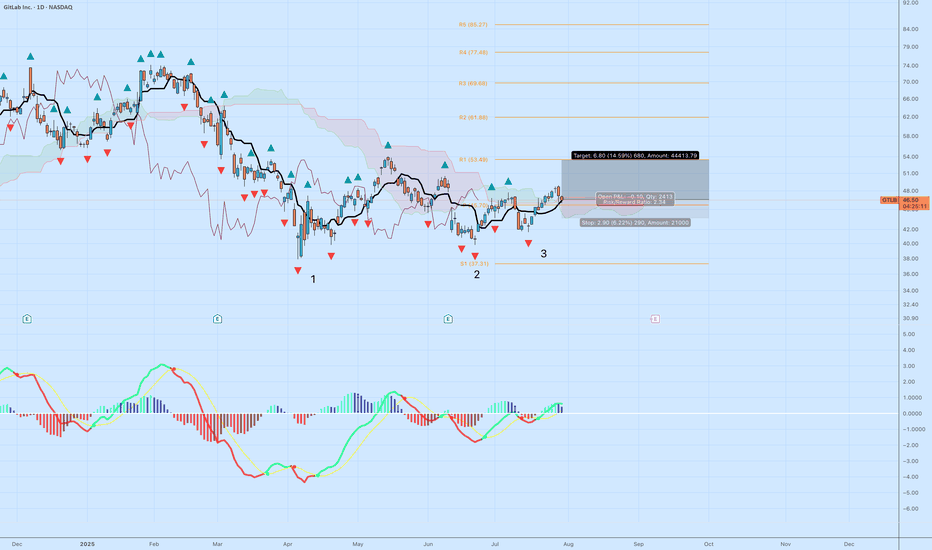

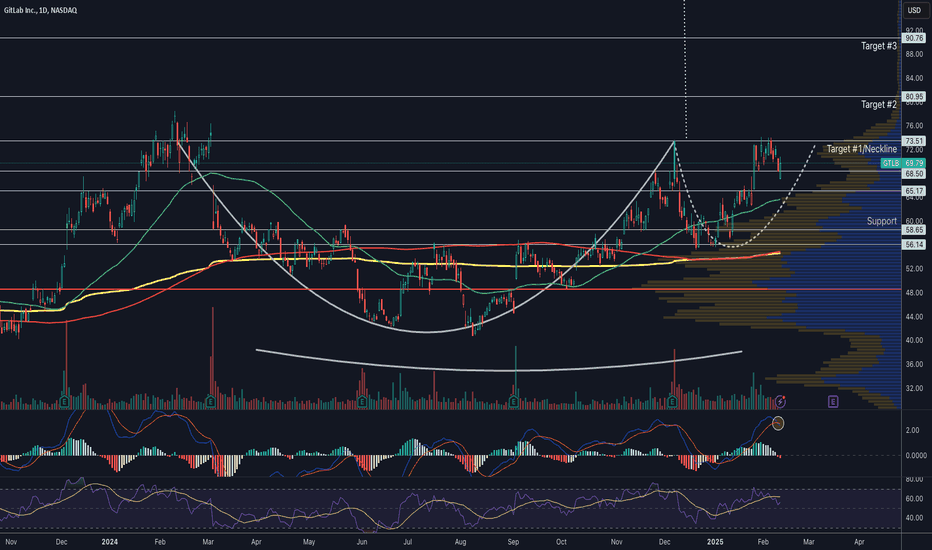

GTLB | Triple Bottom ReversalGitLab (GTLB) is setting up for a potential trend reversal following a textbook triple bottom pattern and a clean breakout above the cloud. Here's the technical breakdown:

Why This Setup Matters

Triple Bottom Pattern: Reversal structure is clear with three defined lows at ~$38, ~$40, and ~$41. The

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.11 USD

−6.33 M USD

759.25 M USD

136.66 M

About GitLab Inc.

