LULU trade ideas

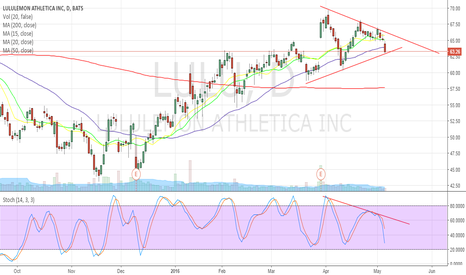

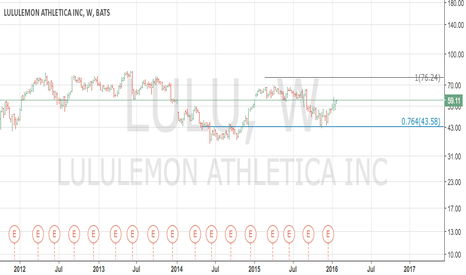

Pennant consolidation pattern developsSee notes on chart. Price/volume action confirms the current pattern analysis. We had a massive volume spike to the upside in the flagpole validating the start of the pattern and when the pennant breaks to the upside on heavy volume, the trade can be made to the upside target noted. Which is about a 10% move. As always wait for the confirmation signal. Using Williams %R(9) should allow us to determine some form of overbought/oversold relationship during the consolidation. A higher risk entry could be at an oversold reading and a lower pennant boundary touch on very low volume, as it might suggest the sellers are gone, but the lower risk entry is a continuation of the prior trend. Look for volume on up days toward the end of the pattern to be higher than on down days as this could give clues to the sentiment. As always trade responsibly and this doesn't constitute advice, just my opinion.

Good trading,

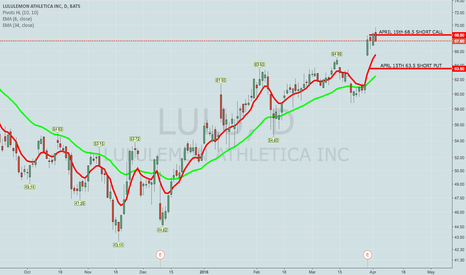

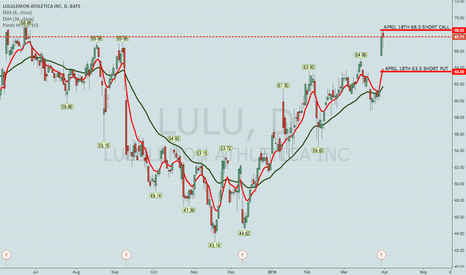

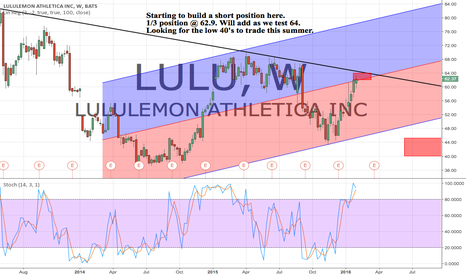

Possible gap shortAll technical traders are aware that 75% of gaps fill. In this case we saw a large surge to the upside. Following that the price was rejected by heavy volume as it came into resistance at the $69 handle. If the price breaks below $65.30, a break of support, investors should considering shorting the stock for a fill back to $61.

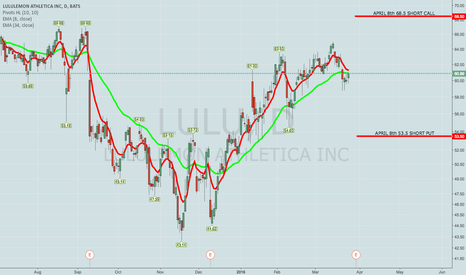

BOUGHT TO CLOSE LULU APRIL 15TH 63.5/68.5 SHORT STRANGLEWith this little dip here we got today, I bought back my LULU short strangle to close it out for a small profit.

