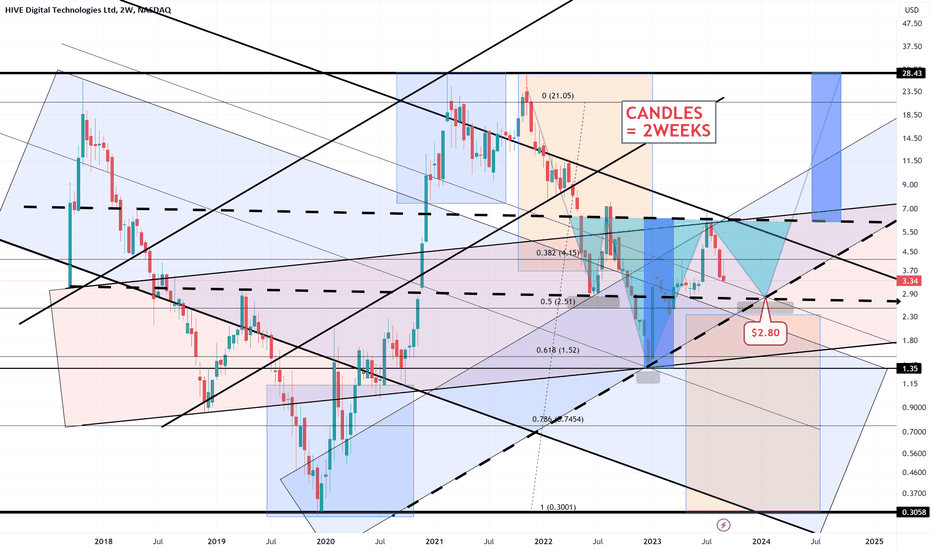

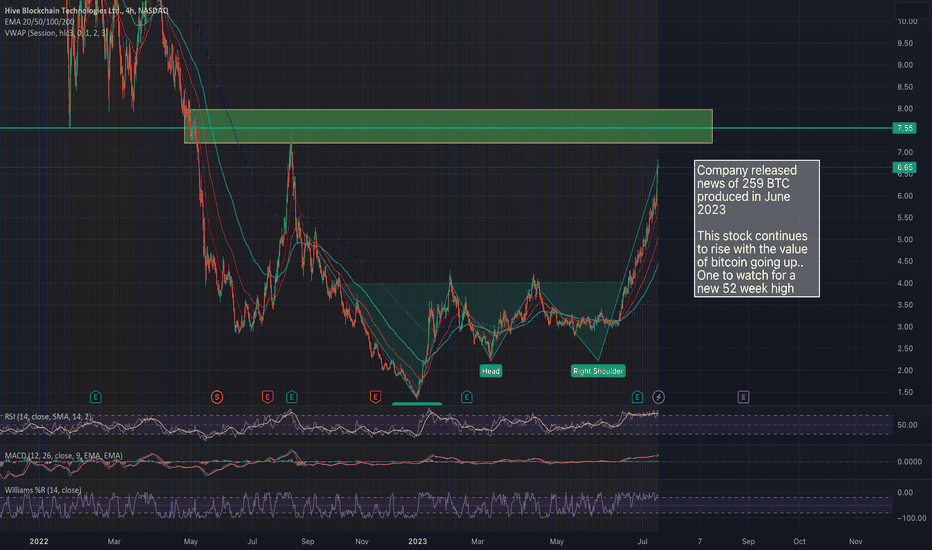

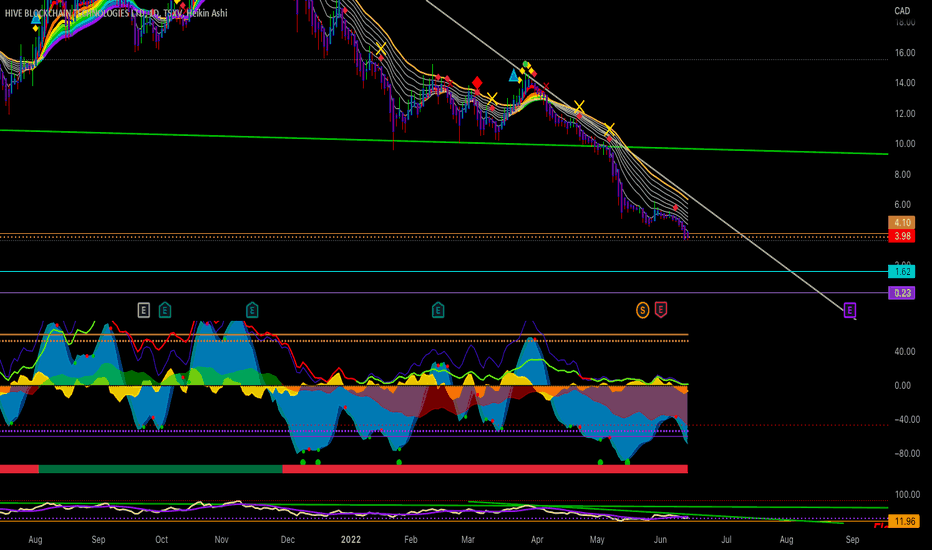

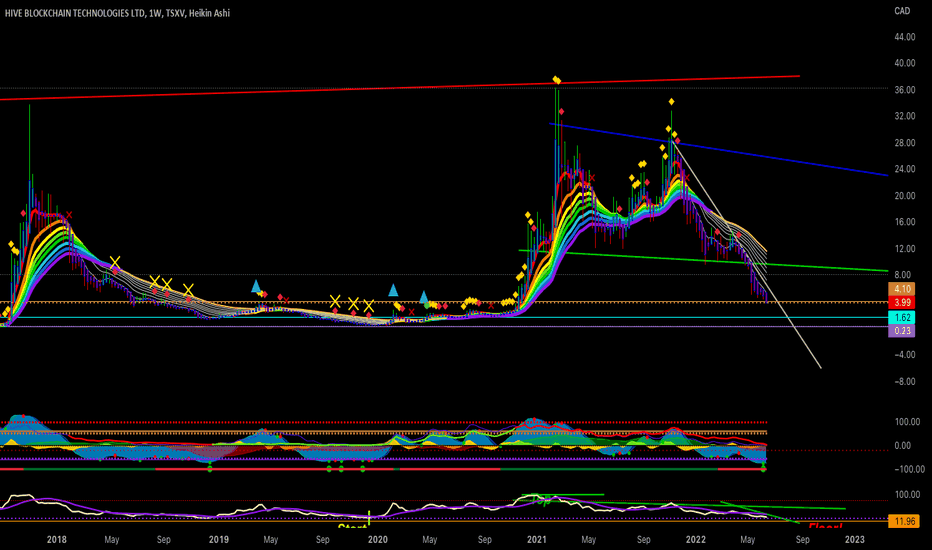

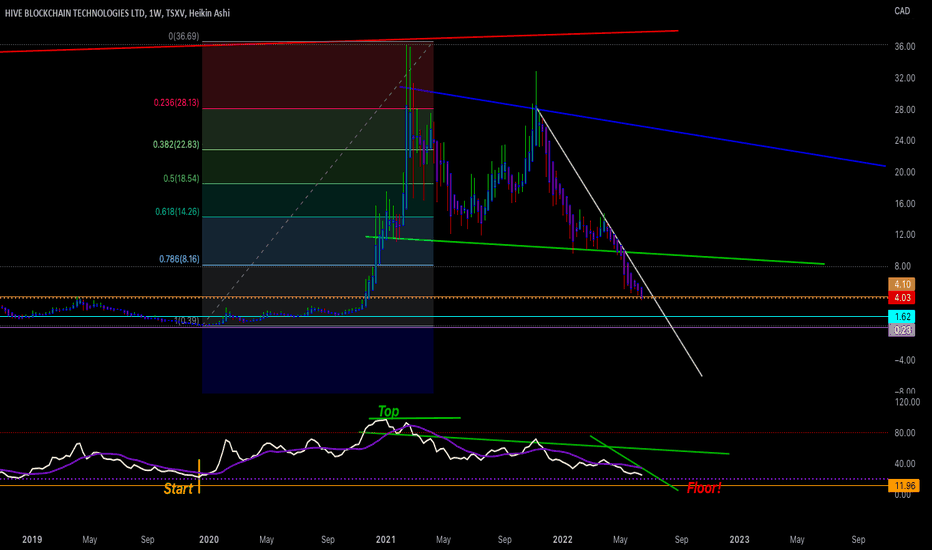

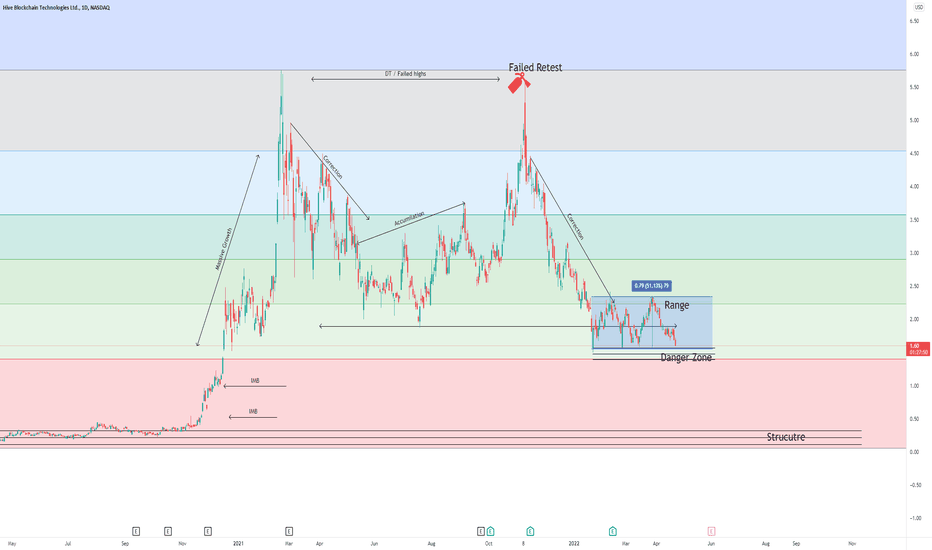

HIVE Next Steps 2023 Q3 & BeyondAm expecting HIVE to continue consolidating within a reversal Head & Shoulders pattern.

Applying the trendlines to the fib line retracement and extension mappings, building out the various channels and then overlaying the relevant pattern(s), it appears the bottom of the right shoulder is approx. $2.80 and the future target is approx. $28.

DYOR NFA ... if $2.80 breaks, may result in a double-bottom around the $0.30 range.

Enjoy every sandwich :)

HIVE trade ideas

Hive (NASDAQ: HIVE) Digital Expands Crypto FootprintHive Digital Expands Crypto Footprint With Sweden Data Center Acquisition

Hive Digital Technologies, a prominent player in cryptocurrency mining, is set to fortify its global influence with the acquisition of a data center and real property in Boden, Sweden. Notably, the move underscores Hive’s commitment to sustainable growth and positions it as a major player in the digital technology sector.