Sector

Industry

CEO

William Staples

Website

Headquarters

San Francisco

Founded

2011

FIGI

BBG00DHTYPH8

Gitlab, Inc. provides code hosting and collaboration platform services. It offers continuous integration, source code management, out-of-the-box pipelines, agile development, and value stream management. The company was founded by Dmitriy Zaporozhets and Sid Sijbrandij in 2011 and is headquartered in Dover, DE.

Related stocks

Worst Behind GTLB. Do you think the worst is behind for GTLB?

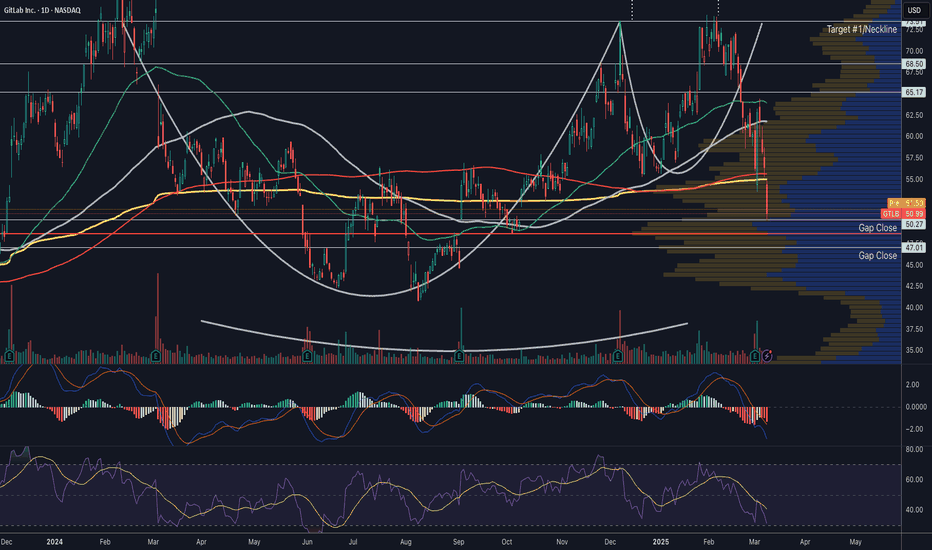

With news of senior management selling stock share and the downgrade, we see a clear test of low since April this year. Since the news always come out the latest, the decline during the last 3 months is likely the explaination to the selling pressure we ha

$GTLB undervalued, Potential 2X, AI assisted coding tailwind- NASDAQ:GTLB is likely one of the play for Agentic AI. When other companies like Windsurf, Codium, Cursor are in a goldrush. NASDAQ:GTLB is selling shovels.

- AI assisted coding is now a theme and is happening at a fast pace. I'm certain NASDAQ:GTLB will be a beneficiary of this trend.

