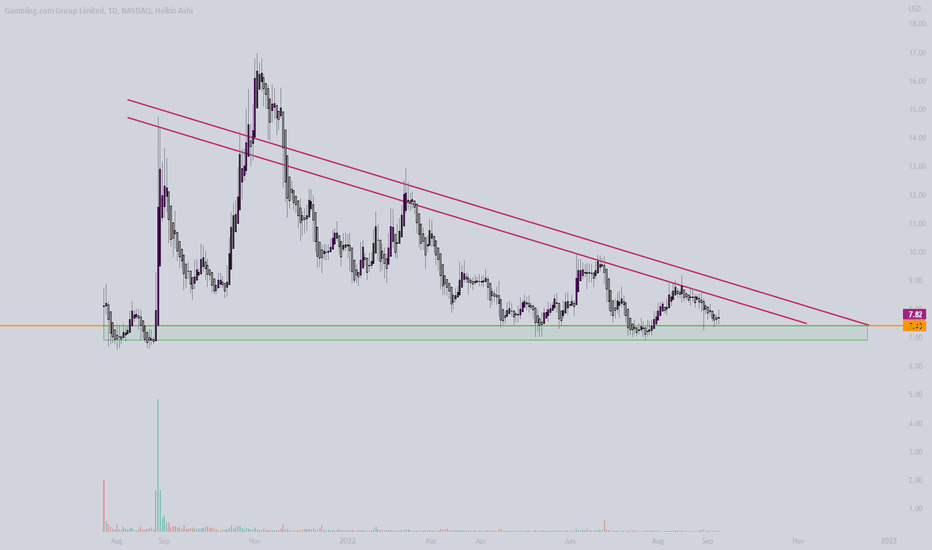

$GAMB Bullish Breakout??Gamb is on the rise and ready to break out of its already strong trend. Gambling.com Group Ltd is a marketing company that specializes in digital marketing for the online gambling industry. They focus on iGaming and sports betting. The company was started by Charles Gillespie and Kevin McCrystle on July 26, 2006, and is based in St. Helier, the United Kingdom.

Online casino regulation is different around the world. In the US, it’s mostly state-specific, while in Europe, it’s a mix of different approaches. Some important things to consider include licensing, protecting players, anti-money laundering (AML), and taxes. It seems like the market is growing and that companies are making sure they’re following the rules, but there are still some challenges like competition and making sure players are protected. #OnlineGambling #Regulation

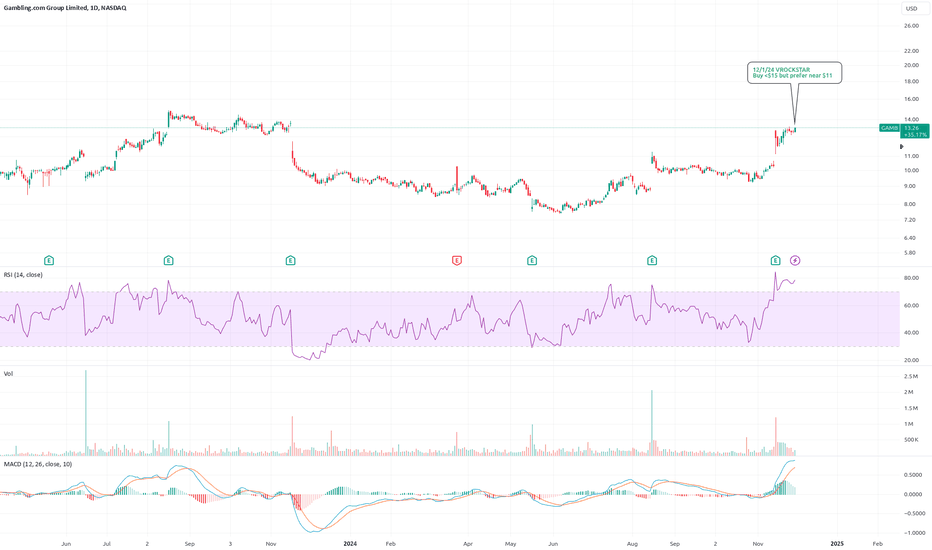

12/1/24 - $gamb - Buy <$15 but prefer near $1112/1/24 :: VROCKSTAR :: NASDAQ:GAMB

Buy <$15 but prefer near $11

- thanks to anon for flagging this one

- cap at sub $500 mm and minimal debt great

- growing mgns and cash flow generation, no stonk based comp issues to flag

- awesome margins (GM and EBITDA)

- supplier to key accounts e.g. NASDAQ:DKNG

- growing well and sub 15x PE today seems reasonable

- not as familiar with gaming names as others, but enough aware to know a good valuation when i see it and chart looks legit and beats are there

- would be something i'd add on a pullback, not going to be too greedy as i'd likely become involved sooner than later (i tend to carry things at even 10 or 25 bps to keep a close eye on it if it's top of watchlist as this has become)

- what do you guys think?

V

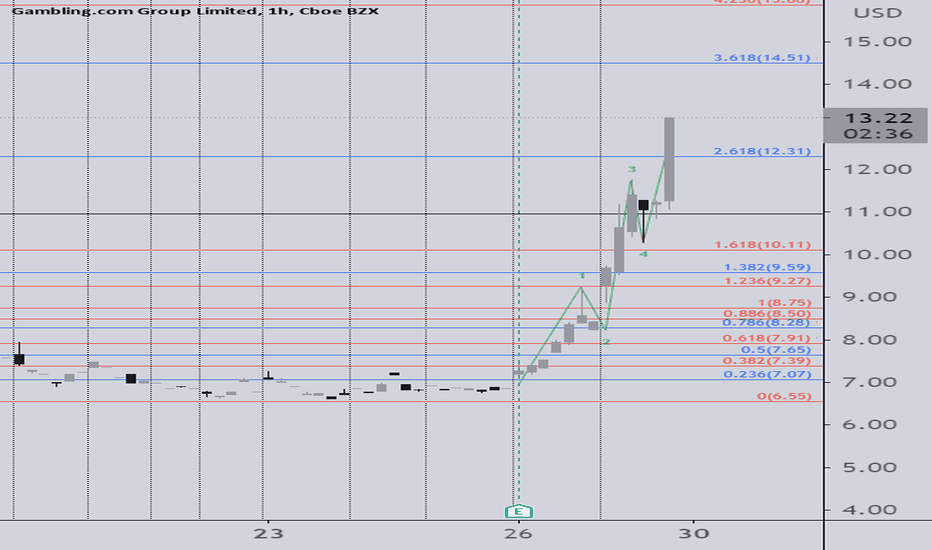

GAMB pushed ATH today, can we see $12.31 before a pull back?Gambling.com Group Limited, just went public and has been something I've been anticipating for awhile now as I have seen this company grow from under 10 people to over 150 in the last 5 years. As American States are opening up to legal betting they are constantly launching new websites and acquiring domain real estate and owning the affiliate gambling marketplace, as they should, since they are "gambling.com".

today looks like a nice EW and thinking the final wave could break $12.31 at the 2.618 FIB Extension. blasted throught the 1.68 FIB EXT

and as i was typing it we blasted through $12.31