Here's the whole chain:

Sold to open LULU April 8th 54/68 short strangle for $130 credit

Bought to close LULU April 8th 54 short put for a $2 debit

Rolled LULU April 8th 68 short call to April 15th 68.5 short call for a $17 credit

Sold to open LULU April 15th 63.5 short put for a $32 credit

Bought to close LULU April 15 63.5/68.5 short strangle for a $143 debit

Total Credits Collected: $179

Total Debits Paid: $145

Profit: $34/contract; $26/contract after fees/commissions

Naturally, it would have been nice if the setup had worked out from the get-go, I'd been able to take 50% of the original credit received as profit and moved on, but things don't always work out that way. The important thing is that it isn't a loser, and that I got out of it fairly quickly for scratch or better and can now redeploy the buying power on a higher probability setup ... .

ROLLING LULU APRIL 8TH 68 TO APRIL 15TH 68.5 SHORT CALLI didn't like how price was dancing around my short call strike post earnings, particularly with an analyst upgrade that's probably keeping it there, so I rolled the April 8th 68 short call to the April 15th 68.5 to give it a touch more space and time to work out (filled for a .12 ($12) credit).

Since I closed out my original setup's short put at near worthless, I also sold a 63.5 short put in the same expiry for an additional .32 ($32) credit), resulting in an April 15th 63.5/68.5 short strangle.

BOUGHT LULU APRIL 8TH 54 SHORT PUT TO CLOSEWith the short put nearing worthless here, I'm closing it out for a .05 debit ($5). I received a .68 credit for the 54 short put ($68), so I realized a profit of .68 - .05 = .63 ($63)/contract on that side.

Unfortunately, price is getting uncomfortably close to my short call side ... .

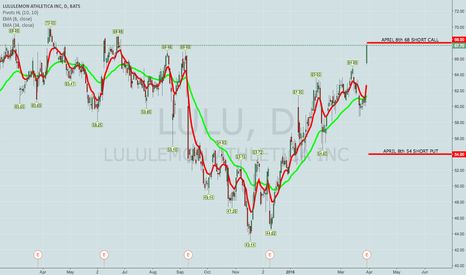

TRADING IDEA: LULU APRIL 8TH 54/68.5 SHORT STRANGLEI'm going to go with a nondirectional bias here (pretty much always do).

Here are the metrics for both a run of the mill one standard deviation short strangle, as well as an iron condor:

April 8th 54/68.5 short strangle

Probability of Profit: 70%

Max Profit: 1.30/contract ($130)

Buying Power Effect/Max Risk: ~$616/undefined

Break Evens: 55.30/67.20

April 15 50/54/68.5/72.5 iron condor

Probability of Profit: 68%

Max Profit: 1.00/contract ($100)

Buying Power Effect/Max Risk: $301/contract

Break Evens: 53.01/69.49

Notes: I had to go a touch farther out in time for the iron condor to get the long options strikes I wanted, but it'll still yield about $100/contract ... . Look to take either setup off at 50% max profit on the volatility contraction that is likely to occur post earnings.

NEXT UP: LULU EARNINGS -- WEDNESDAY BEFORE MARKETLULU announces earnings on Wednesday before market open, so look to put on your setup before close on Tuesday.

This is what I'm looking at tentatively right now:

April 8th 53.5/68.5 short strangle

Probability of Profit: 73%

Max Profit: $124/contract

Buying Power Effect/Max Risk: $616/undefined

Notes: This is a tentative setup. Naturally, a lot depends on how much LULU's volatility rises here, as well as how much its price moves before the announcement. Also, I don't think I'm going to see $1.24 come Tuesday, although you never know (.92's the low; 1.24 the mid; 1.55 the high for this setup).

I'll also try to post a defined risk iron condor if I can work out a setup that'll yield something close to a $1.00 credit ($100/contract) ... .

Last Week's Head and Shoulder's Bottom Was a signal Last week we detected a classic head and shoulder's bottom with a measured price target at $63 zone with a stop loss at recent swing low or the low of the right shoulder. Today's gap should give those fans a great smile. real-time alerts go www.2waytradiing.com