-

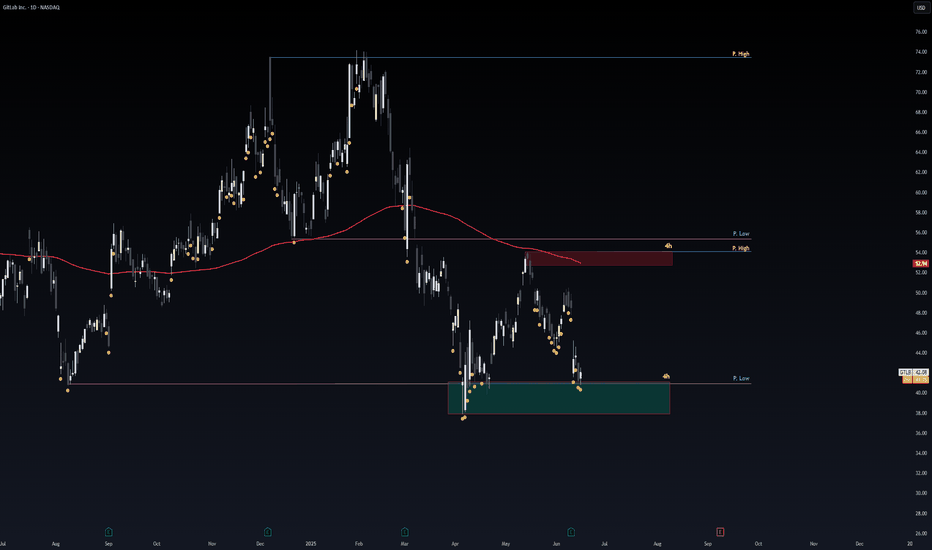

Safe Entry Zone GTLBStock in Ranging Movement.

Stock current at SIGNIFICANT Support Level.

My Beloved Gathie Wood's Best investor ever just bought the stock too.

P.High's & P.Lows(Previous Highs & Previous Lows) acts as good Support and resistances levels.

4h Green Zone Is Buying Zone.

4h Red Zone is Selling Zone.

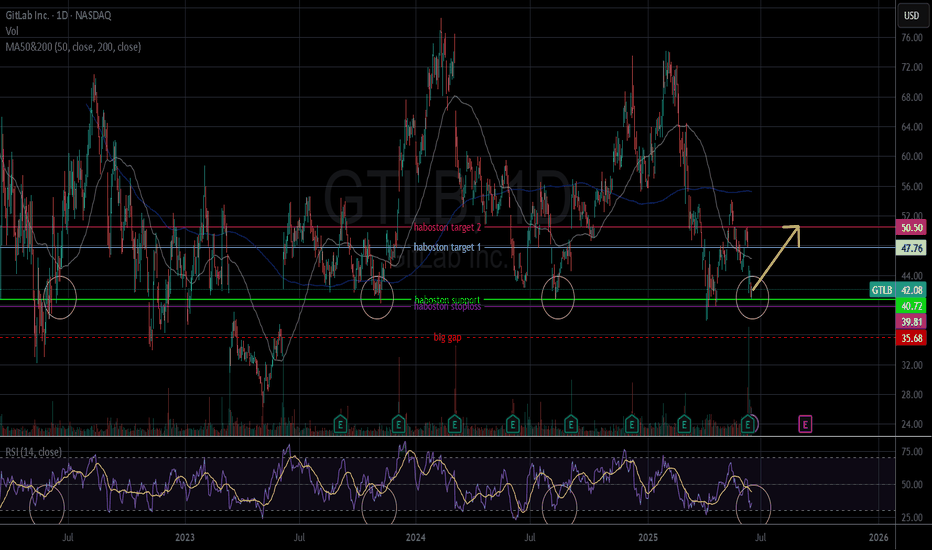

GTLB reverses to increaseBased on wave analysis, the main support line and RSI indicator when the price is oversold below 40, it shows a very high possibility of GTLB reversing to increase.

The price now (Closed on 06.16.2025): $42.08.

Price target: $47.76/ $50.50.

Stop loss: $39.

