Does LYFT remind you of SNAP?

Lyft was founded in 2012, and it generated more than two billion dollars in revenues last year.

Still, there are also some striking throwbacks, beginning with the fact that Lyft is losing a great deal of money: $911.3 million last year, $688.3 million in 2017, and $682.8 million in 2016. That’s almost $2.3 billion in three years. Therefore, In my opinion LYFT stock is over priced and as of right now the valuation is really high.

UBER will be going public soon and it's 5 times bigger than LYFT and has an international presence. I would suggest new investors to not fall in the trap and wait till UBER goes public.

LYFT trade ideas

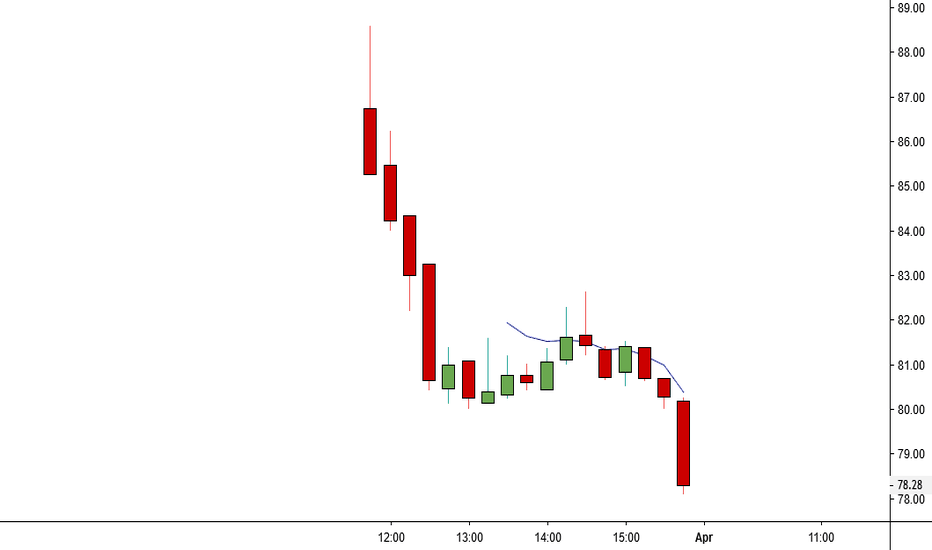

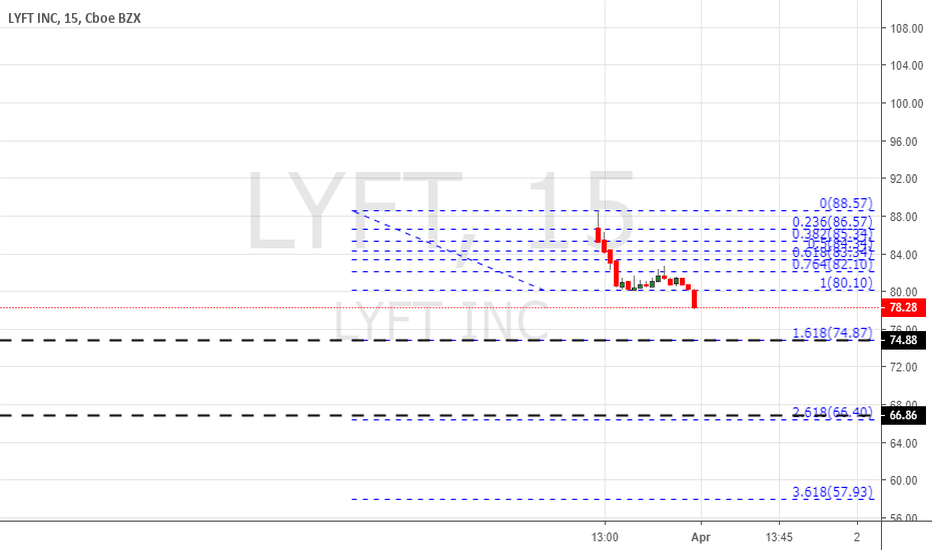

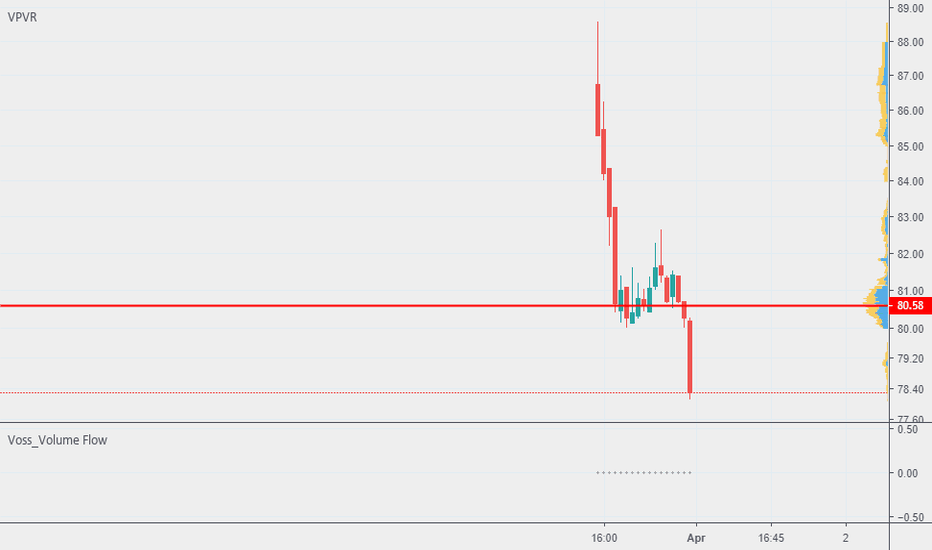