Meanwhile, this strategic investment aligns with the company’s mission to enhance long-term value for investors, leveraging substantial assets to strengthen its balance sheet. The acquisition is expected to contribute to the company’s overall growth strategy and reinforce its commitment to environmental responsibility and energy efficiency.

Hive Digital Broadens Horizon with Sweden Data Center Acquisition

Crypto mining company Hive Digital Technologies has announced a significant expansion initiative with the acquisition of a data center and associated real property in Boden, Sweden. The move aligns with Hive’s commitment to sustainable growth, emphasizing its role as a leading digital asset miner and “green” focused data center builder and operator.

Meanwhile, Hive’s latest move involves a property transfer agreement with Turis AB, solidifying its presence in Boden, Sweden. Notably, this strategic investment complements Hive’s existing data center in close proximity and stems from the European Union’s Horizon 2020 project. In addition, the company plans to leverage this new facility to house its next-generation ASIC servers, aiming to augment its Bitcoin production and further develop its global portfolio.

Johanna Thornblad, Hive Sweden Country President, expressed enthusiasm about the acquisition, citing its strategic location and potential contribution to the company’s growth strategy. In addition, she emphasized the new data center’s alignment with Hive’s commitment to environmental responsibility and energy efficiency, highlighting its status as a “green” energy-powered facility.

According to the Property Transfer Agreement, Hive will acquire the property and on-site assets through a combination of cash and common shares. The company plans to pay up to $750,000 in cash and up to $1,500,000 in common shares, reflecting its dedication to building long-term value for investors.

Notably, completion of the acquisition is subject to regulatory approvals, including the TSX Venture Exchange’s nod. All securities issued as part of the agreement will undergo a statutory hold period of four months and one day from the date of issuance.

Embracing Evolving Technologies

Hive Digital Technologies, earlier in 2023, signaled a shift in focus by dropping “blockchain” from its official name. Meanwhile, the company now emphasizes opportunities in artificial intelligence (AI), cloud computing, and graphics processing units (GPUs).

While maintaining its involvement in Bitcoin and crypto mining, Hive aims to offer efficient alternatives to cloud service providers, leveraging its substantial GPU infrastructure.

Meanwhile, the recent expansion announcement comes on the heels of Hive’s participation in launching the Digital Power Network (DPN), emphasizing the significance of proof-of-work (PoW) mining in the cryptocurrency ecosystem.

Price Momentum

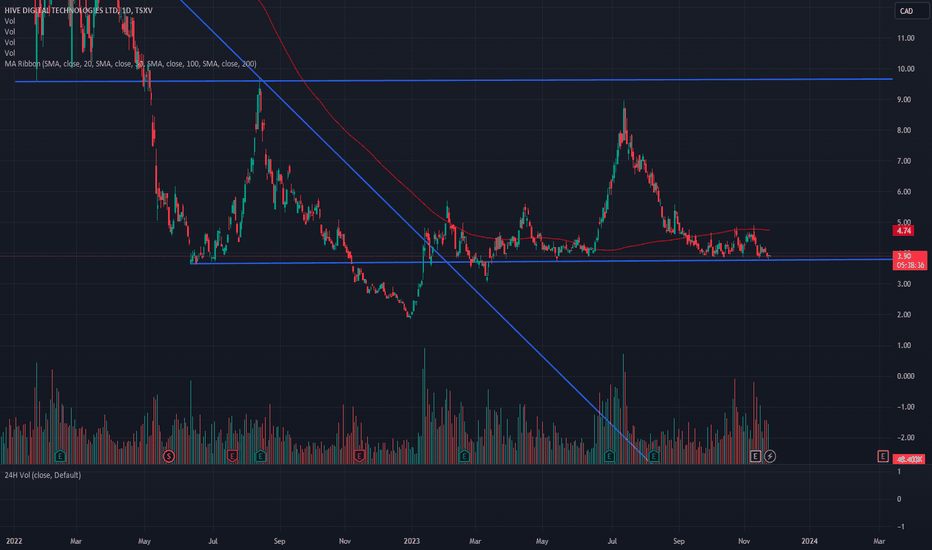

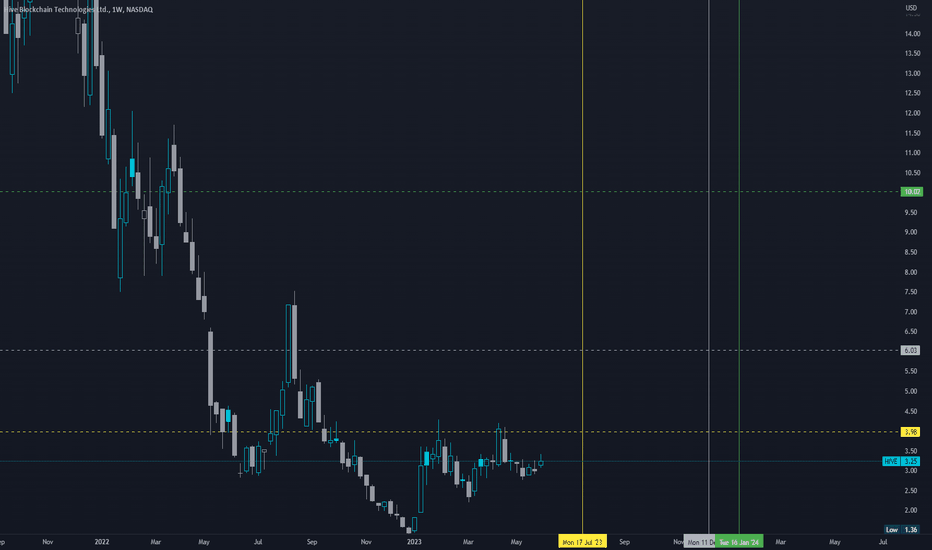

HIVE is trading in the middle of its 52-week range and below its 200-day simple moving average.