!!! Important note for stoploss as price

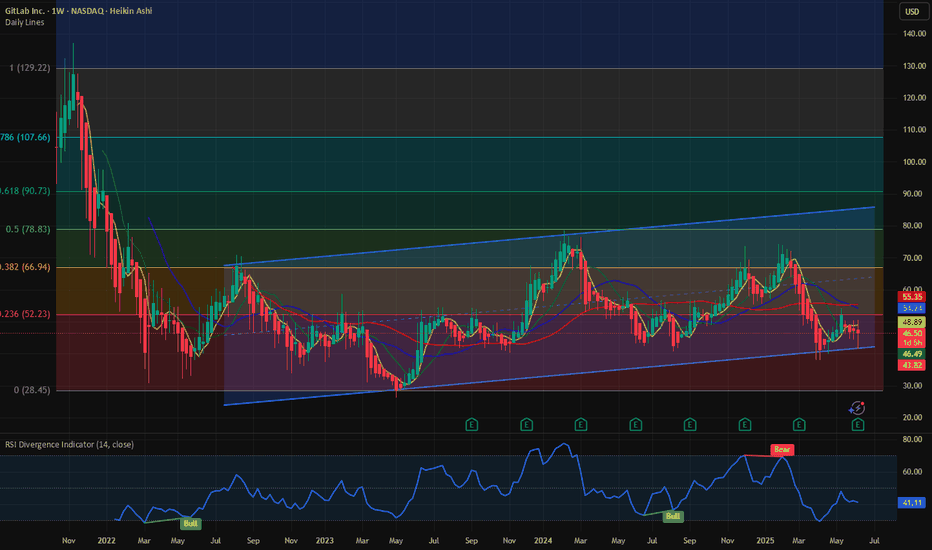

$GTLB: AI SaaS Software stock for tactical and long-term tradeIn this blog space we focus a lot on the AI trade. Be it semiconductors, AI powered Cybersecurity, AI Powered Fintech or just the industry itself, but we have not quietly focused on the AI Software stocks. The second and third derivatives of the AI trade will be more on the software space than Semic

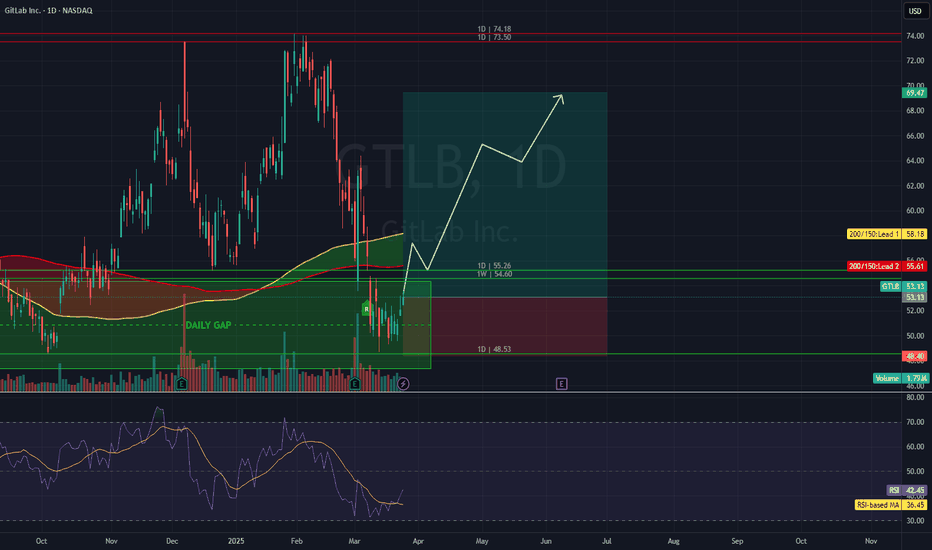

# GitLab's Code Surge #GitLab Inc. (GTLB) is demonstrating potential bullish momentum, with a significant weekly gap around the $50 level. A breakout above the $55.26 level could indicate further strength, positioning the stock to target the $69.47 resistance. This trade setup offers an attractive risk-to-reward ratio, wi

$GTLB - Bad timingNASDAQ:GTLB turned out I couldn't have timed it worse. 😂 During the bear market stocks always backfill their bullish gaps that they left behind. The first gap has been filled. The next gap is around $46 area.