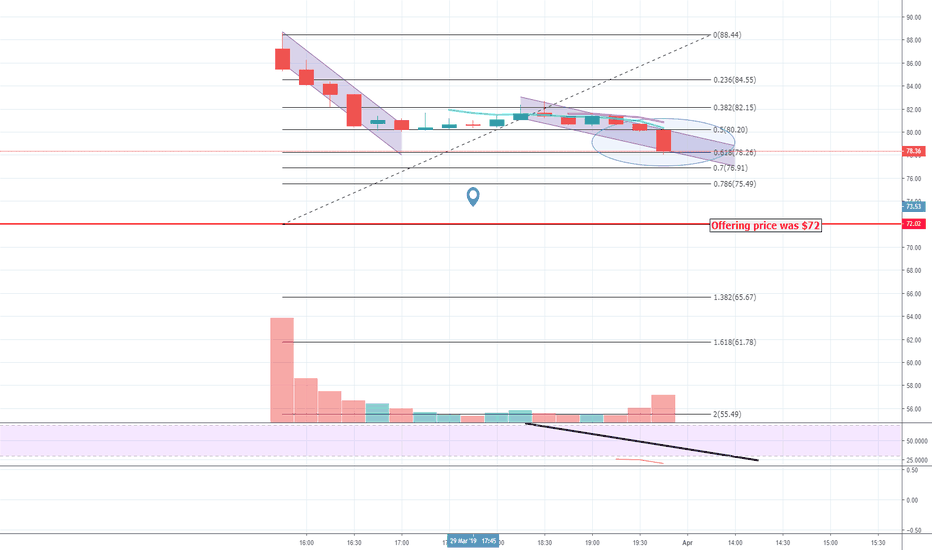

Possibles areas of rebound with fibo extensionsOn friday LYFT launched its IPO at the price of 86.75 but the price close at 78.28 with a negative change of 9.7%, according to the fibonacci extension applied to the 15 minutes chart, from the high to the low before the reversal structure, the downside movement can reach the prices of 75, 67 or 56 before could see a important upside movement.

Legalized Gambling Getting Out As Fast As They CouldWall Street's new flavor of the week, the hot IPO today was a company named Lyft.

Perhaps you'll pardon me for not knowing much about this company.

If it's a ride sharing company, then that's understandable,

as the business model fits today's mentality of rapid growth, of the new economy, over old traditional established.