What does this mean?

Investors are still evaluating the share price, but the stock still appears to have some downward momentum. This is a Neutral sign for the stock's future value.

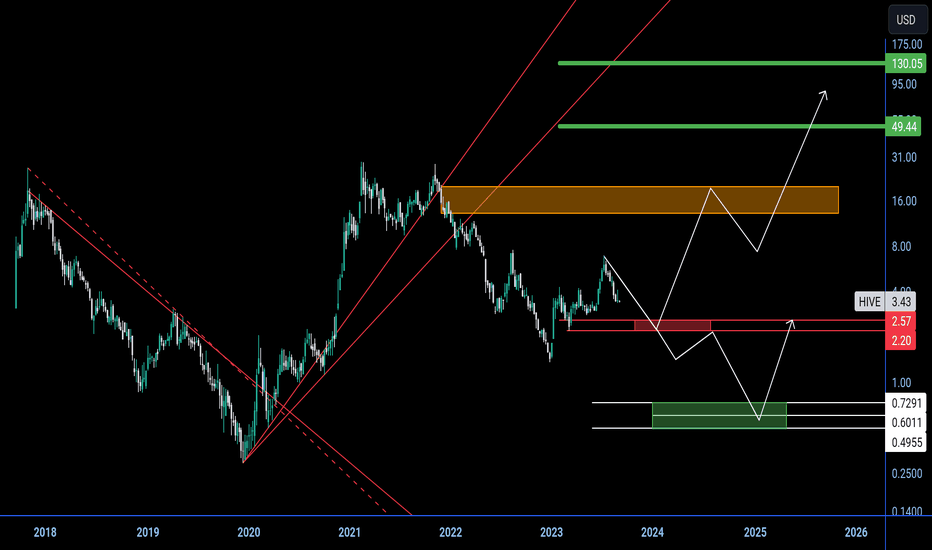

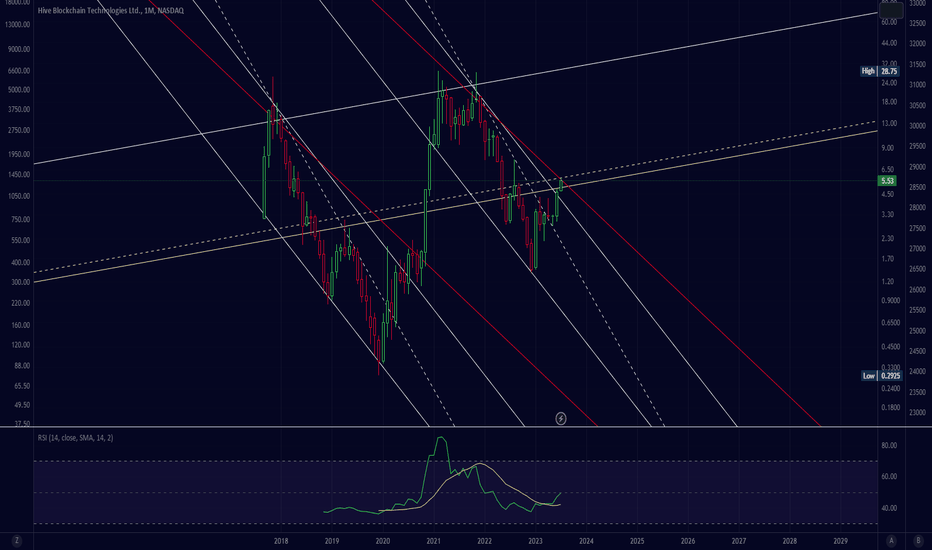

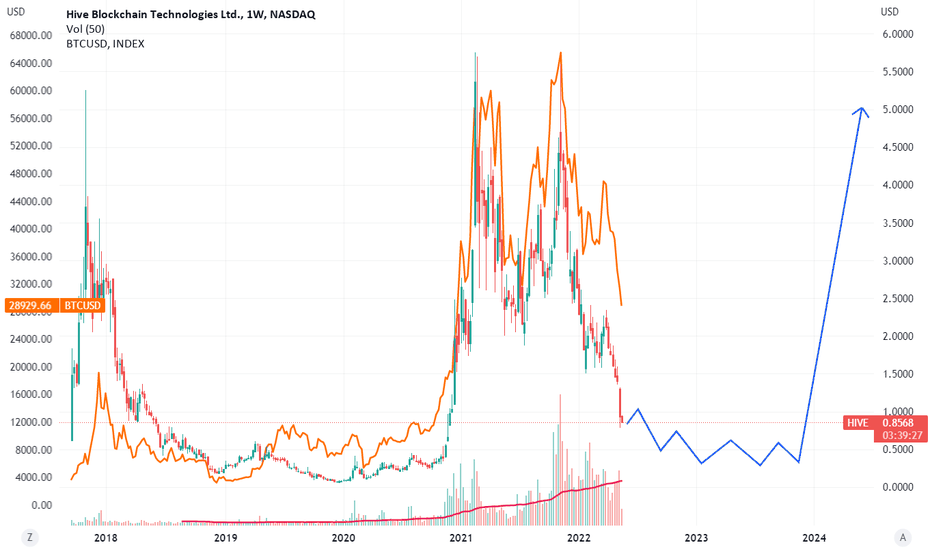

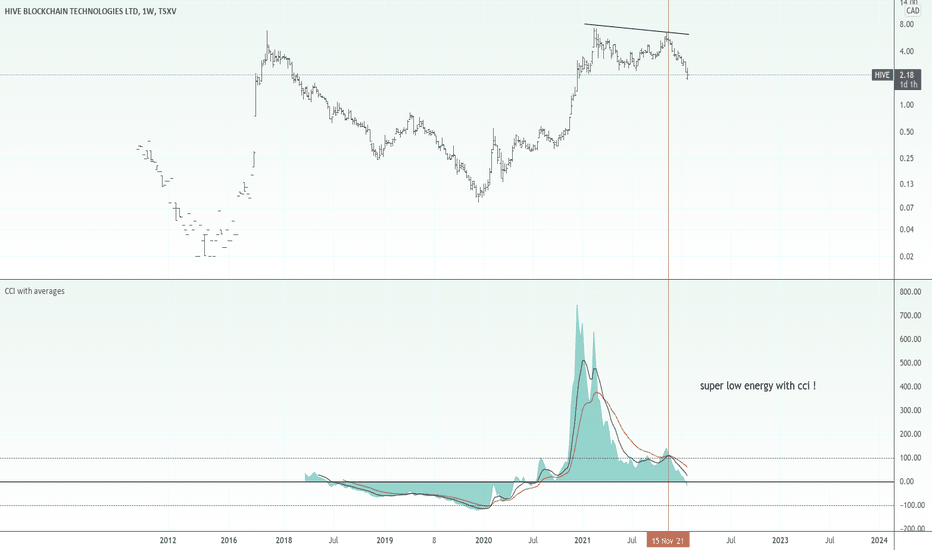

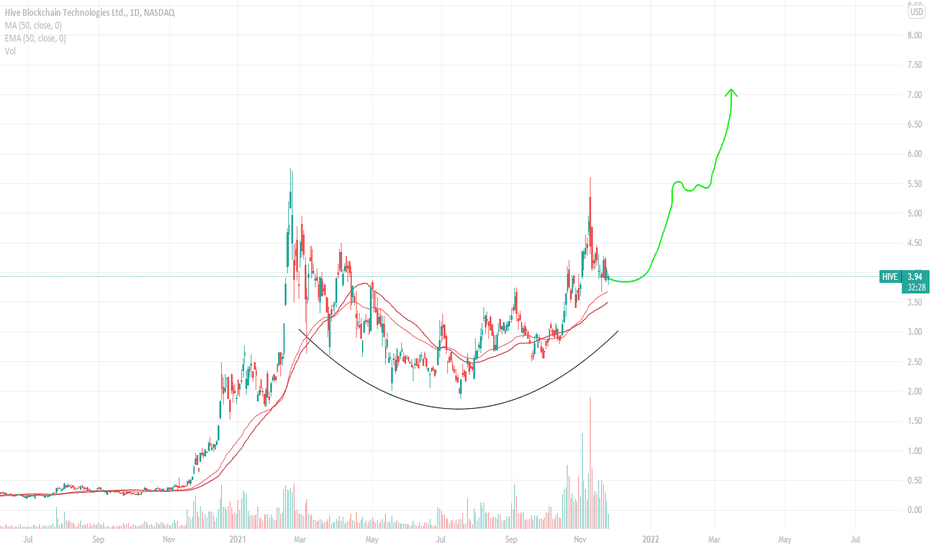

HIVE long term planning NASDAQ:HIVE :: #usstock #dyor #nfa

Note 📌 it's ETHERIUM mining ⛏️ company

Holding #crypto stocks is high risk and may cause lose 100% ur liquid 💰

Phase 1 :: BUY ACCUMULATION -> $2.2-2.6

Phase 2 :: BUY ACCUMULATION -> $0.5-0.7

i don't think 💬 it will reach 2nd phase 📍

If that happens sign 🛑 no new high 📌

Will return to ur 1st phase 📍 later I check ✅ i will update you target 🎯

But split 🪓 accumulation 40-60% liquid 💰

Sell :: $15-40-100-130 ( phase 1 )

#principaltrade :: $15-18

Phase 2 exit are $2-3 but i will update later

so try to catch 🫴 update 📌 everytime ⏰

Be in updated to post 😸 any questions ☺️ on this 📌 ask comment

Even more if u want just contact me personally 👍

BITSTAMP:ETHUSD NASDAQ:HIVE BITSTAMP:BTCUSD

Van ECK Associates Corp added 283,127 HIVE shares in Q4Coin World reported that according to the 13F documents recently disclosed by the US Securities and Exchange Commission, Van ECK Associates Corp increased its stock position in the bitcoin mining company HIVE Blockchain Technologies Ltd. by 49.3% in the fourth quarter of last year, increasing its holdings by 283,127 shares , currently owns $1,235,000 worth of HIVE Blockchain Technologies shares, accounting for approximately 1.02%. Among other hedge funds, State Street Corp now owns 348,212 shares of HIVE worth $1,309,000; BlackRock owns 82,303 shares worth $310,000; and UBS Group AG owns 17,829 shares worth $67,000. (defenseworld)