There is a reason why technicians wait for patterns validation. Most wait for 2 to 3 ses

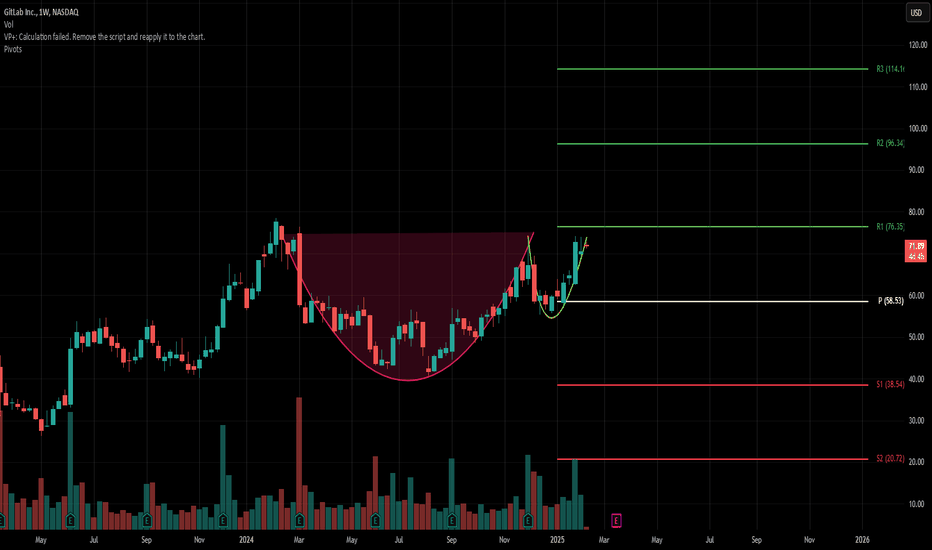

$GTLB is brewing ... Recent earnings estimate revisions for GitLab Inc. have been positive, indicating that analysts are optimistic about the company's near-term performance, which could be influencing the stock's potential upward trend. Plus the weekly chart showing a cup and handle pattern, which add another positive

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where GTLB is featured.

US software stocks: Overlooked operating systems

17 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of GTLB is 41.82 USD — it has decreased by −4.09% in the past 24 hours. Watch GitLab Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange GitLab Inc. stocks are traded under the ticker GTLB.

GTLB stock has fallen by −10.56% compared to the previous week, the month change is a −7.65% fall, over the last year GitLab Inc. has showed a −18.92% decrease.

We've gathered analysts' opinions on GitLab Inc. future price: according to them, GTLB price has a max estimate of 85.00 USD and a min estimate of 45.00 USD. Watch GTLB chart and read a more detailed GitLab Inc. stock forecast: see what analysts think of GitLab Inc. and suggest that you do with its stocks.

GTLB reached its all-time high on Nov 9, 2021 with the price of 137.00 USD, and its all-time low was 26.24 USD and was reached on May 4, 2023. View more price dynamics on GTLB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

GTLB stock is 6.46% volatile and has beta coefficient of 1.27. Track GitLab Inc. stock price on the chart and check out the list of the most volatile stocks — is GitLab Inc. there?

Today GitLab Inc. has the market capitalization of 6.91 B, it has decreased by −5.59% over the last week.

Yes, you can track GitLab Inc. financials in yearly and quarterly reports right on TradingView.

GitLab Inc. is going to release the next earnings report on Sep 9, 2025. Keep track of upcoming events with our Earnings Calendar.

GTLB earnings for the last quarter are 0.17 USD per share, whereas the estimation was 0.15 USD resulting in a 13.86% surprise. The estimated earnings for the next quarter are 0.16 USD per share. See more details about GitLab Inc. earnings.

GitLab Inc. revenue for the last quarter amounts to 214.51 M USD, despite the estimated figure of 212.96 M USD. In the next quarter, revenue is expected to reach 226.90 M USD.

GTLB net income for the last quarter is −35.88 M USD, while the quarter before that showed 10.78 M USD of net income which accounts for −432.67% change. Track more GitLab Inc. financial stats to get the full picture.

No, GTLB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 2.38 K employees. See our rating of the largest employees — is GitLab Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GitLab Inc. EBITDA is −102.53 M USD, and current EBITDA margin is −16.44%. See more stats in GitLab Inc. financial statements.

Like other stocks, GTLB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GitLab Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GitLab Inc. technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GitLab Inc. stock shows the sell signal. See more of GitLab Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.