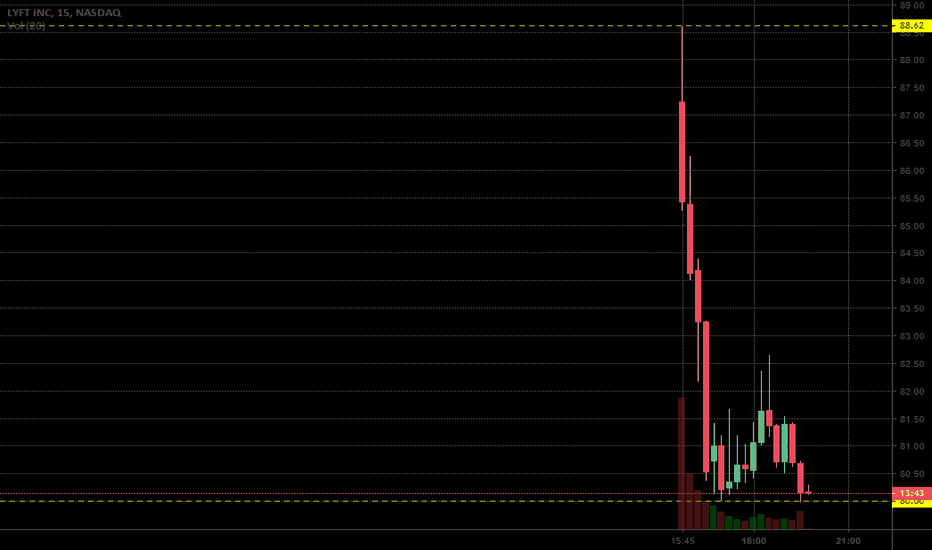

I do know the IPO was oversubscribed, and the stock began trading over $85 a share.

And I do know, from looking at the chart, that on day one,

those who were fortunate enough.. they think,

to get in on the initial offering,must a have felt they had riches waiting to be harvested,

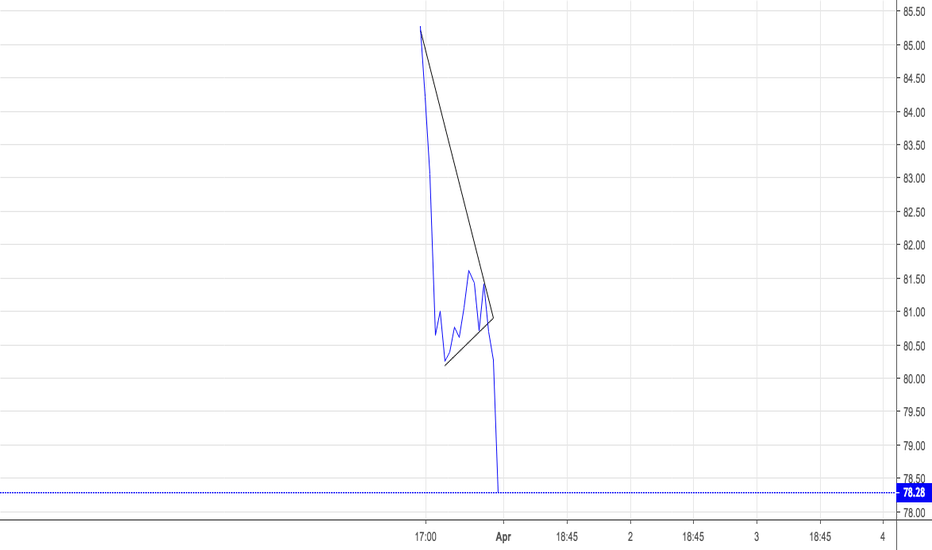

However, a peculiar thing happened after the stock opened mid day.

In a bout of not one, but two selling bursts, Lyft, plunged 10 % in just 3 hours this afternoon.

Those who needed to own the hot IPO at 85, were being overwhelmed by sellers,

who on the other hand were just looking to get out as fast as they could.

The stock market mentality of legalized gambling,

shown in both the flashy, showy aspect of the sales pitch, the IPO

and the immediate bust of the result, the 10% rollover in the value

clearly shows that substantial market risk, however you want to measure +package it

is very much alive and well.

Buyer Beware.

THE_UNWIND

3/29/19

NEW YORK

IPO's are a redistribution of risk! IPO's are the most sought after exit strategy because they are the most profitable. This is a redistribution of risk opportunity for the Owners & Venture Capital firms on to financial firms, and then on to retail investors. Remember! this business is sold. There is always opportunity, but today was not it for retail in LYFT.