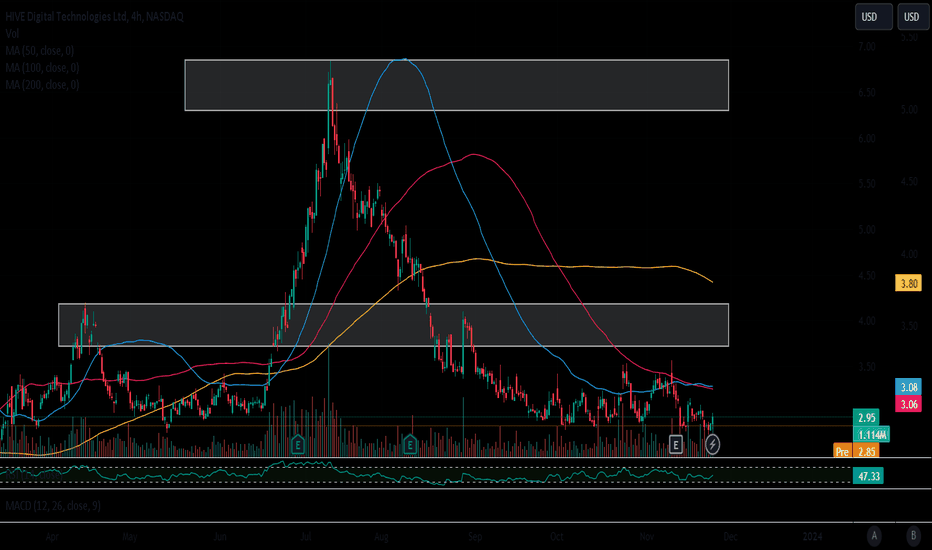

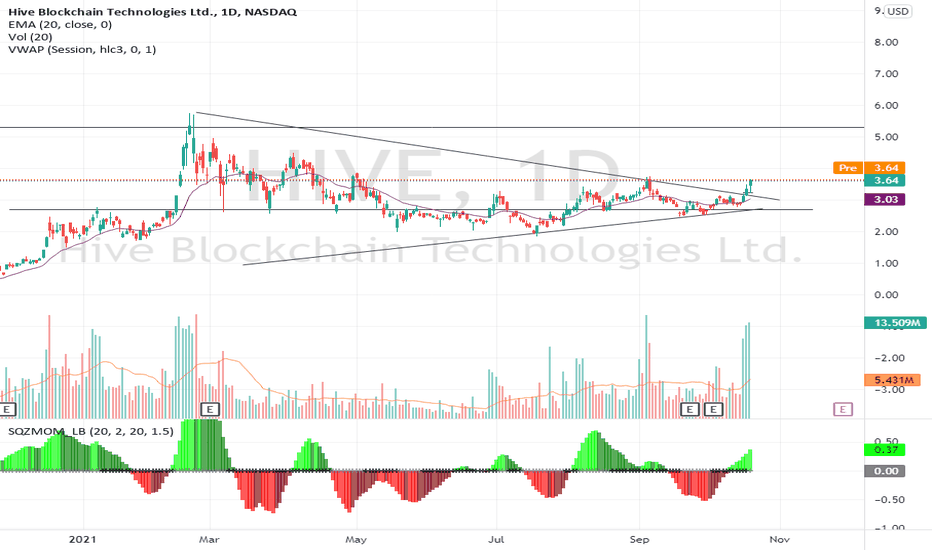

Can The Bee HIVE Save the Company.HIVE in sight of impending danger, can bulls hold the zone or can we see a structure Retest + IMB fills.

Even after calculating the holdings we can see HIVE has failed to sell at every crypto run up, HODLING at its finest.

Can we see HIVE get revived and make a turn around to chase down RIOT

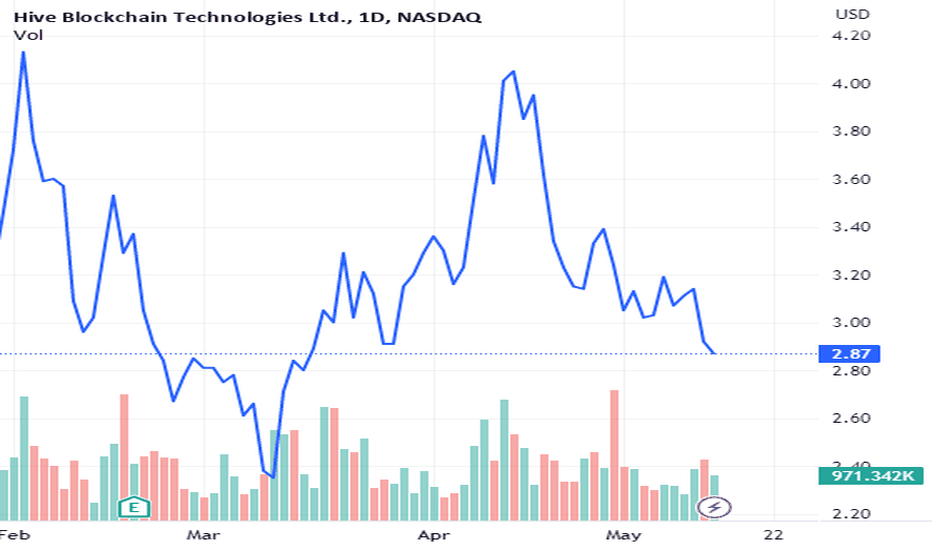

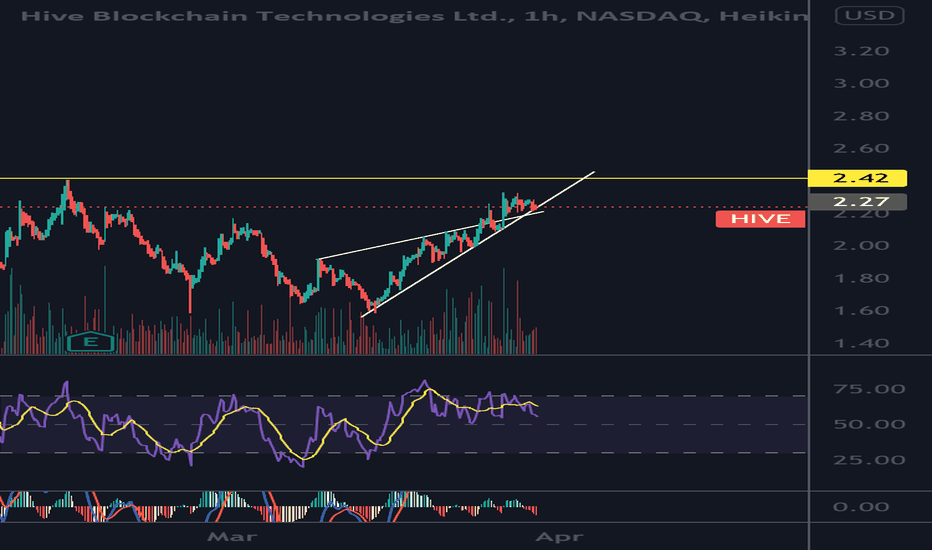

Hive This is one to watch here. We had. Very nice push up and seeing a pull back here. I have uptrend support here around 2.22. This is a level I’m willing to pick up as potential support. If we can hold it and turn around on a 15 min or even better a 1 hour this will confirm support on this uptrend. Enter how you wish. My levels of added are 2.22 and I’ll keep a close eye on any bearish trend breaks. For now I’m only targeting 2.42. But if we pop that then this can really fly

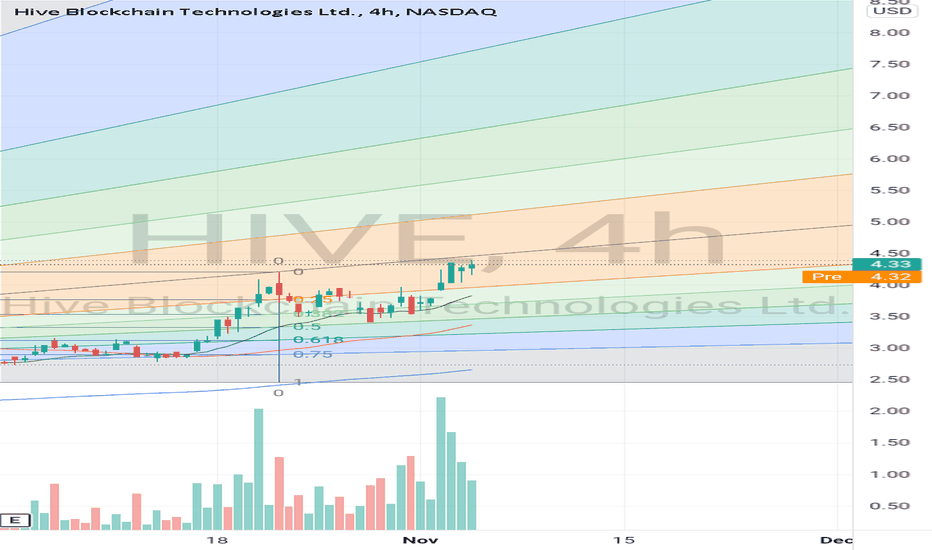

Trading HIVE with Fib Speed Resistant Fan toolsSetup Fib Speed Resistant Fan based on high. Use the tool t9 determine the support and resistant of the price. If the price not reaching the upperline(resistant), the price will pulkback to nearest support. Suitable for intraday, swing or even scalping with using the tool at the smaller timeframe. Every colored zon determine the volatality with the orange zone is the most bullish trend.

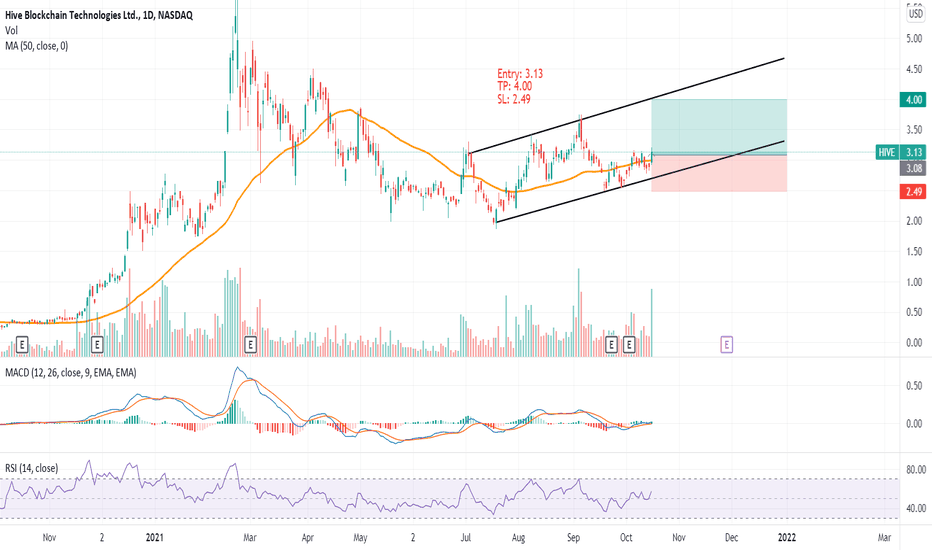

HIVE looks good hereBTC and ETH could hit all time highs this week. Crypto miners are sure to benefit if that happens. While RSI looks a bit high on this one, the top of my drawn out channel suggests a $4.00 price tag could be a reality in the near future. I think a better chance of a 10-20% run up than 10-20% breakdown.

I'll take a swing here and likely hold as long as it stays inside the drawn out channel (while taking profits on the way up).

Obviously the crypto markets have to stay strong for this trade to pan out. HIGH risk HIGH reward

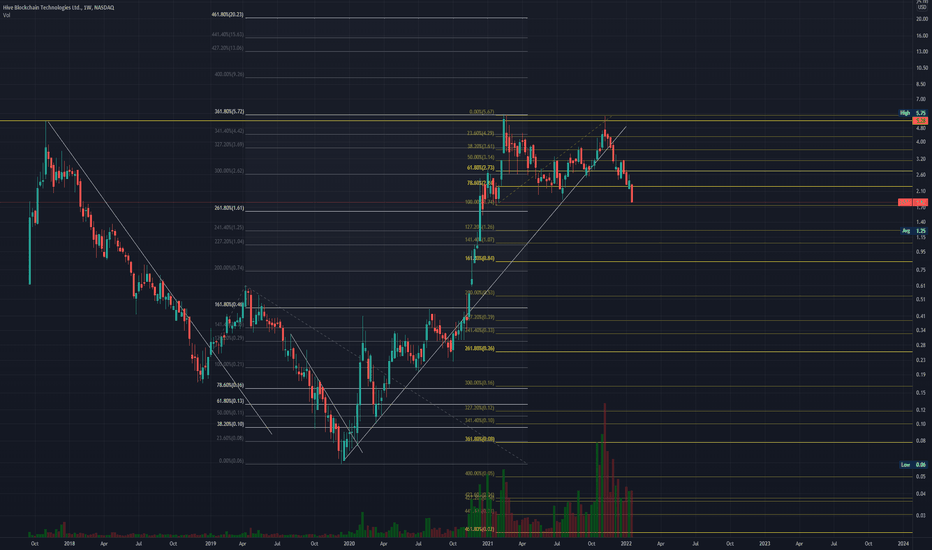

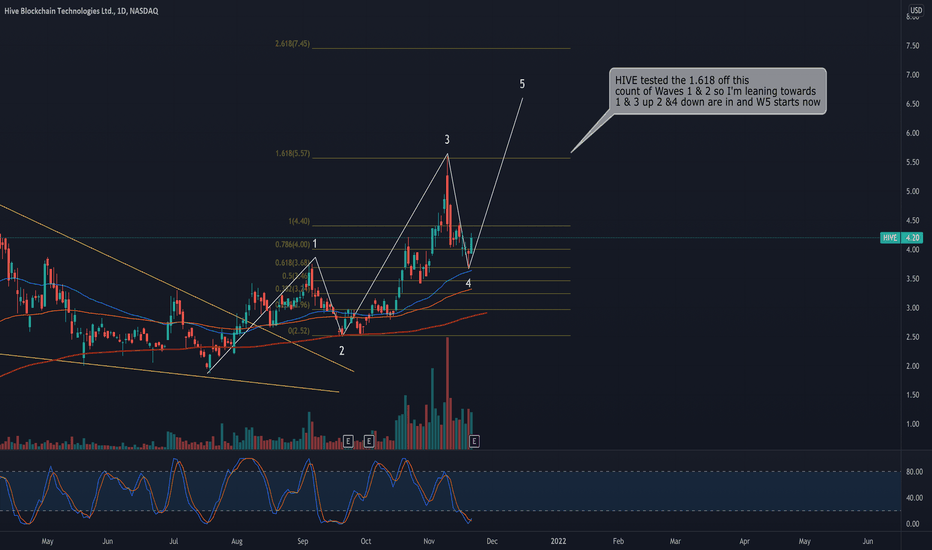

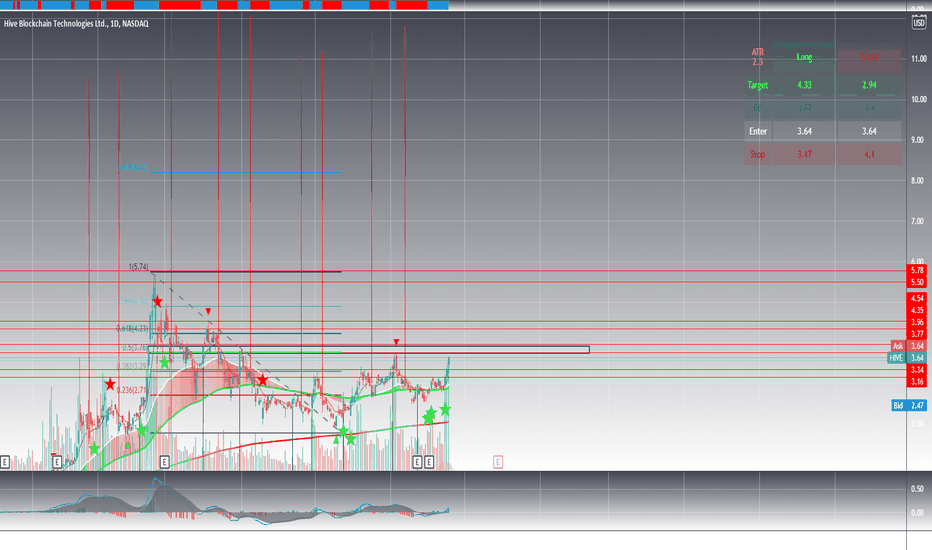

$HIVE Long targets and Stop LossHello Friends,

I am still Long $HIVE and $SDC.

My target for HIVE if we go pass previous high of $5 are

TP1: 8-9.20

TP2: 10-12.40

TP3: 13.20-15

SL is 5.75

Entry was below 3.00 but it is still good time to add a few hundred shares for this position.

I have included my fib retracements to help guide me and others who are thinking the same.

A Bit of Background:

HIVE is the biggest ETH miner right now. They are a North American cryptocurrency miner.